The mandatory use of cash register equipment for business representatives is regulated by law 54-FZ. Violation of this requirement is fraught with penalties and suspension of the outlet's activities. Therefore, every cashier should know how to use a cash register. This employee is also required to comply with the requirements for filling out fiscal documents and know the basics of communication with buyers or consumers of the organization’s services. Is it possible to quickly learn how to work at a cash register? We’ll find out in this article.

- How to operate a cash register: step-by-step steps

- How to turn on the cash register

- Setting up a cash register

- Cash register protection

- Checkout instructions

- How to set the date on a cash register

- How to unlock a cash register

What does a cash register look like?

What is an online cash register and how does it work?

A modern cash register is an electronic device that is designed to interact with the tax office online and allows you to control the store’s revenue.

This equipment is equipped with a fiscal drive for recording and storing all payment information and has the ability to connect to the Internet for continuous sending of OFD data.

The new type of check has become longer and now contains a larger number of details, and it is also possible to create an electronic version of it to be sent to the client’s email or SMS to a phone number.

In addition, based on the provisions of the law, the device must meet certain technical characteristics, for example, have a built-in clock and a serial number indicated on the case.

This expanded functionality simplified inspection checks, and the sales process itself became more transparent.

The operating scheme of the new equipment has additional capabilities: sending an electronic check, updated software and almost autonomous operation of the financial fund. All steps take just a few seconds:

- The client makes payment in cash or by card;

- This data is sent to the FN;

- It encrypts the information, stores it and forwards it to the FD operator;

- The OFD checks the information and then sends it to the tax office;

- After receiving confirmation, the check is printed. Its electronic form is duplicated on the buyer’s e-mail or phone number.

How to operate a cash register: step-by-step steps

Every cashier at their workplace should have a step-by-step instruction or guide on how to operate an online cash register, because a cashier must perform the following actions daily:

- at the beginning of the working day, check the serviceability of the cash register;

- turn on the cash register;

- check the presence of a receipt printing tape (if it is missing, install a new one);

- register a cashier (possibility of some cash register models);

- display test reports (current and for the previous shift);

- meet the buyer;

- punch the receipt of the purchased product or service;

- carry out the plan for the break (check the actual amount of money in the safe and in the machine’s memory, add new product items or other actions as necessary);

- at the end of the shift, recalculate the revenue received and compare it with the value in the memory of the cash register equipment.

Arriving at the workplace, the cashier must make sure that there is no damage to the body of the cash register equipment and information input/output wires, as well as the presence of the necessary seals on the device (if any). You also need to clean the product from dust and dirt. At the end of the preparation, the cashier checks the reliability of the cash register’s connection to a 220 Volt household network (if the equipment is stationary) and the connection to the Internet.

You need to pay attention to the correct installation of the receipt tape. Quite often, the roll is installed upside down, and then they are surprised at the incorrect printing and blame the supposedly faulty printer. The correct position of the roll in the printing device is clearly indicated in the equipment instructions. It is due to the presence of only one layer for printing on thermal tape. Check the ribbon installation when printing the report.

Next, the cashier prints a report for the previous shift. If the amounts are visible in the previously printed report, the employee of the previous shift forgot to reset. If this was not corrected in time and noticed by the inspection authorities, the institution is subject to penalties.

For this reason, how to operate a cash register is a must-have skill even for a junior cashier just starting out in their career. The way out of this situation is to urgently print the report before 24 hours have passed from the date of the first printing of the previous shift's check. If necessary, you need to correct the date and time of the transaction, count the money in the appropriate compartment and reconcile it with the report of the previous shift.

When recalculating the amount, you need to keep in mind non-cash payments to customers. It is reflected on the check as a separate line. Such money is stored in the company’s personal account, and not in a cash safe. It is also recommended to be prepared for the fact that the accountant or owner of the enterprise may ask the cashier to provide an official issue during the working day. This is completely normal. The proceeds must be transferred to collectors, to the specified account or personally to the owner of the institution.

At the end of the work shift, a final report is performed. To do this, you need to have a sufficient balance of the cash register tape. About the successful completion of zeroing, the printed paper will contain the phrases “Registers cleared,” “Report is valid,” and so on. The report is assigned an individual number and stamped with a date and time. These parameters are also subject to mandatory verification by the cashier.

