The operation of fixed assets (FPE) in the production and economic activities of any enterprise is inevitably accompanied by their wear and tear, which often leads to breakdowns of the equipment used and partial destruction of work premises.

In order to prevent the final failure of OS objects and significantly save on costs associated with replacing technical devices, it is recommended to restore the relevant assets in a timely manner.

As is known, restoration of the normal performance of fixed assets is carried out through repair work, as well as the implementation of projects for their reconstruction and modernization.

How is it different from ongoing renovation work?

Reconstruction and modernization include measures that contribute to the improvement or, as an option, the targeted formation of updated technical and economic characteristics of the equipment used.

Repair work implies a set of activities that involve the replacement of certain parts, components, structures of a specific OS object, as well as actions aimed at ensuring its normal functioning.

Repair work, in turn, can be current or capital.

If we judge the purpose of the current repair, it should be noted that it is aimed at eliminating, relatively speaking, minor breakdowns, preventing possible malfunctions, and generally maintaining the current performance of the equipment used.

As for the overhaul, it is carried out to maintain the working condition of the fixed asset by restoring its technical and economic parameters to the required level.

Thus, capital repairs usually involve more serious costs than, for example, routine repairs.

Accordingly, a certain approach is required to the accounting of expenses for major repairs, provided, however, by the current norms and standards.

conclusions

It is obvious that repair costs, including capital repairs of fixed assets, do not lead to an increase in the book value of the corresponding objects.

They are simply included in the costs of the enterprise, which is typical for both accounting and tax accounting. It is noteworthy that for accounting purposes there is no need to separate repair work into the areas of current and major repairs.

The option to reserve repair costs in tax accounting allows you to distribute them evenly over several periods.

How is it different from upgrading the OS?

Modernization of fixed assets and repair work are associated in many ways, so accountants often make many mistakes when preparing reports on work performed.

In order to correctly fill out the statements and make the appropriate entries, you must clearly understand the definition of each concept.

Repair is comprehensive work to troubleshoot and restore the functionality of objects in order to restore operational operations.

In addition, these measures are aimed at prevention in order to replace worn parts and structures.

Important: at the same time, repair work, even when replacing old parts of fixed assets with elements of the latest developments, should not lead to changes in the technical and economic indicators of the equipment as a whole.

The use of routine repairs can be carried out several times a year in order to eliminate minor problems, replace worn parts; the operation of the OS object does not stop during this event.

In general, the entire process is aimed at extending the operational life of the fixed asset.

Overhaul of the OS is carried out once a year with a complete temporary shutdown of the equipment; it involves disassembling the facility to replace components.

Important: for an accountant there is no distinction as to what type of repair was made.

OS modernization is a series of activities aimed at replacing parts and assemblies with more advanced options in order to increase equipment performance, its technological qualities and economic characteristics.

Important: the main feature of modernization is the replacement of existing components, and not failed ones, since in this case it will be a repair.

simplified tax system

Accounting for the cost of repairing fixed assets when calculating the single tax depends on the object of taxation that the organization applies.

If an organization pays a single tax on income, then expenses for repairs of fixed assets do not reduce the tax base. With this object of taxation, expenses are not taken into account (clause 1 of Article 346.18 of the Tax Code of the Russian Federation).

If an organization pays a single tax on the difference between income and expenses, expenses for the repair of fixed assets can be taken into account as expenses when calculating the single tax (subclause 3, clause 1, article 346.16 of the Tax Code of the Russian Federation). The amounts of VAT paid to suppliers (contractors) also reduce the tax base (subclause 8, clause 1, article 346.16 of the Tax Code of the Russian Federation).

Consider the costs of repairing leased fixed assets if:

- by law or in accordance with the contract, the tenant is obliged to carry out repairs of the leased property at his own expense (Articles 616, 644 of the Civil Code of the Russian Federation);

- the expenses incurred comply with the criteria of paragraph 1 of Article 252 of the Tax Code of the Russian Federation (Clause 2 of Article 346.16 of the Tax Code of the Russian Federation).

This approach is confirmed in letters of the Ministry of Finance of Russia dated January 20, 2011 No. 03-11-11/10 and the Federal Tax Service of Russia for Moscow dated July 13, 2009 No. 16-15/071782.

Reduce the tax base as expenses for the repair of fixed assets arise and are paid (clause 2 of Article 346.17 of the Tax Code of the Russian Federation). For example, if an organization repairs a fixed asset with its own resources, then include the cost of spare parts in the tax base as they are replaced (drawing up a report on the replacement of spare parts) and payment to the supplier (clause 2 of article 346.17, clause 2 of article 346.16, clause 1 of article 252 of the Tax Code of the Russian Federation), and employee salaries - as employees are paid (clause 2 of Article 346.17 of the Tax Code of the Russian Federation).

