Author of the article: Sudakov A.P.

Most beginning entrepreneurs operate on a simplified taxation system, which allows them to save on taxes and simplify reporting as much as possible. Moreover, almost all of them operate at a tax rate of 6% on income. But in some cases it may be more profitable to operate on an income minus expenses system. In this article we will look at what is better than USN 6 or 15, and we will also tell you how to switch from one system to another.

General information about the tax regime of the simplified tax system

Business entities using the simplified tax system under the “6% income” scheme are required to pay a tax amount of 6% of the income received, excluding reflected expenses. This tax regime is beneficial to entrepreneurs and organizations that have a consistently low income, but do not incur regular expenses. In addition, the legislation imposes minimum requirements for “USN” employees who pay tax at a rate of 6% regarding accounting and reporting.

If a “simplified person” receives a high income, but at the same time his activities involve regular expenses, then it is advisable for such a business entity to use the simplified tax system according to the “income minus expenses 15%” scheme. This tax regime allows the “USN agent” to reduce the tax base at the expense of incurred expenses.

Recognition of expenses when changing the object of the simplified tax system

According to the general rule, when a taxpayer switches from the simplified tax system “income” to the simplified tax system “income minus expenses”, expenses related to tax periods in which the object of taxation in the form of income was applied are not taken into account when calculating the tax base (clause 4 of article 346.17 of the Tax Code of the Russian Federation) .

It is on the basis of paragraph 4 of Article 346.17 of the Tax Code of the Russian Federation that the Ministry of Finance of Russia concludes: wages accrued during the period of application of the taxable object in the form of income, but paid after changing the taxable object, are not included in expenses (see, for example, letter dated May 26, 2014 No. 03-11-06/2/24949).

This conclusion can be extended to other expenses directly related to the period of the simplified tax system “income”, but paid in the next year, after changing the object of taxation. These could be, for example, expenses:

- for communication services;

- in the form of interest under a loan agreement;

- for auditing, accounting and legal services;

- for business trips, etc.

The Russian Ministry of Finance makes a similar conclusion regarding the agency fee paid by the principal to the agent for goods sold by him. If goods are sold during the period of application of the simplified tax system “income”, and remuneration is paid during the period of application of “income minus expenses”, then expenses in the form of agency fees are not taken into account when calculating the tax base (letter of the Ministry of Finance of Russia dated March 29, 2018 No. 03-11-11/ 20015).

At the same time, regarding the costs of acquiring non-exclusive rights to use software, the Russian Ministry of Finance expresses a different opinion. When acquiring these rights during the period of application of the simplified tax system, “income” with payment of their cost in installments, the amounts of payments paid in accordance with the license agreement after the transition to the simplified tax system “income minus expenses” can be taken into account as expenses in the amount of amounts actually paid (letter from the Ministry of Finance of Russia dated May 24, 2013 No. 03-11-06/2/18966). Based on the terms of the license agreement, the costs of acquiring non-exclusive rights relate to several tax periods, therefore the rule of paragraph 4 of Article 346.17 of the Tax Code of the Russian Federation does not apply in this situation.

This rule does not apply to expenses pre-paid under the simplified tax system “income”, but relating to the period of the simplified tax system “income minus expenses” (provided that this type of expense is provided for in Article 346.16 of the Tax Code of the Russian Federation). This could be expenses for rent, internet services, etc., paid last year in advance or through a security deposit. The period to which the expenses incurred are determined by contracts, primary accounting documents, transcripts and other supporting documents.

Certain types of costs are recognized as expenses of the simplified tax system, taking into account the features specified in paragraph 2 of Article 346.17 of the Tax Code of the Russian Federation. Such expenses with recognition features include the following expenses:

- for the purchase of raw materials and materials;

- purchasing goods for further sale;

- acquisition (construction, production) of fixed assets.

Material expenses are recognized under the simplified tax system at the time of repayment of the debt, that is, on the date of debiting funds from the taxpayer’s current account or payment from the cash register (clause 1, clause 2, article 346.17 of the Tax Code of the Russian Federation). Consequently, if raw materials and supplies were purchased during a period when the object of taxation is income, but in fact the funds in payment were transferred to the counterparty after the object of taxation was changed, such expenses can be taken into account after the transition to the simplified tax system “income minus expenses” (letter of the Ministry of Finance of Russia dated May 26, 2014 No. 03-11-06/2/24949).