The control tape (if any) should be carefully rolled up and stored at the place of calculation for 3 days and 3 years within the enterprise. If you want the amount of non-cash payments to be transferred to the specified bank account, the shift must be closed at the bank payment terminal. The cashier must wait for a report on the correct sending of transaction information to the tax service in the case of an online cash register or take such documents directly to the federal tax service building. The end of the shift is marked by turning off the cash register.

Re-registration

Re-registration of a cash register is necessary in the following cases:

- replacement of fiscal memory,

- changing the company name or full name of the individual entrepreneur,

- changing the address of the device installation location,

- CTO changes.

To re-register a cash register, you need to contact the tax office with an application drawn up in accordance with the form specified by law, the cash register registration card, its passport, and the conclusion of the central service center (if available).

The tax inspector personally inspects the device for serviceability, integrity of the case and the presence of seals, after which he makes a note about re-registration in the passport and registration card. The presence of a representative of the central tax service center and the taxpayer itself is also required.

How to turn on the cash register

Before using the cash register, you first need to know how this equipment is turned on. First of all, you need to install the product on the work surface. This location is usually within easy reach of the cashier and in full view of consumers. Initially, the cash register must be connected to a 220 volt household network without using an extension cord. The devices use batteries to power the backup memory. Before using any function of the cash register, these elements must be installed in it.

To do this, perform the following scheme of actions:

- use a screwdriver to open the place on the device body where the batteries are inserted;

- elements must be inserted in strict accordance with the instructions for the device;

- The compartment is securely closed with a lid and bolted.

To ensure uninterrupted operation of the device, it is recommended to change the batteries once a year. Next comes work with the cash roll. To gain access to it, you need to open the cover of a special compartment on the product body. Having taken out the roll, you need to check its integrity. The paper should be smooth, intact and not have curled ends. Thanks to this, the roll can be easily placed back into the compartment, and the risk of paper wrinkles is significantly reduced.

The paper should be inserted in such a way that the printed receipts can easily come out of the special hole. Also, the check should be convenient to tear off and give to the buyer or consumer of services. To complete the installation of the roll, press the Feed button (or with a similar name). A special mechanism is activated that hooks the paper and drives it through the device. This is a standard algorithm for installing paper for printing receipts at cash registers of any brand.

Next, the device must be unlocked. To do this, the cashier does not need special training. Unlocking is quite easy. In most cases, any cash register has a key with which the responsible employee closes the device to comply with security rules. It is worth turning it and thereby unlocking the equipment.

The cash register is turned on with a special on/off button. Or a key located on the top of the device body. Modern cash registers are equipped with a Mode button, which replaces the key and the button to turn the device on or off. To activate such a cash register, you need to turn this button to the Reg position.

What are the requirements for a cashier?

A cashier is an employee who is in constant contact with customers.

The following qualities will help him cope with tasks:

- Restraint and stress resistance. Since a large flow of visitors passes through the cash register every day, there is a possibility of encountering aggressive people. Therefore, you need to carry out the operation as quickly as possible and not be rude to the buyer.

- Responsibility and attentiveness. The cashier constantly works with money. Despite the large flow of buyers, he must remain vigilant, correctly generate fiscal documents, accept payment and give change. You also need to treat your workplace with the utmost care: it cannot be left without warning the responsible employee, and the cash register must not be left unattended.

After documents for the employee’s employment have been completed (order, employment contract) or an agreement on financial liability has been signed, the cashier will need:

- visit your workplace where the cash register is installed and study the rules for working with it;

- as confirmation of familiarization with the procedure for using the equipment, sign in the familiarization log of responsible employees.

Some company owners approve their internal list of rules for operating commercial equipment. Employees must comply with these requirements, so familiarization with the act is mandatory.

It is impossible to do without familiarizing yourself with the official responsibilities and rights under signature.

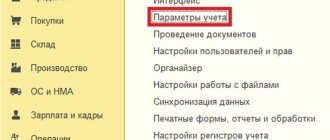

Setting up a cash register

It is better to configure the equipment in stages. It is convenient to configure cash register equipment in such a way as to combine items similar to each other in one category. For example, one category of goods is taxed with a certain value, while for another there are no taxes at all (this also happens). Next you need to set the correct date and time values.

