From January 1, 2021, the new federal minimum wage in Russia is 12,130 rubles. The federal minimum wage (minimum wage) is established simultaneously throughout the entire territory of the Russian Federation. What is the minimum wage established in the constituent entities of the Russian Federation? This material is a table with new minimum wages by region of Russia. You can also find out what minimum wage needs to be applied from January 1, 2021 in a specific region of Russia.

Also see:

- How employers can switch to the new minimum wage starting in 2020

- All salary changes from January 1, 2021: overview

Federal minimum wage in 2019-2021

The minimum wage (minimum wage) at the state level is approved by the relevant federal law. The minimum wage is valid throughout Russia and cannot be less than the subsistence level of able-bodied citizens for the 2nd quarter of the previous year for the purpose of calculating wages (Article 1 of the Federal Law “On Minimum Wages” dated June 19, 2000 No. 82-FZ). In other words, an employee who has actually worked the standard amount of time established by the labor agreement cannot receive a salary less than the established minimum wage. If an employer pays a salary less than the minimum wage, he faces a fine under clause 6 of Art. 5.27 Code of Administrative Offences:

- from 10,000 to 20,000 rub. on officials;

- from 30,000 to 50,000 rub. for legal entities;

- from 1,000 to 5,000 rubles. for individual entrepreneurs operating without forming a legal entity.

To avoid sanctions, issue an additional payment to the employee up to the minimum wage. ConsultantPlus experts explained in detail how to do this correctly. Get trial access to the K+ system and upgrade to the Ready Solution for free.

If previously neither the social nor financial departments of the Russian Federation, nor parliamentarians could establish compliance with the minimum wage to the subsistence level, then in March 2021 the President of the Russian Federation signed Law No. 41-FZ dated 03/07/2018, the norms of which determined that from 05/01/2018 the minimum wage will be equal to the subsistence level of the working-age population for the 2nd quarter of last year. Since then, the minimum wage and the cost of living have been inextricably linked.

Thus, the minimum wage as of May 1, 2018 was 11,163 rubles. The Ministry of Labor approved the cost of living for the 2nd quarter of 2018 in the amount of 11,280 rubles. And since the cost of living for the 2nd quarter of 2021 is equal to the minimum wage for 2021, then from 01/01/2019 the value of the federal minimum wage is 11,280 rubles. In 2021, the minimum wage was 12,130 rubles. Since 2021, the minimum wage is not tied to the subsistence level. Now it is equal to the midian salary calculated by statistics and is equal to 12,792 rubles.

What payments should the employer review in connection with the increase in the minimum wage, ConsultantPlus experts told. Study the review material by getting trial access to the K+ system for free.

The minimum wage regulates not only wages, but also the amount of benefits (including maternity benefits), and until the end of 2021, the amount of contributions for individual entrepreneurs. Let's look at how the minimum wage changed over the period from 2013 to 2021.

What to do if your salary is below the minimum?

If an employee’s accrued salary for a fully worked month is less than the established limit, then the first step should be to contact the employer or accountant. It is necessary to make sure that this is not an accidental error and that a violation was actually committed. If there is an opportunity to resolve the issue without conflict, receive compensation and avoid underpayments in the future, it would be wise to use it.

When such violations are systematic and the employer categorically refuses to correct the situation, there are two options left: change jobs or defend your rights.

Initially, you need to obtain a certificate from the accounting department about the amount of wages and write a written request addressed to the head of the enterprise, asking to explain the reasons why the salary does not reach the established minimum. A requirement is also drawn up for the provision of compensation payments, after which the employer will be obliged to adjust official salaries.

If neither compensation nor a reasonable answer is forthcoming, a complaint is filed against the employer. In this case, you can contact a trade union organization, labor inspectorate, prosecutor's office or courts. The penalty for discrimination against employees is very serious, and the employer will have to go through a lot of checks. All this is troublesome and expensive, so in most cases it is possible to solve the problem peacefully.