In accounting, inventories are written off as expenses at the time of release into production or upon other disposal. Write-off is carried out in the assessment established by the accounting policy of the organization (at the cost of each unit, at the average cost or using the FIFO method) (clause 16 of PBU 5/01 “On approval of the Accounting Regulations “Accounting for Inventories””, approved by order of the Ministry of Finance Russia dated 06/09/2001 No. 44n).

Expenses for payment for goods purchased for the purpose of resale are taken into account as expenses as they are sold (clause 2, clause 2, article 346.17 of the Tax Code of the Russian Federation), as well as in accounting. Therefore, if goods were paid for during the period of application of the simplified tax system “income”, and were sold after the transition to the simplified tax system “income minus expenses”, the cost of such goods can be taken into account in expenses (letter of the Ministry of Finance of Russia dated December 31, 2013 No. 03-11-06/2/ 58778).

Expenses for the acquisition (manufacturing) of fixed assets are taken into account from the moment they are put into operation. During the year, expenses are accepted for reporting periods in equal shares (clause 3 of Article 346.16 of the Tax Code of the Russian Federation).

If fixed assets were acquired, paid for and put into operation during the application of the simplified tax system “income”, the taxpayer will not be able to recognize the costs of their acquisition.

It is lawful to reduce the tax base for such objects only in the case when the fixed asset was paid for and acquired during the period of application of the taxable object “income”, and commissioning was carried out after a change in the taxable object (see letters of the Ministry of Finance of Russia dated October 18, 2017 No. 03-11- 11/68187, dated July 24, 2013 No. 03-11-11/29209).

The opposite situation may also occur, when the fixed asset was purchased during the period of application of the simplified tax system “income” with installment payment. In this case, the organization, after switching to the simplified tax system “income minus expenses,” has the right to take into account as expenses the cost of the specified fixed asset in the part paid after changing the object of taxation (letter of the Ministry of Finance dated December 9, 2013 No. 03-11-06/2/53560).

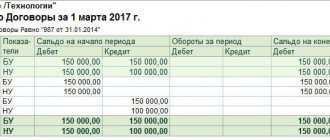

Let's look at how these situations are reflected in 1C: Accounting 8 (rev. 3.0).

Simplified tax system at a rate of 6% and 15%: pros and cons

When choosing a tax regime, take into account the specifics of your company’s activities, the level of income and expenses, and their regularity. Below we provide a comparative description of the regimes within the framework of the simplified tax system. If you are a simplified tax payer, then regardless of the chosen scheme (6% or 15%), you can take advantage of the following main advantages of the simplified regime:

- Minimum requirements for record keeping and reporting. A “USN officer” is not required to file a tax return quarterly; a “simplified person” should report to the Federal Tax Service once a year. As for keeping records, you are only required to keep a Book of Income and Expenses.

Transition to the simplified tax system “income minus expenses” in “1C: Accounting 8”

To change the object of taxation from “income” to “income minus expenses”, it is not enough in the Taxation System register to set the switch to the Simplified position (income minus expenses). For different types of expenses in the program, you will need to enter initial balances in tax accounting registers at the end of the year, that is, before switching to the simplified tax system “income minus expenses.” Before entering balances, all routine month-closing operations for December must be completed, including Balance Sheet Reformation.

BALANCE ENTRY ASSISTANT

To enter initial balances in “1C: Accounting 8” edition 3.0, there is a special processing Assistant for entering initial balances (section Main - Assistant for entering balances).

Pay attention to the hyperlink Balance entry date

. If balances have already been entered for the organization, then the date for entering balances is filled in and cannot be changed. After changing the date for entering balances, old documents for entering balances will be transferred to the new date, and routine operations included in the Month Closing processing for the period preceding the date for entering balances will no longer be performed.

If the balance date has not been established, then it must be set to the end of the year preceding the start of accounting in the program. Then, in the assistant form, you should select the accounting account for which balances are entered, enter the appropriate accounting section and click on the Create button. In the form of the document Entering balances, click on the button Entering balances, you must go to the form of entering balances mode and set the flag to the Entering balances for tax accounting position. The Input of accounting balances and Input of balances in special registers flags must be disabled (Fig. 2).

Rice. 2. Balance entry mode

After setting the mode for entering balances for each new document, you can change the date for entering balances: it should be set to the end of the year, before changing the simplified tax system object. For which accounting accounts and for which sections of accounting should balances be entered? Let's look at specific situations.

