Incoming and outgoing VAT

Input VAT is the VAT that sellers of goods (work, services, property rights) charge you and which you, as a buyer or customer, pay.

That is, input VAT appears for those who purchase something from VAT payers, provided that these transactions are subject to VAT. It also appears for those who pay tax when importing goods into the territory of the Russian Federation. By the way, input VAT is also called input VAT. Output VAT is a tax that you charge and bill to your counterparties when selling goods (work, services, property rights), that is, you act as a seller (supplier, performer). VAT payers are required to charge VAT. The accrued VAT must be paid to the budget at the end of the quarter on time. But first, it can be reduced by deductions, namely input VAT (clause 1 of Article 173, clauses 1, 2 of Article 171 of the Tax Code of the Russian Federation).

VAT included in taxpayer accounting

When purchasing goods (work, services), the taxpayer receives from the supplier primary documents and invoices, which reflect the input VAT. When importing goods, input VAT is calculated on the value reflected in the customs declaration. After receiving the documents, incoming VAT is reflected in accounting by posting:

Thus, input VAT is the tax imposed on the taxpayer when purchasing goods and services. It is accumulated in the debit of account 19, and is subsequently accepted for deduction if the conditions provided for in Art. 172 of the Tax Code of the Russian Federation.

When is input VAT deductible?

Input VAT is involved in calculating the amount of VAT payable: for payers of this tax, incoming VAT is deducted from the amount of output VAT (clause 1 of Article 173 of the Tax Code of the Russian Federation). But this is only possible if a number of conditions are met:

- goods, works, services, property rights (hereinafter referred to as goods) were purchased for use in transactions subject to VAT (clause 2 of Article 171 of the Tax Code of the Russian Federation);

- purchased goods are accepted for accounting;

- the buyer has an invoice from the supplier and primary documents;

- 3 years have not elapsed since the goods were accepted for registration (clause 1.1 of Article 172 of the Tax Code of the Russian Federation).

As a general rule, when purchasing goods on the territory of Russia, for deduction purposes, it does not matter whether they were paid for or not (Letter of the Ministry of Finance dated June 21, 2013 N 03-07-11/23503). But if an organization paid VAT at customs when importing goods into the territory of the Russian Federation, or when performing the duties of a tax agent for VAT, then it can only accept it for deduction if it has a document confirming its transfer to the budget (clause 1 of Article 172 of the Tax Code of the Russian Federation) .

Accounting for advances received and issued

The seller who received the advance formalizes its receipt and shipment of the goods using the following transactions:

A taxpayer who has received an advance shall issue an invoice for the amount of the advance within 5 calendar days from the date of its receipt, even if the sale of goods and services occurred in the same tax period.

The buyer who has issued an advance to the supplier against future deliveries, subject to the fulfillment of the conditions specified in clause 9 of Art. 172 of the Tax Code of the Russian Federation, can deduct the invoiced tax, which is determined at the estimated rate.

In this case, he makes an entry in the purchase book for the amount of the advance payment issued.

After the counterparty has fulfilled his obligations, the buyer makes an entry in the purchase book for the amount of incoming goods and services and a recovery entry in the sales book for the amount of the accepted advance.

In the buyer's accounting, these transactions are recorded as follows:

Subscribe to our newsletter

Yandex.Zen VKontakte Telegram

If the terms of the agreement provide for a special procedure for accounting for advances, then the procedure for accounting for them is determined by the terms of the agreement (subclause 3, clause 3, article 170, clause 6, article 172 of the Tax Code of the Russian Federation).

When input VAT cannot be deducted

Input VAT cannot be deducted if (clause 2 of Article 170 of the Tax Code of the Russian Federation):

- the buyer is not a VAT payer;

- goods were purchased for use in activities not subject to VAT, or for operations the place of sale of which is not recognized as the territory of the Russian Federation.

Then this input tax is taken into account in the cost of purchased goods or as a separate expense (Clause 2, 5, Article 170 of the Tax Code of the Russian Federation). Other cases when tax can be taken into account in the cost of goods are indicated in paragraph 2 of Art. 170 Tax Code of the Russian Federation.

