First, a little theory. Production cost accounting is directly related to product output and cost calculation. In this regard, costs are divided into two groups:

- Direct

- Indirect

Both groups are included in the cost price, but their methods of “getting there” are different. Direct costs can be immediately attributed to a specific finished product, service or semi-finished product. Accounting is maintained on accounts 20 and 23.

Indirect costs are distributed proportionally to some base. In this case, 25 and 26 counts are used.

Direct costs usually include materials and components, the quantity of which can be obtained from the specification.

General production and general business costs are considered indirect. For example, administration salaries, rent, costs for lighting, heating, etc. Since it is not known in advance what part of such costs is included in the cost of a specific product, the total amount has to be distributed among all produced units.

Coefficients of distribution methods are different, often prescribed in industry standards (proportional to direct costs, output volume, planned cost).

Concept and types of production costs

Production costs include those parts that are closely related to the company's main production.

That is, these are direct costs that go into creating products, and the costs of auxiliary areas that support the main production, and costs indirectly related to the production process, as well as losses due to defects.

Take our proprietary course on choosing stocks on the stock market → training course

As for the types of the phenomenon under study, the following are distinguished:

- Labor remuneration;

- Raw materials and material costs;

- Depreciation deductions;

- Payment for services of third-party companies;

- Tax deductions;

- Other.

Alternative (imputed) costs

Unlike financial accounting, which operates only with accomplished facts and actually incurred costs, in management accounting great importance is attached to alternative options, because, by making one management decision, the manager automatically refuses other options for the development of events, and therefore, in addition to real income and expenses, which will be received and implemented during the implementation of the decision made, alternative (imputed) costs inevitably arise, including in the form of lost profits due to the fact that the decision made excluded the possibility of alternative use of resources.

The concept of opportunity costs can also simplify decision making in some situations.

Let's look at a small example. The bakery was approached by a new potential client - the director of a restaurant that had recently opened nearby. He would like the bakery to supply his restaurant with buns every day that need to be baked according to a specific recipe. Of course, he is interested in the price - how much the bakery would like to receive for fulfilling such an order.

Suppose that at the moment the bakery is already working at the limit of its capacity and cannot simply bake buns for the restaurant in addition to the products that it already produces and sells to current customers, in order to begin cooperation with this restaurant, it will be necessary to reduce the production of some of the current types of products and, accordingly, reduce supplies to current customers or retail sales volumes.

Using the concept of opportunity cost, there is an elegant and simple way to solve this problem:

- of course, the price must cover the actual costs of the bakery - this means that you need to calculate the production cost of the buns that the restaurant director would like to receive; in addition, of course, the goal of the bakery is to make as much profit as possible, but this does not mean that you can set any level of profitability and ask for any price, although some amount of profit must be included in the price that will ultimately be set;

- Since in order to fulfill the restaurant's order, it will be necessary to reduce the current production of other types of products, there are alternative (opportunity) costs - in this case, this is the amount of profit that the bakery will lose if it accepts this order and reduces the supply and sales of previous products, that is this is the “lost” profit that the bakery would continue to receive if it refused to cooperate with the restaurant director and worked according to the previous program;

- This means that in order to set the price for buns for a restaurant, you need to add up the sum of the costs of producing these buns (their projected cost) and the “lost” profit from the sale of those products, the production of which will be reduced due to the acceptance of an order from the restaurant.

Let's illustrate with numbers. Let's say that a restaurant wants to receive 1000 buns. To be able to bake them, you will have to reduce the production and sale of French baguettes by 400 units. Let’s assume that the production cost of a baguette is 10 rubles, and its selling price is 19 rubles. In accordance with the calculation based on the recipe for making buns, their production cost should be 4 rubles.

We make the following calculations:

- profit from the sale of one baguette is: 19 - 10 = 9 rubles;

- opportunity cost - the profit that could have been received from selling 400 baguettes if the restaurant's order had been rejected - is 9 rubles. x 400 pcs. = 3600 rub.;

- the minimum price level for buns, at which it generally makes sense to talk about the possibility of accepting this order (replacing part of the baguettes with buns), consists of the sum of the cost of the buns and this lost profit from the baguettes, that is, for a batch of 1000 buns, the restaurant must pay at least : 4 rub. x 1000 pcs. + 3600 rub. = 7600 rub.;

- the minimum price of one bun must be no lower than: 7600 rubles. / 1000 pcs. = 7.60 rub.