An example of how the costs of repairing fixed assets are reflected in accounting and taxation. The organization applies the simplification and pays a single tax on the difference between income and expenses

LLC "Torgovaya" carried out a major overhaul of the store premises. The store is owned by Hermes on a leasehold basis. Under the terms of the lease agreement, the tenant is obliged to carry out repairs to the premises at his own expense. Hermes hired a contractor to carry out the repair work. The cost of the work amounted to 212,400 rubles. (including VAT – RUB 32,400). The act in form No. KS-2 was signed in June. At the same time, the contractor was paid for the months of work.

In accounting and tax accounting, expenses for major repairs are written off at a time.

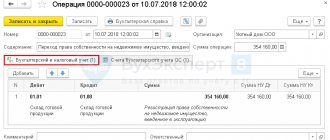

In June, the Hermes accountant made the following entries:

Debit 44 Credit 60 – 180,000 rub. (RUB 212,400 – RUB 32,400) – costs for repairing store premises were written off;

Debit 19 Credit 60 – 32,400 rub. – reflected VAT presented by the contractor;

Debit 44 Credit 60 – 32,400 rub. – VAT is included in costs and is not deductible;

Debit 60 Credit 51 – 212,400 rub. – funds were transferred to the contractor for repair work.

When calculating advance payments for the single tax for the first half of the year, the accountant took into account:

- expenses for repairs of fixed assets in the amount of 180,000 rubles;

- “input” VAT paid to the contractor in the amount of RUB 32,400.

Major and current repairs of the OS, unlike other recovery methods

In the production activities of organizations during the operation of the operating system, wear and tear of the operated objects naturally occurs, and breakdowns occur. Their timely restoration allows you to increase their service life and avoid the cost of purchasing new equipment. Recovery is possible through modernization, reconstruction and repair. Modernization and reconstruction are recognized as work that improves or creates new technical and economic characteristics of an object. Whereas repair includes a set of measures aimed at replacing individual structures, parts, and maintaining its working condition.

Repairs are divided into current and major. Current repairs are aimed at prevention, maintaining the facility in working order and eliminating minor faults. Capital - guarantees the restoration of the technical parameters of the object and its working condition.

Overhaul can be comprehensive, covering the entire facility, or selective, including the repair of individual parts of the facility.

The validity of OS repairs is established by the technical services of organizations by determining the order of scheduled preventive maintenance, while assigning the type of repair.

A feature of accounting for major repairs compared to other types of restoration is that repair costs are included in current costs, while costs for modernization and reconstruction are included in capital costs.

For key differences between repair and OS modernization for tax purposes, see ConsultantPlus. Trial access to the legal system is free.

Rationale for the conclusion:

Major car repairs

According to paragraph 1 of Art. 252 of the Tax Code of the Russian Federation, for the purposes of Chapter 25 of the Tax Code of the Russian Federation, the taxpayer reduces the income received by the amount of expenses incurred (except for the expenses specified in Article 270 of the Tax Code of the Russian Federation). Expenses are recognized as justified and documented expenses (and in cases provided for in Article 265 of the Tax Code of the Russian Federation, losses) incurred (incurred) by the taxpayer. Justified expenses mean economically justified expenses, the assessment of which is expressed in monetary form. Documented expenses mean expenses supported by documents drawn up, in particular, in accordance with the legislation of the Russian Federation. In this case, any expenses are recognized as expenses, provided that they are incurred to carry out activities aimed at generating income.

Based on paragraph 1 of Art. 260, paragraph 5 of Art. 272 of the Tax Code of the Russian Federation, expenses for the repair of fixed assets made by the taxpayer are considered as other expenses and are recognized for tax purposes in the reporting (tax) period in which they were incurred (regardless of their payment), in the amount of actual expenses.

Since the tax legislation does not contain the concept of “major repairs,” the courts, taking into account Art. 11 of the Tax Code of the Russian Federation, for tax purposes, it was recognized as necessary to be guided by the concept of the specified term in the meaning in which it is used in the relevant branch of legislation (see the resolution of the Federal Antimonopoly Service of the East Siberian District dated November 1, 2013 in case No. A19-3291/2013).

Thus, clause 1.16 of the Guiding document RD 37.009.026-92 “Regulations on the maintenance and repair of vehicles owned by citizens (cars and trucks, buses, mini tractors)”, approved by order of the Department of Automotive Industry of the Ministry of Industry of Russia dated November 1, 1992 N 43 (hereinafter referred to as the Regulations), it is defined: repair is a set of works (operations) to eliminate failures (malfunctions) that have arisen and restore full functionality of a vehicle (unit, component, system) within the operational characteristics established by the manufacturer.

In this case, repairs can be either current or major (clause 1.26 of the Regulations).

