Questions about declarations

?

Join our VKontakte group dedicated to EGAIS alcohol

.

In 2021, the Government of the Russian Federation carried out a “regulatory guillotine” during which a number of legislative acts were repealed and new forms of reporting on the volume of alcoholic products were created.

What regulations and orders have lost their force in 2021? - read

Earlier in 2021, by Decree of the Government of the Russian Federation No. 1719 of December 29, 2018, declarations were canceled

for alcohol, forms 11 and 12, they were replaced by

new forms 7

and

8,

respectively. After which the declaration forms were no longer changed.

January 1, 2021

updated reporting forms

come into force and new rules for submission are established.

In the current 2021, alcohol declarations are being filled out and submitted in the old forms.

Deadline for submitting a beer declaration

Reports on the turnover of alcoholic beverages must be submitted by the 20th day of the following month after the end of the quarter. By dates:

- 20 April;

- July 20;

- The 20th of October;

- January 20th.

Corrective beer declarations for the previous year are submitted until April 30 of the current year. Mandatory with explanations of the reasons for filing a corrective declaration.

Go to step-by-step instructions for those who are already registered everywhere and submit the second and subsequent declarations.

Production, storage and circulation of alcohol: who reports and how

Mandatory declaration of alcoholic beverages varies depending on the taxpayer’s area of employment.

The Federal Law “On state regulation of the production and turnover of ethyl alcohol (hereinafter referred to as ES), alcoholic and alcohol-containing products and on limiting the consumption (drinking) of alcoholic products” dated November 22, 1995 N 171-FZ provides for several different situations when entrepreneurs must report to Rosalkogolregulirovanie . In addition to this regulatory act, there is a separate government decree that establishes how the declaration is submitted to Rosalkorugulirovanie (RF Government Decree No. 815 of 08/09/2012). From January 1, 2021, RF PP No. 815 loses force, but for 2021 we report in the old way.

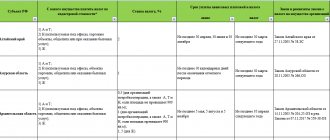

Full table and deadlines for submitting reports on alcohol in 2021 according to the current RF Regulation No. 815.

| What to report | Annex number in government decree No. 815, where the report form is presented | Deadline for submitting an alcohol declaration for the 4th quarter of 2020 |

| on the volume of production and turnover of alcoholic products | application No. 1 | Until 01/20/2021 |

| on the volume of turnover of ethyl alcohol, alcoholic and alcohol-containing products | application No. 2 | Until 01/20/2021 |

| on the volume of supply of ethyl alcohol, alcoholic and alcohol-containing products | application No. 3 | Until 01/20/2021 |

| on the volume of purchases of ES, alcoholic and alcohol-containing products | application No. 4 | Until 01/20/2021 |

| on the volume of transportation of ES (including denatured alcohol), alcoholic and alcohol-containing products | application No. 5 | Until 01/20/2021 |

| on the use of production capacity | application No. 6 | Until 01/20/2021 |

| on the volume of retail sales of alcoholic (except for beer and beer drinks, cider, poire and mead) and alcohol-containing products | application No. 7 | Until 01/20/2021 |

| on the volume of retail sales of beer and beer drinks, cider, poire and mead | application No. 8 | The deadline for submitting the egais beer declaration is until 01/20/2021 |

| on the volume of grapes harvested for the production of wine products | application No. 9 | Until 01/20/2021 |

| on the volume of grapes used for the production of wine, sparkling wine (champagne) | application No. 10 | Until 01/20/2021 |

| on the volume of grapes used for the production of wine products, including wine products with a protected geographical indication, protected appellation of origin, and the full cycle of distillate production | application No. 11 | Until 01/20/2021 |

Errors with region and country code

The finished file must be opened with a text editor (I use notepad) and checked for the region and country code. For some reason, Declarant-Alco does not add them and FSRAR gives an error while loading on the site:

To eliminate this point even before signing, you need to fill in the tags with the country and region code. In my case these are the following numbers:

643 - number of Russia in OKSM (All-Russian Classifier of Countries of the World) 91 - code for the Republic of Crimea (codes of the constituent entities of the Russian Federation)

General filling rules

Correct completion and submission of the alcohol declaration is carried out taking into account the standards prescribed in the order of the Federal Service for Regulation of the Alcohol Market No. 231 dated August 23, 2012. This document contains instructions for drawing up a reporting form that are common to all. On the title page, organizations and individual entrepreneurs must indicate:

- reporting period;

- type of document - primary or corrective;

- information about the individual entrepreneur or organization, including information about all separate divisions and retail facilities;

- Taxpayer Identification Number, checkpoint, address of place of business;

- information about the person who drew up the document and certified it;

- date of submission of the document.

Directly in reports in all columns, indicators must be expressed in deciliters or tons accurate to the third decimal place. Only data for a specific reporting period is indicated, without a cumulative total. And this is important - if the product has not gone through the full cycle of technological processing, information about it is not transmitted to the regulatory authorities.

An example of filling out an alcohol declaration on Form 8

Filing form and penalties

A total of 12 forms for submitting a report on alcohol have been defined; each type of activity has its own form.

For example, legal entities producing alcohol have their own declaration forms - No. 1, 2,3, 4, 7, 10. From 2021, those who sell strong alcohol products may not submit form No. 11 if they:

- sell alcohol under a retail license, but only if they do not work in the catering industry;

- At the time of sale, each bottle is scanned and its data is entered into the EGAIS system.

