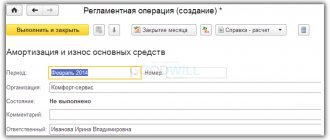

- depreciation must be calculated from the 1st day of the month following the month in which this property was placed on the enterprise’s balance sheet;

- make depreciation charges regardless of financial results;

- make depreciation deductions every month and take them into account in the corresponding tax period;

- grounds for suspending depreciation deductions are considered to be the conservation of an object for a period of 3 months or its long-term repair (more than a year). Contributions resume immediately upon return to service;

- depreciation deductions cease on the 1st day of the month following the month of write-off due to wear and tear, withdrawal from the balance sheet or loss of ownership rights to the property.

Advantages and disadvantages of the linear method

The main advantages of the linear depreciation method:

- Easy to calculate . The calculation of the amount of deductions needs to be made only once at the beginning of the operation of the property. The amount received will be the same throughout the entire service life.

- Accurate recording of property write-offs. Depreciation deductions occur for each specific object (in contrast to non-linear methods, where depreciation is calculated on the residual value of all objects in the depreciation group).

- Uniform transfer of costs to production costs. With non-linear methods, depreciation charges in the initial period are greater than in the subsequent period (write-off occurs in descending order).

The linear method is convenient to use in cases where it is planned that the object will generate the same profit throughout the entire period of its use.

The main disadvantages of the linear method:

The method is not advisable to use for equipment subject to rapid obsolescence, since the proportional write-off of its cost does not ensure the proper concentration of resources necessary for its replacement.

Manufacturing equipment is characterized by a decrease in productivity as the number of years of operation increases. As a result, it will require additional costs for maintenance and repairs due to breakdowns and failures. Meanwhile, depreciation will be written off evenly, in the same amounts as at the beginning of operation, since the linear method does not provide otherwise.

For enterprises planning to quickly update production assets, it will be more convenient to use nonlinear methods.

The total amount of property tax over the entire life of the property to which the linear method is applied will be higher than with non-linear methods.

Technological progress and the linear method

The advantage of straight-line write-off of depreciation, which underlies the straight-line method, completely disappears if the company's assets are subject to rapid obsolescence.

These could be cars, machine tools, exclusive rights to computer programs and other non-financial assets, the use of which becomes ineffective due to the emergence of new, more advanced models and designs.

Real estate can also become obsolete if it no longer meets modern requirements for ergonomics, quality and volume of services provided.

If technological progress and changing requirements influence the rapid obsolescence of an asset, the feasibility of using non-linear methods should be considered when choosing a depreciation model.

In this case, straight-line depreciation does not provide a sufficient concentration of resources necessary to replace the asset. For those companies that plan to quickly update production assets, it is more profitable to use non-linear methods of calculating depreciation.

Linear depreciation and its main features

The simplicity of this method should be considered one of its main advantages. A group of costs for fixed assets is simply written off while the entire service life lasts.

Write-off occurs in equal shares. The calculation system itself is elementary.

All you need is knowledge of information about how much the fixed assets originally cost. The depreciation rate is determined only once. To do this, we take the service life of a specific object as a basis.

Linear depreciation makes it easier for management to adhere to the so-called simplified approach to wear in the main production. Characteristic wear of fixed assets is equal in size.

Starting from the moment when the funds are put into operation, and ending with the moment when the entire cost is repaid. This does not take into account factors such as:

- Intensity of operation.

- Seasonality of work.

This approach will be most relevant in situations where the wear and tear of industrial buildings and other stationary objects is calculated. The impact of the external environment cannot be ignored, as well as the conditions under which the building is operated.

But in other conditions, it can be almost impossible to accurately determine the actual wear and tear of a particular building. Therefore, for many organizations, the most convenient method will be the one in which the write-off occurs in equal amounts that remain the same.

Conditions have a significant impact on the operational life when it comes to production equipment and other groups of fixed assets used in the enterprise. The performance of such objects decreases significantly over time.

Repair and maintenance costs are increasing . Write-offs for the reporting period are no longer possible because depreciation has increased. The method does not involve performing such actions.

When maintaining accounting records, it is necessary to reflect all the actions of the organization. This also applies to individual entrepreneurs’ contributions to extra-budgetary funds.

Management should take a closer look at nonlinear calculation methods if the company is interested in closing the cost of fixed assets as quickly as possible.

In this case, access to linear depreciation will open, deductions associated with products that were actually produced.

To what objects can the accrual method be applied?

There is a division into 10 groups for objects deductions for depreciation, which is determined by operating time. It is mandatory to use the linear method in the case of buildings and devices, transmission facilities when they represent one of the following categories:

- 10 group. With a service life of more than three decades .

- 9 group. 25-30 year period of operation.

- 8 group. 20-25 years is the maximum period for which the original properties are preserved.

The remaining objects allow the use of other existing techniques. This is recorded in the order, which is associated with the accounting policy.

To register an LLC, or any other organization, a legal address is required.

The use of the linear method is possible not only for new objects, but also for those that were previously in operation.

When is it necessary to use the straight-line depreciation method?

The taxpayer is obliged to apply the straight-line method of calculating depreciation to buildings, structures, transmission devices included in the eighth to tenth group (useful life 20-25, 25-30 and over 30 years).

WE OPTIMIZE COSTS FOR EQUIPMENT DEPRECIATION

There are the following ways to optimize depreciation costs:

• Registration of equipment as components.

• Application of bonus depreciation.

• Application of a special increasing factor.

Let's consider these methods.

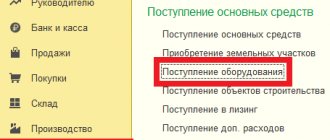

Registration of equipment as components

Considering that in accordance with Art. 256 of the Tax Code of the Russian Federation, depreciable property is property with an original cost of more than 100,000 rubles; the easiest way is to purchase fixed assets “in parts.” For example, not the entire computer, if its cost exceeds 100,000 rubles, but a separate monitor, system unit, mouse, keyboard, etc.

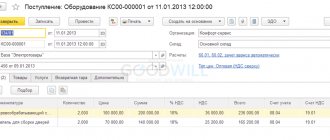

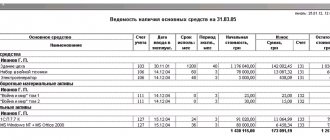

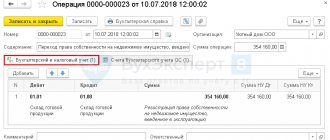

In accounting, fixed assets are accounted for in account 01 “Fixed Assets,” which displays information about the availability and movement of the organization’s fixed assets that are in operation, stock, conservation, leased, or in trust.

