What are profitable investments?

The legislation determines that profitable investments in material assets should be considered financing the purchase of objects with a long period of use, which are endowed with a tangible form and are transferred to other entities for use in their economic activities for a certain period of time for a fee established by the contract.

These include, for example:

- Building.

- Facilities.

- Equipment.

- Vehicles, etc.

That is, in essence, these are fixed assets (fixed assets). But they have a main distinguishing feature - these assets are used in activities not by the owner himself, but by those who lease these assets. Thus, income-generating investments represent leased assets.

The company must carry out separate accounting of fixed assets and income-generating investments, since they have a different nature of use by the entity.

The rules of law require that objects acquired and transferred by an organization to another entity under a rental or leasing agreement must still be reflected in the accounting and reporting of the direct owner.

In this case, it does not matter for what funds the property was acquired - from own sources or from borrowed capital.

These objects must be registered at their original cost, which is the sum of the actual costs incurred for their purchase or construction.

Attention! However, like fixed assets, these assets should be reflected in reporting at their residual value, that is, the amount of depreciation accrued during their use is subtracted from the original cost. A separate line 1160 is provided in the balance sheet to reflect information about these objects.

Peculiarities of accounting for the dealer and the processor

higher).

Production accounting at the dealer consists of two operations:

- transfer of raw materials to the processor,

- registration of receipt of products from the processor and processing services.

To perform the first operation, we will create a document Transfer of raw materials for processing

:

In the list that opens, click create

. Fill out the header and tabular part of the document:

In our example, sand and cement will be transferred to the seller, and bricks will be capitalized as products.

In the tabular part of the document, you need to select as the transfer account 10.07

(in this account, the item will be taken into account not by warehouses, but by counterparties).

Let's go through the document and look at the postings:

From the document, if necessary, you can print the following printed forms:

Now we will reflect the receipt of products and register the services of the processor. To do this, enter the document Receipt from Processing

:

The header of the document is filled out as standard.

On the first tab, we indicate information about the received products, enter the planned price (for substitution in transactions). Select an account 43

:

On the second tab Services

We register the receipt of processing services:

On the third tab Cost Accounts

select cost attribution analytics.

To prevent this amount from being mixed with the production of other products, we will create a new product group Brick production

and select it in the document.

On the Used materials

it is necessary to select those materials that the processor used in the production process.

The command panel has buttons for automatic filling By balances

and

By specification

.

If after the release of the product the processor still has unused materials, then the fact of their return can be reflected on the Returned materials

.

Let's go through the document and look at the postings:

The debt to the supplier, production costs, receipt of products and input VAT are reflected.

To close the 20th account, you need to close the month

:

We will generate a certificate-calculation Cost calculation

:

The cost per unit is shown incorrectly (program error), but the amounts are shown correctly:

Let's look at the fact of product receipt, forming the turnover for account 43:

Let’s make sure that the expensive 20th account is closed successfully:

See also:

Conditional formatting in lists of documents and reference books

What is taken into account on account 03 of accounting

The current Chart of Accounts provides that income-generating investments must be accounted for separately from fixed assets in a special account 03.

Here you can see the objects that the company receives to generate income from renting them out for temporary use by third parties. These objects have the same cost as an OS and have a useful life of more than one year.

An important characteristic for this kind of objects is also established in the form of the presence of a material form. Thus, intangible assets (intangible assets) cannot be reflected in this account.

Thus, in account 03 it is necessary to take into account the costs of purchasing buildings, structures, equipment, vehicles, inventory, etc.

Attention! In addition, on this account it is necessary to show objects that are transferred to other counterparties under a leasing agreement, in cases where the material value is listed on the lessor’s balance sheet. If, according to the provisions of the concluded agreement, such property is included in the balance sheet of the lessee, then off-balance sheet account 011 is used to reflect such funds.

