Civil law determines the legal status of an organization as commercial or non-profit. The latter include municipal and state institutions, which are most often budgetary (but can be both state-owned and autonomous). In such organizations, accounting is carried out in compliance with certain nuances that need to be taken into account by a specialist.

Let's consider how accounting in budgetary organizations differs from accounting in commercial structures, what regulatory documents govern it, and what features an accountant needs to take into account.

What are the basics of budget accounting and budget reporting ?

Maintaining accounting records in the public sector

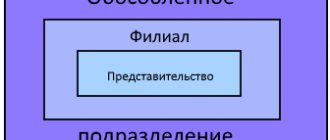

A budgetary institution is a separate non-profit organization formed in the Russian Federation at any level for the purpose of providing state and municipal services and implementing specific government programs (7-FZ of January 12, 1996).

Currently, there are 3 types of such institutions:

- budget;

- autonomous;

- official

Accounting at an enterprise of this type is regulated by the current budget legislation, as well as 402-FZ “On Accounting” dated December 6, 2011.

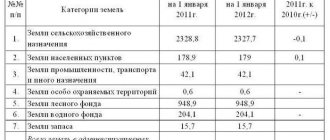

Let's consider three types of state budgetary institutions in a comparative table:

| Name of comparative parameter | Budget | Autonomous | State-owned |

| NPA | 7-FZ “On Non-Profit Associations and Companies” | 174-FZ “On Autonomous Organizations” | BC RF |

| Main activity | Providing services to the population in the field of science, education, healthcare, social protection | Provision of public services and performance of certain functions | |

| Possibility of using funds from income-generating activities | Possible at the discretion of the organization (clauses 2, 3 of Article 298 of the Civil Code of the Russian Federation) | Transfer of such income to the regional and federal budgets | |

| Main source of funding | Subsidization | Budget resources | |

| Document on the basis of which funds are spent | Financial and economic activity plan | Budget estimate | |

| Checking account | In the Federal Treasury | In FCs and commercial banks | In FC |

| Ownership of property | Right of operational management | ||

| Disposal of property objects | Upon receipt of the consent of the owner of the property | ||

| Responsibility for basic obligations | Liability with one’s own assets, except for cases when such obligations are formed due to harm to citizens, in the absence of assets that can be disposed of (liability remains with the founder) | Responsibility is exercised through monetary means. If there are any shortages, the founder becomes liable. | |

Legal status of the organization

The Civil Code divides organizations into commercial and non-profit.

The main goal of commercial organizations is to make a profit. Accordingly, non-profit organizations are those for which profit is not an end in itself. These, in particular, include state and municipal institutions (clause 8, part 3, article of the Civil Code of the Russian Federation). Both federal departments and bodies of federal subjects and municipalities can act as founders of such organizations. A state or municipal institution can be a state-owned, budgetary or autonomous institution (Article 123.22 of the Civil Code of the Russian Federation). In addition to the “statutory” type of activity, a public sector organization can conduct other work only if it does not contradict the goals of its creation. The addition must be specified in the statutory documents.

How accounting is carried out

Features of accounting for budget users are predetermined by their organizational and legal form. When carrying out accounting and reporting, it is necessary to take into account not only the norms and rules established by current legislation, but also the industry-specific features of a specific budget organization: education, science, healthcare, etc. Financial and economic activities in BU, AU and CU are based on the following characteristics:

- accounting in the context of KOSGU and KBK;

- control over the implementation of income and expense items of the estimate;

- treasury budget execution system;

- classification of cash and actual expenses.

Reporting must be submitted to higher regulatory authorities within the established time frame (monthly, quarterly, annually). The balance sheet of accounting entities differs significantly from those of commercial organizations in the structure of the enterprise's liabilities and assets.