Minimum wage for 2015–2018 in Russia

The minimum wage in 2015 was 5,965 rubles. (Article 1 of the Law of the Russian Federation dated December 1, 2014 No. 408-FZ).

The minimum wage 2021, introduced on January 1, 2016, amounted to 6,204 rubles. (Article 1 of the Law of the Russian Federation dated December 14, 2015 No. 376-FZ). From 07/01/2016 it was increased to 7,500 rubles. (Article 1 of the Law of the Russian Federation dated June 2, 2016 No. 164-FZ).

With the beginning of 2021, the value of the minimum wage has not changed, remaining equal to the value of 7,500 rubles, effective from 07/01/2016. However, from July 1, 2017, the minimum wage increased to 7,800 rubles. (Article 1 of the Law of the Russian Federation dated December 19, 2016 No. 460-FZ).

Since January 2021, the minimum wage has increased to 9,489 rubles. From 05/01/2018, as mentioned above, 11,163 rubles.

Read about the role of the minimum wage in setting wages in the material “Art. 135 of the Labor Code of the Russian Federation: questions and answers" .

Incentive accruals

Why is incentives included in the minimum wage? The conditions for accrual of incentive payments are set out in local regulations of enterprises and organizations or collective agreements between the employer and employees. If bonuses are paid monthly, then the accrued amounts are constantly added to the minimum payment. However, the payment of incentives is not an obligation assigned to the employer, it is his right.

Are annual, quarterly, or one-time bonuses included in the minimum payment? In practice, this issue caused certain difficulties, since it did not receive an accurate interpretation in the Labor Code of the Russian Federation. Based on the ruling of the Supreme Court of Karelia No. 33-2448/2018 dated 06/05/2018, it was established that such payments are also subject to inclusion in the minimum wage component.

Let's see what other charges are included in the minimum wage. Compensatory additional payments for work on night shifts, weekends and holidays are calculated at increased rates and, accordingly, are accrued above the minimum wage. However, if this work is carried out within the framework of established duties and fixed standards of labor and working hours, then compensation is accrued within the “minimum wage”.

Additional payment for harmfulness refers to a compensation payment, which is determined by the work regime and special working conditions of employees (Article 129 of the Labor Code of the Russian Federation). Since this payment is a component of wages, it is calculated within the limits of the minimum wage.

What changes in the minimum wage occurred in 2013

The minimum wage in 2013 was 5,205 rubles, which is 39.4 times more than at the beginning of 2000. The minimum wage in 2013 in Russia was equal to 68.2% of the subsistence level for able-bodied persons for the same period. At the same time, in 2000, the minimum wage was 9.33 times less than the subsistence level for able-bodied persons.

Such excesses are explained by the fact that until 2010 the minimum wage was used not only to regulate the level of wages, but also to determine the amount of various socially significant benefits. In 2013–2014, the ratio between the minimum wage and the subsistence level fluctuates at around 67–68%, without demonstrating significant positive dynamics.

Dynamics

Let's take a closer look at how this indicator has changed over the past twenty-plus years. It should be noted that in the 98th year of the last century there was a denomination of the currency, which led to the cutting off of some zeros in the monetary currency of our country.

Schedule. Minimum wage changes by year:

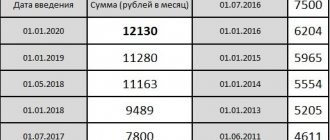

Table. Minimum wages by year in Russia:

| Dated | Monthly minimum wage, in rubles. | Regulated by document |

| 1 Jan 2019 | 11280 | |

| May 1, 2018 | 11163 | FZ-41 (March 7, 2018) |

| 1 Jan 2018 | 9489 | FZ-421 (28 Dec 2017) |

| 1 Jul 2017 | 7800 | FZ-460 (Dec 19, 2016) |

| 1 Jul 2016 | 7500 | FZ-164 (June 2, 2016) |

| 1 Jan 2016 | 6204 | FZ-376 (14 Dec 2015) |

| 1 Jan 2015 | 5965 | FZ-408 (1 Dec 2014) |

| 1 Jan 2014 | 5554 | FZ-336 (2 Dec 2013) |

| 1 Jan 2013 | 5205 | FZ-232 (December 3, 2012) |

| June 1, 2011 | 4611 | FZ-106 (June 1, 2011) |

| 1 Jan 2009 | 4330 | FZ-91 (June 24, 2008) |

| 1 Sep 2007 | 2300 | FZ-54 (April 20, 2007) |

| May 1, 2006 | 1100 | FZ-198 (29 Dec 2004) |

| 1 Sep 2005 | 800 | FZ-198 (29 Dec 2004) |

| 1 Jan 2005 | 720 | FZ-198 (29 Dec 2004) |

| 1 Oct 2003 | 600 | FZ-127 (Oct 1, 2003) |

| May 1, 2002 | 450 | FZ-42 (April 29, 2002) |

| 1 Jul 2001 | 300 | FZ-82 (Aug 19, 2000) |

| 1 Jan 2001 | 200 | FZ-82 (Aug 19, 2000) |

| 1 Jul 2000 | 132 | FZ-82 (Aug 19, 2000) |

| 1 Jan 1998 | 83,49* | |

| 1 Jan 1997 | 83490 | FZ-6 (9 Jan 97) |

| 1 Apr 1996 | 75900 | FZ-40 (22 Apr 96) |

| 1 Jan 1996 | 63250 | FZ-159 (1 Dec 95) |

| 1 Dec 1995 | 60500 | FZ-159 (1 Dec 95) |

| 1 Nov 1995 | 57750 | FZ-159 (1 Dec 95) |

| 1 Aug 1995 | 55000 | FZ-116 (27 Jul 95) |

| May 1, 1995 | 43700 | FZ-43 (20 Apr 95) |

| 1 Apr 1995 | 34400 | FZ-43 (20 Apr 95) |

| 1 Jul 1994 | 20500 | FZ-8 (Jun 30, 94) |

| 1 Dec 1993 | 14620 | Decree 2115 (05 Dec 93) |

| 1 Jul 1993 | 7740 | RF Law 5432-1 (Jul 14, 93) |

| 1 Apr 1993 | 4275 | RF Law 4693-1 (Mar 30, 93) |

| 1 Jan 1993 | 2250 | RF Law 3891-1 (13 Nov 92) |

| 1 Apr 1992 | 900 | RF Law 2704-1 (21 Apr 92) |

| 1 Jan 1992 | 342 | RF Law 1991-1 (06 Dec 91) |

| 1 Dec 1991 | 200 | Decree of the RSFSR number 5 (15 Nov 91) |

| 1 Oct 1991 | 180 | Law of the RSFSR 1028-I (19 April 91) |

* - this year the ruble was devalued, according to which the number of zeros on banknotes was reduced.

Return to content

Limit base for calculating contributions to the Pension Fund in 2014–2018 and the minimum wage

The size of the minimum wage in 2014 began to be used when calculating the amount of insurance premiums for individual entrepreneurs, and this procedure was applied until the end of 2017, despite the fact that insurance premiums from 2021 came under the control of the tax authorities and began to be subject to the provisions of the relevant chapter of the Tax Code of the Russian Federation.

The procedure for calculating contributions paid by individual entrepreneurs to the funds implied that the minimum wage established at the beginning of the tax period was multiplied by 12 months and by the insurance rate of the state fund (PFR, MHIF). If the income received by the entrepreneur for the year exceeds the amount of 300,000 rubles. from the amount of this excess, he had to pay another 1% (subclause 1, clause 1, article 430 of the Tax Code of the Russian Federation).

Read more about insurance premiums and other payments paid by individual entrepreneurs in this article .

To calculate the amount of insurance premiums for individual entrepreneurs for previous years, you will need to know the minimum wage values that were in effect in that tax period. Our experts have collected these values in a convenient table.