You might be interested in:

Accounting account 76 - in what case is it used, characteristics, postings

The concept of an off-balance sheet account

Off-balance sheet accounting includes a group of accounts and subgroups that summarize information on transactions and relate to the movement of inventory items of an enterprise. Postings with their participation are not constantly present in the company’s accounting and quarterly reporting, but are an important element in the preparation of reporting. Balance sheet accounting cannot be carried out correctly without off-balance sheet accounting, because such transactions are not reflected on the balance sheet. Despite this, after the processing process is completed, the balances appear as a final figure and are not taken into account in the balance sheets.

Application

These subaccounts have only an indirect impact on the final result of reporting on the main indicators and are not displayed in reporting or during inventory. Despite this, their structure is standard. There are debits and credits, and accounting occurs according to a standard simple scheme. They allow you to enter information about the receipt of goods and materials, which will be written off in the near future, but must be reflected in fact. These positions are not the property of the enterprise, and therefore are not taken into account in the balance sheet.

Important! Off-balance sheet accounts are a generalizing entry and they are created for analytical purposes, because even temporary positions require accounting.

Characteristics of account 03 – “Profitable investments in material assets”

As indicated in the Chart of Accounts, account 03 is active. The debit balance of such an account reflects the presence at the beginning of the period of certain profitable investments in assets. The debit of the account reflects the receipt of objects, and the credit reflects their disposal.

The balance at the end of the period is calculated by adding the balance of profitable investments at the beginning of the period with the turnover on the debit of the account, and subtracting the turnover on the credit of this account from the resulting amount.

Analytics for the account under consideration is built by type of objects of profitable investment in assets, by tenants and lessees, and also by separately accounted assets.

In addition, a sub-account can be created on this account, which can be used to account for the disposal of objects reflected as profitable investments in tangible assets.

The debit of this subaccount must reflect the cost of the retiring material asset, and the credit - the amount of accumulated depreciation for this object. After this, this sub-account is closed, and the result obtained is applied either to other income or to other expenses of the company.

Attention! However, a business entity has the right not to use it, but to determine the financial result from the disposal of such an object directly on account 91. The chosen method must be fixed in the company’s Accounting Policy.

Account 003 Materials accepted for processing

Debit account 003 Materials accepted for processing (no credit entry).

Materials that were processed were returned to the customer Credit account 003 Materials accepted for processing (according to

The customer's raw materials accepted for processing are accounted for in the off-balance sheet account 003 Materials accepted for processing at the prices stipulated in the contracts. Analytical accounting for this account is carried out by customers, types, grades of raw materials and materials and their locations.

Materials accepted for processing are accounted for in the off-balance sheet account 003 Materials accepted for processing separately by customer, type, grade and storage location. If the received material assets do not comply with the terms of the contract, the buyer accepts these assets for safekeeping. Such values are recorded in off-balance sheet account 002 Inventory assets accepted for safekeeping. This account also records unpaid inventory items received from suppliers that are prohibited from being spent under the terms of the contract until they are paid, as well as inventory items accepted for safekeeping for other reasons. Suppliers take into account in this account inventory items paid for by buyers, which (as an exception) were left in safekeeping, documented with safekeeping receipts, but not removed for reasons beyond the control of the organization. Material assets are recorded on account 002 at the prices provided for in acceptance certificates or in invoices - payment requirements.

Material assets accepted for safekeeping are recorded on the off-balance sheet account 002 Inventory assets accepted for safekeeping. Raw materials and materials of the customer accepted for processing (supply raw materials), unpaid, are recorded in the off-balance sheet account 003 Materials accepted for processing.

Account 003 Materials accepted for processing

Account 003 Materials accepted for processing is intended to summarize information about the availability and movement of raw materials and materials of the customer accepted for processing (raw materials supplied by customers), not paid for by the manufacturer. Accounting for the costs of processing or refining raw materials and materials is carried out on production cost accounts, reflecting the associated costs (with the exception of the cost of raw materials and materials of the customer). The customer's raw materials accepted for processing are accounted for in account 003 Materials accepted for processing at the prices stipulated in the contracts.