LABOR COSTS

In order for expenses to be taken into account correctly in tax accounting, you will need to enter initial balances for accrued and unpaid wages, as well as for insurance premiums.

Example 1

| In 2021, Berezka LLC applies the simplified tax system with the object of taxation “income”. Starting from 2021, Berezka LLC will switch to the “income reduced by the amount of expenses” object. Berezka LLC pays accrued wages and insurance premiums for December 2021 in January 2021. |

In the form of the assistant for entering initial balances, select account 70 “Settlements with personnel for wages”, enter the accounting section of the same name and click on the Create button. In the document form Entering balances, account 70 balances at the end of the year preceding the transition are entered for all employees. In order for the December salary not to be taken into account in expenses when paying (according to the letter of the Ministry of Finance of Russia dated May 26, 2014 No. 03-11-06/2/24949), in the Reflection in the simplified tax system field, select the value Not accepted (Fig. 3).

Rice. 3. Entering salary balances

When posted, the document will generate movements in the registers Other calculations and Expenses under the simplified tax system.

Similarly, it is necessary to enter the initial balances for account 68.01 “Personal income tax when performing the duties of a tax agent,” as well as for all involved subaccounts of account 69 “Calculations for social insurance and security.”

In January 2021, after the salary payment for December of last year is reflected in the program, along with the accounting register, movements are formed in the accumulation registers of the simplified tax system subsystem:

- Book of accounting of income and expenses (section I);

- Other calculations;

- Expenses under the simplified tax system.

At the same time, in the register Book of Income and Expenses (Section I), expenses for the purposes of the simplified tax system are not reflected.

If salary transactions are uploaded from an external program in a consolidated manner, then account 70 balances do not need to be entered.

In this mode of operation, salary expenses are not taken into account in the simplified tax system registers and are not automatically recognized. In this case, balances for taxes and contributions must be entered in any case.

Labor costs will be automatically reflected in KUDiR, starting with payments for January 2021.

COSTS FOR PURCHASE OF FIXED ASSETS

First, let’s look at an example where a fixed asset was purchased during the period of application of the simplified tax system “income” with installment payment.

Example 2

| Berezka LLC in December 2021, during the period of application of the simplified tax system “income”, acquires and puts into operation a machine worth 800,000 rubles. In December 2021, Berezka LLC pays only half the cost of the machine. The remaining amount is transferred to the supplier in January 2021 after the transition to the simplified tax system “income minus expenses”. |

Payment for the machine in December 2021 and January 2021 can be reflected in the accounting system documents Write-off from the current account, and the purchase can be reflected in the document Receipt (act, invoice) with the type of operation Fixed assets. At the same time, the company will be able to take into account only 400,000 rubles in expenses, that is, the amount paid in 2021 (letter of the Ministry of Finance of Russia dated December 9, 2013 No. 03-11-06/2/53560).

In relation to this object, accepted for accounting during the period of application of the simplified tax system “income”, it is necessary to enter tax accounting balances and register payment for 2021.

In the form of the assistant for entering initial balances, select account 01.01 “Fixed assets in the organization”, enter the accounting section Fixed assets and click on the Create button. For a new document, you must set the Enter tax accounting balances mode and specify the date for entering balances as the end of the year. By clicking the Add button in the Fixed Assets form that opens, you must select a fixed asset from the directory of the same name. Despite the fact that only information for tax accounting purposes of the simplified tax system will be used, the document requires filling out data on all tabs of the form.

On the Initial balances tab according to accounting data, the initial cost of the object, the cost at the time of entering balances, accumulated depreciation and the method of reflecting depreciation expenses are indicated.

On the Accounting tab, general information and parameters of fixed asset depreciation are indicated, which correspond to the information specified during commissioning in the document Acceptance for accounting of fixed assets.

On the Tax Accounting tab, fill in the fields (Fig. 4):

- Initial cost (USN) - indicates the cost of the machine (800,000 rubles);

- The amount of accrued depreciation (for the transition to the simplified tax system) - a zero amount is indicated;

- Date of acquisition - indicates the date of receipt of the OS in accordance with the supplier’s primary documents;

- Useful life in months (corresponds to the period specified upon acceptance for accounting);

- The procedure for including cost in expenses is the value Include in depreciable property (Clause 4, Article 346.16 of the Tax Code of the Russian Federation).

Rice. 4. Entering fixed asset balances for tax accounting purposes under the simplified tax system

On the Events tab, the date of acceptance of the OS for accounting and details of the document with the help of which the OS was put into operation are indicated.

