What is a billing period? First of all, we note that this is a fairly broad concept that is used in completely different areas of human activity. For example, in accounting when calculating vacation pay. So, if we talk about what a billing period is in a more global sense, this term allows you to evaluate the effectiveness of an investment project during a given period of time from the start of the project to its completion. However, each area may have its own definition of this term.

Definition of terms

In 2021, control over the payment of all kinds of insurance premiums is carried out by the Tax Service, and therefore reports are now submitted specifically to the branches of this control body. At the same time, many do not know that in accordance with the latest changes in the current legislation, a new reporting form has been introduced, which will need to be submitted based on the results of the first quarter of 2021.

Starting from 2021, the payment of insurance premiums is regulated in accordance with the provisions of the current Tax Code. In particular, Article 423 of the Tax Code indicates that the legislation considers the calendar year as the calculation period for insurance premiums, while reporting must be submitted in the first quarter, half of the year, and also after nine months of the year.

Instructions for filling out the document

The new calculation form combines the previously existing documents 4-FSS and RSV-1, and therefore the following information is required when submitting reports:

- calculated contributions for social, pension and health insurance;

- a complete list of benefits paid;

- personalized information about company employees.

It is worth noting the fact that in this calculation it is not necessary to indicate information about insurance contributions made, and they will need to be reported to the Social Insurance Fund by filling out an abbreviated form.

In the new calculation form, you need to include only the calculated payments and the insurance contributions that are made from them for each employee. There are no lines in which the listed amounts are written, as well as the balances present at the beginning or end of the period, in the statements.

In this regard, there is no need to indicate in this documentation any information related to overpayments or arrears in contributions that remained at the end of previous periods.

Thus, the new calculation contains a fairly large amount of information, but filling out the entire report is optional.

Amounts included in the calculation of average earnings

What charges are taken into account in the calculations is briefly discussed in Art. 139 of the Labor Code of the Russian Federation: these are all payments within the framework of the company’s remuneration system. This issue is discussed in more detail in clause 2 of Regulation No. 922. It specifies what exactly is to be taken into account:

- wages, including piecework, as a percentage of sales, goods, commissions;

- monetary remuneration for civil servants;

- fees in media editorial offices;

- teachers' salaries for overload;

- allowances and additional payments, including for professional skills, combination, length of service, knowledge of other languages;

- payments related to working conditions;

- bonus accruals and remunerations made within the framework of the company’s remuneration rules;

- other types of salary payments.

Payments with social characteristics and that are not payment for work should be excluded from the calculation. We are talking about financial assistance, payment for travel, lunches, vacations, housing and communal services and other similar payments.

Codes of the billing and reporting period in the calculation of insurance premiums in 2021

Submission of a single calculation for insurance premiums is carried out every quarter, and this is done before the 30th day of the month that follows the reporting period. In this case, it is necessary to indicate the code of a particular period, taking it in Appendix No. 3, which is published to the adopted Procedure for the preparation of such documents.

The codes themselves look like this:

It is worth noting the fact that these are not all the codes that need to be indicated in the process of preparing such documentation. In addition, when preparing a single settlement, you will also have to fill out the codes for the category of the insured person, codes for the types of various papers, as well as a number of other numbers assigned in accordance with certain regulations.

Procedure and form of submission

The calculation must be submitted, as mentioned above, before the 30th day of the month following the first, second and third quarter. These deadlines are approved by current legislation and are specified in paragraph 7 of Article 431 of the Tax Code, which came into force in 2021.

Thus, due to the introduction of new legislation after the first quarter, reporting must be submitted:

All companies and entrepreneurs whose activities involve more than 25 people must send documentation exclusively in electronic form using telecommunication channels. If the total number of employees is less than 25 people, then in this case reporting is submitted exclusively on paper. This feature of filing a single calculation is prescribed in paragraph 10 of Article 431 of the Tax Code.

The Tax Service will accept the calculation in accordance with the new form, and it must be submitted to the branch that is located at the location of the company or at the place of registration of a private entrepreneur.

