The time sheet is intended for entering information about the time actually worked by employees of organizations. It must be said that the time sheet form is not strictly mandatory - in principle, it can be arbitrary, that is, each enterprise is free to use its own time sheet form if such a need arises. However, the form was developed and recommended for use by the State Statistics Committee of the Russian Federation and is preferable.

- Form and sample

- Free download

- Online viewing

- Expert tested

FILES

Unified forms of accounting sheets

The Labor Code of the Russian Federation (Article 91) establishes the employer’s obligation to keep records of the time worked by employees. For this purpose, unified forms of time sheets are provided, approved by Resolution of the State Statistics Committee of January 5, 2004 No. 1. The use of these forms is not mandatory, therefore the employer has the right to develop his own. Form No. T-13 is used most often, as it is used for automated processing of credentials.

Order of the Ministry of Finance of the Russian Federation dated March 30, 2015 No. 52n approved the OKUD form 0504421 for use by public authorities (state bodies), local government bodies, management bodies of state extra-budgetary funds, state (municipal) institutions. The same Order defines the procedure for its completion and application.

How to record time worked

For any length of the working day, regardless of the established modes, working time is reflected in the accounting table in two ways:

- method of continuous registration of attendance and absence from work;

- by recording only deviations (no-shows, overtime, etc.).

If the length of the working day (shift) is unchanged, it is allowed to register only deviations, since the terms of the employment contract or internal labor regulations determine the number of working hours for each working day.

If the number of hours worked on different days (shifts) is different, for example, when recording total time worked, then when filling out a time sheet, the continuous recording method should be used. This will allow, after the end of the accounting period, to identify possible overtime hours and adjust the employee’s further involvement in work within the limits of the norm for the length of time worked established for this category.

Notes on the working time sheet about the reasons for absence from work, part-time work or beyond its normal duration at the initiative of the employee or employer, shortened working hours, etc. are made on the basis of documents executed properly (certificate of incapacity for work, certificate of performance of state or public duties, a written warning about downtime, an application for part-time work, the employee’s written consent to work overtime in cases established by law, etc.).

Instructions for filling

The timesheet in question can be filled out in one of two ways:

- continuous - every day attendance, absence, number of working hours, etc. are entered;

- for deviations - data is entered only in cases where an employee is late, does not show up for work, etc.

Information about the reasons for absences, overtime, or incomplete work of a shift can be entered into the timesheet on the basis of third-party documents - sick leave, written consent to overtime, certificate of completion of public works, etc.

The first method is used much more often, since many companies fill out time sheets automatically every day, using form No. T-13 and computer programs that are part of the infrastructure of personnel access control systems to the enterprise. In small organizations, they will still fill out form No. T-12 using a regular ballpoint pen or PC programs like Word.

In any case, the principle of filling out the timesheet is the same. We will consider each step separately.

Step 1. Title page

The first page of the report card is filled out in the following order:

1. In the top field, enter the full name of the company or the full name of an individual entrepreneur (IP). If the organization is large and several timesheets are maintained, you will also need to indicate the name of the department (structural unit) - sales department, marketing department, production department, etc.

2. The next column indicates the OKPO code, which is an all-Russian indicator of enterprises and organizations. It is contained in Rosstat databases. Consists of 8 digits for legal entities and 10 digits for individual entrepreneurs.

3. The first plate of two cells indicates the document number (determined in order) and the date of its preparation (as a rule, the last day of the reporting month is entered). 4. The title page is completed by indicating the reporting period. The time sheet is made for a month, so the reporting period lasts from the first to the last day of the month.

Step 2. Employee information

The main table begins to fill.

In it, each employee is given a separate line. The first three cells contain the following data: 1. Number of the employee in order.

2. Last name and initials of the employee, as well as his position:

3. Personnel number, which is assigned to each employee for the entire period of work in the company and is used in all internal documentation (as a rule, it is transferred to another employee only a few years after the dismissal of the employee who previously worked):

Step 3. Data on attendance, no-show, number of hours

The entry is made in two lines:

- the first indicates attendance/non-appearance;

- the second indicates the number of hours.

Each column is assigned a specific number, and to record data on employee attendance/absence, conventional abbreviations are used, for example:

- I am turnout;

- On a weekend;

- K – business trip;

- From – vacation.

As a rule, few such symbols are used. As a rule, absences are classified according to the presence/absence of a valid reason. Different types of vacations, sick leave, etc. may be indicated.