The Ministry of Finance of Russia proposes to consider repair work that does not entail changes in the functions of the object and its operational characteristics, carried out for the purpose of ongoing maintenance of fixed assets in working order (letters of the Ministry of Finance of Russia dated December 5, 2012 N 03-03-06/1/628, dated December 13, 2010 N 03-03-06/1/772, dated 03/24/2010 N 03-03-06/4/29, dated 04/18/2006 N 03-03-04/1/358).

At the same time, tax legislation, when determining the tax base, does not make expenses associated with repairs dependent on the type of repair performed (current or capital) or the method of its implementation (economic or contract) (letter of the Ministry of Finance of Russia dated November 3, 2006 N 03-03-04 /1/718, dated 06/02/2010 N 03-03-06/1/365).

At the same time, the cost of carrying out work in accordance with Chapter 25 of the Tax Code of the Russian Federation is not a criterion for classifying it as a repair (letter of the Ministry of Finance of Russia dated March 24, 2010 N 03-03-06/4/29).

Arbitrage practice

A similar approach is found in arbitration practice. Thus, the Federal Antimonopoly Service of the Ural District, in its resolution dated August 22, 2013 N F09-7461/13 in case N A47-13822/2012, indicated that tax legislation only separates the concept of repairs, which can be either current or capital, and the concept of capital investments.

In the resolution of the Federal Antimonopoly Service of the Ural District dated December 8, 2008 N F09-9111/08-S3, the court considered the position of the tax authority unfounded, indicating that the taxpayer, in accordance with the law, included the costs of installing the body and the cost of the body as repair expenses. At the same time, it was taken into account that the goal and result of the work performed was to bring the vehicle into proper working condition, and not to change its technological or service purpose, namely, the vehicle’s carrying capacity and other technical characteristics did not change, and the main asset did not acquire new qualities. If the work performed did not lead to a change in the technological or service purpose of the objects, or did not increase the technical and economic indicators, then these works were carried out in order to maintain fixed assets in working condition and are repairs (Resolution of the Federal Antimonopoly Service of the Ural District dated November 13, 2008 N F09-8219/08 -C3).

The resolution of the Ninth Arbitration Court of Appeal dated May 30, 2007 N 09AP-5008/2007 also states that “... work to replace a truck crane engine with an engine with technical parameters identical to the original ones, which by the time of replacement have exhausted their service life, does not apply to reconstruction or completion , retrofitting, modernization or technical re-equipment. The operation performed to replace the engine was correctly qualified as a major overhaul, and the costs were rightfully included by the applicant as expenses under Art. 260 of the Tax Code of the Russian Federation."

Thus, the organization has grounds to reflect the costs of major repairs of its own car as expenses when calculating income tax.

To confirm the need for repairs and, accordingly, the justification of costs, you can use estimates and defective statements. A defective statement is drawn up when fixed assets are damaged or broken down. It contains a list of identified defects of the object and recommendations for their elimination. When repairing equipment, instead of a defective statement, a report on identified equipment defects can be used, drawn up in Form N OS-16, approved by Resolution of the State Statistics Committee of Russia dated January 21, 2003 N 7 (hereinafter referred to as Resolution N 7). The report provides a brief description of the main components and assemblies and describes the identified defects. The form of the defective statement is approved in the accounting policy. In addition, it would be useful to draw up a cost estimate, as well as issue an order, signed by the manager, to send the car for repairs.

When repairs are carried out by contractors, the supporting document will be the corresponding certificate of work performed. The unified form of the act of completion of work on major repairs of motor vehicles has not been approved by the State Statistics Committee of the Russian Federation, so it can be drawn up in any form in compliance with the list of necessary details (Part 2 of Article 9 of the Federal Law of December 6, 2011 N 402-FZ “On Accounting”).

Upon completion of the repair, a Certificate of Acceptance and Delivery of repaired, reconstructed, modernized fixed assets can also be issued (Form N OS-3, approved by Resolution No. 7). This act, in accordance with the Instructions for the use and completion of primary accounting documentation forms, serves to formalize and record the acceptance and delivery of fixed assets from repair, reconstruction, and modernization. In our opinion, whether or not to fill out form N OS-3 during routine repairs, each organization decides independently, depending on the nature of the repairs performed. Form N OS-3 is signed by members of the acceptance committee or a person authorized to accept fixed assets, as well as a representative of the organization (structural unit) that carried out the repairs, approved by the head of the organization or his authorized person and submitted to the accounting department.

If a car is repaired by a specialized service workshop, a work order is used as a contract for the provision of services (performance of work) for repairs. Its registration is carried out in accordance with the requirements of clause 15 of the Rules for the provision of services (performance of work) for the maintenance and repair of motor vehicles (approved by Decree of the Government of the Russian Federation of April 11, 2001 N 290, hereinafter referred to as the Rules). The work order must contain information about the list of spare parts provided by the contractor (clause 16 of the Rules). According to clause 35 of the Rules, the consumer is obliged to check, with the participation of the contractor, the volume and quality of the service provided (work performed), the serviceability of components and assemblies that have undergone repair, and accept the service provided (work performed). If deviations from the contract are detected that worsen the result of the service provided (work performed), replacement of components, incompleteness of the motor vehicle and other shortcomings, the consumer is obliged to immediately notify the contractor about this. These defects must be described in the acceptance certificate or other document certifying acceptance, which is signed by the responsible person of the contractor and the consumer.