Analytical accounting for account 003 Materials accepted for processing is carried out by customers, types, grades of raw materials and materials and their locations.

ACCOUNT 003 MATERIALS ACCEPTED FOR PROCESSING

Account 003 “Materials accepted for processing.” This off-balance sheet account is used by enterprises that accept unpaid raw materials for processing.

Specifics of profitable investments in real estate

Real estate is a special kind of property. According to the law, it is necessary to register ownership with the issuance of an appropriate certificate.

In this regard, accountants sometimes have a question: in what period of time to transfer the value of an object from account 08 to account 03 - before receiving the certificate, or after that.

There is one more feature associated with real estate objects. The law obliges to calculate and transfer property taxes to the budget. This must be done for the first time on the 1st day of the month, which follows the month of its acceptance for registration in the business entity.

PBU 6/01 establishes the rule that an object begins to be accounted for in account 01 or 03 from the moment it fully meets the criteria of a fixed asset. At the same time, this document does not say a word about the need to wait for official paper from a government agency - a certificate. The Ministry of Finance and the Federal Tax Service adhere to the same position in their letters.

Attention! At the same time, it is recommended that the organization itself does not have any confusion - which object has already received state registration and which has not, and that they be taken into account in different sub-accounts. For example, within the group, open two sub-accounts - “Objects that have passed state registration” and “Objects awaiting state registration”.

Accounting for customer-supplied raw materials from the customer in BP 3.0

Complete Accounting 3.0 Course

How to receive the product after payment

After the money arrives to my wallet (in case of payment by transfer) or to my current account (in case of payment from a legal entity), you will automatically be sent a letter with the product attached.

If for some reason the letter does not reach you, write to me about it at [email protected]

and I will duplicate the shipment of the product.

How to implement a product

You can implement the product yourself by viewing the instructions here.

If you have any difficulties with this, I can connect remotely to your database and install processing/extension, as well as show you how to use the new functionality. To do this, write to me at [email protected]

and we will schedule a specific time for contact.

Warranty

If for some reason the product in your database does not start or does not work correctly, then there are 2 options (your choice):

- I connect remotely to your database and fix the error (for free)

- I will return the entire purchase amount back

If after the next configuration update (with the exception of transitions to a new edition, for example from 2.0 to 3.0) the product stops starting, then in this case there are also two options (see.

How to evaluate profitable investments

When assessing income-generating investments, the same rules are used as for fixed assets.

You might be interested in:

Account 28 in accounting: how defects in production are taken into account, characteristics of the account, postings

Initially, the value of such an asset is collected from its direct value, reduced by the amount of taxes, as well as all related expenses.

The latter may include:

- Transportation costs;

- Costs of engaging third-party specialists (for example, appraisers);

- Travel and fuel expenses, if they were associated with the acquisition of this object;

- Mandatory deductions, customs payments and state duties;

- Cost of materials used;

- etc.

Thus, all costs associated with the purchased object are collected in account 08. This is done until it is ready to be rented out or leased to generate income. After completion of all necessary work, the accumulated costs for the facility are transferred in one amount to account 03.

Attention! The state duty, if it was paid before the cost was transferred to account 03, can also be included in the costs of the object. Otherwise, it should be taken into account in account 91.

Provided raw materials in 1C 8.3 from the processor

| №№ | Operation | Document | Document transaction type | Postings |

| 11 | Capitalization of customer-supplied materials | “Receipt (Acts, invoices)” (in the old version “Receipt of goods, services”) | "Materials for recycling" | Dt 003.01 Kt - |

| 22 | Transfer of customer-supplied raw materials to production | "Demand-invoice" | Dt 003.02 Kt003.01 | |

| 33 | Transfer of customer-supplied raw materials to production | "Production report for the shift" | Dt 20.02 Kt 20.01 | |

| 44 | Transfer of products to the customer | "Transfer of goods" | Transfer of products to the customer | No postings |

| 55 | Sales of processing services, write-off of customer-supplied materials. | “Sales of processing services” | Dt 62.01 Kt90.01 Dt 90.02 Kt20.02 Dt 90.03 Kt68.02 Dt - Kt 003.02 | |

| 66 | Return of remaining customer-supplied raw materials | "Return of goods to supplier" | From recycling | Dt - Kt 003.01 |

A service implementation document solves several problems at once. The structure of the document and postings are shown in the figures below. Calculating the cost of services for processing customer-supplied material is no different from calculating the cost of any other production services.

