The minimum wage or the so-called minimum wage is the amount of money that every worker should be guaranteed to receive for monthly work performed in accordance with established standards at each enterprise or organization, regardless of the form of ownership.

Every state revises its minimum wage annually, or at least it should. This is done due to inflation, changing market conditions, and the structure of the domestic and foreign markets. The revision of the size (value) of the minimum wage in Russia, as in principle in any other states, is intended to prevent a deterioration in the lives of citizens.

Dynamics

Let's take a closer look at how this indicator has changed over the past twenty-plus years. It should be noted that in the 98th year of the last century there was a denomination of the currency, which led to the cutting off of some zeros in the monetary currency of our country.

Schedule. Minimum wage changes by year:

Table. Minimum wages by year in Russia:

| Dated | Monthly minimum wage, in rubles. | Regulated by document |

| 1 Jan 2019 | 11280 | |

| May 1, 2018 | 11163 | FZ-41 (March 7, 2018) |

| 1 Jan 2018 | 9489 | FZ-421 (28 Dec 2017) |

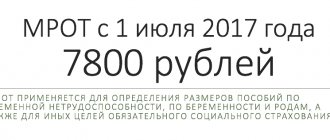

| 1 Jul 2017 | 7800 | FZ-460 (Dec 19, 2016) |

| 1 Jul 2016 | 7500 | FZ-164 (June 2, 2016) |

| 1 Jan 2016 | 6204 | FZ-376 (14 Dec 2015) |

| 1 Jan 2015 | 5965 | FZ-408 (1 Dec 2014) |

| 1 Jan 2014 | 5554 | FZ-336 (2 Dec 2013) |

| 1 Jan 2013 | 5205 | FZ-232 (December 3, 2012) |

| June 1, 2011 | 4611 | FZ-106 (June 1, 2011) |

| 1 Jan 2009 | 4330 | FZ-91 (June 24, 2008) |

| 1 Sep 2007 | 2300 | FZ-54 (April 20, 2007) |

| May 1, 2006 | 1100 | FZ-198 (29 Dec 2004) |

| 1 Sep 2005 | 800 | FZ-198 (29 Dec 2004) |

| 1 Jan 2005 | 720 | FZ-198 (29 Dec 2004) |

| 1 Oct 2003 | 600 | FZ-127 (Oct 1, 2003) |

| May 1, 2002 | 450 | FZ-42 (April 29, 2002) |

| 1 Jul 2001 | 300 | FZ-82 (Aug 19, 2000) |

| 1 Jan 2001 | 200 | FZ-82 (Aug 19, 2000) |

| 1 Jul 2000 | 132 | FZ-82 (Aug 19, 2000) |

| 1 Jan 1998 | 83,49* | |

| 1 Jan 1997 | 83490 | FZ-6 (9 Jan 97) |

| 1 Apr 1996 | 75900 | FZ-40 (22 Apr 96) |

| 1 Jan 1996 | 63250 | FZ-159 (1 Dec 95) |

| 1 Dec 1995 | 60500 | FZ-159 (1 Dec 95) |

| 1 Nov 1995 | 57750 | FZ-159 (1 Dec 95) |

| 1 Aug 1995 | 55000 | FZ-116 (27 Jul 95) |

| May 1, 1995 | 43700 | FZ-43 (20 Apr 95) |

| 1 Apr 1995 | 34400 | FZ-43 (20 Apr 95) |

| 1 Jul 1994 | 20500 | FZ-8 (Jun 30, 94) |

| 1 Dec 1993 | 14620 | Decree 2115 (05 Dec 93) |

| 1 Jul 1993 | 7740 | RF Law 5432-1 (Jul 14, 93) |

| 1 Apr 1993 | 4275 | RF Law 4693-1 (Mar 30, 93) |

| 1 Jan 1993 | 2250 | RF Law 3891-1 (13 Nov 92) |

| 1 Apr 1992 | 900 | RF Law 2704-1 (21 Apr 92) |

| 1 Jan 1992 | 342 | RF Law 1991-1 (06 Dec 91) |

| 1 Dec 1991 | 200 | Decree of the RSFSR number 5 (15 Nov 91) |

| 1 Oct 1991 | 180 | Law of the RSFSR 1028-I (19 April 91) |

* - this year the ruble was devalued, according to which the number of zeros on banknotes was reduced.

