What are cash and cash equivalents?

Cash and cash equivalents include all cash and highly liquid assets with short maturities (typically 90 days or 3 months). This item is always classified as current assets on line 1250 of the balance sheet.

Take our proprietary course on choosing stocks on the stock market → training course

Cash equivalents include bank accounts and marketable securities, which are debt securities with maturities of less than 90 days.

However, cash equivalents often do not include shares or shareholdings because they can fluctuate in value.

Examples of cash equivalents include commercial paper, Treasury bills, and short-term government bonds with maturities of three months or less. Marketable securities and money market assets are considered cash equivalents because they are liquid and not subject to significant fluctuations in value.

Lines in Form No. 1

If the enterprise is located on the simplified tax system (also known as simplified tax system), the totality of all funds located in accounts 51, 50, 52, 55 and 57 is reflected in the debit of line 1250 in the balance sheet. That is, the total amount as of December 31 of the year includes balances on cash, foreign currency and current accounts, special purpose accounts, as well as transfers in transit. If money is placed in a bank deposit account and brings a certain percentage of income to the company, it is recorded as a financial investment. In the balance sheet these are lines numbered 1170 or 1240.

If an organization uses a common tax system, its balance sheet has a slightly different line numbering. Then the company’s funds in the balance sheet will be reflected in line 260. Short-term deposits with accrued interest - in line 250, and long-term - 140.

Concept and understanding of the category

Cash and cash equivalents are a group of assets owned by a company. For ease of understanding, this is the total value of cash on hand and cash-like assets. If a company has cash or cash equivalents, the totality of these assets is always shown on the top line of the balance sheet. This is because cash and cash equivalents are current assets, which means they are the most liquid of the short-term balance sheet items.

Important! Companies with significant amounts of cash and cash equivalents may have a positive view of their ability to meet short-term debt obligations.

Difference between cash and cash equivalents

The key differences are presented in the table below.

| View | Characteristics and distinctive features |

| Cash | Cash in the form of currency. They include all bills, coins and banknotes. |

| Cash equivalents | For an investment to qualify as equivalent, it must be readily convertible into cash and be subject to negligible value risk. Therefore, an investment usually qualifies as a cash equivalent only if it has a short maturity, say three months or less. |

The importance of using these categories

There are several main reasons why these categories are significant. They are reflected in the table below.

| No. | Cause | Characteristics and description | Clarification |

| Source of liquidity | Cash equivalents are held to satisfy short-term cash obligations and not for investment or other purposes and are an important source of liquidity. Thus, companies want to have a cash cushion to withstand unforeseen situations such as revenue shortfalls, equipment repairs or replacements, or other unforeseen circumstances not budgeted for. | Liquidity ratio calculations are important in determining the rate at which a company can pay off its short-term debt. Various options for liquidity ratios include: total liquidity ratio, current ratio, quick ratio. Total liquidity ratio: (cash and cash equivalents + marketable securities) ÷ current liabilities Current ratio: current assets ÷ current liabilities. Quick ratio: (Current asset - stock) ÷ Current liabilities. | |

| Speculative acquisition strategy | Another good reason for saving is an acquisition in the near future. | As an example, consider the cash balance on Apple Inc's balance sheet: · Cash = $13.844 billion · Total assets = $231.839 billion Cash as % of total assets = 13,844 / 231,839 ~ 6% · Total sales in 2014 = $182,795 Cash as % of Total Sales = 13,844 / 182,795 ~ 7.5% Investments of $13.844 billion (cash) + $11.233 billion (short-term investments) + $130.162 billion (long-term investments) amount to $155.2 billion. The combination of all this indicates that Apple may be looking for some kind of acquisition in the near future. |

Money in the current account

In order to reflect the processes associated with the inflow and outflow of funds on current accounts, organizations use accounting account 51. The account is active and can correspond with several other accounts in the accounting chart of accounts. Thus, when carrying out operations with the receipt of funds, accounting reflects the correspondence of the debit of account 51 with the credit of the following plan accounts:

- 50 - cash deposit from the cash register to the settlement account.

- 62 - receipt of money for goods or services from buyers.

- 90.1 - reflection of revenue.

- 91.1 - a reflection of the money that the organization received in the event of the sale of materials, funds and other assets that were not initially intended for sale in the main type of activity.

- 66 – obtaining a short-term loan.

- 67 - obtaining a long-term loan.

