A separate division of a legal entity located outside its location is an object in which the organization has at least one workplace for at least a month. Such departments need to submit reports and pay insurance premiums according to special rules.

In business practice, an organization often has a separate division; in which case should the company submit a separate calculation of insurance premiums for the employees of this division? This question is asked to the Federal Tax Service and the Social Insurance Fund.

Let us remind you that from January 1, 2021, payments for pension insurance, medical insurance, in case of temporary disability and in connection with maternity are regulated by Chapter 34, while payments for insurance against accidents and occupational diseases are still governed by the norms of the Federal Law of July 24 .1998 N 125-FZ. In this regard, some payers believe that the procedure for paying various contributions for separate divisions differs significantly. However, it is not.

As for compulsory insurance, compulsory medical insurance and VNiM, insurance premiums, as well as the submission of calculations, are carried out by insurer organizations at their location - theirs and separate divisions that charge payments and other remuneration in favor of individuals. Another question arises: where to pay insurance premiums for a separate division in 2021? At the location of the OP. To do this, during its registration, the territorial body of the Federal Insurance Service of the Russian Federation assigns a professional risk class to establish the value of the insurance tariff depending on the type of economic activity.

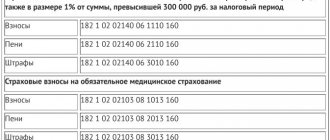

The summarized data is collected in the table:

| Type of insurance premium | At the location of the separate unit (SU) | At the location of the organization itself (GP) |

| At OPS, OMS, VNiM | From payments to employees of the OP, incl. according to the GPA, which are accrued by the OP itself | From payments to employees of SOEs and those OPs that do not themselves pay payments to employees |

| For injuries | From payments to employees of an OP, which is registered with the Social Insurance Fund | From payments to employees of state enterprises and those enterprises that are not registered with the Social Insurance Fund |

What is a separate division: introductory information

Any Russian organization has the right to open one or more separate divisions. They may be branches and representative offices of a legal entity. At the same time, separate divisions (that is, branches and representative offices) are not legal entities and are deprived of the legal capacity inherent in legal entities. This follows from Article 55 of the Civil Code of the Russian Federation.

It is also necessary to say about the Tax Code of the Russian Federation. It follows from Article 11 of the Tax Code of the Russian Federation that a separate division must be located at an address different from the address of the main organization and have stationary jobs, that is, jobs created for a period of more than one month.

Thus, we can say that a separate division of a legal entity is a branch, representative office or stationary workplace (Article 55 of the Civil Code of the Russian Federation and Article 11 of the Tax Code of the Russian Federation).

Below in the table we will explain some of the features of the types of separate divisions.

| Branch | Representation | Stationary workplace |

| The branch carries out all or part of the functions of the main organization. Performs representative functions. | The representative office represents and protects the interests of the main organization. | The employee carries out his labor activity at the workplace. |

| The branch can conduct commercial activities. | The representative office cannot conduct commercial activities. | Cannot conduct commercial activities. Only labor relations. |

| Information about the branch must be contained in the Unified State Register of Legal Entities. | Information about the representative office must be contained in the Unified State Register of Legal Entities | Information is not included in the Unified State Register of Legal Entities. |

Registration of separate divisions with the Federal Tax Service

If a separate division is a branch or representative office and information about it is indicated in the charter and in the Unified State Register of Legal Entities, then at the location of this unit the organization will be registered with the Federal Tax Service automatically based on information from the Unified State Register of Legal Entities (clause 3 of Article 83 of the Tax Code of the Russian Federation).

If a separate division is not a branch or a representative office, but a workplace, then within a month from the date of its creation the organization itself must register with the Federal Tax Service at the location of such a division (clause 3, clause 2, article 23, clause 4 Article 83 of the Tax Code of the Russian Federation). To do this, you need to submit to the Federal Tax Service at the location of the organization itself a message about the creation of a separate division in form No. S-09-3-1. These rules have been in effect previously and will continue to apply in 2021. However, from 2021, organizations with separate divisions will have new responsibilities.

