Compensation in the amount of three times average monthly earnings

Provisions for the number of days actually worked during this period. In this case, the organization can calculate the average daily earnings in the specified order, but the multiplier “number of days (calendar, working) in the period subject to payment” for calculating the average earnings is missing, since there is no period itself subject to payment. After all, the organization does not pay the employee severance pay several months in advance after dismissal, but compensation upon dismissal by agreement of the parties without indicating any period for which it is paid. And the above norms of paragraph 3 of Art. 217, paragraphs. 2 p. 1 art. 422 of the Tax Code of the Russian Federation also speaks of three (six) times the average monthly earnings, and not the average earnings for three (six) months after dismissal. In other words, we are talking about the average monthly earnings of the dismissed employee, multiplied by three (six).

Why do you need to know your average monthly earnings?

The amount of average monthly earnings is required in the following situations.

Calculation of the average monthly salary is necessary in order to pay the employee for the time when he was absent from work for some reason , but he is entitled to monetary compensation. Such payments include accruals for vacation, both regular and educational, payment for sick days or maternity leave, business trips, and downtime.

Often, when applying to various authorities, you are required to provide a document from your place of work about the amount of average earnings. The certificate is required for social services when providing subsidies for utility services, for the pension fund when calculating pensions, for a credit institution when applying for a loan , for the labor exchange when determining the amount of cash assistance for unemployment.

Calculation of severance pay in the amount of three times monthly earnings

Therefore, if payments to such employees threaten to exceed the established amount, pay them in an amount that will not exceed the amount. When determining the total amount, do not take into account the amount of the following payments:

- wages due to employees;

- average earnings retained when sent on a business trip, for off-the-job vocational training, and in other cases when the employee retains average earnings under labor legislation;

- reimbursement of expenses associated with business trips and relocation to work in another area;

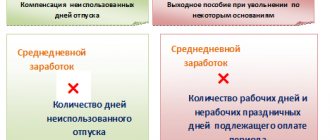

- compensation for all unused vacations;

- average monthly earnings saved for the period of employment.

This procedure is established in Article 349.3 of the Labor Code of the Russian Federation. To do this, you need to divide your salary for the last 12 months (excluding vacation pay and disability benefits) by the number of working days this year

- Calculate the number of working days for the period for which compensation is calculated - that is, for three months, starting from the date of dismissal

- Multiply the amount of average daily earnings by the number of working days in the period for calculating compensation

How to calculate the average monthly earnings for the payment of severance pay, average earnings for the period of employment and compensation upon dismissal Calculation of taxes in connection with the calculation of compensation When calculating compensation payments associated with the reduction or liquidation of a company, the question arises of paying taxes on these amounts. Are they subject to personal income tax? The answer to this question is contained in the Tax Code. According to Art. When determining the total amount, do not take into account the amount of the following payments:

- wages due to employees;

- average earnings retained when sent on a business trip, for off-the-job vocational training, and in other cases when the employee retains average earnings under labor legislation;

- reimbursement of expenses associated with business trips and relocation to work in another area;

- compensation for all unused vacations;

- average monthly earnings saved for the period of employment.

This procedure is established in Article 349.3 of the Labor Code of the Russian Federation. Compensation upon dismissal of a director: is it always mandatory Read on the topic in the electronic magazine Features of calculating compensation in the amount of three times monthly earnings In order to correctly establish the amount of compensation for directors upon dismissal, you need to determine their average earnings and use the correct calculation formula. Let's look at the features of calculating compensation in the amount of three times monthly earnings. For the correct calculation you need: How to determine the average daily earnings to calculate compensation for unused vacation upon dismissal

- Determine the average daily earnings of the dismissed person.

Submitting SZV-M for the founding director: the Pension Fund has made its decision The Pension Fund has finally put an end to the debate about the need to submit the SZV-M form in relation to the director-sole founder. So, for such persons you need to take both SZV-M and SZV-STAZH! <... When paying for “children’s” sick leave, you will have to be more careful. A certificate of incapacity for caring for a sick child under 7 years of age will be issued for the entire period of illness without any time limits.

But be careful: the procedure for paying for “children’s” sick leave remains the same! < ... Home Accounting consultations Average salary Current as of: January 18, 2021 In what cases may an accountant be tasked with calculating the average monthly salary? It turns out that in several.

Who is not paid severance pay?

Severance pay upon dismissal can be defined as a lump sum of money paid to an employee upon dismissal that is not related to the desire of the employee or is not due to his fault. In accordance with Art. 178 of the Labor Code of the Russian Federation, severance pay upon dismissal is paid on the following grounds:

- liquidation of an organization (clause 1, part 1, article 81 of the Labor Code of the Russian Federation);

- reduction in the number (staff) of the organization’s employees (clause 2, part 1, article 81);

- the employee’s refusal to transfer to another job, which is necessary for him in accordance with the medical report, or the employer does not have the appropriate work (Clause 8, Part 1, Article 77 of the Labor Code of the Russian Federation);

- conscription of an employee for military service or sending him to an alternative civil service replacing it (clause 1, part 1, article 83 of the Labor Code of the Russian Federation);

- reinstatement at work of a person who previously performed this work (clause 2, part 1, article 83);

- the employee’s refusal to be transferred to work in another area together with the employer (clause 9, part 1, article 77 of the Labor Code of the Russian Federation);

- recognition of the employee as completely incapable of working in accordance with a medical report (clause 5, part 1, article 83 of the Labor Code of the Russian Federation);

- the employee’s refusal to continue working due to a change in the terms of the employment contract determined by the parties (clause 7, part 1, article 77 of the Labor Code of the Russian Federation).