Step 4. Total number of hours and days for the month

These data are given for half a month and for a month:

1. In the fifth column, enter the number of working days and hours for each half month:

2. In the sixth column the same data is entered, but for a month:

Step 5. Payroll data

To indicate information that affects the calculation of wages, several columns are given:

1. The seventh column indicates the type of payment, which is also encrypted with a symbol and determines the type of cash payment (code “2000” is the standard salary, and “2012” is vacation pay) :

2. The following column contains the corresponding account - the accounting account from which funds are written off to make the specified type of payment (the account for writing off salaries, vacation pay, travel allowances and other payments can be single):

3. The ninth column contains the number of days or hours worked for each type of remuneration (in the top cell you can indicate days of attendance and business trips, and in the bottom cell - vacation pay and sick leave):

4. If during the month one type of remuneration (salary) was applied to all employees, then its code and account number can be entered at the top, and columns 7 and 8 can be left empty, indicating only the days or hours worked in column 9:

Step 6. Information about the reasons and time of no-show

The next few fields are reserved for indicating the reasons why the employee was not present at the workplace. For this purpose, conventions are again used. The reason may be vacation, business trip, etc. The number of days or hours is entered in a separate column. For example, an employee could be absent for 3 days due to a business trip, and 10 days due to vacation:

Step 7. Signatures

At the end of the month, responsible persons put their signatures next to the corresponding position. Must sign:

- the employee who keeps the time sheet;

- head of a structural unit;

- HR worker.

sample timesheet archived in .xls format (Microsoft Excel)

How to fill out a time sheet

When compiling, you must be guided by the Instructions for the use and completion of forms of primary accounting documentation for recording labor and its payment, approved by Resolution of the State Statistics Committee of Russia dated January 5, 2004 No. 1. Special designations are used. When reflecting the amount of time worked, an alphabetic (I) or numeric (01) code is entered next to the employee’s last name, and the duration of work is indicated in the lower lines. If the work schedule falls at night, then complete the form with columns to indicate the necessary details.

If an employee is sent on a business trip, then the time he is on a business trip is marked by putting down an alphabetic (K) or numeric (06) code, and the duration of work is indicated in the lower lines. If, while on a business trip, the employee also worked on weekends, then on such days an alphabetic (РВ) or numeric (03) code is entered, and the duration of work is indicated in the lower lines.

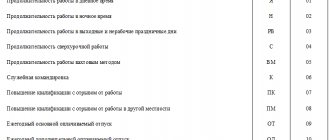

We collected in the table the designations in the timesheet in form 0504421 in 2021.

| Event | Letter code | Digital code | |

| Duration of work during the day | I | 01 | |

| Duration of work at night | N | 02 | |

| Duration of work on weekends and non-working holidays | RV | 03 | |

| Overtime duration | WITH | 04 | |

| Duration of work on a rotational basis | VM | 05 | |

| Business trip | TO | 06 | |

| Advanced training without work | PC | 07 | |

| Advanced training with a break from work in another area | PM | 08 | |

| Annual basic paid leave | FROM | 09 | |

| Annual additional paid leave | OD | 10 | |

| Additional leave in connection with training while maintaining average earnings for employees combining work with training | U | 11 | |

| Reduced working hours for on-the-job trainees with partial pay retention | UV | 12 | |

| Additional leave in connection with training without pay | UD | 13 | |

| Maternity leave (leave in connection with the adoption of a newborn child) | R | 14 | |

| Parental leave until the child reaches the age of three | coolant | 15 | |

| Unpaid leave granted to an employee with the permission of the employer | BEFORE | 16 | |

| Leave without pay under the conditions provided for by the current legislation of the Russian Federation | OZ | 17 | |

| Additional annual leave without pay | DB | 18 | |

| Temporary disability (except for cases provided for by code “T”) with the assignment of benefits in accordance with the law | B | 19 | |

| Temporary disability without benefits in cases provided for by law | T | 20 | |

| Reduced working hours versus normal working hours in cases provided for by law | Champions League | 21 | |

| Time of forced absence in the event of dismissal, transfer to another job or suspension from work being declared illegal, with reinstatement to the previous job | PV | 22 | |

| Absenteeism while performing state or public duties in accordance with the law | G | 23 | |

| Absenteeism (absence from the workplace without good reason for the time established by law) | ETC | 24 | |

| Duration of part-time work at the initiative of the employer in cases provided for by law | NS | 25 | |

| Weekends (weekly vacation) and non-working holidays | IN | 26 | |

| Additional days off (paid) | OB | 27 | |

| Additional days off (without pay) | NV | 28 | |

| Strike (under conditions and in the manner prescribed by law) | ZB | 29 | |

| Absences for unknown reasons (until the circumstances are clarified) | NN | 30 | |

| Downtime caused by the employer | RP | 31 | |

| Downtime due to reasons beyond the control of the employer and employee | NP | 32 | |

| Downtime due to employee fault | VP | 33 | |

| Suspension from work (preclusion from work) with payment (benefits) in accordance with the law | BUT | 34 | |

| Suspension from work (preclusion from work) for reasons provided for by law, without accrual of wages | NB | 35 | |

| Time of suspension of work in case of delay in payment of wages | NZ | 36 | |

Popular questions

When filling out a timesheet, a number of questions arise, the most popular of which are discussed below:

- Do I need to display a 1 hour reduction in working hours on a public holiday?