It's minimum. If the restaurant director is not ready to pay that amount (for example, a neighboring bakery will offer him more favorable conditions), it is better to refuse cooperation and continue to produce the products that you are already producing at the moment. After all, if you agree to a lower price, it turns out that in the end the bakery will receive less profit than it received before.

Plus, other factors must be taken into account. For example, weigh whether it makes sense to spoil or break off relations with your current clients, because reducing the production of baguettes by 400 pcs. means that someone to whom the bakery sold them before will no longer receive these baguettes! Therefore, setting the price for buns at exactly 7.60 rubles, in fact, does not make sense - this price only makes up for the same profit that you are already making with the current production program, but for this you should not sacrifice already established relationships with customers .

Composition and structure of production costs

For competent accounting, in-depth analysis and high-quality planning of production costs, various classifications are used.

The most popular among them are two – by elements and by costing items.

The first option - element-by-element - involves dividing costs into groups based on their economic essence. At the same time, the places where costs arise and the directions of their use are not taken into account.

In the element-by-element classification, the following types of costs are distinguished:

- Materials and raw materials;

- Salaries;

- Depreciation;

- Others.

The costing grouping just involves taking into account costs by location of their occurrence, which makes it possible to calculate the cost of each product in companies characterized by a wide range of products.

Enterprises usually use the following list of costing items:

- Materials (excluding returnable waste).

- Labor remuneration of production personnel.

- Payments for social needs.

- Costs for the maintenance, use and maintenance of production machines.

- General production costs.

- Losses due to marriage.

- General expenses.

- Business expenses.

All these items together form the total cost of the product, and points 1-7 – its production cost.

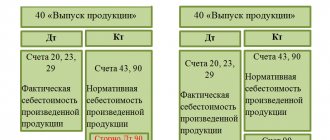

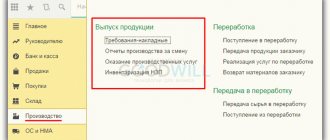

Accounting at standard cost without using account 40

Within a month, as finished products are released from the workshops to the warehouse, the products arrive at standard cost. In this case, do the wiring:

Debit 43 subaccount “Finished products at standard cost” Credit 20 - reflects the standard cost of finished products produced and delivered to the warehouse.

When selling products:

Debit 90-2 Credit 43 subaccount “Finished products at standard cost” - the sold part of finished products is written off at standard cost.

At the end of the month, when the actual cost of manufactured products is known, determine the deviations from the standard cost:

Debit 20 Credit 10 (70, 68, 69, 25, 26...) – reflects the actual cost of manufactured products.

If the standard cost is greater than the actual cost, make reversal entries:

Debit 43 subaccount “Finished products at standard cost” Credit 20 – the cost of finished products manufactured per month is reduced;

Debit 90-2 Credit 43 subaccount “Finished products at standard cost” - the cost of finished products sold in the current month is reduced.

If the actual cost is higher than the standard cost, the postings will be as follows:

Debit 43 subaccount “Deviations of the actual cost of finished products from the standard” Credit 20 - reflects the deviation of the actual cost of finished products from the standard;

Debit 43 subaccount “Finished products at standard cost” Credit 43 subaccount “Deviation of the actual cost of finished products from the standard” - the deviation of the actual cost of finished products from the standard in terms of products in the warehouse is written off;

Debit 90-2 Credit 43 subaccount “Deviations of the actual cost of finished products from the standard” - the deviation of the actual cost of finished products from the standard in terms of products sold is written off.

Element-by-element cost classification

As mentioned above, element-by-element classification involves the allocation of cost items in accordance with the economic essence of these expenses. A complete list of such expenses is also presented in the previous paragraph. Let's take a closer look at the contents of the most significant items on the list.

