According to Law 54-FZ “On the use of cash register equipment,” the deferment for online cash registers ends in 2021. Who should install the cash register and when? How to register and where to service a cash register? What information should I include on the receipt and how can I avoid fines?

The transition to work under a new order is not just about buying new cash register equipment. It is now necessary to enter the names of goods in receipts - from February 1, 2021, this is mandatory for individual entrepreneurs using the PSN, USN, and Unified Agricultural Tax. For this you need a cash register program. Our free application Cash Desk MySklad supports this and all other requirements of 54-FZ. Download and try it now.

Exempt from online cash registers until 07/01/2021

Clause 1 of Article 2 of the Federal Law dated 06.06.2019 No. 129-FZ “On amendments to the Federal Law “On the use of cash register equipment when making payments in the Russian Federation”:

Establish that individual entrepreneurs who do not have employees with whom employment contracts have been concluded, when selling goods of their own production, performing work, or providing services, have the right not to use cash register equipment when paying for such goods, work, and services until July 1, 2021.

What is cash register technology and how does it work?

A cash register is an analogue of an earlier device that issues a check and records the fact of payment or issuance of money. The difference between the modern device is that now, instead of the ECLZ, all operations are remembered by the fiscal drive. It not only stores, but also transmits data to the tax service so that government authorities always have up-to-date information on money and commodity turnover at their disposal.

Cash register models work in conjunction with the Internet, through which they connect with the fiscal data operator - the link between the retailer and the Federal Tax Service. The Federal Law on the use of cash register systems regulates the activities and use of technology, periodically introducing changes in the form of amendments. Therefore, you need to carefully monitor new editions so as not to violate legal requirements.

Exempted from the use of CCP indefinitely

According to Article 2 of Federal Law No. 54-FZ dated May 22, 2003 (as amended on June 6, 2019), the following entities are exempt from the use of cash register equipment without a time limit:

- Credit organizations.

- Organizations and individual entrepreneurs when carrying out the following activities:

- sale of newspapers and magazines on paper;

- sale of securities;

- providing meals to students and employees of educational organizations during training sessions;

- trade in retail markets, fairs, exhibition complexes with some exceptions;

- peddling trade in food and non-food products with some exceptions;

- trade in ice cream kiosks, as well as trade in bottling soft drinks, milk and drinking water;

- trade from tank trucks in kvass, milk, vegetable oil, live fish, kerosene, seasonal trade in vegetables;

- acceptance of glassware and waste materials from the population, with the exception of scrap metal, precious metals and precious stones;

- shoe repair and painting;

- production and repair of metal haberdashery and keys;

- supervision and care of children, the sick, the elderly and disabled;

- sale by the manufacturer of folk arts and crafts products;

- plowing gardens and sawing firewood;

- porter services at train stations and ports;

- leasing (hiring) of own residential premises by an individual entrepreneur, including together with parking spaces;

- retail sale of shoe covers.

- Individual entrepreneurs using the patent tax system, with some significant exceptions.

- Individual entrepreneurs applying the special tax regime “Professional Income Tax”.

- Organizations and individual entrepreneurs carrying out payments in remote or hard-to-reach areas with some exceptions.

- Pharmacy organizations located in paramedic and paramedic-obstetric centers located in rural areas.

- Cash register equipment may not be used when providing services for religious rites and ceremonies, as well as when selling religious objects and religious literature.

- Cash register equipment is not used when making non-cash payments between organizations and (or) individual entrepreneurs, with the exception of payments made by them using an electronic means of payment with its presentation.*

- Cash register equipment may not be used when making non-cash payments:

- partnerships of real estate owners, housing, housing-construction cooperatives for the provision of services to their members and when accepting payments from them for living quarters and utilities;

- educational organizations when providing services to the population in the field of education;

- physical culture and sports organizations when providing services to the population in the field of physical culture and sports;

- houses and palaces of culture, clubs and other similar enterprises when providing services to the population in the field of culture.

- Cash register equipment may not be used by individual entrepreneurs when selling entrance tickets and subscriptions to state and municipal theaters by hand or from a tray.

* An electronic means of payment that can be presented is a corporate bank card linked to a current account. To avoid having to use an online cash register, payments involving the presentation of such business cards will have to be excluded.