Incoming and outgoing VAT: calculation example, documents

VAT is recognized as one of the main taxes collected in the Russian Federation, whose share in the federal budget accounts for a third of taxpayers’ revenues. At the same time, not all entities are required to pay tax. Others periodically have difficulties with the completeness and accuracy of calculations. When calculating VAT, it is important to reflect the tax in the documents presented to customers and to store incoming invoices from suppliers, which give the right to reduce part of the tax when making payments to the budget. In the article we will consider VAT payers, incoming and outgoing VAT, accounting entries for VAT.

In what period can VAT be deducted?

VAT claimed by suppliers can be deducted in the period when all the above conditions are met. However, it is not necessary to do this right away - the law allows tax deductions to be made within three years. This opportunity is convenient to use, for example, when the supplier delays issuing an invoice.

In addition, the deferral mechanism is often used to prevent reimbursement from the budget. This happens when the amount of incoming VAT exceeds the amount of outgoing VAT. Reimbursement is subject to a tax audit, and not every company will do this voluntarily. So, to avoid this, you can deduct not all of the input VAT in the current quarter, but only part of it. The rest of the tax can be deducted later - in any period within three years.

VAT payers

The category of persons whose responsibilities include calculating tax are considered to be organizations and individual entrepreneurs on OSNO engaged in the sale of goods and services within the Russian Federation. These entities are recognized as payers of indirect tax.

A number of organizations and entrepreneurs whose work meets the following conditions are exempt from the need to transfer VAT to the budget:

- preferential tax regimes;

- tax exemption related to low turnover;

- sales of goods and services that are legally exempt from the need to charge VAT;

- sale of goods outside the country.

There is also a need to pay VAT as an indirect payment when importing materials and valuables into the territory of the Russian Federation. In such situations, taxation is carried out at a rate of 0%. Later, buyers independently calculate the tax on the goods received and pay it to the budget. Under these conditions, payers are all entities, regardless of the type of work, the applied taxation regime and total income.

Incoming and outgoing VAT: formula for calculating VAT payable

The formula for calculating VAT payable to the budget is simple. To do this, the amount of incoming tax is subtracted from the amount of outgoing tax, including the actual VAT on import transactions.

VAT (U) = VAT (I) ― VAT (B)

where VAT (U) is the tax payable; VAT (I) is an outgoing tax imposed on customers; VAT (B) - input VAT received from suppliers.

Example of calculating incoming and outgoing VAT

Example. The Romashka organization purchased a batch of materials abroad in June for the amount of 30,000 rubles. I paid 18% VAT on the import of goods (5,400 rubles) in July, and in the same month received confirmation from the INFS of payment. The purchase of domestic raw materials and services in the 3rd quarter amounted to 127,440 rubles, including 18% VAT of 19,440 rubles. Goods were sold to customers in the amount of 371,700 rubles, including VAT 18% of 56,700 rubles. Advance amounts were received from buyers in the 3rd quarter for the upcoming shipment - 20,000 rubles, VAT of 18% was charged on the advance payment - 3,600 rubles.

Outgoing VAT is 56,700 +3,600 = 60,300 rubles, incoming VAT is 5,400 + 19,440 = 24,840 rubles. The tax to be transferred amounted to 60,300 – 24,840 = 35,460 rubles - this amount must be paid to Romashka LLC based on the results of the 3rd quarter.

Why is the tax office so worried about VAT deductions?

Therefore, the tax office makes sure that the VAT that the entrepreneur accepted for deduction is paid by the supplier who charged him this VAT.

Hi all! Since the beginning of the year, our supplier has been changing the rules for shipping goods, and at the same time I will not be able to “contain” their arrival at my warehouse.