For violation of deadlines and submission of false information when declaring, fines are imposed on legal entities and individual entrepreneurs (Article 15.13 of the Code of Administrative Offenses of the Russian Federation). The amount of penalties for legal entities is up to 100,000 rubles, for individual entrepreneurs - up to 10,000 rubles.

Stage 5. Completing the process

This completes the formation of the alcohol declaration. Now you should carefully check the information you entered. If everything is in order, you need to click “Sign and send”:

How to check for errors

Unlike tax authorities, Rosalkogolregulirovanie does not provide control ratios to detect the presence of inaccuracies. Entrepreneurs need to choose some other, but equally safe way of monitoring and analyzing recorded indicators. For example, one of these ways is to check them on the Uchetinfo website. The “Checking Alcohol Declarations” service is available here without any registration and free of charge. Moreover, you can check only one form, but you can compare it with another report if an organization or individual entrepreneur reports on several types of activities at once. Other well-known companies also offer error checking, for example Alkosverka Contour, ICT Center (Alcospot).

Another way to detect discrepancies is to download a special program: an application that will check how correctly the indicators were recorded in different columns. This option is suitable for those who are willing to pay extra for such a service.

If errors are found, you will have to report this to the department: the deadline for submitting a corrective declaration for alcohol is before the deadline for filing declarations for the quarter following the reporting quarter. If this deadline is missed, contact Rosalkogolregulirovanie with a statement in which you request permission to send the adjustment later than the specified deadline - in the manner established by Order of the Ministry of Finance No. 97n dated June 20, 2017.

What is needed to submit the EGAIS declaration

The principle of submitting the EGAIS declaration for beer and other alcohol is identical. However, it is worth remembering that Rosalkogolregulirovanie accepts reports exclusively in electronic form. In order to generate a document in accordance with the requirements of the law, you must:

- Complete UKEP. The acquisition of an electronic signature is required to confirm and subsequently encrypt the data entered into the ED. To be able to work with electronic signatures, you need to install the CryptoPro CSP program. In order for the browser to work correctly, it is better to download the Crypto Pro Browser plugin;

- Download the Declarant Alko program. This software is necessary for drawing up a declaration; it is important to check for updates after installation;

- Install an additional encryption program by choosing from several options offered by the service. It is needed to securely send data to the FSRAR website.

You can submit the declaration yourself or contact Multikas.

Alcohol declaration forms

The declaration is submitted by persons whose work is related to:

- Production of suitable products;

- Transportation;

- Storage;

- Wholesale and retail sales.

Such persons include organizations, individual entrepreneurs and other persons, for example, citizens growing grapes to create wine within the framework of private household plots.

For each of these categories of persons, the declaration form will be different. In addition, the form depends on the type of product with which the declarant interacts. A separate form is provided for individual entrepreneurs. Resolution 815 of 08/09/12 as amended. dated 05.13.16 determines the procedure for filing declarations on the use, production, circulation of alcohol and other products and puts into effect the relevant Rules with declaration forms.

The procedure for filing declarations is regulated by FSRAR Order No. 231 dated 08.23.12. These legislative acts establish 15 annexes with declaration forms. A person licensed to carry out operations with alcoholic and alcohol-containing products chooses the appropriate form depending on the area of activity. In some cases, you may need to complete more than one declaration form. Read also the article: → “List of excisable goods in 2021. Accounting entries.”

Where and when are alcohol reports submitted?

The completed declaration is first sent to the regional executive authority at the place of registration of the reporting entity.

Then, within 24 hours, the reporting must be submitted to the Federal Service for Regulation of the Alcohol Market FSRAR (Rosalkogolregulirovanie). In both cases, controllers accept only an electronic version of the declaration certified by an enhanced electronic signature. The paper version will not be considered passed.

Important! The beer declaration should not be confused with the excise tax declaration - for the first quarter and other reporting periods, the latter is submitted only by producers of beer drinks and transporters of products across the EAEU border. The excise tax return is sent to the tax office.

To prepare reports, organizations and entrepreneurs are given 20 days after the end of the reporting period - quarter, so for the third quarter of the current year they need to report before October 21 (postponement from the weekend). In case of missing the specified deadline, the reporting entity will be punished with a fine. For an official it is imposed in the amount of 5-10 thousand rubles, for a company - 50-100 thousand rubles.

How to draw up an alcohol declaration for the 3rd quarter of 2021

The beer declaration according to the above form consists of a title page and three sections.

- The title book is intended to reflect information about the reporting person (TIN, KPP if available, name of the company or full name of the individual entrepreneur, address of registration and activity, contact details - telephone numbers, email addresses), as well as to indicate the reporting period, year and places for submitting the reporting form. All entered information is certified by the signature of the entrepreneur or, if a legal entity is reporting, by the signatures of its authorized persons, who are most often the director and chief accountant.

- Section 1 is filled in with the following information:

- on receipts (separately by wholesalers, manufacturers, imports, returns and other receipts);

- implementation;

- other disposals (transportation losses, shortages, etc.) of beer and derivative drinks.

In addition, balances at the beginning and end of the reporting period—Q1 2021—are entered into this section for each manufacturer of alcoholic beverages.

- Section 2 provides information about the persons supplying beer to the reporting entity, as well as directly about the manufacturers of such products. The information includes: name of the supplier/manufacturer, tax identification number, checkpoint, details of the incoming document according to which beer products were accepted into the warehouse from the supplier, and the total volume of products received from him.

- Section 3 is filled out similarly to section 2, but instead of the purchase date it contains the date the goods were returned to the supplier.

Each section is certified by the signatures of the persons responsible for preparing the reports.