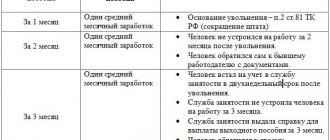

The obligation to pay severance pay and average monthly earnings for the period of employment is established by the Labor Code of the Russian Federation (Articles 84, 178, 180, 296, 318 of the Labor Code of the Russian Federation). In particular, such amounts must be paid to an employee if he is fired due to the liquidation of the organization or due to a reduction in headcount (staff). Mandatory payments upon dismissal may be established by other laws. For more information about this, see When you need to pay severance pay, average earnings for the period of employment and compensation upon dismissal.

Definition of severance pay

Severance pay is considered to be the payment of a month (or two weeks) of earnings for the period of subsequent employment of the employee or as compensation. Severance pay is covered in Art. 178 Labor Code of the Russian Federation.

Also, for a detailed study of this issue, we have posted material for you, which you can read in the article: “Severance pay upon dismissal.”

Next, let's look at the issues of taxation of severance pay.

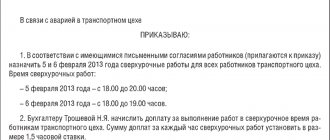

How is an order for this monetary compensation drawn up?

In order for the financial department of the enterprise to have a basis for accruing severance pay, the manager issues a corresponding order. There is no officially established form of order for severance pay.

However, according to generally accepted procedure, the document must contain such details as :

- Company name;

- date of drawing up the order;

- subject of the order;

- reason for the employee’s dismissal (specify the norm of the Labor Code of the Russian Federation);

- note on the accrual of severance pay;

- in special cases, reasons for early termination of an employment contract.

The order for severance pay is no different in appearance from other acts signed by the manager. At the same time, it is not necessary to familiarize the laid-off employee with the order, much less sign it.

Moreover, an accountant can calculate severance pay on the basis of a dismissal order, even if the words “with payment of severance pay” are not written there, since the provisions of labor relations legislation oblige payment of benefits in connection with a layoff.

Thus, it is not necessary to draw up a special document on the calculation of severance pay .

You can find out more about applying for and receiving benefits for those laid off due to staff reduction in this material.

Personal income tax and insurance contributions from benefits under the Labor Code of the Russian Federation

When deciding on the imposition of personal income tax and insurance premiums, the reason for dismissal does not matter. Whether it is a reduction in staff, dismissal for health reasons, refusal to transfer together with the employer to another location, an agreement of the parties - it does not matter. What matters here is the amount of severance pay paid. If you are still in doubt whether severance pay is taxed upon layoff, let’s figure it out together.

In accordance with labor legislation, upon dismissal on the grounds listed in Art. 178 of the Labor Code of the Russian Federation, you must pay the guaranteed amount of severance pay. However, an employment contract or local company regulation may establish an increased amount of benefits. In this case, payment in the specified amount is also mandatory in accordance with Part 1 and Part 8 of Art. 178 Labor Code of the Russian Federation.

However, the Tax Code sets a limit that is not subject to insurance contributions and personal income tax. If the severance pay is greater than the cap, the difference will be subject to taxes.

The amount of severance pay established by the Labor Code that can be paid to an employee is three times the average monthly salary. And for regions of the Far North and equivalent territories, this value can be up to 6 average earnings.

If, in the process of settling the severance pay with the employee, the amount of actual payments turns out to be greater than the amount determined by average earnings in accordance with the Labor Code of the Russian Federation, personal income tax must be withheld from the difference and insurance premiums must be charged.

Example

The employee resigning due to conscription into the army was paid compensation in the amount of half the salary, in accordance with the company's LNA.

The employee's salary was 30,000 rubles. Severance pay 15,000 rubles (according to LNA).

Average earnings, calculated according to the rules established for the payment of benefits, amounted to 1,300 rubles per day. In the two weeks following the day of dismissal there are 10 working days. Thus, according to labor legislation, the amount of the benefit should have been:

- 1300 × 10 = 13,000 rubles.

13,000 rubles from the payment will not be subject to personal income tax or insurance premiums. But the “extra” 2000 rubles must be taxed on both.

Features of saved earnings

The salary retained by the employee during the period of job search has a limited period of two or three months. In some cases, the duration can reach six months. Also, earnings have several features that will have to be taken into account when making reductions, as well as payments:

- payments cease upon employment. For example, if a former employee received a payment and got a new job, then there will be no further accrual;

- Mandatory payments must be made either immediately or as applications from laid-off workers are received. More often, employers make one-time payments, since after this there is less possibility of being held liable in the future for missing a due payment or similar actions;

- if the required average retained earnings are not paid, the employee may demand payment through the court. He also has the right to moral compensation. In addition to additional costs for the employee, the employer may receive sanctions from both the court and the labor inspectorate;

- retained earnings are calculated based on the average monthly salary option. If there is a collective agreement, the amount of compensation may be significantly greater, since it is already established in accordance with the agreement;

- retained earnings are paid in all cases of reduction, but for this it is necessary to record in the employment record that the employee was actually laid off and not dismissed for another reason.

The number of payments may also depend on the category of employees, for example, pensioners after a layoff are paid only double the amount of compensation based on average earnings, and not triple. Some categories of retained earnings are not paid at all. For example, after being laid off, seasonal workers are paid two weeks' wages and all payments stop there.

Important! Earnings of the retained type, if employment is necessary, do not have a set amount, since in all cases it is calculated individually based on the salary of the person being laid off

.

Calculation of severance pay and further payments is made immediately before dismissal. This is due to the fact that the severance pay paid is the same amount as the retained earnings. The difference only appears if there are additional days off in the paid month.