Results

Since 2021, the provisions valid for insurance premiums are regulated by 2 documents: the Tax Code of the Russian Federation (for most of their types) and Law 125-FZ (for “accidental” contributions).

The main condition for payment of contributions and reporting on them by a separate unit is that it calculates and issues wages. According to the Tax Code of the Russian Federation, this circumstance leads to the obligation to separate payments and reporting by division, and according to Law 125-FZ it can serve as one of the grounds for registering a division as an insurer paying premiums and reporting on them. You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

New responsibilities of parent organizations from 2017

From 2021, parent organizations are required to notify the Federal Tax Service at their location that their separate divisions (including branches and representative offices) in 2021 (subclause 7, clause 3.4, article 23 of the Tax Code of the Russian Federation):

- received the right to accrue payments and rewards to individuals;

- lost the authority to accrue payments and rewards to individuals.

The Tax Code of the Russian Federation allows one month for notification to the tax authority to the parent organizations from the date of vesting (or deprivation) of the “separateness” with the specified powers or their loss.

Please note: the new obligation to send these messages has been introduced only in relation to those separate divisions to which the corresponding powers have been transferred or taken away from them after January 1, 2021. There is no need to transmit messages to the Federal Tax Service regarding separate divisions (branches, representative offices) that accrued payments and rewards before 2017. This is provided for in paragraph 2 of Article 5 of the Federal Law of July 3, 2016 No. 243-FZ.

How parent organizations can fulfill their new responsibility

After January 1, 2021, the parent organization has the right to transmit to the Federal Tax Service a message about vesting a separate division (including a branch or representative office) with the authority to calculate payments and remunerations in favor of individuals (or about depriving such authorities) (clause 7 of Article 23 of the Tax Code of the Russian Federation):

- by mail;

- in electronic form via telecommunication channels;

- through the taxpayer’s personal account.

The Federal Tax Service is obliged to approve the procedure for transmitting such messages to the Federal Tax Service in electronic form and the forms of “paper” messages. This is provided for in paragraphs 3 and 4 of paragraph 7 of Article 23 of the Tax Code of the Russian Federation.

A separate division is vested with the authority to accrue payments and rewards to individuals from the date of issuance of the relevant order or instruction of the parent organization.

The form of notification of a Russian organization - payer of insurance premiums about vesting a separate division (including a branch, representative office) with powers (about deprivation of powers) to accrue payments and rewards in favor of individuals was approved by Order of the Federal Tax Service of January 10, 2021 No. ММВ-7-14/4 .

Deadline for submitting the report according to the DAM form

The quarterly calculation of insurance premiums is submitted to the tax authorities no later than the 30th day of the month following the reporting period. If the established day for submitting the report falls on a weekend, then in accordance with the law it is postponed to the first working day (clause 7, article 6.1 of the Tax Code of the Russian Federation).

For 2021, the following deadlines for providing quarterly calculations have been established:

- for 2021 until January 30 (February 1), 2021

- for the first quarter until April 30, 2021

- half a year before July 30, 2021

- 9 months before October 30 (November 1), 2021

Entrepreneurs running peasant farms do not submit quarterly reports; the deadline for submitting the annual report is set, as for other organizations, no later than January 30 of the following year. But since the 30th falls on a Saturday, the deadline is moved to the next working day, February 1, 2021.

Changes for separate divisions since 2017

When transferring the rules on insurance premiums from Federal Law No. 212-FZ of July 24, 2009 to the Tax Code of the Russian Federation, legislators decided that separate divisions will deal with insurance premiums much more often in 2017.

From January 1, 2021, Federal Law No. 212-FZ dated July 24, 2009 “On insurance premiums” loses force. According to Part 11 of Article 15 of this law, until 2021, only those separate divisions that simultaneously:

- had bank accounts opened for themselves;

- had their own balance sheet, separate from the main office;

- accrued various payments and rewards to individuals.