According to clause 18 of the Rules, the transfer of a vehicle for repair is formalized by an acceptance certificate. It indicates the completeness of the motor vehicle and visible external damage and defects, information about the provision of spare parts and materials by the consumer, indicating their exact name, description and price.

Let us recall that on the basis of Art. 313 of the Tax Code of the Russian Federation, confirmation of tax accounting data are primary accounting documents. At the same time, the Ministry of Finance of Russia, in a letter dated January 11, 2006 N 03-03-04/2/1, indicated that the primary documents used in accounting for accounting for these costs, in particular, certificates of repair work performed.

Thus, the cost of major repairs of a company car in tax accounting can be confirmed by a certificate of completion of work, and the feasibility of such repairs by a defective statement.

OS overhaul in accounting - postings

Once the decision on the need for a major overhaul of fixed assets has been made, the facility can be restored by the organization itself or by using equipment and workers from a third-party company on a contract basis. If you go the route of overhaul by the organization’s services, then you need to take into account that expenses will include the cost of spare parts and materials, wages, and insurance premiums.

Accounts for carrying out major repairs in various ways will be as follows:

- if there is a structural unit (repair service):

Dt 23 Kt 10 (16, 69, 70) - repair costs collected;

Dt 20 (25, 26, 29, 44) Kt 23 - expenses are written off depending on the use of the operating system (the account on which depreciation is recorded is debited);

- if there is no repair service, account 23 is not used, and the costs are written off directly to the cost account:

Dt 20 (25, 26, 29, 44) Kt 10 (16, 69, 70);

- If the repair is carried out by a contractor, the cost entry will be:

Dt 20 (25, 26, 29, 44) Kt 60.

For long-term overhauls, it is recommended to transfer objects to a separate subaccount of account 01 “OS under repair”.

The recommendations of ConsultantPlus experts will help you write off materials for OS repairs in accounting and for income taxes. Get free trial access to the system and go to the Ready-made solution.

How to correctly reflect the costs of repair, modernization and reconstruction of fixed assets

Planning costs for the restoration of fixed assets

Classification of repair costs

Submitting requests for repairs

Reflection of expenses for repairs, modernization, additional equipment in the accounting of budgetary organizations

Each institution has fixed assets on its balance sheet as part of non-financial assets. During operation, fixed assets wear out and repairs are carried out to maintain them in working condition.

Work on the restoration of fixed assets can be classified according to the nature of the type of work as:

- Maintenance;

- major repairs;

- modernization;

- reconstruction;

- retrofitting

Note!

The reflection of operations in accounting and tax accounting depends on the type of work: costs for current, medium and major repairs of fixed assets are taken into account as part of the current expenses of the institution, and costs for modernization and reconstruction are attributed to the increase in the initial cost of fixed assets.

Depending on whether repairs or modernizations were carried out, income tax is calculated (provided that the work was carried out using funds received from business activities) and the intended use of budget funds, since modernization and repair expenses are reflected according to different KOSGU codes. If a fixed asset was acquired through entrepreneurial activity, the costs of repairing these objects reduce the income tax base as part of other expenses (clause 1 of Article 260 of the Tax Code of the Russian Federation (hereinafter referred to as the Tax Code of the Russian Federation)).

Justification and confirmation of costs for major repairs

When carrying out major repairs of fixed assets, special attention should be paid to the order of registration of the process. During inspections, tax authorities place high demands on documentary evidence of repairs that have taken place.

First of all, the need for major repairs should be justified. To do this, a report is drawn up, which records the identified defects, or a defect sheet.

You can download a ready-made sample of a defect report from ConsultantPlus, receiving free test access to the system.

The transfer of an object for repair is formalized by an invoice for internal movement - in the case of repairs carried out by its own specialized service or an acceptance certificate if the object is transferred to a contractor.

After completion of the repair work, an acceptance certificate is drawn up, by which the object is accepted back. It is signed by members of the selection committee, persons responsible for the safety and repair of the OS, representatives of the contractor and can be drawn up according to the OS-3 form or a free one.

Documents confirming the actual costs of major repairs can be: estimates and technical documentation confirming the volume of repairs and costs for them, certificates of work performed from the repair organization or internal primary records for materials used for repairs, labor, etc.

