If one of the parents wishes to receive child care benefits for a child up to 1.5 years old, then he needs to collect a package of documents, including a certificate of non-receipt of such payment by the other parent. As a rule, such a certificate must be brought from work by the child’s father, since the mother is on maternity leave. We will tell you what type of certificate a certificate of non-receipt of child care benefits for a child under one and a half years old should have.

- Form and sample

- Free download

- Online viewing

- Expert tested

FILES

Certificate from the father’s place of work stating that he does not use parental leave

Only one member of the child’s family and one who pays insurance contributions to the Social Insurance Fund (Part 4 of Article 13 No. 255-FZ) can receive benefits for caring for a child up to 1.5 years old.

After the birth of the baby, the child’s mother is on maternity leave, and immediately after its completion she can go on maternity leave. To apply for leave, the mother provides a certificate from the father’s place of work confirming that he is not on parental leave and is not receiving benefits.

The child’s mother can go to work immediately after the labor leave, leaving childcare to the father. In order for the child's father to receive benefits, the mother must obtain a certificate from her employer. If the child is cared for by a working grandmother or other relative, then a certificate from the place of work of both parents will be required.

The certificate is issued at the place of employment, for example:

- Working under an employment contract, including fixed-term and unlimited

- Persons undergoing military service under contract

Certificate from the parent’s second place of work confirming non-receipt of benefits for up to 1.5 years

A parent who wishes to receive child care benefits and has several jobs (works part-time) is obliged to:

- Choose one of the employers from whom he will receive benefits

- Provide a certificate from other employers that benefits are not accrued or paid by them

If the second parent has several jobs, then he must also provide a certificate from each employer. This is required so that the state can be sure that child benefit is paid in only one place.

Grounds for refusal of payments

Failure to comply with the procedure for submitting and completing the package of documents may result in a refusal to assign financial assistance to the family. Several scenarios are possible.

| Reason for refusal or return of documents | Consequences |

| Insufficient quantity or incorrect execution of the application and its annexes | Papers will be returned after verification at the time of submission or 5 days after receipt by remote means. There is a possibility of re-application. |

| Misrepresentation of facts in an application or provision of false certificates | Papers will be returned until corrected and current data is provided. |

| Late turnaround time | If the application is submitted after the child reaches 3 or more years of age, the right to receive part of the benefits will be lost forever. There is an option to try to restore the missed deadlines through the court. |

| Not meeting criteria | If, according to certificates submitted to social security (for the last 3 or more months), it turns out that the family does not have the right to apply for financial social security from the state, then assistance will be denied (at least until circumstances change) |

Certificate from social security confirming non-receipt of benefits for up to 1.5 years

A non-working parent can obtain a certificate by contacting the local OSZN.

OSZN can issue a certificate to the following categories of citizens:

- For students

- Unemployed people registered with the employment service

- Working people without official employment

- Women dismissed during pregnancy or labor and employment leave due to liquidation of the organization

The state does not allow receiving two benefits at the same time, for example, you cannot receive unemployment benefits and child care benefits. But a citizen can choose which of these benefits to receive.

Certificate to father about non-receipt of benefits from the Social Insurance Fund

Individual entrepreneurs, self-employed people and persons engaged in private practice can apply to the Social Insurance Fund for a certificate of non-receipt of benefits. Possible situations:

- If a homeowners' association agreement has been concluded, you must contact the Social Insurance Fund for a certificate confirming that benefits have not been assigned and are not being paid.

- If the DSZh agreement has not been concluded, then first you need to get a certificate from the Social Insurance Fund about the absence of an agreement, and then contact the OSZN.

In judicial practice, there are cases when an individual entrepreneur himself issued a certificate of non-receipt of payment, confirming it with a signature and seal (does not apply to self-employed people and private practice specialists). This case includes the case when the Arbitration Court of the Stavropol Territory made a decision in case No. A63-6232/2014, which was later confirmed by the Supreme Court of the Russian Federation.

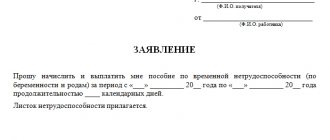

How to issue a certificate of non-receipt of benefits for up to 1.5 years

A certificate of non-receipt of benefits for up to 1.5 years is written in free form, since there is no single established template. In some organizations, documents are drawn up on company letterhead.