It used to be like this. January. The supplier cleared the goods. He came to his warehouse. Some of the goods were sold to my address in January. I sold some of the goods in February. That is, at the end of the month, when I more or less “tested” my balance, my sales, I either received goods from the supplier and showed the advance received that was not covered by sales, or the goods did not arrive. That is, my supplier met me and when I needed it (a large VAT refund from the budget) he made the sale to me the next month, that is, February. In January, in order not to show the refund, I made an uncovered advance payment, etc. regulated VAT payable. Well, when the advance payment was made when the goods did not arrive from the supplier in the reporting month. That is, it was in my hands to somehow vary the goods from the supplier.

Starting from the new year, the supplier will completely transfer my goods in the month in which he cleared customs and take them for safekeeping. I will have a very large VAT refund from the budget. etc. Since we receive the goods in batches, the reimbursement from the budget will be permanent. If we take 12 months as a calculation, then 9 of them are reimbursement, 3 are payable. This arrangement does not suit me, because... The tax office will not wait for the month in which payment will be made.

Please tell me how in this case you can get rid of the large input VAT?

If the supplier is honest and everything else is also honest, then why be afraid. As a last resort, come to the department of desk audits and warn that you will not demand compensation on the account and for the year there will be a total payment to the budget, and not a refund.

If everything is not so smooth, then you can insert an intermediate company between the supplier and yourself - one more, one less.

Again, you can arrange an advance from the same frivolous company for a sale that will not take place in the future and the advance will have to be returned.

| 02.01.2007, 21:04 | #2 |

If the supplier is honest and everything else is also honest, then why be afraid. As a last resort, come to the department of desk audits and warn that you will not demand compensation on the account and for the year there will be a total payment to the budget, and not a refund.

If everything is not so smooth, then you can insert an intermediate company between the supplier and yourself - one more, one less.

Again, you can arrange an advance from the same frivolous company for a sale that will not take place in the future and the advance will have to be returned.

| 02.01.2007, 21:26 | #3 |

No, it doesn't go away.

But I still don’t understand the fear of the tax office. Go through their decision once, forced write-off, dispute in court and return of what was written off, receiving interest from the tax authorities through the court - and then live in peace. Believe me, it's not scary, I've been through it.

Or is there a lot wrong with you? Then sooner or later it will come back to haunt you.

However, let's think logically. It is necessary to either reduce the input VAT or increase the VAT payable. Input is the receipt of goods/materials/services. VAT on sales is the actual sale or advance payment.

| 02.01.2007, 22:35 | #4 |

Yes, you are right, there are a lot of tails. I’m always catching up with yesterday and I don’t want to take a saber with my bare bottom... I’m afraid. During the New Year holidays I will try to cover some of the tails. I'm afraid that they will check 2004, 2005 and 2006; we haven't had an audit since the opening of the company.

Well, if you follow the train of thought, then 1.or reduce input VAT 2.or increase sales. Or show an advance. And then close it as needed. In general, that’s what I did.

I can’t artificially increase sales, because... Having shown the sale of the product, it will actually be in the warehouse. And real buyers will not have enough real balance. Then it will be necessary - to show the goods from a garbage company (I myself was an opponent of such arrivals) - to purchase from a real supplier, but for real money, and in fact there is none in circulation. Do you understand? Then the written-off goods will need to be sold on the left, and money will be received on the left.

That is, if we adhere to the fact that the Supplier is real, but the sales are not real, then we are heading to the fact that in fact, “deposits” of goods are formed in the warehouse, which can be capitalized from a garbage company. - The supplier is not real, then I’m digging my own grave. It’s scary to take decent turnover from such companies.

— In principle, I can restrain implementation. — I can’t increase sales. (The goods are actually there, but according to the balance, they are not) There is no money to pay the real supplier, because The product is not really sold, so I paint myself into a corner and show the receipt from the trash heap. — All that remains is the advance payment, which, if these advances are systematically paid in cash, it is clear that VAT is simply being drawn up.

Still, the most ideal option was when I was holding back the arrival of goods. I would like the supplier to focus on . In general, I don’t know what.