In addition to those specified in Art. 178 of the Labor Code of the Russian Federation in cases of dismissal, severance pay is paid upon termination of the employment contract due to a violation of the mandatory rules for concluding an employment contract established by the Labor Code of the Russian Federation or other federal law, if this violation excludes the possibility of continuing work (Clause 11, Part 1, Article 77 of the Labor Code of the Russian Federation).

Severance pay can also be called compensation paid upon termination of an employment contract with the head of an organization, his deputy or chief accountant in connection with a change in the owner of property in accordance with Art. 181 Labor Code of the Russian Federation. The amount of compensation must be no less than three average monthly earnings.

In addition, if an employment contract with the head of an organization is terminated in connection with the adoption by an authorized body of a legal entity, or the owner of the organization’s property, or a person (body) authorized by the owner of a decision to terminate the employment contract and in the absence of the manager’s fault, he is paid compensation in the amount determined an employment contract, but not less than three times the average monthly salary (Article 279 of the Labor Code of the Russian Federation).

An employment or collective agreement may provide for other cases of payment of severance pay.

| Categories of workers | Benefit amount | Normative act |

| Resigned or retired judges | Monthly monetary remuneration for the last position for each full year of work as a judge, but not less than six times the amount | Article 15 of the Law of the Russian Federation of June 26, 1992 No. 3132-1 “On the status of judges in the Russian Federation” |

| Wives of military personnel performing military service under a contract upon dismissal due to the movement (transfer, secondment) of military personnel to a new place of military service in another locality | Two-month average salary | Order of the Minister of Defense of the Russian Federation dated July 11, 2002 No. 265 |

| Prosecutors, scientific and teaching workers upon retirement, retirement, health or disability, etc. | From 5 to 15 monthly salaries | Article 44 of the Federal Law of January 17, 1992 No. 2202-1 “On the Prosecutor’s Office of the Russian Federation” |

The Labor Code directly establishes cases when severance pay is not paid. Thus, it is not paid to employees:

- dismissed due to unsatisfactory test results (Article 71);

- dismissed on grounds that relate to disciplinary sanctions (Part 3 of Article 192), or on other grounds established by the Labor Code or other federal laws related to the commission of guilty actions (inaction) by employees (Article 181.1);

- who have concluded an employment contract for a period of up to two months (unless otherwise established by federal laws, a collective or labor agreement) (Article 292).

In addition, in accordance with paragraph 62 of the Resolution of the Plenum of the Armed Forces of the Russian Federation dated March 17, 2004 No. 2 “On the application by the courts of the Russian Federation of the Labor Code of the Russian Federation,” severance pay paid to an employee is subject to credit if he is reinstated at his previous job if the dismissal is declared illegal .

Calculation of three times average earnings upon dismissal by agreement of the parties

To accurately determine the average monthly income, you can contact the company’s accounting department. You can independently determine the amount of the benefit, which is determined precisely by calculating the average monthly earnings. Formula for calculations: Average monthly earnings = amount of full salary/actually worked days * number of calendar days. The formula for determining the amount of average monthly earnings is very easy to use. Anyone can use this algorithm for calculations. First, you should carry out mathematical calculations that will determine each component of the formula, and then substitute it into the general scheme for data processing.

What payments are taken into account when calculating

The amount of the benefit will be affected by payments that were made along with wages. There are several categories of payments that will be taken into account when calculating the average monthly income:

- Actual salary received for the actual period worked.

- The bonuses and remunerations that an employee receives in a standard situation are taken into account. The amount is determined by the number of days worked.

- Payments made by the company in its standard position are taken into account.

Regarding compensation and bonuses, certain calculation rules may apply. Such nuances are determined by the moment at which the employee pays, what type of bonuses and rewards the employees receive.

What payments are not taken into account?

According to the law, all regulated payments made by the enterprise must be taken into account in the process of accruals and calculations. The only nuances may be work days and periodic material rewards.

Average monthly salary according to the Labor Code of the Russian Federation

This is possible if, within a month after dismissal, the employee contacted this service, but was not employed by it. These are the rules of Part 2 of Article 318 of the Labor Code of the Russian Federation.

A similar procedure for dismissal due to liquidation of an organization or reduction of staff applies to employees working:

- in areas not classified as regions of the Far North and equivalent areas, but included in the list of territories where regional coefficients and percentage increases in wages are paid (determination of the Supreme Court of the Russian Federation of November 11, 2005 No. 53-B05-9). For example, in the southern regions of the Irkutsk region and Krasnoyarsk Territory;

- on the territory of closed administrative-territorial entities (clause 4 of article 7 of the Law of July 14, 1992

Features that accompany the calculation of average monthly earnings

Formula for determining the amount To determine a specific amount, it is worth using a special formula that accountants use in their work. This scheme is approved by the TR of the Russian Federation and is relevant for modern legislation:

- First, you should add up your wages for all 12 months. To get the most accurate number possible, it is best to use checks or bank statements.

- The resulting number must be divided by 12 working months. Since wage amounts may vary due to periodic accrual of bonuses, remunerations and additional payments, dividing by 12 will help determine the arithmetic average.

- The arithmetic mean is divided by the index 29.3. The presented index represents the optimal number of working days in a month.

If a workweek has more or fewer working days, then the index 29.3 is not used.

