During the creation or development of any company, it needs a financial basis, or authorized capital. As a rule, it is created either by one owner, or by several owners who own the company in certain shares. With such a procedure as a contribution to the authorized capital, postings and other documentary support are made in the manner established by law. This process is quite complicated and requires certain preparation from the company’s owners, as well as the involvement of third-party competent specialists.

Making non-monetary contributions to the authorized capital

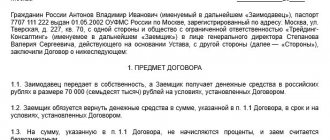

According to civil law, the minimum capital of an LLC, and today it is 10,000 rubles, must be contributed by the founders exclusively in money (Clause 2 of Article 66.2 of the Civil Code of the Russian Federation). Anything over this amount, participants have the right to supplement with property: real estate, transport, equipment, office equipment, goods, securities, etc. What property cannot be accepted as a contribution to the authorized capital is regulated by the Charter of the company.

There are also legislative restrictions on the payment of shares in the authorized capital of certain types of property rights, namely:

- the right to perpetual use of lands;

- the right to lease a plot belonging to the forest fund;

- lease right to state and municipal land of a resident of a special economic zone;

- the right to use property transferred to individual entrepreneurs and small and medium-sized businesses.

By contributing their property to the authorized capital, participants transfer the ownership of it to the company. An exception is cases when the act of acceptance for balance contains an indication of the transfer of things for temporary possession and use for a specific period. When the founder leaves the LLC, his property continues to remain in the organization until the date recorded in the act. An existing participant, with the unanimous permission of the general meeting, can withdraw his non-monetary contribution, promptly compensating the company for the costs associated with the acquisition and use of similar property before the end of the established period.

Results

Contribution of the authorized capital with property occurs in several stages - the founders provide for this possibility in the constituent documents, organize an independent assessment of the property contribution, approve its results, etc. Contribution to the authorized capital with property is possible only after payment in money of the minimum amount established by law.

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Valuation of property contributions to the authorized capital

All non-monetary contributions both when creating a company and when increasing the authorized capital must be assessed in monetary terms. Until the fall of 2014, for property contributed to pay for a share with a nominal value of no more than 20,000 rubles, the founders themselves could establish the monetary equivalent of the value and record it in the protocol. From September 1, any property contributions are subject to independent assessment. The procedure for valuing property contributed to the authorized capital is regulated by the law on valuation activities (No. 135-FZ of July 29, 1998).

According to 135-FZ, the value of the material contribution included in the authorized capital of the company is determined by independent appraisers based on the market situation. They establish the likely price for which the owner could sell the subject property on the open market as a result of an ordinary sale transaction.

This innovation, according to experts, complicates the process of forming authorized capital for many organizations and makes property contributions unprofitable. In small LLCs, the founders often contribute their shares with items such as office furniture, a laptop or MFP, while each object is subject to assessment, and the burden of paying for the service falls on the owner of the property. The period for compiling an assessment report is on average from 2 days to a week. Most appraisers do not require the presentation of the object itself for examination, but are content with documents and photographs.

What will happen to the organization if it ignores the requirement for an independent assessment? The absence of an appraisal act invalidates transactions involving the contribution of property to the authorized capital, and may also become a basis for invalidating the company’s Charter itself. If the value of a property contribution exceeds the limits under antimonopoly legislation, the FAS obliges not only to evaluate it at the real market price, but also to coordinate such an operation with it before the start of the transaction.

Why transfer property within a group of companies

There are the following main reasons why owners of a holding may want to “move from one pocket to another” their property.

- Safety. In this case, business owners want to withdraw property from the company, which may be subject to claims from creditors or regulatory authorities.

- Reorganization. The owners of the holding may decide to change the direction of activity of a particular company in the group. For example, previously the organization was engaged only in trade, but now production will be added to its functions. Naturally, in this case, the corresponding assets.

- Development. This option is similar to the previous one, the difference is that we are not talking about the redistribution of existing functions within the holding, but about the launch of a new project. For ease of doing business, in this case it is logical to create a separate legal entity, which will also require fixed assets.

Selection of an independent appraiser

Art. 3 of Law No. 135-FZ, appraisal means professional activity to establish the market, cadastral and other value of objects. The property contributed to the authorized capital of an LLC can be appraised by a specialized company or a private appraiser registered with the relevant self-regulatory organization (SRO). A list of all current SRO appraisers is provided on the Rosreestr website. Before contacting an appraiser, it is recommended to request title documents and a liability insurance agreement.