Important!

Which accounts does account 03 correspond to?

From the debit of account 03, postings can be made to the following accounts:

- 08—acceptance of acquired property for accounting as an income-generating investment;

- 76 - the value of the property for rent is being clarified due to a previously made mistake;

- 80 - property for rent was received from the participant as a contribution to the authorized capital.

On the credit of account 03, debit correspondence entries can be made with the following accounts:

- — transfer of property from the category of profitable investments to fixed assets;

- — write-off of depreciation of a retiring income investment;

- 76 - compensation for part of the cost of a profitable investment through insurance due to its damage;

- 80 - property was transferred to the founders upon their withdrawal from the company;

- 91 - the value of property is written off upon disposal or sale;

- 94 - the shortage of income-generating property is reflected;

- 99 - write-off of the value of an income-generating investment as a result of its loss due to an emergency.

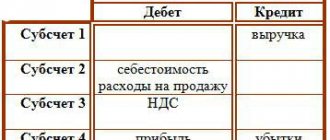

Accounting entries for account 03

The postings that are made with account 03 are in many ways similar to those made for fixed assets.

| Debit | Credit | Operation description |

| Acquisition of property | ||

| Property purchased for further rental | ||

| 19 | 60 | VAT is deducted from the sales amount |

| 68 | 19 | VAT credited |

| 03/1 | 08 | The acquired property is accounted for as an income-generating investment. |

| Renting, leasing | ||

| 03/2 | 03/1 | Transfer of property for rent or leasing |

| 02 | Depreciation has been calculated | |

| 03/1 | 03/2 | Return of property previously leased, leasing |

| Disposal of property | ||

| 03/Disposal | 03/1 | The value of the property is written off |

| 02 | 03/Disposal | Accrued depreciation on retiring assets was written off |

| 91 | Property sold | |

| 91 | 68 | VAT accrued on the sale of property |

| 91 | 03/Disposal | Residual value written off as expenses |

Accounting for raw materials supplied by the customer in 1C

| №№ | Operation | Document | Document transaction type | Postings |

| 11 | Transfer of materials for recycling | "Transfer of goods" | "Transfer of raw materials for processing" | Dt 10.07 Kt 10.01 |

| 22 | Return of materials and products from processing: 2.1- write-off of materials; 2.2 — receipt of finished products; 2.3 — return of remaining materials; 2.4 - accounting for processing services; 2.5 - VAT accounting; 2.6 - invoice; | "Receipt from processing" | Dt 20.01 Kt10.07 Dt 43 Kt 20.01 Dt 10.01 Kt10.07 Dt 20.01 Kt60.01 Dt 19.04 Kt60.01 Dt 68.02 Kt19.04 |

It should be noted that in 1C 8.3, when transferring customer-supplied raw materials for processing, materials are written off at average cost. The contract type must be selected “With supplier”.

The document “Receipt from Processing” has the following structure:

- Products (products from customer-supplied raw materials)

- Services (processing services provided to us by the processor)

- Used materials (consignment materials used in production)

- Returned materials (remains of customer-supplied materials, if any)

- Returnable packaging

- Cost account

Sample of filling out the document “Receipt from processing” in 1C 8.3 for customer-owned processing:

Example of postings from the dealer:

Thus, the program provides the opportunity to take into account all the necessary operations for accounting for customer-supplied materials. The main thing is to follow the chronological sequence of actions and fill out the documents correctly.

Based on materials from: programmist1s.ru