How to calculate average monthly earnings, i.e. average earnings per month

If, for example, your organization is forced to reduce the number of personnel (clause 2 of Article 81 of the Labor Code of the Russian Federation), then you must pay severance pay to each dismissed employee at least in the amount of the average monthly salary (Article 178 of the Labor Code of the Russian Federation). How to calculate the average monthly salary in this case? You can use the formula:

That is, the first action of the formula determines the employee’s average daily earnings, and the second action directly determines the amount of payment for the month.

In other materials on our website you can find more detailed information on how to calculate average monthly earnings when reducing the number of employees.

Calculation of severance pay - we compensate for “moral damage” upon dismissal

For the period from January 13 to February 12, 2012 (21 working days) the following will be paid: 800 * 21 = 16,800 rubles. In the third month the employee was not employed. For the period from February 13 to March 12, 2012 (20 working days) the following will be paid: 800 * 20 = 16,000 rubles. Personal income tax on the amount of severance pay will be: (20,000 – 13,600) * 13% = 832 rubles. Insurance premiums will be charged (insurance rate against accidents at Skazka LLC is 0.2%): (20,000 – 13,600) * 30.2% = 1932.80 rubles. Thus, when calculating severance pay, you need to keep in mind some features of its calculation, as well as correctly calculate personal income tax and insurance contributions. Since he contacted the employment service in a timely manner, the organization is obliged to pay him the average salary for the period of employment for the third month after dismissal. Therefore, on April 13, 2015, Bespalov was paid his average salary. In the third month after dismissal (from March 13 to April 12, 2015) there are 21 working days.

Important

The amount of average earnings for the period of employment for the third month after dismissal was: 21 days. × 971.66 rub./day = 20,404.86 rub. Situation: is it necessary to pay the average salary for the period of employment for the third month to a pensioner dismissed due to the liquidation of the organization (staff reduction)? Yes need. Pensioners have the same rights and responsibilities as other employees of the organization.

Despite the fact that pensioners are not recognized as unemployed (clause 3 of Article 3 of Law No. 1032-1 of April 19, 1991), they are entitled to payment of average earnings for the period of employment.

Benefits upon liquidation of an enterprise

No enterprise or production can give its employees guarantees that it will not go bankrupt or disband. If the financial situation of the production is deplorable and liquidation is planned, then employees must be warned at least 2 months in advance.

In addition, employees are entitled to a number of material benefits. What can workers count on during the liquidation of production?

When contracting

If an employee is laid off, he has the right to compensation, which is the amount of average monthly earnings. Payments are made within 2 months after dismissal. Sometimes payments are made for 3 months.

Upon dismissal

When a person is fired due to the liquidation of an enterprise, the employee can count on the following payments:

- Salary for actual days worked.

- Compensation for unused primary and additional leave.

- Severance pay.

The amounts are determined by legislative acts, as well as instructions.

For severance pay

The calculation is carried out in accordance with the average earnings for the last calendar year. The arithmetic average for all 12 months is determined. If the period of work at the time of liquidation of the enterprise was shorter, then the arithmetic average for the actual time worked is calculated.

For the employment service

After the liquidation of an enterprise, workers can contact the employment service. Here they will help you get a new job that will correspond to your education and professional orientation.

If necessary, the organization will provide financial assistance, which is paid by the state and determined by the legislative framework regarding the Labor Code. Even if such assistance is present, compensation from the previous place of work will be paid in full.

How to calculate three times average monthly earnings

Important Calculation formula:

- First, you should take a statement from the accounting department, which clearly indicates the salary that the employee receives monthly.

- It is worth getting a certificate from HR or accounting that indicates how many days were worked out of the full pay period.

- Using the calendar, calculate the number of working days in accordance with the working week that remain after dismissal.

Having collected all the data, you can begin to process it: divide the amount of the full salary by the days actually worked. Multiply the resulting result by the number of calendar days. This formula is relevant when determining the benefit that an employee who has been laid off will receive. Example of calculations Sometimes it is very difficult to understand the definition of many nuances, even if the calculation formula is elementary. The employee was dismissed due to staff reduction on April 15, 2021.

Calculation of compensation in the amount of three times average monthly earnings

In accordance with paragraph 3 of Art. 217 of the Tax Code of the Russian Federation, compensation payments related to the dismissal of employees are not subject to personal income tax taxation, with the exception, in particular, of the amount of payments in the form of severance pay, average monthly earnings for the period of employment, compensation to the manager, deputy managers and chief accountant of the organization in part exceeding in general, three times the average monthly earnings or six times the average monthly earnings for workers dismissed from organizations located in the Far North and equivalent areas. Thus, compensation payments upon dismissal within three (six times) average monthly earnings are not subject to personal income tax. From a similar norm, paragraphs. 2 p. 1 art.

In what cases is it necessary to calculate

Calculating average monthly earnings can be useful when calculating vacation pay, laying off an employee, or in situations where his rights are infringed.

Different life situations lead to a change in activity type. If this happens through the fault of the employer, then the person can count on temporary financial support. The terms of such payments will be limited to a minimum of 2 months.

To determine material payments, you must know the possible average income for 1 month. Take into account the number of days already worked and the number of working days that will be paid in the future.

The need to determine the amount of average monthly earnings may arise in several cases:

- If an employee is going to be laid off due to a reduction in staff.

- Determination of vacation pay for the employee’s rest period.

- Situations when there is a deterioration in working conditions for an employee or other infringements that are prescribed in the collective agreement of the enterprise.

If an employee has been laid off, the company undertakes to pay an amount equal to the average monthly salary for the period of time determined by the Labor Code of the Russian Federation.