- 55 - crediting the balances of special accounts to the current account.

- 76 - receipt of debt from the debtor.

- 78 - repayment of the shortfall by the client.

When spending money from a current account, use the following correspondence, in which 51 accounts are reflected as a credit, and the following codes as a debit:

- 50 - withdrawal of money from the current account to the cash desk, for example, to pay salaries.

- 60 - payment for goods and services to counterparties and contractors.

- 68 - payment of taxes, duties, and other fees to the state.

- 91.2 - settlements with banks for interest on loans.

- 67 - payment of long-term loans.

- 66 - payment of short-term loans.

- 69 - payment to social funds for employees.

- 58 - financial investments.

- 76 - payment of accounts payable.

To carry out operations, the company provides the following documents to the bank servicing its current account: an announcement for cash deposits, a cash check for issue, a payment order or, when a counterparty requests money, a demand. In some cases, the bank withdraws funds independently. For example, if a request has been received to write off tax debts from the relevant government service.

Pros and cons of availability

Positive aspects of having:

- maturity and ease of conversion. They are beneficial from a business perspective because a company can use them to meet any short-term needs;

- financial repository. Retained equity is a way of storing money until a business decides what to do with it.

Negative aspects of having:

- loss of income: sometimes companies set aside an amount in equivalents that exceeds the amount needed to cover immediate obligations, depending on market conditions. When this happens, the company loses potential income because money that could have generated higher profits elsewhere has been transferred to a cash account;

- low yield: many equivalents have yield. However, the interest rate is usually low. A low interest rate makes sense given that equivalents are low risk.

The most common options and types

Cash and cash equivalents help companies in meeting their working capital needs as these liquid assets are used to pay off current liabilities, which are short-term debts and bills.

Cash is money in the form of currency and includes all bills, coins and notes.

A demand deposit is a type of account from which funds can be withdrawn at any time without notifying the institution. Examples of demand deposit accounts include checking and savings accounts. All demand account balances at the date of the financial statements are included in total cash.

Foreign currency. Companies holding more than one currency conduct transactions such as currency exchange. Currency for foreign countries must be converted into reporting currency for financial purposes. The conversion must provide results comparable to those that would have occurred if the business had completed operations using only one currency. Foreign currency revaluation losses are not reflected in cash and cash equivalents. These losses are reflected in a separate document.

Cash equivalents are investments that can be easily converted into cash. Investments must be short-term, usually with a maximum duration of three months or less. If the investment period exceeds 3 months, it should be classified in an account called “other investments”. Cash equivalents must be highly liquid and easily traded in the market. Buyers of these investments must be easily accessible.

All cash equivalents must have a known market price and should not be subject to fluctuations in value. The value of cash equivalents cannot be expected to change significantly prior to maturity.

Certificates of deposit may be considered cash equivalents depending on their maturity date.

Preferred shares may be considered cash equivalent if they are purchased close to the maturity date and are not expected to fluctuate significantly in value.

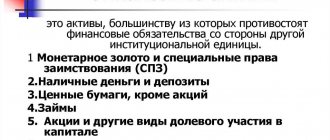

What cash and equivalents do not include

There are some exceptions for current assets and current assets classified as cash and cash equivalents.

Credit collateral. Exceptions may exist for short-term debt instruments such as Treasury bills if they are used as collateral for an outstanding loan or line of credit. Prohibited T-bills must be identified separately. In other words, there may be no restrictions on the conversion of any of the securities listed as cash and cash equivalents.

Inventories. The inventory that a company has in stock is not considered cash equivalent because it cannot be easily converted into cash. In addition, the value of inventory is not guaranteed, meaning there is no certainty as to the amount that will be received for the liquidation of these assets.

Financial investments without DE: line with code 1240

Line 1240 of the Balance Sheet reflects information about those financial investments that are classified as short-term, since their repayment period is a year or less. The amount written in this line is determined using the following calculations:

Account debit balance 55 (in relation to short-term investments on deposits) + Balance on DT account. 58 – Balance according to CT account. 59 (only amounts representing short-term investments) + Balance on DT account. 73.

Financial investments include the cost of:

- Securities issued:

- state and municipal authorities;

- enterprises and companies with a designated payment date.

- Infusions into the authorized capital of companies and firms;

- Loans provided by the enterprise to other institutions;

- Deposits placed in banking institutions;

- Debt to debtors received on the basis of assignment of claims.