Depreciation in accounting is reflected in account 02 “Depreciation of fixed assets,” which collects information about depreciation accumulated during the operation of fixed assets.

If a company purchases equipment for less than 100,000 rubles, it does not need to be accounted for in account 01, nor does it need to be accounted for in account 02, because all expenses can be taken into account at one time.

Example 5

Translogistic LLC purchased equipment (PC) for RUB 115,000. A PC consists of a system unit costing 80,000 rubles. and a 27' diagonal monitor worth RUB 35,000.

If you consider a PC as a “monitor + system unit”, you will have to account for it as a fixed asset, reflecting it on account 01 and transferring the acquisition cost through account 02 “Depreciation”. If we take them into account as independent objects, then since their cost individually does not exceed 100,000 rubles, they will not be fixed assets and their cost can be immediately written off as expenses.

Opinions on the use of this method of optimizing depreciation (registration of equipment not as a whole, but as component parts) vary. So, for example, the Ministry of Finance of Russia in letter No. 03-03-06/2/110 dated 06/02/2010 indicates the following:

On the other hand, there is judicial practice with an opposite opinion.

Application of bonus depreciation

In accordance with Art. 258 of the Tax Code of the Russian Federation, the taxpayer has the right to take advantage of the depreciation bonus, that is, to include in the expenses of the reporting (tax) period expenses for capital investments in the amount of no more than 10% (no more than 30% in relation to fixed assets related to the third to seventh depreciation periods). groups) the initial cost of fixed assets (except for fixed assets received free of charge), as well as no more than 10% (no more than 30% in relation to fixed assets belonging to the third to seventh depreciation groups) of expenses incurred in cases of completion, additional equipment , reconstruction, modernization, technical re-equipment, etc.

If the taxpayer uses this right, the corresponding fixed assets, after their commissioning, are included in depreciation groups (subgroups) at their original cost minus no more than 10% (no more than 30% in relation to fixed assets belonging to the third to seventh depreciation groups ) initial cost included in the expenses of the reporting (tax) period, and the amounts by which the initial cost of objects changes in cases of completion, additional equipment, reconstruction, modernization, technical re-equipment, partial liquidation of objects are taken into account in the total balance of depreciation groups (subgroups) ( change the initial cost of objects for which depreciation is calculated using the straight-line method) minus no more than 10% (no more than 30% in relation to fixed assets belonging to the third to seventh depreciation groups) of such amounts.

If a fixed asset in respect of which a depreciation bonus was applied is sold earlier than five years from the date of its commissioning to a person dependent on the taxpayer, the amounts of expenses that were previously included in the expenses of the next reporting (tax) period are subject to inclusion in the composition of non-operating income in the reporting (tax) period in which such sale was made.

Example 6

JSC Rassvet purchased equipment worth 200,000 rubles, useful life - 4 years (third depreciation group).

We will calculate the amount of depreciation taking into account the use of bonus depreciation in accordance with Art. 258 Tax Code of the Russian Federation:

1. Since the equipment belongs to the third depreciation group, the maximum bonus percentage that can be applied is 30%:

200,000 rub. × 30% = 60,000 rub.

2. Calculate monthly depreciation charges:

(200,000 rubles – 60,000 rubles) / (12 months × 4 years) = 2916.67 rubles.

3. Let's calculate the annual depreciation charges:

12 months × 2916.67 rub. = 35,000.04 rub.

4. For comparison, let’s calculate depreciation charges if the company did not apply bonus depreciation:

• 200,000.00 / (12 months × 4 years) = 4166.67 rubles. — monthly amounts;

• 4166.67 × 12 months. = 50,000 rub. - annual amounts.

5. When applying a depreciation bonus, the annual amount of depreciation charges will be 35,000.04 rubles. against 50,000 rub. provided that bonus depreciation is not applied, which will allow the company to reduce the cost of products manufactured using this equipment by almost 15,000 rubles:

50,000 rub. – 35,000.04 rub. = 14,999.96 rub.

Application of a special increasing coefficient (no more than 2)

We find another method for optimizing depreciation in Art. 259.3 of the Tax Code of the Russian Federation, according to which taxpayers have the right to apply a special coefficient to the basic depreciation rate, but not higher than 2:

1) in relation to depreciable fixed assets used for work in aggressive environments and (or) extended shifts.

For your information

An aggressive environment is understood as a set of natural and (or) artificial factors, the influence of which causes increased wear (aging) of fixed assets during their operation. Working in an aggressive environment also equates to the presence of fixed assets in contact with an explosive, fire-hazardous, toxic or other aggressive technological environment, which can serve as the cause (source) of initiating an emergency.

When applying the non-linear depreciation method, the specified special coefficient does not apply to fixed assets belonging to the first to third depreciation groups;

2) in relation to taxpayers’ own depreciable fixed assets - agricultural organizations of industrial type (poultry farms, livestock complexes, fur-bearing state farms, greenhouse plants);

3) in relation to their own depreciable fixed assets of taxpayers - organizations that have the status of a resident of an industrial-production or tourist-recreational special economic zone or a participant in a free economic zone;

4) in relation to depreciable fixed assets related to objects (except for buildings) with high energy efficiency, in accordance with the list of such objects established by the Government of the Russian Federation, or to objects (except for buildings) with a high energy efficiency class, if in in relation to such objects, in accordance with the legislation of the Russian Federation, the determination of classes of their energy efficiency is provided;

5) in relation to depreciable fixed assets related to main technological equipment operated in the case of the use of the best available technologies, according to the list of main technological equipment approved by the Government of the Russian Federation;

6) in relation to depreciable fixed assets included in the first to seventh depreciation groups and produced in accordance with the terms of a special investment contract.

Application of a special increasing factor (no more than 3)

In accordance with Art. 259.3 of the Tax Code of the Russian Federation, taxpayers also have the right to apply a special coefficient to the basic depreciation rate, but not higher than 3:

1) in relation to depreciable fixed assets that are the subject of a financial lease agreement (leasing agreement) - taxpayers for whom these fixed assets must be accounted for in accordance with the terms of the financial lease agreement (leasing agreement).

