HR records for an individual entrepreneur are no less important than for a large company. Why? The answer is simple: an individual entrepreneur must keep records of the wages of his employees and contributions to the Pension Fund of the Russian Federation. At the same time, it does not matter how many employees he has on staff.

When covering this issue, it is necessary to focus on the distinction between two different employers: an individual and an individual entrepreneur. The first include individuals who hire employees for personal service purposes - they do not keep personnel records.

Individual entrepreneurs acting as employers hire employees to carry out profit-generating activities - they are required to maintain personnel records.

When does an individual entrepreneur need to keep personnel records?

For an individual entrepreneur, personnel records are mandatory only when he acts as an employer of labor, that is, he has at least one hired employee.

The acceptance of a future employee into the staff of an individual entrepreneur must be formalized by signing an employment contract. When this fact can be considered accomplished, personnel records become mandatory for individual entrepreneurs. He must comply with the governing provisions of applicable laws.

Organization of personnel records inappropriately threatens individual entrepreneurs with prosecution, including criminal liability.

During inspections, labor inspection bodies have the right to demand the presentation of the necessary documents for employees, and an individual entrepreneur is obliged to provide them.

In addition to the obligation to maintain personnel records, we can highlight some of its rights and individual responsibilities:

- the right to conclude employment contracts in writing for an indefinite period, as well as contracts of a fixed-term nature;

- the right to issue orders based on the provisions of signed agreements;

- the obligation to maintain work books and register them for those hired for the first time;

- the obligation to provide employees with certificates of pension insurance, if necessary;

- the obligation to adopt all local regulatory documents required and required by law;

- the right to conclude collective agreements;

- the right to conduct training among employees on labor protection requirements and control this knowledge.

Who usually does this?

This question mainly arises in small organizations.

Usually this is done by a personnel officer, since maintaining this record is quite a complex task. Unfortunately, not every manager can be persuaded to introduce such a separate position into the staff. In this regard, personnel management is often carried out by the chief accountant or the manager himself part-time. As a rule, this happens in small companies in order to save money. And it makes no sense to introduce an additional unit into the staff for two or three people. In this case, the scheme turns out like this: the manager registers the employees, and the chief accountant pays their salaries. The main law that regulates the relationship between employee and employer is the Labor Code of the Russian Federation. It is he who determines the rights and obligations of both parties.

Personnel records documents for individual entrepreneurs

Personnel records involve the preparation of relevant documents. The relationship between the individual entrepreneur and his employee must be documented.

In companies, to achieve these goals, there is usually an entire department or position of a human resources specialist, specialized programs are used, and individual entrepreneurs often completely neglect the requirement of documenting labor relations. As a result, representatives of the labor inspectorate issue significant administrative fines during control activities.

All personnel documents required to be maintained by an individual entrepreneur are classified into three types.

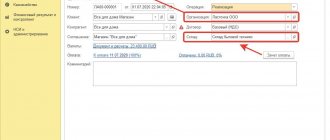

Organizations using UTII accounting are exempt from paying the following taxes: VAT, income tax or personal income tax (for private entrepreneurs), property tax and insurance premiums.To keep records of business transactions of an individual entrepreneur, it is enough to take into account your expenses and income. For this you need an income and expense ledger. Read about accounting for individual entrepreneurs in this article.

Internal regulatory documents . These include labor regulations, collective agreements (when applicable), and necessary instructions regarding the protection of personal information and labor protection. Their presence is regulated by the Labor Code.

This group also includes regulations on remuneration and other personnel documents of individual entrepreneurs, when they are required due to the specific nature of business activities.

No less important is the presence of job descriptions: their preparation is necessary to eliminate possible controversial situations in court.

For example, the dismissal of an employee due to unsatisfactory test results may be considered illegal, since there was no job description and the employee could not be certified.

Organizational documents. This type of personnel documents includes various accounting journals. They register employment contracts, business trips of employees, orders.

Organizational documents are also considered:

- a book in which work records are kept;

- time sheet;

- a schedule for employees to go on vacation;

- staffing table.

Entrepreneur's responsibility

It was discussed above that there are mandatory personnel documents for individual entrepreneurs. However, not everyone makes every effort to properly maintain personnel records.

We recommend you study! Follow the link:

Should an individual entrepreneur have a staffing table and how to draw it up?

Ultimately, the employer may face liability. For individual entrepreneurs in 2021, there are three groups of punishments: administrative, criminal, financial.

It is important for individual entrepreneurs to study all types.

