When VAT exemption is unprofitable

In some cases, it is not profitable to use the VAT exemption. One of the reasons is that input VAT on goods (work, services) used for activities exempt from tax is not deductible (subclause 1, clause 2, article 170, subclause 1, clause 2, article 171 of the Tax Code of the Russian Federation ). If the taxpayer has declared an exemption from tax and then issues invoices, VAT is still not deductible (letter of the Ministry of Finance of Russia dated September 19, 2013 No. 03-07-07/38909).

Therefore, the question of the advisability of using tax exemption should be decided based on comparative analysis. If the effect of applying the exemption established by paragraph 3 of Art. 149 of the Tax Code of the Russian Federation turns out to be unprofitable for the main activity, then the taxpayer may refuse to use the VAT exemption (clause 5 of Article 149 of the Tax Code of the Russian Federation).

If old benefits were canceled or new ones were introduced

It may turn out that legislation abolishes old ones or establishes new benefits. In this case, the tax is calculated in the order that was in effect at the time the goods were shipped. The date of payment by the buyer does not matter (clause 8 of Article 149 of the Tax Code of the Russian Federation).

The old product benefit has been cancelled.

Let's say that when the goods were shipped, the benefit for them was canceled.

Then the company must pay VAT, even if the buyer paid for these goods when the exemption was still in effect. EXAMPLE 3. After the goods were shipped, the VAT benefit was for the sale of goods that were not subject to VAT.

The goods were paid for by the buyer on June 10, and shipped to him on July 5. Let’s assume that on July 1, changes to the Tax Code came into force, canceling the benefit for these goods. For goods shipped on July 5, Radar must pay VAT, since at the time of their shipment the exemption was no longer in effect. If the buyer made an advance payment before the changes canceling the benefit came into force, the seller needs to issue an invoice already including VAT and require the buyer to pay an additional amount of tax.

EXAMPLE 4. The seller received an advance for goods before the abolition of the VAT exemption.

Kosmos LLC sells goods not subject to VAT. On December 20 of this year, the buyer transferred an advance to Kosmos to pay for the goods in the amount of 50,000 rubles.

(without VAT). From January 1 of the following year, the benefit for these goods was canceled, and they began to be subject to VAT at a rate of 10%. Cosmos shipped the goods to the buyer on January 10. The Cosmos accountant must make the following entries: December 20 DEBIT 51 CREDIT 62 SUBACCOUNT “ADVANCES RECEIVED”

— 50,000 rub.

– advance payment has been received from the buyer; January 10 DEBIT 62 SUBACCOUNT “PAYMENTS WITH CUSTOMERS” CREDIT 90-1

- 55,000 rubles.

(RUB 50,000 + RUB 50,000 × 10%) – revenue from the sale of goods is reflected (including VAT); DEBIT 62 SUB-ACCOUNT “ADVANCES RECEIVED” CREDIT 62 SUB-ACCOUNT “PAYMENTS WITH CUSTOMERS”

- 50,000 rubles.

– prepayment is credited; DEBIT 90-3 CREDIT 68 SUBACCOUNT “VAT CALCULATIONS”

- 5000 rub.

(RUB 55,000 × 10%: 110%) - VAT is charged. As a result of these transactions, the buyer incurred a debt in the amount of RUB 5,000. When the buyer pays off the debt, an entry must be made in the accounting: DEBIT 51 CREDIT 62 SUB-ACCOUNT “SALEMENTS WITH BUYERS”

— 5000 rub. - money has been received from the buyer.

A new product benefit has been established

If at the time of shipment the benefit is not yet in effect (that is, changes adopted in the legislation have not yet entered into force), you will have to pay VAT.

Even if the money arrives at a time when the benefit is already in effect. EXAMPLE 5. If at the time of shipment there is a VAT benefit,

Radar LLC sold goods that were subject to VAT. The goods were shipped to the buyer on June 10 and paid for on July 5. Let us assume that on July 1, changes to the Tax Code came into force, allowing a company not to pay VAT when selling these goods. Despite the fact that the money was received on July 5, for goods shipped on June 10, Radar must pay VAT, since at the time of their shipment, the benefit was not yet in effect.

The greatest difficulties will arise if the buyer transferred money for the goods in advance, including tax, and before the goods were shipped, the law established a new benefit.

In this case, if on the date of shipment the goods are no longer subject to VAT, the accountant needs to deduct the VAT paid on the advance payment and return the tax amount to the buyer.

EXAMPLE 6. What to do if payment was received for a preferential product, including VAT.

