All employees of the organization who directly work with cash are responsible for strict compliance with the strict norms of cash discipline established by federal legislation and internal regulations of the business entity.

This means that even when hiring, they must be familiar with the relevant instructions, regulations and orders of the enterprise, as well as with the Directives of the Central Bank of the Russian Federation, the requirements of the laws of the Russian Federation and other regulatory documents.

If the management of the employing company neglects the proper implementation of this stage, and the signature on familiarization is put by the responsible employee purely nominally, violations of cash discipline cannot be ruled out in the future.

Failure to comply with these rules by an economic entity entails liability provided for by current legislation.

Requirements for recording cash transactions

Maintaining cash documentation is required for organizations that use cash in payments.

| Operation requiring accounting | Registration / documents |

| Receipt of funds using cash register, BSO, checkbook | Receipt cash order (form KO-1) |

| Issuance of amounts for reporting, for remuneration of employees, settlements with partners | Expense order (form KO-2) |

| Entering into accounting data from PKO and RKO | Cash book (form KO-4) |

| Data accounting when there are several cashiers | Cashier accounting book form (KO-5) |

When conducting cash transactions, the following requirements must be met:

- Each operation is subject to mandatory documentary recording.

- Ensuring a cash register limit – the maximum amount of funds stored in the cash register at the end of the operating day.

- Limitation of the maximum allowable amount (100 thousand rubles) for settlements between legal entities.

The transaction is recorded at the time it is completed.

conclusions

It is easier for business entities to comply with the basic requirements of cash discipline than to allow violations of the rules for conducting cash transactions.

Failure to comply with the procedure for maintaining an operating cash register and the rules for using online cash registers entails the imposition of monetary fines.

In addition, violators of cash regulations are more often subject to audits initiated by the tax service.

Penalties are differentiated depending on the organizational form of the business entity.

Violation of the maximum permissible fund limit

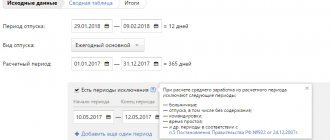

To confirm the limit, the enterprise issues an order. The calculation is made based on the company's cash turnover or the amount of current cash needs. The indicator chosen by the company is indicated in the order. The absence of an approved limit means that there should be no cash in the cash register at the end of the day.

It is not necessary to set a limit if there are simultaneous conditions:

- If the organization is a small enterprise.

- The company has an annual turnover of 800 thousand rubles and employs less than 100 people.

If the organization did not previously have the right to unlimited storage of amounts at the cash desk, the issued order approving the limit must be canceled.

Compliance with the cash limit is subject to mandatory verification by control authorities. For violation of cash accounting requirements, the enterprise is brought to administrative liability under Art. 15.1 Code of Administrative Offenses (Code of Administrative Offenses of the Russian Federation). A fine is imposed in the amount of 40 to 50 thousand rubles per organization and from 4 to 5 thousand rubles per official. The presence of an accounting error or intent does not affect the prosecution.

The statute of limitations for bringing to administrative liability is 2 months, calculated from the moment the violation was committed.

Example #1. Excess balance available

Let's consider an example of meeting deadlines when imposing administrative sanctions. The enterprise CJSC "Kvadrat" allowed the presence of an excess balance in October 2015. In January 2016, an inspection by the Federal Tax Service revealed a violation. An administrative fine was imposed on the company, issued in excess of the permissible time limit. Conclusion: the Kvadrat enterprise must file a lawsuit to cancel the sanction. To prevent the closure of the account, it is advisable to deposit the amount and return it to the account after the court decision.

Identification of untimely capitalized funds in the cash register

Allowing the storage of funds in the cash register that are subject to accounting, receipt and documentation is considered a violation of cash discipline. The discrepancy is determined by reconciling the data from the cash register fiscal report and the cash book amounts.

| Violation | Article | Sanctions |

| Identification of untimely capitalized revenue | 15.1 Code of Administrative Offenses | An amount of 4 to 5 thousand rubles is imposed on the official if it is possible to prove the cashier’s guilt and from 40 to 50 thousand rubles on the organization |

| Identification of unaccounted revenue amounts | Art. 120 Tax Code of the Russian Federation | Gross violation of income accounting rules – 10 thousand rubles |

| Presence of violations committed in several periods | Art. 120 Tax Code of the Russian Federation | 30 thousand rubles |

| Identification of amounts of unrecorded revenue resulting in an underestimation of accrued tax | Art. 120 Tax Code of the Russian Federation | 20% of the amount of the difference not received by the budget, limited by the upper limit of 40 thousand rubles |

A fine may be imposed on an enterprise or official in accordance with the Tax Code of the Russian Federation and the Code of Administrative Offenses simultaneously.

