It is not always possible to put purchased equipment into operation immediately. As a rule, it needs installation. Such equipment is recorded on account 07. Separately, it is necessary to take into account equipment that cannot be put into operation immediately after receipt. Such fixed assets also require modification and installation, and equipping with auxiliary parts. Both units of equipment and complexes are considered similar operating systems. Let's consider all the nuances of accounting for objects that need installation.

Question: How to reflect in the accounting of a Russian organization the acquisition and import into the territory of the Russian Federation of equipment that requires installation for the purpose of use in production, as well as the installation of this equipment, if the equipment was purchased from a Kazakh seller, is imported from the territory of the Republic of Kazakhstan, the installation of the equipment is carried out a Kazakh contractor on the territory of the Russian Federation? The contractual cost of the equipment is 2,000,000 rubles, the cost of installation work is 200,000 rubles. (excluding VAT). Settlements with the seller and contractor are made after receipt of the equipment and completion of installation work, respectively. The Kazakh contractor is not registered with the tax authorities of the Russian Federation as a VAT payer and does not have a representative office in the Russian Federation. View answer

What is meant by equipment that needs to be installed?

What is meant by equipment that needs installation in accounting? This is a complex of depreciable objects that are prepared before they are put into use. The assets under consideration differ in the following characteristics:

- Long-term operation.

- Relatively high cost.

- An object can reduce or increase the material benefits that a firm receives.

- The facility cannot be operated without initial installation; it requires preparation of the foundation and installation of supports.

- Requires assembly of basic elements.

- The equipment needs settings and software installation.

The list of equipment under consideration includes production facilities and laboratory equipment.

Question: How to record the acquisition of production equipment that requires installation and its installation by auxiliary production? Equipment requiring installation (machine) was purchased under a sales contract at a price of RUB 960,000. (including VAT RUB 160,000). The cost of installing equipment is 50,000 rubles. The equipment is intended for use in production for a period exceeding 12 months. View answer

What exactly is the equipment that needs installation? The necessary list is contained in the Instructions for the chart of accounts, approved by Order of the Ministry of Finance No. 94n dated October 31, 2000. In particular, this is the following technique:

- Objects of industrial importance installed in constructed/reconstructed buildings.

- Objects put into use after their elements are assembled and attached to the foundation/floors. This category includes control and measuring equipment.

Question: How to record the purchase of production equipment that requires installation and its installation by a contractor? Equipment requiring installation (machine) was purchased under a sales contract at a price of RUB 960,000. (including VAT RUB 160,000). The contractual cost of installation of purchased equipment intended for use in production for a period exceeding 12 months is 60,000 rubles. (including VAT 10,000 rub.). Installation was performed by a third party (not the equipment supplier). For the purposes of tax accounting of income and expenses, the accrual method is used. View answer

What does not apply to equipment that needs installation

The equipment to be installed does not include the following objects:

- TS.

- Agricultural equipment.

- Construction equipment.

- Tools for production employees.

- Household type equipment.

- Autonomous machines.

That is, the listed objects are taken into account in the standard order. They do not fit on account 07 since they do not need to be installed first. Such objects are placed on account 08. They are recorded as they arrive at the warehouse.

Asset characteristics

Fixed assets, which include equipment for installation, are considered depreciable tangible assets, for which preparatory measures are carried out before direct operation. Such OSs have a number of specific properties:

- expected long-term use;

- high price;

- the ability to influence the amount of material benefit of the enterprise (after commissioning);

- impossibility of launching without installation, supply of communications, preparation of the foundation, supports or platform, assembly of main components, commissioning, configuration, programming, etc.

Assets can be technological, production, and equipment - laboratory, energy. The presented OS group does not include free-standing machines, household equipment, working tools, construction and agricultural equipment, and vehicles.