When posted, the document will generate movements in the OS Initial Information register (tax accounting of the simplified tax system).

To register payment for fixed assets and intangible assets, the program uses the document Registration of payment for fixed assets and intangible assets for the simplified tax system (section of fixed assets and intangible assets) (Fig. 5).

Rice. 5. Registration of OS payment

When posted, the document will generate a register entry for Registered payments of fixed assets (STS).

Under the terms of Example 2, the costs of purchasing a machine are taken into account for the purpose of determining the tax base in the 1st, 2nd, 3rd and 4th quarters of 2019 in equal parts of 100,000 rubles. (RUB 400,000 / 4).

Expenses for the acquisition of fixed assets for the purposes of the simplified tax system in the program are recognized at the end of each quarter when performing a regulatory operation Recognition of expenses for the acquisition of fixed assets for the simplified tax system, included in the month-end closing processing. When carrying out this regulatory operation, entries on expenses for the acquisition of fixed assets are made in the tax accounting registers, the Book of Income and Expenses (Section I) (Fig. 6) and the Book of Income and Expenses (Section II)

.

Rice. 6. Recognition of expenses for the acquisition of fixed assets

Now let’s look at an example where a fixed asset was purchased and paid for during the period of application of the simplified tax system “income”, and was put into operation after a change of object.

Example 3

| The organization Berezka LLC in December 2021, during the period of application of the simplified tax system “income”, purchased and paid for a machine worth 485,000 rubles. Starting from 2021, Berezka LLC switched to the simplified tax system “income minus expenses”. In January 2021, the machine was put into operation. |

Payment for the machine in December 2021 can be reflected in the document Write-off from the current account.

Since the OS was received in one period and put into operation in another, you should use two different program documents from the OS and intangible assets section:

- in December 2021 - Receipt (act, invoice) with the type of operation Equipment;

- in January 2021 – Acceptance of fixed assets for accounting. On the Tax Accounting (USN) tab, you can immediately register payment for 2021.

When posting the document Acceptance for accounting of fixed assets, movements are generated in the registers of the simplified tax system subsystem, therefore, unlike Example 2, entering balances is not required.

Since the fixed asset was put into operation during the simplified taxation system “income minus expenses”, then, in accordance with the letter of the Ministry of Finance of Russia dated October 18, 2017 No. 03-11-11/68187, the costs of purchasing this fixed asset can be taken into account when calculating tax in 2021. Under the terms of Example 3, expenses for the purchase of a machine are automatically recognized in the 1st, 2nd, 3rd and 4th quarters of 2021 in equal parts of 121,250 rubles. (RUB 485,000 / 4).

MATERIAL COSTS

Let's consider an example of accounting for material costs when changing a simplified tax system object.

Example 4

| The organization Berezka LLC in December 2021, during the period of application of the simplified tax system “income”, purchased materials for a total amount of 20,000 rubles. In the same month, the materials were written off as general business expenses. Payment for materials was transferred to the supplier in 2019 after the transition to the simplified tax system “income minus expenses”. |

The receipt of materials is reflected in the document Receipt (act, invoice) with the transaction type Goods (Purchases section), and the write-off of materials as expenses is reflected in the document Requirement-invoice (Warehouse section). During the period of application of the simplified tax system “income”, neither one nor the other document makes movements into the registers of the simplified tax system subsystem. In order for the cost of materials to be taken into account at the time of payment in 2021 (according to the letter of the Ministry of Finance of Russia dated May 26, 2014 No. 03-11-06/2/24949), for tax accounting purposes it is necessary to enter initial balances.

In the form of the assistant for entering initial balances, select the corresponding account 10 “Materials”, enter the accounting section of the same name and click on the Create button. For a new document, you must set the Enter tax accounting balances mode and specify the date for entering balances as the end of the year. By clicking the Add button in the form that opens, you need to fill out the tabular part (Fig. 7):

- select a materials account;

- indicate the name from the Nomenclature directory;

- indicate the batch document and the settlement document;

- in the Expense Status field, select the value Not written off, not paid;

- in the field Reflection in the simplified tax system – Accepted;

- indicate the quantity and amount of remaining materials, including the cost in the currency of settlement, which will be accepted for expenses after the change of object.

Rice. 7. Entering balances for materials

When posted, the document will generate movements in the Expenses register under the simplified tax system.

