Federal taxes and fees in the Russian Federation Taxes existed in Rus'.

Gradually, taxation underwent changes, as a result of which federal and regional taxes, as well as local ones, were allocated to a separate group. Regional and local payments to Russian citizens are known to a greater extent than federal ones, which will be discussed further.

Three-level tax “territory”

All existing duties are divided into three categories ( Article 12 of the Tax Code of the Russian Federation ):

- Federal level.

- Regional level.

- Local level.

For greater clarity and understanding of the subject of the conversation, we will characterize each of the listed categories separately.

Federal tax

Federal duties established by the current Tax Code of the Russian Federation are strictly required to be paid throughout the country.

Regional tax

Regional duties are those that are established by the Tax Code of the Russian Federation and are required to be paid only in each individual subject of the Russian Federation.

In the process of adopting regional duties, the following elements of taxation are always approved:

- interest on tax duties;

- system and time of payment of tax duties;

- reporting form for each individual regional duty.

All other fragments of taxation are established by current legislation. When they are approved by the legislative (representative) authorities in the constituent entities of the Russian Federation, as a rule, various concessions are provided with reasons for their use.

Local tax

Local duties are those established by the current Code and legal acts of municipal authorities. They are required for repayment in specific municipal territories.

Local taxes and fees usually begin and cease to operate on the territory of each municipality, and in strict accordance with the current Tax Code of the Russian Federation, as well as all regulations adopted by municipal authorities.

Excise taxes

Excise taxes deserve special consideration - what kind of tax is it: federal or regional? Excise tax is an indirect tax that is levied on the price of goods or services provided. The presented fee applies to certain types of products - alcohol, tobacco, fuel and other goods. These fees are paid by organizations, individual entrepreneurs, as well as sellers who deliver goods across customs borders.

Tax rates are set as follows:

- at a fixed rate;

- at an ad valorem rate - the estimated value of the goods at customs is taken into account;

- at a combined rate.

Reference: Ad valorem rate is a rate set as a percentage of the value of the taxable object.

Excise tax rates for each type of product are fully listed in Article 193 of the Tax Code of the Russian Federation.

Tax “hierarchy” presented in the table

| №/№ | Tax level | Tax list |

| 1. | Federal taxes | value added tax; excise taxes; personal income tax; corporate income tax; tax on mineral extraction; water tax; fee for the use of flora and fauna objects; fee for exploitation of water resources; National tax. |

| 2. | Regional taxes | property duty of organizations; transport tax; gambling tax. |

| 3. | Local taxes | land duty; property tax for individuals; trade fee. |

Taxes: collection method

Fees, in relation to the methods of their collection, can be reasonably divided into two categories:

- Direct tax ( direct ).

- Indirect tax ( indirect ).

Direct taxes are established specifically in relation to the income portion of the taxpayer's property: the use and possession of this property is the reason for withholding the tax duty.

Direct taxes include: personal income tax, duty on corporate profits, property tax for legal entities and individuals. Direct taxes are:

- Taxes of a real nature - they are taken from the value of property: this is a property duty in relation to legal entities and individuals.

- Personal duties - they are taken from the income amount of earnings: corporate income tax.

Indirect taxes are often called consumption duties. They are included in the price of goods in the form of a premium and are paid by buyers.

The subjects of indirect taxation are sellers of goods (works and services), and the bearers and actual payers of such tax are consumers.

Indirect taxes include: value added tax, excise taxes, customs duties, etc. Indirect taxes include:

- Taxes are universal - they are levied on all goods (works and services): this is VAT.

- Taxes of an individual nature - they are levied on a clearly limited range of goods (works and services): these are excise taxes.

Speaking about indirect taxes, it should be noted that these taxes are the easiest for the state, if we think from the point of view of their collection.

They seem extremely attractive to the state “machine” also due to the fact that they go to the treasury directly and are not tied to the economic activities of the subject of taxation. At the same time, excellent collection efficiency can be achieved even in conditions of declining production capacity, and even unprofitable activities of the entire company.

All this works in a comprehensive manner, and this is what can create a reliable flow of tax revenue to the state treasury.

Specialized tax regimes

In addition to the general tax system, in which organizations must make payments for all tax deductions imposed on them, there is also a list of specialized regimes that allow you to avoid paying most tax fees, replacing them with one or more payments. Let's take a closer look at them.

Working in specialized modes

Regime 1. UTII - a single tax on imputed income, is applied to certain types of activities of entrepreneurs, such as:

- retail trade;

- public catering;

- veterinary treatment;

- provision of household services;

- vehicle maintenance, technical, washing, and repairs;

- advertising services, their placement and distribution;

- services for the provision of retail space for rent, as well as land areas;

- passenger and cargo transportation;

- provision of parking spaces.

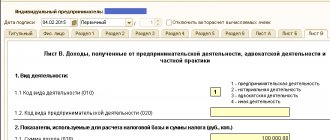

Mode 2. Simplified taxation system - a simplified taxation system, used for legal entities and individual entrepreneurs who start in the market with various commercial activities. They may abandon the general taxation system in favor of this specialized regime.

In order for the opportunity to apply the simplified tax system to be available, the applicant company must meet the following characteristics:

- up to one hundred people on staff;

- income is less than 150 million Russian rubles;

- the residual value is also 150 million;

- the company's share in third-party organizations is no more than a quarter;

- a company using the simplified tax system cannot have branches.

A company can switch to a simplified taxation system if in the year of filing the application for the transition it received income of less than 112.5 million Russian rubles.

Regime 3. Unified agricultural tax – unified agricultural tax. This is a specialized mode suitable for companies producing household goods.