Thus, until 2021, the three specified conditions had to be simultaneously met. But since 2021 the situation has changed. For a separate unit to have the obligation to submit reports to the Federal Tax Service and pay insurance premiums, legislators left only one criterion - the accrual of remuneration to individuals. This follows from the new provisions of paragraphs 7 and 11 of Article 431 of the Tax Code of the Russian Federation. Also see “Insurance premiums from 2017: overview of changes.”

Thus, the obligation to pay insurance premiums and submit calculations for insurance premiums by separate divisions in 2017 arises regardless of the presence of:

- separate balance;

- an open bank account.

It is possible that some accountants will have a logical question: “can the parent organization in 2021 independently submit reports and pay insurance premiums for its separate divisions that pay payments and rewards to individuals”? In our opinion, it will be impossible to do this in 2021. The fact is that the provisions of the Tax Code of the Russian Federation in force since 2021 do not provide that the parent organization has the right to “assume” the responsibility for paying insurance premiums and submitting settlements for its “separate entity”, which accrues payments and rewards to individuals.

From 2021, separate divisions that calculate payments and rewards to individuals must submit calculations of insurance premiums to the Federal Tax Service at their location using a new form approved by Order of the Federal Tax Service of Russia dated October 10, 2016 No. ММВ-7-11/551. RSV-1 will not be submitted to the UPFR from 2021.

We also believe it would be advisable to consider one more situation. Let’s assume that until 2021, a separate division of the organization did not have a separate current account and balance sheet, but accrued payments and rewards to individuals. Until 2021, such a unit, by virtue of the law, did not have to independently pay insurance premiums and submit RSV-1 calculations to the Pension Fund of the Russian Federation. The parent company did this for him (Part 11, Article 15 of Federal Law No. 212-FZ of July 24, 2009). However, by virtue of paragraph 11 of Article 430 of the Tax Code of the Russian Federation, starting from 2021, such a division is obliged to independently transfer insurance premiums and submit reports on insurance premiums to the Federal Tax Service. If the parent organization does not want the separate division to do this, then it will be necessary to issue an order “On depriving the separate division of the authority to accrue payments and remunerations in favor of individuals.” And report this to the Federal Tax Service within one month (Part 7, Clause 3.4, Article 23 of the Tax Code of the Russian Federation as amended, effective from 2021).

For foreign separate divisions, insurance premiums are paid and reports are submitted by the head office. This approach has been used before and will be used in 2021. The changes discussed in this article apply exclusively to separate divisions of Russian companies.

Calculation form and procedure for filling out the DAM form

In order to report on social contributions for the fourth quarter of 2020, you will have to use a new form approved by Order of the Federal Tax Service of the Russian Federation dated October 15, 2020 N ED-7-11/ [email protected]

Read more New RSV form 2020

The form of calculation has become simpler, but the new changes cannot be called drastic. It is most convenient to fill out the document in the following order: first, fill out the title page, then Section 3 and the rest of the appendices, and only at the very end proceed to filling out the first section.

Title page

The main innovation of the title page is the appearance of a field to reflect information about the average number of personnel. This innovation freed companies and individual entrepreneurs from submitting an independent report on their headcount to the Federal Tax Service.

Let's look at line-by-line filling.

TIN - 10-digit taxpayer number (12-digit for individual entrepreneurs)

Checkpoint - a 9-digit code assigned by the inspection where the declaration is submitted

The correction number is “0—” for the initial submission of the report, and the serial number of the correction for the updated report. Billing period - indicate the period code (see table)

| Taxable period | For legal entities and individual entrepreneurs | In case of reorganization (liquidation) |

| I quarter | 21 | 51 |

| half year | 31 | 52 |

| 9 months | 33 | 53 |

| year | 34 | 90 |

By location (accounting) (code) - the full list is given in Appendix No. 4 to the Filling Out Procedure, the most common are “120” for individual entrepreneurs and “214” for organizations.

The name of the organization is the full name of the taxpayer from the constituent documents.

Average headcount - indicates the number of personnel, which is calculated in accordance with clauses 76-79.11 of Rosstat Order No. 711 dated November 27, 2021.

