Accounting entries for income tax are a reflection of business transactions in an organization's accounting using the double entry method.

The main regulatory document establishing the rules for preparing accounting records for income tax (IIT) is PBU 18/02 (Order of the Ministry of Finance dated November 19, 2002 No. 114n). Non-profit organizations and companies that are exempt from paying the Tax Tax have the right not to apply these provisions. But small businesses were allowed to choose: reflect transactions according to general rules and use entries for calculating income tax, or organize simplified accounting.

What is this in accounting?

According to PBU 9/99 “Income of the organization”, revenue is recognized as income from ordinary activities - revenue from the sale of goods or products, as well as receipts that are associated with the provision of services and performance of work. In accounting, revenue does not mean any income from sales, but only income from the main type of activity, while the remaining income is recognized as other income (we talked in more detail about how revenue differs from income and other accounting concepts here).

Reference! In organizations in which the main subject of activity is the provision of assets under a lease agreement for temporary use, revenue is rent receipts.

In accounting, revenue is recognized subject to the following conditions:

- revenue can be determined in terms of value;

- the organization has the right to receive this revenue;

- as a result of the operation, the economic benefits of the company will definitely increase;

- the property rights to the product (goods) have been transferred to the buyer or the work has been accepted by the customer (service has been provided);

- the costs of this operation can be determined.

That is, revenue is considered an increase in economic benefits , which leads to an increase in the assets of a given organization. Often, revenue is recognized without actual cash receipts (accrual basis). But small businesses have the opportunity to record revenue using the cash method - when funds are received. Read this material about what to do when proceeds from a buyer are credited to your bank account or cash register.

To record revenue in accounting, account 90 “Sales” is used (we tell you more about which accounting account revenue is displayed on here). Sub-accounts are opened for account 90:

- subaccount 90.1 – records are kept of receipts considered revenue;

- subaccount 90.2 – the cost of sales is recorded (what is the difference between the concepts of “revenue” and “cost” read here);

- subaccount 90.3 – records of VAT amounts are kept;

- subaccount 90.4 – records of excise tax amounts are kept;

- subaccount 90.9 – necessary to reflect the financial result of the organization’s sales for the reporting month.

Use of profits

The decision on the distribution of net profit is made by the owners (founders) of the organization (general meeting of shareholders or meeting of participants in an LLC). Such a decision is usually made at the beginning of the year following the reporting year.

Important

The distribution of net profit is within the exclusive competence of the general meeting of participants (shareholders) and cannot be carried out by the sole direction (order) of the head of the organization.

Net profit can be used for:

- payment of dividends to shareholders (participants) of the organization;

- creation and replenishment of reserve capital;

- repayment of losses from previous years.

In the first two cases, reflect the use of net profit in the debit of account 84:

DEBIT 84 subaccount “Profit subject to distribution” CREDIT 75 (70)

– dividends accrued to shareholders (participants) of the organization;

DEBIT 84 subaccount “Profit subject to distribution” CREDIT 82

– net profit was directed to the creation and replenishment of the organization’s reserve capital.

If the owners of the organization decided to use the net profit to pay off losses of previous years, make an entry in the accounting to the subaccounts of account 84:

DEBIT 84 subaccount “Profit subject to distribution” CREDIT 84 subaccount “Uncovered loss”

- net profit is aimed at paying off losses of previous years.

Important

The meeting of shareholders (participants) of the organization may decide not to distribute the profit received at all (or leave some part of it undistributed).

After you have recorded the use of profits (repayment of losses), the balance in the “Profit to be distributed” subaccount of account 84 shows the amount of retained earnings. This amount can be transferred to the appropriate subaccount:

DEBIT 84 subaccount “Profit subject to distribution” CREDIT 84 subaccount “Retained earnings”

- reflects the amount of retained earnings of the organization.