Lifetime of OS after reconstruction

Reconstruction work can lead to an increase in the useful life of the fixed asset. In this case, for accounting purposes, the remaining useful life of the reconstructed fixed asset must be revised (clause 20 of PBU 6/01, clause 60 of the Methodological Instructions approved by Order of the Ministry of Finance of Russia dated October 13, 2003 No. 91n). This is what the acceptance committee does when accepting a fixed asset from reconstruction:

- based on the period during which it is planned to use the fixed asset after reconstruction for management needs, for the production of products (performance of work, provision of services) and other generation of income;

- based on the period after which the fixed asset is expected to be unsuitable for further use (i.e., physically worn out). This takes into account the mode (number of shifts) and negative operating conditions of the fixed asset, as well as the system (frequency) of repairs.

This procedure follows from paragraph 20 of PBU 6/01.

The acceptance committee must indicate in the report in form No. OS-3 that the reconstruction work did not lead to an increase in useful life.

The results of the review of the remaining useful life in connection with the reconstruction of a fixed asset must be formalized by order of the manager.

Situation: how to calculate depreciation in accounting after reconstruction of a fixed asset?

The procedure for calculating depreciation after the reconstruction of a fixed asset is not defined by accounting legislation. Paragraph 60 of the Methodological Instructions, approved by Order of the Ministry of Finance of Russia dated October 13, 2003 No. 91n, provides only an example of calculating depreciation charges using the linear method. So, according to the example, with the linear method, the annual amount of depreciation of fixed assets after reconstruction is determined in the following order.

Calculate the annual depreciation rate of fixed assets after reconstruction using the formula:

| Annual depreciation rate for fixed assets after reconstruction using the linear method | = | 1 | : | Useful life of a fixed asset after reconstruction, years | × | 100% |

Then calculate the annual depreciation amount. To do this, use the formula:

| Annual amount of depreciation of fixed assets after reconstruction using the linear method | = | Annual depreciation rate for fixed assets after reconstruction using the linear method | × | Residual value of fixed assets taking into account reconstruction costs |

The amount of depreciation that must be accrued monthly is 1/12 of the annual amount (paragraph 5, clause 19 of PBU 6/01).

If an organization uses other methods of calculating depreciation (the reducing balance method, the method of writing off value by the sum of the numbers of years of useful life, the method of writing off value in proportion to the volume of production (work)), then the annual amount of depreciation charges can be determined in the following order:

- similar to the order given in the example for the linear method;

- independently developed by the organization.

The used option for calculating depreciation on fixed assets after reconstruction should be fixed in the accounting policy of the organization for accounting purposes.

An example of reflecting depreciation on a fixed asset in accounting after its reconstruction

Alpha LLC repairs medical equipment. In April 2021, the organization reconstructed production equipment that was put into operation in July 2013.

The initial cost of the equipment is 300,000 rubles. The useful life according to accounting data is 10 years. The method of calculating depreciation is linear. As a result of the reconstruction, the useful life of the facility increased by 1 year.

Before the reconstruction of the fixed asset, the annual depreciation rate was 10 percent ((1: 10 years) × 100%).

The annual depreciation amount was 30,000 rubles. (RUB 300,000 × 10%).

The monthly depreciation amount was 2,500 rubles. (RUB 30,000: 12 months).

RUB 59,000 was spent on equipment reconstruction. The reconstruction lasted less than 12 months, so depreciation was not suspended. At the time of completion of the reconstruction, the actual service life of the equipment was 33 months. Its residual value according to accounting data is equal to: 300,000 rubles. – (33 months × 2500 rub./month) = 217,500 rub.

After reconstruction, the useful life of the fixed asset was increased by 1 year and amounted to 8.25 years (7.25 + 1). The annual depreciation rate for equipment after reconstruction was 12.1212 percent ((1: 8.25 years) × 100%).

The annual amount of depreciation is 33,515 rubles. ((RUB 217,500 + RUB 59,000) × 12.1212%).

The monthly depreciation amount is RUB 2,793. (RUB 33,515: 12 months).

What is repair, types of repair

Repair is maintaining a fixed asset in good condition and preventing its failure. Repair does not change the properties of the object; it restores functionality and eliminates faults.

If there have been changes in the properties of the object that are not related to the workload and technical and economic indicators of the object (power, service life), and also the quality and range of products (works, services) have not changed, then the restoration work performed can be classified as repair.

Repair is divided into:

- current;

- capital;

- carried out in an economic way (with one’s own resources);

- performed by contract.

How to determine when repairs are ongoing and when they are major? Overhaul is the replacement of worn-out main parts, structures, and elements with more durable and economical ones that improve the operational capabilities of the objects being repaired.

Major repairs cannot include a complete change or replacement of the main structures, the service life of which in buildings and structures is the longest (for example, stone and concrete foundations of buildings and structures, all types of building walls, underground network pipes).

Routine repair is the maintenance of fixed assets to keep objects in working order; it eliminates minor damage and malfunctions. During current repairs, the operation of buildings does not stop, including heat, water and energy supplies.