The specified special coefficient does not apply to fixed assets belonging to the first to third depreciation groups;

2) in relation to depreciable fixed assets used only for scientific and technical activities;

3) in relation to depreciable fixed assets used by taxpayers exclusively in carrying out activities related to the production of hydrocarbons in a new offshore hydrocarbon field;

4) in relation to depreciable fixed assets used in the field of water supply and sanitation, according to the list established by the Government of the Russian Federation.

Example 7

Gamma LLC purchased equipment worth 150,000 rubles, useful life - 3 years (third depreciation group).

Let's calculate depreciation charges taking into account the possibility of applying increasing factor 2 in accordance with the approved accounting policy of the company:

1. The amount of monthly depreciation, subject to the application of an increasing factor, will be:

150,000 / (12 months × 3 years) × 2 = 8333.33 rub.

Thus, the entire purchase amount will be written off not over 3 years, but over one and a half years (RUB 8,333.33 × 1.5 years × 12 months), in an accelerated manner, taking into account the increasing coefficient.

In this case, the annual depreciation amounts will be:

• 8333.33 rub. × 12 months = 100,000 rub. - First year;

• 8333.33 rub. × 6 months = 50,000 rub. - second year.

2. If the company did not apply the increasing factor, then depreciation charges would be:

• 150,000 / (12 months × 3 years) = 4166.67 - monthly charges;

• 4166.67 × 12 months. = 50,000.00 rub.

3. Let’s calculate the savings on income tax by reducing the tax base using the example of the first year of operation:

(100,000 – 50,000 rub.) × 20% = 10,000 rub.

Depreciation rate

The depreciation rate shows what percentage of the cost of a fixed asset must be attributed to the cost of a product or service for a certain period.

Often this period is a month. Since depreciation is calculated monthly. However, for aggregated calculations, the annual depreciation rate can also be used.

The depreciation rate can be calculated using the formula:

where Nam is the depreciation rate.

Thus, if the useful life of the equipment is 5 years, then 1/60 of the cost of this equipment will be included in the monthly cost.

In other words, the monthly depreciation rate will be 1.67%, and the annual rate will be 20%.

Formula for calculating depreciation

With the linear depreciation method, the calculation formula is:

A = C*K/12,

where A is the amount of monthly depreciation charges;

C – primary cost of property;

K – depreciation rate, calculated according to the formula in paragraph 3.

If you need to calculate the annual amount of depreciation charges, then you do not need to divide by 12 (the number of months in a year), or it is enough to divide the initial cost of the property by its service life.

Determination of the norm of the indicator

To carry out a linear calculation, you must first calculate the annual rate. This indicator reflects the amount of funds that are written off by inclusion in the cost of goods produced. Simply put, this is the percentage of the initial cost of the property that is written off in 1 year.

The formula for determining the annual rate is as follows:

K = (1 : n) * 100%

- the K indicator expresses the annual depreciation rate;

- n – indicator reflecting the SPI.

By dividing the final result by the number 12, you can determine the monthly norm. This indicator reflects the percentage of the initial cost that must be depreciated over 1 month of operation of the facility.

How are calculations made in practice?

The primary cost of the object will be the basis for calculation. It is easy to determine - sum up all the costs of purchasing or constructing a particular object.

The replacement cost indicator is used if the value of the property has been revalued.

The classification list of fixed assets will help determine the operational period of the objects. It is here that they are divided into a certain number of groups.

But the organization itself can set operational deadlines if it is not on this list.

In this case, the calculation goes to:

- Operating conditions in the near future.

- Physical wear and tear, its estimated value.

- Predicted time of use.

For calculations, the formula is usually used:

K=(1:n)*100

N – designation of service life, in annual equivalent.

K – depreciation rate for the year.

The result obtained is divided by 12 if it is necessary to determine the monthly norm.

As for the linear method of calculating depreciation costs, in this case the formula looks slightly different:

A=C*K/12

K – Symbol of depreciation rate.

C – Data on the property, its original cost.

A – Depreciation group of deductions by month.

Dividing by 12 becomes unnecessary if depreciation deductions are calculated for the year.

An example of calculating depreciation using the straight-line method

A fixed asset worth 1,000,000 rubles was added to the company’s balance sheet in March. The accountant determined that its operational life, according to differentiation by depreciation groups, will be 10 years.

The procedure for calculating depreciation using the straight-line method for this example:

- We determine the annual depreciation rate: K = 1/10*100% = 10%.

- The monthly depreciation rate will be: 10%/12 = 0.83%.

- We determine the amount of monthly depreciation charges:

1,000,000*10%/12 = 8333 rubles.

- The amount of depreciation charges for the year of operation is:

1,000,000 rubles /10 years = 100,000 rubles.

Thus, using the straight-line method, depreciation must be calculated from April in the amount of 8,333 rubles per month.

Linear calculation formula

Knowing the cost and operating term, as well as calculating the annual depreciation rate, you can make a subsequent calculation. For these purposes, a linear depreciation formula is used, into which known variables must be inserted.

The formula itself looks like this:

A = C * K / 12

Wherein:

- A – the amount of monthly depreciation;

- C – the initial cost of a specific fixed asset;

- K is the annual rate, which is determined using the formula presented above.

As a result of applying this formula, it is possible to calculate how much is to be written off during the month in the form of depreciation. If the result of multiplying indicators C and K is not divided by 12, the amount to be written off within 1 year will be known.

Basics of the method on video:

Transition from non-linear to linear depreciation method

If a non-linear depreciation method was initially used, and later it was decided to use a linear one (the Tax Code allows changing depreciation methods, but not more than once every 5 years), then accountants may have a lot of questions in connection with such a transition.

- What useful life is used in the calculation? When switching to the straight-line depreciation method, deductions are calculated based on the remaining useful life of the asset. This period must be determined on the 1st day of the month of the tax period, when the use of the linear method begins (paragraph 2, paragraph 4, article 322 of the Tax Code of the Russian Federation).

- What value of the object should be taken as the basis for the new method of calculating depreciation? When switching to the linear depreciation method, you need to remember that part of the cost of the fixed asset has already been depreciated, so the calculation uses the residual value, which is also determined at the beginning of the tax period (clause 4 of Article 322 of the Tax Code of the Russian Federation). This is the position of officials (letter of the Federal Tax Service of Russia for Moscow dated December 1, 2009 No. 16-15/125942, letter of the Ministry of Finance of Russia dated January 28, 2010 No. 03-03-06/1/28).