Material costs

This group of costs includes funds paid for:

- Purchase of materials and raw materials that are an integral part of manufactured products or necessary to ensure the process of their production;

- Purchase of packaging materials;

- Purchase of semi-finished products and spare parts, which are then subjected to installation and other processing methods;

- Remuneration of contractors hired for production purposes;

- Payment for fuel and energy resources received from suppliers used for production.

Important!

The amount of returnable waste is subtracted from the amount of material costs. These include resources that are underutilized in production and suitable for further exploitation for technological purposes. Although, perhaps, their initial consumer properties change somewhat. Accordingly, returnable waste is valued differently - not always at the price of the original materials.

Contributions for social needs

This article takes into account deductions at the current rates from the wage fund to state funds: Social Insurance Fund, Pension Fund, Employment Fund. The specific amount of this part of the costs, accordingly, depends on two factors:

- The amount of rates applicable to a company in a particular field of activity;

- The size of the organization's salary fund.

Depreciation of fixed assets

This reflects the amounts of depreciation charges calculated based on the goal of fully restoring the cost of equipment used during production. The amount of these expenses depends on the depreciation method chosen for the relevant objects, the cost of the objects themselves, their useful life and depreciation rates.

Results

One of the most significant tasks of accounting is accounting for production costs, since information about production costs is needed directly by the director of the enterprise to formulate the financial policy of the enterprise, aimed at increasing profitability and reducing costs.

Therefore, it is so important for an accountant to determine the methods for arranging production costs and methods for distributing them between products that are suitable for his enterprise. You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Typical grouping of costs by costing items

This grouping involves accounting for expenses by place of origin and destination.

With its help, the cost of production is determined both for workshops and for the company as a whole. A typical list of costing items is given above. It can be modified depending on the scope of the company. Let's take a closer look at the main points of the grouping.

Raw materials and supplies, purchased products, semi-finished products, fuel and energy for technological purposes

The title of the article speaks for itself. This takes into account the material costs needed to produce a specific product. Returnable waste is deducted.

Labor costs for production workers

In the calculation grouping of costs, this item is included in several items at once: this is the remuneration of the main production personnel, and part of general and general production costs, and a component of the costs of operating and maintaining equipment.

Contributions for social needs

This is also a complex item, as it includes the costs of paying obligatory contributions to state funds, which are charged from the wage fund. And employee remuneration, as mentioned in the previous paragraph, is an element included in the structure of several costing items at once.

Expenses for the maintenance and operation of machinery and equipment

This includes costs such as:

- Maintenance of equipment and mechanisms;

- Repair of machines, machine tools, vehicles, tools;

- Depreciation charges calculated for fixed assets;

- Wear and tear of "low value".

General production expenses

This is a complex item consisting of costs of various economic content. What they have in common is that they belong to ordinary activities, and their main purpose is to service the main and auxiliary production areas of the company.

General production costs, for example, include:

- Expenses for maintenance of equipment and mechanisms;

- Salary of service personnel;

- Payments to landlords;

- Supporting materials;

- Lighting/heating costs;

- Depreciation deductions;

- Insurance of objects used in production, etc.

This article also includes non-production costs - for example, losses during downtime, payment of shortages.

Losses from marriage

It is customary to consider defective products if their quality characteristics do not meet accepted standards, as a result of which they cannot be used for their intended purpose.

The article under consideration includes the cost of units of products finally recognized as defective, as well as the amount of damaged materials and the cost of correcting the defect.

General running costs

This comprehensive article brings together costs related to the management of the company and the organization of the reproduction process itself. This, in particular, includes such elements as expenses for the maintenance of the AUP, maintenance of premises and mechanisms for general business purposes, as well as certain types of material costs (for example, office supplies), etc.

Business expenses

These are the costs of financing loading and unloading activities, costs associated with the storage and sale of goods, costs of marketing campaigns and other costs related to pre-sale preparation and sale of products. The article is complex in nature, it includes costs that differ in economic nature: these are materials, and salaries of the relevant categories of personnel, and the costs of operating certain types of non-current assets.