If, after being laid off, it is not possible to get a job immediately, the company will provide financial assistance, which is determined by the size of the average monthly income.

Average monthly salary according to the Labor Code of the Russian Federation

In accordance with paragraph 3 of Art. 217 of the Tax Code of the Russian Federation, compensation payments related to the dismissal of employees are not subject to personal income tax taxation, with the exception, in particular, of the amount of payments in the form of severance pay, average monthly earnings for the period of employment, compensation to the manager, deputy managers and chief accountant of the organization in part exceeding in general, three times the average monthly earnings or six times the average monthly earnings for workers dismissed from organizations located in the Far North and equivalent areas.

Thus, compensation payments upon dismissal within three (six times) average monthly earnings are not subject to personal income tax.

From a similar norm, paragraphs. 2 p. 1 art. 422 of the Tax Code of the Russian Federation it follows that compensation payments upon dismissal within three (six times) average monthly earnings are also not subject to insurance contributions.

At the same time, the procedure for calculating the specified threefold (sixfold) amount of average monthly earnings has not been established by the Tax Code of the Russian Federation.

From the Letters of the Ministry of Finance of Russia dated N 03-04-06/31391, the Ministry of Labor of Russia dated N 17-4/B-283, it follows that in the situation under consideration, the general procedure for calculating the average wage (average earnings) established by Art. 139 of the Labor Code of the Russian Federation, Regulations on the specifics of the procedure for calculating average wages (approved by Decree of the Government of the Russian Federation No. 922) (hereinafter referred to as the Regulations).

According to paragraphs 4, 9 of the Regulations, the calculation of the average salary of an employee, regardless of his mode of work, is based on the salary actually accrued to him and the time actually worked by him for the 12 calendar months preceding the period during which the employee retains the average salary (calculated period).

When determining average earnings, average daily earnings are used.

The average employee's earnings are determined by multiplying the average daily earnings by the number of days (calendar, working) in the period subject to payment.

Average daily earnings, except in cases of determining average earnings for vacation pay and payment of compensation for unused vacations, are calculated by dividing the amount of wages actually accrued for days worked in the billing period, including bonuses and remunerations taken into account in accordance with clause 15 of the Regulations, by the number of days actually worked during this period.

In this case, the organization can calculate the average daily earnings in the specified order, but the multiplier “number of days (calendar, working) in the period subject to payment” for calculating the average earnings is missing, since there is no period itself subject to payment. After all, the organization does not pay the employee severance pay several months in advance after dismissal, but compensation upon dismissal by agreement of the parties without indicating any period for which it is paid.

And the above norms of paragraph 3 of Art. 217, paragraphs. 2 p. 1 art. 422 of the Tax Code of the Russian Federation also speaks of three (six) times the average monthly earnings, and not the average earnings for three (six) months after dismissal.

In other words, we are talking about the average monthly earnings of the dismissed employee, multiplied by three (six).

In our opinion, in this regard, the organization should calculate the employee’s average monthly earnings based on the average monthly number of working days in the billing period, and not the average earnings based on the number of working days in three months after dismissal.

The average monthly number of working days should be determined by dividing the number of working days in the billing period according to the production calendar of a five-day working week by 12.

Based on the foregoing, we believe that for the purposes of exemption from personal income tax and insurance contributions, compensation paid to an employee upon dismissal by agreement of the parties without indicating the period for which it is paid, an organization working on a five-day workweek schedule should calculate three times the employee’s average monthly earnings by dividing the wages actually accrued to him for the 12 months preceding his dismissal (payroll period) by the number of days actually worked during this period and multiplying the resulting average daily earnings by the average monthly number of working days in the payroll period and by three.

No votes yet.

Please wait…

In accordance with paragraph 3 of Art. 217 of the Tax Code of the Russian Federation, compensation payments related to the dismissal of employees are not subject to personal income tax taxation, with the exception, in particular, of the amount of payments in the form of severance pay, average monthly earnings for the period of employment, compensation to the manager, deputy managers and chief accountant of the organization in part exceeding in general, three times the average monthly earnings or six times the average monthly earnings for workers dismissed from organizations located in the Far North and equivalent areas.

Thus, compensation payments upon dismissal within three (six times) average monthly earnings are not subject to personal income tax.

From a similar norm, paragraphs. 2 p. 1 art. 422 of the Tax Code of the Russian Federation it follows that compensation payments upon dismissal within three (six times) average monthly earnings are also not subject to insurance contributions.

At the same time, the procedure for calculating the specified threefold (sixfold) amount of average monthly earnings has not been established by the Tax Code of the Russian Federation.

From the Letters of the Ministry of Finance of Russia dated N 03-04-06/31391, the Ministry of Labor of Russia dated N 17-4/B-283, it follows that in the situation under consideration, the general procedure for calculating the average wage (average earnings) established by Art. 139 of the Labor Code of the Russian Federation, Regulations on the specifics of the procedure for calculating average wages (approved by Decree of the Government of the Russian Federation No. 922) (hereinafter referred to as the Regulations).

According to paragraphs 4, 9 of the Regulations, the calculation of the average salary of an employee, regardless of his mode of work, is based on the salary actually accrued to him and the time actually worked by him for the 12 calendar months preceding the period during which the employee retains the average salary (calculated period).

When determining average earnings, average daily earnings are used.

The average employee's earnings are determined by multiplying the average daily earnings by the number of days (calendar, working) in the period subject to payment.