Return to content

History in the world and in the USSR

In the world, minimum wage mechanisms began to be established at the legislative level at the turn of the 19th-20th centuries to resolve conflicts with trade unions. The first such act was passed by the New Zealand Parliament in 1894. In most countries, the minimum wage is set not in monthly, but in hourly terms. For example, in the USA, since 2015, the minimum wage is $7.25 per hour, which, with an eight-hour working day and a five-day working week, corresponds to an average of $1.3 thousand per month (about 75 thousand rubles at the current exchange rate).

In the RSFSR, the concept of “obligatory minimum wage” for labor was first introduced by the Labor Code of 1922. By the Decree of the Central Committee of the CPSU, the Council of Ministers of the USSR and the All-Union Central Council of Trade Unions dated December 12, 1972, the minimum wage for workers and employees was set at 70 rubles. per month and did not change until 1991.

Who installs it and how?

According to Federal Law 82, which was adopted in 2000, this parameter throughout the Russian Federation can be established by the federal or regional government. In this case, the federal parameter is established only by the federal government, and the regional one - at a tripartite meeting of a special regional commission (Article 133.1).

In accordance with the content of the law, the exact date of change in the minimum wage does not have a fixed value and is set to any date during the calendar year. And the very intention to change it is announced by a special decree of the government of the Russian Federation.

Return to content

Contradictions in legislation

According to Federal Law No. 82 of July 19, 2000, the minimum wage is tied to the PM indicator and cannot be set lower. But at that time it was impossible to increase the “minimum wage” so sharply. This step would cause a business that had just begun to recover from default to go into the shadows.

Part 1 of Article 133 of the Labor Code of the Russian Federation did not work, and the minimum wage did not keep up with the growing minimum wage. Thus, in the period 2001–2006, the “minimum wage” amounted to 12–23% of the subsistence minimum in Russia. The government had to supplement the norm with a clause that the linking of the minimum wage to the minimum wage is carried out in accordance with Art. 421 of the Labor Code of the Russian Federation, which provides for the procedure and timing of increases through the adoption of a federal law. Such a law was adopted only on December 25, 2018, No. 481.

What's in the regions?

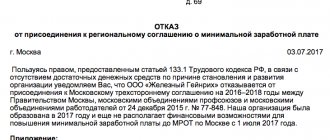

According to the legislation of the Russian Federation, regional legislators, depending on their economic development and intraregional social conditions, have the right to set their own minimum wage, which may differ from the federal one.

The regional minimum wage is legally fixed at a meeting at which the value is agreed upon between the three responsible participants in the region: the regional government, the association of trade unions and the association of employers. After its adoption, all regional employers will be required to pay no less than this established value, unless they send an official refusal to the regional administration within 30 days. Information on the currently valid regional minimum wage can be obtained from the state labor inspectorate of the region.

Return to content

Living wage and consumer basket

The subsistence level is the minimum income level, which is the necessary amount to ensure and maintain the average standard of living in the country. This indicator represents the approximate cost of the consumer basket.

The cost of living is calculated separately for each region. It is also determined for various categories of the population - pensioners, children, able-bodied citizens.

A consumer basket is an approximate calculated list of product items that characterizes the typical structure of annual consumption of one person. This value can also be calculated for the whole family.

It is advisable to use this set for settlement transactions for the minimum consumer budget (subsistence level). This is a kind of basis for comparing the calculated and real consumer levels.

If we consider the structural composition of the annual consumer basket, then it includes the following annual set of products for an able-bodied person:

- potatoes – 100.4 kg;

- bread products (bread and pasta in terms of cereals, flour, legumes) – 126.5 kg;

- vegetables and melons - 114.6 kg;

- fresh fruits - 60 kg;

- meat products and semi-finished products – 58.6 kg;

- fish products - 18.5 kg;

- milk and dairy products - 290 kg;

- vegetable oil, margarine and other fats - 11 kg;

- eggs – 210 pcs;

- other products (salt, tea, spices) - 4.9 kg.

