Latest version of Art. 136 of the Labor Code of the Russian Federation established the rights of employees to receive equal income. Now salaries must be paid at least every six months. At the same time, when determining the timing of its issuance, employers cannot go beyond 15 calendar days from the end of the period for which the salary was accrued.

These new rules of the Labor Code of the Russian Federation came into conflict with the accounting rules, according to which salaries are calculated once a month, based on the results of the period worked. And in the middle of the month an “advance” is paid, which is often not related to actual production. As a result, many accountants find themselves in a quandary: do they now need to calculate each payment based on the fact of work? And if so, is it necessary to withhold personal income tax from each payment?

The Ministry of Finance has issued several clarifications with a clear indication: personal income tax must be calculated and withheld only once a month upon final settlement with the employee (see letters dated 02/01/2017 No. 03-04-06/5209 and dated 04/13/2017 No. 03-04-05 /22521). Moreover, in letter dated 01.02.2017 No. 03-04-06/5209, employees of the Ministry of Finance noted that these rules remained unchanged even after amendments were made to Art. 136 of the Labor Code of the Russian Federation, that is, no tax is withheld from the “advance payment” (no matter how it is calculated). But then a letter from the Ministry of Finance dated 05.05.2017 No. 03-04-06/28037 was issued, which said that personal income tax is subject to withholding from wages for the first half of the month, which again led to confusion.

This letter notes that, according to the rules of paragraph 4 of Art. 226 of the Tax Code of the Russian Federation, the calculated tax must be withheld from the taxpayer’s income upon actual payment. And then we consider the situation when personal income tax was calculated from income in kind, or from financial benefits, that is, when there is income, but there is no corresponding cash payment. And in such a situation, the letter says, the previously calculated tax must be withheld not only from the salary paid upon final payment, but also from the “advance payment”. After all, the latter, according to the rules of the Labor Code of the Russian Federation, is also a salary, that is, income subject to personal income tax (clause 6, clause 1, article 208 of the Tax Code of the Russian Federation). And as a contrast, another example is given: from the funds transferred to repay the loan, the previously calculated personal income tax cannot be withheld, since the repaid loan amount is not the income of the individual. So this letter is not about calculating personal income tax from an “advance”, but about withholding personal income tax previously calculated from other income.

Algorithm for calculating and paying personal income tax for individual entrepreneurs on OSNO

Note!

Since the beginning of 2021, the procedure for calculating personal income tax by entrepreneurs has changed. Previously, advance payments were calculated by specialists from the Federal Tax Service; now individual entrepreneurs must do this themselves.

Below is a step-by-step algorithm for calculating and paying personal income tax for individual entrepreneurs on the OSN, which was relevant until 2021:

- The individual entrepreneur received his first income of the year.

- Calculated the amount of estimated income for the whole year (minus expenses).

- Filled out and submitted the 4-NDFL declaration to the Federal Tax Service (with information about the expected income).

- I received notifications from the Federal Tax Service with the calculated amounts of advances for the payment of personal income tax.

- Paid advance payments on time (specified in notifications).

- At the end of the year, I compiled and submitted the 3-NDFL declaration.

- Paid or returned the tax calculated according to the 3-NDFL declaration.

Results

To summarize the above, we can formulate the following: when paying an advance, personal income tax is not withheld by the tax agent.

But when making an advance payment under a civil contract, you should carefully read the terms of the contract itself and make the appropriate decision - to withhold personal income tax or not. You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Payment of personal income tax in 2020-2021

From the beginning of 2021, entrepreneurs must calculate their advance payments themselves. Therefore, you no longer need to file a 4-NDFL declaration.

— it’s cancelled.

At the end of the 1st, 2nd and 3rd quarters, the individual entrepreneur calculates the amount of the advance payment based on the revenue received, tax deductions and the personal income tax rate. He transfers the received amount to the budget.

