Classification of production costs

All costs that arise in a manufacturing company can be divided into two groups: direct and indirect (overhead).

A specific list of types of expenses that belong to a particular group is determined by the organization itself and enshrined in its accounting policies. But, as a rule, direct costs include:

- Raw materials and materials.

- Equipment depreciation.

- Workers' wages and insurance premiums accrued on them.

Overhead costs can also be divided into two groups:

- General production.

- General economic (managerial).

The first group relates to the costs of managing the production process, and the second - to the management of the enterprise as a whole.

For example, the salary of a shop manager or foreman is general production costs, and the remuneration of a director or chief accountant is general economic costs.

Subaccounts

For account 20 the following recommended sub-accounts can be opened for the main activities of the enterprise:

- 20-01 “Crop production”. This takes into account the costs of crop production and its branches - horticulture, floriculture, growing seedlings.

- 20-02 “Livestock” - accounting for the costs of output from livestock farming and its industries - dairy and beef cattle breeding, sheep farming, fish farming, beekeeping, etc.

- 20-03 “Industrial production”. This subaccount reflects all direct costs associated with the manufacture of goods, preparation and development of production, other production costs, as well as production maintenance and management costs.

- 20-04 “Other main production” - cost accounting for other main activities of manufacturing enterprises.

Costing methods

The basis of production accounting is the calculation (calculation) of the cost of finished products. But the products can be very diverse - from needles to complex machines and ocean liners. Therefore, the calculation methods will differ.

The custom method is used for:

- Production of technically complex products with a long production cycle (mechanical engineering, shipbuilding).

- Construction.

- Work under a contract.

- Small-scale production.

In this case, a separate cost estimate or estimate is drawn up for each order.

The cross-cutting method is used if the finished product is obtained from the original raw material after several stages of processing. A typical example of such production is the food or oil refining industry. In this case, the cost is determined at each intermediate stage (redistribution).

The evaluated result of each stage (semi-finished product) is the raw material for the next cycle. At the last stage, the cost of the final product is calculated.

The boiler method is that all production costs are taken into account together (in one “boiler”).

There is no analytical accounting. The cost per unit of production is determined by dividing all costs by the volume of output. Therefore, this accounting option is used by small enterprises or those companies that produce one type of product.

Results

The procedure for writing off production costs used in the organization is largely determined by the provisions of the accounting policy, which should reflect:

- level of cost formation;

- bases for the distribution of accounts 25 and 26;

- with the transfer method of accounting - the use of a semi-finished or unfinished method;

- use or non-use of account 40.

If there is internal consumption of products (works, services), it becomes necessary to establish a sequence for closing costs by department in order to avoid the occurrence of counter closing processes.

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Accounting and distribution of costs in production

Direct costs are reflected on account 20 “Main production” in correspondence with accounts for materials, payments, wages, etc.

DT 20 - CT 10 (60, 69, 70, 76, etc.)

General production expenses (account 25) and general business expenses (account 26) during the month are taken into account in the same way as direct ones:

DT 25 (26) - CT 10 (60, 69, 70, 76)

General production expenses at the end of the month are also transferred to account 20:

DT 20 – CT 25

The distribution of overhead costs between products is carried out according to the selected base. This could be, for example, the cost of materials consumed or workers' wages.

For general business expenses, the following options are possible:

- The distribution is similar to general production.

DT 20 –KT 26

- Attribution directly to cost.

DT 90 – KT 26

The selected base and method of distribution of general production and general business expenses must be reflected in the accounting policy.

Future expenses

Even with stable production volumes in different reporting periods, the actual amounts of expenses may vary significantly. For example, this is possible if:

- the organization’s activities are seasonal;

- the employee vacation schedule is uneven;

- There is no schedule for scheduled preventive maintenance of equipment.

Individual expenses are associated with the receipt of income in several reporting periods. Distribute them between reporting periods. This will need to be reflected in the Income Statement. The same rule applies in cases where the relationship between income and expenses cannot be clearly defined. This is stated in paragraph 19 of PBU 10/99.

Here are some expenses that are included in future periods:

- with mining and preparatory work;

- with preparatory work for production due to its seasonal nature;

- with the development of new production facilities, installations and units;

- with land reclamation and other environmental measures;

- with uneven repairs of fixed assets carried out throughout the year (when the organization does not create an appropriate reserve or fund).

Such examples are given in the Instructions for the chart of accounts (account 97).

Attention: after spending more than they earned, many people decide to cheat. In order not to show a loss, expenses are included in deferred expenses. And they violate the procedure for reflecting income and expenses in accounting. Officials will be fined for this. The organization itself may also suffer. There is another danger. By hiding a loss from the bank, the borrower commits a criminal offense. For this, the manager will be imprisoned for up to five years (Article 176 of the Criminal Code of the Russian Federation).

In general, expenses are taken into account based on the purpose. In the period to which they relate, regardless of the fact of payment (clauses 2, 4 and 18 of PBU 10/99).

As you can see, there are no special conditions for unprofitable periods. Even when there is no income at all. Therefore, let’s say, the current month’s rent cannot be written off as a future expense during the year.

r />

Alpha LLC rents a sales area. The monthly rent is RUB 250,000.

Error!

Debit 97 Credit 60 – 250,000 rub. – monthly rent payment is included in deferred expenses.

Correctly like this:

Debit 44 Credit 60 – 250,000 rub. – expenses for renting a sales area are reflected.

What to do

Errors from previous years will only be discovered during verification. But it will most likely not be possible to avoid responsibility. It’s better to recalculate your taxes yourself, submit the correct information, and pay penalties.

If the error occurred this year, then everything can be corrected. Cancel erroneous entries. Qualify expenses correctly. Generate correct reporting and calculate taxes. There won't be any trouble.

r />

Here's how to fix the error in the above situation:

Debit 97 Credit 60 – 250,000 rub. – the RBP was reversed from the costs of renting the sales area;

Debit 44 Credit 60 – 250,000 rub. – expenses for renting a sales area are reflected.

In accounting, first reflect such expenses on account 97 “Deferred expenses”:

Debit 97 Credit 60 (76...) – costs are taken into account as part of deferred expenses.

And then gradually include them in production costs:

Debit 20 (25, 26) Credit 97 – part of deferred expenses is taken into account as part of expenses for ordinary activities.

Determine the procedure and timing for transferring future expenses to the cost of products, works or services. For example, the following expenses can be written off:

- evenly over the period approved by order of the manager;

- in proportion to sales income.

The established procedure for writing off expenses of future periods should be fixed in the accounting policy for accounting purposes (clause 4, 8 of PBU 1/2008).

Attention: there are those who decide to write off deferred expenses at a time. They do this, wanting to understate the large profit of the current period, or simply out of ignorance. As a result, officials will be fined. In some cases, the organization will also suffer. However, everything can be fixed.

Distribute future expenses. So, let’s say, after spending money on an annual license, write off its cost in accounting during this period. Just as prescribed in the accounting policy. They do this, for example, evenly or in proportion to the volume of production. This follows from paragraph 65 of the order of the Ministry of Finance of Russia dated July 29, 1998 No. 34n, paragraph 19 of PBU 10/99 and confirmed in the letter of the Ministry of Finance of Russia dated January 12, 2012 No. 07-02-06/5.

r />

Let's say the Alpha organization has received a certificate of conformity for its products with a validity period of five years. The cost of the certificate was 50,000 rubles. According to the accounting policy at Alfa, RBP is written off evenly.

Error!

Debit 20 Credit 76 – 50,000 rub. – the fee for the certificate is taken into account as part of expenses for ordinary activities.

Correctly like this:

Debit 97 Credit 76 – 50,000 rub. – the fee for the certificate is included in deferred expenses.

Monthly:

Debit 20 Credit 97 – 833 rub. (RUB 50,000: (5 years × 12 months)) – deferred expenses are written off.

What to do

In accounting, reverse the entry that was written off by the RBP at a time. Remember, this can only be done within the year in which the mistake was made.

r />

Here's how to fix the error in the above situation:

Debit 20 Credit 76 – 50,000 rub. – the amount previously erroneously included as expenses for ordinary activities is reversed;

Debit 97 Credit 76 – 50,000 rub. – the fee for the certificate is included in deferred expenses.

At the same time, expense the amounts written off for the past months. For example, if three months have passed since costs were accepted for accounting:

Debit 20 Credit 97 – 2500 rub. (3 months × (50,000 rubles: (5 years × 12 months))) – deferred expenses are written off.

Situation: how can a newly created organization reflect in accounting the costs associated with the preparation and development of production (preparatory expenses)?

Include such costs as deferred expenses.

After all, these expenses are associated with generating income in the future. They are classified as costs associated with the development of new types of activities (productions). For example, for mining enterprises this may include geological work, laboratory analyses, sample testing, etc.

There is no need to take into account such expenses in the cost of products, works or services until they generate income.

Therefore, the incurred preparatory costs must be reflected as follows:

Debit 97 Credit 10 (02, 70, 69...) – expenses for the development of new types of activities (productions) are reflected.

Any fact of economic life must be documented with supporting documents. As with any primary documents, they must indicate all the necessary details. Such requirements are established in Article 9 of the Law of December 6, 2011 No. 402-FZ.

In accounting, it is necessary to maintain the connection between expenses and income. Therefore, transfer preparatory expenses to the cost of products, works or services with which they were associated, after income is received within the framework of the new activity. In accounting, reflect this by posting:

Debit 20 (26, 44...) Credit 97 – preparatory expenses are written off as the cost of products, works or services.

Determine the procedure according to which you will transfer future expenses to cost price yourself.

Such instructions are in the Instructions for the chart of accounts and paragraph 19 of PBU 10/99.

An example of reflecting preparatory expenses in the accounting of a newly created organization

OJSC "Proizvodstvennaya" was registered in January. In the same month, Master carried out preparatory work to launch new equipment. The organization had no income in January, expenses were:

- 60,000 rub. – the salary of the employees who carried out the trial run of the equipment, and contributions for compulsory pension (social, medical) insurance and insurance against accidents and occupational diseases;

- 60,000 rub. – materials used for testing.

According to the accounting policy, in “Master” preparatory expenses for accounting purposes are written off evenly over the next 12 months. This period is counted from the date of receipt of income associated with costs.

In January, Master’s accountant made the following entries:

Debit 97 Credit 70 (69) – 60,000 rub. – the salaries of the employees who carried out the trial run and insurance premiums were accrued;

Debit 97 Credit 10 – 60,000 rub. – the cost of materials used during the trial run has been written off.

In February, Master received its first revenue from product sales. In accounting, from February of the current year to January of the next year, the accountant makes the following entries:

Debit 20 Credit 97 – 10,000 rub. ((60,000 rub. + 60,000 rub.) : 12 months) – deferred expenses are included in the cost of production.

In tax accounting, preparatory expenses can be immediately written off as a reduction in taxable profit.

Since the periods of recognition of preparatory expenses in accounting and tax accounting do not coincide, temporary differences arise. They are reflected in accounting according to the rules of PBU 18/02. For more information about this, see The relationship between accounting and tax accounting indicators when reflecting income taxes.

Accounting for production costs during production

There are two ways to formulate product costs:

- Accounting "as per fact".

In this case, after the month, actual production costs are transferred to account 43 “Finished products”:

DT 43 - CT 20

After the product is sold, its cost is written off:

DT 90 – KT 43

- Accounting at planned cost.

Using only actual cost is not always convenient. It can be accurately determined only at the end of the month, when salaries are calculated, bills for heat and electricity are received, etc. But what if products are produced quickly and transferred to the warehouse every day? In this case, additional account 40 “Product Output” is used.

During the month, finished products are accounted for at planned cost:

DT 43 - CT 40

The cost of products sold is written off in the same way as the previous option:

DT 90 – KT 43

At the end of the month, the debit of account 40 reflects the actual cost.

DT 40 – CT 20

If the actual cost turns out to be more than planned, then it must be additionally written off to account 43

DT 43 – CT 40

If the cost plan is not fulfilled, then this posting should be reversed

DT 43 – CT 40

Interaction with other accounts

Account correspondence 20 on debit is carried out with the following sections:

- Section 1 - 02, 04, 08.

- Section 2 - 10, 11, 16.

- Section 3 - 20, 21, 23, 25, 26, 28, 29-3.

- Section 4 - 40, 41, 43.

- Section 6 - 60, 68, 69, 70, 71, 73, 75, 76, 79.

- Section 8 - 94, 96.

On loan account 20 interaction with other accounts is carried out as follows:

- Section 2 - 1, 11.

- Section 3 - 21, 28.

- Section 4 - 40, 43.

- Section 6 - 76, 79.

- Section 8 - 90, 91, 94, 99.

Work in progress accounting

The actual cost is usually calculated monthly. This is convenient because... many costs (for example, wages, utilities, communication services, etc.) can only be determined based on the results of the month. Naturally, the production cycle often does not coincide with the calendar month. In this case, unfinished production is formed.

Its valuation corresponds to the debit balance of account 20 at the end of the month. Depending on the methodology adopted at the enterprise, the “work in progress” can:

- Include only direct and overhead costs.

- Calculate based on full cost, i.e. taking into account general business expenses.

Business trip abroad

A business trip is an employee’s trip outside the territory of permanent work to perform official tasks. A business trip can be both within the territory of the Russian Federation and abroad.

Accounting for travel expenses for trips abroad

The list of travel expenses is given in paragraph 12 of paragraph 1 of Article 264 of the Tax Code of the Russian Federation, these include expenses for:

- Directions

- Housing

- Daily allowance

- Visa application

- Registration of a foreign passport

- Consular, airfield fees, fees for the right of entry, passage, transit of transport, for the use of sea canals, etc.

As for travel and accommodation, there are no special differences.

Daily allowance

Daily allowances for foreign business trips are also set by the organization independently. Up to 2,500 rubles, according to the law, daily allowances when traveling abroad are not subject to personal income tax.

An organization can set the daily allowance amount different for each individual country. The daily allowance established for a particular country begins to apply from the moment the business traveler enters that country.

Border crossing marks are placed in the international passport, which will serve as a document confirming daily allowance expenses.

Visa costs

This type of expense is typical for a business trip abroad. Departure in another direction must be accompanied by a visa. Visa costs can be taken into account for tax purposes if there are documents confirming the provision of services (consulting, delivery of a completed visa, etc.), payment for these services, fees and other fees associated with the visa application. In addition, you must make a copy of the visa page. This copy will serve as a document confirming these expenses. It is with this copy that it will be possible to take into account expenses when taxing.

Costs for obtaining a passport

If the employee does not have a valid passport, then the costs of obtaining it can also be taken into account for tax purposes. Documents on the basis of which these expenses can be written off are documents confirming the provision of services and payments, as well as a copy of the pages of the international passport.

Documentation of a foreign business trip

Registration begins with the formation of a job assignment, for example, in the T-10a form. Based on the official assignment, a business trip order is drawn up. To do this, you can use the unified forms T-9 or T-9a. The first form is filled out when one employee is sent on a business trip abroad, the second - when a group of employees departs.

When an employee leaves abroad, he is given a certain amount to report on the basis of the advance report AO-1. When returning from a trip abroad, the employee must submit a completed advance report and attach all supporting documents to it.

When traveling on a business trip across the territory of the Russian Federation, the employee must also submit a travel certificate containing notes on the employee’s visits to various organizations at the destination.

When traveling abroad, you do not need to fill out a travel permit. It will be replaced by a page of the international passport with customs marks on border crossing. It is on the basis of these marks that the accountant will be able to correctly determine the amount of daily allowance that must be paid to the employee while on a business trip.

Another point is that an employee on a business trip abroad can be given money both in domestic and foreign currency. In the second case, you need to buy the required amount of currency.

Accounting for production defects

The production process does not always go perfectly. Often, during product quality control, defects are detected. To account for it, special account 28 “Defects in production” is used.

The cost of defective products is transferred to account 28 from account 20:

DT 28 – CT 20

If the materials that went into the production of a defective product can be partially used, then they are taken into account as inventories:

DT 10 – CT 28

If the guilty person is identified, then the cost of the marriage can be recovered from him.

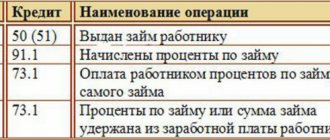

DT 73 - CT 28 - the amount of recovery is allocated to settlements with the employee who committed the defect.

DT 70 – CT 73 – the amount is withheld from the culprit’s salary.

If the cost of the defect could not be fully compensated, then the remaining amount is applied to the cost of production:

DT 20 – CT 28

Business trip within the Russian Federation

Almost every organization is faced with the need to send its employees to perform work tasks in other locations. At the same time, accountants are faced with the need to properly document this trip, called a business trip, and correctly account for related expenses, called travel expenses.

The correctness of accounting for travel expenses is the most pressing issue, since these expenses can only be taken into account for taxation if they are correctly taken into account and documented.

Duration of business trip

The duration of a business trip is not limited by any legal regulations, so an employee can be on a business trip as long as necessary to complete the assigned tasks.

The first day of a business trip is the day of departure from the place of permanent work, and the last day is the day of arrival. That is, if an employee has a train ticket to another city dated October 25 at 23.45, and a return ticket is dated October 27 at 6.15, then the duration of the business trip will be 3 days. Departure and arrival times are calculated according to local time (location of permanent work).

Documentation of a business trip

Registration begins with writing a job assignment, for which the existing unified form T-10a can be used. As a rule, the official assignment is drawn up by the person sending the employee on the trip (immediate superior, manager).