How to calculate the total cost

The current accounting rules allow for the possibility of forming the accounting cost of products at the production level, i.e., without including in it the general business expenses for which account 26 is intended to be collected. In this case, the amounts collected on this account are completely debited on a monthly basis to the account for accounting for financial results from sales. If it is necessary to obtain data on the total cost, information about it in such a situation can be obtained through simple calculations.

For more information about the formation of production costs, read the material “What costs does the production cost of products include?”

If the enterprise has decided to formulate the accounting cost as a full one, then account 26, like account 25, will be distributed and its share will be an integral part of the final cost of each type of product.

The collection of expenses on account 26 occurs in relation to each of the general business units. In composition, these costs are similar to general production costs and can be divided into the same groups, with the possible exclusion of costs for product quality. Additionally, this includes expenses:

- on personnel selection and training,

- medical support,

- protection of the territory,

- garbage removal, sewerage,

- communication services,

- representative events,

- services of lawyers and auditors,

- holding meetings of owners,

- payable taxes attributed to expenses.

Check whether you are calculating the cost of products correctly using the Typical Situation from ConsultantPlus. Study the material by getting trial access to the K+ system for free.

Direct and indirect costs of production of products

The classification of production costs is not limited to element-by-element and calculation groupings. There are other types of characteristics - for example, expenses are often divided into types depending on the method of attributing certain product items to direct and indirect costs.

Direct costs directly correlate with the size of products produced or with the time spent on their production. There are three groups of such expenses:

- Direct material - payment for resources, which subsequently become an integral part of manufactured products;

- Direct labor - remuneration of personnel directly involved in the production of one or another type of product;

- Direct overheads - the resources on which these funds are spent do not become a structural part of the released product, but this type of costs still directly depends on the volume of output (this may be payment for electricity necessary for the operation of workshop equipment).

Indirect costs are more general in nature. Their dependence on the quantity of goods produced is very conditional (an increase in production volume to a certain level does not affect them in any way). Indirect costs are also divided into three groups:

- Indirect material - payment for by-products not used directly for the manufacture of products, but necessary for organizing the production process itself (various lubricants, office supplies, etc.);

- Indirect labor - remuneration for the work of auxiliary workers, office staff, storekeepers, employees servicing machines and equipment, etc.; This also includes losses from downtime and overtime work for key personnel;

- Indirect overheads – maintenance of the AUP, rental payments, expenses for the development of innovations, etc.

If direct costs are directly attributed to the cost of certain types of products, then indirect costs need to be distributed proportionally to some base. Typically this is the salary of production employees, but there are other options.

What are the documents that determine the cost of a unit of production?

Before the start of production of any product, a list of expenses necessary for the production of a certain volume of this product is compiled. The volume of production is called a costing unit, and the list itself is called a cost estimate. Calculation is done in 2 options:

- Quantitative, determining the volumes of direct material and labor costs required for production, a list and approximate percentage of overhead costs. This calculation option is used as the basis for the description of the production process and is used throughout the entire time of working with the product.

- Cost, in which costs are reflected in their monetary value. Such calculation depends both on the price level and on the actual relationship between direct and overhead costs. Therefore, it is compiled with sufficient regularity, receiving a document that reflects the dynamics of the cost value and makes it possible to set an adequate selling price for the product.

Read about existing methods for calculating cost in the article “The concept of cost in accounting (nuances).”

Analysis of the production cost structure using an example

Analysis of the cost structure allows you to see which resources are consumed in the greatest quantities during the operation of the company. If these are materials, then production is considered material-intensive, if the main share in the cost structure belongs to wages - labor-intensive.

The cost structure is a list of the ratios of individual types of costs to their total amount. This point is largely determined by the industry in which the company operates.

Analysis of the structure involves comparing the shares of the main types of costs over time. The goal is to identify the causes of changes, study their impact on the efficiency of the company, and also search for reserves for reasonable cost reduction.