The following product names are subject to tax deductions:

- crop products;

- related to agriculture and forestry;

- animal products;

- products obtained from fish farming and other resources.

Payments for the fee are made by producers of agricultural goods, in addition to organizations providing various services to producers in the required area.

Those companies that are not related to the production of agricultural products, but only carry out primary processing and its subsequent stages, cannot apply for work under the Unified Agricultural Tax.

Regime 4. Taxation system for the implementation of production sharing agreements. This is a specialized system that is used in cases where agreements concluded in accordance with the law regarding production sharing are being implemented.

This variety is beneficial for use:

- investors;

- government agencies.

For the first group of people, the benefit consists of convenient conditions for monetary contributions to the processes:

- for searching for minerals;

- their prey.

The state structure receives a guaranteed profit from its activities.

The agreement that is the basis for the application of this regime must comply with a list of certain characteristics:

- be concluded after an auction has been held granting the rights to use and search for mineral resources;

- provide the state with a share of a certain size, 32% of all products produced previously;

- if investment efficiency indicators increase, then the share owned by the state increases accordingly.

Video – Taxes of the Russian Federation

Taxes and their purpose

Depending on their purpose, all taxes can be divided into two categories:

- General tax.

- Target tax.

General purpose taxes are established in a general order regime. General taxes include many taxes levied in any tax system.

They have a distinctive feature: after they enter the state treasury, they are depersonalized and spent on specific purposes, which are determined by the corresponding budget.

Targeted taxes can be divided into two types: special and emergency .

The special tax duty is intended to finance certain programs that have a specific purpose. This fee is assigned to a specific type of expense. Regarding Russia:

- These are taxes on transport;

- These are taxes on the reproduction of the raw material base.

An emergency tax duty is usually imposed in emergency situations.

Specific values: how to find out

As we defined above, each municipality may have individual tax rules and regulations. Therefore, taxpayers need to know the specific values and established procedures in a timely manner to avoid penalties.

You can find out what standards are established in a particular municipality or region at the nearest branch of the Federal Tax Service or on a special portal. The electronic service was developed by the Federal Tax Service and allows you to obtain information about established tax standards free of charge and without registration.

To obtain the information you are interested in, you will need to select a region (the location of the taxpayer) and determine the type of fiscal liability. The system generates information based on approved regulations.

Taxes and accounting

With regard to financial feasibility and the method of reflection in the accounting records of the accountant, it is reasonable to divide all taxes into the following categories:

- Tax duties included in the price tag of goods upon sale.

- Tax levies related to costs and expenses of the production process.

- Taxes that relate to financial results.

- Tax fees that are offset by net profit that remains for the use of the taxpayer.

We remind you that even if you thoroughly study all the data that is in the public domain, this will not replace the experience of professional lawyers! To get a detailed free consultation and resolve your issue as reliably as possible, you can contact specialists through the online form .

Tax and budget level

With regard to belonging to the budget level, all tax duties are divided as follows:

- Assigned tax - this tax must purposefully and completely go to a specific budget “basket”, or to an extra-budgetary fund. In this category, it is customary to easily identify duties that are poured into budget “baskets” of different levels: federal, regional and local.

- Regulated tax - this tax is received simultaneously in the budgets of various levels, but in such a proportion as determined by law.

How are payments classified?

All payments administered by the Federal Tax Service, when credited to the treasury, are classified according to the budget classification code. That is, when transferring funds to the budget, the taxpayer indicates the BCC in the payment order or receipt, which corresponds to a specific fiscal obligation.

Obligations credited to the municipal treasury can be determined by the 12th and 13th symbols of the 20-digit budget classification code. So, when transferring to the KBK, indicate the value “03” (precisely by 12-13 characters).

Tax and its classification in relation to the subject of taxation

We present to your attention a classification table reflecting the ratio of tax duties and subjects of taxation:

| №/№ | Subject of taxation | Tax |

| 1. | Tax fees intended for payment by a legal entity | income tax; company property tax. |

| 2. | Tax duties intended for payment by an individual (citizen) | citizen income tax; citizen property tax. |

| 3. | Mixed tax levies | VAT; transport tax; gambling tax. |

Summary

All tax liabilities are divided into three categories. Their division depends, first of all, on the budget for which they are intended.

The Tax Code of Russia is the main document that serves as the foundation for the fiscal system of the entire country.

With regard to local and regional fees, the specific features of purpose and collection that are established by the authorities of the corresponding rank are characteristic. But at the same time, representatives of the authorities of the second and third levels do not have the right to deviate from the general norms that are enshrined in the Tax Code.

It is through fiscal payments that the revenue side of the country’s budget is formed: after all, the money goes there directly. In relation to obligations of the first and second levels, redistribution between lower budget “baskets” may be allowed, namely: funds such as subsidies, subventions and other transfers.

Such distribution is regulated by this budget legislation - this is the Budget Code of Russia.

Features of establishing payment obligations

The law requires that new taxes be introduced in the form of additions or changes to the Tax Code of the Russian Federation. Adoption of a legislative act in another form is not permitted.

The timing of implementation of changes is also important. As a general rule, amendments cannot come into force earlier than 1 month from the date of publication. In addition, they cannot come into force before the next tax period.

Another important rule is complete tax certainty. The adopted rules require the following list: object of taxation base, rate, tax period, calculation procedure (calculation) and payment procedure. If at least one of these elements is missing, the tax is considered unestablished and the taxpayer has the right not to make payment to the budget.

However, benefits are not a mandatory element of this payment. Their establishment depends on the specific situation. Often benefits are provided to pensioners and disabled people, allowing them to receive additional income.

Establishing a fee (duty) involves determining the payer and some of the elements of the tax. In particular, there is no tax period.