The procedure for applying the classification according to the BCC was approved by Order of the Ministry of Finance of the Russian Federation dated 06/08/2018 No. 132n (applicable from 2021). Instructions for drawing up and submitting reports on budget execution, the forms of such reporting and the rules for filling them out are presented in Orders of the Ministry of Finance No. 191n dated December 28, 2010 and No. 33n dated March 25, 2011. The primary and main accounting registers are fixed by Order No. 52n dated March 30, 2015.

The basic rules for maintaining accounting records in BU, AU, and CU are as follows:

- Accounting is kept only in rubles.

- Accounting is maintained on an ongoing basis, starting from the moment of registration of the organization.

- The basics of accounting, namely the budget chart of accounts and instructions for its application, were approved by Order of the Ministry of Finance No. 157n dated December 1, 2010. The key method is double entry in offsetting accounts.

- Analytical data must correspond to turnover and balances in the context of synthetic accounts.

- Each financial and business transaction must be registered, carried out and confirmed by primary documentation.

- The institution must independently develop and approve its accounting policies.

- It is necessary to ensure the proper level of internal control in the accounting department.

- All accounting assets and liabilities must be restated periodically.

- The information provided by BU, AU, CU in reports must be relevant and reliable.

The accounting and reporting principles of accounting are based on such key concepts as legality, reliability, independence, consistency, availability, relevance, correctness, prudence, comparability, timeliness and monetary measurability.

Results

It is easiest to carry out accounting for non-profit organizations that carry out only socially basic activities.

The results from it are recorded on the account. 86. It is more difficult to maintain accounting for an NPO that additionally engages in entrepreneurship. In this case, the accountant will have to clearly separate the results of socially fundamental activities (with accumulation on account 86) and entrepreneurial ones (with accumulation on account 90). The results from other activities of the non-profit organization (sale of assets) are recorded in the account. 91. Profit (loss) from business and other activities must be closed at the end of the year on the account. 86. More complete information on the topic can be found in ConsultantPlus. Free trial access to the system for 2 days.

Accounting policy of the institution

Accounting rules provide for mandatory adherence to the provisions of the enterprise's own accounting policies. From January 1, 2019, the organization’s accounting activities are based on Order No. 274n dated December 30, 2017 on the approval of the federal accounting standard on accounting policies for public sector institutions. In accordance with federal standards, each budgetary institution needs to develop its own accounting policy (Letter of the Ministry of Finance of the Russian Federation No. 02-06-05/30974 dated 05/08/2018).

Accounting policy is understood as a set of basic methods, methods and rules of accounting in an institution. Users also find the procedure for drawing up the UE in Federal Law No. 402 and PBU 1/2008.

An accounting policy is a document that primarily reflects the methodology for working with the real assets and liabilities of an organization. Changes to this document are made once a year - before the start of a new reporting period. However, there are a number of situations when adjustments to the UE are carried out during the calendar year.

The UP 2021, drawn up in accordance with the FSB and current legislation, prescribes the following aspects:

- selected form of accounting;

- structural and sectoral features of financial and economic activities;

- depreciation methods used in budgetary institutions;

- used regulatory legal acts, primary documents (magazines, reporting forms);

- responsible employees;

- the procedure for reflecting transactions with profitability and costs, materials, fixed assets, etc.;

- methods for assessing accounting objects;

- inventory rules;

- working chart of accounts, etc.

The chief accountant or other employee responsible for accounting at the enterprise is appointed responsible for the formation and compliance with the rules of the UP.

Balance sheet structure

At first glance, the balance sheets of commercial and budgetary organizations are similar - both contain an asset and a liability, which are divided into several parts. However, upon closer examination, an experienced accountant will discover significant differences. For example, a budgetary institution is required to separately indicate transactions with target funds, its own income, and funds at temporary disposal. If in the balance sheet of a budgetary institution an accountant reflects data for the reporting year and the previous year, then when working with commercial accounting, you will have to prepare a balance sheet for the reporting year and the two previous ones.