In 2021, when posting the document Write-off from a current account registering payment for materials to the supplier, movements are generated in the registers of the simplified tax system subsystem, including in the register Book of Income and Expenses (Section I), where expenses are reflected for the purposes of the simplified tax system.

COSTS OF PURCHASING GOODS FOR RESALE

Let's consider how the balances of unsold goods are taken into account when changing the object of the simplified tax system.

Example 5

| The organization Berezka LLC in December 2021, during the period of application of the simplified tax system “income”, purchased and paid for goods for further resale for a total amount of 15,000 rubles. The goods were sold in 2021 after the transition to the simplified tax system “income minus expenses”. |

In order for the cost of goods to be taken into account at the time of their sale in 2019 (in accordance with the letter of the Ministry of Finance of Russia dated December 31, 2013 No. 03-11-06/2/58778), for tax accounting purposes it is necessary to enter initial balances.

In the form of the assistant for entering initial balances, select account 41.01 “Goods in warehouses”, enter the accounting section Goods and click on the Create button. For a new document, you must set the Enter tax accounting balances mode and specify the date for entering balances as the end of the year. By clicking the Add button in the form that opens, you need to fill out the tabular part (Fig. 8):

- select a goods account;

- indicate the name from the Nomenclature directory;

- indicate the batch document and the settlement document;

- in the Consumption Status field, select the value Not written off;

- in the field Reflection in the simplified tax system – Accepted;

- indicate the quantity and amount of remaining goods, including the cost in the currency of settlement, which will be accepted for expenses after the change of object.

Rice. 8. Entering balances for goods

When posted, the document will generate movements in the Expenses register under the simplified tax system.

In 2021, when posting the Sales document (act, invoice), reflecting the sale of goods to the buyer, movements are generated in the registers of the simplified tax system subsystem, including in the register Book of Income and Expenses (Section I), where expenses are recognized for the purposes of the simplified tax system.

COSTS OF ACQUISITION OF NON-EXCLUSIVE RIGHTS

Let's consider how the costs of acquiring non-exclusive rights to the results of intellectual activity are taken into account when changing the object of the simplified tax system.

Example 6

| The organization Berezka LLC in December 2021, during the period of application of the simplified tax system “income”, acquired non-exclusive rights to use software under a license agreement for a total amount of 12,000 rubles. The payment under the license agreement was paid in January 2021 after the transition to the simplified tax system “income minus expenses”. In accordance with the accounting policy, expenses for the acquisition of non-exclusive rights are taken into account over two years in equal shares. |

An organization can accept the amount of a fixed payment as expenses after its actual payment in January 2021 (letter of the Ministry of Finance of Russia dated May 24, 2013 No. 03-11-06/2/18966). Moreover, the costs of purchasing, adapting and installing licensed software are taken into account as expenses at a time (clause 19, clause 1, article 346.16 of the Tax Code of the Russian Federation).

In accounting, the costs of purchasing software, paid in the form of a fixed payment, can be classified as deferred expenses (paragraph 2 of clause 39 of PBU 14/2007 “Accounting for intangible assets”, approved by order of the Ministry of Finance of Russia dated December 27, 2007 No. 153n) . The period of use of the program is established in the license agreement. If the deadline is not established in the agreement, then the taxpayer can set the deadline independently, enshrining this rule in its accounting policy (letter of the Ministry of Finance of Russia dated March 18, 2013 No. 03-03-06/1/8161). When writing off expenses, you can be guided by an assessment of the expected receipt of future economic benefits from the use of this program (clause 3 of PBU 21/2008 “Changes in estimated values, approved by order of the Ministry of Finance of Russia dated October 6, 2008 No. 106n).

In “1C: Accounting 8” edition 3.0, the receipt of a non-exclusive right to use a software product can be reflected in the document Receipt (act, invoice) with the transaction type Services. When filling out the tabular part of the document, you must indicate the name of the licensed software received, its cost, cost account (97.21 “Other deferred expenses”) and the corresponding analytics. At the end of the month, after completing the regulatory operation Write-off of deferred expenses, the cost of the software will be uniformly included in expenses for accounting purposes over 24 months, based on the specified start and end dates of write-off.

In order to take into account the costs of acquiring non-exclusive rights at a time in tax accounting, you must manually make an entry in the accumulation register of the Book of Income and Expenses (Section I). The document Record of the book of income and expenses of the simplified tax system from the Operations section is intended for this purpose. Initial balances are not entered in Example 6.