The information above is presented in abbreviated form; you can read it in full in Article 2 of Federal Law No. 54-FZ dated May 22, 2003.

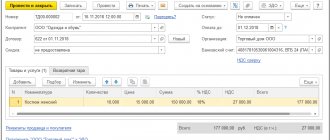

Requirements for a check and BSO

According to the new law on online cash registers, the receipt has changed since 2021. It now has 17 more mandatory positions.

What does the new check look like?

You can download a comparison of the details of the old and new checks as a separate file.

Now BSO is the same as a check. They have the same details and the same look. The adopted law on online cash registers states that strict reporting forms require a special device, but they can also be printed on a regular online cash register.

Individual entrepreneurs who use a patent or UTII write the name of the product on their receipts starting in 2021.

Obligation of buyers to punch a receipt

Are organizations and individual entrepreneurs required to use cash register systems when paying for goods and services in cash or with a corporate card linked to a current account?

In accordance with paragraph 1 of Article 1.2. Federal Law No. 54-FZ “Cash register equipment... is used on the territory of the Russian Federation without fail by all organizations and individual entrepreneurs when making payments , except in cases established by this Federal Law.”

Calculations according to article 1.1. Federal Law No. 54-FZ is “... acceptance (receipt) and payment of funds in cash and (or) by bank transfer for goods, work, services ..."

According to the definition of the concept of “settlements”, paragraph 1 of Article 1.2. and paragraph 9 of Article 2 of Federal Law No. 54-FZ, all organizations and individual entrepreneurs are required to use cash register systems when paying money for goods, work, services in cash and (or) by bank transfer with presentation of an electronic means of payment.

However, in paragraph 2 of Article 1.2. Federal Law No. 54-FZ states that “When making a payment, the user is obliged to issue a cash receipt... to the buyer (client) …” There is no mention of issuing a check to the seller.

In addition, Article 4.7 of Federal Law No. 54-FZ lists the mandatory details of a cash receipt, among which there is “a sign of payment (receipt of funds from the buyer (client) - receipt, return to the buyer (client) of funds received from him - return of receipt, issuance of funds to the buyer (client) - expense, receipt of funds from the buyer (client) issued to him - return of expense).” There is no mention of issuing funds to the seller.

Whether in practice these two arguments will be taken into account by tax authorities in favor of organizations and individual entrepreneurs is unknown. But there is an option, confirmed by paragraph 2 of the Letter of the Federal Tax Service dated August 10, 2018 No. AS-4-20 / [email protected] , when the buyer and seller can make a payment with one check, punched by the seller of goods, works, services. This is possible when payments are made by an accountable person of an organization or individual entrepreneur.

The cash receipt issued to an accountable person must indicate the buyer’s TIN as of July 1, 2019. Read more about this in Letter of the Federal Tax Service dated August 10, 2018 No. AS-4-20/ [email protected]

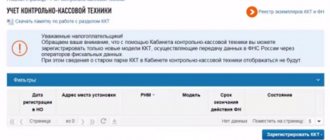

Main

With

Since 2021, 54-FZ applies to almost every business. To legally trade or provide services, you need to connect an online cash register.

2

Determine how much you are willing to spend at a time: if the business is stable, buy your own cash register; If you are just starting out or work seasonally, rent a CCP.

With

Determine what kind of fiscal storage is needed for your business. Buy a tax account and install it in the cash register - the easiest way is to take the “cash register + fiscal drive” kit.

With

Enter into an agreement with the OFD - this is a legal requirement. Choose an operator that has a tax license and additional capabilities for business analytics.

With

Buy an electronic signature. This is not necessary, but it changes life for the better: all communication with government agencies can be transferred online and save a ton of paper.

With

Register the cash register with the tax office. If you have an electronic signature, this can be done online through your personal account.

Responsibility for violation of laws on CCP

Liability for violation of the legislation on the use of online cash registers is regulated by the Code of the Russian Federation on Administrative Offenses dated December 30, 2001 No. 195-FZ (as amended on May 29, 2019).