If the company has any separate divisions that make payments to individuals, then in this case they will also have to submit reports, but to those tax departments that are located on their territory. Moreover, in this situation there is no difference whether the branch has its own current account or a separate one.

The first section of the document must be completed by all persons who pay funds to individuals. In particular, you need to provide here summary information on the amounts that must be paid during the billing period for pension, social and medical contributions.

It is also in this section that you need to indicate a list of amounts that are sent to the Pension Fund in accordance with the additional tariff, as well as those contributions that are made in order to provide employees with additional social insurance. Each such value must initially be indicated in its entirety, and only then is it indicated for the last three months, broken down by all months.

In addition, for each individual type of contribution, a specific budget classification code will be required, and this is a mandatory requirement, thanks to which Tax Service employees can record debts under certain codes on the payers’ personal account.

It is also necessary to fill out the second section indicating personalized information for all insured persons, while filling out the second section is mandatory only for those entrepreneurs who operate in the field of organizing farms.

How to calculate and withhold personal income tax

Companies and entrepreneurs paying salaries to their employees are tax agents in relation to them. This means that the accountant must calculate personal income tax on the amount of the salary, withhold it from the employee’s income and transfer it to the budget.

Tax is charged not only on the salary itself, but also on vacation pay and sick leave benefits (with the exception of maternity benefits, which are exempt from personal income tax). In addition, payments in kind are subject to tax: lunches, participation in corporate events, etc. The personal income tax rate in this case is 13%. Please note: the amount of personal income tax withheld should not exceed 50% of the amount paid to the employee.

Example 3

In January, the employee received income from his employer in the amount of 35,000 rubles. Accounting has calculated that the tax on an employee’s salary is 4,550 rubles. (RUB 35,000 x 13%) (to simplify, we considered the situation when the employee is not provided with tax deductions). The accountant transferred this amount to the budget, and the employee received 30,450 rubles. (35,000 - 4,550). Thus, the amount of tax withheld did not exceed the 50 percent limit.

Accounting is required to keep records of income and withheld tax for each individual in specially designed tax registers (see “Tax registers: instructions for use”). In addition, accountants must, at the request of individuals, issue them income certificates in the approved form.

Tax withheld from wages must be transferred to the budget no later than the day following the day the income is paid.

An exception is provided only for vacation pay and sick leave (including for child care)—personal income tax must be transferred to the budget no later than the last day of the month in which they are paid.

The employer is also required to submit to the tax office information about income paid in the previous year. To do this, no later than March 1, you need to fill out and submit to the inspection certificates in form 2-NDFL. If 11 or more people received income, they must report online. If there are 10 people or less, it can be done on paper (see “The Federal Tax Service clarified who is required to report on personal income tax and contributions via the Internet starting from 2021”).

In addition, it is necessary to submit quarterly reports on personal income tax in form 6-NDFL.

Fill out and submit 6‑NDFL and 2‑NDFL for free via the Internet

Responsibility for failure to meet deadlines

In case of failure to comply with the established deadlines for the first quarter, the Tax Service has the right to bring the company or private entrepreneur to administrative liability, imposing an appropriate fine on it. Today, the standard fine amount is 5% of the total amount of insurance premiums that must be paid, but it is worth noting the fact that when calculating this fine, the tax authorities will remove the amount that was transferred on time.

Over time, the 5% will continually increase, increasing over and over again each month, but ultimately the amount cannot add up to more than 30% of the amount due. On the other hand, current legislation also establishes a minimum threshold for such fines, and it is 1000 rubles.

If, within the established time frame, the entrepreneur pays only a certain part of the contributions, then in this case the amount of the fine is calculated as the difference between the total amount specified in the documentation and the one that was actually transferred to the budget.

Vladimir Ilyukov

Determining the billing period is the first task that the accountant must solve when calculating vacation or in other cases of maintaining average earnings. All cases when an absent (non-working) employee retains the average salary are established in different places of the Labor Code of the Russian Federation. Here are some of them.

- Annual paid leave, Art. 114 Labor Code of the Russian Federation.

- Compensation for unused vacation, Art. 126-127 Labor Code of the Russian Federation.