The device programming mode starts when the key is turned to the PROG (P) position. If there is a button on the case, then you need to go to the Program menu item and in this mode set the desired configuration. Many device models are equipped with a special lever located under the cover of the paper roll compartment. This element is also switched to Program mode. You need to set up the cash register only according to the job description of the cashier-operator of the online cash register.

How to issue a check to a buyer

To understand how to use an online cash register, an employee needs to understand the algorithm for issuing a receipt to a buyer:

- The cashier scans the item, thereby opening a receipt

- The buyer hands over the payment to the cashier

- After receiving the funds, the cashier completes the sales process by generating a cash receipt

If necessary, an electronic version of the cash receipt is sent to the buyer’s e-mail or phone number.

In order to simplify the process of entering personal data, the developers have created a Federal Tax Service application with which the buyer can transfer his personal data to the cashier via a QR code.

When paying for a purchase, you may need to deposit funds in different ways. For example, if the buyer does not have enough money on the card, he can pay the remaining amount in cash. In this case, the cashier generates one check. In which both payment methods are recorded, indicating the amount of each of them.

Operations for which a receipt must be generated include:

- Sale. The check is issued after the cashier receives the funds or after the funds are written off from the client’s payment card.

- Return. A refund receipt is issued if a refund was issued to the buyer based on the return of the goods to the store. The return receipt must be accompanied by a return application, which indicates the buyer’s passport details, date and reason for returning the goods.

- Making adjustments. An adjustment is necessary if the sale was made at an incorrect price or without using an online cash register (for example, when there was a power outage). In this case, a correction check is issued.

- Making an advance payment. A check is issued when the buyer makes an advance payment.

- Making an advance payment. The difference from an advance payment is that an advance payment is made for a specific specific product, while an advance payment is a payment for an unspecified product (for example, the purchase of a gift certificate).

- Issue of goods on credit/installments. The algorithm for generating and issuing a check in this case will be the same as for a regular sale, the differences lie in the absence of the fact of transfer of funds to the cashier and the indication of the payment method indicated in the check.

Analysis of concepts

In order to understand the concept of “cash discipline”, you first need to understand the differences between the terms “Cash Register” and “Cash Office”:

Cash register (CCT)

– this is a device necessary for

receiving

funds from your customers, and in some cases, issuing them (for example, returning goods). There can be any number of such devices and each of them must have its own reporting documents.

Enterprise cash desk (operating cash desk)

– this is the totality

of all cash transactions

(reception, storage, issue). The cash register receives revenue received, including from the cash register. All cash expenses related to the activities of the enterprise are made from the cash desk, and money is handed over to collectors for further transfer to the bank. The cash register can be a separate room, a safe in the room, or even a drawer in the desk.

So, all cash transactions must be accompanied by the execution of cash documents, which is usually meant by compliance with cash discipline.

Cash discipline

is a set of rules that must be followed when carrying out operations related to the receipt, issuance and storage of cash (cash transactions).

The basic rules of cash discipline are:

- registration of cash documents (reflecting the movement of cash in the cash register);

- compliance with the cash register limit (the maximum amount of money that can be kept in the cash register at the end of the working day);

- compliance with the rules for issuing cash to accountable persons (employees);

- compliance with the limitation of cash payments between business entities within the framework of one agreement in an amount of no more than 100 thousand rubles.

Calculation sign

A payment attribute is a cash receipt detail indicating the reason for the receipt/disbursement of funds to/from the organization's cash desk.

The calculation attribute can be specified in four options:

- “Receipt” - will contain a sales receipt. For example, when a buyer purchases household appliances in a store.

- “Return of receipt” will be indicated on the return receipt. For example, if household appliances turned out to be of inadequate quality, and the buyer decided to return the goods.

- “Expense” - will be indicated in the receipt upon receipt of the goods on a paid basis. For example, a point for accepting scrap metal - issuing money when accepting metal;

- “Refund of expenses” - will be present on the receipt if the operation involves returning the goods to the client. For example, a customer returns money to pick up an item.

As of January 1, 2019 , the requirements to update the FDF to version 1.05 came into force. In the new version, such details have appeared as “Attribute of the subject of payment, indicating a specific subject of payment, for example, “lottery winning”, “excise goods”, “service”, prepayment, advance payment, etc.

