Local taxes and fees are those tax contributions that are paid to local budgets. At the same time, the rates (payment rates) of these taxes are set by the government , or more precisely by its representative bodies.

Typically, this group of mandatory payments to the state includes taxes on property owned by individuals, on land, on activities for profit (that is, business activities of individuals, including trade), resort and other targeted fees, taxes on local advertising, based on the presence of dogs and so on.

The concept of local taxes and fees

Local authorities are also given limited powers by domestic legislation to establish local taxes and fees in the territory under their control.

The granting of such powers is due to the inability to fully ensure the interests of the basic municipal districts at the expense of the republican and regional budgets, which is why local taxation and the formation of the local budget are designed to ensure the local interests of the population and the territorial unit as a whole and to promote its development.

Local taxes and fees are mandatory payments that are established by the local authorities of the basic administrative-territorial unit within the limits of the rights and powers granted to such authorities by federal tax legislation and the Tax Code of the Russian Federation.

Like federal and regional, local taxes and fees are included in the taxation system of the Russian Federation.

The nature of such taxes and fees does not differ from other obligatory payments payable to the budgets of higher levels; they have a pronounced fiscal nature and are designed to provide financial expenses for the municipal budget.

Double taxation

Bilateral international treaties of the Russian Federation on the avoidance of double taxation Russia Countries with which the treaty is in force Countries with which the treaty has been signed but has not entered into force

Russia has treaties on the avoidance of double taxation with the following countries:[2]

|

|

|

System of local taxes and fees

The system of local taxes and fees is also provided for by the Tax Code of the Russian Federation and is represented by an exhaustive list of both taxes and fees. State power represented by local government cannot go beyond this list and establish additional fees or local taxes.

Local taxes are presented in the form of taxes:

- federal;

- regional;

- local, put into effect by the self-government body within the municipality.

Local fees include:

- Federal level;

- local level.

Within the region, the introduction of fees is not provided for by the Tax Code of the Russian Federation, and accordingly is unacceptable, which is why the system of fees throughout the country is represented by two levels.

We will recalculate and minimize tax deductions

Sign up for a consultation with a specialist

+7

...at the same time, the “stratification” of regions is growing

In 2021, 32 regions showed negative dynamics in tax collections, in 2017 there were 15 “losers” left. And if at the end of 2016 there were also donor regions among them (due to the situation with oil prices on the world market), then at the end of 2017, they were no longer there.

In 2021, the stratification of regions has doubled: already 30 territories have shown a decrease in tax collections to the federal budget. That is, the crisis may be over, but only in the oil industry. On average, collections in these regions fell by 20%.

In the Volga Federal District, such dynamics were demonstrated by Mordovia (the record holder for public debt, we recall), whose collections fell by 18% (from 14.2 to 11.6 billion rubles), the Nizhny Novgorod region - a decrease by 15% (to 75.4 billion rubles), Mari El - fees decreased by 10%, to 7.4 billion rubles, and Ulyanovsk region - fees fell by 4%, to 20.3 billion rubles. Let us note that a year earlier in the Volga Federal District there was only one region whose tax collections into the federal budget decreased - this is the Kirov region.

Three of the five regions that showed the highest revenues in 2021 are “oil” regions: Khanty-Mansi Autonomous Okrug, Yamal-Nenets Autonomous Okrug and Tatarstan. Photo oilcapital.ru

It is significant that the oil regions also demonstrated a drop in collections in the Volga Federal District. Things are going worst in Chechnya: having collected 1 billion rubles a year earlier, they collected nothing here in 2021, having also received 27 billion rubles in subsidies to equalize budgetary security. The situation is similar in the Lipetsk region. The Trans-Baikal Territory and the Jewish Autonomous Region are in a precarious position.

Types of local taxes and fees

Local taxes include the following:

1. Land tax. The Russian tax system provided for the introduction of this tax in order to stimulate the rational use of land with all the ensuing consequences, as well as for the development of local infrastructure. The regulatory framework consists of two levels:

- federal laws;

- acts issued by local representative bodies.

Cities of federal significance, which include Moscow and St. Petersburg, have their own characteristics, but they relate more to the procedure for introducing the specified tax.

When establishing a land tax, the authority by whose decision it is introduced also determines:

- tax rates;

- payment procedure;

- payment terms.