At the end of the year, the individual entrepreneur calculates the tax for the year, taking into account the listed advances. He pays the amount received to the budget. If the personal income tax amount is less than the listed advances, the difference can be returned.

Deadlines for personal income tax payment

Advance payments are paid to individual entrepreneurs by the 25th day of the month following the end of the quarter. Taking into account the postponement of holidays in 2021, the dates are as follows:

- advance payment for the 1st quarter - until April 26;

- advance payment for half a year - until July 26;

- advance payment for 9 months - until October 25.

At the end of the year, the individual entrepreneur fills out a 3-NDFL declaration, in which he calculates the tax for additional payment (refund). It must be submitted no later than April 30. The additional tax amount must be paid by July 15.

The detailed procedure for calculating advance payments and annual tax can be found below (slider “Example of calculating advance payments and annual tax”

).

Tax notice on advance payments

The tax notice must be sent to the entrepreneur no later than 30 working days before the payment deadline established by paragraph 9 of Article 227 of the Tax Code of the Russian Federation (paragraph 2, paragraph 2, article 52, paragraph 6, article 6.1 of the Tax Code of the Russian Federation). This rule also applies when the inspectorate recalculates the amount of advance payments based on the adjusted declaration. The notification form was approved by order of the Ministry of Taxes and Taxes of Russia dated July 27, 2004 No. SAE-3-04/440.

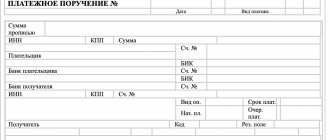

The notification must necessarily be accompanied by a sample payment document for the transfer of the advance payment - notification in form No. PD (tax) (clause 3 of the order of the Ministry of Taxes of Russia dated July 27, 2004 No. SAE-3-04/440). The notification form was put into effect by letter dated February 18, 2005, Federal Tax Service of Russia No. MM-6-10/143, Sberbank of Russia No. 07-125B.

A tax notice can be transmitted:

- personally to the entrepreneur or his representative;

- by registered mail. In this case, the notification is considered received after six working days from the date of its sending (clause 4 of article 52 of the Tax Code of the Russian Federation);

- in electronic form via telecommunication channels.

Situation: should an entrepreneur make advance payments for personal income tax if he has not received a tax notice?

No, you shouldn't.

Transfer of advance payments for personal income tax is made exclusively on the basis of tax notices (clause 9 of article 227 of the Tax Code of the Russian Federation). Until a tax notice is received from the inspectorate, the obligation to pay tax (advance payments) does not arise (clause 4 of article 57 of the Tax Code of the Russian Federation). Therefore, if an entrepreneur has not received a notification about the payment of advance payments for personal income tax, he may not transfer these amounts to the budget.

The validity of this conclusion is confirmed by arbitration practice (see, for example, the resolution of the Federal Arbitration Court of the Central District of July 3, 2006 No. A-62-834/2005).

How is PFDL calculated in 2021 for individual entrepreneurs?

The tax for the year is calculated using the following formula:

Personal income tax = (Received income of an individual entrepreneur - Tax deductions) x Tax rate - Advance payments

Individual income received

To determine the personal income tax base, all income of an individual entrepreneur received by him in cash and in kind, in the form of material benefits, as well as when the right to this income arises, is taken into account. Income received both on the territory of the Russian Federation and abroad is subject to accounting.

An individual entrepreneur must determine the tax base separately for each type of income for which different tax rates are provided.

A complete list of income taken into account when calculating income tax is given in Art. 208 Tax Code of the Russian Federation.

Tax deductions

When calculating the amount of tax to be paid, an individual entrepreneur can use all types

tax deductions. The main deduction for individual entrepreneurs is professional and represents the possibility of accounting for all expenses incurred in the process of carrying out business activities.

Professional deductions can be provided in the amount of:

- Actual expenses incurred, if they are economically justified and documented;

- In the amount of 20% of all income received for the year, if there is no documentary evidence of expenses.