Features of accounting for costs of equipment that needs installation

For accounting, account 07 “Equipment for installation” is used. It is considered active. Based on the debit balance, you can understand whether there is equipment that needs installation at the beginning of the period. Debit turnover records the receipt of equipment that needs installation. The final balance reflects the availability of equipment that needs installation at the end of the reporting period.

FOR YOUR INFORMATION! Detailed accounting by account. 7 is carried out according to the storage location of the equipment and its name/brands.

Nuances of accounting for equipment that needs installation

OSes that require installation must be sent to a separate synthetic account. Objects will be held in a segregated account until they are ready for use. It is assumed that after installation the OS will be launched.

Equipment is recorded in accounting based on the total amount of expenses incurred for acquisition and preparation. In particular, these are the following expenses:

- Cost of equipment.

- Delivery of the object and its shipment.

- Adjustment and installation work.

- Storage of equipment until it is started.

- Installation of supports for equipment and foundations.

An enterprise can simultaneously purchase several objects that need installation. In this case, the total costs are distributed among the assets involved.

Installation is either carried out by company employees or outsourced. This activity may include the following work:

- Installation of the asset in the area where the launch will take place.

- Assembly of parts.

- Attaching control elements.

- Analysis of the performance of the object and its serviceability.

- Wiring insulation.

If the equipment was not launched on time, this is recorded in the reporting.

Installation costs are credited to the value of the asset on the basis of these papers: an act of work performed by the contractor, an accounting certificate. Help is needed when the installation was carried out by company employees. The next stage is checking the functionality of the equipment. After this, the equipment is put into operation. The asset becomes the OS.

Features of accepting equipment for accounting

Accounting for equipment that needs installation involves drawing up primary documentation. The primary report is compiled according to these forms:

- OS-14 (acceptance certificate).

- OS-15 (sending equipment for installation work).

- OS-16 (defect detection).

- OS-1 (accounting in OS status).

These forms are not required to be used. The company itself can approve the necessary forms of documents.

Acceptance of equipment for registration

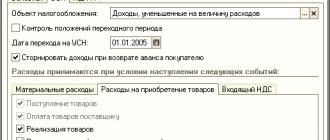

After acceptance is completed, registration must be carried out. For this purpose, there is a document “Acceptance for accounting of fixed assets”, available in the same section. After calling a new window to fill with the “Create” button, you must enter:

- "OS Event". The option of acceptance with or without commissioning is selected.

- Financially responsible person responsible for the equipment.

- “Location of OS” indicating the department in which installation was carried out.

Next, fill out the table part and its tabs. The “Non-current assets” tab indicates the type of transaction and the method of receipt of the purchase. Here the range of purchased equipment is selected from the directory.

Through the “Fixed Assets” tab, access is provided to the equipment card, which is entered in the directory of the same name. The card itself is mainly generated automatically based on documents entered by the user. It reflects the current and primary cost of equipment, the amount of depreciation, and reference data. The system takes information from the document, so when it changes, it is automatically reflected in the directory.

The “Accounting” tab allows you to reflect the methods for calculating depreciation and service life of equipment. The depreciation account is 02.01, and the equipment accounting account is 01.01.

The “Tax Accounting” tab is required to be filled out by enterprises paying income tax. The values are set as in the previous tab.

After posting the document, the system will create a set of transactions

They reflect the receipt of equipment to the account on 01.01.

Postings when purchasing equipment

When purchasing equipment that needs installation, you need to record it at the initial cost. It includes all costs associated with the purchase. When purchasing, these transactions are used:

- DT07 KT60. Supply of equipment requiring installation.

- DT19 KT60. VAT accounting for technology.

- DT07 KT60. Inclusion of delivery costs into the price of the object.

- DT19 KT60. Accounting for VAT on delivery.

Accounting must reflect the receipt of equipment as a contribution to the authorized capital. For this, the following posting is used: DT07 KT75/1 (capitalization of equipment in the assessment approved by the founders).