OKVED2 code is a value from the OKVED2 classifier corresponding to the type of activity being carried out.

The following is a block to be filled in in case of reorganization (liquidation) of an organization .

The contact phone number is displayed with the country and city code. All numbers are written in a row without spaces or other symbols.

The number of sheets of the declaration is reflected , and, if available, the number of sheets of supporting documents.

Finally, the full name of the person certifying the accuracy and completeness of the information provided .

Signature

and

date .

Title page

Section 1

If the company made payments to its employees during the reporting period, then number 1 is indicated on line 001 “Payer type (code)”; for those who did not make payments, code 2 is provided. Accordingly, in the first case, the corresponding accruals should be indicated in lines 031-033 , in the second – zero values are entered.

for lines 111-113 . This was done to be able to reflect reimbursement of expenses in connection with temporary disability of employees in the calculation, even in cases where wages were not accrued.

Zero reporting should consist of a title page, Section 1 without appendices, which will indicate code 2, and Section 3 without table 3.2.

Section 1 consists of 9 appendices.

If during the reporting period the company applied several tariffs, then Appendix 1 to Section 1, as before, is filled out in several copies. The tariff code is indicated in accordance with the changes made in the classifier. Please note that the new form excludes codes 02 and 03. For those who apply the basic tariff for calculating insurance payments, code 01 is provided, which is indicated regardless of the chosen taxation system. Also, codes 04 and 05, which were entered in the case of using reduced tariff rates, have been removed from the register. Due to changes made to the legislation, such benefits have been terminated.

The following codes were entered into the register during the year:

| New code | Who points |

| 17 | Organizations from the unified register of residents of the Special Economic Zone in the Kaliningrad Region (Federal Law dated January 10, 2006 No. 16-FZ) |

| 18 | Russian companies that produce and sell their animated audiovisual products, regardless of the type of contract and (or) provision of services (performance of work) for the creation of animated audiovisual products |

| 19 | Payers of contributions with the status of a participant in a special administrative region (Federal Law of August 3, 2018 No. 291-FZ), who pay ship crew members for the performance of labor duties. Vessels must be registered in the Russian Open Register of Ships |

In Subsection 1.1 and 1.2 of Appendix 1 there is line 045, which is intended to form the amount of expenses accepted for deduction that are related to the receipt of income under the contracts listed in clause 8 of Art. 421 Tax Code of the Russian Federation. This line reflects expenses that have documentary evidence, as well as those that are accepted for deduction in the established amounts, regardless of the presence of documentary evidence.

In the new form of Calculation of insurance premiums in Appendix 2, a new line “Payer's tariff code” has appeared. Now, when using different tariffs simultaneously, this section will need to be filled out on several sheets, similar to Appendix 1. A new line 015 to reflect the number of people from whose payments insurance payments are accrued.

block 001-006 is intended to indicate charges for each individual tariff. Lines 070-090 indicate the total amounts for all applicable tariffs. Line 055 is intended to indicate the tax base from which contributions are calculated to stateless persons at a rate of 1.8%.

Appendix 5 has been developed to calculate compliance with the conditions for the use of reduced tariffs by IT companies in accordance with paragraphs. 3 p. 1 art. 427 Tax Code of the Russian Federation. When filling out a section in the new DAM, you must use new tariff codes. row 060 has also been added to the table to reflect information about company registration in the special zone resident form.

Added Appendix No. 5.1, which is filled out in case of applying a reduced tariff.

Appendix 6 is also intended to determine the legality of applying a reduced tariff for non-profit organizations using the simplified tax system and tariffs established by paragraphs. 3 p. 2 art. 427 Tax Code of the Russian Federation.

Appendix 7 is filled out by organizations that are engaged in the production of animation and audiovisual products using the reduced tariff established by paragraphs. 6 paragraph 2 art. 427 Tax Code of the Russian Federation. The new edition has expanded the list of codes (see Appendix No. 7 of the RSV)

Appendix 8 is intended for information on temporarily staying foreign citizens who pay contributions at a rate of 1.8%. Previously, such information was reflected in Appendix 9.