Cosmos LLC sold products of its own production, subject to VAT.

To pay for the products, the company received an advance in the amount of 120,000 rubles. (including VAT - 20,000 rubles). The advance payment was received on June 25. Let’s assume that on August 1, changes to the Tax Code came into force, allowing the company to use the benefit. Starting from this time, Kosmos products are not subject to VAT. The goods were shipped to the buyer on August 10. The Kosmos accountant must make the following entries: June 25 DEBIT 51 CREDIT 62 SUB-ACCOUNT “ADVANCES RECEIVED”

- 120,000 rubles.

– advance payment received from the buyer; DEBIT 62 SUB-ACCOUNT “ADVANCES RECEIVED” CREDIT 68 SUB-ACCOUNT “VAT CALCULATIONS”

- 20,000 rubles.

(RUB 120,000 × 20%: 120%) – VAT is charged on the advance; until July 25, August 25, September 25 DEBIT 68 SUBACCOUNT “VAT CALCULATIONS” CREDIT 51

- 6667 rub.

– VAT was paid to the budget based on the results of the tax period (according to the declaration for the second quarter); August 10 DEBIT 62 SUBACCOUNT “PAYMENTS WITH CUSTOMERS” CREDIT 90-1

- 100,000 rubles.

(120,000 − 20,000) – revenue from the sale of products is reflected (excluding VAT); DEBIT 68 SUB-ACCOUNT “VAT CALCULATIONS” CREDIT 62 SUB-ACCOUNT “ADVANCES RECEIVED”

- 20,000 rubles.

– VAT accrued on the advance payment is accepted for deduction; DEBIT 62 SUB-ACCOUNT “ADVANCES RECEIVED” CREDIT 62 SUB-ACCOUNT “PAYMENTS WITH CUSTOMERS”

- 100,000 rubles.

– the received advance is credited; DEBIT 62 SUBACCOUNT “ADVANCES RECEIVED” CREDIT 51

- 20,000 rub. – the amount of VAT is returned to the buyer. Transactions related to writing off the cost and generating the financial result are made in the generally established manner.

For which transactions can you refuse VAT exemption?

Refusal of tax exemption is possible for transactions specified in paragraph 3 of Art. 149 of the Tax Code of the Russian Federation. pp. 1 and 2 tbsp. 149 of the Tax Code of the Russian Federation does not give such a right, and it is impossible to refuse exemption for the operations listed in these paragraphs.

More details about what operations are listed in Art. 149 of the Tax Code of the Russian Federation, read the material “Operations not subject to VAT: types and features.”

If a taxpayer has several types of transactions that are suitable for exemption, then a waiver can be made for all or several types of transactions. That is, refusal is allowed as for all subparagraphs of clause 3 of Art. 149 of the Tax Code of the Russian Federation, and according to one of them.

Example

Initial data:

The real estate company sells residential buildings, residential premises and shares in them (subclause 22, clause 3, article 149 of the Tax Code of the Russian Federation), and in addition carries out charitable activities (subclause 12, clause 3, article 149 of the Tax Code of the Russian Federation).

Solution:

A legal entity carries out 2 types of operations provided for by different subparagraphs of clause 3 of Art. 149 of the Tax Code of the Russian Federation. The company has the right to write a statement of refusal to exemption for one of the transactions or both. That is, she can, for example, refuse the exemption for charitable activities and continue to use the exemption for real estate activities and vice versa.

If the exemption is waived, all contracts and transactions concluded by the taxpayer in connection with the exempt activity will be subject to it. The waiver should not apply based on who the buyer is.

For example, a company providing banking services for granting loans (subclause 15, clause 3, article 149 of the Tax Code of the Russian Federation) does not have the right to refuse the exemption in relation to services provided to legal entities, and when providing the same services to individuals, continue to use the exemption from tax

Read about the existing types of VAT exemption in the article “How to obtain an exemption from VAT in 2014-2016?”

"Popular" benefits

In practice, VAT benefits are most often used for the provision of medical or educational services. And here there are some peculiarities that must be taken into account in the work.

Medical services

The sale of “...medical services provided by medical organizations, individual entrepreneurs engaged in medical activities, with the exception of cosmetic, veterinary and sanitary-epidemiological services” is not subject to VAT. If veterinary and sanitary-epidemiological services are financed from the budget, then they are also not subject to VAT. This benefit is established by subparagraph 2 of paragraph 2 of Article 149 of the Tax Code of the Russian Federation.

The benefit can be used by medical organizations and institutions, private individual entrepreneurs - doctors and medical centers on the balance sheet of non-medical companies.