The letterhead usually already contains all the details of the organization, but if the filling is done on a blank sheet of paper, then information about the organization that issued the document is indicated at the top:

- Name of the organization indicating the form of ownership (full name for individual entrepreneurs)

- Details: INN, KPP, OGRN (if available)

- Contact information: postcode, address, telephone

Then the registration data of the document is indicated:

- Outgoing number

- Date of document creation

Below in the middle of the line is written the name of the document: “Help”.

The red line contains information about the parent: full name, period of work and position held by the employer.

The new paragraph provides information that child care benefits under 1.5 years of age were not assigned and were not paid to the bearer of the certificate. The following sentence contains information about the child: full name and date of birth.

After which the purpose of issuing the document is indicated, for example, for presentation at the place of demand.

The signature of the head and the seal of the organization are placed at the bottom.

Despite the fact that the certificate is written in free form. According to the law (Letter of the Ministry of Health and Social Development No. 18-1/2756), the certificate must contain information about the recipient, and that payments for child care benefits and leave were not assigned or received to them.

FAQ

Question : I worked at Brewery LLC. As of April 21, 2021, I am fired. What period is indicated in the salary certificate?

Answer : The certificate provides information about earnings from January 1 to the last day of March.

The certificate indicates income for the last full three months of work

Question : My son will turn 18 on December 31, 2019. Explain when does adulthood come?

Answer : A child does not become an adult on his birthday, but after it, on the next day.

Question : I belong to the category of low-income citizens. It is necessary to confirm your status and provide a certificate of income. In fact, I live at an address different from my registered address. Should the certificate indicate the place of residence or registration?

Answer : The document indicates the place of registration of the person on the date of preparation. If a citizen is temporarily registered, the address is indicated in brackets. It is necessary to indicate the place of actual residence in the absence of any registration.

The certificate indicates the place of registration of the person

Question : Are the amounts I received while participating in the election commission considered income?

Answer : The specified amounts of money must be included in the family budget income. Additionally, indicate all financial receipts in any form (cash or non-cash).

Question : My husband received his salary in foreign currency. How should the amount be indicated on the certificate? If income information is recorded in rubles, then at what rate should it be converted?

Answer : Income is indicated in Russian rubles as of the date the certificate is prepared. Foreign currency is converted into national currency at the official exchange rate of the Central Bank of the Russian Federation, which is publicly available. Just use the link: https://www.cbr.ru/currency_base/daily/.

Income is indicated in Russian rubles

Question : I have company shares, how are they taken into account in the amount of income?

Answer : Shares belong to the category of issue-grade securities. The section indicates the total market price. If the purchase is in a foreign currency, the equivalent in Russian rubles should be indicated at the official exchange rate of the Central Bank of the Russian Federation.

Question : How are property assets valued?

Answer : To assess the financial situation of a person, all movable and immovable objects are indicated. They are valued at market value.

To assess the financial situation, movable and immovable objects are indicated

Question : My family and I live and are registered together with my wife’s parents. Is it necessary to indicate the size of the mother-in-law's and father-in-law's pension? Will the cost of an apartment owned by the father-in-law be taken into account when defining a family as low-income?

Answer : Your wife's parents are members of your family. The income of all people living together must be indicated. The apartment in monetary terms and parents' pensions will be taken into account.

Question : Registered with my family in my mother’s apartment. Mom also has registration in the apartment. However, we do not live together; we rent an apartment in another area. We have our own family budget, we eat separately from our mother, we do not have common things or household items. How can I prove that my mother is not a member of my family?

Answer : Formally, your mother will be a member of the family as long as there is registration at one place of residence. You can establish in court the legal fact of the absence of family relations. All specified circumstances must be proven. Evidence must be provided in sufficient volume. You can invite witnesses to the court and submit certificates. If it is difficult for you to obtain a particular document from an official body, contact the judge in writing with a request for a judicial request. Justify the request by the fact of refusal to provide you with documents and the impossibility of obtaining evidence yourself in any other way.

If a relative is registered in the same living space as citizens who want to receive an income certificate, his income is also taken into account

Question : Indicate what is the validity period of the income certificate for three months?