- What should you do if, when switching to the straight-line depreciation method, the period of actual operation exceeded the useful life of the object, but the cost of the fixed asset was not completely written off as expenses? In such a situation, it is necessary to charge depreciation of the object until its value is written off (letter of the Ministry of Finance of Russia dated July 21, 2014 No. 03-03-RZ/35549). In this case, the useful life is determined by the taxpayer in accordance with the provisions of paragraph. 2 clause 7 art. 258 of the Tax Code of the Russian Federation and taking into account safety requirements and other factors affecting the wear and tear of the object.

Top 5 Dating Sites

Our ranking of dating sites is a recommendation.

rub.10Task 2.2. Determine the initial and replacement cost of fixed assets as of 01/01/05. The initial data is given in the table. Types of fixed assets Quantity, units Date of acquisition Acquisition price, thousand.

And you make the further decision yourself. As you've probably already guessed, there are two types of dating sites: free ones, and those that you pay for. For the free ones, you only need to register and fill out basic personal information and upload a few photos. Paid sites only provide audiences with serious intentions.

By choosing premium services, you open up new options that usually include virtual and real gifts, photo sharing, instant messaging, and many other options. One of the most popular dating sites for Russians is. This site has served as a platform for thousands of men to meet girls who will appreciate them and find the love they have been looking for all along.

As one of the largest sites, it has earned trust among the thousands of users it has in its database.

Laboratory work calculation and analysis of the use of fixed assets (2 hours)

6 and 7 are calculated only by economics students. For all other students, depreciation is calculated for all fixed assets using the straight-line method. The position “Machinery and equipment” is calculated entirely using the linear method.

Table 6. Calculation of depreciation using the reducing balance method No. Name of group of fixed assets (assets) Year of operation Residual value at the beginning of the year, rubles Service life, years Acceleration factor, units Annual depreciation rate taking into account the acceleration factor, % Annual depreciation charges, million .

RUB Residual value at the end of the year, million

rub.4.2 Working machines and equipment1 38332.9 10 2 20 7666.6 30666.32 30666.3 10 2 20 6133.3 24533.03 24533.0 10 2 20 4906.6 19626.44 19626.4 10 2 20 3925 .3 15701.15 15701.1 10 2 20 3140.2 12560.9 Depreciation over 5 years 25772.0 Table 7.

Calculation of depreciation by writing off the cost by the sum of the number of years of useful use

In what cases is it used?

Linear calculation is used in relation to material and intangible objects. The duration of their operation or useful functioning should not be less than 1 year. The initial cost of property that is subject to depreciation is from 40 thousand rubles.

The presented method must be applied to buildings and structures if the service life exceeds 20 years. For objects with a different period, other options for calculating deductions may be used.

The following are not subject to depreciation:

- land;

- Natural resources;

- securities;

- capital construction projects (if it is not completed).

Such objects are not subject to wear and tear, so their cost cannot be included in the cost of manufactured products or services provided.

Usage example

To better understand the features of using the presented calculation method, it is recommended to consider an example.

The enterprise acquired and placed on its balance sheet an object with an operational life of 20 years. The cost of the presented object is 2 million rubles.

Calculation stages:

- Determine the annual rate:

K = (1: 20 years) * 100% = 5%

- Determine the monthly norm:

5% / 12 = 0.41%

- Determine the amount of monthly deductions:

A = (2 million * 5%) / 12 = 8.333

That is, starting from the month following the start of use of the object, the enterprise accrues 8,333 rubles for the entire period of operation.

What is this method?

The straight-line method is an accrual method in which the cost of fixed assets is transferred to finished products evenly throughout the entire period of operation .

The basis for such calculations is the initial cost. It is the sum of all costs spent on purchasing the asset, its delivery, installation and commissioning.

If the company revalued its property, then the replacement cost is used in the calculations.

Calculating the amount of depreciation is impossible without establishing the duration of the service life. It is recommended that its duration be determined in accordance with the state-developed classification of fixed assets. However, it is possible to independently forecast the period of operation of the property. To do this, the following factors are analyzed:

- physical wear and tear, which is associated with the mode and working conditions;

- possible period of use corresponding to the power of the equipment;

- regulations and other legal restrictions on the time of use of the asset.

The positive aspects of using this method include the following:

- simplicity of calculations, no need to do lengthy calculations and understand complex formulas;

- the value of the property is transferred evenly to the finished product;

- depreciation is calculated for each object;

- this method is used in tax accounting;

- no regular recalculations are required;

- suitable for calculating depreciation of real estate.

Along with the advantages, there are also a number of disadvantages due to the peculiarities of production:

- the deterioration of the original condition of the equipment over time is not taken into account;

- obsolescence is not taken into account;

- not suitable for large organizations that use equipment unevenly, that is, when some machines are idle;

- the load on the means of production is not taken into account.

The negative consequences of using the linear method are inferior to the advantages. That is why the vast majority of enterprises choose it for accounting.

Accrual procedure

Deductions are made from the first day of the month following the date the asset is registered.

This process is completed only in two cases:

- after full transfer of cost to finished products;

- disposal of an object from the enterprise’s property as a result of sale, theft, breakdown and other cases.

In this case, depreciation charges cease to be accrued from the first day of the month following the date of exclusion of the asset from the organization’s property.

Accrual may be temporarily suspended if:

- the object is mothballed for a period of more than three months;

- the property has been under reconstruction or modernization for over a year.

Once the assets are returned to production, deductions should be resumed. The annual depreciation amount must be calculated taking into account the replacement cost.

Sometimes the assets of an enterprise include assets that were used in other organizations. Such objects include:

- contributions to the authorized capital;

- fixed assets acquired after reorganization;

- assets purchased are not new.

For such objects, the rules, calculation and procedure for calculating depreciation are exactly the same as for new ones. However, it is worth considering the length of their stay in another company. For current accounting, it is necessary to subtract the time of its actual operation from the useful life period. All accumulated depreciation for this object in another company is taken together with the book value of the asset.

