What is Form T-12 (working time sheet)

Based on the T-12 form, introduced into document management practice by the State Statistics Committee in Resolution No. 1 dated January 5, 2004, a time sheet is generated, which is intended for use for the following purposes:

- keeping records of employee visits to their place of work in accordance with the established schedule;

- determining indicators for calculating employee salaries;

- generation of certain statistical data on personnel (for example, sent to Rosstat or research agencies).

It should be noted that the form in question must be filled out manually (on a PC using Word or a similar program, or printed out with a ballpoint pen). And the time sheet, intended to be filled out automatically when access control systems are activated, is compiled on the basis of another Goskomstat form - T-13. The selected form of time sheet for 2021 must be indicated in the accounting policy.

ConsultantPlus experts explained what sanctions are provided for errors in timesheets. Get trial access to the system and upgrade to the Ready Solution for free.

Read about what the T-13 form is in the article “Unified Form No. T-13 - Form and Sample” .

Answers to frequently asked questions

Question No. 1: Good afternoon! Please tell me how the days of conferences where the employee participated, as well as the days of other educational events, are indicated in the unified form No. T-12.

Answer: The fact is that the designation of such days is regulated by the internal regulatory documents of the organization and its position. As a rule, an organization can count these days as paid work, then the value “I” is entered here. An organization can also regard them as advanced training, then the meaning “PC” takes place. However, each organization may have a different rate of payment for these days.

Question No. 2: Good afternoon! I would like to know how to reflect overtime days on the T-12 report card? Is it possible to specify a work time of more than 8 hours with the “attendance” value?

Answer: Let's start by answering the second question - yes, it can. Now let's move on to the first question. There are two ways to reflect overtime hours: simply indicate the total amount of time worked, or indicate the value in the appropriate column through a fraction, for example, 8/3, where the generally accepted work time is indicated first, and then overtime. The second option is the most preferable, since it is immediately clear how many hours the employee worked overtime.

When is it expected to use the work time sheet form 0504421 according to OKUD

The work time sheet form corresponding to OKUD number 0504421 (T-12 has a very similar name to it, so sometimes confusion can arise when applying a particular document) was introduced into business circulation by the Ministry of Finance of the Russian Federation, which issued order No. 52n dated March 30, 2015. This document is used for the same purposes as T-12, but is subject to use in government agencies.

The time sheet corresponding to form 0504421 also has a fairly similar structure to form T-12. Therefore, for an employee of the HR department, as a rule, there is no problem adapting to a document approved by the Ministry of Finance if he is accustomed to using the form from Goskomstat, and vice versa.

Instructions for filling out form 1-T

Form 1-T, valid in 2021, was approved by Rosstat Order No. 485 dated August 6, 2018. Appendix No. 2 to the order provides instructions for filling it out.

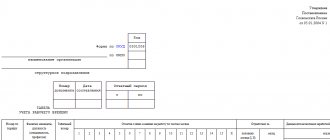

The form contains a title page and one table with information.

Title page

The title page is filled out similarly to other statistical forms.

Indicate in it the year for which you are reporting, the full and short name of the organization and postal address with zip code.

In the code part of the form, indicate the OKPI code based on the notification of its assignment.

Keep records of exports and imports in the Kontur.Accounting web service. Simple accounting, payroll and reporting in one service

Is the use of time sheets f. allowed in private companies? 0504421

The use of timesheets in form 0504421 is not prohibited for private companies. The fact is that from 01/01/2013, companies that are not directly required by law to use specific unified forms of primary sources are allowed to use any others. Therefore, a private company has the right to use, in order to monitor the time spent at work by hired employees, a time sheet on the form T-12, form 0504421, or another form developed independently. One way or another, the company must have such a document - due to the fact that, in accordance with the provisions of Art. 91 of the Labor Code of the Russian Federation, each employer must monitor the time spent at work by hired employees.

Read more about filling out the T-12 form in the material “Unified Form No. T-12 - Form and Sample” .