Answer : If you need to provide information specifically for the specified period, then the period for submission is unlimited. But a certificate is submitted to the social security department every three months to confirm the person’s security for a specific period and to classify the family as low-income. Therefore, you will need to update all information about your earnings. Certificates for the past three months are valid only for the next month.

Question : Will the fact of payment of alimony to a child from his first marriage be taken into account in the reference data?

Answer : The fact of transferring alimony must be taken into account when determining income for three months. The certificate indicates payments on a separate line and is deducted from the total amount.

Alimony is also taken into account in the income certificate

Question : I was given a maternity benefit in the amount of 45,000 rubles. Maternity leave lasted 140 days. I received my salary for less than a full calendar month (10 days) before maternity leave. I submitted an application to the social protection department with documents, including a certificate of income for three months to receive benefits. What benefit will be paid if the second month has 31 days, and the third month has 30 calendar days?

Answer : The calculation is made in the following order:

For the period worked (10 days of the last month): 45,000/140 x 10 = 3214.28 rubles.

For the second month: 45,000/140 x 31 = 9,964.28 rubles. (31 days).

For the third month: 45,000/140 x 30 = 9642.85 rubles (30 days).

The amount varies depending on the number of calendar days in the month worked.

Question : I submitted an application for payment of benefits and additional documents, two months have passed, and there are no payments. What is the reason for the delay in accrual?

Answer : Contact the organization where you applied for benefits in writing for clarification. It may be necessary to supplement the application package with your application. The benefit must be transferred within ten days from the date of application. If clarifications are not forthcoming from the organization or are provided inappropriately, contact the prosecutor’s office with a complaint.

If payments are not made without any reason, the citizen has the right to contact the prosecutor's office

The state supports vulnerable segments of the population, such as large, low-income families with children. For them, there is a separate type of state support - benefits, one-time payments. Employers are obliged to assist in obtaining this assistance and provide all information as soon as possible.

What documents are needed to obtain a certificate?

To obtain a certificate of non-receipt of child care benefits, a citizen must contact the accounting department, human resources department or directly to the manager at the place of work (service). Documents usually include the child's birth certificate.

If an employee works for an individual entrepreneur, then a certificate can be obtained from him, on the basis that he is his employer.

Documents required to obtain a certificate from the OSZN:

- Passport

- Child's birth certificate

If the recipient is a full-time student, then a certificate from his educational institution is also provided.

Documents required to obtain a certificate from the Social Insurance Fund (for individual entrepreneurs and persons engaged in private practice):

- Application for a certificate

- TIN for individual entrepreneurs

- Certificate of registration in the Unified State Register of Individual Entrepreneurs

Comment on the rating

Thank you, your rating has been taken into account. You can also leave a comment on your rating.

Is the sample document useful?

If the document “Sample certificate of non-use of vacation and non-receipt of monthly child benefit” was useful to you, we ask you to leave a review about it.

Remember just 2 words:

Contract-Lawyer

And add Contract-Yurist.Ru to your bookmarks (Ctrl+D).

You will still need it!

When is a certificate not needed?

There are situations when a certificate of non-receipt of payments is not needed:

- Divorce by parents before applying for benefits

- There is no record of the father on the child's birth certificate

If the child’s father lives separately, but has not divorced, he refuses to provide a certificate of employment. For information, you can contact the employer directly, for example by sending a registered letter. Perhaps the management of the child’s father will agree to a meeting and provide a certificate, but this is not provided for by law. Therefore, it is possible that you will need to apply to court for a certificate or to obtain a divorce.

If the father is indicated on the child's birth certificate, the parents are not married, or do not even live together. To apply for benefits, the mother still needs a certificate from the father’s place of work or from the OSZN.

Who is entitled to child benefits?

Financial support for families is paid provided that the parents or persons replacing them:

- citizens of Russia and permanently reside in the territory of the Russian Federation;

- citizens of Russia performing military service outside its borders (under international treaties);

- refugees who received this status in the Russian Federation, foreigners permanently residing here;

- foreign specialists working in Russia who are subject to compulsory social insurance under Law No. 255-FZ (except for highly qualified ones).

Parents who have placed their children in the care of the state (regardless of citizenship or residence) cannot claim payments.