The following cannot be considered financial investments:

- Shares of a company's own, purchased from shareholders in order to later cancel or resell them;

- Infusions into movable property and immovable property, taken for use or possession for a time for a fee agreed upon by agreement, to generate income;

- Bills of exchange issued to organizations when making trade payments;

- Jewelry in the form of expensive metals, stones, jewelry, antiques, purchased not for use in production processes.

The cost of long-term investments is not reflected on line 1240. A different line is allocated for them under code 1170.

Calculation example

Example No. 1. For example, suppose that the opening balance of the cash account was 10,000 rubles, the total amount of debits for the year was 15,000 rubles, and the total amount of credits for the year was 8,000 rubles.

Let's add each account's total debit to its opening balance. For example, let's add 15,000 tr. to the total amount of debits to the initial balance on the cash account of 10,000 tr., which is equal to 25,000 tr.

We subtract the total number of credits of each account from each result to calculate the year-end balance for each account.

For example, we subtract 8,000 rubles. in the total amount of loans on the cash account from the result of 25,000 tr. This equals a final cash balance of 17,000 rubles.

We will calculate the ending balance of each account to determine the balance at the end of the year in cash and cash equivalents.

For example, if the year-end balances for cash, wages, petty cash investments and money market investments are respectively 17,000, 5,000, 1,000 and 4,000 TR, then their amount should be calculated. It is equal to 27,000 tr. as the balance of cash and cash equivalents at the end of the year.

Indicate the balance of cash and cash equivalents at the end of the year in line 1250 of the balance sheet in the current assets section.

PASSIVE

The Balance Passage consists of the following sections:

- Capital

- long term duties

- Short-term liabilities

SECTION 3 CAPITAL

Article 1310 “Authorized capital”

Formula = Account credit balance 80 Authorized capital"

Article 1320 “Own shares”

Formula Debit balance for account 81. (item is reflected in brackets)

Article 1340 “Revaluation of non-current assets”

Formula - We take the balance on account 83 in terms of the revaluation of intangible assets and fixed assets.

Article 1350 “Additional capital”

Formula = Take the balance of account 83, except for the revaluation of fixed and intangible assets

Article 1360 “Reserve capital”

Formula = Take the balance of account 82 “Reserve capital” credit.

Article 1370 “Retained earnings (uncovered loss)”

Formula = Take the balance on the credit account 99 (profit and loss, if the balance on the debit then put a minus in front of the amount) + Take the balance on the account 84 (Retained earnings, if the balance on the debit then put a minus in front of the amount). If the amount turns out to be a minus (loss), then write the amount in parentheses. And when we calculate the total for section 3, we subtract this amount.

Article 1300 “Total for Section 3”

Formula = Authorized capital - Own shares + Revaluation of non-current assets, additional capital + Reserve capital + Retained earnings (if in parentheses with a minus, then subtract)

SECTION 4 Long-term liabilities

Article 1410 “Borrowed funds”

Formula = Credit balance on account 67 “Long-term loans and borrowings” (in terms of more than 12 months of repayment)

Article 1430 “Evaluated liabilities”

Formula = Credit balance of account 96 “Reserves for future expenses” (in terms of more than 12 months from the reporting date)

Article 1450 “Other obligations”

Formula = Account balance 86 (targeted financing in terms of long-term ones) + 60,62,68,69 (in terms of repayments over 12 months).

TOTAL for section 4

Let's summarize all the articles in section 4.

What can increase cash on the balance sheet?

Companies can increase cash through increased sales, collection of overdue accounts, control of expenses, and financing and investment. These options are reflected in the table below.

| Growth option | Characteristic |

| Sales growth | Increased sales usually mean higher levels of cash on the balance sheet. When a company makes a cash sale, the accounts must increase the sales account on the income statement and the cash account on the balance sheet. When it receives cash payments on credit accounts, the company converts the amounts from accounts receivable to cash. Innovative and quality products, targeted marketing and superior customer service are some of the ways to consistently achieve higher sales and gain a competitive advantage in the market. |

| Accounts receivable management | Some sales are cash and others are on credit. The accounts receivable balance in the current assets section of the balance sheet contains outstanding credit accounts. Although a business may receive most payments during the billing period, some bills are past due while others are not due for collection. More stringent credit control procedures, such as reducing credit limits for customers who have fallen behind in the past or waiving loans to customers experiencing financial difficulties, can reduce the number of overdue accounts and increase cash flow. Sending automatic email reminders, following up with overdue customers, and offering discounts for early payment of invoices are some of the other ways to manage accounts receivable and increase cash on your balance sheet. |