Those being laid off are given severance pay to find a new job. Also, for the period of new employment (two or three months), retained earnings are paid, which is the second part of the redundancy compensation. The amount of monthly earnings is individual for each employee and is calculated separately if there is no amount established by the collective agreement.

Taxes on additional compensation upon reduction or liquidation of a company

Also, upon dismissal due to layoff, an employee may receive additional compensation. The procedure for its payment is prescribed in Art. 180 Labor Code of the Russian Federation. This compensation is paid upon dismissal before the expiration of the notice period for layoffs. Please note that the payment of this benefit is not subject to personal income tax and insurance contributions and is not included in the calculation in the limit that we discussed above. This fact is indicated by clause 1 of Art. 217 of the Tax Code of the Russian Federation, Letters of the Ministry of Finance of Russia dated 04/01/2019 No. 03-04-05/22289, dated 03/20/2018 No. 03-15-06/17473, dated 07/31/2017 No. 03-04-07/48592.

The situation is similar with compensation paid before the date of liquidation of the company.

How to calculate the amount?

To calculate the amount of severance pay, you should use the presented algorithm and formulas.

- Calculate the number of working days in the month beginning on the day following the day of layoff.

- Decide what the billing period is (the last 12 months worked), as well as how many actual working days are included in it.

- Calculate the average daily earnings using the formula:

Average daily earnings = actual accrued wages for the billing period: number of days worked for the billing period . - Substitute the obtained data into the formula and find the amount of severance pay:

Severance pay = number of working days in the month following the reduction * average daily earnings.In other words, to obtain the final value, you need to multiply the result of point 2 of the algorithm by the result of point 4.

When determining average earnings per day, vacation days, sick leave, as well as weekends and holidays are not taken into account.

Calculation example

To make it completely clear how this benefit is calculated, here is a clear example of calculating the benefit :

On March 15, 2021, the sales manager received a letter from the manager, which states that in two months there will be a reduction in the number of personnel. The manager is not discouraged, because he has a lot of time ahead to find a new job, and in addition, he will receive severance pay.

Let us carry out calculations for dismissal due to reduction according to the order of the algorithm. To do this, you will need data on your annual salary. Over the last year, 343,220 rubles were accrued to the manager. At the same time, vacation was provided in August 2021, the payment of which was equal to 14,800 rubles.

- The notification arrived on March 15, 2021, which means the dismissal will occur on May 15, 2021. The period from May 16 to June 15 inclusive includes 22 working days. Therefore, severance pay will be calculated for 22 days.

- The period of the last 12 months of work (from May 16, 2021 to May 15, 2018) according to the production calendar consists of 247 working days. But if we take into account the vacation of 12 days, then the actual number of days is 235.

- Daily earnings = (RUB 343,220 – RUB 14,800) / 235 days. = 1397.53 rub.

- Severance pay = 22 days. * RUB 1,397.53 = 30,745.70 rub.

The amount of payment that will be accrued to the sales manager is RUB 30,745.70.

Important! When the accrued salary for the last working year is calculated, vacation pay and sick leave do not take into account.

Income tax

So, now you know that taxes on severance pay during a layoff are not paid up to the legal limit. Let us next consider the issue of accounting for severance pay for tax purposes.

According to Art. 255 of the Labor Code of the Russian Federation, severance pay is taken into account in labor costs. In this case, on the contrary, the size of the benefit does not matter. However, do not forget one very important point. This is the economic justification of the costs. For example, your company is being liquidated, there are a lot of debts to creditors, and you decide to pay a severance package to the financial director in the amount of 10 salaries. This may raise questions from inspectors. And in case of a dispute, you will prove your case in court. This is indicated by Letters of the Ministry of Finance of Russia dated 03/18/2020 No. 03-03-06/1/20894, dated 03/19/2019 No. 03-03-07/17871, dated 02/11/2019 No. 03-04-06/8796, dated 04/25. 2017 No. 03-04-06/24848, No. 03-04-06/24850, No. 03-04-06/24853 (clause 3), dated 08/19/2016 No. 03-03-06/1/48797, dated 07/24 .2017 No. 03-03-06/1/46887.

Accounting

For accounting purposes, severance pay, average earnings for the period of employment and compensation upon dismissal are labor costs (clauses 5 and 8 of PBU 10/99). Reflect the accrual of these payments by posting:

Debit 20 (23, 25, 26, 44...) Credit 70

– severance pay and compensation upon dismissal were accrued to employees;

Debit 20 (23, 25, 26, 44...) Credit 76

– the average salary for the period of employment was accrued to former employees.

The use of account 76 “Settlements with other debtors and creditors” for settlements with former employees is due to the fact that account 70 takes into account only settlements with personnel working in the organization at the time of payment accrual (Instructions for the chart of accounts).

An example of how severance pay is reflected in accounting for an employee dismissed during the liquidation of an organization

P.A. Bespalov works as a storekeeper at Alpha LLC. On January 13, he was fired due to the liquidation of the organization. When an employee is dismissed due to liquidation, the organization pays him severance pay in the amount of average monthly earnings.

Bespalov's average daily earnings is 484 rubles/day.

The severance pay was calculated for the first month after dismissal - from January 14 to February 13. In this period, according to Bespalov’s work schedule (five-day work week), there are 23 working days. The severance pay amounted to 11,132 rubles. (484 RUR/day × 23 days). Bespalov received it on the day of his dismissal, January 13.

The Alpha accountant made the following entries in accounting:

Debit 25 Credit 70 – 11,132 rub. – severance pay accrued;

Debit 70 Credit 50 – 11,132 rub. - severance pay was issued.