Table of minimum wages by year

The minimum wage table is also convenient because you can see not only the value of the indicator, but also track its dynamics.

| Minimum wage 2013 The minimum wage for 2013 is 5,205 rubles. (approved December 2012) |

| Minimum wage 2014 The minimum wage in 2014 is 5,554 rubles. (approved December 2013) |

| Minimum wage 2015 The minimum wage in 2015 is 5,965 rubles. (approved December 2014) |

Minimum wage 2016

|

Minimum wage 2017

|

Minimum wage 2018

|

| Minimum wage 2019 From 01/01/2019 - 11,280 rubles. |

| Minimum wage 2020 From 01.01.2020 - 12,130 rub. |

| Minimum wage 2021 From 01/01/2021 - 12,792 rubles. |

When an employer has the right to set a salary less than the minimum wage

The employer has the right to set the salary less than the “minimum wage” in the cases provided for in Art. 133 Labor Code of the Russian Federation:

- the employee is employed part-time (working day or week), which is stated in the employment agreement;

- part-time work;

- the employee did not work the required working hours, for example as a result of absenteeism;

- production or labor standards have not been developed, and also if the employee has made defects in his work;

- temporary incapacity for work (sick leave). In this case, only days actually worked are paid;

- downtime of the production process through no fault of the employer;

- going on vacation at your own expense.

If the salary is less than the minimum wage, the employer will have to:

- with the help of additional payments, bring the “minimum wage” to the appropriate level. The accrual of additional payment is formalized by a separate order to the employment agreement;

- increase the employee's salary. If the manager decides to increase the salary, it is necessary to make a new staffing table and make changes to the employment agreement.

How much is the minimum wage in 2021 in the largest regions

In accordance with Art. 133.1 of the Labor Code, the governments of the constituent entities of the Federation can sign regional agreements with associations of trade unions and employers, which establish the local level of the minimum wage.

IMPORTANT! The regional minimum wage cannot be lower than the minimum wage established by federal legislation.

If a subject has established its own minimum wage, then the salary of an employee who has worked the standard amount of time cannot be lower than the regional minimum wage.

Let's consider the minimum wage values in 2021 in the regions of the Russian Federation (as of January 21, 2021):

- The minimum wage for Moscow is 20,589 rubles.

- In St. Petersburg, the minimum wage is 19,000 rubles.

- The maximum value of the minimum wage in the Central District was recorded in the Moscow region at the level of 15,000 rubles.

- In almost all other constituent entities of the Russian Federation, the minimum wage for 2021 is equal to the federal average of 12,792 rubles. In a number of regions, regional coefficients need to be taken into account.

A complete directory of minimum wages by region can be found in ConsultantPlus. Get free access to the system and go to the material.

Procedure for accepting minimum wage

The minimum wage indicator is introduced based on the signing of an agreement by a tripartite commission between representatives:

- local authorities;

- employer communities;

- representatives of the interests of trade union workers.

As a result of negotiations, a decision is made to accept the agreement, which is published in an official source. After reading the agreement, employers either accept the terms of the document or have the right to refuse it within thirty days from the date of publication. In case of refusal, a written reasoned refusal is drawn up with documentary evidence of each argument.

The commission considers the refusal of the employer who is invited to the meeting. The employer has no right not to attend a meeting of the collegial body.

Results

The minimum wage for 2021 has been increased to 12,792 rubles.

Starting in 2021, officials decoupled the minimum wage from the subsistence level. Now it is equal to the midian salary calculated by statistical authorities. In 2021, the minimum wage was 12,130 rubles. In 2021, the minimum wage is 11,280 rubles. Since May 2018, the minimum wage has become equal to the subsistence level of the working-age population for the 2nd quarter of 2021 and amounted to 11,163 rubles. Regions also have the right to set the minimum wage, but it cannot be lower than the federal figure. You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Forecast

Today, the government is trying to implement measures that will result in the minimum wage being higher than the subsistence level. And it is planned to further increase this gap to improve the lives of the country’s working population. But the pace at which this is being implemented today is unlikely to improve the situation of the working population.

After all, the situation with prices for the main categories of goods also does not stand still. That is, a growing consumer basket does not allow one to buy more goods and improve the quality of life.