When it comes to choosing appraisal companies, they often focus on prices. The cost of services varies depending on the region, the reputation of the company, and the type of property: from 1,000 rubles for a laptop to 50,000 or more for securities. The speed of reporting and the willingness to carry out the procedure remotely may be important for owners. The activities of appraisers are not limited geographically, so you can use the services of a company from any region of the Russian Federation.

In Art. 16 Federal Law No. 135 establishes restrictions on the choice of appraisers from the point of view of conflict of interest. A private appraiser or company should not be involved in any way with the customer and his property:

- not be related;

- not to be business partners and not to have an employer-employee relationship;

- not be a creditor or debtor of the client;

- have no rights or property interests in relation to the objects of assessment.

The appraiser is responsible for overestimating the value of the non-monetary contribution transferred by the founder to the LLC. If, within a three-year period from the date of payment/increase in the authorized capital at the expense of the valued property, the participants have subsidiary liability for the obligations of the company, the appraiser is also involved jointly and severally within the limits of the allowed overstatement.

Losses caused by the appraiser are compensated by:

- property of the appraiser-individual;

- funds from the appraisal company;

- compensation under a liability insurance contract within the limits of the insured amount;

- SRO compensation fund up to 5 million rubles per insured event.

Transfer of use rights to the company

In pursuance of the founding agreement, not only material assets can be transferred to the company. Participants are allowed to grant the company the right to use the facilities. A common option is to provide premises to the society. In this case, the real estate remains the property of the LLC participant. The enterprise operates the space for its intended purpose free of charge throughout the entire period stipulated by the constituent agreement. Depreciation of real estate is carried out by the direct owner (letter of the Supreme Arbitration Court of the Russian Federation No. 58 dated January 18, 2001). Property rights are recognized as an asset of the company.

A participant can also assign powers to a firm under an agreement concluded with a third party. It is important to objectively assess the market value of such an asset, as well as accurately determine the period of its validity. If the agreement is terminated early, there will be a need to compensate for losses. The damage will be recovered from the founder who transferred the property right to the company.

The procedure for assessing property contributed to the authorized capital

For a company planning to form/increase its authorized capital through material contributions, the action algorithm is as follows:

- The owners of the property included in the management company select an appraisal company and enter into a simple written agreement with it. The document indicates the object, the method of its evaluation, the full name of the specific appraiser, the SRO in which it is registered and other information in accordance with Art. 10 of Law 135-FZ.

- The customer provides the appraiser with the necessary information, documents, and provides access to the appraisal object.

- The received act on the assessment of the property contribution is approved by the general meeting of LLC participants within 6 months from the date of drawing up the report, as long as it is considered valid. But no later than 4 months from the date of registration of the legal entity. The protocol indicates the object transferred as payment for the management company’s share (name and identifying characteristics), its value in monetary terms, and the decision to establish the value, adopted unanimously. The amount entered in the protocol cannot be higher than the price determined by an independent appraiser.

- The property is transferred to the company according to the transfer and acceptance certificate signed by the participant and the general director of the LLC. The period for contributing shares to the management company when creating a legal entity is determined by the Charter, but according to the law it cannot exceed 4 months.

Property transfer options

Most groups of companies are built according to approximately the same scheme. Externally, structures may look complicated, but this is most often due to the fact that the actual business owners do not want to “shine the light.” But the essence of the legal structure of a holding is almost always the same: the founders, individuals, control the group’s organizations directly or through a management company.

Thus, property can be transferred:

- From the founder - subsidiary company.

- From a subsidiary to the founder.

- Between two related companies that have common founders.

Next, we will consider various methods of transferring property in relation to the status of the transferor and receiver of the purchase and sale of property

This method makes sense to use only when transferring property between two legal entities related by a common owner, because In the relationship between parent and subsidiary companies, there are more interesting options.

Let's consider the tax consequences of such a sale.

- Income tax or simplified tax system

To avoid paying these taxes, you need to minimize your revenue. If the seller works for OSNO, then the price should be equal to the residual value of the object or slightly exceed it. When the seller uses the simplified tax system “Income minus expenses”, one must proceed from the costs of purchasing or creating the object being sold.

However, tax authorities always closely monitor transactions within holdings. If the income from transactions between interdependent Russian companies exceeds 1 billion rubles per year, these transactions are subject to mandatory control. But “smaller” transactions may also attract the attention of inspectors. For example, if one of the parties to the agreement pays income tax, and the other uses one of the special regimes (Article 105.14 of the Tax Code of the Russian Federation).

Therefore, you need to prepare a justification for the selling price in advance. For example, a decrease in the cost of equipment can be explained by a high degree of wear and tear, defects discovered during inspection, etc.