Article 14.5. Sale of goods, performance of work or provision of services in the absence of established information or non-use of cash register equipment in cases established by federal laws:

2. Failure to use cash register equipment in cases established by the legislation of the Russian Federation on the use of cash register equipment shall entail the imposition of an administrative fine on officials in the amount of one-fourth to one-half of the amount of the settlement carried out without the use of cash register equipment, but not less ten thousand rubles ; for legal entities - from three-quarters to one of the amount of the settlement made using cash and (or) electronic means of payment without the use of cash register equipment, but not less than thirty thousand rubles . 3. Repeated commission of an administrative offense provided for in Part 2 of this article, if the amount of settlements made without the use of cash register equipment amounted, including in the aggregate, to one million rubles or more, –

entails disqualification for officials for a period of one to two years ; in relation to individual entrepreneurs and legal entities - administrative suspension of activities for a period of up to ninety days .

4. The use of cash register equipment that does not meet the established requirements, or the use of cash register equipment in violation of the procedure for registering cash register equipment, the procedure, terms and conditions for its re-registration, the procedure and conditions established by the legislation of the Russian Federation on the use of cash register equipment its applications -

entails a warning or the imposition of an administrative fine on officials in the amount of one and a half thousand to three thousand rubles ; for legal entities - a warning or the imposition of an administrative fine in the amount of five thousand to ten thousand rubles .

5. Failure by an organization or individual entrepreneur to provide information and documents at the request of tax authorities or the provision of such information and documents in violation of the deadlines established by the legislation of the Russian Federation on the use of cash register equipment, –

entails a warning or the imposition of an administrative fine on officials in the amount of one and a half thousand to three thousand rubles ; for legal entities - a warning or the imposition of an administrative fine in the amount of five thousand to ten thousand rubles .

6. Failure by an organization or individual entrepreneur, when using cash register equipment, to the buyer (client) of a cash receipt or a strict reporting form in electronic form, or failure to transfer these documents on paper to the buyer (client) at his request in cases provided for by the legislation of the Russian Federation on the use of control equipment - cash register equipment, –

entails a warning or the imposition of an administrative fine on officials in the amount of two thousand rubles ; for legal entities - a warning or the imposition of an administrative fine in the amount of ten thousand rubles .

Let's sum it up

- If the bill to repeal Law No. 54-FZ of May 22, 2003 is adopted, all its provisions will be transferred to the Tax Code of the Russian Federation, and the law itself will cease to be in effect.

- It is planned to introduce a new type of inspections - operational ones. Their goal is to check the completeness of recording calculations and accounting for cash register receipts.

- Fines for violation of work with cash register systems will “move” from the Code of Administrative Offenses of the Russian Federation to the Tax Code of the Russian Federation and will be supplemented with new types.

- Blocking of websites, online stores and messenger profiles will be added to the existing sanctions.

If you find an error, please select a piece of text and press Ctrl+Enter.

Limitation of liability until 07/01/2020

Article 2 of Federal Law No. 171-FZ of July 3, 2019 abolishes fines for public transport and the housing and communal services sector until July 1, 2020:

“To suspend until July 1, 2021 the effect of parts 2 – 4 and 6 of Article 14.5 of the Code of the Russian Federation on Administrative Offenses ... in relation to the use of cash register equipment when making payments by drivers or conductors in the cabin of a vehicle when selling travel documents (tickets) and coupons for travel on public transport, as well as payments for services in the field of housing and communal services (including services of resource supply organizations).”

Representatives of public transport and the housing and communal services sector will not be fined until July 1, 2021 for the following violations:

- Failure to use cash register equipment.

- Repeatedly registered non-use of CCP.

- Using an online cash register that does not meet established requirements.

- Using an online cash register that meets established requirements with violations.

- Failure to provide a paper or electronic check to a client upon request.

How to report to government agencies online

To “communicate” with the Federal Tax Service online, you need a qualified electronic signature - CEP. This is analogous to your signature: you can use it to certify electronic documents. CEP allows you to interact with government agencies remotely: correspond with the tax, Federal Customs Service and other authorities, regularly send reports to the Federal Tax Service, Pension Fund of the Russian Federation, Social Insurance Fund and Rosstat. To transfer data to all government agencies through one program, you need to install an electronic document management system (EDF).

For remote communication with officials and business partners, Sberbank offers an E-invoicing system. It has built-in electronic document management, reporting and a document designer - this way you reduce the time for preparing and submitting reports, do not make mistakes in templates and waste less paper.