He clears goods - 2006 - he kept them in his warehouse for 2-3 months - 2007 - wants to immediately transfer the cleared goods to us. Well, what good does it do him? I understand if this was related to payment. That is, today is a product, tomorrow is money, but no. The rules of the money game do not change. That is, he immediately dumps our customs-cleared goods and waits with the money. After all, the sales are immediately credited to him, although I don’t think he bothers with it.

I set my priorities: 1. Receive goods from a real supplier. 2. Do not greatly distort the remaining goods.

Is it possible to build something in this situation? Although I understand that this is too much, without sacrificing anything.

I was recently at a VAT seminar with Stepanoyeva, she said that there is an unspoken order that if the amount to be credited for VAT is more than 1,000,000 rubles, then it needs to be checked. If offices (in Moscow) show a credit for reimbursement of more than 92% of sales, then the same goes for verification. I estimated my VAT, it’s like crazy. 97-98%. But maybe it will pass somehow.

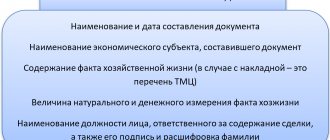

VAT documents

Business transactions of entities related to the conduct of activities must be documented. Tax calculations are no exception. Particular attention should be paid to documents on input VAT, since if invoices are missing or incorrectly executed, the inspectorate has the right to refuse the deduction, which will lead to an increase in the final amount of the transfer and penalties.

Incoming and outgoing VAT: confirmation documents

The table below presents documents for incoming and outgoing VAT.

What is VAT. The essence of value added tax

The easiest way to understand what VAT and what the essence of value added tax is is to consider a specific example.

First, let's define what added value . For example, an organization purchased a certain product for 100 rubles and sold it for 300 rubles. In this case, the added value is 200 rubles. (300 rub. – 200 rub.).

Example 1 – The essence of VAT

The Alpha company produces metal, which it sells to the Beta company for 100 rubles plus VAT. The Beta metal company produces metal structures and sells them wholesale to the store for 300 rubles plus VAT. The store, in turn, sells these structures to citizens for 800 rubles, also plus VAT.

The added value is:

- From the Alpha company - 100 rubles

- The Beta company has 200 rubles (300 – 100)

- At the store – 500 rubles (800 – 300)

VAT is equal to the product of value added and the tax rate (18%):

- The Alpha company has 100 rubles * 18% = 18 rubles

- Beta company – 200 rubles * 18% = 36 rubles

- At the store – 500 rubles * 18% = 90 rubles

It is these amounts that each company and store must transfer to the budget.

But this method of calculating VAT is not used in practice, because it is quite complex. Therefore, VAT is calculated either in one stage or in three.

Stage 1 - Output VAT

At this stage, the so-called “outgoing” VAT , i.e. VAT, which is charged on all sales revenue. In accounting, this amount is reflected in the credit of account 68 “Calculations for taxes and fees” (sub-account “VAT”).

From the conditions of our example it is clear that the “outgoing” VAT on revenue will be equal to:

- The Alpha company has 18 rubles (100 rubles * 18%)

- The Beta company has 54 rubles (300 rubles * 18%)

- At the store – 144 rubles (800 rubles * 18%)

Stage 2 - Input VAT

At this stage, the so-called “input” VAT , i.e. VAT, which is paid to suppliers of goods. In accounting, this amount is reflected in the debit of account 19 “Value added tax on acquired assets.”

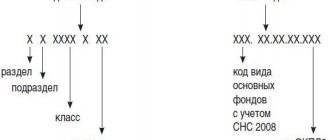

Account 19 by subaccounts

[goo_mid] Accounting for the amount of incoming VAT on the account. 19 is maintained separately for the acquisition of:

- fixed assets, including those requiring installation;

- goods, works, services necessary for construction and installation work produced for own consumption;

- goods purchased for subsequent resale.