| Cost control | Controlling expenses increases cash levels. Sales growth is an important but not sufficient condition for increasing cash flow. For example, if a five percent increase in sales requires a seven percent increase in marketing spending, cash levels may actually decrease rather than increase. Companies incur variable costs such as direct labor and raw materials. The companies also recorded overhead costs such as administrative staff salaries and advertising. Negotiating better terms with suppliers and adjusting production shifts to accommodate rising or falling demand are ways to manage variable costs. Streamlining business processes, reducing travel, and using contractors instead of in-house employees are some ways to reduce overhead costs. |

| Financing and investment activities | Companies can increase cash levels through financing and investing. Financing activities include proceeds from bank loans and from issuing shares or bonds to investors. For small businesses that may not have easy access to financial markets, an infusion of cash from founding partners, venture capitalists and angel investors will increase cash on the balance sheet. Paying dividends and interest from investments in stocks and bonds also increases cash levels. Selling excess capital investments, such as regional offices, distribution centers, excess equipment or unused vehicles, increases cash on the balance sheet. |

| Other | Other ways to increase cash include selling investments in subsidiaries or spinning off business units. |

Conclusions about what a change in indicator means

If the indicator is higher than normal

Not standardized

If the indicator is below normal

Not standardized

If the indicator increases

A positive factor if it meets the needs. Negative if this is not the case.

If the indicator decreases

A positive factor if it meets the needs. Negative if this is not the case.

Notes

The indicator in the article is considered from the point of view not of accounting, but of financial management. Therefore, sometimes it can be defined differently. It depends on the author's approach.

In most cases, universities accept any definition option, since deviations according to different approaches and formulas are usually within a maximum of a few percent.

The indicator is considered in the main free online financial analysis service and some other services

If you need conclusions after calculating the indicators, please look at this article: conclusions from financial analysis

If you see any inaccuracy or typo, please also indicate this in the comment.

I try to write as simply as possible, but if something is still not clear, questions and clarifications can be written in the comments to any article on the site.

Sincerely, Alexander Krylov, anfin.ru

Section: Indicators and ratios of financial analysis Tags: Balance sheet

FAQ

Question No. 1. What is included in cash?

Answer. These include such means as:

- money;

- currency;

- cash in current accounts;

- cash in savings accounts;

- bank amounts;

- Money transfers.

Question No. 2. What is considered cash equivalents?

Answer:

Answer. These include such means as:

- short-term government bonds;

- bills;

- securities;

- money market funds;

- treasury bonds.

Question No. 3. What are the main criteria for classifying cash and cash equivalents?

Answer. The two main criteria for classification as a cash equivalent are that:

- the asset can be easily converted into a known amount of cash;

- it must be so close to the maturity date that there is little risk of changes in value due to changes in interest rates at the time of maturity.

Question No. 4. In what situations is cash and cash equivalents analysis used?

Answer. Information about cash and cash equivalents is sometimes used by analysts in comparison to a firm's current liabilities to assess its ability to pay its bills in the short term. However, this analysis may be flawed if there are accounts receivable that can be easily converted into cash within a few days.

Question No. 5. What is included in cash?

Answer. In economic terms, cash is the form of exchange for all business transactions and activities of a company. In other words, it is a standard payment method for businesses. This is a banknote that is legal tender for all public and private debts.

Question #6 : Are certificates of deposit included in this category?

Answer. Yes, certificates of deposit are short-term securities that are easily converted into a known amount of money in a short period of time. Certificates of deposit are always included in cash equivalents.

Balance Sheet Lines

Everyone who has ever held a balance sheet in their hands, much less drawn it up, paid attention to the “Code” column. Thanks to this column, statistical authorities are able to systematize the information contained in the balance sheets of all companies. Therefore, it is necessary to indicate codes in the balance sheet only when this report is submitted to state statistics bodies and other executive authorities (Art.

In the balance sheet, line codes from 2014 must correspond to the codes specified in Appendix 4 to Order No. 66n. At the same time, outdated codes from the expired order No. 67n with the same name, dated July 22, 2003, are no longer applied.

