The deadline for submitting the Calculation of Insurance Premiums for the 1st quarter is expiring soon - in 2021, you must submit the form before May 3 inclusive . In this material we will pay attention to how to reflect last year’s social insurance expenses, which were reimbursed in the 1st quarter of this year.

The problem is that, due to the expenses mentioned above, the indicator for line 090 of Appendix 2 to Section 1 does not reflect the actual state of calculations for social insurance contributions. Let's look at why this happens and what to do.

Procedure for payment of benefits

According to the rules in force today, sick leave and maternity benefits are paid in one of two ways:

- At the expense of the employer with subsequent reimbursement. This method is used in all regions, with the exception of participants in the FSS pilot project (point 2).

- Directly from the fund. We are talking about the “Direct Payments” project, which is carried out in some regions of Russia (Resolution of the Government of the Russian Federation dated April 21, 2011 No. 294).

Everything said below applies only to payers of insurance funds from point No. 1.

At the end of the month, the policyholder determines the amounts:

- accrued insurance premiums;

- benefits paid.

If more contributions are accrued than benefits paid, the difference is transferred to the Social Insurance Fund. If on the contrary, that is, the difference between contributions and benefits turns out to be a minus sign, then it is counted against future payments or returned from the Fund to the policyholder.

Exceptions to this procedure are provided only for benefits for the first 3 days of sick leave.

Calculation sample

We will show you how to fill out the DAM if there was a refund from the Social Insurance Fund, using the example of a report for the 3rd quarter of 2021. Let’s say an organization employs 15 people, and they were paid monthly remuneration totaling 300,000 rubles. In August, disability benefits were paid in the amount of 40,000 rubles, and in September - 60,000 rubles. In addition, sickness benefits in the amount of 100,000 rubles were paid for six months. In July, the company received compensation from the Social Insurance Fund for benefits for 6 months of 2021 in the amount of RUB 24,600.

Look where the RSV reimbursement from the Social Insurance Fund is reflected in the report for tax authorities for the 3rd quarter of 2021:

How benefits are reflected in the RSV

When filling out the DAM form, benefits should be reflected in Appendix 2 to Section 1 :

- line 080 reflects the amount of compensation received by the policyholder from the Fund;

- on line 090 - the difference between the amount of benefits paid to insured persons and the amount of accrued contributions.

The Tax Service explained exactly how the amount of contributions is reflected in line 090 in a letter dated 08/23/17 No. BS-4-11 / [email protected] The calculation is made using the following formula (indicators are taken from the corresponding lines of Appendix 2 to Section 1):

Amount in line 090 = Line 060 - Line 070 + Line 080

The result is interpreted as follows:

- If it is positive , it means that the policyholder has a debt. In the column “Total from the beginning of the billing period” of line 090 the calculated value is indicated, and in the column “Characteristic” - 1.

- If the result is negative , then the Fund is in debt. In the column “Total since the beginning of the billing period” the value without the “-” sign , and in the column “Sign” - 2.

How to fill out line 090 in the calculation of insurance premiums

Line 090 in the calculation of insurance premiums is present in several sections of this document and in a number of appendices to them. Let's look at the features of entering data into this line.

Where in the 2018 report on contributions there is line 090

Algorithms for filling out line 090 of the calculation of contributions

Sample of filling out line 090 for Appendix 2 to Section 1

Results

Where in the 2018 report on contributions there is line 090

The form for calculating insurance premiums, valid for 2021, was approved by order of the Federal Tax Service of Russia dated October 10, 2016 No. ММВ-7-11/ [email protected] Its form involves dividing the report into three sections, of which for ordinary employers sections 1 and 3 are required to be completed Section 2 is intended to be completed in relation to members of peasant farms.

The calculation of insurance premiums for 2021 contains line 090 in sections 1 and 3, as well as in appendices 2–4 and 10 to section 1 and appendix 1 to section 2.

The very fact of the presence of this line and the content of the information reflected in it depend on the amount of data entered into the corresponding structural unit of the report, since all information included in a section or annex must be reflected in lines sequentially numbered.

For this reason, the content of line 090 is quite variable:

- in section 1, devoted to summary information on the amounts accrued for the period payable, it shows the amount of contributions for additional social security;

- in Appendix 2 to Section 1 it will reflect the result of reducing the accrued amounts of contributions by the amount of expenses incurred for the payment of insurance coverage;

- in Appendix 3 to Section 1 it will contain data on payments of social benefits for funerals (number of recipients, number of benefits and their total amount);

- in Appendix 4 to Section 1, line 090 will show the number of recipients, data on the duration of paid periods and the amount of additional maternity benefits for persons injured in the accident at the Mayak association;

- in Appendix 10 to Section 1, intended for information related to students whose income may be taxed at a reduced rate, it is supposed to reflect the date of the certificate confirming the fact of full-time study;

- in Appendix 1 to Section 2, this line should show information on the amount of contributions accrued to the member of the peasant farm;

- in Section 3, it provides the name of the individual who received the income from the reporting employer.

