Active accounts are accounts for recording the movement of company assets, that is, to reflect the facts of receipt, movement and disposal of monetary, property and intangible assets of an economic entity.

The basic rule of accounting is to record business transactions by making entries using the double entry method. For this purpose, organizations widely use accounting accounts established at the legislative level. The method of drawing up the posting depends on what classification characteristic (type) a specific accounting account has. In the article we will find out how this type of accounting account is determined, and also present all active and passive accounting accounts in a table.

Recording transactions on accounts

In accounting, all business transactions are recorded in the form of accounting entries using special created accounts, each of which is assigned a unique number.

Basic accounting procedures (examples) can be found here.

Similar transactions are grouped in separate accounts. The name of the account directly indicates the specifics of the transaction reflected on it.

All changes that directly occur with economic assets and their sources lead to their change in monetary terms.

The list of accounts officially approved in the Russian Federation - Chart of Accounts (Order of the Ministry of Finance dated October 31, 2000 No. 94n) is suitable for use in any industry.

For example, an accountant of a furniture factory will take into account lumber and furniture fittings on account 10 “Materials”, an accountant of a legal consultation will take into account pens and paper, etc.

In practice, enterprises use only accounts that correspond to the specifics of the type of activity in which they are engaged. The accounts used by the enterprise constitute the Working Chart of Accounts of the enterprise, which in turn is an integral part of the Accounting Policy.

Read about the applicable accounts in 2021 - 2021 in this material.

The account has a tabular form: the left side is called “debit”, the right side is called “credit”.

To indicate the balance of an account either at the beginning or at the end of a period, the term “balance” exists.

Accounting accounts are either active or passive. The accounts on the sides of the balance sheet are named and correspond to their contents.

The structure of the accounts is similar (both active and passive accounts have sides called “debit” and “credit”), but the meaning of these sides is different - it is important to remember this.

N.N. Tomilo, 3rd Class Advisor to the State Civil Service of the Russian Federation, in his consultation explained the differences between active and passive accounts. Study the opinion of the official in ConsultantPlus. If you do not have access to the system, get a trial demo access for free.

Mixed accounts

Some ledger accounts may have both credit and debit balances. Such mixed accounts are called active-passive accounting accounts. For example, accounting accounts reflecting information on settlements with customers or suppliers. Consequently, when goods are shipped to a buyer, an account receivable is formed in the accounting system, and when an advance payment is received from the same buyer against future deliveries, an account payable is formed. It cannot be hidden. Settlements with suppliers are carried out similarly to account 60.

Account 84 “Retained earnings, loss” is also considered both an active and passive account, since it can have both a credit and a debit balance at the end of the reporting period.

Active accounts

Active accounts are those that are used to record information about the property of the enterprise. For example: money, including in foreign currency, transfers in transit, own shares.

An increase in funds in an active account is reflected as a debit, and a decrease as a credit. At the end of the period, the balance of the active account is debit.

Active accounts include: , , 04, 07, 08, 09, , 11, , , 21, 23, 25, , , 29, , , 44, 45, 46, , , 52, 55, 57, 58, 81, , 97.

Example

Shtrabak LLC purchased a laptop. The cost of the laptop is 87,000 rubles. without VAT. The debit of account 01 “Fixed assets” has an opening balance of 0 rubles. The accountant reflected the acceptance of the laptop as a debit, since the account used is active. The final debit balance is RUB 87,000.

Account grouping, table

To avoid errors when preparing accounting entries, you need to know and take into account the classification attribute. Remembering the types of business accounting accounts is quite difficult. We suggest using a simple table with a list of accounts.

Active, passive and active-passive accounts, table.

| Account type or attribute | Account number according to Order of the Ministry of Finance No. 94n | Characteristic |

| A | 01 | Fixed assets |

| P | 02 | Accrued depreciation of fixed assets |

| A | 04 | Objects of intangible assets |

| P | 05 | Depreciation accrued on intangible assets |

| A | 08 | Investments in non-current assets |

| A | 10 | Materials, raw materials, fuel, etc. |

| A | 19 | VAT |

| A | , 21, , , , 28, 29 | Cost accounts - main production, semi-finished products from production, auxiliary production (shops), general production (OPR) and general economic (OKhR) costs, production defects, servicing production (economy) |

| AP | 40 | Output |

| A | 41 | Goods |

| A | 43 | Finished products |

| A | 44 | Selling expenses, sales expenses |

| A | 45 | Products shipped |

| A | , 51, , , , | Cash accounts (financial assets) - cash, cash account, currency account, special accounts, transfers in transit, financial investments |

