The accounting reflection of fines in accounting is carried out depending on the type:

- contractual penalties are recorded as income and expenses in 91 accounts;

- penalties under contracts are taken into account as part of the income tax base;

- tax penalties are not taken into account for tax purposes.

In the activities of organizations, there almost always comes a time when, through the fault of the contractor or due to circumstances, the company is subject to penalties. The specifics of accounting for fines depend on many factors.

Accounting for fines and penalties

ACCOUNTING 2015: reflection of fines and penalties in accounting.

In the accounting of the creditor organization (supplier of goods, performer of work, services), fines and penalties received for violation of the terms of the contract are recognized as other income (clause 7 of the accounting regulations “Income of the organization” (PBU 9/99), approved by order of the Ministry of Finance of Russia dated 06.05 .1999 N 32n). They are taken into account in amounts recognized by the debtor or awarded by the court in the reporting period in which they were actually recognized by the debtor or the court made a decision on collection (clause 10.2 of PBU 9/99). To take into account penalties recognized by the debtor, it is necessary to have documents confirming their recognition and allowing one to determine the amount of the recognized debt. It may be a bilateral act signed by the parties, a letter from the debtor confirming the fact of violation of the obligation, indicating the amount of the recognized penalty, or another similar document.

When taking into account penalties based on a court decision, the following must be taken into account.

Conditions mitigating liability

It is possible to achieve a mitigation of punishment in the form of a reduction in the size of the fine for non-payment of VAT. It is only necessary to prove the presence of mitigating circumstances of the offender.

The list of circumstances is specified in Article 112 of the Tax Code of the Russian Federation and includes:

- Difficult financial situation.

- Personal or family circumstances.

- The taxpayer is under outside influence, coercion or threats.

The list is not final; if necessary, the judge independently decides whether there are mitigating circumstances. In addition, if a citizen has previously been held accountable for a similar offense, this circumstance will be classified as aggravating.

Overpayment of VAT

The legislation does not contain specific explanations for the question of whether an overpayment of taxes is a mitigating circumstance. The decision on this issue remains with the judge; most often in practice, the court makes a decision in favor of the taxpayer and reduces the amount of the fine.

In court, an entrepreneur can insist that an overpayment on his part proves that he has no motive for deliberate tax evasion.

Failure to pay VAT for the first time

The answer, as with the previous question, is ambiguous; there are no clear legislative guidelines on this matter.

In practice, the courts are inclined to recognize this circumstance as a mitigating one, because an entrepreneur who failed to pay tax for the first time could have made a mistake with the amount or deadline.

Voluntary payment of taxes

If the entrepreneur paid the VAT debt before the start of inspections by regulatory authorities and detection of non-payment, the court will recognize this circumstance as mitigating guilt.

A reduction in the degree of guilt also occurs in the case of timely elimination of arrears on the basis of clarifying declarations.

The legislation also does not contain specific instructions on this matter; the decision remains with the judge presiding over the case.

Penalty from the buyer for violating the delivery deadline for wiring and VAT! Help me please!

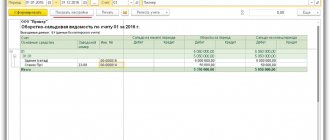

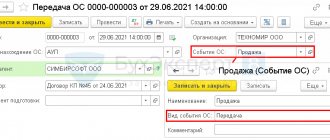

Decisions of the arbitration court enter into legal force one month after their adoption, unless an appeal has been filed (clause 1 of Article 180 of the Arbitration Procedure Code of the Russian Federation). Consequently, the reflection of penalties for violation of contractual obligations based on a court decision in accounting should occur in the reporting period when a month has passed from the date of the decision of the arbitration court. Amounts of claims (claims) submitted that are not recognized by the payer (not awarded by the court) are not accepted for accounting. Penalties collected from counterparties for non-compliance with contractual obligations, in amounts recognized by payers or awarded by the court, are reflected in the following entries: - debit 76-2 “Settlements on claims” credit 91-1 “Other income”: penalties recognized by the debtor or awarded by the court; — debit 51 credit 76-2: penalties received.