- Additional study leaves, Art. 173-174, 176 Labor Code of the Russian Federation.

- Business trips, art. 167 Labor Code of the Russian Federation.

- Downtime due to the fault of the employer, Art. 157 Labor Code of the Russian Federation.

- Advanced training, Art. 187 Labor Code of the Russian Federation.

- Donation of blood and its components (donor days), art. 186 Labor Code of the Russian Federation.

- Severance pay in connection with dismissal due to liquidation of the organization, reduction of staff (number) of employees, conscription of the employee for military service; Art. 178 Labor Code of the Russian Federation.

- And other.

To determine the amount of average wages (average earnings) for all these cases, a single procedure has been established, Art. 139 Labor Code of the Russian Federation. At the same time, according to paragraph. 7 tbsp. 139 of the Labor Code of the Russian Federation, the specifics of calculating average earnings are regulated by Decree of the Government of the Russian Federation dated December 24, 2007 No. 922 “On the specifics of the procedure for calculating average wages”, hereinafter Resolution No. 922.

Upon superficial analysis, it seems that the phrase “... or for a period exceeding the billing period

"seems unnecessary, erroneous, and illogical. This conclusion can be reached if by “period exceeding the billing period” we mean months outside the base billing period. If you count from the month of the occurrence of the event in which the average earnings are saved, then this is the 13th, 14th or other month.

This is a misunderstanding. Here, a period exceeding the main billing period means the entire period preceding the period of maintaining average earnings

. Let's consider a fairly typical situation for a female employee of an organization.

- 06.2016

. Employment date. - 11.2016 to 16.04.2017

. Maternity leave period; 140 calendar days. The child was born on 02/07/2017. - 04.2017 to 08.07.2018

. The period of parental leave is up to 1.5 years. We believe that the employee did not take out maternity leave for a child under three years of age. - 08.2018

. From this date, the employee goes on another paid leave.

The example data is illustrated in the following figure.

In this figure, the months of the main billing period are shown on a yellow background. This is the period from 08/01/2017 to 07/31/2018. The period that exceeds the main billing period is the period from November 1, 2016 to July 31, 2018. The hexagons representing the months of this period are filled with gray.

The calculation period for calculating the employee’s annual leave includes the months from 11/01/2015 to 10/31/2016. They are indicated by blue hexagons.

Situation 4: accruals are available only in the month of going on vacation

Verbatim quote, paragraph 7 of Resolution No. 922.

“If the employee did not have actually accrued wages or actually worked days for the billing period and before the start of the billing period, the average earnings are determined based on the amount of wages actually accrued for the days actually worked by the employee in the month of occurrence of the event that is associated with maintaining the average earnings"

For example, an employee was hired on April 10 of the current year, and on April 25 he was given paid leave in advance. A more realistic situation is when an employee goes on a business trip, for example, on the day he is hired. The billing period is equal to the period from April 10 to April 24 inclusive.

Situation 5: no billing period

Clause 8 of Resolution No. 922 provides for a rather rare situation.

“If the employee did not have actually accrued wages or actually worked days for the pay period, before the start of the pay period and before the occurrence of an event that is associated with maintaining the average earnings, the average earnings are determined based on the tariff rate established for him, salary (official salary) "

It is difficult to imagine a case where an employee goes on another vacation on the day he is hired, but theoretically it is possible. A more realistic situation is when an employee goes on a business trip, for example, on the day he is hired. In this case, there is no billing period.

Conclusion

The article discusses situations in relation to the standard duration (12 calendar months) of the billing period. However, everything said is also true for any other duration of the billing period. It is only important to remember that if an organization applies a calculation period of a duration other than 12 calendar months, then the corresponding decision must be reflected in the collective agreement or in a local act, paragraph. 6 tbsp. 139 Labor Code of the Russian Federation.

It is not necessary that all months of the billing period be fully worked out. When calculating annual leave or compensation for unused leave, the average monthly number of calendar days in the calculation period is used to determine average earnings. A separate article will be devoted to this issue.

If necessary, the billing period is shifted by 12 months only if there are no accruals in the base billing period; situation 2. In other cases, it is shifted back to the first month inclusive, in which there are accruals taken into account in the average earnings, situation 3.