"Beneficiaries"

The following are exempt from trading using cash registers:

- representatives of small businesses working in the shoe repair industry;

- traders in unequipped markets;

- sellers of goods "from hand";

- kiosks with periodicals;

- Russians renting out their homes;

- companies that work with non-cash payments;

- securities lending firms;

- public transport workers;

- organizing public catering in educational institutions;

- religious organizations;

- sellers of handicrafts;

- postage stamp sellers;

- businessmen in areas that are difficult to reach (a list of such areas is compiled by local authorities).

Payment method indicator

The payment method attribute indicates how the payment was made.

The sign of the payment method can be indicated both in the form of a code word and in the form of a digital designation:

- Code ADVANCE PAYMENT 100% (or 1 in the digital version) - indicates that the seller has received an advance payment for the goods in the amount of 100%;

- Code ADVANCE PAYMENT (or 2) - the buyer made a partial advance payment for the goods;

- ADVANCE code (or 3) - receiving an advance for an item that has not been defined. For example, if a buyer purchases a gift certificate, the seller cannot find out in advance which product will be purchased, in this case the payment method is indicated as “advance”;

- Code FULL PAYMENT (or 4) - indicated when the buyer pays in full and immediately receives all of his goods;

- Code PARTIAL SETTLEMENT AND CREDIT (or 5) - this can include the situation when the buyer purchases goods on credit, while paying a down payment, i.e. the goods will be partially paid for, and the remaining amount will be issued as a loan;

- TRANSFER ON CREDIT (or 6) - here the payment method will be to purchase the goods on credit in full without a down payment, and the goods in this case are transferred to the buyer immediately;

- LOAN PAYMENT (or 7) - is indicated when the buyer makes a payment to repay the loan, and it does not matter whether the next payment is made or the payment is made in full.

Applying a correction check

A correction check is created by the cashier if payments were made without using an online cash register:

- Inability to use online cash register due to breakdown

- Inability to use the cash register due to a power outage

- The occurrence of surpluses or shortages in the cash register due to the inattention of the cashier

In any of these situations, the cashier will have to generate a correction check. The differences from a regular check with a correction check are quite significant:

- Firstly, it is impossible to indicate the list of goods that were purchased on the correction receipt. This is due to the fact that in almost every situation in which the formation of this fiscal document is necessary, there is no possibility of establishing which specific goods were purchased. As an example, we can take the formation of such a check when a shortage is detected at the end of a work shift.

- Secondly, it is worth paying attention to such details as a sign of calculation. When generating a fiscal document for correction, this detail can be of only two types:

- “arrival” when surplus is detected

- "expense" when a shortage is detected

The correction check must always be accompanied by an explanatory note detailing the reason for the correction. The explanatory note will be useful in the event of a tax audit, because Federal Tax Service employees pay special attention to correction checks.

Most often, correction checks are confused with refund checks. A refund receipt is generated when the cashier needs to correct an operation that has already been completed. For example, when a cashier mistakenly punches out an extra item. In this case, it is necessary to cancel the operation by generating a new fiscal document with a settlement attribute, which will indicate “return of income”. The check must also contain the amount of the erroneously issued check. Additionally, a new receipt is generated indicating the correct purchase amount.

Instructions for working with smart terminals using the example of KKT "Evotor"

Manufactured by KKT, they are equipped with a touch screen and additional connectors for connecting external devices. You can also download applications and updates directly from the Evotor store.

The cashier's procedure when working at KKT Evotor:

Refilling the receipt tape. Lift the printer cover and install the receipt tape so that it comes from under the roll, pull the tape over the edge of the receipt feed compartment and lower the cover until it clicks.

Device activation. Plug the device into the socket and press the cash register power button (depending on the model, it may be on the bottom or side). The shift opens during the first sale.

Sale of goods at a free price. Click on [Sales] →[+]→[Product]→[Free price]→enter the price and quantity of the product→[To check]→[Payment]→enter the payment method→enter the amount of money received from the buyer→[Pay] .

Selling a product item from the KKM database. Sale]→[+]→[Product]→ scan the barcode of the product→enter the quantity→[Payment]→[Payment method]→amount of money received from the buyer→[Pay].