Filling principles

To indicate each action that is noted in the report card, encoding is provided in two versions - alphabetic and numeric . The organization can choose which of the options to use:

There are also two ways to maintain a timesheet:

- Complete entry of information. This means filling out the document every day for all employees. It is also noted that the employee showed up for work.

- Introducing deviations. In this case, by default it is assumed that all employees are at work, and the report card indicates only the deviation from the normal situation. That is, late, no-show, downtime. This option is suitable if working hours are taken into account cumulatively.

The timesheet must be maintained during the accounting period, that is, you need to make notes on it every day. And with the summarized accounting of working time - on the day when there is some deviation.

However, experts recommend entering data on working time into the timesheet in pencil or keeping it in draft form, and here’s why. For example, employee Ivanov did not show up today without warning. This should be noted on the schedule by entering the code NN (failure to appear for an unknown reason). But later he will most likely explain the reason for his absence. Accordingly, the code will need to be changed to something else. If you mark everything down at once, the document will have to be redone several times.

How are vacations indicated on the time sheet?

Unified forms for keeping records of employee visits at Russian enterprises T-12 and T-13 involve reflecting information about vacations using the codes given on the title page of form T-12.

These codes are presented in two varieties: alphabetic and digital. The use of both is equivalent. Moreover, the organization’s local regulations may also stipulate a certain mixed application option or involve the use of completely different codes. The employer also has the right to independently develop and use a report card form with symbols in it.

Let's see what designations apply to vacations.

Primary and additional leave

When an employee goes on regular paid leave, and the company uses the T-12 or T-13 form, the letter code OT or digital code 09 is recorded in the accounting table, which is given in the report card, for each day of the employee’s vacation.

If the rest is additional, then a different code is entered: OD (10).

Study and unpaid leave (administrative leave)

In the provisions of Art. 128 of the Labor Code of the Russian Federation, leave at the expense of the employee is divided into 2 types:

- provided by the employer voluntarily at the request of the employee - in this case, the DO code (16) is reflected in the timesheet;

- mandatory provided by the employer at the request of the employee - OZ code (17) is used.

Study leave also has 2 types according to labor legislation (Article 173 of the Labor Code of the Russian Federation):

- leave for study with preservation of earnings - reflected using code U (11);

- unpaid leave for passing entrance exams, sessions, state exams - is recorded in the report card using the UD code (13).

You can learn more about the legislative regulation of the provision of study leave in the article “Study leave under Article 173 of the Labor Code (nuances).”

Maternity and child care leave

Maternity leave provided in accordance with Art. 255 of the Labor Code of the Russian Federation, is reflected in the report card using code P (14). Child care leave provided under Art. 256 of the Labor Code of the Russian Federation, is fixed using the coolant code (15).

A scenario is possible in which an employee on maternity leave will work part-time. If this is so, then when recording her visits in the report card, the “double” code I (01) and OZH (15) will be used. These codes can be specified in one cell of the timesheet using the “/” symbol (for example, Я/Ож or 01/15), or you can add an additional line to the timesheet form.

Theoretically, there can be three codes in one cell. For example, if an employee agreed to go on a business trip and worked a day off there. In this case, the table will write: K/RV/Coolant (06/03/15).

Help for the economist: the procedure for filling out Form 12 “labor report”

Who should submit the report?

According to Instructions No. 163, the following commercial organizations are required to submit a report:

– legal entities with an average number of employees per calendar year of more than 100 people, their separate divisions with a separate balance sheet;

– small organizations with an average number of employees per calendar year of 16–100 people, subordinate to state bodies, as well as organizations whose shares are state-owned and transferred to the management of state bodies; their separate divisions with a separate balance sheet.

Document:

Instructions for filling out the state statistical reporting form 12 “Labor Report”, approved by Belstat Resolution No. 163 of August 19, 2013 (hereinafter referred to as Instructions No. 163).

What is the deadline for submitting the report?

The report is monthly and is submitted to the state statistics body in the form of an electronic document or on paper (by mail or courier).

The deadline for submitting the report is the 12th day after the reporting period.