When insurance premiums were transferred under the control of tax authorities in 2021, a new chapter 34 was added to the Tax Code of the Russian Federation, regulating their calculation and payment procedure. It reveals the concepts that define both reporting periods and billing periods in relation to insurance premiums. In this article we will tell you about the billing period for insurance premiums in 2021, and consider the payment deadlines.

Wherein:

- The reporting period is a quarter, half a year, etc.;

- and the calculated year is the calendar year.

During the billing period, accounting forms the basis for future accruals for insurance premiums. Each billing period is represented by four reporting periods, based on the results of which interim results can be summed up, as well as reporting can be submitted to the tax authority.

Payroll calculation under the piecework wage system: nuances

With piecework wages, as with the second option of time-based wages, which we discussed above, the employer also sets monthly standards for working time and output. Exceeding the relevant standards can increase piecework wages:

- Proportional to production.

Example

Electrical engineer Ivanov works at a television assembly plant. He receives a salary based on a piece-rate scheme, in which the employer has set a standard for assembling 2 televisions within 8 working hours. If it is completed, Ivanov receives 2,000 rubles (tariff: 1,000 rubles for 1 assembled TV).

For each subsequent assembled TV, Ivanov receives 1,000 rubles, regardless of the volume of production.

- Using a progressive scale.

Example

Machine operator Petrov works at a fastener production plant in the bolt production shop. He receives a piece-rate salary, according to which the employer sets a standard for production: 100 bolts within 8 working hours. When it is completed, Petrov receives 390 rubles (tariff - 3 rubles 90 kopecks for 1 bolt).

For every 50 additional bolts collected, Petrov receives 10 rubles apiece. For every 50 following them - 20 rubles. For each subsequent bolt - 30 rubles.

In some cases, a regressive scale may also be used. For example, when the production model of an enterprise requires employees to fulfill planned targets as accurately as possible without significantly exceeding them (as an option, in order to increase the efficiency of control over costs of raw materials).

A separate type of salary is the one that is paid during the employee’s business trip (Articles 139, 167 of the Labor Code of the Russian Federation). Let's study the specifics of its calculation.

Calculation and reporting period for insurance premiums

The reporting period is recognized as:

- first quarter;

- half year;

- nine month;

By the way, for entrepreneurs who carry out their activities independently, without hiring employees and pay contributions only “for themselves,” there is no reporting period. In addition to entrepreneurs, such taxpayers include lawyers, notaries, etc. There are no specific deadlines for paying contributions during the year; they can pay the entire amount no later than December 31 of the accounting year.

If entrepreneurs have hired employees, they make deductions in the same manner as for organizations and submit reports at the end of each reporting period.

When an organization registered as a legal entity after the beginning of the year, the first billing period is set to the period from the date of registration to the end of the year.

Example 1.

Continent LLC received a certificate of registration of a legal entity on April 13, 2021. Thus, the billing period for Continent LLC will be as follows: from April 13, 2021 to December 31, 2017. And the subsequent billing period will be equal to the full 2020 calendar year.

If the liquidation (reorganization) of a company occurs before the end of the calendar year, the end of the billing period will be the day the liquidation of the company or its reorganization is completed.

Example 2.

Romashka LLC filed documents for liquidation. On November 18, 2017, Romashka LLC received an extract from the Unified State Register of Legal Entities. Accordingly, the billing period for insurance premiums will be as follows: from January 1, 2017 to November 18, 2021 inclusive.

In the event that the creation of a legal entity occurred after the beginning of the year, and liquidation or reorganization occurred before its completion, the calculation period should be recognized as the period from registration to liquidation.

Example 3.

Premier LLC received a certificate of registration on April 5, 2017, and an extract from the Unified State Register of Legal Entities on liquidation on November 1, 2021. The calculation period for strass contributions will be as follows: from April 5, 2021 to November 1, 2021 inclusive.