- VAT

If both organizations work for OSNO, then in general there are no VAT expenses for the holding. The tax charged by the seller will be reimbursed by the buyer.

It’s worse if the receiving party uses one of the special modes. Then the VAT that the seller will charge will be “lost” for the business. Only if the buyer uses the simplified tax system “Income minus expenses,” VAT can be taken into account in costs and partially compensated (in the amount of 15% of the amount).

Contribution to the authorized capital in goods

The founder contributed goods to the authorized capital. The company is on the general taxation system. What taxes does he need to pay to the budget? The founder has a 100% stake in the management company.

In tax accounting (both under the OSN and under the simplified tax system), when transferring property to the authorized capital, income and expenses do not arise (clause 3 of Article 270, subclause 2 of clause 1 of Article 277 of the Tax Code of the Russian Federation).

For profit tax purposes, the value of the contribution to the authorized capital is recognized as equal to the tax (residual) value of the transferred property.

If the property is transferred by the VAT payer, then he must restore the tax previously accepted for deduction on this property (clause 1, clause 3, article 170 of the Tax Code of the Russian Federation, Letter of the Ministry of Finance dated 08/15/2016 N 03-07-03/47566, dated 09/04. 2015 N 07-01-06/51145, dated 05/14/2015 N 03-03-06/1/27742). Recoverable tax amount:

- if goods are transferred, it is equal to the amount of VAT claimed for deduction on them

The transfer of property to the authorized capital is formalized:

- if a used OS is transferred - by an act of acceptance and transfer of an OS object (for example, according to the OS-1 form). Do not forget to indicate in the act the residual value of the asset according to tax accounting data, its service life and the amount of VAT recovered on it;

- if other property is transferred - by an acceptance certificate (for example, in form M-15), in which the amount of restored VAT must also be indicated.

Accounting (clause 14 of PBU 19/02, Letter of the Ministry of Finance dated 04/28/2016 N 07-01-09/24880).

Acceptance for accounting of the share of property received in payment (in monetary value agreed upon by the company's participants) is reflected in the debit of accounts 08 “Investments in non-current assets”, 10 “Materials”, 41 “Goods”, etc. in correspondence with the credit of account 75 “Settlements with founders", subaccount 75-1 "Calculations for contributions to the authorized (share) capital" (clause 9 of PBU 6/01, clause 8 of PBU 5/01, Instructions for using the Chart of Accounts).

Applications

Related questions:

- Contribution to the authorized capital with property - VAT One of the founders of the company makes a contribution to the authorized capital with property that was brought from abroad. Should this property be taken into account together with customs payments (VAT) or at the contract value? ✒….

- Contribution of the founder to the property of the LLC Our company needs financial support from the founder. Help is needed in selecting the optimal financing mechanism. Consideration is given to gratuitous financial assistance and the founder's contribution to the property. However, in the current version of the Charter this...

- Receipt of fixed assets from the founder Good afternoon! Please tell me how can I take into account and what accounting entries will reflect the receipt of fixed assets from the founder in the organization’s accounting? ✒ In this case, this operation can be carried out….

- Contribution to the authorized capital in foreign currency The LLC decided to increase the authorized capital by 75,000 euros by making an additional contribution by the sole shareholder of the non-resident Company. The Decision to increase the capital capital states that the company’s capital capital increases by 75,000....

Accounting entries

The rules for reflecting payment of shares by the founders are enshrined in the recommendations of the Ministry of Finance of Russia No. 91n dated 10/13/03. In accounting documents, the process is formalized as follows:

| Item no. | Wiring name | Debit | Credit |

| 1 | Receipt of property contribution from the founder | 08 | 75 |

| 2 | Formation of authorized capital from contributions of participants | 75 | 80 |

| 3 | Acceptance of assets for accounting and recognition of them as fixed assets | 01 | 08 |

| 4 | Write-off of the value of property with an assessment of up to 40 thousand rubles at a time | 10 | 08 |

Often, during the transfer process, the final value of the property increases. Clause 12 of PBU 6/01 allows you to include in the valuation of an asset not only the amount approved by the founders, but also the costs of delivery, installation, launch, and setup. Transactions to accumulate value are reflected in one of the following ways:

| Item no. | Wiring name | Debit | Credit |

| 1 | Costs for acceptance and launch of property received from the participant | 08 | 60 |

| 2 | Costs of assets transferred by the owner to the company | 08 | 76 |

Standard posting for depreciation will be made according to accounts (Dt.) 91 or and (Kt.).

What is needed to make a non-monetary contribution to the authorized capital?