Accounting for depreciation is carried out using contra account 02. In the course of its activities, the enterprise records with postings all cases of movement of the accumulated amount. For example:

| Operation | Debit | Credit |

| Depreciation accrued | 20 (23, 25, 26, 29, 44) | 02 |

| Write-off upon disposal of fixed assets | 02 | 01/select |

| Markdown when revising the cost of fixed assets | 02 | 84 (91.2) |

| Overestimation of depreciation | 83 (91.1) | 02 |

All these entries are entered into the transaction journal based on the depreciation calculation sheet. The cost of fixed assets is subject to transfer to finished products on a monthly basis .

The amount of depreciation, additional accruals and markdowns as a result of the revision of the value of assets should be promptly entered into the inventory card of the object.

Advantages and disadvantages of the linear method

The popularity of the linear method is due to its ease of use. Its essence is that every year an equal part of the cost of this type of fixed asset is depreciated. The depreciation amount will remain unchanged over the years.

In addition, the advantages of this method include the fact that, unlike the reducing balance method, it allows you to accurately write off the entire cost of equipment.

However, if an item of fixed assets is subject to obsolescence, then the use of the linear method does not accurately reflect the change in the value of the fixed asset. This is due to the fact that funds subject to obsolescence lose their value faster. In fact, a business may need to replace an OS, such as a computer, before it reaches the end of its useful life.

Thus, the linear method is advisable to use for those types of fixed assets where time, and not obsolescence (obsolescence), is the main factor limiting service life.

When is it beneficial to use?

The linear method is often called straight-line, uniform.

Each month the cost of the fixed asset is written off in equal amounts.

When is it convenient? First of all, in cases where the OS object has a long useful life.

For example, in tax accounting, the linear calculation method is even mandatory for buildings, structures, and transfer devices from 8 to 10 depreciation groups.

Thus, the uniform method of deductions is convenient if:

- the asset has a long SPI;

- the characteristics and capabilities of the asset change slowly over time;

- the object is operated evenly throughout its entire service life;

- there is no need to quickly replace or update the fixed asset.

Also, the method is often used by those companies that want to keep the same records for accounting and tax purposes.

The calculation procedure is almost the same, so the differences will be minimal or absent.

Another reason is the organization’s reluctance to understand non-linear methods and to constantly recalculate depreciation.

This is especially true for small enterprises with a small number of fixed assets.

What numbers are involved in calculating depreciation using the straight-line method?

Linear is the method of calculating depreciation of an asset, which allows its value to be evenly transferred to the cost of finished products (work performed, services rendered).

To calculate the monthly depreciation amount using this method, you will need two figures:

- the initial cost of the asset (determined by the norms of clause 8 of PBU 6/01 “Accounting for fixed assets”, Article 257 of the Tax Code of the Russian Federation);

- useful life (established according to the rules of paragraph 4 of PBU 6/01, paragraph 1 of Article 258 of the Tax Code of the Russian Federation).

A distinctive feature of this method is equal monthly depreciation charges. That is, having calculated this indicator once, you will not need to make additional calculations if you do not plan to change the depreciation method.

To help students and graduate students

In the second year of operation, depreciation is calculated at 40% of the residual value, i.e.

(120 - 48) x 40 = 28.8 thousand rubles. etc. When writing off the cost based on the sum of the numbers of years of the useful life of the object, depreciation charges are determined based on the initial cost of the fixed assets object and the annual ratio, where the numerator is the number of years remaining until the end of the service life of the object, and the denominator is the sum of the numbers of years of the service life of the object .

Example. An object of fixed assets worth 120 thousand rubles was purchased. Useful life is 5 years.

The sum of the service life is 15 years (1 + 2 + 3 + 4 + 5). In the first year of operation of the specified object, depreciation may be charged in the amount of 5/15, or 33.3%; in the second year - 4/15, i.e. 26.7%; in the third year - 3/15, i.e.

20.0%; in the fourth year - 2/15, i.e. 13.3%; in the fifth year - 1/15, i.e. 6.7%. Depreciation charges

How to calculate depreciation of fixed assets using the straight-line method

To determine the amount of monthly depreciation charges using the straight-line method, it is necessary to have data on the initial cost of the object, establish the useful life and calculate the depreciation rate.

1. Initial cost of the object

The initial cost of an object is calculated by adding up all the costs of its acquisition or construction.

2. Useful life (operational period)

The useful life (operational period) is established by studying the list (classification) of fixed assets, in which fixed assets are divided into depreciation groups.

If the object is not indicated in the list, then its service life is assigned by the organization depending on:

- predicted time of use;

- expected physical wear and tear;

- expected operating conditions.

3. Formula for depreciation rate

The annual depreciation rate is calculated using the formula:

K = (1: n)* 100%,

where K is the annual depreciation rate;

n – service life in years.

If you need to find out the monthly depreciation rate, then the result is divided by 12 (the number of months in a year).

4. The formula for calculating depreciation using the linear method is as follows:

A = PS*K/12,

where A is the amount of monthly depreciation charges;

PS – primary cost of property;

K – depreciation rate, calculated according to the formula in paragraph 3.

If you need to calculate the annual amount of depreciation charges, then you do not need to divide by 12 (the number of months in a year), or it is enough to divide the initial cost of the property by its service life.

Based on these formulas, it becomes clear that the main difference of this method is the uniform transfer of the value of property to the company’s costs.

Thus, it is advisable to use the linear method of calculating depreciation if economic activity is stable, brings uniform profit and does not require rapid write-off of fixed assets.

Linear calculation is not suitable for calculating wear on quickly worn-out objects, with high intensity of production processes, as well as with premature obsolescence of property.

If new production is being developed, it is recommended to slow down the write-off of wear and tear; and in cases where the organization does not lack cash and can promptly update obsolete assets, accelerated depreciation with subsequent replacement of written-off equipment, machinery, tools, etc. would be optimal.

Example. Straight-line depreciation method

The organization purchased passenger vehicles for RUB 400,000. excluding VAT.

According to the classification rules, the car is included in 3 gr.

The useful life is set at 48 months.

To calculate monthly/annual depreciation amounts, you need to determine the annual depreciation rate and then the depreciation amount.

Annual depreciation rate = 1/4 = 25%;

monthly depreciation rate using the straight-line method, expressed as a percentage = 1/48 = 2.083%.

Monthly depreciation = 400,000 rubles. x 2.083% = 8332 rub.

Annual depreciation = 400,000 rubles. x 25% = 100,000 rub.