Answers to frequently asked questions

Question No. 1: Is it possible to apply any of the deductions when withholding personal income tax from a penalty?

An individual, when receiving income in the form of a penalty or a fine, can only claim a standard deduction for himself in the amount of 500 or 3000 rubles. rub. (for your child – from 1,400 to 12,000 Russian rubles). The law does not prohibit the use of a standard deduction.

It should be borne in mind that this deduction will be possible only if there are certain grounds and if the specific conditions provided for in Art. 218 Tax Code of the Russian Federation. Key point: the standard deduction is provided only to residents of the Russian Federation (i.e., those citizens whose income is subject to personal income tax at a rate of 13%).

Reflection of penalties in the debtor’s accounting

In the debtor’s accounting, penalties paid (fines, penalties) for violation of contractual obligations are included in other expenses (clause 12 of the accounting regulations “Organization expenses” (PBU 10/99), approved by Order of the Ministry of Finance of Russia dated May 6, 1999 N 33n). Penalties ( fines, penalties ) in accordance with clause 14.2 of PBU 10/99 are accepted for accounting in amounts recognized by the organization or awarded by the court in the reporting period in which the court decision on their collection was made, regardless of the time of actual payment of funds and other forms of implementation . After recognizing (awarding) a penalty, the debtor attributes it to the increase in other expenses. To do this, in the same reporting period, they make an entry for the corresponding amount: - debit 91-2 “Other expenses” credit 76-2: penalties for violation of contractual obligations awarded by the court or recognized by the organization are reflected.

Repayment of debt to the creditor is reflected by the following entry: - debit 76-2 credit 51: penalties for violation of contractual obligations have been paid.

Example of accounting entry for fines and penalties

The seller shipped a consignment of goods to the buyer in the amount of 2,360,000 rubles including VAT. The buyer paid for the goods 9 days late. According to the terms of the agreement, for late payment a fine of 50,000 rubles and a penalty of 0.1% of the unpaid amount for each day of delay are provided. The seller filed a claim for a fine of 50,000 rubles and penalties of 21,240 rubles (2,360,000 rubles x 0.1% x 9). The buyer partially agreed with the claim, expressing his readiness to pay the accrued amount of penalties and a fine in the amount of 5,000 rubles, which he reported in writing on July 24, 2012. This offer was eventually accepted by the seller. In the buyer’s accounting, the above business transactions are accompanied by the following entries: - debit 41 credit 60: 2,360,000 rubles - goods accepted for accounting; - debit 19 credit 60: 360,000 rubles - the amount of VAT presented by the seller of goods is allocated; — debit 60 credit 51: 2,360,000 rubles — funds were transferred for goods; — debit 91-2 credit 76-2: 26,240 rubles (21,240 + 5000) — the supplier’s claim for late payment for goods was recognized; - debit 76-2 credit 51: 26,240 rubles - fines and penalties are listed.

In the seller’s accounting, the shipment of goods and the accrual of penalties are taken into account as follows (without posting to write off the actual cost of shipped goods): - debit 62 credit 90-1: 2,360,000 rubles - the buyer’s debt for shipped goods is reflected; — debit 90-3 credit 68 subaccount “Calculations for VAT”: 360,000 rubles — VAT is charged for shipped goods; - debit 51 credit 62: 2,360,000 rubles - payment received for goods shipped; — debit 76-2 credit 91-1: 26,240 rubles — penalties for violation of the contract in the amount recognized by the buyer are taken into account in other income; - debit 51 credit 76-2: 26,240 rubles - funds have been received against the submitted claim.

If the penalty to be paid is clearly disproportionate to the consequences of the violation of the obligation, then the debtor has the right through the court to demand its reduction.

REFLECTION IN ACCOUNTING OF FINES, PENALTIES, PENALTY UNDER BUSINESS AGREEMENTS OF THE DEBTOR ORGANIZATION

In accounting, fines, penalties, and penalties for violation of contractual obligations are included in non-operating expenses. This is determined by paragraph 12 of Order of the Ministry of Finance of the Russian Federation dated May 6, 1999 No. 33n “On approval of the accounting regulations for “organizational expenses” PBU 10/99” (hereinafter referred to as PBU 10/99).