Average daily earnings, except in cases of determining average earnings for vacation pay and payment of compensation for unused vacations, are calculated by dividing the amount of wages actually accrued for days worked in the billing period, including bonuses and remunerations taken into account in accordance with paragraph.

What is this concept - average monthly salary?

First of all, you need to determine what average earnings are. This is a value that shows how much an employer should pay on average to its employee for a certain period. Depending on the purpose of the accrual, the following may be taken into account:

- Average daily - it is needed when it comes to payment or compensation for a working day (for example, during a business trip), a day of paid rest (accrual of vacation pay or compensation for them if the employee did not use vacation), sickness benefits (“sick leave”).

- Average monthly - it is calculated, as a rule, when paying severance and other benefits for periods calculated in months.

In this case, the usual method for calculating the monthly average is that upon dismissal, by agreement of the parties, the daily earnings are first calculated, and then the result is multiplied by the required number of days.

For dismissal that occurs by agreement, the law does not provide for mandatory payment of compensation . The Labor Code of the Russian Federation requires the employer to accrue and pay the employee only two basic amounts:

- Unpaid salary for the month in which the contract is terminated.

- Vacation pay compensation if the employee did not want to take vacation in kind and quit after it ended.

However, these are just the basic rules. Art. 78 of the Labor Code of the Russian Federation speaks only about the agreement of the parties - which means that the specific conditions of dismissal can be determined by the employee and his management independently .

In practice, quite often we talk about “compensation” - payments from the employer provided for by the employment contract, other regulations of the enterprise, or the terms of a specific agreement with a specific employee.

There is an explanation from the Ministry of Finance of the Russian Federation regarding these payments. In its letter No. 03-03-06/1/188, the ministry indicated that in the absence of norms in local acts, the employee and management have the right to conclude an additional agreement to the employment contract, indicating in it the amount and procedure for payment of compensation due upon termination of the contract with the common consent of the parties .

It is then that the amount of “compensation” is often calculated using average earnings per month or per day of work.

Calculation of average daily earnings upon dismissal

In the first month after dismissal (from January 14 to February 13, 2015), according to the four-day working week calendar, there are 18 working days. The severance pay was: 18 days. × 971.66 rub./day = 17,489.88 rub.

Within two months after his dismissal, Volkov was unable to find a job, which is confirmed by his work book. To maintain the average earnings for the first month, the accountant counted the paid severance pay.

In the second month (from February 14 to March 13, 2015), according to the four-day working week calendar, there are 14 working days. Average earnings for the second month were: 14 days. × 971.66 rub./day = 13,603.24 rub.

An example of calculating severance pay and average earnings for the period of employment for an employee dismissed due to the liquidation of an organization. In the organization P.A. Bespalov works as a storekeeper, his salary is 20,000 rubles.

per month. On January 12, 2015, he was fired due to the liquidation of the organization.

It's fast and free! Table of contents:

- Main characteristics

- Basic rules for the formula for calculating average monthly earnings upon dismissal by agreement of the parties

- Formula for determining the average salary per day

- Calculation procedure

Key Features The average amount of money that an employer pays an employee as compensation for his work is often calculated over a monthly period, but sometimes daily wage calculations are required. Average earnings per day is the total amount of the employee’s salary for the entire pay period, divided by the number of days during which the individual performed his or her job duties.

To do this, you need to divide your salary for the last 12 months (excluding vacation pay and disability benefits) by the number of working days this year

- Calculate the number of working days for the period for which compensation is calculated - that is, for three months, starting from the date of dismissal

- Multiply the amount of average daily earnings by the number of working days in the period for calculating compensation

How to calculate the average monthly earnings for the payment of severance pay, average earnings for the period of employment and compensation upon dismissal Calculation of taxes in connection with the calculation of compensation When calculating compensation payments associated with the reduction or liquidation of a company, the question arises of paying taxes on these amounts. Are they subject to personal income tax? The answer to this question is contained in the Tax Code.

According to Art.

Average earnings for the period of employment

The amount of average earnings for the period of employment depends on when the employee gets a job again:

- if he does not get a job within the first month after dismissal, then count his severance pay against the average earnings for the first month;

- if he does not get a job within the second month after dismissal, then pay him the average salary for that month;

- if he does not get a job within the third month after dismissal, then pay the average salary only if within two weeks after dismissal the employee applied to the employment service, but was not employed (confirmed by the decision of the employment service).

Thus, severance pay is paid for the first month after dismissal. In this regard, the average earnings for the period of employment for the first month after dismissal do not need to be calculated.

Calculate the average earnings for the period of employment for the second and third months using the formula:

| Average earnings for the period of employment for the second (third) month after dismissal | = | Number of working days (hours) in the second (third) month after dismissal (from the day following the end of the first (second) month) | × | Average daily (hourly) earnings |

Such rules for the payment of severance pay and average earnings for the period of employment upon dismissal in connection with the liquidation of an organization (reduction of staff) are provided for in Article 178 of the Labor Code of the Russian Federation.

Situation: is it necessary to pay a dismissed employee the average salary for the period of employment if he got a new job in the middle or at the end of the second month after dismissal?

Yes need. Proportional to the time during which the dismissed employee was not employed.

It is explained this way. Upon dismissal due to liquidation of the organization or reduction of staff, in addition to severance pay, the organization is obliged to pay the dismissed employee the average salary for the period of employment, not exceeding two months from the date of dismissal (in exceptional cases - three months). This is provided for by Part 1 of Article 178 of the Labor Code of the Russian Federation.

This means that in case of employment within the second month, the employer is obliged to pay the former employee the retained average salary. But only for those working days of the month during which this person did not work.