If necessary, they may also provide for in the same laws:

- tax benefits;

- grounds for providing benefits;

- procedure for providing benefits;

- the amount of money that is not subject to taxation for certain categories of taxpayers.

Taxpayers of land tax are:

- legal entities - organizations;

- individuals.

An important criterion for classifying them as taxpayers is the presence of a land plot that they own with one of the following rights:

- property;

- use on an ongoing basis;

- lifelong ownership, transferred by inheritance.

Individuals and legal entities using plots of land in accordance with a lease agreement or under the right of free-term use are excluded from the number of taxpayers of such tax.

The object of payment of land tax is a piece of land that is territorially related to the municipality where the local government authorities have introduced such a tax. An exception to this rule are plots of land that:

- according to the legislation of the Russian Federation were withdrawn from circulation;

- According to the legislation of the Russian Federation, circulation was limited.

2. Tax on property of individuals.

The subjects of property tax payment are citizens (not only Russian ones) who are the owners of property that is subject to tax in accordance with federal law. Such property includes:

- residential building, apartment or room;

- country house;

- garage;

- other buildings, structures and premises, as well as shares in the ownership of the above property.

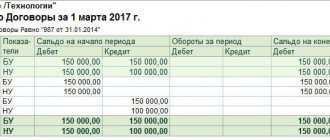

The calculation of the tax amount depends on the tax base, which is annually as of 01.01. calculated in accordance with the total investment cost.

Local taxes include only trade fees. However, the effect of the right to establish local self-government is territorially limited. Such a fee can be introduced only on the territory of several administrative-territorial units, namely:

- Moscow;

- Saint Petersburg;

- Sevastopol.

Tax “hierarchy” presented in the table

| №/№ | Tax level | Tax list |

| 1. | Federal taxes | value added tax, excise taxes, personal income tax, corporate income tax, mineral extraction tax, water tax, duty for the use of flora and fauna, duty for the exploitation of water resources, state duty. |

| 2. | Regional taxes | property duty of organizations, transport tax, gambling tax. |

| 3. | Local taxes | land duty, personal property tax, trade tax. |

Principles of local taxes and fees

Local taxes and fees exist and operate according to the general principles of the entire tax system of the country. These include the following principles:

1. The principle of justice. When introducing a particular tax, the existence of an objective opportunity for the target group of taxpayers to pay the tax (fee) must be taken into account;

2. The principle of universality and equality of taxation. The obligation to make payments to the budget, if there are legal grounds, lies with an indefinite circle of persons who are equal in their rights and responsibilities. It is not permissible to unjustifiably exempt some payers from paying a tax (fee) and simultaneously collect it from others under the same conditions.

3. The principle of economic feasibility. The establishment of taxes cannot be spontaneous and arbitrary, but must be justified from an economic point of view. Their introduction should not infringe on the rights and freedoms of citizens provided for by the Constitution of the Russian Federation.

4. The principle of unity of the economic space of the Russian Federation. Taxes (fees) that in any way encroach on the integrity of the country’s economic space are unacceptable. Mandatory payments to the budget cannot directly or indirectly affect the freedom of movement within the country, both goods (works, services) and financial resources. Any obstacle to legally permitted business activities by introducing mandatory payments is prohibited.

5. The principle of compliance with the procedure for establishing a tax (fee). Taxes (fees) that are not provided for in the Tax Code of the Russian Federation or are introduced in violation of the procedure are not subject to payment.

6. Certainty of tax liability. By regulation, when the obligation to pay to the budget is introduced, all elements of taxation must be fixed. The wording of tax legal norms must be clear so that the taxpayer clearly knows for what, how much, and when the corresponding tax is required to be paid to the budget.

7. Presumption of interpretation of tax doubts in favor of the taxpayer. If there are vague formulations and doubts about tax rules, their interpretation is carried out in favor of the taxpayer.