In accordance with clause 14.2 of PBU 10/99, fines, penalties, penalties are accepted for accounting in the amounts awarded by the court in the reporting period in which the court made a decision on their collection.

In accordance with the Chart of Accounts and the Instructions for its application, approved by Order of the Ministry of Finance of the Russian Federation dated October 31, 2000 No. 94n, in accounting for the reflection of fines, penalties, penalties, account 91 “Other income and expenses” is intended, subaccount 91-2 “Other expenses » in correspondence with accounts for settlements or cash.

| Account correspondence | Contents of operation | |

| Debit | Credit | |

| 91-2 “Other expenses” | 76 “Settlements with various debtors and creditors” | Penalties for violation of contractual obligations awarded by the court are reflected |

| 76 “Settlements with various debtors and creditors” | 51 “Current accounts” | Penalties paid for violation of contractual obligations |

Example 1.

The Vega organization shipped a consignment of goods to the Delta organization in the amount of 236,000 rubles (excluding VAT). According to the terms of the agreement, for late payment for goods, a fine of 50,000 rubles and a penalty of 0.1% for each day of delay are provided. The Delta organization did not make the payment on time, thereby violating the terms of the contract. The Vega organization filed a claim for a fine in the amount of 50,000 rubles and penalties in the amount of 3,200 rubles. The Delta organization agreed with the claim made against them.

| Account correspondence | Sum | Contents of operation | |

| Debit | Credit | ||

| 41 "Products" | 60 “Settlements with suppliers and contractors” | 236 000 | Goods accepted for accounting |

| 91-2 “Other expenses” | 76 “Settlements with various debtors and creditors” | 53 200 | Received a complaint from the supplier |

| 60 “Settlements with suppliers and contractors” | 51 “Current accounts” | 236 000 | Payment for goods reflected |

| 76 “Settlements with various debtors and creditors” | 51 “Current accounts” | 53 200 | Fines and penalties listed |

TAXATION OF FINES, PENALTY, PENALTY UNDER BUSINESS CONTRACTS FOR THE DEBTOR ORGANIZATION

INCOME TAX

For the purpose of calculating income tax, the amount of the fine payable is taken into account as part of non-operating expenses not related to production and sales, in accordance with subparagraph 13 of paragraph 1 of Article 265 of the Tax Code of the Russian Federation (hereinafter referred to as the Tax Code of the Russian Federation).

The date of recognition of expenses in the form of a fine, penalty, or penalty for a taxpayer who determines income and expenses using the accrual method is the date the organization recognizes the fine. This follows from subparagraph 8 of paragraph 7 of Article 272 of the Tax Code of the Russian Federation:

“the date of recognition by the debtor or the date of entry into legal force of the court decision - for expenses in the form of amounts of fines, penalties and (or) other sanctions for violation of contractual or debt obligations, as well as in the form of amounts of compensation for losses (damage).”

For organizations that determine income and expenses on a cash basis, expenses in the form of fines, penalties and (or) other sanctions for profit tax purposes are recognized after their actual payment (clause 3 of Article 273 of the Tax Code of the Russian Federation).

Please note that in order to recognize fines, penalties, penalties as part of non-operating expenses, a document is required that confirms the fact of violation of contractual obligations by the debtor. That is, the requirement of Article 252 of the Tax Code of the Russian Federation must be met, expenses must be justified and documented.

VALUE ADDED TAX

Penalties are calculated based on the terms of the contract, or at the written request of the creditor, or by court decision. Do I need to issue an invoice for the amount of the penalty? In accordance with paragraph 1 of Article 168 of the Tax Code of the Russian Federation, when selling goods (work, services), the supplier issues the corresponding invoices to the buyer. But if a penalty is accrued, no shipment of goods, performance of work, or provision of services occurs, therefore, the supplier does not issue an invoice for the amount of penalties.