It is not difficult to distinguish previously used codes from modern ones - by the number of digits: modern codes are 4-digit (for example, lines 1230, 1170 of the balance sheet), while outdated ones contained only 3 digits (for example, 700, 140).

For information on what the form of the current balance sheet with line codes looks like, read the article “Filling out Form 1 of the balance sheet (sample).”

The lines of the passive part of the balance sheet reflect the sources of funds that the company manages, in other words, the sources of its financing. The information contained in the liability lines helps to understand how the structure of equity and borrowed capital has changed, how much the company has attracted borrowed funds, how many of them are short-term and how many are long-term, etc. Thus, the liability lines provide information about where the funds came from and to whom the company should return them.

The purpose of the asset and liability lines of the old balance sheet form (Order No. 67n) does not differ significantly from the purpose of the lines of the updated balance sheet - the only difference is in the list of these lines, their coding and the level of detail of the information.

Before deciphering an asset item, let’s consider its code - it carries certain information. So, the first digit shows that this line refers to the balance sheet (and not to another accounting report); 2nd - indicates the section of the asset (for example, 1 - non-current assets, etc.); The 3rd digit reflects assets in increasing order of their liquidity.

NOTE! The requirement for detail may not be fulfilled by small businesses (clause 6 of Order No. 66n).

Read about what distinguishes accounting carried out by small businesses in the material “Features of accounting in small enterprises.”

| Line name | Code | Decoding the string | |

| By order No. 66n | By order No. 67n | ||

| Fixed assets | 1100 | 190 | The total amount of non-current assets is reflected |

| Intangible assets | 1110 | 110 | The information reflected in lines 1110–1170 is explained in the notes to the statements (information on the availability of assets at the reporting dates and changes for the period is disclosed) |

| Fixed assets | 1150 | 120 | |

| Profitable investments in material assets | 1160 | 135 | |

| Financial investments | 1170 | 140 | |

| Deferred tax assets | 1180 | 145 | The debit balance of account 09 is indicated |

| Other noncurrent assets | 1190 | 150 | Filled in if there is information about non-current assets that are not reflected in the previous lines |

| Current assets | 1200 | 290 | The final result of current assets is determined |

| Reserves | 1210 | 210 | The total balance of inventories is given (debit balance of accounts 10, 11, 15, 16, 20, 21, 23, 28, 29, 41, 43, 44, 45, 97 without taking into account the credit balance of accounts 14, 42) |

| Value added tax on purchased assets | 1220 | 220 | Indicate account balance 19 |

| Accounts receivable | 1230 | 240 | The result of adding the debit balances of accounts 60, 62, 68, 69, 70, 71, 73, 75, 76 minus account 63 is reflected |

| Financial investments (excluding cash equivalents) | 1240 | 250 | The debit balance of accounts 55, 58, 73 (minus account 59) is given - information on financial investments with a circulation period of no more than a year |

| Cash and cash equivalents | 1250 | 260 | The line contains the balance of accounts 50, 51, 52, 55, 57, 58 and 76 (in terms of cash equivalents) |

| Other current assets | 1260 | 270 | Filled in if data is available (for the amount of current assets not indicated in other lines of the section) |

| Total assets | 1600 | 300 | Total of all assets |

Liability codes are also 4-digit: the 1st digit is the line’s belonging to the balance sheet, the 2nd is the number of the liability section (for example, 3 is capital and reserves). The next digit of the code reflects obligations in order of increasing urgency of their repayment. The last digit of the code is for detail purposes. Total liabilities in the balance sheet are line 1700 of the balance sheet. In other words, total liabilities in the balance sheet are the sum of lines 1300, 1400, 1500.

| Line name | Code | Decoding the string | |

| By order No. 66n | By order No. 67n | ||

| TOTAL capital | 1300 | 490 | The line contains information about the company's capital as of the reporting date |

| Authorized capital (share capital, authorized capital, contributions of partners) | 1310 | 410 | Information on lines 1300–1370 is detailed in the statement of changes in equity and the statement of financial results (in terms of net profit for the reporting period). The company has the right to determine the additional amount of explanations about capital. |

| Revaluation of non-current assets | 1340 | 420 | |

| Additional capital (without revaluation) | 1350 | ||

| Reserve capital | 1360 | 430 | |

| Retained earnings (uncovered loss) | 1370 | 470 | |

| Long-term borrowed funds | 1410 | 510 | The information is deciphered in tabular (Form 5) or text form in the explanations to the balance sheet |