| AP | , , , 69, 71, 73, 75, 76, 79 | Accounts for settlements with suppliers, with customers, with the budget for taxes and insurance premiums, with extra-budgetary funds, with accountable persons, with debtors, creditors, with employees for other operations, with founders and shareholders, internal business settlements |

| P | , , 67, 70 | Accounts for settlements with the personnel of an economic entity, for loans and borrowings (regardless of the term), for created reserves, in terms of doubtful debts |

| P | 80, 83, 82 | Capital accounts, reserves - statutory, additional, reserve |

| AP | 84 | retained earnings |

| AP | 90 | Sales |

| AP | 91 | Other income and expenses |

| A | 94 | Shortages |

| AP | 99 | Profits, losses |

Passive accounts

Passive accounts are those that demonstrate methods of forming property (loans provided, contributions from participants, etc.).

An increase in funds is reflected as a credit, a decrease - as a debit. At the end of the reporting period, the balance of the passive account is credit.

The following accounts are considered passive: 02, 05, 42, 59, 63, 66, 67, 70, 77, , 82, 83, 96, 98.

Example

The only participant in Shtrabak LLC was granted a loan. Loan in the amount of 150,000 rubles. arrived at the bank account of Shtrabak LLC.

Shtrabak LLC keeps records of settlements for short-term loans on account 66. The initial credit balance on this account is 0 rubles.

The accountant reflected the receipt of 150,000 on the loan, since the account is passive. Loan turnover—RUB 150,000.

In less than a month, 50,000 rubles. were returned to the lender. The accountant completed the posting, and an entry appeared in the debit of account 66 - 50,000 rubles. The total turnover on the debit of the account is 50,000 rubles.

The final credit balance is RUB 100,000.

Definition and purpose of passive accounts

Definition 2

Passive accounts are accounting accounts whose purpose is to record the movement, status, and changes in the amount of sources of funds of the enterprise.

Passive accounts reflect transactions during which the amount of funds (assets of the enterprise) changes, as well as types of transactions that can change the composition of the enterprise's debts. An example of the latter is the internal movement of enterprise funds between passive accounts, as an example of the withholding of taxes from employee salaries.

Note 1

The purpose of passive accounts is to record the obligations of an enterprise to its partners, the state or employees.

Need advice from a teacher in this subject area? Ask a question to the teacher and get an answer in 15 minutes! Ask a Question

Balance sheet

The debit balances make up the left side of the balance sheet - the asset, and the credit balances make up the right side of the balance sheet - the liability. The balance sheet total (of each section) is called its currency.

Information about the financial condition of an enterprise in rubles as of a certain date can be obtained through the balance sheet, as well as information about the nature and size of the property.

Information in the balance sheet is grouped into sections, and sections consist of items. Balance is a Latin word and translates to “two cups.” Maintaining equality between assets and liabilities is the main principle of balance.

The sum of all balance sheet asset items (indicators characterizing the organization's economic assets) is equal to the sum of all balance sheet liability items (indicators characterizing the sources of economic assets).

Balance sheet data is used to control the amount of economic assets, their structure, sources, analyze the financial condition of the organization, and its solvency. The main form of accounting reporting, which is provided to regulatory authorities and interested users (banks, counterparties), is the balance sheet.

For more information about reporting forms, see the section “Accounting statements of the organization.”

Let's understand the basics

Legislators have determined a unified way of systematizing and grouping information about the economic activities of Russian enterprises and institutions.

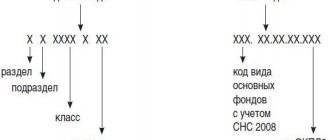

Order of the Ministry of Finance No. 94n establishes a Unified Chart of Accounts for commercial and non-profit organizations, and Order No. 157n - for public sector institutions. Accounting accounts are special digital and alphabetic codes that are used to reflect business transactions in accounting, or more precisely, when drawing up accounting entries.

Each account has its own classification characteristic, which is determined by the “balance sheet” method. This means that, like a balance sheet, all accounts are divided into assets and liabilities. And some accounts can be reflected in both assets and liabilities. Consequently, all accounts are divided into active, passive and active-passive accounts; the table for budgetary organizations contains about 1000 such codes.

Concept and structure of an accounting account

During the operation of an enterprise, many different economic processes occur: raw materials and supplies are received, products are produced and sold, wages are calculated and paid, etc. In order to correctly reflect numerous business transactions in accounting, they are grouped according to homogeneous business characteristics. Accounting accounts are used for this grouping. The list of all accounts changing in accounting is given in the standard chart of accounts.

Depending on what funds are recorded in the accounting accounts, they are divided into:

- Active;

- Passive;

- Active-passive.

Active accounts

Active accounting accounts keep records of the enterprise's assets (presence, receipt and disposal of business assets).

Active account scheme

| Debit | Credit |

| Initial balance - the balance of business assets at the beginning of the reporting period | |

| Debit turnover is the sum of business transactions that cause an increase in the enterprise’s economic assets during the reporting period | Loan turnover is the amount of business transactions that cause a decrease in the enterprise’s economic assets during the reporting period |

| Final balance - the balance of business assets at the end of the reporting period |

The ending balance is calculated using the following formula:

Sk = Sn + Od - Ok

Active accounts have the following features:

- the opening balance is always a debit balance and shows the availability of funds at the beginning of the reporting period;

- debit turnover reflects the receipt of funds;

- loan turnover reflects a decrease in funds;

- the final balance is always a debit balance and shows the balance at the end of the reporting period;

- active accounts reflect the presence and movement of economic assets and property of the enterprise.

The main active accounts include:

- 01 Fixed assets;

- 04 Intangible assets;

- 10 Materials;

- 20 Main production;

- 43 Finished products;

- 50 Cashier;

- 51 Current accounts;

- 52 Currency accounts;

- 58 Financial investments;

Passive accounts

Passive accounting accounts keep records of the sources of economic assets.

Passive account scheme

| Debit | Credit |

| Initial balance - the balance of sources of formation of economic assets at the beginning of the reporting period | |

| Debit turnover - the sum of business transactions that cause a decrease in the sources of formation of economic assets during the reporting period | Loan turnover is the amount of business transactions that cause an increase in the sources of formation of economic assets during the reporting period |

| Closing balance - the balance of sources of formation of economic assets at the end of the reporting period |

The final balance is calculated using the following formula:

Sk = Sn + Ok - Od

Passive accounts have the following features:

- The opening balance is always a credit balance and shows the amount of capital or the presence of liabilities of the enterprise at the beginning of the reporting period;

- Debit turnover shows a decrease in the capital or liabilities of the enterprise;

- The final balance is always a credit balance and shows the amount of capital or the presence of liabilities of the enterprise at the end of the reporting period;

- On passive accounts, records are kept of the sources of formation of the enterprise’s economic assets, i.e. capital or liabilities.

The main passive accounts include:

- 60 Settlements with suppliers and contractors;

- 66 Calculations for short-term loans and borrowings;

- 67 Calculations for long-term loans and borrowings;

- 68 Calculations for taxes and fees;

- 69 Calculations for social insurance and security;

- 70 Settlements with personnel for wages;

- 80 Authorized capital;

- 82 Reserve capital;

- 83 Additional capital;

- 99 Profits and losses.

Active-passive accounts

Designed for simultaneous accounting of both property and the sources of its formation.

Active-passive account scheme

| Debit | Credit |

| Initial balance - the balance of property at the beginning of the reporting period | Initial balance - the balance of sources of formation of economic assets at the beginning of the reporting period |

| Turnover by debit - transactions can be displayed either to increase property or to reduce balances | Loan turnover - operations can be displayed either to reduce property or to increase sources |

| Closing balance - the balance of property at the end of the reporting period | Closing balance - balance of sources at the end of the reporting period |

The main active-passive accounts include:

- 71 Settlements with accountable persons;

- 75 Settlements with founders;

- 76 Settlements with various debtors and creditors;

- 99 Profits and losses.

If the enterprise is owed by other organizations or individuals, then these debtors are called debtors, and their debt to the enterprise is called receivable.

If an enterprise uses borrowed or attracted funds, then it has accounts payable to other organizations or individuals who are creditors to it.

The company owes creditors, and debtors owe the company itself.

Classification of accounting accounts

This is the combination of accounts into groups based on the principle of homogeneity of economic content, the indicators of property, liabilities and business transactions reflected in them.

Accounts are classified:

- By structure (Active, Passive, Active-passive);

- According to the economic content, accounts of property and sources of its formation are distinguished, as well as according to business transactions in the areas of supply, production and sales;

- By purpose:

- Inventory - for accounting of the organization’s property, always active. Accounting is carried out in monetary and natural measures;

- Cash - for accounting for cash, always active. Accounting is carried out only in monetary terms;

- Current accounts - designed to record all types of payments. Accounting is carried out in monetary terms. Almost all are active-passive;

- Regulatory - clarify the assessment of certain types of property. Accounting is carried out in monetary terms. Always passive;

- Collection and distribution - designed to take into account indirect costs that require preliminary distribution. Always active;

- Reporting and distribution - designed to distribute costs between reporting periods;

- Calculation - designed for accounting and control of costs and for determining costs;

- Operational-effective - designed to identify the result of economic activity. Active-passive. Accounting is carried out in monetary terms;

- Financial-effective - designed to take into account accumulation and losses as a financial result. Active-passive accounts;

- Fund accounts are intended for accounting and control over the capital of an enterprise. Always passive.

Accounting accounts can also be divided into two groups:

- Balance sheet accounts are all balance sheet accounts combined into one system, having correspondence with each other and ensuring accounting of all financial and economic activities of the organization;

- Off-balance sheet accounts are accounts whose balances are not included in the balance sheet, but are shown behind its total, i.e. behind the balance. Accounting for them is carried out without using the double entry method. Entries are made in special statements according to the columns Income and Expense. In the chart of accounts, they are numbered in three accounts from 001 to 011. They are intended for accounting for property that is not the property of the organization.

Double entry of business transactions in accounting accounts

Double entry is an entry as a result of which each business transaction is reflected in the accounting accounts twice, in the debit of one account and in the credit of another, related account for the same amount. The double entry method determines the existence of such concepts as correspondence of accounts and accounting entries.

Account correspondence is the relationship between accounts that occurs under the double entry method.

An accounting entry is a registration of correspondence between accounts, when a record is simultaneously made of the debit and credit of accounts for the amount of a business transaction to be registered.

Accounting entries are distinguished:

- simple , i.e. An entry is made as a debit to one account and a credit to another.

- complex , i.e. the amount is distributed across the debit of several accounts and reflected in the credit of one account. Or one account is debited and several accounts are credited.

D51 K50 - correspondence of accounts;

D51 K50 2000 - registration of accounting entries.

Synthetic and analytical accounts

In accounting, 3 types of accounts are used to obtain information. According to the degree of detail they are divided into synthetic, analytical and sub-accounts.

Synthetic accounts (1st order accounts) contain generalized indicators about the property, liabilities and business operations of an organization for economically homogeneous groups in monetary terms.

Analytical accounts (3rd order accounts) - detail the content of synthetic accounts, reflecting data on certain types of property, liabilities and business transactions, expressed in natural, labor and monetary measures.

Subaccounts (2nd order accounts) - are intermediate accounts between synthetic and analytical and are intended for additional grouping of analytical accounts within a given synthetic account. Accounting is usually carried out in monetary terms.

Accounting uses synthetic and analytical accounting

Synthetic accounting is the recording of generalized accounting data on types of property, liabilities and business transactions according to certain economic characteristics, which is maintained on synthetic accounting accounts.

Analytical accounting is accounting that is maintained in personal and other analytical accounting accounts, grouping detailed information about property, liabilities and business transactions within each synthetic account.

Relationship between synthetic and analytical accounts

- The opening balance for all analytical accounts opened according to the synthetic account data is equal to the opening balance of the synthetic account to which they are opened;

- The turnover of all analytical accounts opened using the synthetic account data must be equal to the turnover of the synthetic account;

- The final balance for all analytical accounts opened for this synthetic account is equal to the final balance of the synthetic account.

How to distinguish

Experienced specialists know by heart which category this or that type of account belongs to. A less experienced accountant will need to know how to distinguish active from passive. As an example, we can take 62 “Settlements with customers”. It will be necessary to perform an analysis to understand what type it can be classified as.

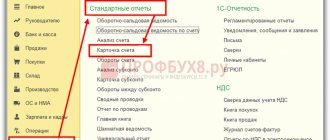

Chart of accounts in 1C program

The 62nd account reflects relationships with customers. For example, sale or purchase of goods, services, shipment. By selling products, the person purchasing the goods becomes a debtor to the company, which is indicated according to debit 62. Accounts receivable is an asset of the company, which means that an increase in the asset is indicated according to Debit.

After paying for the products, the debt decreases, so the decrease in the asset is reflected in Kt 62. It turns out that 62 represents an active account. But, there are cases when the buyer transfers an advance payment, then the company’s accounts payable to him or a liability turns out. It will pass according to Kt 62. After the products are shipped to the customer against the prepayment, accounts payable are reduced, the decrease in liabilities is indicated in accordance with Kt 62. In this situation, account 62 is classified as passive.

The considered example shows that count 62 has two types of signs, so it is classified in the third category, active-passive. In a similar way, you can analyze any other account and understand which class it belongs to. Electronic programs have built-in symbols and indicate opposite each value its type, according to the classification.

In accounting, there are three types of accounts. They have their own scheme and structure. You should know all existing species according to classification and be able to distinguish one from another.