Thus, in the billing period, at the end of each month, contributions are calculated based on the results of each month, based on the salary or other remuneration paid to employees. In this case, payments are taken into account from the beginning of the billing period to the end of the reporting month. The calculation is made taking into account the tariff rate, existing allowances or benefits to the tariff rate, subtracting the amount of the insurance payment calculated from the beginning of the billing period until the previous month.

Example 4.

Continent LLC paid salaries and bonuses to employees:

- January 2021 – 120,000 rubles

- February 2021 – 140,000 rubles

- March 2021 – 130,000 rubles

At the end of January, the accountant calculated and paid contributions to compulsory pension insurance at a rate of 22%:

- 120,000 x 22% = 26,400 rubles

Based on the results of February, the accountant made the following calculation:

- (120,000 + 140,000) x 22% – 26,400 = 30,800 rubles

At the end of March, the accountant made the following calculation:

- (120,000 + 140,000 + 130,000) x 22% – (26,400 + 30,800) = 28,600 rubles

What personnel information does an accountant need to calculate payroll?

To correctly calculate an employee’s salary for the past month, an accountant must have the following information:

- the date from which the employee began work (for newly hired employees);

- the remuneration system established for the employee (in most cases - time-based or piecework);

- the amount of remuneration established for the employee (salary amount, tariff rate, etc.);

- time actually worked during the month (with a time-based system), or the volume of products produced or services provided (with a piece-rate system);

- the date from which the employee stopped working (for dismissed employees).

This information comes to the accounting department from the HR department. As a rule, HR officers provide accountants with photocopies of hiring and dismissal orders, vacation orders, employment contracts, staffing schedules and time sheets. If a company has a payroll program installed, then HR officers enter data into it, and the accounting department makes calculations based on them.

Create a staffing table using a ready-made template Try for free

Deadlines for submitting reports on insurance premiums

At the end of each reporting period, organizations are required to submit reports on insurance premiums to the tax authority. It is submitted no later than the 30th day of the month following the reporting period. That is, the report for the 1st quarter must be submitted no later than April 30. In the event that the last day of delivery falls on a weekend, the deadline is moved to the first next working day. So, in 2021, April 30 is a day off, and May 1 is a holiday, then the deadline for delivery is postponed to May 2.

The report is provided electronically or in paper form, it depends on the average headcount of the organization for the previous year. For example, if in 2021 it was more than 25 people, then the report will need to be submitted only in electronic form. Otherwise, the company will face penalties of 200 rubles. If the average headcount is less than 25 people, the company itself chooses the method of reporting. There will be no penalty for providing the report in non-electronic form.

Calculation of average earnings upon dismissal

When an employee is dismissed, a company is liquidated or staff is reduced, he is paid severance pay in the amount of average monthly earnings (Part 1 of Article 178 of the Labor Code of the Russian Federation).

Since this payment is provided for by the Labor Code of the Russian Federation, the general procedure is used to calculate average earnings using average daily earnings (regulation No. 922).

According to paragraph 9 of the regulation, to determine the average salary, you need to multiply the average daily salary by the number of paid working days.

The average daily salary is calculated using the formula:

SDNZ = accruals for days worked in the billing period / number of days worked.

Calculation example

An employee of a company with a five-day work week was dismissed due to staff reduction on August 17, 2021. He is paid for the period from August 18 to September 17, 2021, that is, 23 working days. Billing period: August 1, 2021 – July 31, 2021. The salary for this period amounted to 420,000 rubles (vacation pay is not taken into account). He worked there for 230 days.

SDNZ = 420,000/ 230 days. = 1,826 rubles;

SZ - 1,826 rubles x 23 days. = 41,998 rubles.

Responsibility for violations in reporting

If, when checking the report, the inspector finds an error, the company will be notified of its elimination in electronic or paper form. At the same time, the period established for eliminating the error is 5 working days when sending an electronic notification and 10 when sending by mail. If the company, for any reason, ignores the inspector’s requirement, the calculation receives the status of unrepresented. For this, the company will be fined in the amount of 5% of the calculated insurance premiums for each month of delay.

The amount of the fine cannot exceed 30% of contributions, but it cannot be less than 1000 rubles.

The legislative framework.