In a commercial structure, the asset is divided into non-current and current assets, the circulation of funds forms the basis of the asset of the commercial balance sheet. State employees have two components: financial and non-financial assets, and funds are divided into those expressed in monetary terms and those that have a tangible form. The balance sheet liability in a commercial structure contains an indication of own and borrowed funds. The latter are divided into long-term and short-term liabilities. For the balance sheet of a budgetary institution, it is important to reflect the types of payments, regardless of their repayment period.

Budget chart of accounts

The Ministry of Finance has developed a unified chart of accounts for the budgetary sector and instructions for its application (Order of the Ministry of Finance No. 157n dated December 1, 2010). The specified register is valid for both government agencies and BUs. In the unified plan itself there is an indication that each type of government organization must use a private chart of accounts:

- AU - Order No. 183n dated December 23, 2010;

- BU - Order No. 174n dated December 16, 2010;

- KU - Order No. 162n dated December 6, 2010.

PS for BU, AU, CU consists of balance sheet and off-balance sheet accounts. Balance sheet accounts are divided into five sections:

- Non-financial assets (fixed assets, intangible assets, non-relevant legal assets, financial assets, finished products, depreciation, expenses, investments in non-financial assets).

- Financial assets (cash, securities, accounts receivable, etc.).

- Liabilities (payments, accounts payable).

- Financial result (income and expense accounts).

- Authorization of expenses (appropriations, LBO, planned indicators).

Off-balance sheet accounts reflect movements in the valuation of those assets that do not belong to the organization or, for established reasons, cannot be accounted for on balance sheet accounts. For example, fixed assets worth up to 10,000 rubles.

Payment for work and services to third party suppliers: invoices and postings

Suppose a government agency has entered into a contract with an outside firm to provide consulting services.

The fact that the institution has accepted budgetary obligations for the entire amount of the contract with the supplier is reflected in the posting

- Dt 1 501 13 226;

- Kt 1 502 11 226.

Account 1 501 13 226 is used by us because it includes codes:

- 1 - reflecting the fact of accepting obligations at the expense of budgetary funds;

- 501 - showing the acceptance of budget obligations under the limit;

- 13 - reflecting the fact of sanctioning limits in the current year;

- 226 - showing that the institution pays for services (according to KOSGU).

Account 1 502 11 226 is used by us because it includes codes:

- 502 - reflecting, in fact, the fact that the institution has accepted budgetary obligations;

- 11 - showing that the liabilities relate to the current financial year.

The fact that a business entity accepts monetary obligations (their amount is determined by the terms of the agreement and may be less than the amount of budget obligations - for example, if an advance is made as specified in the agreement) is reflected by the posting:

- Dt 1 502 11 226;

- Kt 1 502 12 226.

In turn, the code Kt 1 502 12 226 is used by us because:

- includes a code of type 502, which reflects the fact that the institution has accepted its own financial obligations;

- includes code 12, which indicates that the financial liability relates to the current financial year.

Features of drawing up accounting entries

The principles of accounting imply the reflection of the results of financial and economic activities through accounting entries. An entry is an accounting tool that records the transactions of an institution.

The scheme for compiling transactions is quite simple - each operation is recorded as a debit to one and a credit to another (corresponding) accounting account. This method is called double entry. The double entry method is a key accounting principle.

All accounting accounts are divided into three types:

- active - the organization’s assets are held on them;

- passive - necessary to reflect the sources of formation of assets, that is, liabilities;

- active-passive, or mixed - for recording alternately formed receivables and payables to counterparties on the same account, as well as for recording active and passive financial results.

In this case, the following combinations of accounts can be taken into account in the posting:

- asset - liability;

- active - active-passive;

- passive - active-passive;

- two active-passive accounts.

Accounting for non-profit organizations engaged in business activities

Keeping accounting records for an NPO engaged in business is more difficult. Here, the accountant initially needs to set up strict control over the distribution of income and expenditures between socially basic activities and entrepreneurial ones.

