Today we will analyze account 20 “Main production” . Why is it needed, what is taken into account on it. Which entries in account 20 reflect the accounting of production costs. For greater clarity, examples of cost accounting and cost formation on accounts are given. 20. In this article we will look at accounting for production costs, typical transactions and situations for account 20.

Account 20 records the costs of the main production, that is, all the organization’s expenses related to production are reflected.

What is production? In fact, production is the process of creating the cost of finished products, and the cost of finished products is, as we found out in the last article, the sum of all costs associated with production and sales. All these costs are collected in the debit of the account. 20 “Main production”, forming the cost.

| ★ Best-selling book “Accounting from scratch” for dummies (understand how to do accounting in 72 hours) > 8000 books purchased |

Reflection of expenses for the needs of main and auxiliary production

Below are typical entries reflecting expenses attributable to the costs of main production. Postings reflecting the expenses of auxiliary production are generated in the same way. In this case, in the postings, account 23 “Auxiliary production” is indicated as a debit account.

| Account Dt | Kt account | Wiring Description | Transaction amount | A document base |

| 20 | 60.01 | Works (services) of a production nature performed by third parties are reflected | Cost of work performed | Certificate of completed workInvoice (received) |

| 20 | 10 | Reflects the consumption of inventories (raw materials, purchased products, fuel, etc.) for the needs of the main production | Cost of material resources | Requirement invoice (TMF No. M-11) Limit card (TMF No. M-8) |

| 20 | 70 | Wages accrued to employees of main production | Salary amount | Accounting certificate-calculation |

| 20 | 69 | Insurance premiums have been calculated for employees of primary production | Amount of insurance premiums | Accounting certificate-calculation |

| 20 | 02 | Accrued depreciation of fixed assets involved in the main production | Amount of depreciation charges | Accounting certificate-calculation |

| 20 | 01 | The write-off of fixed assets worth less than 20 thousand rubles is reflected. put into operation for the needs of the main production | Cost of fixed assets | OS-1 Certificate of acceptance and delivery of fixed assets (except for buildings and structures) |

| 20 | 97 | The share of deferred expenses related to the reporting period is reflected | Amount of deferred expenses | Accounting certificate-calculation |

| 20 | 94 | Shortages (losses from spoilage) of inventories were written off within the approved norms of natural loss | Shortfall amount | Inventory list according to the form INV-3Accounting certificate-calculation |

| 20 | 71 | Travel expenses of employees of the main production are reflected | Amount of travel expenses | Advance report |

simplified tax system

If an organization pays a single tax on income, the expenses of service industries and farms do not reduce the tax base. Such organizations do not take into account any expenses (clause 1 of Article 346.18 of the Tax Code of the Russian Federation). Moreover, if service industries and farms sell products, provide services (perform work) to other organizations and citizens, only income from their sales will be taken into account when calculating the single tax (Clause 1 of Article 346.15 and Article 249 of the Tax Code of the Russian Federation).

If an organization pays a single tax on the difference between income and expenses, take into account the costs of service industries and farms in the manner prescribed in Article 346.17 of the Tax Code of the Russian Federation. In this case, expenses must be included in the list of expenses that can be taken into account when calculating the single tax (clause 1 of Article 346.16 of the Tax Code of the Russian Federation). Apply this procedure if service industries and farms sell products, provide services (perform work) to other organizations and citizens (Article 346.17 of the Tax Code of the Russian Federation).

Reflection of general production (general business) expenses

Below are typical entries that reflect expenses attributable to general production costs. Postings reflecting general business expenses are generated in the same way. In this case, the postings indicate account 26 “General business expenses” as a debit account.

| Account Dt | Kt account | Wiring Description | Transaction amount | A document base |

| 25 | 60.01 | Works (services) of a general production (general economic) nature performed by third-party organizations are reflected | Cost of work performed | Certificate of completed workInvoice (received) |

| 25 | 10 | Reflects the consumption of material resources (raw materials, purchased products, fuel, etc.) for general production (general economic) needs | Cost of material resources | Requirement invoice (TMF No. M-11) Limit card (TMF No. M-8) |

| 25 | 70 | Reflects the wages of employees attributed to general production (general business) costs | Salary amount | Accounting certificate-calculation |

| 25 | 69 | Insurance premiums attributed to general production (general business) costs are reflected | Amount of insurance premiums | Accounting certificate-calculation |

| 25 | 02 | Accrued depreciation of fixed assets for non-production (general economic) purposes | Amount of depreciation charges | Accounting certificate-calculation |

| 25 | 01 | The write-off of fixed assets worth less than 20 thousand rubles is reflected. put into operation | Cost of fixed assets | OS-1 Certificate of acceptance and delivery of fixed assets (except for buildings and structures) |

| 25 | 97 | The share of deferred expenses related to the reporting period is reflected | Amount of deferred expenses | Accounting certificate-calculation |

| 25 | 71 | Travel expenses reflected | Amount of travel expenses | Advance report |

UTII

In relation to the services that service industries and farms provide to third-party consumers, in the municipalities where these units are located, the use of UTII may be provided (Article 346.26 of the Tax Code of the Russian Federation). In this case, the organization has the right to transfer the activities of its auxiliary units to this special tax regime. To do this, she must register for tax purposes as a UTII payer.

The object of UTII taxation is imputed income for a specific type of activity of the organization (clauses 1, 2 of Article 346.29 of the Tax Code of the Russian Federation). Therefore, the costs of service industries and farms do not affect the determination of the tax base for UTII.

If an organization applies UTII in relation to its main activities and in relation to the activities of service industries and farms, taxes must be calculated separately for each type of activity (clause 2 of Article 346.29 of the Tax Code of the Russian Federation).

If an organization combines UTII with a simplified tax regime, organize separate accounting of property, liabilities and business transactions in relation to activities carried out within the framework of each of the special tax regimes (clause 7 of Article 346.26 of the Tax Code of the Russian Federation).

Reflection of the cost of products, services provided, work performed in auxiliary production

The typical entries below reflect the distribution of the share of general production and general business costs for the needs of auxiliary production. In addition, entries are provided reflecting the write-off of the costs of auxiliary production for the cost of products (work, services) produced through these production and for the needs of the main production

| Account Dt | Kt account | Wiring Description | Transaction amount | A document base |

| 23 | 25 | Distribution of general production costs to the costs of auxiliary production in proportion to the selected distribution base | Amount of overhead costs | Accounting certificate-calculation |

| 23 | 26 | Distribution of general business expenses into costs of auxiliary production | Amount of general business expenses | Accounting certificate-calculation |

| 40 | 23 | We reflect the cost of production of auxiliary production | Cost of manufactured products | Accounting certificate-calculation |

| 20 | 23 | Distribution of auxiliary production costs to the main production costs in proportion to the selected distribution base | Amount of expenses of auxiliary productions | Accounting certificate-calculation |

| 90.2 | 23 | We reflect the cost of work and auxiliary production services | Cost of work, services | Accounting certificate-calculation |

| 90.2 | 26 | Write-off of general business expenses to the cost of sales of the reporting period (in the case when general business expenses are not distributed among production costs) | Amount of general business expenses | Accounting certificate-calculation |

Names of Cost items and their groups

Every enterprise, trying to make money, is forced to spend money and incur costs. The specific list of such costs varies among firms, but there are some common ones. For example, “office”, “employee salaries”, some types of taxes, “cartridge refilling”, “electricity”, “utilities”, “premises rental” and many, many others. Look at the list of specific cost items used in two operating businesses.

list of cost items

cost items list

As you can see, the list is unlimited: the names of cost items depend on the accountant. Of course, three conditions should be adhered to: a) the name must reflect the essence of the cost, b) too much detail in the items provides a detailed analysis, but increases the complexity of registration, c) a too general name for the cost item makes the work easier, but the possibility of detailed analysis is lost.

Along with the names of cost items, it is possible to combine them into groups. What name should I give to the group? This question is always relevant for companies. Accounting suggests assigning each cost to one of five groups: “Material costs”, “Depreciation”, “Labor costs”, “Payroll taxes”, “Other”.

If we take these five groups as a basis, then we will certainly lose a detailed cost analysis, since these groups are too generalized. The following SALT by Account report shows what the collected costs will look like.

Balance sheet only by cost groups

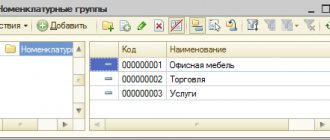

For accounting purposes this may be sufficient. But for the analysis of the activities of the enterprise, for the possibility of management decisions in such groups, detail is lost. The way out of this situation will be a special technique for filling out a list of costs. If we take the 1C Accounting program as a basis, then the “List of Costs” directory can be filled out as follows.

Directory of cost items by group

In each group that accounting offers us, we can enter any name of a cost item, thereby maintaining detail and the possibility of detailed analysis. Now the “Account SALT” report may look like this.

Balance sheet by groups and cost items

As you can see, we were able to use recommended groups and retain the necessary detail for analysis and decision making.

Reflection of the cost of manufactured products, services provided, work performed

The above diagram of typical transactions is used to reflect the cost of manufactured products (work performed, services rendered). General and general production expenses are distributed to the costs of the main production (included in the cost of sales - for general expenses) in full. Accounts 25 and 26 do not have a balance at the end of the reporting period.

On account 20 “Main production” at the end of the reporting period there may remain a debit balance in the volume of work in progress. Additionally, you can familiarize yourself with standard postings reflecting the release of finished products.

| Account Dt | Kt account | Wiring Description | Transaction amount | A document base |

| 20 | 23 | Distribution of expenses of auxiliary productions in proportion to the selected distribution base | Amount of expenses of auxiliary productions | Accounting certificate-calculation |

| 20 | 25 | Distribution of overhead costs in proportion to the selected distribution base | Amount of overhead costs | Accounting certificate-calculation |

| 20 | 26 | Distribution of general business expenses (in the case when general business expenses are not included in the cost of sales of the reporting period) | Amount of general business expenses | Accounting certificate-calculation |

| 40 | 20 | We reflect the cost of manufactured products. The cost of resources in work in progress is determined by inventory | Cost of manufactured products | Accounting certificate-calculation |

| 90.2 | 20 | We reflect the cost of work performed and services provided. The cost of resources in work in progress is determined by inventory | Cost of work, services | Accounting certificate-calculation |

| 90.2 | 26 | Write-off of general business expenses to the cost of sales of the reporting period (in the case when general business expenses are not distributed among the costs of the main production) | Amount of general business expenses | Accounting certificate-calculation |

The concept of Costs..., but is it the same?

Reading books and textbooks on accounting, you will find that together with the concept of Costs, the concept of Expenses is often found. Yes, so often that they sometimes even appear together in the same sentence. You can think about the equality of these concepts. However, there is a fundamental difference between them.

Costs in accounting are a reduction in an enterprise's resource, but without its loss. Resources such as money, materials, or others are exchanged for another resource or obligation. For example : We paid the supplier in money for previously received materials - “the money turned into materials.” Or they could first pay the supplier and thereby “fix” his obligation to us. In any case, the resource “money” is not lost, but “transformed” either into materials or into an obligation.

Expenses in accounting are the irrevocable conversion of a company's resources to generate Revenue. For example : We sold a product and transferred it to the buyer. At this point, the cost of the goods is considered an Expense for the company.

Now that the fundamental difference between these concepts has been defined, you should be attentive to the events taking place at the enterprise so that for the words Costs and Expenses you clearly understand what their meaning is.

List of accounts involved in accounting entries:

|

|

BASIC

Keep tax records of income and expenses for the activities of service industries and farms separately from other types of activities in accordance with the rules of Article 275.1 of the Tax Code of the Russian Federation.

An example of reflection in accounting and taxation of costs of service industries and farms

Alpha LLC, in addition to its main divisions, has a service production facility - a canteen, which provides food to all employees of the organization on a paid basis, as well as to other persons.

In March, the canteen’s expenses amounted to RUB 277,080, including:

- material expenses for cooking – 75,000 rubles;

- salary (including contributions for compulsory pension (social, medical) insurance and contributions for insurance against accidents and occupational diseases) of workers - 52,080 rubles;

- depreciation of canteen equipment - 150,000 rubles.

At the beginning and end of the month there are no work in progress balances in the canteen.

In March, the canteen sold products worth RUB 217,370 to the organization’s employees. (including VAT – RUB 33,158). Revenue from sales of products to other persons amounted to RUB 144,914. (including VAT – 22,106 rubles).

The accounting policy for accounting purposes establishes that the canteen's costs are distributed in proportion to the revenue received.

In accounting, the accountant reflected the costs of the canteen and the provision of food as follows.

In March:

Debit 29 Credit 10 – 75,000 rub. – products for preparing lunches were donated;

Debit 29 Credit 70 (69) – 52,080 rub. – salaries of canteen employees have been accrued (insurance premiums and contributions for insurance against accidents and occupational diseases from the salaries of canteen employees);

Debit 29 Credit 02 – 150,000 rub. – depreciation accrued on equipment used in the canteen is taken into account;

Debit 73 Credit 91-1 – 217,370 rub. – canteen products were sold to the organization’s employees;

Debit 76 Credit 91-1 – 144,914 rubles. – the canteen’s products were sold to other persons;

Debit 91-2 Credit 29 – 278,680 rub. – the cost of sold products of the canteen is taken into account as expenses;

Debit 91-2 Credit 68 subaccount “VAT calculations” – 55,264 rubles. (RUB 33,158 + RUB 22,106) – VAT is charged on the sale of canteen products.

Since the canteen is a service industry, in tax accounting the accountant calculated the financial result from its activities separately. When calculating income tax, he took into account 307,020 rubles as income. (RUB 217,370 + RUB 144,914 – RUB 55,264), included in expenses – RUB 277,080.

Write-off of costs for material products

The cost of material items created during the production process, depending on the purpose of these items, can be taken into account as part of:

- finished products, if during its production all stages of processing have been completed and the product is intended for sale to third parties:

Dt 43 Kt 20 (23, 29);

- semi-finished products, if the item represents an intermediate result of processing in a chain of stages of this processing and will be used further in its own production, but can also be sold externally:

Dt 21 Kt 20 (23, 29);

- material costs for production, if semi-finished products arising from the transfer method are taken into account using the non-semi-finished method:

Dt 20 (23, 29) Kt 20 (23, 29);

- material reserves, if there is an intention to use the created item for the organization’s own needs:

Dt 10 (07, 08) Kt 20 (23, 29).

Read more about the incremental method of accounting in the material “The incremental method of cost accounting - essence and features.”

If there is a need to generate data in accounting regarding deviations between actual and planned costs, account 40 can be used to write off the amounts collected in cost accounting accounts:

Dt 40 Kt 20 (23, 29).

The planned cost in this case will be reflected as follows:

Dt 43 Kt 40.

Account 40 must be closed monthly (Chart of Accounts, approved by order of the Ministry of Finance of the Russian Federation dated October 31, 2000 No. 94n). Therefore, the identified deviations will adjust the cost of either products sold during the reporting period (Dt 90 Kt 40 or Dt 40 Kt 90), or products remaining unsold at the end of the period (Dt 43 Kt 40 or Dt 40 Kt 43).

Setting up accounting policy settings

Carrying out operational actions requires choosing in advance the method by which the planned procedures will be carried out. It is defined in the UP. In the program, you need to go to the “Main” tab, and then to the “Settings” field - “Accounting Policy”. Here we note an alternative for estimating MPZ: by average value or by FIFO.

It is worth considering the features when writing off materials and how to write off from 10 accounts in “1C”:

- Companies whose work is carried out on a general basis have the right to choose any assessment method (from those indicated above). But if they need to evaluate by unit cost, then check the box next to FIFO. This is also suitable for organizations operating in a “simplified” manner. If the simplified scheme operates within 15%, then the choice of alternative variation will be closed. You should strictly choose FIFO.

- An average cost estimate is required for raw materials accepted for processing. The information function specifically notifies staff about this.