Sending purchase information via SMS. After all the goods have been sent out, click [For payment]→click on the [Electronic check] switch→select the [By SMS] section→enter the customer’s phone number→send→[Pay].

Return. In the main menu, select the desired section. In cases where the client does not have a receipt, select [Without receipt]→[+]→[Product]→in the product list of the cash register we find the required item→[For return]→type of payment with which it was paid→cost of the product at the time of sale→ [Pay]. If there is a receipt, then first enter its number and repeat the steps described above, with the exception of selecting a product from the catalog.

Z-report. Open the administration mode, enter the password → [Reports] → [Cash report] → [Close shift] → After issuing the fiscal document, turn off the cash register.

Closing a shift and collection

Every cashier must learn the rule: there should be no more than twenty-four hours between the opening and closing reports of a shift.

For example, if a cash register shift is open at 15:00 on August 1, it must be closed no later than 15:00 on August 2.

The opening and closing times of the cash register shift are not established by law.

At the end of the day, the cashier generates a report on the closure of the cash register shift (an earlier analogue was a z-report), then a PKO (receipt cash order) is generated and the totals are recorded in the cash book.

What documents need to be filled out when working with CCP?

With the advent of online cash registers, life has become a little easier for businessmen, because the burden of completing a variety of papers has been removed from them. But some still remain, here is the list:

- Cash book. It is necessary to register all the money accepted by the cashier and data on the transactions performed. It should be drawn up according to the KO-4 model in paper electronic form. You should not treat it mediocrely, because if an inspection comes and the Federal Tax Service employees do not receive it in the proper form, the entrepreneur faces a fine: individual entrepreneurs - up to 5,000 rubles, legal entities - up to 50,000 rubles.

- Incoming and outgoing cash orders.

Other documents that are necessary when operating an online cash register are produced using cash register programs. These include correction checks, refund checks, etc.

How to work as a cashier with an online cash register in difficult situations

This could include situations such as:

- Power outage.

If the cash register operates without a battery (and it is not possible to use an uninterruptible power supply), then it obviously cannot be used for the purpose of fiscalizing the amounts accepted from customers. In this case, trade will have to be suspended, since accepting funds from buyers without subsequent fiscalization of the accepted amount is an administrative violation and leads to large fines.

However, if there is reliable information that the electricity has been turned off for a long time, and customers really need goods from the store (for example, if these are essential food products), then, as a last resort, you can try to release them without punching receipts - by issuing documents to customers, replacing checks (for example, these can be sales receipts or strict reporting forms). But later you must:

- break through revenue using familiar correction checks;

- notify the Federal Tax Service of the forced non-use of online cash registers due to a long power outage (with a certificate or other document from Energosbyt attached stating that there was a power failure).

However, this method of “legalizing” sales when the online cash register is disabled only reduces (albeit significantly) the likelihood of a fine, but does not reduce it to zero. It all depends on the position of the specific tax office. It is possible that the store owner will have to prove his case in court.

- Internet shutdown.

This is the most minor problem. The online cash register can fully function without a constant Internet connection. The main thing is to ensure the transfer of fiscal data to the OFD at least once every 30 days . But if you don’t do this, the fiscal drive will be blocked if you fail to fulfill this obligation. Therefore, if a malfunction in the Internet is detected, it would be a good idea for the cashier to inform management or the employees responsible for the network about this.

- Failure of cash register equipment (for example, it has a software glitch, it is damaged, something was spilled on it, etc.).

A cash register that refuses to work obviously cannot be used. Its non-use, although forced, constitutes the same administrative violation as the failure to use the cash register during a power outage. Therefore, in general, there is only one recommendation - stop trading.

But there are also non-standard situations. For example, a massive technical failure in the operation of a cash register from a certain manufacturer, as happened on December 17, 2017. Here again, however, sellers have a cost-effective way of responding to the situation—essentially similar to the one discussed above in the blackout scenario. You can continue trading without punching checks (optionally, issuing BSO or sales receipts to customers to confirm the purchase), and then:

- fiscalize accepted amounts using correction checks;

- if there has been a massive technical failure in the operation of a cash register from a certain manufacturer, request from such cash register manufacturer documentation confirming the occurrence of a massive failure in the cash register equipment (and certifying the fact that the store is not at fault);

- send to the Federal Tax Service all available information on the situation that has arisen.