Thus, the data that falls into line 090 will vary significantly in structure (they reflect not only the amount or quantity, but also information indicated by letters, as well as dates).

Algorithms for filling out line 090 of the calculation of contributions

The variety of types of information entered predetermines the use of several algorithms for filling out line 090 of the calculation of insurance premiums. These algorithms can be divided into three main groups:

- The data is entered into the line in the required form in the required values. This applies to reference information, such as information on benefits paid (Appendices 3 and 4 to Section 1), data by date (Appendix 10 to Section 1) or name (Section 3) or the amounts of individually assessed fixed contributions (Appendix 1 to Section 2) .

- The information is entered in conjunction with the transcript given in other lines of the same structural unit of the report. This applies to the data shown in section 1, where the amount reflected on line 090 corresponds to accruals for the last quarter and is reported monthly in lines 091–093.

- The information entered into the line requires preliminary mathematical processing and compliance with certain rules when filling out the fields provided in the line. Adhering to such requirements, fill out line 090 in Appendix 2 to Section 1.

Of the described algorithms, the last one is the most difficult, since its use requires filling out five groups of fields simultaneously, which are a combination of data about the amount and its attribute, but at the same time tied to one line of the report.

Each of these groups is intended for very specific information, but the procedure for filling out the calculation given in order No. MMV-7-11 / [email protected] does not contain any clarification of this purpose, giving a specific description of only two options for the value of the attribute indicating that whose benefit (the fund or the payer) the result of the calculations was formed.

Subscribe to our accounting channel Yandex.Zen

Subscribe

But how can you navigate the purpose of each of the five groups of row fields? There are rules for this too, but they are contained in the report itself.

Sample of filling out line 090 for Appendix 2 to Section 1

The data on line 090 in Appendix 2 to Section 1 should reflect the result of accrual of contributions payable or refundable from the fund in the following breakdown (clause 11.15 of Appendix No. 2 to Order No. ММВ-7-11 / [email protected] ):

- monthly for the last quarter of the reporting period;

- for the last quarter of the reporting period as a whole;

- cumulative total since the beginning of the year.

The fields provided in the report form for entering this information are located in three lines: the top (with two groups of fields), the middle (also with two groups of fields) and the bottom (with one group of fields).

The exact order in which the necessary data should be shown is indicated by the information provided in the report form above the fields of line 090, as well as in the footnotes marked with asterisks. Reading them together allows you to understand that you need to use the fields that fall on line 090 as follows:

- in the top line of the field groups on the left will display data on the results of accruals on an accrual basis from the beginning of the year, and on the right - the total amount of accruals made for the last quarter;

- the middle line of the field groups will show the accrual amounts for the first month of the last quarter of the period (on the left) and the second month (on the right);

- The bottom line will include the amount of accruals for the third month of the last quarter.

Each of the amounts will be accompanied by an attribute mark, from which it is clear in whose favor the result of comparing the contributions accrued for the period and the expenses incurred to pay these contributions is formed.

A sample of filling out line 090 of the calculation of insurance premiums in Appendix 2 to Section 1 for 9 months of 2021 may be as follows if, for example, in the second month of the 3rd quarter the maternity benefit calculated from the minimum wage was paid:

2 31 320,00 2 40 940,00

1 3770,00 2 48 190,00

1 3480,00

Results

Line 090 in the calculation of insurance premiums is present in several structural units of this report. Depending on its specific location, it is intended for different information. This information can be text data, dates, quantities or amounts. The greatest difficulty is filling out line 090 in Appendix 2 to Section 1.

Source: https://nalog-nalog.ru/strahovye_vznosy_2017/edinyj_raschet_po_strahovym_vznosam/kak-zapolnit-stroku-090-v-raschete-po-strahovym-vznosam/

Discrepancies

As a result, it turns out that line 090 reflects a balance that does not correspond to the accounting data. Because of this, accountants have doubts about whether they filled out the above DAM lines correctly.

In fact, a discrepancy does not mean there is an error at all. It arises due to the specifics of the DAM form - it does not contain cells in which the incoming and outgoing balances should be reflected. Therefore, the amount by which benefits paid in 2021 exceed the amount of contributions is not reflected in the DAM for the 1st quarter of 2021. Accordingly, if in the 1st quarter a refund was received from the Social Insurance Fund, then from the calculation it will not be clear that it compensates for the difference between benefits and contributions for the previous year.