The composition of expenses is determined by the individual entrepreneur independently, in the manner prescribed by Chapter. 25 Tax Code of the Russian Federation.

Note

: It is beneficial to use a deduction in the amount of 20% of the income received when the documented amount of expenses incurred is less than the deduction provided in the amount of 20%.

In addition to professional ones, an individual entrepreneur can apply property, social, standard, investment and “loss” deductions. The procedure for their application is similar to that for ordinary citizens (that is, all necessary documents must be attached to the declaration).

Note:

deductions can be used to reduce income taxed at a rate of 13% (except for income from equity participation in an organization). Thus, if an individual entrepreneur is a non-resident, he will not be able to claim deductions (including professional ones).

From the beginning of 2021, an additional personal income tax rate of 15% (Law No. 372-FZ of November 23, 2021). It applies to individual entrepreneurs’ income exceeding 5 million rubles. You must pay tax at a rate of 15% on income exceeding 5 million rubles.

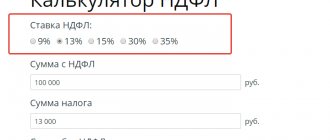

Tax rates

The basic tax rate for personal income tax for individual entrepreneurs is 13%

. It applies to the amount of income of an entrepreneur up to 5 million rubles inclusive.

For income exceeding 5 million rubles, the rate applies 15%

.

If an individual entrepreneur is a non-resident of the Russian Federation, he pays personal income tax at the rate 30%

.

A 15% rate applies to income over 5 million rubles. For example, if the tax base of an individual entrepreneur for 2021 is 6 million rubles, then in total he must pay: (5 million * 13%) + (1 million * 15%) = 800 thousand rubles.

A working entrepreneur must calculate tax based on his own actual income, without taking into account payments made to him by his employer. The Federal Tax Service will aggregate data from the 3-NDFL declaration (probably its form will change) submitted by the individual entrepreneur and the 2-NDFL certificate submitted by the employer. If the total amount of a citizen’s income exceeds 5 million rubles, the tax authority itself will calculate the additional personal income tax payment taking into account the increased rate and send a notification. This explanation was given by the head of the Department of Taxation of Personal Income and Administration of Insurance Contributions, Mikhail Sergeev, during the All-Russian Winter Online Business Congress “Taxes and Reporting in 2021”.

An example of calculating advances and taxes for the year

IP Ivanov I.I. uses OSNO. Let's calculate his tax for 2020.

For the 1st quarter of 2021, the individual entrepreneur earned income in the amount of 400,000 rubles. His advance payment will be: 400,000 x 13% = 52,000 rubles.

For 6 months, the income of the individual entrepreneur amounted to 700,000 rubles. He must pay: 700,000 x 13% - 52,000 = 39,000 rubles.

The amount of income for 9 months is 1,000,000 rubles. The advance payment will be: 1,000,000 x 13% - (52,000 + 39,000) = 39,000 rubles.

In just one year, IP Ivanov earned 1,200,000 rubles. Until April 30, 2021, he needs to submit a 3-NDFL declaration. His tax for the year will be 1,200,000 x 13% - (52,000 + 39,000 + 39,000) = 26,000 rubles. It must be paid by July 15, 2021.

According to Labor Code there is always a salary

As already mentioned, the Labor Code requires wages to be paid twice a month. In Art. 129 of the Labor Code of the Russian Federation states that salary is not only the amount that an employee receives upon final payment at the end of the month; This includes any payments to an employee, the basis for the accrual of which is the performance of labor functions. This means that for the purposes of labor legislation, an “advance” on wages simply does not exist: payment in the middle of the month is precisely wages. And since we are talking about wages, then it must reflect the actual work standard fulfilled, as required by Art. 129 Labor Code of the Russian Federation.