How can a tax collector switch from 6% to 15%

As practice shows, if the expenses of the “USN agent” account for more than half of the income, then in this case it is advisable for business entities to change the tax regime to “income minus expenses 15%”. The transition order is presented below.

Step 1: Prepare the notice. Unlike registration, when switching to the “income – expenses 15%” scheme, you are not required to collect an impressive package of necessary documents. In this case, you just need to draw up a notification in Form 26.2-6. You can fill out the form on paper or electronically on the Federal Tax Service website.

Step 2. Send a notification to the Federal Tax Service. Depending on your desire and convenience, you can:

- fill out the notification at home and submit it to the fiscal service in person. In this case, it is advisable to make 2 copies of the document: one for the Federal Tax Service specialists, the second for you with a note from the office about acceptance;

- send the document in paper form by mail. To do this, you will need to go to the nearest post office, where you can send a notification letter. Upon receipt of the document, the Federal Tax Service employee will sign for receipt, and you will be sent a “stub” with the date the document was accepted;

- use the electronic resource of the Federal Tax Service and send a notification via the Internet. To do this, you need to first register on the Federal Tax Service website. After registration, you can fill out an application electronically and submit it online.

Do not forget about the deadlines for submitting an application for the transition: if you plan to apply the simplified tax system of 15% from 2021, then you must submit a notification no later than 12/31/17.

Some nuances of the transition

Finally, let's look at a few nuances so that you don't have any questions about switching to a new system. We will analyze very real situations and questions that aspiring entrepreneurs have.

- On December 10, 2021, individual entrepreneur Nikolay Vasko contacts the territorial office and submits an application to switch to a new taxation system. The application was delivered to the Federal Tax Service in person, one copy was given to the employee, the second was left with Vasko. Will the individual entrepreneur receive a notification about the successful transition to the new system? No, according to the law, the Federal Tax Service does not have to notify entrepreneurs or LLCs that changes are occurring. If the document is registered and taken into account, it will automatically switch to the new system from January 1, 2021.

- switched to a 15% income minus expenses system from January 1, 2018. At the same time, in December she purchased a batch of clothes worth 20 thousand rubles for the purpose of their subsequent sale. Can this money be converted into expenses? Since the purchase was made at a rate of 6%, it was not reflected in expenses. Since the sale was carried out in February 2021, that is, after applying the rate of income minus expenses of 15%, they can be included in expenses (with an amount of exactly 20 thousand rubles). The tax office will accept this option as correct, on the basis that the clothes were sold already in the new period.

As you can see, there is nothing particularly difficult about the transition. It is enough to simply draw up a corresponding application and send it to the tax office.

Attention:

The date of submission of the application is not important, the main thing is to submit it before the end of the year. The deadline for the official transition to the new system is January 1 next year.

Before moving on, compare the modes and decide whether such an action makes sense. As a rule, this is advisable if your expenses are quite high, but keep in mind that the tax authorities will not count the purchase of an air conditioner for the office or a 500-liter aquarium as expenses.

Typical errors in calculations

Let's consider three main mistakes made by organizations and individual entrepreneurs when switching to a non-USN 15%.

Mistake #1. Transition to the simplified tax system of 15% during the reporting year.

Individual Entrepreneur Kukushkin is a payer of the simplified tax system of 6%. In June 2021, due to a change in the specifics of his activities and a significant increase in the level of expenses, Kukushkin submitted an application to change the regime - from the simplified tax system of 6% to 15%. From 07/01/17 Kukushkin calculates the tax at a rate of 15%, taking into account expenses incurred.

Kukushkin has the right to change the regime only from the beginning of next year (not earlier than 01/01/18). This rule applies to all taxpayers, regardless of the reasons for the regime change. Based on the notification submitted in June, Kukushkin becomes a tax payer at a rate of 15% from 01/01/18.

Mistake #2. Transfer of organizations - parties to the property trust management agreement.

Kursiv LLC is a party to the property trust management agreement. In December 2021, due to a decrease in expenses, Kursiv filed a notification about changing the regime to the simplified tax system of 6%. “Kursiv” does not have the right to change the regime to the simplified tax system of 6%, since the company is participating in a management agreement. This limitation is provided for in Art. 346.14 Tax Code. “Kursiv” can apply the simplified tax system only at a rate of 15%.

Mistake #3. Change of tax regime after reorganization.