Based on the job assignment, a business trip order is generated using the unified form T-9 or T-9a, if it is necessary to send more than one employee.

Based on the order, the employee is given an accountable amount for travel expenses. Upon return, the employee must report on the funds spent within three days using an advance report form AO-1, which provides a list of expenses incurred. The unspent amount is returned to the enterprise's cash desk with the issuance of a cash receipt order in the KO-1 form. If the money received under the report was not enough for the employee, then the amount spent in excess of the advance received is reimbursed to the employee - issued from the cash register with the execution of an expense cash order in the KO-2 form.

The employee must attach supporting documents confirming the expenses incurred to the advance report.

An advance report is an important document that allows you to take into account expenses incurred for tax purposes, so its execution is mandatory.

Another document that an employee must submit upon arrival from a business trip is a travel certificate, which contains the signatures of responsible persons of all organizations visited by the traveler, as well as the seals of these organizations. In addition, the dates of departure from each organization and the dates of arrival at them are indicated. The first entry is made upon departure from the place of permanent work, and the last entry upon return.

A travel certificate is also an important document, as it serves to confirm daily allowance expenses; from the records of the travel certificate, you can understand how many days the business trip lasted.

Travel expenses

Expenses incurred on a business trip, which can be taken into account when calculating the tax base for income tax, are listed in paragraph 12, paragraph 1, article 263 of the Tax Code of the Russian Federation.

The main costs include:

- Directions

- Accommodation

- Daily allowance

Travel expenses

The organization pays the employee all transportation costs to and from the destination, as well as all travel on official business at the destination.

Moreover, the costs of paying for public transport (bus, tram, trolleybus, train, plane), taxi (if it is fixed in local acts, orders of the organization), rented transport are taken into account.

While moving, the employee must collect all documents that can be used to confirm the fact of services provided and payment made (checks, tickets, travel documents, vehicle rental agreements, etc.).

Living expenses

The organization pays the employee for living expenses at the destination. The payment may be for a hotel room, rented apartment or other housing.

Additional services used by the employee at the hotel (sauna, swimming pool, massage, restaurant) are not paid for.

In case of pre-booking a hotel room, the costs of the reservation can also be taken into account if there are documents confirming these costs.

When returning, the employee must provide all documents received at his place of residence: apartment rental agreements, service provision certificates, checks, invoices, etc.

Daily allowance

For each day of travel, the organization pays the employee a daily allowance - a fixed amount that the employee can spend on any expenses not related to travel or accommodation.

The amount of daily allowance for a business trip is not limited either higher or lower. The organization independently sets the amount of daily allowance that it considers appropriate and justified.

Legislative documents regarding the amount of daily allowance only say that within 700 rubles. no need to take into account personal income tax. From amounts over 700 rubles. it will be necessary to withhold personal income tax. Value 700 rub. used by the border when traveling within the territory of the Russian Federation. If an employee travels abroad, then the daily allowance, within which personal income tax is not withheld, is 2,500 rubles.

Accounting for travel expenses (postings)

When an employee is sent on a business trip, he is given a sum of money for reporting.

The issuance of this amount is reflected by posting D71 K50 (51) , the posting is carried out on the basis of the advance report.

We previously examined account 71 “Settlements with accountable persons”; it is intended for accounting for amounts issued for reporting, including for business trips.

When returning to the organization, if the employee has money left, it is received using entry D50 (51) K71 (posting is carried out on the basis of a cash receipt order), if the employee spent more than the amount received, then the excess amount is reimbursed to him by making entry D71 K50 (51) (posting is carried out on the basis of a cash receipt order).

The amount issued to the accountable person can be written off using the following entries:

- D20 (23, 25, 26, 29) K71 - if the business trip is related to the main activity of the production organization

- D44 K71 - if it is related to the main activity of a trading organization

- D08 K71 - if its main goal is the acquisition of a fixed asset

- D10 K71 - if the purpose of the business trip is to purchase materials

- D91/2 K71 - if the business trip is of a cultural and entertainment nature

If an employee has made expenses that the organization does not recognize, then these expenses can be deducted from the employee’s salary: entry D70 K71 or contributed by the employee to the cash register: entry D50 K71.

If an organization pays any expenses not through an employee, but independently from a cash register or from a current account, for example, buys a plane or train ticket, then the following transactions are made:

- D50/3 K76 - the purchased ticket was credited to the box office

- D71 K50/3 - ticket issued to a posted worker

- D20, 23, 44, 91/2 K71 - expenses for purchasing a ticket have been written off