A debit card is a convenient tool for everyday payments. To get the maximum benefit from its use, you need to know some concepts that will allow you to adjust your actions, fulfill the bank’s conditions and receive bonuses.

The calculation of bonuses, such as free service, cash back, accrual to the balance, etc., for the Tinkoff card product is based on payment transactions for a certain period.

What documents to fill out when issuing salaries?

Article 136 of the Labor Code obliges employers to notify each employee in writing of all accruals and deductions, as well as the final amount of salary that the employee will receive. To fulfill this requirement, companies and entrepreneurs draw up and issue so-called payslips to employees.

The form of such a sheet is not established, so each employer develops it independently. The main thing is that the form contains fields for all the necessary information.

In addition, you should fill out either a payroll statement (you can use form No. T-49) or two other statements: settlement (you can use form No. T-51) and payment (you can use form No. T-53). In the case when salaries are transferred to cards, only a payslip is needed.

When does the billing period begin?

The start date of this period is individual for each client. It depends on the day on which the statement is generated. You can find out the date by calling the customer service center, in your online bank or in the statement you have already received. The date indicated after the phrase “for the period from...” will be the beginning of the settlement period. In some cases, it may begin at the beginning of a new month.

This date can be changed by calling the bank's hotline (the offer is considered individually).

What is the billing period for?

The debit card billing period for calculating the annual service.

The cost of servicing a TKS debit card account is 99 rubles. per month. However, if during the spending period the cardholder opened a deposit, had an active cash loan in rubles or an account balance of 30,000 rubles or more, then this money will not be charged from him.

For the first month, the client will be charged the cost of service. For subsequent months, this will depend on compliance with the specified conditions.

It turns out that if you simply keep at least 30,000 rubles in your account, you can use it for free. Another advantage is that if you make a deposit, you can also receive interest. It is important to know that this balance will be taken into account at the end of each day, and if on one day the required amount turns out to be less than even a penny, then the client will be charged a service charge of 99 rubles.

Peculiarities

You may be interested in: How an advance is calculated: the calculation procedure, rules and features of registration, accrual and payment

As a rule, a settlement period is not a one-time period, but a recurring period of time, which is introduced in the financial system for the convenience of mutual settlements. It is after this period that the results are summed up, calculations and other financial transactions are completed.

There are no specific deadlines for the billing period. It is often determined individually and is always specified in the contract between the parties. It is upon its completion that calculations must be made.

The calculation period for calculating interest on the account balance.

You can receive additional interest without even opening a deposit. If during the expendable period the user has from 0 to 300,000 rubles stored on the card account, then TKS charges 8% (now the income has been increased to 14%).

If the amount turns out to be more than 300,000 rubles, then the client will be able to receive only 4% on the balance. The bank will charge the same interest on the balance if no payment transactions were made on the card account during the billing period. It is worth knowing that only transactions of purchasing goods using plastic or its details are taken into account. Transactions such as payments for mobile communications, Internet, transfers to electronic accounts and other transfers will not be counted. If the transaction has gone through, but has not yet been processed by the bank, then it is also not protected.

Accrued interest is paid on the date the statement is generated.

When to calculate and pay vacation pay and sick leave benefits

If an employee goes on vacation during the month, the accountant is obliged to issue vacation pay no later than three days before the start of the vacation (we are talking about calendar days - letter of the Ministry of Labor dated July 30, 2014 No. 1693-6-1). This means that, unlike regular salaries, vacation pay must be calculated without waiting for the end of the month. There is enough time for this, because the employee must be notified of the vacation no later than two weeks before the start of the vacation, and most often it is during this time that the vacation order is issued.

The situation with sick leave benefits is different. It can be calculated and paid along with wages, that is, after the end of the month in which the employee brought closed sick leave to the accounting department.

Work with electronic sick leave and submit all related reporting through Kontur.Extern

Calculation period for accruing the cash back bonus.

Cash back is credited on each last day of the spending period. At the same time, its size cannot exceed 3,000 rubles. (everything higher is burned). If the client has several cards and the total cash back exceeds this threshold, then it will be credited in proportion to the money spent.