Restrictions on the purposes of using cash from the cash register of individual entrepreneurs and legal entities

Cash received at the cash desk for goods sold, services provided or work performed cannot be spent by a legal entity or individual entrepreneur for any other purposes other than the following:

– making wage payments to employees;

– making payments to employees that are of a social nature;

– payment of insurance compensation amounts;

– you can issue cash from the cash register for the personal needs of an individual entrepreneur, which should not be related to his activities as an individual entrepreneur;

– it is allowed to pay for goods, services, works (with the exception of securities;

– issue cash to employees on account;

– return money from the cash register for returned goods previously purchased for cash, services not performed;

Are there organizations for which there are no restrictions on spending cash from the cash register?

Currently, in the Russian Federation, credit institutions have full right to independently dispose of cash in their cash desk.

Placement in the cash register of funds not related to the organization’s cash flow. Example

In addition to untimely accounted funds, there may be amounts in the cash register that do not belong to the company and are the property of the cashier or other persons. Excess cash in the cash register refers to violations committed by the cashier. In a number of situations, the amount arises for use as a small change brought in by the cashier.

Let's consider the example of having amounts in the cash register that do not belong to the company. does not have a cash register, but makes payments to employees accountable to people through the cash register. Cashier Novikova A.A. used its own cash to simplify payments to employees. The amount of 200 rubles was placed in the cash drawer without documents. When counting the amounts in the cash register, an inspector from the Federal Tax Service found small change - a small change in the amount of 200 rubles, which did not belong to the company. Conclusion: Cashier Novikova A.A. was fined 5 thousand rubles.

If you need to use a small change when making payments with a cash register, you can get change from the cash register at the cash register at the beginning of the day. The amount must be returned after the closing of the cash register day. The cashier's contribution of funds to the operating cash desk is not allowed.

Unlike organizations, individual entrepreneurs have the right to make contributions and receive funds for personal needs. When conducting cash transactions (for internal control and in the absence of an order to cancel them), a corresponding entry is made in the cash register or cash register.

How to avoid problems

Avoiding any problems with the acquisition and operation of online cash registers is not so easy. To do this, you need to choose the right cash register specifically for your line of business, register it with all the necessary authorities on time, and then follow all reporting rules and monitor the work of employees.

There are several rules on how to properly organize your activities with the advent of an online cash register:

- The correct choice of equipment is one of the most important components. If you are buying a cash register for a taxi, then it should be light and compact; if you are buying a cash register for a catering establishment, it should have more memory, high quality and reliability. This affects not only the work with it, but also the correct registration of the cash register at the tax office. It is necessary that the cash register fully complies with all the requirements of 54-FZ.

- Registering a cash register with the Federal Tax Service is the second most important step before starting work. You can take it both online, directly on the OFD website, and offline.

- Connect the cash register to a program that will transfer all data to the tax office.

- It is necessary not only to register an online cash register, but also to register your activities, at a minimum, in order to correctly and competently pay taxes, such as UTII and Unified Agricultural Tax.

- Next comes constant monitoring of the activities of employees and checking the condition of the cash register. The cash register must comply with all legal requirements, as well as its operation.

Thus, in order to completely avoid problems, it is necessary not only to comply with all the requirements of 54-FZ. It is necessary to monitor the condition of the equipment, as well as how employees work with the cash registers. Full control and perfect timely reporting will help you avoid fines and other unpleasant consequences. A good reputation as an individual entrepreneur is much more important than a few bounced checks as savings.

Exceeding the limited amount of settlements between organizations

Legislation in Bank of Russia document No. 3073-U dated 10/07/2013. a limit has been established on the amount of cash payments between organizations. A limit of 100 thousand rubles is allowed. Features of applying the restriction:

- The limit is considered within one contract. If payments through the cash register are made under a long-term agreement, it is necessary to keep records of expenses or income under the counterparty and the agreement.

- The amount can be deposited or issued under different agreements several times during the day.

- Payment of the invoice is considered acceptance of the offer.

Exceeding the settlement limit between organizations entails the imposition of sanctions under Art. 15.1 Code of Administrative Offences.