First of all, you need to follow the wording of the purpose of the funds received and sent in contracts and primary documents. For example, the receipt of money by an NPO with the purpose of “Payment for holding a sporting event” will be regarded by tax authorities as taxable income. It would be more correct to indicate: “Targeted contribution for the organization and holding of a sporting event. NDS is not appearing". Moreover, the specified VAT mark is required.

The same goes for spending money. An accountant should avoid general statements. For example, instead of the purpose “Purchase of paper,” it is better to indicate “Purchase of paper for a charity drawing competition” or “Purchase of paper for the needs of the administrative department.” When maintaining accounting, such specific descriptions of the costs (payments) made will help to quickly distribute them between the correct accounting accounts.

Next, you need to carefully check the adequacy of the documentary justification for the costs incurred. Such justifications, in addition to primary documents, are:

- orders for distribution of funds;

- letters and orders of NPO participants;

- applications of citizens (organizations) to receive funds (assistance) from NPOs;

- other.

To separately account for costs for socially basic activities and entrepreneurial activities, you need to open the appropriate sub-accounts for cost accounts:

- 20-1 and 26-1 - for socially basic;

- 20-2 and 26-2 - for entrepreneurial.

The financial results of the NPOs under consideration are reflected as follows:

- from socially basic activities - on the account. 86;

- from entrepreneurship - to the account. 90, profit (loss) is written off annually to the account. 86;

- from the sale of assets (other transactions) - on the account. 91 with closing at the end of the year on the account. 86.

In the previous section, we already showed the entries compiled by non-profit organizations for socially fundamental activities and for the sale of assets. Now let’s look at the formation of transactions in an NPO for transactions related to its business:

| Action | Dt | CT | Note |

| Acquisition of fixed assets, intangible assets for business using targeted funds | 08 | 60 | VAT is excluded from the cost of fixed assets and intangible assets and is deductible provided that the fixed assets and intangible assets will be used in business activities subject to VAT |

| 19 | 60 | ||

| 01, 04 | 08 | ||

| 60 | 51 | ||

| 86 | 83 | The purchase of fixed assets and intangible assets at the expense of targeted funds is reflected | |

| Revenue from sales of goods and provision of services | 62 | 90-1 | Accounted for under the rules applicable to commercial entities |

| 90-3 | 68 | ||

| Costs associated with business are reflected | 20-2, 26-2 | 69, 70 | Costs of remuneration of employees engaged in business |

| 20-2, 26-2 | 10, 76, 60 | Costs for materials, services, work of third parties, individual entrepreneurs | |

| 19 | 10, 76, 60 | ||

| 20-2, 26-2 | 02, 05 | Depreciation of fixed assets, intangible assets involved in business | |

| Generating business results | 90-2 | 41, 43, 45 | Reflection in the results of the cost of purchase, production of goods sold |

| 90-2 | 20-2, 26-2 | Monthly attribution of incurred costs to financial results | |

| 90-9 (99) | 99 (90-9) | Monthly closing of the account balance. 90 | |

| 99 (84) | 84 (99) | The resulting profit (loss) at the end of the year is attributed to the increase (decrease) of target funds | |

| 84 (86) | 86 (84) | ||

| Purchase and sale of securities | 58 | 60, 76 | Purchase of securities. You can find detailed explanations on securities accounting in the following articles: “Accounting for financial investments - PBU 19/02”; “Accounting for securities in accounting (nuances)” |

| 60, 76 | 58 | ||

| 58 (91-2) | 91-1 (58) | Revaluation of securities (monthly or quarterly) | |

| 91-2 | 76 | Costs of brokerage, consulting and other services related to the circulation of securities | |

| 76 | 91-1 | Securities sold | |

| 91-2 | 58 | The book value of securities is written off | |

| Formation of results from transactions with securities | 91-9 (99) | 99 (91-9) | Profit (loss) revealed |

| 99 (84) | 84 (99) | Transfer of profit (loss) to the target funds account at the end of the year (activity) | |

| 84 (86) | 86 (84) |

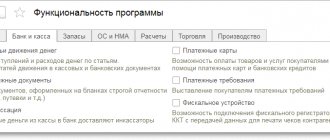

Service capabilities

- Control of the correctness and completeness of the entered data;