If the last day of the deadline for submitting a report falls on a Saturday, Sunday, public holidays and public holidays (non-working days), then the end of this period is considered the next working day.

For reference:

the report is considered unsubmitted if there is no signature of the person responsible for its preparation and presentation.

Report writing rules

Legal entities, their separate divisions that have a separate balance sheet, draw up a report, including data on the divisions included in their structure that do not have a separate balance sheet, located on the same territory as them

(regional district, city of regional subordination, Minsk).

Legal entities, their separate divisions that have a separate balance sheet, the structure of which includes divisions that do not have a separate balance sheet and are located in another territory

(regional district, city of regional subordination, Minsk), prepare a separate report for all structural divisions that do not have a separate balance sheet and are located within the same territory. At the same time, in the details “Information about the respondent”, in the line “Territory of location of the structural unit”, the actual location of these units is indicated (name of the district, city of regional subordination, Minsk).

For reference:

data on separate divisions located outside the territory of the Republic of Belarus are not reflected in the report.

What documents are needed to fill out the report?

The report is compiled based on:

– orders (instructions) of the employer (for example, on hiring, on dismissal, on granting labor and social leave, on disciplinary action, etc.);

– timesheets or other documents recording the use of employees’ working time;

– payroll statements;

– certificates of incapacity for work and certificates of temporary incapacity for work;

– other primary accounting and other documents.

How are report sections completed?

The report consists of 5 sections, which are filled out in accordance with Instructions No. 163. In this case, you should be guided by the Labor Instructions.

The procedure for filling out section. I “Number of employees, wages and hours worked”

Section I of the labor report consists of 2 tables.

In table 1 reflects the following indicators:

• page 01

– average number of employees,

which is determined based on the number of employees on the payroll (excluding external part-time workers and citizens who performed work under civil contracts).

The average number of employees does not include employees on maternity leave or childcare leave until the child reaches the age of 3 years; those who did not show up for work, whose absences were documented by certificates of incapacity for work or certificates of temporary incapacity for work; those on leave without pay, except for those on leave provided at the initiative of the employer, etc. (subclause 10.1, clause 10 of the Labor Instructions);

Important!

Persons

hired

on a part-time basis or

transferred at the employee’s written request

to work on a part-time basis

are reflected in proportion to the time worked

(subclause 10.4, clause 10 of the Labor Instructions).

Persons transferred to work on a part-time basis at the initiative of the employer

, in the average number of employees are reflected

as whole units

(subclause 10.5, clause 10 of the Labor Instructions).

• employee wage fund:

– page 02

– payroll;

– page 03

– external part-time workers;

– page 04

– unlisted personnel, including citizens who performed work under civil contracts.

The composition of payments included in the wage fund is reflected in paragraphs. 48–50 Instructions for work.

The following features must be taken into account:

– accrued and reserved premium amounts are reflected in the fund as they are actually paid;

– amounts accrued for labor and social leave are included in the wage fund of the reporting month only in the amount attributable to the vacation days of the reporting month. Amounts due for vacation days in the next month are included in the next month's payroll;

– bonuses, compensation for unused labor leave, financial assistance and other payments to employees on maternity leave, to care for a child under 3 years of age and not included in the average payroll, are not reflected in the wage fund;

• page 05

– average monthly salary;

• page 06

– number of man-hours worked. Data is reflected on all man-hours actually worked by employees, including overtime and worked on public holidays, non-working holidays and weekends, both for the main job and for part-time work in the same organization, including hours of work on business trips (except for man-hours , worked by external part-time workers and citizens who performed work under civil contracts);

Important!

Also, page 06 reflects the man-hours worked by employees on the payroll both under the main employment contract and under a contract for part-time work or a civil contract in the same legal entity.

• page 07

– the size of the 1st category tariff rate actually established in the organization for all personnel.

For reference:

the indicators

“number of man-hours worked”

and

“size of the 1st category tariff rate”

are filled out in reports for January - March, January - June, January - September, January - December.

If an organization has several tariff rates of the 1st category, the weighted average tariff rate of the 1st category for the organization as a whole is reflected. To calculate the weighted average tariff rate of the 1st category, the average number of employees is used.