They are reflected respectively in subaccounts 19-1 (for fixed assets), 19-2 (for intangible assets), 19-3 (for material and production resources) and others. These three accounts are the main ones and are regularly used for accounting purposes. In addition, on the specified account, the amounts of VAT on travel, advertising expenses and entertainment expenses are taken into account in separate lines.

If we consider the accounting entries for reflecting incoming tax amounts, broken down by subaccounts, they will be written as follows:

- Dt 19-1 - Kt 60 - the amount of VAT accounted for purchased fixed assets for carrying out taxable activities is allocated.

- Dt 19-2 - Kt 60 - similar for purchased intangible assets.

- Dt 19-3 - Kt 60 - the same for MPZ.

When tax is deducted based on invoices, the following posting is recorded:

- Dt 68 - Kt 19-1 (2, 3) - VAT is presented for deduction on capitalized and paid fixed assets, intangible assets and inventories.

VAT on purchased assets and company production costs

The amount of value added tax on inventories acquired for production activities is included in the enterprise’s expenses, which is reflected in the accounting accounts using the following entry:

- Dt 20 (23, 29) - Kt 19-3 - write-off of tax amounts on purchased inventories used in the production of products not subject to VAT. Here in correspondence with account. 19 accounts of the main, as well as additional/service industries are used.

Also, expenses can be written off to other company accounts, including 25, 26, 44, if these are general business or production expenses or if the goods were subject to resale (account 44). They correspond from 19 hours. by debit: “Dt 25, 26, 44 - Kt 19.”

General rule: if the amount of tax on ext. cost (according to the norms of the Tax Code of the Russian Federation) is not subject to return from the budget, then it is reflected in the accounts of material assets, costs, and other expenses.

An example of accounting for VAT in settlements with suppliers and accepting it for deduction: entries with explanations

Let's look at a situation where, during March 2014, a company purchased products from a supplier and resold them to its customers. The batch was purchased and sold in full. The purchase costs amounted to 12,000 rubles, of which 1,830.51 rubles were VAT. The tax amount was separated from the cost of the goods and attributed to account 19. In accounting, this operation is reflected in two accounting entries:

- Dt 41 - Kt 60 - 10,169.49 rubles - the cost of purchased goods is taken into account;

- Dt 19 - Kt 60 - 1,830.51 rubles - reflected input VAT in connection with the purchase of a consignment of goods.

At the end of the reporting period in 2014, the organization writes off the tax amount to account 68, using its right to reduce debt to the budget. The posting is recorded:

- Dt 68 - Kt 19 - 1,830.51 rubles - the amount was transferred to the debit of the budget settlement account to reduce the amount of accrued tax.

In the same month of 2014, the company sells goods to its customers at a price 1.5 times more than the purchase price (18 thousand rubles). The following transactions reflect the operation:

- Dt 90-2 - Kt 41 (10,169.49 rubles) - reflects the cost of products sold;

- Dt 62 - Kt 90-1 (18,000 rubles) - the buyer’s debt to the company is taken into account (taking into account the amount of VAT equal to 2,745.76 rubles);

- D 90-3 - K 68 (2,745.76) - the amount of VAT is allocated for accrual to the budget.

Then we determine the financial result of the transaction, calculating the difference between debit and credit turnover in the “Sales” account: 10,169.49 + 2,745.76 - 18,000 = - 5,084.75 rubles. The minus sign means that there was a profit. We transfer it to account 99 “Profit and Loss”:

- Dt 90-9 - Kt 99 (5,084.75 rubles) - profit from March sales of 2014.

As a result, on the account. 68 we have formed the amount of VAT to be transferred to the budget. It is defined as the difference between credit and debit (amounts to be accrued and offset):

2,745.76 - 1,830.51 = 915.25 rubles - tax for transfer to the budget, formed as a result of March 2014 sales.

In this example, we looked at how VAT calculations are reflected for accounting purposes and how the amount that will be transferred to the budget is determined.

VAT formula

“Output VAT” - “Input VAT” = VAT payable to the budget

Simply put, an organization must charge VAT on the entire amount received from customers (Output VAT) and also charge VAT on the amount of purchases paid to suppliers (Input VAT). Reduce “Output VAT” by “Input VAT” and transfer the resulting amount to the budget.