This position is adhered to by specialists from the Russian Ministry of Labor in oral explanations.

An example of paying average earnings for the period of employment. The employee started a new job in the middle of the second month after being fired

In the organization P.A. Bespalov works as a storekeeper, his salary is 20,000 rubles. per month. On January 12, 2015, he was fired due to the liquidation of the organization. Therefore, Bespalov is entitled to:

- severance pay;

- average earnings for the period of employment.

Bespalov's severance pay was paid on the day of his dismissal - January 12, 2015. To determine severance pay, the calculation period is the time from January 1 to December 31, 2014. Bespalov's earnings for this period amounted to 240,000 rubles. (RUB 20,000/month × 12 months). During the pay period he worked 247 days.

Bespalov's average daily earnings were: 240,000 rubles. : 247 days = 971.66 rub./day.

In the first month after dismissal (from January 13 to February 12, 2015) there are 23 working days. The severance pay was: 23 days. × 971.66 rub./day = 22,348.18 rub.

The day after his dismissal, Bespalov registered with the employment service.

During the first month after his dismissal (from January 13 to February 12, 2015), Bespalov was unable to find a job. To maintain the average earnings for the first month after dismissal, the accountant offset the amount of severance pay paid in connection with the dismissal.

During the second month (from February 13 to March 12, 2015) after his dismissal, Bespalov got a new job. His employment date was March 2, 2015. The number of days during which Bespalov was listed as unemployed was 11 working days (from February 13 to February 27 inclusive), which is confirmed by the absence of entries in his work book. On March 2, he was paid the average salary for 11 working days. The amount of average earnings for the period of employment for the second month after dismissal was: 11 days. × 971.66 rub./day = 10,688.26 rub.

Situation: how to calculate the average monthly earnings for payment of severance pay, average earnings for the period of employment and compensation upon dismissal?

The legislation does not provide for a methodology for calculating average monthly earnings. For all cases of maintaining average earnings, a uniform procedure has been established for its calculation based on the average daily (hourly) earnings (Article 139 of the Labor Code of the Russian Federation). Therefore, when calculating the amount of severance pay, average earnings for the period of employment and compensation upon dismissal, it is necessary to use it. The different names that are used to determine the amount of payments cannot serve as a basis for using any other procedure.

For example, severance pay upon dismissal due to staff reduction (liquidation of an organization) must be paid in the amount of the employee’s average monthly earnings (Article 178 of the Labor Code of the Russian Federation). This means that the employee’s average daily (hourly) earnings must be maintained for a month after dismissal. Calculate compensation to an employee for early dismissal in proportion to the time remaining before the expiration of the notice period for termination of the employment contract (Article 180 of the Labor Code of the Russian Federation).

When a manager is dismissed by decision of the owner, he is paid compensation in the amount of three times the average monthly salary (Articles 181, 279 of the Labor Code of the Russian Federation, Resolution of the Constitutional Court of the Russian Federation of March 15, 2005 No. 3-P). In this case, compensation should be calculated based on the average daily (hourly) earnings and working days (hours) during the first month after dismissal (Article 139 of the Labor Code of the Russian Federation, clause 9 of the Regulations approved by Decree of the Government of the Russian Federation of December 24, 2007 No. 922 ). Then it needs to be multiplied by three.

Situation: how to calculate the average earnings for the period of employment of a laid-off person if the organization has established a part-time working week?

Calculate your average earnings based on the number of working days in a month, focusing on the part-time working week calendar.

In this case, the general rule applies: to calculate the average earnings, you need to multiply the average daily earnings by the number of actual working days in the period for which payment is due (clause 9 of the Regulations approved by Decree of the Government of the Russian Federation of December 24, 2007 No. 922). There are no specific provisions in the law for cases where an organization establishes a part-time work week. Just pay for the number of working days per month, taking into account this operating mode.

An example of paying average earnings for the period of employment. The employee did not start a new job in the middle of the second month after being fired. After the dismissal, the organization switched to part-time work

A.V. Volkov worked as a storekeeper, his salary was 20,000 rubles. per month. On January 13, 2015, he was fired due to staff reduction.

After the dismissal (from January 14, 2015), the organization introduced a four-day working week.

In connection with his dismissal due to staff reduction, Volkov is entitled to:

- severance pay;

- average earnings for the period of employment.

Volkov’s severance pay was paid on the day of his dismissal – January 13, 2015. To determine severance pay, the calculation period is the time from January 1 to December 31, 2014. Volkov’s earnings for this period amounted to 240,000 rubles. (RUB 20,000/month × 12 months). During the pay period he worked 247 days.

Volkov's average daily earnings were:

240,000 rub. : 247 days = 971.66 rub./day.

In the first month after dismissal (from January 14 to February 13, 2015), according to the four-day working week calendar, there are 18 working days. The severance pay was:

18 days × 971.66 rub./day = 17,489.88 rub.

Within two months after his dismissal, Volkov was unable to find a job, which is confirmed by his work book.

To maintain the average earnings for the first month, the accountant counted the paid severance pay.

In the second month (from February 14 to March 13, 2015), according to the four-day working week calendar, there are 14 working days. Average earnings for the second month were:

14 days × 971.66 rub./day = 13,603.24 rub.

An example of calculating severance pay and average earnings for the period of employment for an employee dismissed due to the liquidation of the organization

In the organization P.A. Bespalov works as a storekeeper, his salary is 20,000 rubles. per month. On January 12, 2015, he was fired due to the liquidation of the organization. Therefore, Bespalov is entitled to:

- severance pay;

- average earnings for the period of employment.