If the initial cost of the fixed asset and the useful life in tax accounting are established similar, the organization will recognize a monthly expense in the same amount when calculating the income tax base.

How to calculate in tax accounting?

If the linear method is chosen for tax purposes, then it must be applied to all fixed assets without exception. In this case, the calculation of deductions is carried out for each object separately.

The procedure for calculations using the linear method is prescribed in Article 259.1 of the Tax Code of the Russian Federation.

To make the calculation, you also need to know the initial cost of the asset, its useful life and the depreciation rate.

However, in contrast to the accounting calculation procedure, in tax accounting the norm is calculated for one month. It is then multiplied by the original cost and gives the amount of monthly depreciation to be charged to expenses.

Formulas:

Monthly norm = 1 * 100% / SPI in months

Monthly depreciation = Initial cost * Monthly rate.

How to calculate depreciation using the non-linear method in tax accounting?

Term of use

The indicator is determined based on the characteristics and purpose of the object. For these purposes, a classification containing a list of OS types can be used. There they are divided into categories depending on their useful life (USL).

In many cases, objects do not meet the criteria presented in the classifier. In this case, the calculations use the predicted service life, which is determined taking into account the conditions of use and the expected wear rate.

Accrual stages

The depreciation process must be carried out in accordance with established rules and requirements. They apply to all methods, including linear.

Basic Rules:

- Depreciation charges are introduced from the month following the date of commissioning and putting the object on the balance sheet.

- Calculated monthly deductions are made regardless of profit or other financial results.

- Deductions are subject to accounting in the corresponding tax period.

- If the facility is not in use for more than 3 months or is under repair for more than 1 year, deductions are suspended.

- If property rights are lost, written off due to wear and tear, or completely removed from the balance sheet, depreciation will stop accruing from the next month.

It must be taken into account that the linear calculation is carried out for each OS object separately. At the same time, the initial (or replacement) cost of the object is a constant factor.

Therefore, having calculated the annual and monthly depreciation rates, these indicators do not change until decommissioning.

The main differences between Western standards and Russian practices

- There is no concept of liquidation value in PBU 6/01

According to IFRS, depreciable cost means the actual cost of the acquisition minus the estimated liquidation value, that is, the company can depreciate fixed assets not to zero, but to a certain amount, which is defined as the amount for which what remains of the fixed asset can be sold after its operation. According to PBU 6/01, fixed assets must always be depreciated to zero cost. As a result, all MS EXCEL functions have a residual_cost (the value of assets at the end of their useful life). In principle, it can be omitted or 0 can be entered, for example APL(1000;;5) or APL(1000;0;5) . But the function FOO(), which implements the Fixed Reduction of Balance Method, in the case of specifying a zero residual amount, pays off the entire cost in the first period! (although this function is still not in demand in domestic practice, since such a method is not included in PBU 6/01).

- The depreciation period is a multiple of the month or year

Unlike Russian standards, which specify that depreciation is calculated “on a monthly basis starting from the next month after putting into use,” GAAP does not provide such detailed recommendations, and companies can calculate depreciation in their own way, for example, for 15 days in the month of acquisition and 15 days per month of departure. All MS EXCEL functions have a Period parameter, which can take values of year, month, day, and generally be any period of time. Russian practice is limited to depreciation periods equal to a year and a month. Those. this difference does not impose any additional restrictions on the applicability of MS EXCEL functions in Russian practice. However, if we remember that the amount of monthly depreciation for accounting purposes is calculated as 1/12 of the annual depreciation amount, then, of course, such a calculation algorithm is not supported by the built-in functions of MS EXCEL. The difference between the two approaches for the Reducing Balance method can be seen on the graph.

- The acceleration coefficient is strictly regulated

In international practice, the method of reducing the balance is also used. The difference between this method in Russian practice is that the acceleration coefficient is not determined by the company, but is established in accordance with the legislation of the Russian Federation. The functions PUO() and DDOB() have a parameter Coefficient, which determines the rate of depreciation using the Declining Balance method. Because it can be set arbitrarily, then no problems arise: naturally, it can be set equal to 2 and 3, as is customary in domestic practice.

Versatility and computational simplicity are not the only advantages of the method

The linear method has two main advantages:

- universality - the absence of differences between the algorithms for accounting and tax accounting and calculation of depreciation, which eliminates the need to reflect differences according to PBU 18/02 “Accounting for calculations of corporate income tax”;

- simplicity of calculation - when choosing the linear method of calculating depreciation, complex and regular calculations of depreciation are not needed; a simple formula is used when putting the asset into operation.

In addition, two more features of the method can be mentioned that distinguish it from nonlinear algorithms for calculating depreciation:

- Uniform inclusion of depreciation in costs. A uniform write-off of depreciation will be an advantage of the linear method if it is more profitable and convenient for the company to transfer costs in the amount of depreciation to the cost evenly. For example, when putting an object into operation, it is planned that it will generate the same profit throughout the entire period of use. If the greatest profit is expected to be received in the first months of operation of the asset and there is an interest in writing off the largest amounts of depreciation during this period, a non-linear accrual method should be chosen.

- Accounting accuracy. Unlike non-linear methods, where depreciation is calculated for a group of objects in a depreciation group, the linear method allows you to track the amount of accumulated depreciation and the residual value for each specific object. To do this, it is enough to build competent analytical accounting for accounts 01 “Fixed assets” and 02 “Depreciation of fixed assets”.

Overview of MS EXCEL functions used to calculate depreciation

After considering the nuances of domestic legislation regulating the calculation of depreciation, its differences from foreign standards and calculation examples, we can begin to draw conclusions regarding the applicability of MS EXCEL functions for domestic practice.

To calculate depreciation charges in MS EXCEL there are functions:

- Nuclear submarine (SLN - Straight-Line) - calculation using the linear method. The function is applicable for calculation using the linear method, but the Remaining_cost argument must be equal to 0; (see example file, Linear sheet))

- ASCH (SYD - Sum-of-Year's Digits) - calculation by writing off the cost by the sum of the numbers of years of useful life. The function is applicable for calculations using this method, but the Remaining_cost argument must be equal to 0, and the period parameter must be a multiple of the year (see example file, sheet Sum of numbers of years)).

- FOO (DB - fixed-Declining Balance) - calculation using the fixed-declining balance method. The function is NOT applicable in Russian practice, because This method is not included in the list of permitted depreciation methods. In addition, if the Residual_cost parameter is equal to zero, depreciation is written off in the first period.