EXAMPLE 1 Based on the results of the past year, the net profit of JSC Aktiv amounted to 70,000 rubles. In the analytical accounting for account 84, the accountant of Aktiv JSC provided the following subaccounts: - 84-1 “Profit to be distributed”; — 84-2 “Retained earnings.” On December 31 of last year, when reforming the balance sheet, the Aktiva accountant made the following entry: DEBIT 99 CREDIT 84-1 – 70,000 rubles. – net profit is reflected. In February of this year, at the general meeting of shareholders, it was decided to use net profit as follows: - allocate 5% to replenish reserve capital; - 50% should be used to pay dividends to shareholders. Based on this decision, the Aktiva accountant reflected the use of profits with the following entries: DEBIT 84-1 CREDIT 82 - 3500 rubles. (RUB 70,000 × 5%) – funds were allocated to replenish reserve capital; DEBIT 84-1 CREDIT 75 – 35,000 rub. (RUB 70,000 × 50%) – funds were allocated to pay dividends to shareholders; DEBIT 84-1 CREDIT 84-2 – RUB 31,500. (70,000 – 3500 – 35,000) – reflects the amount of retained earnings.

In what documents is this amount reflected?

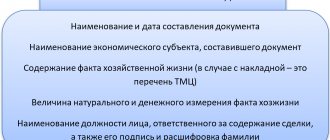

To reflect revenue from the sale of products (performance of work or provision of services) in accounting, it is necessary to have documents that confirm the transfer of property rights to these products to the buyer. Sources of information about the company’s revenue are the following documents:

- Source documents:

- contracts with clients for the sale of products, services and works;

- waybills;

- invoices;

- invoices for delivery of finished products;

- requirements for product release;

- warehouse cards;

- log of received and issued invoices;

- sales book;

- invoices for the sale of finished products, bills of lading, cargo customs declarations;

- turnover sheets, quantitative and total cards;

- certificates of services rendered or work performed.

- Analytical and synthetic accounting registers:

- main book;

- order magazines No. 10, No. 11 and No. 15;

- statement No. 16.

Postings

In an organization's accounting, revenue is reflected at the time of its recognition - that is, at the time of transfer or shipment of products. The exception is transactions under contracts that specify the specifics of the transfer of property rights. When selling products to wholesale customers, the following transactions are recorded:

- D 62 K 90.1 – revenue from sales of goods or provision of services was reflected;

- D 90.2 K 41 – the cost of goods sold or services provided is written off;

- D 90.3 K 68 – VAT is charged on the cost of goods sold or services provided;

- D 51/52 K 62 – payment received from the buyer to a current/currency account.

Posting to retail revenue at the cash register can be done directly with account 90 “Sales”, since there is no need to keep records of settlements with retail customers on account 62 “Settlements with buyers and customers”, since payment and shipment are made simultaneously: D 50 K 90.1 – revenue from retail sales was taken into account.

According to the Instructions for using the Chart of Accounts, to reflect cash transferred for collection, posting to account 57 “Transfers in transit” is used:

- D 57 K 50 – cash was issued to the bank’s collection service (you can learn about the procedure for accounting entries when depositing proceeds with the bank here).

- D 51 K 57 – cash was credited to the company’s current account.

How to record the receipt of revenue to a current account through a collector

An employee of the organization or a collector can hand over the money to the bank. In this case, it is also necessary to reflect the issuance of funds through account 57.

| Business transaction | Wiring |

| Products (works, services) of the organization were sold | Debit 62 / Credit 90.1 |

| Payment for products (work, services) has been received at the organization's cash desk | Debit 50 / Credit 62 |

| Cash issued to collectors | Debit 57 / Credit 50 |

| Cash handed over to the bank by the collector | Debit 51 / Credit 57 |

Step-by-step instructions for recording in accounting

When reflecting revenue in accounting, the following entry is used: D 62 K 90.1 – revenue from the sale of finished products is reflected, the products are shipped to the buyer (work is performed or services are provided).

Simultaneously with this operation, the cost of production is written off. If an organization accounts for finished products at actual cost, then the write-off is reflected by the following entries: D 90.2 K 43 - products written off at actual cost .