Equipment depreciation

Depreciation is calculated monthly based on the results of the “Month Closing”. Its calculation is carried out automatically by the system based on the initially entered accounting parameters. Calculation of depreciation begins from the next month after the acquisition of equipment.

“Closing the month” is carried out using a special assistant that simplifies the work.

After the operation is completed, you can access the details through the active link.

Direction of equipment for installation

The cost of equipment sent for installation is written off from the account. 07 in DT sch. 08. These postings are used:

- DT08 KT07. The equipment is aimed at installation work.

- DT08 KT60. The cost of the facility includes installation costs.

- DT19 KT60. VAT on installation.

The building can be erected by contract method. In this case, the customer can send the equipment for installation based on the transfer certificate. The object in this case will continue to be on the account. 07 (implies the customer's invoice). The contractor enters the equipment into off-balance sheet account 005. The cost of equipment sent for installation is withdrawn by the contractor from the off-balance sheet account. 005. The cost of the object sent to the contractor will not be deducted from the developer’s account. But this only applies to equipment whose installation has not begun.

Receipt of additional expenses

Access to the document is carried out through the “Receipt of OS” section. Moreover, filling out the header is no different from working with other receipt documents. In the “Main” tab, you need to indicate the service itself, its cost and the applicable VAT rate, as well as the method of distribution.

Data on purchased equipment is entered into the “Products” tab.

After posting the document, the system generates a set of accounting entries

It can be seen that additional expenses were included in the cost of the purchased machine.

Input VAT on equipment requiring installation

VAT on equipment requiring installation is deductible in full. But tax can be deducted only after it has been recorded in the account. 07. In this case, it is not necessary to put the OS into operation. There is a full refund of VAT on additional expenses.

VAT is deducted if these three conditions are met:

- The OS is used in work that is subject to VAT.

- There is an invoice drawn up in accordance with the law.

- The OS has been accepted for accounting.

NOTICE! When selling and transferring equipment free of charge, its cost is written off in DT account 91.

Moving Equipment

Any movement of equipment is carried out between departments with transfer from one responsible person to another. When moving, the user has the opportunity to make changes to the depreciation method used. In such a situation, you will need to provide certain details.

In general, the procedure is not very different from working with goods and should not raise questions for users.

Equipment inventory

The main purpose of inventory is to determine surpluses or shortages. In the process of filling out the document, it is necessary to reflect the position of the equipment and the person in charge. Then, using the “Fill” button, you can enter basic information automatically.

Based on the results, all that remains is to write off or accept the equipment (surplus/shortage).

The concept of acceptance in accounting

The concept of acceptance, based on the above definition in the Civil Code of the Russian Federation, is applicable to an offer. In turn, an invoice for payment can be considered as an offer in which the seller (supplier) offers the buyer to purchase a certain product or service for a certain amount. According to Art. 435 of the Civil Code of the Russian Federation, an offer is recognized as a specific proposal sent to addressees (one or more), which fully expresses the intention of the person who sent it to enter into a contractual relationship with the addressee. In the case of acceptance of an invoice, such an action is its full or partial payment. Thus, in order to reflect the acceptance of the invoice, it is necessary to reflect the entries for the accrual of debt, the accrual of VAT, if necessary, and the payment made on this invoice.

Certificate of acceptance and transfer of equipment: correct execution of the document

The price of the contract, according to paragraph 2 of Article 709 of the Civil Code of the Russian Federation, includes compensation for the contractor’s costs and the remuneration due to him. It can be determined by drawing up an estimate. Thus, the contract may stipulate that the equipment, the cost of which will subsequently be compensated by the customer, is purchased by the contractor. Reflection of transactions in the accounting of the contracting organization, the costs of purchasing equipment that requires installation, the cost of which is included in the estimate, are recognized as part of material costs (subclause

4 paragraphs 1 art. 254 of the Tax Code of the Russian Federation).