Please note that the payer of the penalty (buyer), calculated on the amount of the penalty, does not have the right to deduct VAT. Since Article 171 of the Tax Code of the Russian Federation does not provide for the possibility of accepting a tax deduction for VAT on this basis.

According to paragraph 2 of Article 171 of the Tax Code of the Russian Federation, tax amounts presented to an organization for goods, work, services, property rights acquired for the implementation of transactions recognized as objects of taxation and for goods (work, services) acquired for resale are subject to deduction.

As we can see, the organization has no grounds to offset the tax paid against penalties.

A similar point of view is reflected in the letter of the Ministry of Taxes and Taxes of the Russian Federation dated April 27, 2004 No. 03-1-08/1087/14.

Therefore, the organization attributes the total amount of sanctions, together with the tax, to non-operating expenses in its accounting as of the date of the letter of agreement to pay the sanctions under the contract.

For profit tax purposes, the organization takes into account the amounts on the claim without VAT, since all cases when VAT can be taken into account in expenses are listed in Article 170 of the Tax Code of the Russian Federation (Appendix No. 4).

Example 2.

The Vega organization shipped products to the Delta LLC organization in the amount of 295,000 rubles (including VAT 45,000 rubles).

How to correctly calculate and write off penalties

These amounts are accrued, paid and written off in accordance with the Tax Code of the Russian Federation and PBU 10/99. The entire process regarding the formation of entries is reflected in two options, priority is given to each of them depending on the method of interpretation of accounting and tax accounting standards.

If we interpret this concept from the perspective of accounting standards, then these penalties are equivalent to penalties and write-offs occur in the same manner. In tax accounting, these two concepts differ both in the way they are reflected and in their characteristics.

Since penalties are completely devoid of any signs of penalties due to the lack of a fixed amount, they cannot be taken into account as a reduction in the expense base when determining the taxation option, so they are taken into account in the category of other costs. In this case, the accountant must use one of two accounts - 91 or 99 - and consolidate this method in the accounting policy of the enterprise.

Under contract

If the matter does not concern delays in personal income tax, but relates to failure to fulfill obligations assumed to counterparties, then entries are generated taking into account account 91, since sanctions associated with non-payment of obligations relate to other income or expenses, depending on who the receiving party is. side.

Since sanctions are calculated for non-payment of debt obligations, then the debtor will have the following entries:

- Dt 91 Kt 76 – subaccount “Calculations for claims”.

The debt recipient has the following entries:

- Dt 76 Kt 91 – subaccount “Other income”.

For insurance premiums

You can calculate the amount payable yourself and pay it, or wait for a notification from the inspection inspector after he has completed the inspection. In order for accruals on insurance premiums to be taken into account, it is necessary to open sub-accounts for each type of sanctions for account 69.

The accountant records these entries as follows:

| Operations | Dt | CT |

| Sizes added/additionally added | 99 | 69 |

| Making a payment | 69 | 51 |

In this case, the nuances regarding the time of reflection of the operation should be taken into account; for this, the following factors should be taken into account:

- if the amount was calculated independently by the accountant, then the posting should be dated at the same time as the invoice certificate;

- if a notification is received based on the results of the audit, it is necessary to date the posting to the date on which the decision to accrue the amount comes into force.

According to clarifications of the Ministry of Finance of Russia No. 07-04-09/78875 of 2016, it is necessary to take into account penalties for insurance contributions to the Social Insurance Fund on expense accounts, and therefore the entries for payments to the Social Insurance Fund have the following form:

| Operations | Dt | CT |

| Accrued amount of funds | 26 or 44 | 69 |

| Making a payment | 69 | 51 |

For a penalty

A penalty is a certain amount that the debtor undertakes to pay in case of non-compliance with the clauses of the agreement, but if these circumstances are not specified in the agreement, then the counterparty has no right to demand a penalty. In this case, the agreement may be worded regarding the payment of a penalty in one of three options:

- payment of penalties only;

- payment of debt and penalties from above;

- payment of one of the amounts at the choice of the debtor.