Also take into account the periodicity factor; major repairs are carried out much less frequently than current ones: for example, major repairs are carried out annually, current repairs are carried out monthly.

Reflection in accounting

Repair costs are included in the cost of production, while modernization and reconstruction costs are included in the initial cost of the facility.

If you do not reasonably reflect the restoration of fixed assets as a repair, then the tax base for property tax will be underestimated (reconstruction and modernization increase the cost of fixed assets, and therefore property tax) and for income tax (costs will be written off immediately, and not through depreciation).

The organization must reflect fixed assets in accounting according to the degree of their use, located:

- in operation,

- in stock (reserve);

- under repair;

- at the stage of completion, additional equipment, reconstruction, modernization and partial liquidation;

- on conservation.

According to clause 20 of the Methodological Instructions, approved by order of the Ministry of Finance of Russia dated October 13, 2003 No. 91n.

To account for fixed assets undergoing long-term repairs, it is advisable to reflect them in a separate subaccount of account 01 “Fixed assets under repair.”

Debit 01 subaccount “Fixed assets in repair” Credit 01 subaccount “Fixed assets in operation”

– the fixed asset was transferred for repair.

Debit 01 subaccount “Fixed assets in operation” Credit 01 subaccount “Fixed assets in repair”

– fixed asset taken from repair.

If the repair is short-term, then it will be enough to rearrange the inventory cards of the fixed assets being repaired into the group “Fixed assets under repair” in the file cabinet. When an OS is received from repair, the inventory card is moved accordingly (according to clause 68 of the Methodological Instructions, approved by Order of the Ministry of Finance of Russia dated October 13, 2003 No. 91n).

Repair costs

If objects that are not yet part of the operating system are being repaired, then the costs of repairs are included in their original cost. If fixed assets are repaired, then the costs of repairs are considered current expenses.

Household repairs

If repairs are carried out by an organization with the help of a repair shop, then the costs are reflected in account 23 “Auxiliary production”.

Debit 23 Credit 10,69,70... - expenses for repairing the OS are reflected.

After signing the act of acceptance and delivery of repaired fixed assets (according to OS-3 form), all expenses accumulated in account 23 are written off to cost accounting accounts:

Debit 20 (25, 26, 29, 44...) Credit 23 - the costs of repairing the OS are written off.

If there is no repair shop in the organization, repair costs are immediately written off to expense accounts as they arise, without the participation of 23 accounts.

Contract repair

When repairs are carried out with the participation of a contractor, expenses are written off as follows:

Debit 20 (25,26,29,44...) Credit 60 - the costs of repairs performed by the contractor are written off.

Does the cost of the OS increase?

The question is often asked whether financing the costs of major repairs leads to an adequate increase in the book value (estimated) value of the corresponding fixed asset.

The answer to this is contained in the standard regulating the accounting procedure for fixed assets.

In addition, some clarifications on this issue are provided by the provisions.

Thus, the initial (primary) cost of fixed assets is subject to a legal increase only if the quality characteristics of the corresponding fixed asset item have actually improved as a result of its modernization and (or) reconstruction.

As for repair costs, including the costs of major repairs, they are not included in the price of the fixed asset and, accordingly, do not increase the value of this asset.

What's happened?

As mentioned earlier, a major overhaul of an operating system usually involves a significant amount of work that significantly contributes to a noticeable improvement in the technical condition of such objects.

As a rule, this repair requires a lot of time. If you follow the generally accepted regulations, it is carried out at the enterprise once every few years.

Current repairs, as is known, are carried out in organizations regularly - much more often, according to the established schedule.

It should be noted that for the purposes of accounting, it is not at all necessary for an accountant to distinguish between the types of repair work carried out in relation to fixed assets.

In addition, OS repair is not specifically differentiated either in accounting or tax accounting.

You should know that major repairs of the operating system can be carried out comprehensively, that is, completely covering the entire object being restored, or, alternatively, selectively, that is, providing for the elimination of breakdowns of individual parts (elements) of equipment.

The feasibility of carrying out the next major overhaul is determined and justified by technical services authorized to carry out similar actions in certain organizations.

If we compare accounting for capital repairs of fixed assets taking into account other restoration activities and projects, it should be noted that repair costs are always included in current costs, and investments in reconstruction and modernization are usually classified as capital expenses.

Does the cost of the OS increase?

The question is often asked whether financing the costs of major repairs leads to an adequate increase in the book value (estimated) value of the corresponding fixed asset.

The answer to this is contained in standard PBU 6/01, which regulates the accounting procedure for fixed assets.

In addition, some clarifications on this issue are provided by the provisions of the Tax Code of the Russian Federation.

Thus, the initial (primary) cost of fixed assets is subject to a legal increase only if the quality characteristics of the corresponding fixed asset item have actually improved as a result of its modernization and (or) reconstruction.