- DDOB (DDB - Double-Declining Balance) - calculation using the double-declining balance method. The function is applicable for calculation using the Reducing balance method, but the Residual_cost parameter must be equal to 0, and the period parameter must be a multiple of the year (see example file, sheet Reducing balance) (since the monthly accrual = 1/12 of the annual depreciation amount, and this is not the same as monthly accrual (see example file, sheet Difference).

- VDB (VDB - Variable-Declining Balance) - calculation using the declining balance method; The function allows you to calculate using the linear method (the Coefficient parameter should be =1, Residual value should be =0). The function is also applicable for calculations using the Reducing Balance method, but the remaining_cost parameter must be equal to 0, the [without switching] parameter d.b. =TRUE, and the period parameter must be a multiple of the year (see example file, Reducing Balance sheet).

- AMORDEGRC - calculates the depreciation amount for each period using the depreciation rate (French accounting system); The function has the ability to use a variable depreciation rate for each period. The function has not been tested for possible use in Russian practice.

- AMORLINC - calculates the amount of depreciation for each reporting period (French accounting system). The function has not been tested for possible use in Russian practice.

The example file on the Functions sheet provides examples of using the functions SLN, SYD, DB, DDB and VDB, as well as their alternative formulas. The examples discussed there are of only some academic interest (although very dubious), because disconnected from practice.

Note : A good description of functions for calculating depreciation can be found in these articles (English) ]]> https://www.vertex42.com/ExcelTemplates/depreciation-schedule.html ]]>]]> https://www.excel-easy .com/examples/depreciation.html ]]>

Postings for calculating depreciation using the straight-line method

When calculating depreciation, standard entries should be made monthly depending on where the fixed asset or intangible asset is used. The accounts used depend not only on the type of depreciable property (for loan 02 - for fixed assets, and 05 - intangible assets), but also on the type of its use. For example, depreciation of industrial objects is reflected, as a rule, in the debit of account 20, and trade organizations usually accrue depreciation in the debit of account 44. The attribution of depreciation to expenses in accounting is reflected by the following entries:

- Debit of account 20 Credit of account 02 - reflects the write-off of depreciation of the object for the main production.

- Debit of account 23 Credit of account 02 - reflects the write-off of depreciation of an auxiliary production facility.

- Debit of account 25 Credit of account 02 - reflects the write-off of depreciation of an object for general production purposes.

- Debit of account 26 Credit of account 02 - reflects the write-off of depreciation of a general purpose object.

- Debit of account 44 Credit of account 02 - reflects the write-off of depreciation of the object of trading companies.

- Debit of account 91 Credit of account 02 - reflects the write-off of depreciation for an object leased.

- Debit of account 20 (23, 25, 26, 44) Credit of account 05 – the write-off of depreciation for intangible assets is reflected.

How to work with property that has been used?

Organizations often operate objects that have already been used . Among them:

- Fixed assets received by an enterprise through succession when a legal entity was reorganized.

- Property received as a contribution to the authorized capital.

- Objects whose condition was not new already during the acquisition process

For such objects, depreciation is calculated in exactly the same way as for fixed assets. The only difference is that the service life is calculated slightly differently.

To determine it, we subtract from the period established by the former owners the time during which the equipment was actually used.

The main thing is to remember that the results of financial activities should not be affected by the absence or presence of these deductions at a particular enterprise. They are necessarily included in expenses for the tax period to which they relate.

It is acceptable to use non-linear methods of depreciation calculations, but it is the linear method that will be convenient, for example, for buildings or structures. And for other objects that are not directly used in production processes.

Methods for calculating depreciation of fixed assets:

Calculation for used OS

Many enterprises, in the course of their activities, acquire facilities that have previously been used. In addition to non-new property, items that were contributed as a contribution to the authorized capital are regarded as used. This category also includes property that remained at the enterprise after its reorganization.

Depreciation using this method for objects that have already been used is carried out in the same way as for new ones. Therefore, the calculation procedure is similar.

The exception is that used OSes will have a shorter service life. To calculate it, you need to subtract the number of years that the object was used by the previous owner from the service life indicator from the classifier. Further calculations are carried out using the previously described formulas.

Accounting for depreciation of fixed assets

Depreciation is a monetary unit of wear and tear. That is, this is part of the cost of an asset, which is included monthly in the cost of products, services, and goods.

Through depreciation, there is a gradual transfer of the value of a fixed asset, at which it is listed in accounting, to products and goods.

Ultimately, the money spent on the acquisition of operating systems is returned to the company after receiving payment from buyers and clients for the purchased values.

This process is gradual and continues throughout the entire useful life. To account for it, the accountant makes monthly entries in specially designated accounting accounts.

As long as the fixed asset is listed on the balance sheet of the enterprise, the accountant must make monthly depreciation deductions. This procedure is carried out until complete wear and tear, write-off due to unsuitability, breakdown or transfer to other persons.

The process of depreciation accumulation is suspended only in two cases:

- The OS is under conservation, provided that its duration exceeds 3 months.

- Restoration, modernization, reconstruction of an object, if this process takes more than a year.

If a decision is made to sell an object or write it off, the accountant determines the residual value of the asset. To do this, the depreciation accrued for the entire period is written off by posting to account 01, where the residual parameter is determined.

If during the operation of equipment or another object the initial cost changes due to revaluation, then depreciation accumulations are also recalculated and the necessary entries are made.

Thus, the accountant is faced with the need to reflect entries for accounting for depreciation of fixed assets in the following cases:

- making monthly depreciation payments;

- changes in accumulated deductions due to revaluation of the value of fixed assets (may either increase or decrease);

- write-off of a depreciable object as unnecessary (physical or moral wear and tear, breakdown, irreparable defects);

- disposal of fixed assets to third parties (sale, donation, contribution to the authorized capital of other enterprises).

How is the excess accrued amount for the previous period reflected?

If depreciation for the previous period was accrued incorrectly in an excessive amount, then the errors must be corrected. It is important in what period they were admitted - the current year or the past.

The mechanism for correcting accounting errors is prescribed in PBU 22/2010.

If the amount of depreciation has been excessively accrued, then it is necessary to reverse the excess accruals using red entries for those accounts for which incorrect entries were made.