Here is a list of medical services that are not subject to VAT.

1. Services provided under compulsory health insurance. Such services can be provided to both individuals and companies. The list of these services is given in Decree of the Government of the Russian Federation dated October 4, 2010 No. 782 and Methodological recommendations approved by the Ministry of Health of the Russian Federation and the Federal Compulsory Medical Insurance Fund on August 28, 2001 No. 2510/9257-01, 3159/40-1.

2. Services provided to the population according to the list approved by Decree of the Government of the Russian Federation dated February 20, 2001 No. 132. These include:

- diagnostic, prevention and treatment services directly provided to the population within the framework of outpatient (including pre-medical) medical care, including medical examination;

- diagnostic, prevention and treatment services directly provided to the population as part of inpatient medical care, including medical examination;

- diagnostic, prevention and treatment services directly provided to the population in day hospitals and by the services of general (family) doctors, including medical examinations;

- diagnostic, prevention and treatment services directly provided to the population in sanatorium and resort institutions;

- health education services provided directly to the public.

According to financial officials, if a licensed organization provides the population with medical services mentioned in this list free of charge, then these services are also not subject to VAT (letter of the Ministry of Finance of Russia dated April 13, 2016 No. 03-07-11/21224).

3. Services for collecting blood from the population. A medical organization or private doctor must have an agreement with a medical organization providing medical care in outpatient and inpatient settings.

4. Services provided by medical organizations and private doctors to pregnant women, newborns, disabled people and drug addicts.

5. Emergency medical services.

6. Services for medical personnel on duty at the patient’s bedside.

7. Pathological services.

8. Services of pharmacies for the manufacture of medicines for medical use (the benefit is provided for in subclause 24, clause 2, article 149 of the Tax Code of the Russian Federation).

9. Services for the manufacture and repair of spectacle optics (except for sun protection), repair of hearing aids and prosthetic and orthopedic products, services for the provision of prosthetic and orthopedic care (the benefit is provided for in subclause 24, clause 2, article 149 of the Tax Code of the Russian Federation).

10. Sanitary, epidemiological and veterinary services financed from budget funds. In this case, the company must have the following documents:

- license;

- contract for the provision of veterinary or sanitary-epidemiological services indicating the source of financing;

- written notification of the customer, to whom funds have been allocated from the federal budget, to the company about the targeted budget funds allocated to him to pay for sanitary-epidemiological and veterinary services;

- a certificate from the financial authority about the opening of financing of veterinary and sanitary-epidemiological services at the expense of the regional or local budget.

Veterinary and sanitary-epidemiological services that are not financed from the budget or are financed on a repayable basis are subject to VAT.

A company or doctor engaged in private practice must have a license to practice medicine.

If there is no such license, then the benefit cannot be applied.

If your company provides medical services that are not subject to VAT, then you cannot refuse this benefit.

But the services of intermediaries in the field of medical services are subject to VAT.

EXAMPLE 7. Intermediary medical services are subject to VAT.

Be Healthy LLC provides paid emergency medical services to the population. At the same time, the company transports patients both within the framework of emergency care and for hospitalization for preventive and diagnostic purposes. Services provided within the framework of emergency care are not subject to VAT. Transportation of patients for hospitalization for preventive or diagnostic purposes, that is, in situations that do not threaten the life and health of people, is subject to VAT, since it is an intermediary service.

Educational services

Sales are not subject to VAT (subclause 14, clause 2, article 149 of the Tax Code of the Russian Federation) “...services in the field of education provided by non-profit educational organizations for the implementation of general education and (or) professional educational programs (main and (or) additional), professional training programs specified in the license, or the educational process, as well as additional educational services corresponding to the level and focus of educational programs specified in the license, with the exception of consulting services, as well as services for leasing premises.”

In other words, services in the field of education are exempt from VAT not only if they are specified in the license. The benefit also applies to additional services that correspond to the educational programs of the organization (for example, classes with a speech therapist in a preschool educational institution). The benefit is provided only to non-profit educational organizations. They do not pay VAT regardless of how the income received from the provision of educational services is distributed.

There are a number of fairly common services of non-profit educational organizations that are subject to VAT. Such services include, in particular:

- consulting services;

- premises rental services;

- sales of goods of own production, manufactured by educational enterprises;

- sale of goods purchased externally.

Services of commercial organizations and individual entrepreneurs in the field of education are taxed in accordance with the generally established procedure.

Classes with children in clubs, sections and studios are not subject to VAT (subclause 4, clause 2, article 149 of the Tax Code of the Russian Federation).