As for repair costs, including the costs of major repairs, they are not included in the price of the fixed asset and, accordingly, do not increase the value of this asset.

Cost accounting

Important! When the management of an organization makes an informed decision about the need to perform a major overhaul of the operating system, it is necessary to choose the appropriate method for carrying it out.

Typically, this activity can be carried out according to one of the following two approaches:

- restoration of a technical object using our own resources, that is, the internal resources of the enterprise itself;

- attracting resources from external (third-party) organizations through the conclusion of contract agreements.

Correct registration of all processes and procedures associated with the overhaul of fixed assets at an enterprise is of great importance for the correct accounting of relevant costs.

You should be aware that documentary evidence of the repairs carried out often becomes the object of close attention from tax officials.

At different stages of OS overhaul, the following documents must be drawn up:

- Justification of the need for this repair. For an OS object, an act of recording identified faults or, as an option, a defective statement is drawn up.

- If an object is transferred to the enterprise’s own division for repairs, an invoice is issued certifying the fact of internal movement.

- If the repair of a fixed asset is entrusted to an external organization, a corresponding contract and a certifying acceptance certificate are drawn up.

- The fact of completion of major repairs and return of the object to its intended place is also documented in the acceptance certificate.

- All paid expenses and incurred expenses must be confirmed by payment documents, estimate and technical documentation.

BASIC: input VAT

The legislation does not provide for the specifics of accounting for input VAT on materials (work, services) purchased for repairing fixed assets (Article 172 of the Tax Code of the Russian Federation). Therefore, when repairing fixed assets, input VAT is deductible in the usual manner. That is, after registration of the specified materials (works, services) (paragraph 2, paragraph 1, article 172 of the Tax Code of the Russian Federation) and in the presence of an invoice (paragraph 1, paragraph 1, article 172 of the Tax Code of the Russian Federation). The exception to this rule is when:

- the organization enjoys VAT exemption;

- the organization uses the fixed asset only to perform VAT-free transactions.

In these cases, input VAT is included in the cost of materials (work, services) used during repairs. This follows from paragraph 2 of Article 170 of the Tax Code of the Russian Federation.

If an organization uses a fixed asset to perform both taxable and non-VAT-taxable operations, distribute the input tax on the cost of materials (work, services) used in repairs (clause 4 of Article 170 of the Tax Code of the Russian Federation).

Documentation of repairs

Repairs are preceded by drawing up:

- a defective statement reflecting the condition of the object, which can be made in 1 copy if the repairs are carried out on their own or in a mixed way, and drawn up in 2 copies if the repairs are carried out by a third-party contractor;

- estimates for repair work drawn up either by a third-party contractor or by its own department carrying out repairs;

- an order from the manager to carry out repairs, which reflects the timing of the repair work, the forces carrying it out, and, if necessary, decisions to replace temporarily absent OS;

- agreement for repairs, if it will be done by a third party;

- invoice for the internal movement of fixed assets, if the object is being repaired in its own department.

Upon completion of the repair work, the following is drawn up:

- certificate of acceptance of the object from repair;

- invoice for internal movement of fixed assets, if the object was repaired in its own department;

- a record of the repair performed in the OS inventory card.

Personal income tax and insurance premiums

If the organization hired third parties to carry out repair work, then withhold personal income tax when paying remuneration (subclause 6, clause 1, article 208 and clause 1, article 226 of the Tax Code of the Russian Federation).

Also calculate contributions for compulsory pension (medical) insurance (Part 1, Article 7 of Law No. 212-FZ of July 24, 2009). Do not pay contributions for compulsory social insurance to the Federal Social Insurance Fund of Russia (Clause 2, Part 3, Article 9 of Law No. 212-FZ of July 24, 2009).

Charge contributions for insurance against accidents and occupational diseases if such an obligation is provided for in the contract with the contractor (Part 1, Article 20.1 of the Law of July 24, 1998 No. 125-FZ).

Repair of fixed assets: what is it?

Definitions of repair as a way to maintain and improve the efficiency of fixed material assets are not provided in modern regulations. The Regulation on carrying out planned preventive repairs of industrial buildings and structures MDS 13-14.2000, approved by Decree of the USSR State Construction Committee dated December 29, 1973 No. 279, has not been cancelled, and therefore is considered relevant: it defines the repair of this particular type of fixed assets. This is considered a combination of technical measures related to improving or maintaining at the same level the operational characteristics of buildings, structures and their structures.

Characteristics of repair of fixed assets

Repair, as a way to maintain the OS in an effective condition, is characterized by the following factors:

- the functions of the fixed asset being repaired remain unchanged;

- the technical capabilities of the asset are not expanded;

- the characteristics of the object are as close as possible to the original ones;

- the initial cost of the asset reflected on the balance sheet increases as a result of repairs.