In addition, it is worth taking into account non-food products, which include half the amount spent on food. In addition, it is worth taking into account utility bills and other services, which are conventionally taken as 50% of the cost of the food basket.

What is it used for?

The minimum wage is intended to be able to influence the lower salary threshold in Russia, as well as to establish various social benefits (pregnancy, temporary disability, and so on). The minimum threshold gives a signal to all Russian employers that they must pay their employees a salary not lower than the minimum wage.

This parameter is also used to calculate on its basis tax deductions, penalties and other levies that are established by law in the territory of the Russian Federation. Employers do not have the legal right to pay an employee a monthly salary below the minimum wage, but there are exceptions. Such an exception is the employee’s part-time or part-time work - in this case, the salary may be lower than the minimum wage.

Return to content

The purpose of the minimum wage in the Russian Federation

The minimum wage in the Russian Federation establishes the lower level of the monthly salary of an employee who has worked the full working hours and fulfilled the job duties assigned to him. See also in what cases salary and wages may be lower than the minimum wage.

The minimum wage, or more precisely, the average daily earnings calculated from the minimum wage, is used to calculate minimum benefits for temporary disability and maternity.

Previously, based on the minimum wage, the amount of fixed contributions of individual entrepreneurs paid to social funds (PFR and MHIF) was calculated. Since 2021, these contributions are paid to the Federal Tax Service, and since 2018 they have been detached from the minimum wage and the amount of contributions in a fixed amount has become regulated by the Tax Code (Article 430).

What are the fines?

According to the Code of Administrative Offenses (clause 6 of Article 5.27), employers, if the salary they pay to an employee is less than the minimum wage, they face the following penalties:

- from 10 thousand to 20 thousand rubles - for persons holding responsible positions;

- from 30 thousand to 50 thousand rubles - for legal entities;

- from 1 thousand to 5 thousand rubles - for individuals carrying out entrepreneurial activities without legal registration.

Control and support bodies

Payment of remuneration for work is controlled by four departments:

- Ministry of Labor and Social Protection of the Population.

- Financial departments: federal, municipal.

- State Labor Inspectorate: carries out scheduled and unscheduled on-site inspections.

- Prosecutor's office: federal, municipal.

Some authorities check the quality of fulfillment of obligations by traveling according to plan. But unscheduled inspections are also likely if employees file a complaint against the manager. An employee has the right to complain not only about reduced wages, but also about incorrect calculation of payments. After the application is sent to the appropriate department, local executive authorities will begin to investigate. The case may go to court, so employers who have entered into a tripartite agreement are more likely to comply with the law.

Funds for paying the minimum wage are provided from budget sources. According to Art. 2 Federal Law No. 82 of June 19, 2000 (as amended on December 25, 2018), the minimum wage is determined by firms that are financed from four types of sources:

- public money not included in the state budget, profit received from business or other activities;

- municipal treasury;

- federal treasury;

- personal budget.

Minimum wage after 1991

On April 19, 1991, the Supreme Council of the RSFSR adopted the law “On increasing social guarantees for workers,” which established the minimum wage at 180 rubles. per month starting October 1, 1991 and 195 rubles. - since January 1, 1992. However, already on November 15, 1991, the government of the RSFSR adopted a resolution establishing the minimum wage in the amount of 200 rubles. since December 1, 1991.

In total, from 1991 until the redenomination of 1998, various federal laws or direct decrees of Russian President Boris Yeltsin increased the minimum wage 17 times. From January 1, 1997, the minimum wage was 83 thousand 490 non-denominated rubles. As a result of redenomination from January 1, 1998, this amount amounted to 83.49 rubles. and was five times less than the living wage established at that time, i.e., the valuation of the consumer basket (450 rubles). At the same time, since the mid-1990s, the minimum wage began to be used in legislation to determine tax rates, to calculate fines, etc. The minimum wage is 83.49 rubles. remained until 2000.