| Deferred tax liabilities | 1420 | — | Indicate the credit balance of account 77 |

| Estimated liabilities | 1430 | — | The credit balance of account 96 is reflected - estimated liabilities, the expected fulfillment period of which exceeds 12 months |

| Other long-term liabilities | 1450 | 520 | Provides information about long-term liabilities not indicated in the previous lines of the section |

| TOTAL long-term liabilities | 1400 | 590 | The final result of long-term liabilities is reflected |

| Short-term debt obligations | 1510 | 610 | Account credit balance 66 |

| Short-term accounts payable | 1520 | 620 | The total credit balance of accounts 60, 62, 68, 69, 70, 71, 73, 75, 76 is reflected. The information is deciphered in the notes to the balance sheet (for example, in Form 5) |

| Other current liabilities | 1550 | 660 | Filled in if not all short-term liabilities are reflected in other lines of the section |

| Total current liabilities | 1500 | 690 | The total total of short-term liabilities is indicated |

| Liabilities of everything | 1700 | 700 | Summary of all liabilities |

Read about what characterizes simplified accounting in the article “Simplified reporting for small businesses.”

Line 1310 Authorized capital (share capital, authorized capital, contributions of partners) Line 1320 Own shares purchased from shareholders Line 1340 Revaluation of non-current assets Line 1350 Additional capital (without revaluation) Line 1360 “Reserve capital” Line 1370 Retained earnings (uncovered loss) Line 1300 AND that under section III

Line 1410 Borrowed funds Line 1420 Deferred tax liabilities Line 1430 Estimated liabilities Line 1450 Other liabilities Line 1400 Total for section IV

Line 1510 Borrowed funds Line 1520 Accounts payable Line 1530 Deferred income Line 1540 Estimated liabilities Line 1550 Other liabilities Line 1500 Total for section V Line 1700 Balance sheet

Debit balance on account 50 "Cash"] plus [Debit balance on account 51 "Settlement accounts"] plus [Debit balance on account 52 "Currency accounts"] plus [Debit balance on account 55 "Special accounts in banks"](except deposits that are not cash equivalents) plus [Debit balance of account 57 “Transfers in transit”] plus [Debit balance of account 58 “Financial investments”] (analytical accounts for cash equivalents) plus [Debit balance of account 76 “Settlements with different debtors and creditors"] (analytical accounts for cash equivalents) The value of an asset or liability expressed in foreign currency is recalculated into rubles at the official exchange rate of this foreign currency to the ruble, established by the Central Bank of the Russian Federation.

| Indicator name | Code | Which account data is used? | Algorithm for calculating the indicator |

| Intangible assets | 1110 | 04 “Intangible assets”, 05 “Amortization of intangible assets” | D04 (excluding R&D expenses) – K05 |

| Research and development results | 1120 | 04 | D04 (in terms of R&D expenses) |

| Intangible search assets | 1130 | 08 “Investments in non-current assets”, 05 | D08 – K05 (all regarding intangible exploration assets) |

| Material prospecting assets | 1140 | 08, 02 “Depreciation of fixed assets” | D08 – K02 (all regarding material exploration assets) |

| Fixed assets | 1150 | 01 “Fixed assets”, 02 | D01 – K02 (except for depreciation of fixed assets accounted for in account 03 “Income-generating investments in tangible assets” |

| Profitable investments in material assets | 1160 | 03, 02 | D03 – K02 (except for depreciation of fixed assets accounted for on account 01) |

| Financial investments | 1170 | 58 “Financial investments”, 55-3 “Deposit accounts”, 59 “Provisions for impairment of financial investments”, 73-1 “Settlements on loans provided” | D58 – K59 (in terms of long-term financial investments) D73-1 (in terms of long-term interest-bearing loans) |

| Deferred tax assets | 1180 | 09 “Deferred tax assets” | D09 |

| Other noncurrent assets | 1190 | 07 “Equipment for installation”, 08, 97 “Deferred expenses” | D07 D08 (except for exploration assets) D97 (in terms of expenses with a write-off period exceeding 12 months after the reporting date) |