EXAMPLE 8. Fees for additional classes at school are not subject to VAT.

The school has a swimming pool on its balance sheet. In addition to the main classes with students, the organization also conducts additional classes for children under 18 years of age on a paid basis. In this case, fees received for additional classes are not subject to VAT.

If your company provides services in the field of education and is entitled to a benefit, then you must definitely apply it. You cannot refuse the benefit.

The services of intermediaries in the field of education are subject to value added tax at a rate of 20 percent.

In general, intermediaries deserve to talk about their taxation in a little more detail.

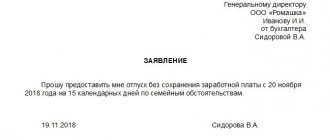

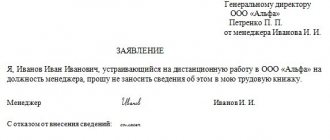

What form is used to refuse to use tax exemption?

Refusal to use the exemption due to the nature of the action is considered a notification.

In order for the taxpayer to exercise his legal right, he should send a refusal application to the tax authority at the place of registration no later than the 1st day of the period from which it is planned to issue a refusal of exemption. If this date coincides with a holiday or weekend, the application is submitted on the next working day (clause 7 of Article 6.1 of the Tax Code of the Russian Federation, letter of the Federal Tax Service of Russia dated August 26, 2010 No. ШС-37-3/10064).

The form of the application is not established by law, so it is drawn up in any form.

The statement states:

- a list of ongoing operations for which it is planned to issue a waiver of exemption,

- the period from which the taxpayer intends to refuse to use the exemption,

- validity period during which it is planned not to use the exemption (at least 1 year).

Application for benefits for applying a reduced tax rate

Is it necessary to submit an application for a benefit to apply a reduced tax rate in relation to land plots of a certain type of permitted use?

Reduced tax rates for the taxation of land plots for certain types of permitted uses are not tax benefits. Thus, to apply a reduced rate (for example, the rate established by Article 2 of Moscow Law No. 74 dated November 24, 2004 in the amount of 0.1% in relation to land plots occupied by the housing stock), an application for a benefit is not required.

What are the consequences of failure to submit an application for refusal?

If the deadline for submitting a notice of refusal to release is violated or the application is not submitted at all, then this will not entail any negative consequences. Moreover, a taxpayer who has in fact refused to apply the exemption (i.e., pays sales tax on sales), but has not submitted an application for this, also has the right to apply deductions when calculating the tax payable.

Read more about this in the article “We didn’t have time to notify the tax authorities about the refusal of VAT exemption.

What about deductions? You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Arbitration practice

In July 2015, the Arbitration Court of the Moscow District considered one of these cases. From 2010 to 2012, the management company (MC) applied the VAT exemption due to it in accordance with subparagraph 29 of paragraph 3 of Article 149 of the Tax Code of the Russian Federation. At the same time, the amounts of “input” tax were reflected as part of the costs taken into account when forming the income tax base. A year after the specified period, the management company filed updated VAT returns with tax amounts to be reimbursed. Then the company sent to the tax office an application for refusal of preferential taxation on VAT in the period under review. The Federal Tax Service considered that the Criminal Code violated the procedure established by law for refusing tax exemption, and did not accept the VAT amounts for deduction. Thus, the case ended up before the arbitrators.

During the trial, the management company adjusted its income tax obligations for 2010–2012. However, this did not help her: the court ruled in favor of the tax service and indicated that preferential taxation can be abandoned solely on the basis of an application submitted before the tax period in which VAT is expected to begin to be calculated (Resolution of the Administrative District of Moscow dated July 23, 2015 No. F05- 9189/2015 in case No. A40-144426/14). This procedure, according to the arbitrators, is designed to maintain the taxation system in a stable and stable state, as well as to plan budget revenues in a timely manner.

A similar situation was considered at the beginning of last year by the Arbitration Court of the Volga District. The only difference was that in this case the company filed an application for refusal of preferential taxation before filing updated returns, which reflected the VAT refund. However, this fact did not have a significant impact, since the arbitrators also sided with the tax inspectorate and recognized the refusal to refund VAT as lawful (Resolution of the AS PO dated January 28, 2015 No. F06-19353/2013, F06-20058/2013 in case No. A55-6412/ 2014 ).

Thus, in such situations, arbitration courts come to the following conclusions. It is impossible to “retroactively” refuse tax exemption in the case when the taxpayer fulfilled its obligations to the budget taking into account the right to a benefit and included the amount of “input” VAT in income tax expenses.