In table 1 of the report, all of the above indicators, with the exception of the size of the tariff rate, are filled in according to the columns for the last month of the reporting period, for the reporting period and for similar periods of the previous year, the size of the 1st category tariff rate - for the last month of the reporting period.

Table 2 of the report contains background information.

Data on pages 11–12, 16–18

– indicators from table.

2 “Reference information” are filled out in the report for January – December. Line 15

– indicator “Debt on loans and wages as of the 1st day of the month following the reporting period.”

The procedure for filling out section. II “The average number of employees on the payroll for the period, the average number of citizens who performed work under civil contracts, and external part-time workers”

In table 3 reports display the following indicators in columns and rows:

• in gr. 1 – average number of employees on payroll for the last month of the reporting period

(average monthly number). It is calculated by summing the number of payroll employees for each calendar day of the last month of the reporting period, including public holidays, non-working holidays and weekends, and dividing the resulting amount by the number of calendar days in the month.

The list of employees on average for the period does not include employees on maternity leave, child care leave until the child reaches 3 years of age, external part-time workers and citizens who performed work under civil contracts;

• in gr. 2 – average number of employees on payroll for the reporting period.

It is determined by summing the average monthly number of employees for all months that have elapsed during the reporting period and dividing the resulting amount by the number of months in the reporting period (clause 8 of the Labor Instructions);

• in gr. 3 and 4 – the average number of citizens who performed work under civil contracts,

which is determined based on the accounting of these persons for each calendar day as whole units during the entire period of validity of this contract (clause 12 of the Labor Instructions);

Important!

Not reflected in the gr. 3 and 4 data on payroll employees who have entered into civil contracts with the same organization.

• in gr.

5 and 6 – the average number of external part-time workers,

which is calculated in proportion to the actual time worked (clause 11 of the Labor Instructions).

The above indicators are distributed among the structural divisions of the organization and are reflected as a whole by division:

– located on the territory of each city of regional subordination;

– located on the territory of each district.

Data on structural divisions for which a separate report is presented in section. II are not reflected.

In table 3 reports, all of the above indicators are filled in according to the columns for the last month of the reporting period and for the reporting period.

Important!

An employee registered within one organization (including separate divisions) as an internal part-time worker is not included in the average number of external part-time workers.

The procedure for filling out section. III “Work in forced part-time employment and movement of payroll workers (without external part-time workers)”

Section III is presented in Table. 5, the indicators in which are filled in according to gr. 1 (for the reporting month) and gr. 2 (for the reporting period).

In Sect. III, data on an employee who, during the reporting period, was transferred to part-time work several times, had more than one vacation at the initiative of the employer, or was on full-day downtime several times, is reflected only once.

If an employee was granted leave during the reporting period, or was transferred to work on a part-time basis (at the initiative of the employer), or was on a full-day downtime, then data about this employee is reflected

on pages 100, 102 or 106.

In Table. 5 are reflected:

– on pages 104, 105 and 107 –

data in person-days per working day;

Important!

On pages 100–107, data on intra-shift downtime is not reflected.

– page 110

– the number of employees with whom an employment contract was concluded during the reporting period and whose hiring was formalized by order of the employer;

– page 111

– the number of workers hired for additionally introduced jobs as a result of reconstruction, expansion of production, increase in shifts;

– page 116

– in gr.

2 – the number of workers hired for highly productive jobs from among those hired in the reporting period for additionally introduced jobs as a result of reconstruction, expansion of production, increase in shifts;

– page 112

– the number of employees dismissed from the organization, regardless of the grounds for termination of the employment contract, whose dismissal was formalized by order;

– page 114

– the number of employees dismissed for absenteeism and other violations of executive and labor discipline;

– page 115

– the number of dismissed (transferred, displaced) workers from among those previously hired in the reporting period for additionally introduced jobs as a result of reconstruction, expansion of production, increase in shifts in case of exclusion of the corresponding staffing units from the staffing table.