Bespalov's severance pay was paid on the day of his dismissal - January 12, 2015. To determine severance pay, the calculation period is the time from January 1 to December 31, 2014. Bespalov's earnings for this period amounted to 240,000 rubles. (RUB 20,000/month × 12 months). During the pay period he worked 247 days.

Bespalov's average daily earnings were: 240,000 rubles. : 247 days = 971.66 rub./day.

In the first month after dismissal (from January 13 to February 12, 2015) there are 23 working days. The severance pay was: 23 days. × 971.66 rub./day = 22,348.18 rub.

The day after his dismissal, Bespalov registered with the employment service.

During the first month after his dismissal (from January 13 to February 12, 2015), Bespalov was unable to find a job. To maintain the average earnings for the first month after dismissal, the accountant offset the amount of severance pay paid in connection with the dismissal.

During the second month (from February 13 to March 12, 2015) after his dismissal, Bespalov was also unable to find a job, which is confirmed by the lack of entries in his work book. Therefore, on March 13, 2015, he was paid his average salary. In the second month after dismissal (from February 13 to March 12, 2015) 18 working days. The amount of average earnings for the period of employment for the second month after dismissal was: 18 days. × 971.66 rub./day = 17,489.88 rub.

During the third month (from March 13 to April 12, 2015) after his dismissal, Bespalov was also unable to find a job, which was confirmed by the lack of entries in his work book and the decision of the employment service. Since he contacted the employment service in a timely manner, the organization is obliged to pay him the average salary for the period of employment for the third month after dismissal. Therefore, on April 13, 2015, Bespalov was paid his average salary. In the third month after dismissal (from March 13 to April 12, 2015) there are 21 working days. The amount of average earnings for the period of employment for the third month after dismissal was: 21 days. × 971.66 rub./day = 20,404.86 rub.

Situation: is it necessary to pay the average salary for the period of employment for the third month to a pensioner dismissed due to the liquidation of the organization (staff reduction)?

Yes need.

Pensioners have the same rights and responsibilities as other employees of the organization. Despite the fact that pensioners are not recognized as unemployed (clause 3 of Article 3 of Law No. 1032-1 of April 19, 1991), they are entitled to payment of average earnings for the period of employment. Article 178 of the Labor Code of the Russian Federation does not provide for any exceptions for them.

A similar point of view was expressed in the letter of Rostrud dated February 11, 2010 No. 594-TZ.

How to calculate compensation paid not exceeding three times the average monthly salary

139 of the Labor Code of the Russian Federation, Regulations on the specifics of the procedure for calculating average wages (approved by Resolution of the Government of the Russian Federation No. 922) (hereinafter referred to as the Regulations).

According to paragraphs 4, 9 of the Regulations, the calculation of the average salary of an employee, regardless of his mode of work, is based on the salary actually accrued to him and the time actually worked by him for the 12 calendar months preceding the period during which the employee retains the average salary (calculated period).

When determining average earnings, average daily earnings are used.

The average employee's earnings are determined by multiplying the average daily earnings by the number of days (calendar, working) in the period subject to payment.

Average daily earnings, except in cases of determining average earnings for vacation pay and payment of compensation for unused vacations, are calculated by dividing the amount of wages actually accrued for days worked in the billing period, including bonuses and remunerations taken into account in accordance with clause 15 of the Regulations, by the number of days actually worked during this period.

In this case, the organization can calculate the average daily earnings in the specified order, but the multiplier “number of days (calendar, working) in the period subject to payment” for calculating the average earnings is missing, since there is no period itself subject to payment. After all, the organization does not pay the employee severance pay several months in advance after dismissal, but compensation upon dismissal by agreement of the parties without indicating any period for which it is paid.

And the above norms of paragraph 3 of Art. 217, paragraphs. 2 p. 1 art. 422 of the Tax Code of the Russian Federation also speaks of three (six) times the average monthly earnings, and not the average earnings for three (six) months after dismissal.

In other words, we are talking about the average monthly earnings of the dismissed employee, multiplied by three (six).

In our opinion, in this regard, the organization should calculate the employee’s average monthly earnings based on the average monthly number of working days in the billing period, and not the average earnings based on the number of working days in three months after dismissal.

The average monthly number of working days should be determined by dividing the number of working days in the billing period according to the production calendar of a five-day working week by 12.

Based on the foregoing, we believe that for the purposes of exemption from personal income tax and insurance contributions, compensation paid to an employee upon dismissal by agreement of the parties without indicating the period for which it is paid, an organization working on a five-day workweek schedule should calculate three times the employee’s average monthly earnings by dividing the wages actually accrued to him for the 12 months preceding his dismissal (payroll period) by the number of days actually worked during this period and multiplying the resulting average daily earnings by the average monthly number of working days in the payroll period and by three.

No votes yet.

Please wait…

In accordance with paragraph 3 of Art. 217 of the Tax Code of the Russian Federation, compensation payments related to the dismissal of employees are not subject to personal income tax taxation, with the exception, in particular, of the amount of payments in the form of severance pay, average monthly earnings for the period of employment, compensation to the manager, deputy managers and chief accountant of the organization in part exceeding in general, three times the average monthly earnings or six times the average monthly earnings for workers dismissed from organizations located in the Far North and equivalent areas.

Thus, compensation payments upon dismissal within three (six times) average monthly earnings are not subject to personal income tax.