Calculation of sick leave based on the minimum wage from July 1, 2021

The calculation of sick leave based on the minimum wage will change from July 1, 2021. For everyone who earned little, or did not have time to work for six months before the first sick leave or maternity leave, benefits will increase.

Minimum wage for calculating sick leave in 2021 FSS

From July 1, the minimum wage will increase from 6204 to 7500 rubles. Therefore, the calculation of sick leave will change based on the minimum wage.

From July 1, 2021, other benefits will be received by employees who:

- insurance period is less than six months (at the time of illness or maternity leave). In these cases, the benefit for the whole month will not exceed 1 minimum wage;

- earnings for the billing period are small. Sick leave and maternity leave cannot be less than the minimum amount (details in the next section).

New calculation of sick leave based on the minimum wage from July 1, 2021:

- will affect illnesses and maternity leave that began after this date;

- will not affect the average earnings for additional sick leave (for example, for complicated childbirth). Primary and additional sick leave are issued for one insured event.

Benefits must be recalculated if the employee went on maternity leave before July 1, 2021, and at that time her insurance period was less than six months. For days of maternity leave after July 1, calculate the benefit taking into account the new minimum wage.

Minimum wages by region

With changes and additions from 07/01/2016

| Region of the Russian Federation | Minimum wage size in 2021 |

| Central Federal District | |

| Belgorod region | 8694 |

| Bryansk region | 6500 |

| Vladimir region | 6204 (for budgetary organizations) 7000 (for extra-budgetary organizations) |

| Voronezh region | 6204 (for budgetary organizations) 8787 (for extra-budgetary organizations) |

| Ivanovo region | 8645 |

| Kaluga region | at the subsistence level |

| Kostroma region | 7500 (for public sector organizations) at the subsistence level (for non-budgetary organizations) |

| Kursk region | 7500 (for public sector organizations) at the subsistence level (for non-budgetary organizations) |

| Lipetsk region | 6000 (for public sector organizations) not less than 1.2 subsistence level (for non-budgetary organizations) |

| Moscow region | 12500 |

| Oryol Region | 9778 |

| Ryazan Oblast | 6350 (for budgetary organizations) 7500 (for non-budgetary organizations) |

| Smolensk region | 6200 |

| Tambov Region | 6240 (for budgetary organizations) 7500 (for extra-budgetary organizations) |

| Tver region | 7500 (for budgetary organizations) 7280 (for non-budgetary organizations) |

| Tula region | 11000 (from 01.08.2016) (for budgetary organizations) 13000 (from 01.08.2016) (for non-budgetary organizations) |

| Yaroslavl region | 6000 (for budgetary organizations) 8021 (for extra-budgetary organizations) |

| Moscow | 17300 |

| Northwestern Federal District | |

| Republic of Karelia | 7213 (for public sector organizations in the northern regions: Belomorsky district, Kalevalsky district, Kemsky district, Loukhsky district, Kostomuksha) 5796 (for public sector organizations in other districts) at the subsistence level (for non-budgetary organizations) |

| Komi Republic | 6500 |

| Arhangelsk region | 7500 |

| Vologda Region | 7500 |

| Kaliningrad region | 10000 |

| Leningrad region | 7800 |

| Murmansk region | 13650 |

| Novgorod region | 6204 (for public sector organizations) at the subsistence level (for non-budgetary organizations) |

| Pskov region | 7500 |

| Saint Petersburg | 11700 |

| Nenets Autonomous Okrug | 6204 |

| Southern Federal District | |

| Republic of Adygea | 7500 |

| Republic of Kalmykia | 7500 |

| Krasnodar region | 7500 (for public sector organizations) at the subsistence level (for non-budgetary organizations) |

| Astrakhan region | 7500 (for budgetary organizations) 7350 (for non-budgetary organizations) |

| Volgograd region | 7500 (for public sector organizations) not less than 1.2 subsistence minimum (for non-budgetary organizations) |

| Rostov region | 7500 |

| North Caucasus Federal District | |

| The Republic of Dagestan | 7500 |

| The Republic of Ingushetia | 7500 |

| Kabardino-Balkarian Republic | 7500 (for public sector organizations) at the subsistence level (for non-budgetary organizations) |