The procedure for filling out section. IV “Number and wage fund of certain categories of workers”

In Sect. IV is filled in table. 6 of the report, which reflects the following data:

– on pp. 120–122

– about teaching staff of all educational institutions and other organizations carrying out educational activities;

– on pp. 123–124

– about medical workers.

The procedure for filling out section. V “Number and wage fund of workers by type of economic activity”

In Sect. V are reflected:

– average number of employees;

– wage fund for payroll employees and external part-time workers;

– the average number of employees on the payroll for the period;

– the average number of citizens who performed work under civil contracts;

– the average number of external part-time workers by type of economic activity carried out in the organization.

131 free

the name of the types of economic activity carried out by the organization is indicated, in column B for these lines - their codes in accordance with OKRB 005-2011.

A practical example of filling out the 12th “Labor Report” for January – June 2021

Using an example, we will look at the procedure for filling out reports, calculate indicators, and fill out a labor report.

Step 1. Calculate population indicators.

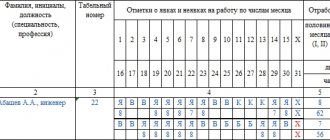

We will calculate the average payroll and payroll headcount indicators based on the work time sheet for June 2021 (see Table 1 on pp. 34–35). For convenience and clarity, the timesheet contains information about the size of the tariff rate of the 1st category.

All employees of our organization who work part-time, or hired part-time, or transferred on their own initiative, are reflected in the calculation of the average headcount in proportion to the time worked.

Table 1

Time sheet for June 2020

Based on the report card for the use of working time, we will draw up an auxiliary table for calculating the average and payroll number for June (see Table 2).

table 2

Calculation of average and payroll numbers

In addition, a civil contract was concluded to carry out work from June 1 to June 19. The average number for June is 0.6.

The external part-time worker worked 72 hours. The average number is 0.4.

Let's calculate in the table. 3 indicators of the number of employees since the beginning of the year.

Table 3

Calculation of headcount indicators since the beginning of the year

Step 2. Calculate the wage fund.

According to the summary payroll statement for June (see Table 4), employees were accrued the following amounts. For clarity, in table. 4 indicates whether this type of accrual is included in the wage fund, and the commentary makes reference to the paragraph in the Labor Instructions.

Important! When filling out report forms, indicators of the number of employees in the forms of state statistical observations must be reflected in whole numbers (clause 3 of the Labor Instructions).

Table 4

Summary statement of accruals for June

The total wage fund for June is equal to 39.5 thousand rubles, from the beginning of the year (we add up with accounting data for 5 months) - 225.8 thousand rubles.

When filling out labor statistics, starting with reports for February 2021, it is necessary to take into account the changes that have occurred in connection with the introduction of Labor Instructions, and pay special attention to payments that were previously included in the wage fund.

We calculate the wage fund for the same periods last year in the same way. For June 2021, our wage fund is equal to 36.2 thousand rubles, from the beginning of the year - 213.0 rubles.

We similarly calculate the wage fund for citizens performing work under civil contracts and external part-time workers.

Important!

If during the reporting period there was a change in the methodology for calculating labor statistics, then the data for the reporting period and for the corresponding reporting period of the previous year are presented based on the methodology adopted in the reporting period (clause 8 of Instructions No. 163).

Step 3. Calculate the average monthly salary.

The average monthly salary is calculated using the formula shown in table. 1 labor report.

Step 4. Calculate the number of man-hours worked.

We take information about the number of man-hours worked (except for those worked by external part-time workers and citizens who performed work under civil contracts) from the time sheet. In our case - 5,620 person-hours for June, since the beginning of the year - 32,089 person-hours.

We calculate data for last year in the same way.

Step 5. We calculate the size of the 1st category tariff rate actually prevailing in the organization for all personnel.

The organization has two tariff rates of the 1st category, therefore the weighted average size of the tariff rate of the 1st category for the organization as a whole is reflected. To calculate the weighted average tariff rate of the 1st category, the average number of employees is used.

The average number of employees for June was 34 people, incl. for 31 people the tariff rate of the 1st category is set at 55 rubles, for 3 people – 70 rubles.