In March 2021, Factor LLC (payer of the simplified tax system 6%) was reorganized into Vector LLC. Upon the fact of the reorganization, Vector filed a notice of change of regime to the simplified tax system of 15%. From 2nd quarter 2021 Vector pays advance tax at a rate of 16%.

For reorganized companies, the general rule for switching to the simplified tax system is 15%: organizations can change the regime only from the beginning of the year. The notification submitted by Vector in March 2021 is the basis for the application of the simplified tax system of 15% from 01/01/18.

Conditions for applying the simplified tax system

In order to continue to apply the simplified tax system in its activities, the taxpayer must meet the following conditions:

- The average number of employees is less than 100 people.

- Revenue - no more than 150,000,000 rubles.

Read about income limits for applying the simplified tax system in the article “Income limits when applying the simplified tax system.” Read about what changes to these limits have been introduced since 2021 here.

- The residual value of the fixed assets must be less than RUB 150,000,000.

There are also a number of certain conditions (Article 346.12 of the Tax Code of the Russian Federation) under which the simplified tax system cannot be applied. In particular, we are talking about some types of activities in which working for the simplified tax system is prohibited. In addition, if an organization has branches or the share of other organizations in its authorized capital is more than 25%, then it cannot apply the simplification.

In order to be able to change the object of taxation (move) from the simplified tax system of 6% to the simplified tax system of 15%, it is necessary to comply with the general conditions under which the simplified tax system can be applied. The legislation does not provide for any additional restrictions for single tax payers.

Rubric “Question and answer”

Question No. 1. 12/14/17 Individual Entrepreneur Murashkin submitted documents to the Federal Tax Service on the transition to the simplified tax system of 15%. Murashkin delivered the notification personally; Murashkin kept one copy of the document as confirmation of the application. From what moment is Murashkin considered a tax payer at rate 15? Does Murashkin need to receive additional notification from the Federal Tax Service?

The law does not oblige the Federal Tax Service to additionally inform payers about the transition from the simplified tax system of 6% to 15%. Based on the notification that Murashkin submitted on 12/14/17, he is considered a tax payer at a rate of 15% from 01/01/18.

Question No. 2. Zeus LLC, which previously used the simplified tax system of 6%, changed the regime to the simplified tax system of 15% from 01/01/18. In November 2021, Zeus purchased a batch of stationery for resale (cost 12,303 rubles). Stationery products were sold on 02/12/18 (sales price 18,401 rubles). How can Zeus take into account income and expenses from the sale of stationery?

The sale price (18,401 rubles) should be reflected in the income of the 1st quarter. 2021. Despite the fact that stationery was purchased during the period of application of the simplified tax system of 6%, their cost can be taken into account in expenses (RUB 12,303). Reason – stationery products were sold during the period of application of the simplified tax system of 15%.

How to switch to simplified tax system

The payer can switch to simplified payment in 2 ways:

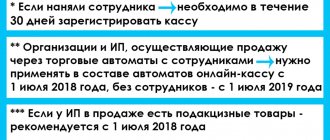

- By submitting a notice of transfer to the Federal Tax Service together with the documents submitted upon registration within 30 days from the date of state registration (clause 2 of Article 346.13 of the Tax Code of the Russian Federation).

- By changing one system for calculating and paying taxes to another, you can switch to the simplified tax system starting next year by notifying the Federal Tax Service no later than December 31.

How to change the simplified tax system to another tax payment regime can be found in the section “Transition from the simplified tax system to another regime.”

Do you need to receive confirmation of the transition to the simplified tax system, read the article “Certificate of a simplified taxation system (STS)”.

What to consider when choosing a simplified tax system option

When applying the simplified tax system “income minus expenses”, it will not be possible to avoid paying tax, even if the activity is unprofitable. At least 1% of income will still have to be paid to the budget. Exceptions to this rule:

- you did not receive any income at all - there were no receipts from customers to the bank account or to the cash register;

- An individual entrepreneur has no employees and a small income - he has the right to reduce the tax on the amount of insurance premiums in full.

When choosing an object of taxation, it is necessary to make a mathematical calculation based on the estimated amounts of income and expenses. You should be guided by the fact that if the estimated amount of expenses (economically and documented) is 60% or more of the estimated amount of income, then it is more profitable to use the simplified tax system of 15%. But there are caveats here:

- organizations and individual entrepreneurs paying a trade fee can deduct its amount from the calculated amount of the “income” tax of the simplified tax system, subject to the actual payment of the fee to the budget;

- Organizations and individual entrepreneurs can reduce the calculated tax when the object of taxation is “income” on insurance premiums for themselves and employees by up to 50% (if an individual entrepreneur does not have employees, he can reduce the tax by 100%).