If an error was made in the current year

Depreciation is corrected until accounts 20 or 44 are closed (depending on where savings are taken into account):

Posting reversal: Dt 20 (44) Kt 02 - for the amount of excess depreciation.

Correction after closing account 20 (or 44):

You also need to adjust account 90 to reflect expenses that are not accepted for tax accounting.

Posting reversal: Dt 90.3 Kt 20 for the overcharged amount.

If the excess accrual occurred in the year ended

Adjustments must be made to account 91 - posting: Dt 02 Kt 91.

Method 2. Reducing balance method

Let's start by calculating the annual amount of depreciation, as prescribed by PBU 6/01. The annual amount of depreciation charges is equal to (paragraph 3 of clause 19 of PBU 6/01, paragraph “b” of clause 54 of the Methodological Instructions):

SAgod = OS x NA,

where SAgod is the annual amount of depreciation; OS - the residual value of the fixed asset at the beginning of the year; NA is the annual depreciation rate, which, in turn, is calculated as follows:

NA = (100% / N) x K,

where N is the number of years during which the organization plans to use this object; K is the acceleration coefficient (see paragraph 3 of clause 19 of PBU 6/01, paragraph “b” of clause 54 of the Guidelines and the note below).

The amount of depreciation to be calculated monthly is 1/12 of the annual amount. Since the residual value of a fixed asset is taken at the beginning of each reporting year, the annual depreciation amount will decrease every year. The monthly depreciation amounts will remain the same for each year.

Example 2.1 (from the Guidelines for PBU 6/01 ) . An item of fixed assets worth 100 thousand rubles was purchased. with a useful life of 5 years. Acceleration factor =2. The solution is given in the example file on the Reduced Remaining sheet. Year. amount of JSC Annual depreciation rate = (100% / 5 * 2), which will be 40 percent.

- In the first year of operation, the annual amount of depreciation charges is determined based on the initial cost formed when accepting the fixed asset item for accounting, 40 thousand rubles. (RUB 100,000 x 40% / 100%)

- In the second year of operation, depreciation is charged at the rate of 40 percent of the residual value at the beginning of the reporting year, i.e. the difference between the initial cost of the object and the amount of depreciation accrued for the first year will amount to 24 thousand rubles. (RUB 100,000 – RUB 40,000) x 40% / 100%).

- In the third year of operation, depreciation is accrued in the amount of 40 percent of the difference between the residual value of the object formed at the end of the second year of operation and the amount of depreciation accrued for the second year of operation, and will amount to 14.4 thousand rubles. ((60,000 rub. – 24,000 rub.) x 40% / 100%), etc.

This is where the solution in the Methodological Recommendations ends. But, we will try to continue it using the proposed calculation logic.

- In the 4th year of operation, depreciation is accrued in the amount of 40 percent of the residual value of the object at the beginning of the 4th year of operation (calculated as the difference between the residual value of the object at the beginning of the 3rd year and the amount of depreciation accrued for the third year of operation) and will be 8 .64 thousand rub. ((RUB 36,000 – RUB 14,400 = RUB 21,600) x 40% / 100%).

- In the 5th year of operation, depreciation is accrued in the amount of 40 percent of the residual value of the object at the beginning of the 5th year of operation (i.e. = 21,600 rubles - 8,640 rubles = 12,960 rubles) and will amount to 5,184 rubles. (RUB 12,960 x 40% / 100%).

Note : To calculate the Annual Amortization Amount using the Reducing Balance method, you can use the DDOB() and PUO() functions. But making calculations to determine monthly charges using these functions is incorrect, because according to PBU 6/01, the amounts of monthly depreciation during each year must be unchanged.

In our calculations, the residual value of the object at the end of the last year of useful use was 7,776 rubles. But, remember that according to PBU 6/01, depreciation charges are charged until the cost of this object is fully repaid or this object is written off from accounting. Why did we not pay off the cost of the object in full? This is a consequence of the applied calculation algorithm using the Diminishing Balance method: using it, the property will never be fully depreciated.

There are two ways out of this situation. The first is to write off an asset, for example, because it has become unusable or has been sold. The second method is to completely write off the remaining cost in the last month of the service life to the credit of account 02 “Depreciation of fixed assets” and to the debit of the cost accounting account. This can be done by invoking the principle of rationality. It allows you to recognize costs as expenses of the reporting period if their amount is not significant. The materiality criterion is prescribed in the accounting policy. For example, it could be 1 percent of the original cost ( ]]> https://www.glavbukh.ru/art/21188-amortizatsiya-osnovnyh-sredstv ]]> ).

Since the residual value of the fixed asset is taken at the beginning of each reporting year, the annual depreciation amount will gradually decrease. The monthly depreciation amounts for each year will remain unchanged and equal to 1/12 of the Annual Depreciation Amount (see the example file on the Declining Balance sheet)

Note : In example 2.1 it is implicitly assumed that the fixed asset item was accepted for accounting in December, i.e. accounting began in January.

conclusions

The linear method of calculating depreciation assumes that physical wear and tear of the property occurs evenly throughout the entire operational period. This mainly applies to stationary structures, which do not wear out and become obsolete as quickly as equipment.

If it is impossible to accurately determine the rate of depreciation of property, then the linear method will be the most convenient and simplest. This method is also suitable if the company purchases property for a long period of use and does not plan to quickly replace it.

Sources

- https://www.klerk.ru/buh/articles/481913/

- https://FBM.ru/bukhgalteriya/linejjnyjj-sposob-dlya-nachisleniya-amort.html

- https://investolymp.ru/linejnyj-metod-nachisleniya-amortizaczii.html

- https://sovetkadrovika.ru/spravochnik/raschet/amortizacii-linejnym-sposobom.html

- https://nalog-nalog.ru/nalog_na_pribyl/rashody_nalog_na_pribyl/linejnyj_metod_nachisleniya_amortizacii_osnovnyh_sredstv_primer_formula/

- https://PravoDeneg.net/buhuchet/linejnyj-sposob-rascheta-amortizatsii.html

- https://ZnayDelo.ru/buhgalteriya/nachislenie-amortizacii-linejnym-sposobom.html

- https://www.audit-it.ru/terms/accounting/lineynyy_metod_amortizatsii.html

- https://praktibuh.ru/buhuchet/vneoborotnye/os/amortizatsiya/provodki-schet-02.html