Video - report on a massive technical failure in the operation of online cash registers on December 17, 2017:

But this method is applicable if the cash register refused to work for reasons beyond the direct control of the retailer. If the CCP fails because something was spilled or dropped on it, the scheme we considered most likely will not work.

A special case is the failure of the cash register due to force majeure.

- Force Majeure.

Scenarios with a power outage, a breakdown of cash register equipment, and, possibly, a long-term Internet outage due to the destructive effects of natural or man-made factors, are possible here. The cash register can be washed away by a rain wave, or some heavy object can fall on it during a strong gust of wind.

In this case, trade must be stopped by law, but no one in their right mind would think about this. The store must be ready to immediately supply those in need with essential goods - with or without receipts. And the Federal Tax Service, most likely, will not even try to demand any clarification from the business entity regarding the non-use of online cash registers.

If you do not know how to register a cash register with the tax office, step-by-step instructions will help you understand the algorithm for this procedure.

We advise you to read the article about the nuances of using cash register equipment by individual entrepreneurs in different taxation systems.

What innovations were used in terms of calculation, registration and payment of UTII.

Video - how to use the EKR 2102K-F online cash register:

Let's sum it up

A salesperson who has reached 18 years of age, has entered into a liability agreement with the employer, and has read the operating manual and regulatory documents can operate a cash register. The cashier’s responsibilities include accepting money from customers, processing purchases, issuing change and receipts, and preventing third parties from being near the device. An individual entrepreneur can work with the cash register independently without completing any additional documents.

At the beginning of the day, the cash register should be turned on by printing a zero receipt. If the tape runs out, you must stop work, remove the old roll, seal and sign it, and install a new one. Online cash registers are a new generation of devices that directly interact with the fiscal data operator and thus significantly speed up and facilitate the work of the seller.

Buy a cash register for the office

Sources:

- https://DirMagazina.ru/568-kak-polzovatsja-kassoj-instrukcija-dlja-kassira/

- https://OnlineKas.ru/rabota-na-kasse/kak-polzovatsya-kassovym-apparatom/

- https://5cms.ru/article/work-online-kassa

- https://Class365.ru/stati/8611-kak-rabotat-na-kasse/

- https://onlain-kassy.ru/ispolzovanie/kak/rabotat-s-onlajn-kassoj.html

- https://uvolsya.ru/raznoe/kak-rabotat-s-kassovym-apparatom/

Individual entrepreneur without a trading apparatus conditions Trading equipment and egais beer Online trading equipment for a beauty salon models Automation of trading equipment in a cafe Trading equipment for alcohol egais Procedure for working for trading . device Use bargaining. machine How can housing and communal services avoid using online cash registers? Work schedule for housing and communal services payment cash registers. Cash register equipment for cafes with egais. Work for retail equipment at a gas station. How to determine which operating system. Honest sign scanners How to properly register in an honest sign Honest sign software Honest sign training Barcode honest sign Honest sign what signature is needed FSIS honest sign Barcode scanner for an honest sign OFD fiscal data Submission to the fiscal operator. data Hand-held printer for price tag Cost of tag code Scanners 2D tags law from 2021 Honest sign for shoe residue label retail Example code for shoe labeling Procedure for labeling shoe residue Tire label in 1c How to find out the country of tire manufacturer by labeling List of goods subject to labeling from 2021 List of non-food products essentials during quarantine List of non-food products during quarantine How business will suffer from coronavirus Which business has suffered the most from coronavirus Which business will suffer now Which business will suffer first How cafes should act during quarantine Bargaining. buy equipment with a data transfer function Buy a drive for an online cash register Rules for selling medical masks Rules for selling masks Termination of lease due to coronavirus text of the law deregistered due to coronavirus for imputation Grant to support small businesses in Moscow Bargaining. equipment without fiss. Accumulation Violation of sanitary requirements for trade organizations Subsidies for small businesses during coronavirus Subsidies for small businesses during the quarantine period Obtaining subsidies for small businesses coronavirus Subsidies for small businesses during a pandemic The advantages of working remotely during quarantine The advantages during quarantine The advantages of remote work during quarantine Qr code on checkout Smart pawnshop online cashier Fiscal operator activation code. Dan. Replacing an official document without replacing a fn. Re-registering an official document without replacing a fn. Changing an official document without replacing a fn. procedure. Replacing an official document without replacing a fn. Reg. terminal for payment by bank cards Requirements for the cash register of an institution Requirements for the cash register of an organization 2021 Requirements for the cash register of an enterprise 2021 Trade. Equipment for entrepreneurs according to new requirements Cash equipment under 54 Federal Law Types of trading. Equipment of equipment used in the store Where to buy bargain. Equipment with a fiscal drive Pos device egais How to correctly apply a card to the terminal Automation of pos terminals Cash desk for public catering egais 1c retail setting up tobacco labeling Services to the public application bargaining. Equipment Connecting a pos terminal to the cash register Contactless equipment Connecting a terminal for paying with bank cards Connecting an acquiring terminal Connecting a pos terminal to 1c Electronic signature for an honest sign Contactless trading. Equipment Setting up shoe markings in 1c retail Equipment for cards in commerce Trading. automation for an online store 2021 Logbook for testing employees for covid 19 Couriers during coronavirus Rospotrebnadzor lifting restrictions Logbook for testing employees for coronavirus Gradual lifting of restrictions in Russia Rospotrebnadzor project What to do after registering in an honest sign When non-food stores will open after quarantine Expiration date of the fiscal drive in a cash register Not using a cash register when a fine is established How to use an electronic cash register in a cafe Installing an acquiring terminal Registration in an honest sign official website Cash register control. equipment for LLC Conclude an agreement to test employees for coronavirus Connecting a POS terminal to the CRM system Rating of cash registers for online stores Coronavirus and online stores Online store coronavirus Work of online stores in connection with coronavirus How to work at the checkout in a store How to work at the checkout in a grocery store The principle of operation at the checkout in a supermarket Cash register equipment for LLC How to work with a payment terminal at the checkout Bargaining. equipment for LLC in 2021 Cash register equipment for a turnkey store Pos terminals for entrepreneurs Payment by card cost of the terminal Deadlines for labeling clothes Connecting a pos terminal Cash registers for LLC on USN 2021 Application of KKT LLC Cash register transactions retail revenue Cash register services How to find out the fiscal operator data Contour registration in an honest sign Is it possible for an LLC to work without a cash register Cash register LLC on imputation Cash register for online stores buy Operation of a non-food store during quarantine Cash register of a retail store Cash register store Connecting a pos terminal to a computer Registering a cash register for an online store Connecting a pos terminal Will online stores be closed from for coronavirus Mobile phone. mpos

Beware of violations

Numerous regular inspections organized by tax authorities in different regions of the country show that to this day many entrepreneurs work in violation of the rules for using cash registers, but still hope that this will go unnoticed. It should be remembered that the laws on the introduction of cash registers were adopted for a reason; thanks to them, the legal purity of the transaction is ensured. In addition, strict adherence to the rules in the event of a conflict situation will allow you to “pull the blanket over yourself,” since there will be no complaints about your activities.

To avoid violations during the work process, carefully read the rules for operating cash register equipment, because there are answers to almost all questions. Take into account the latest legal acts in force in your region. This will allow you to keep your finger on the pulse of events. Finally, remember that you should only use machines that have been included in the state register. Take into account the classifier, which regulates which units are suitable for which area. This will allow you to avoid problems with the law and conduct business for a long time and with benefit for yourself.

Sources:

- https://kontur.ru/articles/5183

- https://www.malyi-biznes.ru/kassovaya-disciplina/

- https://nalog-nalog.ru/buhgalterskij_uchet/vedenie_buhgalterskogo_ucheta/kassovaya_disciplina_i_otvetstvennost_za_ee_narushenie/

- https://OnlineKas.ru/rabota-na-kasse/kak-polzovatsya-kassovym-apparatom/

- https://5cms.ru/article/work-online-kassa

- https://www.DigitalServ.ru/kak-polzovatsya-kassovym-apparatom/

- https://assistentus.ru/forma/dolzhnostnaya-instrukciya-kassira/

- https://BusinessMan.ru/rabota-s-kkm—chto-eto-uchet-i-pravila-rabotyi-na-kassovom-apparate.html