Conducting payments without using cash register equipment (CCT)

Enterprises conducting cash payments with other organizations, individual entrepreneurs or the public are required to use cash registers. Organizations using a taxation system with imputed income or a patent have the right not to use equipment and issue individuals with another document instead of a cash receipt.

Sanctions are imposed in accordance with Art. 14.5 Code of Administrative Offences. A penalty may be imposed if one of the following conditions is met:

- Lack of a cash register registered with the Federal Tax Service.

- Conducting settlements using equipment that does not have a registered fiscal memory.

- Lack of posting of received amounts via cash register with issuance of a cash receipt.

If a cash register is not used, a fine is imposed on the official and (or) organization.

| Nature of the violation | Executive | Organization |

| The violation is isolated | From ¼ to ½ of the amount received without using technology, but not less than 10 thousand rubles | From ¾ to the full settlement amount, but not less than 30 thousand rubles |

| Conducting settlements in the amount of more than 1 million rubles | Disqualification from one year to 2 years | Suspension of activities for up to 3 months |

| Lack of a receipt issued at the buyer's request | Warning or fine in the amount of 2 thousand rubles | Warning or fine in the amount of 10 thousand rubles |

If a person does not provide information on the use of CCP within the allotted time, sanctions will be imposed on the official in the amount of 1.5 to 3 thousand rubles or on the enterprise in the amount of 5 to 10 thousand rubles. The minimum penalty is a warning.

We can talk about the use of KKM only in cases where the enterprise uses equipment included in the register or approved for use until it is completely worn out with a registered EKLZ. Otherwise, cash register is considered as a technique for maintaining internal accounting.

Penalty for failing to clear a receipt at an online cash register

Sellers are required to provide a paper document and, at the client’s request, send its digital counterpart by e-mail or mobile phone. According to Federal Law No. 54, individual entities can use cash registers remotely, that is, outside the place of settlement:

- online stores;

- automatic devices (vending machines);

- delivery services;

- cleaning, repair and other organizations that provide on-site services to the client;

- enterprises in the housing and communal services sector;

- taxi services, buses, trams, etc.

Instead of classic checks, they can provide the client with a form with a link to the OFD website, where the document is available for download, or demonstrate a QR code on the screen of a mobile device. Other methods of issuing a check are described in Art. 1.2 54-FZ.

Regardless of which method of fulfillment of the obligation the seller chooses, the same sanctions apply. The fine for failing to clear a receipt at an online cash register is RUB 2,000. for officials and 10,000 rubles. - for legal entities. If the customer asked for an electronic copy and did not receive it, the store will be fined the same amount. The size of the penalty does not depend on the form of ownership, tax regime and sales volume.

1. Ask our specialist a question at the end of the article. 2. Get detailed advice and a full description of the nuances! 3. Or find a ready-made answer in the comments of our readers.

Financial liability of cashiers

Conducting and recording cash transactions in strict accordance with legal requirements often depends on the competent actions of the cashier. In addition to the employment contract, an agreement on full financial responsibility is concluded with the cashier. If there is a shortage of funds at the cash register or other violations are detected in the cashier’s work, the person shall compensate for the damage in full.

If material losses are discovered after the dismissal of a person, the decision on compensation for damages is made by the court. Dismissal of an employee does not exclude his financial liability. The damage must be documented. At the legislative level, responsibility is determined by Art. 233 Labor Code of the Russian Federation.

Changes in the procedure for applying CCP under 54 Federal Law

The new edition of Federal Law-54 and the changes coming to it radically change the interaction of entrepreneurs with regulatory services and consumers:

- transmission of information on financial transactions is carried out automatically through the OFD on the Internet;

- the terminology “electronic check” has appeared, which must be sent at the client’s request to his email or via SMS message;

- ECLZ has been replaced by a microchip called a “fiscal drive”, the format of fiscal data is established by law;

- The requirements for compiling a BSO for those involved in providing services to the public have changed.

Carrying out cash discipline control

The check of the cash register is carried out according to a decision signed by the head or deputy of the Federal Tax Service. Control of operations can be identified as a separate office activity (mainly for enterprises using cash register machines) or included in the company’s on-site inspection plan.

Seizure of documents during desk control is carried out for a separate period. An on-site inspection is characterized by a random selection of days with a detailed study of materials. Indicators of compliance with the limit and the maximum amount of settlements between organizations are subject to complete control.