Transfer of equipment for installation: wiring

If the object is a contribution to the authorized capital, it is registered with the posting “Dt 07 - Kt 75”. The posting “Debit 07 - Credit 70, 71, 76” accompanies the reflection of other costs associated with the receipt of this object by the organization (transportation, storage, etc.). Depending on the situation, account 15 can be used in a manner similar to the rules applied when accounting for materials. Transfer of equipment for installation - posting “Credit 07 - Debit 08-3”. If a corresponding accounting object has been delivered to the construction site, the contractor must include its indicators in off-balance sheet accounting in account 005. After commissioning for installation, the object is removed from the specified off-balance sheet account. Until the installation of equipment by the contractor begins, its cost continues to be registered with the developer. Completion of installation is documented by posting “Debit 03 – Credit 08-3”, which means accounting for the object as an independent fixed asset.

Results

Settlements with suppliers involve the use of account 60 with the opening of sub-accounts for it, provided for by the working chart of accounts of an economic entity. In addition to account 60, account 76 may also be involved in such operations. Payments to suppliers are reflected in the debit of these accounts. The choice of the account corresponding to the loan will depend on how the payment was made: non-cash (from a current, foreign currency or specialized bank account) or in cash.

Posting - transferred from the current account to suppliers

Purchasing raw materials, materials, goods, fixed assets, intangible assets, works, services by transferring non-cash funds is a simple process. This usually happens in several stages:

- A supply agreement (performance of work, provision of services) is concluded between economic entities.

- The supplier issues an invoice for payment for materials (work, services).

- The buyer transfers in whole or in part - according to the terms of the contract - the amount indicated in the invoice.

- The shipment is made to the buyer's address.

The stages may vary: someone does without a contract, while all the conditions are written down in the invoice; valuables (work, services) can be paid after their shipment (fulfillment, provision).

The following entries appear in the accounting:

- Dt 60.2 Kt 51 - based on the payment order and bank statement, the transfer of funds to the supplier is reflected on account of the future supply of materials (works, services).

- Dt 08, 10, 20, 25, 41... Kt 60.1 - valuables, works, services are capitalized on the basis of transfer documents (invoices, acts, etc.) Valuables can be delivered directly by the supplier to the buyer, sent through a freight forwarding company, or the buyer picks them up by proxy.

- Dt 19 Kt 60.1 - VAT is reflected if it is highlighted in the supplier’s invoice.

- Dt 60.1 Kt 60.2 - the transferred advance payment is counted against received valuables, works, services.

If payment occurs after shipment, then the last entry in accounting is not made, and account 60.1 will correspond with account 51.