Administrative liability is provided in several situations:

- In case of an unjustified refusal to conclude a collective agreement, the fine will be from three to five thousand rubles.

- Incorrect collection, storage, and use of information about an employee may result in a fine. You will have to pay from 500 to 1,000 rubles.

- Work without formalizing the employment relationship with an appropriate form of contract, as well as evading its conclusion, entails a fine of 5 to 20 thousand rubles. Repeated prosecution for such a violation will result in an increase in the monetary penalty. You will have to pay 30-40 thousand rubles.

- Illegal use of the labor of foreigners, refusal to notify the migration service about the employment of such citizens leads to the imposition of a fine. Its size depends on the qualifications of the foreign citizen and the place of activity.

Criminal liability may also arise in several cases:

- dismissal of a pregnant woman, as well as a woman with children under three years of age. In this case, you will have to pay a fine of up to two hundred thousand or work 180 hours;

- Delaying wages for more than two months for mercenary or personal purposes is punishable by a penalty of up to 500 thousand rubles.

Financial liability arises when wages are delayed. In this case, you will have to pay the employee overdue payments, calculated based on the refinancing rate - 1/300 for each day.

Maintaining work books for individual entrepreneurs

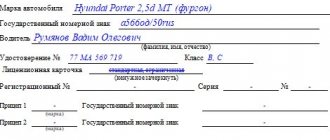

When registering a new employee, an individual entrepreneur must, in accordance with labor legislation, issue a hiring order and make an entry in the work book.

The work book is prepared in accordance with established regulations. The hired employee may have it on hand or not if he is hired for the first time. An individual entrepreneur is required to create a work book, if it is missing, and make an appropriate entry about hiring.

The obligation to maintain personnel records for individual entrepreneurs, in particular, to maintain work records, arose with the introduction of amendments to the Labor Code of the Russian Federation relatively recently. Until this moment, employees working for individual entrepreneurs were somewhat infringed on their rights.

Now the work book for workers has become a document confirming labor activity during this period.

An individual entrepreneur as an employer is considered responsible for maintaining work books, organizing their storage and accounting. A new work book is created by an individual entrepreneur based on a written application from the employee, where he indicates the reason for the absence of a work book.

Why is it needed?

In any organization, regardless of the number of people, there is an obligation to maintain such records.

It helps document the movement of all personnel. To do this, it is imperative to know the regulatory documents relating to labor. In addition, you need to have HR management skills. This type of accounting is intended for the need:

- correctly distribute people in work processes;

- look for unused reserves;

- identify and eliminate personnel problems in a timely manner.

You can get detailed information about this process from the following video:

Outsourced HR accounting for individual entrepreneurs

Individual entrepreneurs quite often outsource personnel records to third-party organizations. This happens for several reasons:

- keeping a full-time employee performing HR work is unprofitable in terms of financial costs;

- if there is a full-time employee, then most often it is an incompetent person who combines several functions for additional pay. This usually leads to violations of personnel records and labor legislation and, as a consequence, to administrative fines.

Such an employee can perform only part of the functions; he does not monitor changes in legislation and the emergence of new requirements. In practice, such HR record keeping can have a negative impact on the overall functioning of the business.

Involving an outsourcing company allows an individual entrepreneur to optimize their costs and receive professional assistance.

Possible sanctions for ignorance

In the absence of personnel records, officials will be held accountable under the Law “On Administrative Offences”. They are subject to a fine:

- for an official - in the amount of 1 to 5 thousand rubles;

- for legal entities – from 30 to 50 thousand rubles.

In addition, it is possible to suspend the organization’s activities for up to 90 days . If the offense is repeated, the manager may be disqualified.

If an organization faces an inspection by regulatory authorities, it is important to prepare for it. To do this you need to know:

- supervisory authorities must notify authorities of the upcoming procedure at least three days in advance;

- the verification should not exceed twenty days;

- They do not have the right to conduct an on-site inspection without a supervisor.

This type of accounting is the main component of any enterprise. Therefore, its reliable management allows you to avoid a large number of troubles.

HR reporting in 2021: HR calendar

In addition, the order of Rosstat states that a periodic form is being introduced (once every 2 years) - No. 57-T “Information on wages of employees by profession and position.” It will need to be filed for 2021 only for odd-numbered years. Once every 3 years you will have to submit:

Failure to submit or untimely submission of reports to Rosstat constitutes an administrative offense, liability for which is provided for by the provisions of Article 13.19 of the Code of Administrative Offenses of the Russian Federation and is punishable by fines in the amount of: