Accounting Features

The results of a comprehensive audit of an organization’s assets may vary:

- shortage - when accounting balances are greater than actual ones;

- surplus - when excess goods or materials are identified that are not in the accounting data;

- re-sorting - when some material assets are missing, but there are extra values under other items.

In addition, there is also an audit of mutual settlements, the results of which the accountant also displays in accounting. The main document in any situation is the collation sheet of inventory results of inventory items, form No. INV-19; on its basis, accounting of inventory results is carried out. The matching statement may be of a different form if this is specified in the accounting policy. On its basis, an inventory is carried out; accounting entries will reflect the identification of shortages, surpluses and re-seorts.

We prepare and carry out inventory

The obligation to conduct an annual inventory of property and financial obligations is established by the Regulations on accounting, approved by the Ministry of Finance on July 29, 1998. No. 34n. The rules and procedure for carrying out this procedure are established by the Methodological Instructions (Order of the Ministry of Finance No. 49 of June 13, 1995), they list the composition of property and liabilities subject to audit, and the forms of documents that can be used to document the results.

The main stages of inventory are shown in the table:

| Stage | Document | Explanation |

| Preparation | Manager's order to conduct an inventory | The order indicates: the timing of the inventory, the reason for the inventory, the list of inventory property, the list of financially responsible persons and the composition of the commission |

| Carrying out | Inventory list | Members of the commission maintain an inventory (count) of property and its condition |

| Data Mapping | Collation statement | Reconciliation of the data presented in the inventory with the data in accounting. Drawing up comparison sheets to identify discrepancies. |

| Registration and approval of results | Accounting certificate | Bringing accounting data into correspondence with actual availability. Write-off of shortages or capitalization of surpluses |

Reasons for conducting an inventory, in addition to the annual obligation, may be:

- Change of financially responsible person;

- Fact of theft or damage;

- Disaster;

- Organizational reasons (change of manager, reorganization, etc.):

The results of the inventory can be:

To carry out an inventory at the enterprise, a commission consisting of at least three people is formed. Based on the results of the inventory, the commission draws up matching statements, inventory lists, acts:

Shortage: wiring

Shortage, unfortunately, is the most common result of inventory, especially in trading companies and warehouses. This is due to various factors:

- careless storage;

- theft by employees or clients;

- natural decline (so-called “shrinkage”, “decay”, etc.);

- other factors.

It is allowed to write off painlessly only shortfalls within the limits of natural loss norms. Such standards are established for each type of product, material and raw material and are officially enshrined in the accounting policy. The rest of the shortage is written off to the perpetrators, and only if they could not be identified is it written off. A step-by-step algorithm for accounting for identified shortages by an accountant.

Step 1. First, you need to attribute the cost of all missing assets to account 94 “Shortages and losses from damage to valuables” using the following entries:

- Dt 94 Kt 10 (07, 08, 41, 43) - shortage of materials (equipment, investments in non-current assets, goods);

- Dt 94 Kt 50 - lack of money in the cash register.

If there is a shortage of fixed assets or intangible assets, several entries will have to be made, since it is necessary to take into account not only the residual value, but also the depreciation accrued over the period of their operation. They will look like this:

- Dt 02 Kt 01 - depreciation of missing fixed assets;

- Dt 05 Kt 04 - depreciation of missing intangible assets;

- Dt 94 Kt 01 (04) - residual value of missing fixed assets or intangible assets.

Step 2. If there are not enough materials or raw materials within the limits of natural loss, then they can be immediately written off to expense accounts. In order for the accountant to have the right to make such entries, the head of the company issues an order based on the results of the inventory. When all formalities are completed, the postings will look like this:

Dt 20 (44) Kt 94.

Step 3. If there is a shortage of more valuables than the established standards, the shortage must be attributed to the persons responsible for it. To do this, there must be a corresponding conclusion of the commission and an order from management. After completing all these documents, the following entry is made in the accounting registers:

Dt 73 Kt 94.

For account 73, analytical accounting is required in the context of all culprits with the corresponding entries.

Step 4. If the perpetrators could not be identified or they were able to defend in court the impossibility of compensating the company for losses, the amount of the shortfall is included in other expenses. The wiring looks like this:

Dt 91-2 Kt 94.

Results

Inventory results are reflected in accounting according to a strictly regulated algorithm in special statements, inventories and journals. Surpluses are received as other income of the company, and shortages are written off at the expense of the guilty parties, and if there are none, they are reflected in the accounts as other expenses.

Sources: order of the Ministry of Finance of the Russian Federation dated July 29, 1998 No. 34n

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Inventory surplus: postings

If during the audit, unaccounted for material assets, which are usually called surplus, were identified, they must be registered or capitalized. The accountant must do this at the market value on the date of the inventory. Commercial organizations include this amount in their financial results, while non-profit organizations increase their income with it. For these purposes, passive synthetic account 91-1 “Other income” is used. In order to correctly display surpluses in accounting, we have collected the transactions in one table.

| Type of assets being capitalized | Debit | Credit |

| Cash in the cash register | 50 "Cashier" | 91-1 “Other income” |

| Fixed assets | 08 “Investments in non-current assets” | 91-1 “Other income” |

| Materials | 10 "Materials" | 91-1 “Other income” |

| Goods | 41 "Products" | 91-1 “Other income” |

Sub-accounts, accounting statements and other documents are used for analytics. Fixed assets registered in this way are subject to depreciation in the usual manner.

Accounting for inventory results

The most important goal of an organization’s accounting is to ensure the safety and control of the efficient use of assets. Inventory helps to determine the actual balances of inventory items that are current as of the reporting date, compare them with accounting data and promptly identify surpluses, mis-grading or shortages. Correct reflection of inventory in accounting requires preparation. When carrying out a planned procedure, the manager approves the order to carry out the procedure in the INV-22 form, indicating the timing, responsible persons of the commission and the subject of the procedure. Unscheduled implementation is carried out under various emergency circumstances.

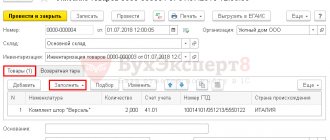

The inventory results are documented in the following accounting documents:

- Inventory sheet - the form is filled out in accordance with the unified forms of Goskomstat Resolutions No. 88 of August 18, 1998, No. 26 of March 27, 2000. Depending on the inventory object, forms INV-1 (for fixed assets), INV-1a (for objects of intangible assets), INV-3 (for inventory and materials), INV-11 (for expenses related to future periods), INV-15 (for cash) and other forms.

- Matching statement - the form is filled out to reflect the final results and discrepancies between inventory items. INV-18 is used to reflect fixed assets, INV-19 – for inventory items.

- An act in form INV-24 is drawn up for the purpose of monitoring the procedure.

Note! According to Law No. 402-FZ, an enterprise has the right to independently develop forms of applicable primary documents if all required details are available.

Possible reasons for the detected money

The discovery of excess cash in an organization's cash register is often perceived ambiguously by the employer.

This makes management's reaction to the facts of cash surpluses significantly different from the typical consequences of identifying cash shortages, in which embezzlement/theft usually becomes the priority version.

Thus, the presence of excess, unaccounted cash in the cash register can be caused, for example, by the sale of goods at an erroneously indicated (inflated) price or, alternatively, underweight.

Although, of course, such situations rarely arise by chance with modern control and transaction systems.

Speaking about possible reasons, we cannot exclude the fact that cashiers of trade organizations sometimes report their own money to the cash register.

This is often done when there is a shortage of change bills in order to freely give change to customers.

Sometimes employees forget about this, which causes excess cash to appear in the cash drawer.

One way or another, these facts can be regarded as violations of cash discipline, which is not acceptable from the point of view of conducting cash transactions.

Determining the culprit

In order to find out the reasons for the situation and correctly record cash surpluses in accounting, the inventory commission sends appropriate requests to financially responsible entities - the organization's cashiers.

Employees of the company who are personally responsible for the correct management of the cash register provide written explanations regarding excess cash.

Explanatory notes from responsible persons make it possible to identify the entities responsible for the appearance of cash surpluses.

In addition, the solution of this problem is effectively facilitated by reconciling factual information with accounting information.

How is an explanatory note drawn up by the cashier of an organization?

If an audit reveals a cash surplus at an enterprise, the responsible cashier is obliged to provide his employer with an explanatory note regarding this fact.

Current legislation provides that the head of a business entity must require the cashier to provide the necessary explanations in writing within 2 (two) days.

Being a financially responsible entity, the cashier does not have the right to refuse to write an explanatory note.

This paper is an official document.

It can be compiled manually or as a computer printout. One way or another, the explanatory note is written on the official form (form) of the business entity and signed by the cashier (with a transcript).

The explanatory document drawn up by the cashier regarding the detected excess cash contains two key sections:

- Description of facts/circumstances. The prerequisites for the situation that arose or the real events that led to its occurrence are indicated.

- A statement of specific reasons for the appearance of excess (unaccounted for) cash in the cash register. As a rule, there are several such reasons. They should be correctly identified to minimize the degree of guilt and mitigate future liability.

In addition, the explanatory paper, presented in two copies, must contain the following mandatory details:

- name of the business entity (employing company);

- Full name, position of the manager;

- the name of the paper itself (“Explanatory”);

- Full name, position of the responsible employee (cashier);

- date of preparation of the document, signature of the originator.

When the document is fully drawn up and signed by the cashier, it should be provided to the employer. The manager signs the paper (both copies) with the registration number. One copy must remain with the compiler (cashier).

What documents need to be completed?

The work of the inventory commission to identify and investigate cash irregularities in the organization is necessarily recorded by maintaining a special protocol, which reflects the following:

- detailing the results of the cash audit;

- description of methods used to identify cash surpluses;

- expert conclusions regarding the discovery of excess cash in the company's cash register.

The results of the activities of the inventory commission in the prescribed form are provided to the head of the organization, who authorizes the acceptance of excess cash into the cash desk by issuing a special administrative act.

The documentary basis for drawing up such an order is the cash inventory report, drawn up by the audit commission according to the INV-15 standard and containing the following information:

- basic details of the company;

- number and date of the inventory order (documentary basis for verification);

- number and date of formation of the INV-15 act;

- date of execution of the cash audit regulated by management order;

- financially responsible entity (full name, position) with signature;

- detailing of factual information and accounting data on the state of cash;

- determination of the total - the amount of the detected surplus;

- numbers of the latest cash orders (receipt / expense);

- Full name, position, signatures of all commission members;

- confirmation by the cashier of responsibility for the available cash in the cash register;

- the reason for the detected excess;

- signature of the financially responsible entity (with transcript);

- the manager's verdict regarding the discovered surplus;

- signature of the manager (with transcript and date).

Reflection of surpluses for tax accounting purposes

In tax accounting, the opportunity to reflect property as part of fixed assets appears only if the following conditions are simultaneously met:

- the object must be the property of the enterprise;

- the fixed asset will be used to generate income;

- the service life of the property must be more than 1 year;

- the initial cost of the fixed asset should not be less than 40,000 rubles.

If an object discovered during an audit of fixed assets does not meet one of the listed conditions, then it should be taken into account as part of the inventory.

Particular attention must be paid to property valuation. The initial cost of a fixed asset is the amount of its valuation. In this case, the assessment must be documented or carried out by an independent specialist. If the valuation of the discovered property is carried out by the enterprise itself, then official sources of information on the prices of similar goods can be used as a source of data on the value.

Surpluses are recognized as non-operating income; accordingly, the value of such property is subject to taxation.

In tax accounting, compared to accounting, a difference is formed - a permanent tax liability for income tax, which is reflected: Dt 99 Kt 68.

conclusions

Like cash shortages, cash surpluses detected during an audit require certain actions on the part of the inventory commission, management, and the responsible cashier.

Everything is carefully documented by the protocol, an inventory act is necessarily drawn up, and the financially responsible entity prepares an explanatory document regarding the cash surplus.

The reasons for the appearance of unaccounted cash are clarified, the guilty party is determined, the employer issues a verdict on accepting the cash surplus for accounting and imposing sanctions on the culprit, and appropriate orders are issued.

Write-off of shortage of raw materials in excess of normalized losses at the expense of the culprit

If the person responsible for the shortage is identified, he will compensate the damage to the enterprise at his own expense. If the amount of compensation exceeds the amount of the shortfall, the difference is additionally reflected as “other income”.

| Account Debit | Account Credit | Wiring Description | Transaction amount | A document base |

| 73.02 | Reimbursement of the amount of shortage of materials by the guilty party | 3 | Accounting certificate-calculation | |

| 73.02 | 91-1 | Difference between amount recovered and book value of missing materials | 1 |

How to register a find during re-registration?

During the recalculation of property, surpluses may be discovered that arise for the following reasons:

- fixed assets were previously written off, but are still in use;

- the fixed asset is operated without documents confirming the enterprise's ownership of it and is not listed in the accounting registers.

Such “finds” should be capitalized. This procedure can be represented as follows:

| Stages of capitalization of surplus | Contents of the procedure |

| Determining the value of discovered property | An organization can independently determine the fair value of a discovered object that is not registered. Sources of information can be information about similar funds on the balance sheet of the enterprise, press materials, etc. To establish the value, you can use the services of a professional independent assessment. When determining the price of an object, it is necessary to take into account its condition, degree of wear and tear |

| Documenting | The director of the organization issues an order to capitalize surplus property discovered during the inventory. Based on the order, it is necessary to draw up an acceptance and transfer act, form OS-1, in which, as information about the receipt of the object, it should be indicated that it was discovered during the inventory. Then fill out the fixed asset inventory card. |