The weighted average tariff rate of the 1st category, established for all personnel, will be 56.3 rubles. ((55.0 rub. × × 31 people + 70 rub. × 3 people) / 34 people).

Step 6. We calculate the indicators of movement of payroll workers and part-time work.

Based on orders for personnel, we fill out section. III report on labor.

Step 7. Distribution of employees and wages by type of economic activity.

The organization carried out one type of economic activity in accordance with OKRB 005-2011: milk processing - 10511.

Step 8. Fill out the tables of the 12th report.

The obtained indicators are reflected in the sections of the report.

Step 9. We sign the statistical reports and submit them to the state statistics body.

Submission of the report in the form of an electronic document is carried out using specialized software, which is posted on the official website of Belstat: https://www.belstat.gov.by.

The report in the form of an electronic document is signed with an electronic digital signature, the public key verification certificate of which is issued in the State Public Key Management System for verification of electronic digital signatures of the Republic of Belarus.

For your information!

Belstat has the right:

– check the reliability of primary statistical data by comparing them with data from primary accounting and other documents;

– receive from respondents the necessary explanations and materials in case of detection of distortions in the data of state statistical reporting;

– give the respondent mandatory instructions to eliminate identified distortions in the data of state statistical reporting.

Submission of distorted data of state statistical reporting, untimely submission (failure to submit) of such reporting entails the application of administrative or criminal liability measures

in the manner established by the legislation of the Republic of Belarus.

Attention! samples of filling out sections IV of report 12 in the “Documents” section.

Victoria Sokolova, leading labor economist

What to put on your report card if your vacation falls on a holiday

In accordance with Art. 120 of the Labor Code of the Russian Federation, non-working holidays falling during the period of the annual main or annual additional paid leave are not included in the number of calendar days of leave and are not taken into account.

Holidays established by regional legislation are also excluded from vacation (see Resolution of the Presidium of the Supreme Court of the Russian Federation dated December 21, 2011 No. 20-ПВ11).

It follows that holidays falling on vacation in the report card must be designated by code “B” or 26.

And if you want, you can set your own code for this. This was indicated by the Ministry of Labor in letter No. 14-2/B-370 dated April 27, 2017.

How to designate non-working paid days if the employee was at home in self-isolation? The answer to this question is in ConsultantPlus. If you don't already have access to the system, get a trial online access for free.

Form No. 2 - purchase prices

From the reporting for January of the next year, you need to use the adjusted form No. 2 - purchase prices “Information on purchase prices of certain types of goods”.

The table is supplemented by column 8 “Reasons for changes in the volume of acquisition”, where you need to indicate one of seven codes explaining the change in volume.

The list of respondents includes individual entrepreneurs whose number of employees exceeds 100 people.

According to the recommendation, when selecting information to fill out the form, you should select the most representative product groups, and from them - individual types of goods regularly purchased during the reporting year.

To simplify filling out the columns “Name of product type” and “Product code OKPD2”, the instructions provided a list of types of goods that are included in the report.

For the column “Reasons for price changes”, a new code 13 has been added: “There is no change in price/tariff or the change is insignificant.”

Results

The Russian legislator has introduced forms for monitoring the presence of employees at work, adapted for employers of any form (including companies, both private and public). Employers who are not government agencies have the right to use any form of appropriate accounting documents. However, the T-12 uniform continues to be one of the most comfortable.

Sources:

- Resolution of the State Statistics Committee of the Russian Federation dated January 5, 2004 N 1

- Order of the Ministry of Finance of Russia dated March 30, 2015 N 52n

- Labor Code of the Russian Federation

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Form No. 12-F

Annual statistical form No. 12-F “Information on the use of funds” has not undergone significant changes, but the procedure for filling it out has been clarified.

Thus, from the report for 2021, the form must include indicators for separate divisions that operate outside the Russian Federation.

The list of capital investments (line 295) is supplemented with costs for the purchase of vehicles.

It is clarified that lines 312-321 of the form reflect labor costs and accruals for wage payments.