But in practice, this is often not the case: the amount of payment for the first half of the month is determined by calculation as a part of the salary that all employees receive, regardless of actual output. This discrepancy between practice and the letter of the Labor Code of the Russian Federation was even the subject of consideration by Rostrud, whose specialists, in letters dated May 20, 2011 No. 1375-6-1 and dated December 24, 2007 No. 5277-6-1, confirmed that there is an internal contradiction in the Labor Code of the Russian Federation when salary also refers to a payment that may not be related to actual work. And in this case, it is more correct to talk not about paying wages, but about paying part of the wages.

However, these letters were issued before the amendments to Art. 136 of the Labor Code of the Russian Federation, where a direct connection is now established between the date of payment of wages (and not part of the wages) and the period for which it was accrued. That is, the legislator clearly requires the calculation of wages for a certain period. Therefore, it is no longer possible to use the logic set out in the above letters from Rostrud. This means that companies need to switch to a different principle for forming payments and even pay salaries for the first half of the month based on the time actually worked in this period.

Personal income tax reporting for individual entrepreneurs in 2021

Declaration 3-NDFL is submitted once a year until April 30. If this day falls on a weekend, it is moved to the next working day.

Declaration 3-NDFL for 2021 must be submitted to the tax authority before April 30, 2021

.

Declaration 3-NDFL for 2021 must be submitted to the tax authority before May 2, 2022

.

Information in the 3-NDFL declaration is entered in accordance with the KUDiR (book of income, expenses and business transactions), which individual entrepreneurs are required to maintain under the general taxation regime.

More details about the 3-NFDL declaration.

Certificate 2-NDFL (patent) – we issue a certificate to a foreign employee

When drawing up a certificate to be issued to an employee, the employer uses the template presented in the Appendix to Order No. ММВ-7-11 / [email protected] Information that the recipient of the income is a foreigner is entered in section 2. This is reflected in the codes for taxpayer status , citizenship and identification document. In sections 3 and 4, information on income accruals and deductions for children is entered in the usual manner.

The amount of fixed payments for a patent is indicated only in section 5. It is reflected in a separate line, and the calculated personal income tax is reduced by its amount. The details of the notification received by the employer from the Federal Tax Service for income tax adjustments do not need to be indicated in the employee’s certificate.

The third case is payment of the premium simultaneously with the advance

Another exceptional and controversial situation is when the employee’s bonus is paid simultaneously with the advance payment. Officials of the Ministry of Finance consider it correct to withhold personal income tax directly when paying bonuses. They classify the bonus as an incentive payment, not counting it as wages, and insist on transferring tax to the budget at the time of disbursement of funds (Letter dated March 27, 2015 N 03-04-07/17028). There is no need to transfer 13% of the advance payment to the treasury. But the judges do not share the ministry's opinion. There is judicial practice, from which it follows that a bonus for labor success and achievements is an element of remuneration. And the date of receipt of income in the form of a bonus can be considered the last day of the month (Resolution of the AS of the North-Western District dated December 23, 2014 No. A56-74147/2013). But in order to avoid disputes with the inspectorate and not bring the matter to court, it is better to transfer personal income tax to the treasury immediately after paying the bonus or to accrue incentive payments during the final payment at the end of the month.

An example of personal income tax payment when paying a premium along with an advance

The employee's salary of 30,000 rubles is paid twice, 10,000 rubles (advance payment) and 20,000 rubles (final payment). Megapolis LLC transferred 23,050 rubles to an employee on June 25: an advance of 10,000 rubles. and a bonus of 13,050 rubles. Until June 26, the organization withheld and paid personal income tax to the budget in the amount of 1,950 rubles. (13% of the premium in the amount of 15,000 rubles). The employee received the second part of the salary on July 8 in the amount of 16,100 rubles. Tax on the advance and the rest of the salary is transferred on July 8 or 9. It is equal to 4,900 (30,000 * 13%).

General provisions

So, in almost all situations there is no need to withhold this tax from advance transfers.