In these cases, the 60% threshold does not work, since the accounting for contributions and trading fees in the “income” and “income-expenditure” options is fundamentally different:

- “income” - the tax on contributions and fees is reduced;

- “income-expenses” - contributions and fees reduce the amount of income.

Here is an example of tax calculation for individual entrepreneurs and LLCs for different objects of taxation:

We have already written about reporting on the simplified tax system, as well as about reporting of individual entrepreneurs on the simplified tax system without employees.

Subscribe to our newsletter

Yandex.Zen VKontakte Telegram

What is the difference between the two types of simplification

The simplified tax system is a special tax regime, which is regulated by Chapter 26.2 of the Tax Code of the Russian Federation.

It can be used by both legal entities and individual entrepreneurs. In connection with the abolition of UTII from 01/01/2021, simplified taxation will become the most popular tax regime for small businesses, so it is important to understand its intricacies. When simplified, one of the following objects is taxed: Read more about income and expense simplification in the article, and about income simplification for individual entrepreneurs here.

Each object of taxation has its own tax rate: We wrote about the minimum tax in the article.

A special transition period has been introduced in 2021, during which tax rates will increase. It is associated with achieving acceptable limits for the application of the simplified tax system:

Let's talk separately about the procedure for accounting for insurance premiums: Let's summarize the differences in the diagram: An incorrect choice of the object of taxation can lead to excessive payment of tax, so this choice should be approached with special care.

What tax rates exist under the simplified tax system?

Entrepreneurs choose the simplified tax system:

- due to low tax rates - 15/6% (or lower) compared to 20% income tax;

- no VAT (with some exceptions).

How to apply the simplified tax system is described in Chapter 26.2 of the Tax Code of the Russian Federation. In this article we will not talk about the conditions for applying the simplified tax system; we will focus only on tax rates.

Within the framework of the application of the simplified tax system, the following tax rates are allowed (Article 346.20 of the Tax Code of the Russian Federation):

Starting from 2021, changes are being introduced to the Tax Code of the Russian Federation in relation to some limits on the simplified tax system and the corresponding tax rates.

If the annual income ranges from 150 to 200 million rubles, and the average headcount ranges from 100 to 130 people, then the business entity does not lose the right to the simplified tax system, but is obliged to apply increased tax rates - 8 and 20%.

Details about the procedure for applying increased rates are written in the ConsultantPlus review. You will receive even more relevant information if you sign up for a free trial access to K+.

The taxpayer cannot choose the tax rate: they are determined by law. But he can choose the object of taxation, which determines the rate that should be applied when calculating the tax. In this article we will focus on the main rates:

- 15% for the “income-expenditure” simplified tax system;

- 6% with a “profitable” simplified tax system.

It is necessary to think over your choice in advance and indicate it in a special notice on Form 26-2.1. You will find an example of filling out a notification by a newly registered organization at the beginning of the article. There is also a blank notification form there.

Read about the balance sheet under the simplified tax system.

What to do if you made a mistake with the choice of tax object

The object of taxation under the simplified tax system is selected before the start of the activity. Let’s say that during the operation of the enterprise the following points could become clear:

- the object of taxation was chosen at random without preliminary calculations;

- an error has crept into the calculations made;

- new types of activities are introduced and the amount of income and expenses changes significantly;

- market nuances were not taken into account, so the cost and income amounts used in the calculations are incorrect.

As a result, the use of the current tax object may turn out to be very unprofitable for the businessman, and he will want to change it. A natural question arises: is this action permissible and when can the object of taxation be changed under the simplified tax system?

The answer is positive: with the simplified tax system, it is possible to move from 6 to 15%, as well as vice versa. The legislation allows such a transition, but limits it to certain periods. The procedure for changing the object of taxation under the simplified tax system in 2020-2021 has not changed. You can switch from 6 to 15% under the simplified tax system within the time limits established by clause 2 of Art. 346.14 Tax Code of the Russian Federation. The change from 15% to 6 under the simplified tax system is regulated by the same article.

After submitting an application to change the object of taxation under the simplified tax system, you do not need to wait for permission from the tax authorities. Changing the object of taxation, as well as applying the simplified tax system, is of a declarative nature.