Task: prepare accounting entries

Hello, please help. Did I make the entries and calculations correctly? Thank you. Suppliers' invoices for material assets received at the warehouses of Vector LLC were accepted: A) purchase price, including TZR 200,000 10 60 B) VAT Total: 236,000 2 Equipment for the workshop under construction was handed over for installation 150,000 08 07 3 Contractor's invoice for completed construction work was accepted installation work on the construction of the workshop building: A) cost of construction and installation works without VAT B) VAT 28800 19-1 60 Total: 188800 4 Obsolete equipment (fixed asset item) written off: A) original cost 100,000 01-1 01 B) amount of accrued depreciation written off on the date of write-off 97500 02 01-1 C) the residual value is written off 2500 91-2 01-1 D) the cost of capitalized spare parts and scrap from dismantled equipment 1500 10 91-1 5 The invoice of a specialized installation organization was accepted for work accepted according to the act on the installation of production equipment : A) cost of installation services provided 50000 08-4 60 B) VAT 9000 19-1 60 Total: 59000 6 Completed fixed assets were accepted into operation: A) workshop building (transferred for state registration) - 4 B) production equipment Total: 1000000 7 Material assets were released from the warehouse and spent: A) for the manufacture of products B) for the repair of fixed assets, maintenance and operation of equipment and the economic needs of workshops C) for the repair and maintenance of fixed assets for general economic purposes D) for packaging of sold products 5000 43 10 Total: 220000 8 Accrued depreciation of fixed assets: A) production equipment, buildings and workshops B) buildings, general household equipment Total: 137500 9 Accrued depreciation on intangible assets used for general production needs 10 Accepted invoices from suppliers and third parties: A) for current repairs of the office building B) for utilities consumed by workshops C) for utilities and communication services of general business units D) for information and consulting services 7500 26 76 E) VAT on repair work and consumed services Total: 11 Cash received from the current account funds to the cash desk for the payment of wages, travel, business expenses 12 Paid from the organization's cash desk: A) wages, temporary disability benefits 127500 70 50 B) issued on account for travel and business expenses 6250 71 50 Total: 133750 13 Cash received to the organization's current account: A) from the buyer for sold products B) to pay off accounts receivable for a recognized claim 5000 51 76 Total: 1055000 14 Paid from the organization's current account: A) invoices of suppliers and contractors B) personal income tax C) UST contributions to the pension fund, social insurance fund, compulsory health insurance fund. D) alimony withheld under writs of execution 1525 76 51 Total: 724475 15 Wages and temporary disability benefits accrued to the organization’s personnel: A) workers for the manufacture of products B) workers and employees for maintenance and management of workshops 40000 25 70 C) managers, specialists and employees for managing the organization D) benefits for temporary disability 5000 69 70 Total: 177500 16 From accrued wages and other payments the following were withheld: A) personal income tax B) on writs of execution (alimony) 3300 70 76 Total: 24600 17 UST accruals, contributions to compulsory pension insurance, accident insurance were made: A) from the wages of workers of the main production workshop 43312 20 69 B) from the wages of workers engaged in servicing workshops 15400 25 69 C) from the wages of management personnel 9048 26 69 Total : 67760 18 The amount of VAT on purchased and paid valuables, work performed, services rendered is classified as a tax deduction 72000 68 19-1 19 Expenses for business trips of the enterprise management apparatus are reflected according to approved advance reports, including in excess of the norm of 1450 rubles. 5250 26 71 Permanent tax liability for the amount of excess expenses 348 99 68.3 20 Overhead expenses were written off A) general production expenses of workshops B) general business expenses of the organization 21 Finished products were capitalized in the warehouse at actual cost (the balance of work in progress at the end of the year amounted to 100,355 rubles) 22 Finished products were shipped products to customers in accordance with contracts: A) actual cost of products sold 835000 90-2 43 B) at the cost sold, according to settlement documents 1220400 62 90-1 C) for the amount of VAT due to the budget 21600 90-3 76 23 Written off expenses for sales of products 5000 90 44 24 Determine and write off the financial result from the sale of products 358800 90-9 99 25 Accrued reserve for doubtful debts 15000 91.2 63 26 Accrued property tax of the organization for the 4th quarter 8000 91.2 68 27 Write off to other financial results income and expenses 24000 99 91.9 28 A conditional income tax expense was accrued according to accounting data for the 4th quarter. 29 Unpaid wages-4 were deposited 30 Cash in excess of the established limit was deposited from the cash register into the current account 31 According to the minutes of the meeting of founders from retained earnings of previous years: A) reserve capital was formed B) dividends were accrued 32 Deferred tax assets were accrued 7000 09 68 33 Deferred tax liabilities were accrued 4000 68 77 34 The net profit of the reporting year was written off. The allocated amounts had to be determined.

Other transactions - the supplier’s invoice for materials, work, services has been paid

The current account, the transactions with which we examined in the previous section, is most often used in settlements between economic entities. However, payment can be made not only from it; there are other ways to make it. Account correspondence can take the following form:

- Dt 60 Kt 50 - paid to the supplier in cash; the supplier's cash receipt must be attached to the receipt documents if he is required to use a cash register.

- Dt 60 Kt 52, 55 - if payment is made by bank transfer from a foreign currency or specialized account in a banking institution.