The Tax Code does not have the concept of “Input” and “Output” VAT, but they are widely used in practice.

It may seem that the calculation of VAT is simple arithmetic, because it consists of two elements, but in fact, the calculation of both elements is governed by complex (sometimes incomprehensible even to specialists) rules. But more on that later...

Outgoing VAT is “sell”, and incoming VAT is “buying”

If you issue an invoice to a counterparty with a allocated VAT amount, this is output VAT. The buyer will transfer you money for goods or services along with VAT, and then you must pay the same amount of VAT to the budget if you do not have input VAT by which you can reduce it.

When a counterparty issues you an invoice with VAT, this is input VAT. You transfer money to the supplier for goods or services along with VAT, and then you can deduct this amount of VAT from the output tax (Article 171 of the Tax Code of the Russian Federation). But this is only possible if a number of conditions are met. Moreover, it is not necessary to make deductions in the same quarter; they can be deferred for up to three years (with some exceptions).

Incoming VAT is recorded in the purchase book, and outgoing VAT is recorded in the sales book.

The difference between the outgoing and incoming taxes for the quarter is the amount of VAT that you must transfer to the budget at the end of the quarter. If the output VAT is less than the input VAT, that is, you paid more tax to suppliers than you billed to customers, then VAT will be refunded. This money can be returned to the company's account. But keep in mind that tax officials don’t like this and will find fault. Read more about this in this article.

Proper use of VAT deductions can significantly reduce the tax burden of an organization. But in order to protect yourself from claims from controllers, you need to calculate everything and use legal ways to reduce the tax burden on business. Otherwise, the savings will result in multimillion-dollar additional charges and fines.

We will work out optimization methods taking into account the specifics of your business and offer safe options. You will save without attracting the attention of tax authorities.

If one of the parties to the transaction is not a VAT payer, that is, applies a special tax regime (“simplified taxation”, UTII or works on a patent) or has obtained an exemption from VAT under Article 145 of the Tax Code of the Russian Federation, then everything looks different.

Situation 1: Supplier on a general system, buyer on a special mode

In this case, the supplier is also obliged to charge VAT, issue an invoice to the buyer and transfer the tax to the budget. But the buyer does not have the right to deduct “input” VAT, which means he simply pays the entire invoice including VAT and includes this amount as expenses.

Situation 2: Supplier on a special regime, buyer on a general taxation system

In this situation, the supplier will not charge VAT and issue an invoice, and the buyer will not have “input” VAT on the common system.

But if the supplier wants, he has the right to charge VAT and issue an invoice. Then he generates “outgoing” VAT, which he is obliged to pay to the budget despite the special regime (clause 5 of Article 173 of the Tax Code of the Russian Federation). In such a situation, the buyer is subject to “input” VAT. Whether he can accept it as a deduction is a moot point. The Constitutional Court believes that it can (Determination No. 460-O dated March 29, 2016), but tax authorities do not like to recognize such deductions, so be prepared for the fact that you will have to sue the Federal Tax Service.

If you are a VAT payer and need input tax, it is more profitable for you to work with counterparties on a common taxation system.

What should a taxpayer do if a gap has been identified?

In any case, the taxpayer is obliged to respond to the tax authorities’ request regarding the declaration. The order here is as follows:

- Within 6 days, send a receipt for acceptance of the electronic document (i.e. request). This is a formal requirement of the Tax Code of the Russian Federation, which is not directly related to VAT. But if it is not fulfilled, then after another 10 days the tax authorities will have the right to block the company’s accounts (clause 3 of Article 76 of the Tax Code of the Russian Federation).

- Within 5 days, respond to the request itself.

The receipt and response to the request must be sent to the Federal Tax Service in electronic form, otherwise the explanations will be considered not provided.