Repair of fixed assets is carried out in different ways:

- repairing damage;

- repair;

- replacement of individual elements, structures and assemblies;

- maintenance (maintenance, lubrication, checking, cleaning, setting, adjustment, etc.).

Reflection of capital repairs in tax accounting

The Tax Code of the Russian Federation does not define the concept of repair, however, clause 2 of Art. 257 of the Tax Code of the Russian Federation explains cases when the initial cost of an asset can be changed:

- completion, retrofitting, modernization;

- reconstruction;

- technical re-equipment.

These terms are united by the fact that as a result of such work, the OS acquires improved performance or new functions. The same cannot be said about the renovation. Rules clause 1 art. 260 of the Tax Code of the Russian Federation classifies RR as part of other expenses and speaks of recognizing them in the period in which they were incurred. In addition, it is possible to create a reserve for future repairs, then expenses in tax accounting will be shown evenly over several periods. The choice of accounting method for RR must be recorded in the accounting policy.

ATTENTION! It is possible to reserve assets by distributing them over RR periods only in tax accounting (clause 3 of Article 260 of the Tax Code of the Russian Federation). That is, in income tax expenses you need to include contributions to the reserve, and actual expenses should be written off against the reserve as they are received. Accounting does not provide for deductions to the reserve for OS repairs.

Find out how to properly create a reserve for OS repairs in tax accounting in ConsultantPlus. Learn the material by getting trial access to the system for free.

Classification of repairs of fixed assets

Depending on what is taken as the basis for dividing into groups (scope of work, their cost, duration, degree of interference in the functioning of the fixed asset and the order of organization), repairs can be divided into several categories.

- If planning is possible:

- scheduled preventive maintenance – carried out regularly, without waiting for problems in the functioning of the fixed asset, in order to prevent a decrease in efficiency;

- emergency repair - emergency elimination of problems or disruptions in the operation of an object to restore its functionality;

- restorative repair is a type of emergency repair, when work is forced to be carried out after the impact on fixed assets of any emergency situations beyond human control, for example, natural disasters.

- According to the volume and characteristics of the work performed:

- current repair – the smallest in scale and cost of repair actions performed, designed to ensure effective operation until the next repair, without affecting the main functional characteristics of the facility (can be carried out several times during the year);

- medium repair is a more labor-intensive process, involving large costs, requiring partial intervention in the operation of the fixed asset being repaired; most often associated with the replacement of parts and important components (not performed more than once a year);

- major repairs are the most expensive and time-consuming of all types of restoration repair work; they completely cover the facility, providing for high-level interventions, as a result of which it falls out of service during the repair (carried out occasionally).

- economic method of repair - maintenance and/or restoration of an object is carried out by attracting internal resources of the organization itself;

- contract repair method - hiring external contractors to carry out the work.

Current and major repairs: how to distinguish

The division of repairs into current and capital is important, since these types of work are reflected differently in the enterprise’s accounting and other reporting. Meanwhile, the regulations of tax and accounting legislation do not provide a clear distinction and definition of these types of repair work.

The letter of the Ministry of Finance of the Russian Federation dated January 14, 2004 No. 16-00-14/10 “On the grounds for determining types of repairs” explains that the organization itself must develop provisions on the basis of which repair work will be classified as current or capital. In this case, it is permissible to use the provisions of documentation that has remained relevant since the times of the USSR, such as the cited Resolution of the State Construction Committee No. 279.

Let's consider the main differences between current and major repairs, which are accepted in business practice.

| № | Base | Maintenance | Major renovation |

| 1 | Periodicity | No more than once a year | More than one year |

| 2 | Nature of work | Elimination of damage, malfunctions, replacement of individual parts | Complete disassembly, replacement of all damaged or worn elements |

| 3 | Duration | Not very long lasting | Long lasting |

| 4 | Basic execution method | More often economic | More often a contractor |

| 5 | Regularity | Must be carried out according to special schedules | Depends on the degree of wear and tear of the fixed asset, is assigned specifically |

| 6 | Additional work | Not provided | May be accompanied by reconstruction, modernization |

Tax accounting of expenses for repairs and reconstruction of premises

Expenses for the repair of fixed assets made by the taxpayer are considered as other expenses when calculating income tax. If the organization does not create a reserve for upcoming repair expenses, then they are recognized for tax purposes in the amount of actual expenses in the reporting (tax) period in which they were incurred (clause 1 of Article 260 of the Tax Code of the Russian Federation). This rule can also be used by the lessee when leasing depreciable fixed assets, provided that the contract (agreement) between the lessee and the lessor does not provide for reimbursement of these expenses by the lessor (clause 2 of Article 260 of the Tax Code of the Russian Federation).

Expenses for the reconstruction (modernization) of depreciable property increase the initial cost of the fixed asset item (Clause 2 of Article 257 of the Tax Code of the Russian Federation). They are taken into account in expenses that reduce income received by calculating depreciation on the object.