On the eve of holidays and non-working days, the working hours of full-time employees may be reduced by 1 hour. In this case, the work week can be either 5-day or 6-day. In any case, this reduction must be reflected in the time sheet, otherwise inspectors may insist that employees worked overtime on such days. - Why is there 2 cells for each day in the table?

It’s simple: the first cell indicates the symbol of the type of labor, and the second cell indicates the number of hours worked. The timekeeper may, at his discretion, use either an alphabetic or a numeric code. - How many times a month should I fill out a timesheet?

This must be done every day so that employee time recording is reliable. At the end of each month, the total number of hours worked by each employee is summed up. The time sheet signed by the responsible persons is transferred to the accounting department to calculate wages for the month worked. - Do I need to fill out a separate timesheet for the advance payment?

If the company provides for advances, to calculate their amount, the accountant must receive a timesheet for the first half of the month (from the 1st to the 15th inclusive). To do this, the HR department can give him the document on the 16th, and take it back on the 17th. There are other options: certify a copy of the advance payment slip, which will remain in the accounting department and will be filed for calculation; generate separate timesheets for the first and second half of the month, and then a consolidated one. The procedure for transferring the timesheet for advance payment must be recorded in the company’s internal documents. - Is it possible to make corrections to the timesheet?

In general, they are prohibited, but in some cases changes may be made to the document. For example, if an employee reported sick leave late or, while on vacation, got sick and brought sick leave after returning to work. All changes to the timesheet must be made on the basis of supporting documents received from the employee.

The report card in question is an act that contains information about each employee’s compliance with the work regime. To maintain it, you can use the forms recommended by the State Statistics Committee - No. T-12 or No. T-13. In any case, at the end of each reporting period, the completed document must be submitted to the accounting department to calculate salaries and various compensations provided for by the terms of the employment contract.

Weekends and holidays in the report card

They are reflected in accordance with the production calendar, which takes into account all established holidays and their transfers in accordance with Government Decrees. Days off for different categories of employees vary depending on the work schedule established for them. The document uses different holiday accounting codes. It depends on how the organization pays for these days and on what basis they are provided.

A day off in accordance with the employee’s schedule is indicated by a letter (B) or numeric (26) code. It does not affect the established wages.

If, at the initiative of the company, employees receive an additional day off, and the company reduces the monthly work rate for them, then the employees receive a full salary, and these days are not paid by the company. For such days, the timesheet contains an alphabetic (B) or numeric (26) code.

Another case of a company establishing an additional day off is when employees go on a day off, and the company pays for these days according to the average. It turns out that workers receive a salary for days worked, and an average salary for additional paid days off. For such a case, an alphabetic (OB) or numeric (27) code is provided.

Results

The Russian legislator has introduced forms for monitoring the presence of employees at work, adapted for employers of any form (including companies, both private and public). Employers who are not government agencies have the right to use any form of appropriate accounting documents. However, the T-12 uniform continues to be one of the most comfortable.

Sources:

- Resolution of the State Statistics Committee of the Russian Federation dated January 5, 2004 N 1

- Order of the Ministry of Finance of Russia dated March 30, 2015 N 52n

- Labor Code of the Russian Federation

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Storage period for time sheets

Such an accounting table is a personnel document relating to the organization of labor, for which Art. 22.1 of the Law on Archival Affairs establishes a special storage period, namely:

- five years from the end of the year in which it was compiled, if the time sheet took into account only the work of those employees who work under normal working conditions;

- 50 years from the date of drawing up the TURV, if it took into account the work of employees engaged in harmful or dangerous work.

Accounting and taxes

Based on the data indicated in the table, the accounting department calculates wages and various benefits. This data also affects the payment of taxes. Let's pay attention to the main risks.

When passing tax audits, including income tax, the company must provide reliable data on the number of days and hours worked by each employee in order to confirm the correctness of the accruals. If violations are discovered, the amount of income tax indicated in the reports will be recognized as incorrect, which will entail the imposition of penalties.

When withholding personal income tax from an employee’s earnings, the organization, as a tax agent, must find out whether this person is a tax resident of the Russian Federation in order to use the correct tax rate in the calculation. The report card will be able to confirm the actual presence of the employee in the country. This feature should especially be taken into account by those employers who send employees on business trips to Belarus or Kazakhstan, because when crossing these borders, no marks are made in the citizen’s passport. If a dispute arises, the company will be able to prove that it applied the correct rate, withheld and charged personal income tax in full.

Correctly filling out the timesheet guarantees the company the ability of the Social Insurance Fund to count expenses on sick leave, because it is impossible to officially confirm the number of days worked, which are extremely important when calculating these amounts.