If the identified discrepancies do not lead to an underestimation of the VAT amount, then the updated declaration does not need to be submitted; explanations will suffice. If necessary, you can attach scanned copies of documents to the explanations, for example, invoices from the supplier.

However, it is not always possible for a businessman to “fend off” claims so easily. Tax authorities often call the payer to a commission and demand that “doubtful” deductions be excluded from the declaration.

It is important to understand here that discrepancies in the information in the declaration with the data of suppliers do not yet give tax authorities the right to refuse VAT deductions. ASK VAT-2 data is simply auxiliary information that inspectors use during inspections.

And even if it is confirmed that the supplier has not fulfilled its obligations to pay tax, this fact in itself cannot be the basis for “withdrawal” of VAT deductions from its customers (Clause 3 of Article 54.1 of the Tax Code of the Russian Federation).

An unjustified tax benefit must be justified. To do this, tax authorities must collect information about counterparties, conduct an in-depth audit along the entire chain and prove the businessman’s intent to evade VAT.

If inspectors manage to prove that all counterparties in the chain were associated with the taxpayer and acted in concert to reduce VAT, then the courts often side with the tax authorities (for example, resolutions 9 AAS dated 05.18.2017 No. 09AP-10542/2017 and 17 AAS dated 19.02 .2018 No. 17AP-18548/2017-AK)

But tax authorities often want to achieve their goal in a simpler way and try to force a businessman to voluntarily give up controversial deductions. To do this, they put psychological pressure on the company’s management: they talk about a possible on-site inspection, transfer of materials to law enforcement agencies, etc.

What a businessman should do depends on the specific situation. If the amount of the deduction is small, and the counterparty is really dubious, it may be easier to agree with the inspectors’ demands.

But if we are talking about a significant amount, and the taxpayer is confident in his counterparty, then there is no point in giving in to pressure from the tax authorities and losing money.

The court will most likely side with the businessman if he proves that the controversial transaction was real and all necessary measures were taken to verify the counterparty (for example, resolutions of the AS UO dated January 15, 2018 No. F09-8180/17 and AS VSO dated January 25. 2018 No. Ф02-7481/2017).

Deductions of “input” VAT are the subject of special attention of tax authorities

The more deductions you declare, the less VAT you will pay to the budget. This is beneficial for you, but not for the state. In addition, many illegal tax optimization schemes are based on the right to make deductions and refund taxes. Therefore, tax authorities strictly ensure that the rules for deductions of input VAT are observed and use any reason to refuse a deduction.

Each VAT return undergoes a desk audit “with passion”. During the inspection, inspectors may request additional information and documents. They will check especially carefully if the declaration contains too large a share of deductions or VAT to be refunded. If in a certain quarter you have a lot of deductions, and you do not want to attract unnecessary attention from controllers, it makes sense not to use all the deductions at once, but to “spread” them over future periods.

Incoming and outgoing VAT

Input VAT is a tax that is paid by those who purchase something. That is, by receiving an invoice for this percentage, the buyer is a taxpayer and has the right to accept an additional deduction from the state budget from the amount of the outgoing party.

This value added tax is formed upon receipt of the goods to the seller and in the presence of the SF and, accordingly, payment for it. Payment is handled by the buyer himself, and presentation is handled by the seller or the person who provides assistance.

Output VAT is charged to customers by the seller. When selling the item itself, the amount of interest is imposed and is fixed in the SF provided to the consumer.

The second type of tax must be paid for a certain period of time. The amount of input interest is deductible from it, so the amount of tax can be reduced and the payment will be a reduced version.

If an advance is provided between counterparties for the upcoming delivery of material through the Federation Council, then the tax is paid on the advance funds and then deducted after receiving the final document.

Briefly about the main thing

- Value added tax is considered to be included when the buyer purchases goods and services with VAT included.

- This tax is considered outgoing when the company ships products or provides services to its counterparty.

- The difference between the incoming (paid) tax and the outgoing (received) tax is transferred to the budget, if the VAT received is greater, or is taken into account when paying other taxes.