Notes

- https://dic.academic.ru/dic.nsf/enc_law/1305 Encyclopedia of Lawyer

- List of international treaties on the avoidance of double taxation between the Russian Federation and other states

- ↑ 12345678910111213141516171819202122232425262728293031323334

D. B. Kuvalin “Economic policy and behavior of enterprises: mechanisms of mutual influence” Chapter “Ways of adaptation of Russian enterprises to the transformational economic crisis” Archived on September 23, 2015. // M.: MAKS Press, 2009 - ↑ 12

Taxes for the rich? The economy was not allowed into the “shadow” Archival copy dated May 19, 2010 on the Wayback Machine // Prime-TASS, May 13, 2010 - Barsenkov A. S., Vdovin A. I., “History of Russia. 1917-2007" - M.: Aspect Press, 2008 - p. 772

- Main directions of tax policy in the Russian Federation for 2008-2010. // Ministry of Finance of the Russian Federation

- ↑ 12

Statements from management Archived May 18, 2011. // Ministry of Finance of the Russian Federation - ↑ 12

Putin's tax policy promises success // The Wall Street Journal, November 26, 2002, Translation into Russian - Revival of Russia // Financial Times, October 30, 2001

- Political gesture // Expert, March 24, 2008

- ↑ 12

Filippov A.V. “Recent history of Russia. 1945—2006" - Economic managers are betting on Putin // Frankfurter Allgemeine Zeitung, March 11, 2004, Translation into Russian (inaccessible link)

- Sergei Katyrin: I don’t think that oil will rise to $90. Russian newspaper. Retrieved December 22, 2015.

Features of local taxes and fees

Despite the similarity of local taxes and fees with the general characteristics of the entire Russian tax system, local taxes and fees have their own distinctive features:

- funds received by the relevant local budget are subject to spending exclusively on the needs of the municipality itself;

- local withholding taxes are accumulated in the local budget; higher budgets at the regional or federation level are distributed in certain proportions between all three levels, including the local one.

- the decision to introduce and collect appropriate fees lies solely with local authorities;

- control over the use of local budget funds is also carried out locally by self-government bodies.

- a wide range of powers for the legal regulation of local taxation, which includes the ability to reduce tax rates and establish benefits and privileges for certain categories of tax payers.

How the Ministry of Finance cut the volume of subsidies to the regions by exactly 5%

But according to the new rules of the Ministry of Finance of the Russian Federation, in order to receive a subsidy, regions had until August 2021 to “assess the effectiveness of tax benefits, report them to the Ministry of Finance and include ineffective ones in the cancellation plan by September.” The Russian authorities have now begun to pay attention to the increase in tax and non-tax revenues for the year, investments, and the number of employees in small and medium-sized businesses. Unemployment in regions applying for assistance will have to decline. Regions whose income share of subsidies over the last 3 years has exceeded 40% will have to report to Anton Siluanov’s team on budget execution, otherwise aid will be reduced by 5%. If the region does not sign the agreement, subsidies for next year will be reduced by 10%.

Regions in which the share of subsidies in their income over the last 3 years has exceeded 40% will have to report to Anton Siluanov’s team. Photo by Maxim Platonov

The procedure for establishing local taxes and fees

The enactment and cancellation of a particular local tax (fee) is carried out according to the rules prescribed by the domestic tax code, on the basis of legislative decisions of bodies performing representative functions at the basic level. This competence of local authorities is enshrined in Article 39 of the federal law “On the General Principles of the Organization of Local Self-Government.” According to this norm, local authorities have the right to establish (cancel):

- local taxes (fees);

- preferential conditions for local taxation for certain categories of payers.

In addition, one-time contributions of funds to the local budget by citizens living in a certain territory on a voluntary basis may be provided.

Voluntariness consists of citizens expressing their will at a local referendum, meeting, etc.

Collection of land and property taxes is also carried out after the relevant decision is made at the local level. Moreover, such a decision should not contradict the federal tax code.

Author of the article

Tatarstan could single-handedly subsidize a third of Russia's regions

Let us note an interesting fact - Tatarstan, judging by its tax collections to the federal budget last year (490 billion), alone could “feed”, or rather, subsidize, two-thirds of the regions of Russia that receive small subsidies. And if we take only the most subsidized regions, then the entire amount of taxes that the federal center received last year from Tatarstan could be distributed this year almost exactly among 28 constituent entities of the Russian Federation, including such “subsidy eaters” as Dagestan, Yakutia, Kamchatka , Chechnya, Altai and Stavropol territories, Crimea, Buryatia, Tuva. That is, it turns out that Tatarstan “subsidizes” more than a third of all Russia.

Tatarstan alone could “feed” two-thirds of Russia’s regions this year