Let's explain with an example. In 2021, the positive difference between benefits paid and assessed contributions amounted to 25 thousand rubles. It is reflected like this:

- In the DAM for 2017, line 090 of Appendix 2 to Section 1 indicates the amount of 25 thousand rubles with attribute 2.

- In accounting, in the debit of account 69, the subaccount “Social Insurance Settlements” at the end of the year there remains a balance of 25 thousand rubles.

In the 1st quarter of 2021, the company did not charge contributions or pay benefits, but received compensation for last year’s expenses from the Social Insurance Fund in the amount of 25 thousand rubles. The reflection is like this:

- In the DAM for the 1st quarter of 2021: on line 080 of Appendix 2 to Section 1 - the amount is 25 thousand rubles;

- on line 090 of Appendix 2 to Section 1 - the amount is 25 thousand rubles with sign 1.

Conclusions: according to accounting data, there is a zero balance, and the DAM form indicates that the policyholder owes 25 thousand rubles. However, all data is correct.

What kind of payment is this and where is it submitted?

Employers who make payments to employees pay insurance premiums from them for:

- compulsory pension insurance;

- compulsory health insurance;

- social insurance in case of disability and in connection with maternity.

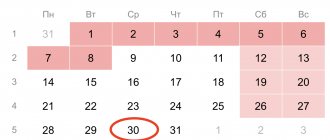

The rules for their calculation and payment are established by Chapter 34 of the Tax Code of the Russian Federation. Employers are required to submit calculations of insurance premiums to the tax office on a quarterly basis no later than the 30th day of the month following the reporting quarter. The report form is established by Order of the Federal Tax Service No. ММВ-7-11/ dated 10.10.2016.

Please note: as of January 1, 2019, a new rule comes into force according to which organizations employing more than 10 people are required to report electronically. Amendments to Art. 431 of the Tax Code of the Russian Federation was introduced by Federal Law No. 325-FZ of September 29, 2019. And the calculations based on the results of the current year will have to be submitted according to the updated requirements. Currently, employers who make payments to 25 or more employees report online.

Calculation form

How to check

If you have doubts about the correctness of filling out the DAM, it is recommended to reconcile the calculations with the budget . This is the most reliable method that will give a 100% guarantee that there will be no errors.

You can also check the balance of social insurance settlements using a calculation certificate (Appendix 1 to the letter of the Federal Social Insurance Fund of Russia dated December 7, 2016 No. 02-09-11/04-03-27029). Such a certificate, along with other documents, is submitted to the Fund by those policyholders who want to receive compensation.

The document contains fields that reflect the debts owed by the policyholder and the Fund at the beginning and end of the reporting period. Thus, the mentioned calculation certificate reflects the real state of settlements with the Social Insurance Fund.

In conclusion, let us mention that when checking, inspectors are not guided by the contents of line 090 of Appendix 2 to Section 1. The document from which they receive data on mutual settlements is the Budget Payment Card . Reconciliation of the policyholder is carried out precisely on the basis of this card, and not at all according to data from the DAM.

How to fill out an interim FSS report

Before drawing up a report, make sure that the amount of payments exceeds the amount of accrued contributions and there are documents confirming the expenses. Fill out the interim report on the 4-FSS form approved by the fund. The report is no different from the quarterly one, but there are a number of features:

- the report is compiled as needed and therefore does not have a set date for submission;

- in the “reporting period” column of the title page, fill in the cells after the fraction, which indicate the number of the interim report, for example, an organization submits such a report for the second time, which means the period code is “02”;

- tabular values are filled in for the first or first and second months of the quarter, while the report is presented for the period from January to the month of payment of employee benefits;

- Documents are attached to the interim report: an application to the Social Insurance Fund for reimbursement, copies of documents confirming expenses (sick leave, birth certificate, etc.).

Reimbursement period for FSS expenses

The policyholder can submit an application at any time. The period for consideration of the application by Social Insurance specialists is limited. The Fund is given 10 calendar days to transfer funds from the date of submission of the full set of documents (Part 3, Article 4.6 of Law No. 255-FZ of December 29, 2006). However, the FSS can make a decision faster.

The period may be extended if the Foundation’s specialists decide to conduct a desk or on-site inspection. In these cases, a decision must be made after summing up the results of the inspection (Part 4, Article 4.6 of the Federal Law of December 29, 2006 No. 255-FZ). In this case, the duration of the inspection should not exceed 3 and 2 months, respectively (Part 1, Article 4.7 of the Law of December 29, 2006 No. 255-FZ, Clause 2 of Article 26.15, Clause 9 of Article 26.16 of the Law of July 24, 1998 No. 125-FZ Federal Law).