According to officials, the penalty for late payment of goods should be attributed to the payment of sold products, thus, the accountant must reflect the penalty as part of other income. In this case, this must be done on the date the court decision comes into force or on the voluntary recognition of this amount by the debtor. The entries will be as follows:

| Operations | Dt | CT |

| Accrual of penalties | 76 | 91 |

| Receipt of amount | 51 | 76 |

| Charge VAT on the amount received | 91 | 68 |

Accounting and tax accounting of fines for violation of contractual obligations

In accordance with the agreement, Delta LLC must pay for the products received within 15 days. For each day of delay, Delta LLC must pay a penalty in the amount of 0.5% of the cost of the products under the contract. Delta LLC delayed payment by 10 days. A claim was made to the organization. In response to the submitted claim, Delta LLC agreed to pay a penalty based on the terms of the contract.

| Account correspondence | Amount, rubles | Contents of operation | |

| Debit | Credit | ||

| 41 "Products" | 60 “Settlements with suppliers and contractors” | 250 000 | Goods accepted for accounting |

| 19 “Value added tax on acquired assets” | 60 “Settlements with suppliers and contractors” | 45 000 | The amount of VAT on goods accepted for accounting is reflected |

| 60 “Settlements with suppliers and contractors” | 51 “Current accounts” | 295 000 | Payment has been made for the products received |

| 91-2 “Other expenses” | 60 “Settlements with suppliers and contractors” | Penalty for late payment is taken into account (295,000 x 0.5% x 10 x 118%) | |

| 60 “Settlements with suppliers and contractors” | 51 “Current accounts” | Penalty paid | |

For profit tax purposes, Delta LLC will take into account only 14,750 rubles. The organization will not be able to take into account the amount of accrued VAT on the penalty in the amount of 2,655 rubles in expenses, since this case is not mentioned in Article 170 of the Tax Code of the Russian Federation.

You can find out more about the issues of payment of fines, penalties and penalties under business contracts in the book of JSC “BKR-Intercom-Audit” “”.

This material was prepared by a group of methodological consultants

Calculation nuances

Penalties are funds paid in excess of the overdue payment of taxes and fees. They are calculated for each day of delay, starting from the first day following the last day of payment, up to the day of payment of the debt. It is calculated as a percentage of the unpaid amount according to 1/300 of the refinancing rate at the time of the delay. The calculation is based on the following formula:

P = N (overdue tax amount) * Dn (number of days in debt) * 1/300 Sref (refinancing rate)

The taxpayer must calculate the fines independently and pay them along with the next payment or when paying in arrears; if this is not done, the Federal Tax Service will independently calculate the fines, and if they refuse to pay, they can forcibly collect them from the debtor’s funds or property.

Concept, essence and reflection of penalties in accounting, postings

First of all, let's look at the definition. A penalty is a type of penalty, which is determined for failure to fulfill or improper fulfillment by participants in legal relations of their obligations under contracts and other civil legal acts. This includes fines and penalties.

Such a material sanction is other income for the receiving participant (clause 7 of PBU 9/99) and other expenses for the obligated participant (clause 11 of PBU 10/99).

The account on which the main accounting actions for accounting for sanctions are reflected is 76 “Settlements with various debtors and creditors.”

Results

Sanctions reflected in accounting in the form of penalties and fines arise:

- in relations between counterparties due to violation of contractual relationships;

- in case of non-compliance with the requirements of tax legislation.

In both cases, a specific legal entity may be both a payer and a recipient of payments under sanctions. That is, entries for fines and penalties will reflect either expenses or income in his accounting:

Accounting analytics should be organized by counterparties and claims (for account 76), types of taxes and sanctions (for account 68), and assignment of sanctions (for account 91).