But there are some cases when this issue becomes controversial. According to general legislative rules, there are two concepts: the date of actual receipt of money and the day of payment. This is clearly stated in Art. 223 Tax Code of the Russian Federation. Some inexperienced accountants confuse these concepts or equate them, which is a mistake. The fact is that actual income is determined on the day when the amount a person earns per month becomes known. This figure is considered the tax base, which is subject to taxation. Most often this is the last day of the month - it is then that this amount is already known.

Exception

There is one non-standard situation that requires separate consideration. This is the case when wages are accrued in the middle of the month, and the advance payment is accrued at the very end. For example, an employee received an advance payment for August on August 31, and his salary for August was accrued on September 12. In this case, the date of actual receipt of money and the date of advance payment coincided. This means that you can form a tax base right on this day and transfer money to the state budget the next day.

The accounting department of an enterprise must clearly understand when an advance is subject to personal income tax and when it is not. If you make tax deductions from this money at the wrong time, this will entail punishment from the Federal Tax Service, and it is better to avoid this.

Responsibility of an employer who does not pay an advance

The procedure for calculating and paying an advance (as well as full earnings) should not be violated. Otherwise, the company cannot avoid penalties. Often, employees themselves insist on paying their earnings in one lump sum. This position is extremely dangerous. The norms of the Labor Code of the Russian Federation clearly define the number of payments per month: at least two. This means that all employees are given uniform rules for receiving the first and second half of their earnings for the period worked.

Violation of this rule is fined and the employer and the official responsible for such an operation suffer. The following sanctions apply to employers:

- 30,000 to 50,000 rubles (for a primary violation);

- 50,000 to 100,000 rubles (in case of repeated violation).

In relation to official representatives of the company (chief accountant or general director) it is established:

- 10,000 to 20,000 rubles (for the first time);

- 20,000 to 30,000 rubles (repeat);

- Or disqualification (removal from professional duties) from 1 to 3 years.

There are also financial penalties for employers who pay advances late. Based on Art. 236 of the Labor Code of the Russian Federation, the amount of compensation is paid to personnel for delayed wages from the day that occurs after the established deadline for payment of wages.

The amount of a fixed advance payment in 6-NDFL: how not to make a mistake in terms

We’ve figured out how to show an advance on salary in 6-NDFL. But sometimes it also indicates an advance of a completely different nature, namely: a fixed advance payment (FAP), which is paid by foreigners working on the basis of a patent.

For him, the calculation has a separate line 050 and its own reflection rules, due to the offset between the personal income tax advance, which is transferred by the employee under the patent, and the tax that the employer has calculated and must transfer to the budget from the income paid to the employee.

Thus, the amount of the FAP in line 050 should not exceed the amount of tax from such employees included in line 040. When the personal income tax paid under a patent is less than the tax calculated on wages, the entire fixed advance is reflected in line 050. When more, only a part of it equal to the calculated personal income tax. If the foreigner continues to work and receive a salary, the difference is counted in subsequent periods.

Filling out the calculation in such a situation is discussed line by line in the article “Nuances of filling out 6-NDFL for “patent” foreigners .

Nuances

There are specifics about how to transfer personal income tax when transferring other payments. For example, there are specifics when sick leave or vacation is paid.

The company must pay personal income tax when the last day of the month arrives.

It is considered that the company has fulfilled its obligation if the payment is made and the treasury code is correctly written in the financial documents.

Advances to report

Issuance of money on account is one of the types of advances used by organizations. Funds can be given out for various purposes. This could include travel expenses, purchasing materials for business needs, and settlements with suppliers. Other goals set by management may also be identified.

Accountable funds can only be issued to an employee of the company. Moreover, the manager should fix the list of employees who are accountable persons. In addition, the organization should approve limits on advances of accountable amounts, reporting deadlines and additional payment rules.

Accountable funds are issued based on the employee’s application or the manager’s order. The amount can be transferred to cards or issued in cash from the cash register.