Cash back is calculated based on:

- 1% for all payment transactions during the settlement period (max. RUB 3,000)

- 5% for increased bonus categories (they change at the discretion of TKS, for example, in October, November and December 2014 - gasoline, automobile services, pharmacy chains, transport) (max. RUB 3,000)

- Up to 30% on special offers from bank partners (you can activate them in your online account or in the application for your mobile device). If a refund was made under a special offer, and the client has already received a reward, the bank will write off the accrued bonuses from the account. The maximum bonus amount can be 6,000 rubles. If a client has several TKS cards, and the total amount of bonuses for them exceeds this threshold, then bonuses will be awarded in proportion to 6,000 rubles. on all cards.

For example, if you spend about 10,000 rubles per month on a card. and have a balance of 30,000 rubles, then in a year you can return about 4,700 rubles.

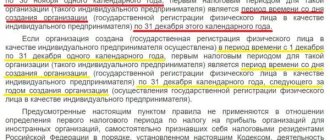

Billing and reporting periods

Billing period

for insurance premiums, in general,

the calendar year

(read about exceptions below)

- clause 1 of Art.

10 of the Law of July 24, 2009 No. 212-FZ. For example, from

January 1 to December 31, 2010

Reporting periods

are recognized (see

paragraph 1 of Article 10 of the Law of July 24, 2009 No. 212-FZ):

· first quarter;

· half a year;

· nine months of the calendar year;

· calendar year.

In some cases (when an organization is created, liquidated and/or reorganized within a calendar year), the reporting period is determined differently.

Features (rules) of determining the billing period in individual cases

If the organization was created after the beginning of the calendar year, the first billing period for it is the period from the date of creation until the end of this calendar year (Clause 3, Article 10 of Law No. 212-FZ of July 24, 2009).

For example, if an organization was created on March 15, 2010, then the first billing period for it will be the period from March 15 to December 31, 2010.

If the organization was liquidated or reorganized before the end of the calendar year, the last billing period for it is the period from the beginning of this calendar year until the day the liquidation or reorganization was completed (clause 4 of article 10 of the Law of July 24, 2009 No. 212-FZ).

For example, the liquidation of the organization ended on November 17, 2010 ,

therefore, the last billing period for it will be the period from January 1 to November 17, 2010.

If an organization created after the beginning of the calendar year is liquidated or reorganized before the end of this calendar year, the calculation period for it is the period from the date of creation to the day the liquidation or reorganization is completed (Clause 5 of Article 10 of the Law of July 24, 2009 No. 212-FZ) .

Example: an organization was created on February 8, 2010 and reorganized on September 23, 2010. In this case, the billing period for this organization is the period from February 8 to September 23, 2010.

Please note that according to paragraph 6 of Art. 10 of the Law of July 24, 2009 No. 212-FZ

These rules do not apply to organizations from which one or more organizations are separated or joined.

What has changed compared to the unified social tax?

The period, which for the purpose of calculating the unified social tax was called the tax period, for the purpose of calculating insurance premiums is called the billing period.

Accrual of vacation payments in days

After determining total earnings, to calculate vacation pay, you should calculate the average daily wage. If the employee has worked in full for the last 12 months, without deductions for the days of the pay period, then the calculation is made using the formula: SD.z. = Salary : 12 : 29.3.

Where:

- Salary – the total amount of earnings for the entire period;

- 29.3 – average number of days in one month;

- 12 – value of the billing period in months (in this case the year is set).

Let's consider an example of calculating average daily earnings for calculating vacation payments: from March 14 to April 27, 2021, accountant X will be granted annual paid leave. For the calculation, the period from 03/01/15 to 02/29/16 is used, which is fully worked out, without deductions. X receives a monthly fixed salary of 18 thousand rubles. Calculate average daily earnings.

Let's do the calculations:

- The total salary for the year will be: 18,000 × 12 = 216,000 rubles.

- The average daily wage will be determined at: 216,000: 12: 29.3 = 614.33 rubles.

- In total, for 14 days of vacation, the company must pay the amount: 614.33 × 14 = 8600.62 rubles.