Calculation of fines: postings

It is better for both the guilty party and the party receiving the income to use a separate subaccount for accounting for penalties, fines and other penalties under civil contracts - 76.2. The amounts of such sanctions are taken into account in the amount established by the court and in the reporting period to which the court decision is dated (clause 14.2 of PBU 10/99). According to clause 76 of the regulations under Order of the Ministry of Finance of Russia dated July 29, 1998 No. 34n, the receiving and obligated parties must reflect penalty payments in accounting until actual mutual settlements are made.

Penalty: entries for accounting

Let's look at how to reflect the accrual of penalties in accounting; entries will be presented for both the obligated party and the party receiving the income (for non-profit organizations).

| Obliged Party | Receiving party | the name of the operation |

| Dt 91.2 Kt 76.2 | Dt 76.2 Kt 91.1 | Penalty by court decision, accounting entries - recognition of compensation on the basis of a title document |

| Dt 76.2 Kt 51 | Dt 51 Kt 76.2 | Penalty under the contract, postings, transfers |

If a penalty must be sent to an individual (under a civil law agreement and other civil legal acts), then the sequence of accounting actions will be as follows:

- Dt 76.2 Kt 50 - payment of a penalty to an individual who is not an individual entrepreneur in cash;

- Dt 76.2 Kt 68 - accrual of personal income tax for the sanction;

- Dt 68 Kt 51 - payment of personal income tax;

- Dt 91.2 Kt 69 - calculation of insurance premiums for the amount of recovery (clause 1, clause 1, article 420 of the Tax Code of the Russian Federation);

- Dt 69 Kt 51 - payment of insurance premiums.

If compensation under an employment contract is accrued within the framework of the standard established by Art. 236 of the Labor Code of the Russian Federation, then it is not subject to personal income tax (clause 3 of Article 217 of the Tax Code of the Russian Federation, Letter of the Ministry of Finance No. 03-04-05/11096 dated 02/28/2017). Moreover, if in a labor or collective agreement such a standard is specified in an amount higher than that determined by labor legislation, then personal income tax will also not be charged for collection.

Typical correspondence with examples

Penalties should not reduce income tax, so it is better to use the entry Dt 99 “Tax sanctions” Kt 68.4 “Income tax”.

Example 1

LLC "Antares" delayed the payment of personal income tax for 20 days in the amount of 75,000 rubles, the company's accounting department independently calculated the penalty and paid it along with the due amount of tax. The refinancing rate at the time of delay is 9%.

The amount of the penalty is calculated as follows: 75,000 * (1/300 * 9) * 20 = 450 rubles

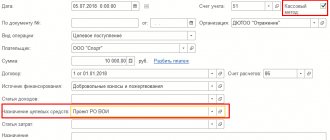

The following entries are made in the accounting:

- based on the accountant’s certificate, the calculated penalty is reflected Dt 99 Kt 68.4 - 450 rubles;

- By means of a payment order, a penalty is paid by transferring the amount of 450 rubles from the current account and is reflected by posting Dt 68.4 Kt 51.

Example 2

The company made a delay in payment for goods for a period of 77 days, while the refinancing rate for 54 days was 9%, and for 23 days 8.5%. The amount of debt is 15 thousand.

The penalty calculation is formed as follows:

Example 3

The company is a debtor regarding the transfer of tax in the amount of 78 thousand, the period of delay is 22 days, and the refinancing rate is 8.5%.

Calculation of penalties:

78,000 * (1/300 * 8.5%) * 22 = 486.2 rubles.

The following are the wiring:

| Dt | CT | Description | Sum | Base |

| 99.06 | 68.04.1 | Calculation of penalties for personal income tax | 486, 2 | Accounting information |

| 68.04.1 | 51 | Transferring a fine to the budget | 486, 2 | Payment order |

If accounting occurs on account 91, then you must also indicate the PNO in the amount of 97.24 rubles, and the postings will be displayed as follows:

| Dt | CT | Description | Sum | Base |

| 91.02 | 68.04.1 | Calculation of penalties for personal income tax | 486,2 | Accounting information |

| 99 | 68.04.1 | Reflection of PNO | 97,24 | Accounting information |

| 68.04.1 | 51 | Payment to the budget | 486,2 | Payment order |