If an organization keeps records of finished products at planned (standard) cost, then the write-off is reflected in accounting in the following way:

- D 43 K 40 – finished products are accepted for accounting at planned cost.

- D 90.2 K 43 – finished products are written off at planned cost.

- D 40 K 20 – actual cost is reflected (at the end of the month).

- D 90.2 K 40 – deviations of actual from standard costs (overexpenditure) are written off.

- D 90.2 K 40 – reversal: deviations of actual and standard costs are written off (savings).

Important! The cost of services provided or work performed is not reflected in account 43 “Finished products”, and the actual costs for them are written off to account 90 “Sales” from the production cost accounts. - D 90.2 K 20 – costs for services/work are written off.

How to plan profit?

There are many ways to use enterprise profits. They carry not only economic meanings, but also public and social ones. So, the company can:

- optimize the production process using available funds;

- increase production volumes;

- increase cash remuneration for employees;

- improve the workspace;

- modernize or fully automate existing equipment;

- invest funds or provide them as a loan to generate income for the period of validity of the loan agreement.

The method of planning the profit of enterprises, based on the listed areas, is to carefully take into account expenditure and income items in order to reduce the former and increase the latter.

For example, a company received indicators for the reporting period, one of which is unprofitable.

After analyzing the activities of this production area, it was decided to modernize the production line in order to reduce the cost of servicing existing machines and increase the number of products produced.

At the end of the next quarter, activities were planned to replace the machines based on projected profits for the future period.

Available funds in the required amount after deducting all total costs will be used to implement the established plan.

Taxation

Operations for the sale of products (services or works) on the territory of the Russian Federation are objects of taxation, which means that the organization (if it is a VAT payer) is obliged to charge VAT on the sales amount, according to Art. 146 of the Tax Code of the Russian Federation (we talk about what is considered revenue from sales in a separate material). The moment of accounting for the tax base is the earliest of the following dates (Article 167 of the Tax Code of the Russian Federation) :

- day of transfer/shipment of goods (provision of services or performance of work);

- the day of payment or prepayment for future deliveries of goods (provision of services or performance of work).

If the moment of determination of the tax base is set on the day of payment or prepayment for future supplies of goods (provision of services or performance of work) or on the day of transfer of ownership rights, then the moment of determination of the tax base arises on this day (Clause 14 of Article 167 Tax Code of the Russian Federation).

In some cases, the determination of the VAT tax base may not correspond at all to the moment the proceeds from the sale are accrued.

If the contract provides for the transfer of property rights at the time of transfer of goods, proceeds from the sale are recognized at the time of shipment , therefore, the moment the VAT tax base is determined is recognized on the same day.

Reference! The amount of VAT receivable from the buyer (client) is recorded in subaccount 90.3 “VAT”.

To reflect the tax on the day of shipment, the following entry is made in accounting: D 90.3 K 20 - VAT is charged on the proceeds from the sale.

If the contract stipulates that the transfer of property rights occurs at the time of transfer of goods, and the goods are shipped on an advance payment basis, then revenue is accounted for at the time of shipment . In this case, the moment of determining the tax base for VAT is the moment of prepayment against future supplies of goods.

In this situation, the moment of determining the VAT tax base has already arrived, but revenue has not yet been recognized in accounting.

At the time of shipment, revenue is recognized and the tax base is determined again. VAT will be reflected on the day of shipment . And now VAT on the amount of payment or prepayment received on account of future supplies of goods (services or work) is subject to deduction.

Revenue is the most important element demonstrating the effectiveness of the company's financial results. The importance of revenue is proven by the fact that the amount of taxes paid by the enterprise - starting from VAT and ending with income tax - depends on the accuracy of its reflection in accounting.

In the event of an accounting error, the company expects incorrect readings in the annual financial statements and problems in interaction with the tax authorities. In this regard, it is necessary to pay a lot of attention to keeping records of revenue and avoid making mistakes.

We talked about how accounting records revenue with and without VAT in a separate article.