Appendix 9 is filled out by insurers who have employees who are undergoing training or working in student groups. Pension contributions are not calculated from these payments. In the previous edition, Appendix 10 was allocated for such policyholders.

Section 2

This section of the Insurance Premium Calculation form is entirely intended for peasant and farm households. The new changes affected only Appendix 1, where when indicating the personal data of members of the household, it will now be necessary to enter passport data, gender and date of birth in full. Completing this section is not particularly difficult.

Section 3

The form in question is intended to reflect personalized information. For subsection 3.2.2, a new coding has been developed that establishes the basis for calculating contributions at an additional tariff and in accordance with working conditions.

New codes of insured persons in subsection 3.2.2

| Code | Name |

| 110 | Those employed in the types of work specified in clause 1, part 1, art. 30 400-FZ, for payments for which an additional tariff is applied (clause 1 of Article 428 of the Tax Code of the Russian Federation) |

| 120 | Those employed in the types of work specified in clauses 2–18, part 1, art. 30 400-FZ, for payments for which an additional tariff is applied (clause 2 of Article 428 of the Tax Code of the Russian Federation) |

| 131 | Those employed in the types of work specified in clause 1, part 1, art. 30 400-FZ, class of working conditions - harmful, subclass of working conditions - 3.1 |

| 132 | Those employed in the types of work specified in clause 1, part 1, art. 30 400-FZ, class of working conditions - harmful, subclass of working conditions - 3.2 |

| 133 | Those employed in the types of work specified in clause 1, part 1, art. 30 400-FZ, class of working conditions - harmful, subclass of working conditions - 3.3 |

| 134 | Those employed in the types of work specified in clause 1, part 1, art. 30 400-FZ, class of working conditions - harmful, subclass of working conditions - 3.4 |

| 140 | Those employed in the types of work specified in clause 1, part 1, art. 30 400-FZ, class of working conditions - dangerous, subclass of working conditions - 4 |

| 231 | Those employed in the types of work specified in clauses 2–18, part 1, art. 30 400-FZ, class of working conditions - harmful, subclass of working conditions - 3.1 |

| 232 | Those employed in the types of work specified in clauses 2–18, part 1, art. 30 400-FZ, class of working conditions - harmful, subclass of working conditions - 3.2 |

| 233 | Those employed in the types of work specified in clauses 2–18, part 1, art. 30 400-FZ, class of working conditions - harmful, subclass of working conditions - 3.3 |

| 234 | Those employed in the types of work specified in clauses 2–18, part 1, art. 30 400-FZ, class of working conditions - harmful, subclass of working conditions - 3.4 |

| 240 | Those employed in the types of work specified in clauses 2–18, part 1, art. 30 400-FZ, class of working conditions - dangerous, subclass of working conditions - 4 |

Section 3

How tax authorities and funds organize accounting for separate divisions

Since 2021, Article 84 of the Tax Code of the Russian Federation, dedicated to the rules for tax registration, has been supplemented with clause 3.1. It stipulates that tax inspectorates at the location of the “isolations” are required to keep records of data on their powers to make payments to individuals. This is based on messages from payers mentioned above.

Also in 2021, a package of amendments to the Tax Code was adopted (https://asozd2.duma.gov.ru/main.nsf/(SpravkaNew)?OpenAgent&RN=11078-7&02), obliging tax authorities to report electronically to the Pension Fund of the Russian Federation, the Social Insurance Fund and FFOMS information on tax registration of companies at the location of their separate divisions in 2021, which make payments and other remuneration to individuals (new sub-clause 15, clause 1, article 32 of the Tax Code of the Russian Federation). Starting from 2021, tax authorities are required to inform the above funds within three days:

- on the vesting of “single-parties” (including branches and representative offices) with the powers to calculate payments and remunerations, as well as on the deprivation of such powers;

- on a change of location to a “separate” location (exception: branches and representative offices);

- on the closure of such separate divisions.

Read also

27.07.2016