| Reserves | 1210 | 10 “Materials”, 11 “Animals for growing and fattening”, 14 “Reserves for reducing the cost of material assets”, 15 “Procurement and acquisition of material assets”, 16 “Deviation in the cost of material assets”, 20 “Main production”, 21 “Semi-finished products own production”, 23 “Auxiliary production”, 28 “Defects in production”, 29 “Service production and facilities”, 41 “Goods”, 42 “Trade margin”, 43 “Finished products”, 44 “Sales expenses”, 45 “Goods shipped”, 97 | D10 D11 – K14 D15 D16 D20 D21 D23 D28 D29 D41 – K42 D43 D44 D45 D97 (for expenses with a write-off period of no more than 12 months after the reporting date) |

| Value added tax on purchased assets | 1220 | 19 “Value added tax on acquired assets” | D19 |

| Accounts receivable | 1230 | 46 “Completed stages of work in progress”, 60 “Settlements with suppliers and contractors”, 62 “Settlements with buyers and customers”, 63 “Provisions for doubtful debts”, 68 “Settlements for taxes and duties”, 69 “Settlements for social insurance and security", 70 "Settlements with personnel for wages", 71 "Settlements with accountable persons", 73 "Settlements with personnel for other operations", 75 "Settlements with founders", 76 "Settlements with various debtors and creditors" | D46 D60 D62 - K63 D68 D69 D70 D71 D73 (except for interest-bearing loans accounted for in subaccount 73-1) D75 D76 (less reflected in the accounts for VAT calculations on advances issued and received) |

| Financial investments (excluding cash equivalents) | 1240 | 58, 55-3, 59, 73-1 | D58 – K59 (in terms of short-term financial investments) D55-3 D73-1 (in terms of short-term interest-bearing loans) |

| Cash and cash equivalents | 1250 | 50 “Cash”, 51 “Current accounts”, 52 “Currency accounts”, 55 “Special bank accounts”, 57 “Transfers in transit”, | D50 (except for subaccount 50-3) D51 D52 D55 (except for the balance of subaccount 55-3) D57 |

| Other current assets | 1260 | 50-3 “Money documents”, 94 “Shortages and losses from damage to valuables” | D50-3 D94 |

| Indicator name | Code | Which account data is used? | Algorithm for calculating the indicator |

| Authorized capital (share capital, authorized capital, contributions of partners) | 1310 | 80 “Authorized capital” | K80 |

| Own shares purchased from shareholders | 1320 | 81 “Own shares (shares)” | D81 (in parentheses) |

| Revaluation of non-current assets | 1340 | 83 “Additional capital” | K83 (in terms of amounts of additional valuation of non-current assets) |

| Additional capital (without revaluation) | 1350 | 83 | K83 (except for amounts of additional valuation of non-current assets) |

| Reserve capital | 1360 | 82 “Reserve capital” | K82 |

| Retained earnings (uncovered loss) | 1370 | 99 “Profits and losses”, 84 “Retained earnings (uncovered loss)” | Or K99 K84 Or D99 D84 (the result is reflected in parentheses) Or K84 - D99 (if the value is negative, reflected in parentheses) Or K99 - D84 (the same) |

| Borrowed funds | 1410 | 67 “Calculations for long-term loans and borrowings” | K67 (in terms of debt with a maturity date of more than 12 months at the reporting date) |

| Deferred tax liabilities | 1420 | 77 “Deferred tax liabilities” | K77 |

| Estimated liabilities | 1430 | 96 “Reserves for future expenses” | K96 (in terms of estimated liabilities with a maturity period of more than 12 months after the reporting date) |

| Other obligations | 1450 | 60, 62, 68, 69, 76, 86 “Targeted financing” | K60 K62 K68 K69 K76 K86 (all in terms of long-term debt) |

| Borrowed funds | 1510 | 66 “Calculations for short-term loans and borrowings”, 67 | K66 K67 (in terms of debt with a maturity of no more than 12 months as of the reporting date) |

| Accounts payable | 1520 | 60, 62, 68, 69, 70, 71, 73, 75, 76 | K60 K62 K68 K69 K70 K71 K73 K75 K76 (in terms of short-term debt, minus VAT calculations reflected in the accounts on advances issued and received) |

| revenue of the future periods | 1530 | 98 “Deferred income” | K98 |

| Estimated liabilities | 1540 | 96 | K96 (in terms of estimated liabilities with a maturity date of no more than 12 months after the reporting date) |

| Other obligations | 1550 | 86 | K86 (in terms of short-term liabilities) |