| Karachay-Cherkess Republic | 7500 |

| Republic of North Ossetia-Alania | 7500 |

| Chechen Republic | 8252 |

| Stavropol region | 8588 |

| Volga Federal District | |

| Republic of Bashkortostan | 7500 (for budgetary organizations) 8900 (for non-budgetary organizations) |

| Mari El Republic | 9251 |

| The Republic of Mordovia | 7500 |

| Republic of Tatarstan | 6204 (for budgetary organizations) 7309 (for extra-budgetary organizations) |

| Udmurt republic | 7500 |

| Chuvash Republic | 7500 (for budgetary organizations) 6988 (for non-budgetary organizations) |

| Perm region | at the subsistence level |

| Kirov region | 7500 |

| Nizhny Novgorod Region | 7500 (for budgetary organizations) 9000 (for non-budgetary organizations) |

| Orenburg region | 7500 |

| Penza region | 7500 |

| Samara Region | 7500 |

| Saratov region | 7500 (for budgetary organizations) 7900 (for non-budgetary organizations) |

| Ulyanovsk region | 6500 (for budgetary organizations) 10000 (for non-budgetary organizations) |

| Ural federal district | |

| Kurgan region | 7500 (for budgetary organizations) 7620 (for extra-budgetary organizations) |

| Sverdlovsk region | 8862 |

| Tyumen region | 7700 (for budgetary organizations) 9300 (for non-budgetary organizations) |

| Chelyabinsk region | 6100 (for budgetary organizations) 8300 (for extra-budgetary organizations) |

| Khanty-Mansiysk Autonomous Okrug - Yugra | Minimum wage, taking into account the regional coefficient and percentage increase in wages |

| Yamalo-Nenets Autonomous Okrug | 12431 |

| Siberian Federal District | |

| Altai Republic | 7500 (for budgetary organizations) 8751 (for non-budgetary organizations) |

| The Republic of Buryatia | 7500 |

| Tyva Republic | 7500 (for budgetary organizations) not less than 6300 (for non-budgetary organizations) |

| The Republic of Khakassia | 7500 |

| Altai region | 7500 (for budgetary organizations) 9400 (for non-budgetary organizations) |

| Transbaikal region | 6044 (for budgetary organizations) 8095 (for extra-budgetary organizations) |

| Krasnoyarsk region | 6204 (for budgetary organizations) 9544 (for extra-budgetary organizations) |

| Regions of the Far North of the Krasnoyarsk Territory | 16130 (Norilsk, Taimyr Dolgano-Nenets municipal district) 14269 (North Yenisei district) 19009 (Evenkiy municipal district) 15313 (Turukhansky district) 15200 (Yeniseisk) |

| Irkutsk region | 7774 (for budgetary organizations) 9717 (for extra-budgetary organizations) |

| Kemerovo region | 13617 |

| Novosibirsk region | 9030 (for budgetary organizations) 9390 (for extra-budgetary organizations) |

| Omsk region | 6204 (for budgetary organizations) 7135 (for extra-budgetary organizations) |

| Tomsk region | 7500 (for budgetary organizations) 8581 (for extra-budgetary organizations) |

| Far Eastern Federal District | |

| The Republic of Sakha (Yakutia) | 15390 |

| Kamchatka Krai | 16910-19510 |

| Primorsky Krai | 7500 |

| Khabarovsk region | 11414-15510 |

| Amur region | 7500 |

| Magadan Region | 18750 (for budgetary organizations) 20250 (for non-budgetary organizations) |

| Sakhalin region | 16838 |

| Jewish Autonomous Region | 7500 |

| Chukotka Autonomous Okrug | 6204 |

| Crimea | |

| Republic of Crimea | 6204 (for budgetary organizations) 7042 (for extra-budgetary organizations) |

| Sevastopol | 6204 (for budgetary organizations) 7343 (for extra-budgetary organizations) |

Archive:

Archive: Table of minimum wages by regions of the Russian Federation for 2015 in PDF format