Example. Data on expenses of EURASIA LLC for two years are shown in the table.

| Indicator name | Last year | This year | ||

| Amount, t.r. | Specific gravity. % | Amount, t.r. | Specific gravity, % | |

| Output | 468 410 | – | 327 195 | – |

| Spending | 288 023 | 100 | 220 140 | 100 |

| Of them: | ||||

| Material costs: | 136 007 | 47,22 | 90 275 | 41 |

| raw materials | 129 384 | 44,92 | 82 943 | 37,68 |

| fuel | 3 068 | 1,06 | 4 722 | 2,14 |

| energy | 3 555 | 1,24 | 2 610 | 1,18 |

| Salary | 82 245 | 28,56 | 73 100 | 33,21 |

| Contributions for social needs | 38 138 | 13,24 | 35 100 | 15,95 |

| Depreciation | 972 | 0,34 | 865 | 0,39 |

| Other expenses | 30 661 | 10,64 | 20 800 | 9,45 |

The table shows that in the reporting year there was a decrease in the amount of costs. This is largely due to a reduction in production output. Perhaps this moment was also influenced by measures to reduce the cost of manufactured products.

In both periods under review, the greatest weight in costs is occupied by material costs and wages. The share of labor costs increased (from 28.56% to 33.21%). The share of material costs, on the contrary, decreased. Accordingly, first of all, one should look for reserves for reducing costs precisely by salary items.

An increase in the weight of depreciation charges signals a decrease in capital productivity. An increase in the share of other costs indicates changes in their composition: for example, an increase in bank interest on loans, an increase in tax rates, a change in rental rates, etc.

Assessment of the implementation of planned targets and the dynamics of the cost of commercial products

Analysis of production costs includes activities aimed at assessing achievements against planned indicators and studying the dynamics of product costs.

Actual cost of production

When analyzing the actual cost of production, three main indicators are usually used:

- Z0 – unit cost of goods for the previous year;

- Z1 – cost of the same unit of goods in the current year;

- Zpl is the planned cost of this unit of production.

Example. At the plant, the cost of manufacturing one object according to the plan should be 150 thousand rubles, but the actual costs this year amounted to 159 thousand rubles, and in the previous year - 155 thousand rubles. A total of 150 such products were manufactured, while 200 were planned.

Let's calculate a number of analytical indices.

Plan index = Zpl/ Z0 = 150/155 = 0.97 = 97%

That is, it is planned to reduce expenses by 3%.

Plan execution index = Z1/ Zpl = 159/150 = 1.06 = 106%

That is, the above-plan cost increase was 6%.

Dynamics index = Z1/ Z0 = 159/155 = 1.0258 = 102.58%

That is, the actual increase in costs was 2.58%

It turns out that with a planned reduction in the cost of the facility by 3%, it increased by 2.58%. The actual amount of overspending for the entire number of objects (150 in the example) was:

(Z1 – Z0)*Q1 = (159 – 155)*150 = 600 thousand rubles.

The reduction in actual cost is calculated using the following formula:

(Z1* Q1/ Z0* Q1)*100 – 100 = 102.58 – 100 = 2.58%

Costs did not decrease, but increased by 2.58%, the task was not completed.

Absolute amount of actual cost

The absolute amount of actual savings is calculated as follows:

Z0* Q1 – Z1* Q1

If we take the figures from the example above, then the absolute amount of actual savings was: 155*150 – 159*150 = – 600

Accounting at standard cost using account 40

Within a month, as finished products are released from the workshops to the warehouse, receive them at standard cost. In this case, do the wiring:

Debit 43 Credit 40 – reflects the standard cost of finished products produced and delivered to the warehouse.

At the end of the month, when the actual cost of finished products is known, reflect it in the debit of account 40. At the same time, write off the deviations of the actual cost from the standard cost. In this case, make the following entries:

Debit 40 Credit 20 (23) – reflects the actual cost of finished products;

Debit 90-2 Credit 40 – reversed, the amount of excess of the standard cost of manufactured products over the actual cost is written off;

or

Debit 90-2 Credit 40 – the amount of excess of the actual cost of manufactured products over the standard cost is written off.

This procedure is provided for in the Instructions for the chart of accounts (accounts 40 and 43).