From a similar norm, paragraphs. 2 p. 1 art. 422 of the Tax Code of the Russian Federation it follows that compensation payments upon dismissal within three (six times) average monthly earnings are also not subject to insurance contributions.

At the same time, the procedure for calculating the specified threefold (sixfold) amount of average monthly earnings has not been established by the Tax Code of the Russian Federation.

From the Letters of the Ministry of Finance of Russia dated N 03-04-06/31391, the Ministry of Labor of Russia dated N 17-4/B-283, it follows that in the situation under consideration, the general procedure for calculating the average wage (average earnings) established by Art. 139 of the Labor Code of the Russian Federation, Regulations on the specifics of the procedure for calculating average wages (approved by Decree of the Government of the Russian Federation No. 922) (hereinafter referred to as the Regulations).

According to clause

Dismissal by agreement of the parties: formula and calculation of average monthly earnings

Attention There are no such difficulties and nuances here. As you can see, dismissal by agreement of the parties is indeed much easier to implement both in practice and when preparing documents. How dismissal is formalized In addition to its peculiarities, the removal of an employee from performing duties has a number of requirements for the execution of the contract. It is produced in several stages:

- Drawing up an agreement between the parties. This is the basis for dismissing an employee. Therefore, you need to be as careful as possible when drafting it. However, there is no clear law that would regulate the procedure for drawing up the document. Therefore, it can be written in any form. The main thing is that it states:

- the grounds on which the employee is dismissed.

Certificate of average monthly earnings, sample

Taking into account the purposes of providing a form on the amount of average monthly earnings, there are several options:

- 2-NDFL is issued to receive subsidies from social protection authorities, as well as to obtain loans from banks.

- Form No. 182n is necessary for calculating sick leave when dismissing an employee from one place and transferring him to another job. It contains information about salaries for the last 2 years.

A certificate of earnings for the last full 3 months to determine the amount of unemployment payments is drawn up on the basis of the form specified in the letter of the Ministry of Labor No. 16-5/B-421 dated 08/15/2016.

Important !

Calculation of average monthly earnings is required when establishing the amount of payments for days of incapacity, when applying for vacation, to calculate unemployment benefits and determine the amount for maternity leave, to pay for days of downtime. Each of these benefits has features when calculating them that must be taken into account. Post Views: 80

Examples of calculating three times the average monthly salary upon dismissal

15 of the Regulations, for the number of days actually worked during this period.

In this case, the organization can calculate the average daily earnings in the specified order, but the multiplier “number of days (calendar, working) in the period subject to payment” for calculating the average earnings is missing, since there is no period itself subject to payment. After all, the organization does not pay the employee severance pay several months in advance after dismissal, but compensation upon dismissal by agreement of the parties without indicating any period for which it is paid.

And the above norms of paragraph 3 of Art. 217, paragraphs. 2 p. 1 art. 422 of the Tax Code of the Russian Federation also speaks of three (six) times the average monthly earnings, and not the average earnings for three (six) months after dismissal.

In other words, we are talking about the average monthly earnings of the dismissed employee, multiplied by three (six).

In our opinion, in this regard, the organization should calculate the employee’s average monthly earnings based on the average monthly number of working days in the billing period, and not the average earnings based on the number of working days in three months after dismissal.

The average monthly number of working days should be determined by dividing the number of working days in the billing period according to the production calendar of a five-day working week by 12.

Based on the foregoing, we believe that for the purposes of exemption from personal income tax and insurance contributions, compensation paid to an employee upon dismissal by agreement of the parties without indicating the period for which it is paid, an organization working on a five-day workweek schedule should calculate three times the employee’s average monthly earnings by dividing the wages actually accrued to him for the 12 months preceding his dismissal (payroll period) by the number of days actually worked during this period and multiplying the resulting average daily earnings by the average monthly number of working days in the payroll period and by three.

No votes yet.

Please wait…

In accordance with paragraph 3 of Art. 217 of the Tax Code of the Russian Federation, compensation payments related to the dismissal of employees are not subject to personal income tax taxation, with the exception, in particular, of the amount of payments in the form of severance pay, average monthly earnings for the period of employment, compensation to the manager, deputy managers and chief accountant of the organization in part exceeding in general, three times the average monthly earnings or six times the average monthly earnings for workers dismissed from organizations located in the Far North and equivalent areas.

Thus, compensation payments upon dismissal within three (six times) average monthly earnings are not subject to personal income tax.

From a similar norm, paragraphs. 2 p. 1 art. 422 of the Tax Code of the Russian Federation it follows that compensation payments upon dismissal within three (six times) average monthly earnings are also not subject to insurance contributions.

At the same time, the procedure for calculating the specified threefold (sixfold) amount of average monthly earnings has not been established by the Tax Code of the Russian Federation.

From the Letters of the Ministry of Finance of Russia dated N 03-04-06/31391, the Ministry of Labor of Russia dated N 17-4/B-283, it follows that in the situation under consideration, the general procedure for calculating the average wage (average earnings) established by Art.

Over the past three months, how and why to count

A certificate of average earnings for 3 months is required according to Resolution of the Ministry of Labor No. 62 of 08/12/2003 in the following situations:

- to calculate the amount of unemployment benefits;

- to calculate the scholarship for the duration of training in retraining or advanced training courses.

Average earnings are calculated for 3 full calendar months before the month of dismissal or the month of training.

It should be borne in mind that when determining this value, it is not necessary to include the employee’s days of absence due to illness, days of downtime, or time paid for caring for disabled children . If, after all deductions for the accepted 3-month period, the salary turns out to be zero, then another full 3 months are taken for calculations.