- Control of balances when writing off (moving) material assets;

- Monitoring the correctness of entered entries (accounting records);

- Control of input and editing of documents and operations;

- Control of modification and deletion of documents entered before the “date of prohibition of editing”;

- Control when deleting data;

- Table of accounts (quick viewing of account totals);

- Numerical and formula calculators for performing routine calculations;

- A calendar that allows you to set a date, standard or custom period;

- Managing rules for rounding amounts;

- Group processing of documents;

- Data exchange (downloading, uploading directories, downloading, uploading data);

- Data exchange with the 1C: Salaries and Personnel program in *.xml format;

- Loading budget classifiers;

- Loading the BIC classifier (Directory of bank identification codes for settlement participants on the territory of the Russian Federation);

- Exchange of information about settlement documents with treasury systems;

- Exchange of information about payment documents with systems such as “Client-Bank”;

- Reconciliation of accounting results and denomination;

- Transfer of information from information databases of the previous edition of the budget configuration;

- Calling the legal system from the Information Technology Support (ITS) disk or 1C:Garant. Legal support" (supplied separately);

- Online user support: preparation and submission of opinions on the use of the 1C: Accounting 7.7 program; preparing and sending requests to the technical support department; receiving and viewing responses from the technical support department; participation in a survey of users of the 1C: Accounting program, conducted in order to study problems that arise during operation; updating regulated reports and configuration from the web server (produced only when the information technology support (ITS) disk is installed); receiving exchange rates from the server of RIA "Ros Business Consulting"; quick transition to the most interesting sections of the Internet site.

Scalability

Depending on the volume of accounting data and document flow technology in the institution, Configuration “1C: Enterprise 7.7. Accounting for budgetary institutions" can be used with the program "1C: Accounting 7.7" ("1C: Enterprise 7.7" with the "Accounting" component)

- professional,

- network versions, as well as

- versions for SQL (client-server).

Attention!

To use the configuration, you must first install a licensed copy of one of these systems on your computer.

The delivery of the software product "1C: Accounting 7.7 PROF for budgetary institutions" includes the standard configuration "Accounting for budgetary institutions", edition 6 and the program "1C: Accounting 7.7" professional version.

By using the component “Working with distributed information bases” (supplied separately), you can organize a unified accounting system in institutions and organizations that have geographically remote divisions that are not connected by a local network.

Flexibility and customizability

The standard configuration “Accounting for budgetary institutions” is a ready-made solution that allows you to keep records without additional settings and modifications.

In addition, the standard configuration can be adapted to any accounting features in a specific budgetary institution or organization. The 1C:Enterprise system includes a tool - the Configurator, which allows you to completely change the configuration:

- edit directory properties, change the composition of stored information, the number of nesting levels, code type (numeric, text), etc.;

- create new directories of arbitrary structure;

- customize the appearance and behavior of forms for entering information;

- edit existing and create new documents of any structure;

- change screen and printed forms of documents;

- modify existing and create new journals for working with documents;

- edit forms and algorithms for generating standard and specialized reports;

- create any additional reports and information processing procedures;

- describe the behavior of the system in a built-in language.

Differentiation of access rights to information

The program has the necessary administration tools. The 1C:Enterprise system includes tools that allow the administrator to:

- maintain a list of system users;

- assign users a password to log into the system;

- assign users rights to access information processed by the system;

- create custom user interfaces, including menus and toolbars;

- view the list of working users;

- get user work history.

Thus, for each user (accounting employee), within a single configuration, it is possible to restrict access to information contained in the system information base and track every step of the user’s work in the system.