The Kontur.Accounting web service will help you optimize VAT: it will tell you what documents are needed to apply for a tax deduction, warn you about incorrect amounts being calculated, and save you from overpayments and fines. The system is convenient for keeping records, calculating salaries, reporting, and building management reports. All newcomers work for free for two weeks.

Presentation of tax to buyers: output VAT

The taxable base is goods that are presented to buyers at a premium. VAT is an indirect tax; therefore, the transfer of amounts into total capital occurs at the expense of the ordinary consumer.

Tax payments from suppliers are required in the following situations:

- when advance money is received for future deliveries;

- when a product is sold or the rights to own property change;

- if previously received materials were valued at a different value, that is, changes occurred.

During the sales process, a special document is filled out - an invoice. It highlights the tax amount. Depending on the product group, it can be 10% (baby food, periodicals, medicines), 0% (products sent for export) and 20% (other types of goods not included in the first two categories).

All amounts displayed are subject to contribution to the country fund. If an advance is issued, an SF is attached to it, which also indicates the output VAT. This percentage is subject to deduction after the goods have been shipped in real time.

What do tax authorities do when they find a VAT gap?

In case of any gap, tax authorities send requests to both parties to the transaction. And further actions of inspectors depend on the specific situation.

The ASK VAT-2 system builds a “tree of connections” in which not only the supplier “closest” to the taxpayer being checked is visible, but also the entire chain.

Each organization in the system is assigned its own color depending on the degree of tax risk (letter of the Federal Tax Service of the Russian Federation dated 06/03/2016 N ED-4-15 / [email protected] ).

- Green color – low risk. The organization fulfills its tax obligations, actually conducts business, and has assets.

- Yellow color – medium risk. The organization really works, but periodically violates its obligations to the budget.

- Red color – high risk. The company either does not pay taxes at all, or does so in a minimal amount; there are no assets.

Companies classified as medium and high risk are subject to enhanced control. The same applies to their counterparties throughout the chain.

Input VAT

In addition to transferring to the budget, the supplier’s representative has the right to minimize the amount of tax on the input share. The supplying party avoids double taxation due to the fact that it can act as the opposite party purchasing the goods, the price of which includes interest.

To exercise the right to deduct input VAT, you must submit an invoice, since this document is the only confirmation. It is prohibited to use other documentation. The percentage is calculated based on the documents presented and the information contained in them.

OOO

The joint stock company pays to the budget the amount that is calculated using the above formula. It is important to follow the order, deadlines and correct completion of documentation responsible for all accounting before the inspection institution.

As a rule, an LLC uses OSNO, that is, the main taxation system. And it has a number of advantages, for example, compensation for the difference when deducting; greater demand from large counterparties; no restrictions on annual revenue and others. The only downside is that you need to report quarterly and maintain payment procedures.

Incoming and outgoing VAT: formula for calculating VAT payable

Thanks to the formula, you can make calculations and find out the specific payment that needs to be made to the inspection body.

The diagram looks like this:

(U) = (Is.) – (In.), where U is the tax intended for payment; Is. – outgoing percentage and In. – entrance part.

Let's look at an example. A certain woman purchased a whole batch of products in June for a total amount of 30,000 rubles abroad. When importing in July, she paid a tax in the amount of 6,000 rubles (20%) and received confirmation from the inspectorate about the operation. In the third quarter, domestic raw materials were purchased in the amount of 127,440 rubles, and of this, 20% tax was equal to 25,488 rubles. Revenue from the sold material amounted to 371,700 rubles, where VAT amounted to 74,340 rubles. To account for future shipments in the third period, advance amounts of 20,000 rubles were made, of which the collection amounted to 4,000.

Next, we calculate the outgoing payment 74340+4000=78340 rubles. A day off is considered as follows: 25488+ 6000= 31488 rubles. To understand the amount to be paid, it is necessary to subtract the second from the first figure found, that is, 78340-31488 = 46852 rubles. It is this percentage that Solntse must pay to the Federal Tax Service at the end of the third quarter.