We are going to register an LLC for three people. Now we are thinking about the authorized capital. Couldn't figure out whether the authorized capital of an LLC can be in non-monetary form? For example, if I don’t have free money to invest in a business, can I transfer, for example, a dacha or a car? Will such authorized capital be considered legal? And if it is possible, then who, what body should then evaluate the value of the transferred property? How is this formalized in principle? Where should I go? I heard that sometimes appraisers are brought in. How should the valuation of this property be properly assessed? Should an official or some official person be present when the property is appraised?

06 June 2012, 18:16 Galina, Omsk

Free transfer of property

This option is convenient to use if you need to transfer objects from a subsidiary to the parent company.

A “daughter gift” is not subject to income tax in accordance with paragraph 11 of Art. 251 Tax Code of the Russian Federation. To do this, the receiving company must own more than 50% of the authorized capital of the transferring one.

It is important to remember that the parent company, having received the property, cannot transfer it to third parties within a year. Otherwise, you will have to pay income tax.

Sometimes tax authorities try to reclassify a “daughter gift” as a payment of dividends, but the courts, including the highest authority, in this case are on the side of taxpayers (Resolution of the Presidium of the Supreme Arbitration Court of the Russian Federation dated December 4, 2012 No. 8989/12).

The approach of the inspectors to VAT here is generally similar to the contribution to property, which was discussed above. But since the transfer of an object from a subsidiary to a parent company can hardly be considered an investment, then most likely the businessman will have to accept the position of the tax authorities. Those. the transferring company charges VAT, but the receiving company cannot deduct it.

Lawyers' answers (2)

City not specified

According to Art. 14 of the Law “On Limited Liability Companies”, the authorized capital of a company is made up of the nominal value of the shares of its participants, the size of the authorized capital of the company must be at least ten thousand rubles, the size of the authorized capital of the company and the nominal value of the shares of the company’s participants are determined in rubles. Thus, the size of the authorized capital of the company must be no less than 10,000 (ten thousand) rubles. At the same time, it must be remembered that at the time of state registration of the company, its authorized capital must be paid by the founders in at least half, and the payment period can be determined by the agreement on the establishment of the company or in the case of the establishment of the company by one person by the decision on the establishment of the company and cannot exceed one year from the date of state registration of the company.

The authorized capital of an LLC can be paid for in money, things, securities, and non-property rights.

The monetary valuation of non-monetary contributions to the authorized capital is approved by a decision of the general meeting, adopted unanimously by all participants of the company (Article 15 of the Law “On LLC”).

Those. the monetary valuation of non-monetary contributions is made and then approved by the participants of the society themselves . however, this is allowed only for deposits worth no more than 20 thousand rubles - if the value of the non-cash deposit is more than 20 thousand rubles. then such contribution must be assessed by an independent appraiser. At the same time, the founders themselves do not have the right to value the property above the price established by independent appraisers. Changes are also made to the documents for registering an LLC. A property valuation act is drawn up (signed by all founders). And we draw up an act of acceptance and transfer of the authorized property for the full balance of the company, necessarily, only after the completion of the state registration of the company (signed by the founder and personally by the general director).

A report on the assessment of non-monetary contributions is an integral element of the package of documents for registration or reorganization of a company. as well as upon purchase. In addition, the assessment of non-monetary contributions is necessary in order to accept them for accounting and tax accounting.

The purpose of assessing a non-monetary contribution is to justify its market value in order to make a decision on the contribution of this non-monetary contribution to the authorized capital. In this case, the market value of the non-monetary contribution to the authorized capital is determined, that is, the price for which it can be sold at the moment.

The importance of correct assessment of a non-cash contribution lies in the fact that the declared value of a non-cash contribution owned by a company will be the basis for calculating property tax and calculating depreciation charges. Thus, the assessment of the non-monetary contribution made to the authorized capital will directly affect the financial performance of the company.

Those. if you decide to make a non-monetary contribution. then I advise that it should not exceed 20 thousand rubles. so that YOU can evaluate the property yourself without involving an appraiser.

You contribute a computer and a printer to the authorized capital. In the decision you will write something like this: Contribute 100% of the share in the authorized capital with property consisting of:

- This computer costs 7,800 rubles.

- This printer costs 2200 rubles.

Total 10,000 rubles.

There is also an accounting aspect when contributing a share of property. If you do not have documents for the acquisition of the contributed property, then for tax accounting purposes (calculation of taxes), its value will be zero. That is, you will not be able to reduce the tax base by income tax or the simplified tax of 15% on the value of such property. If you have such documents, then the value of the property for tax accounting purposes (not to be confused with the valuation of the contribution, which is taken into account only in accounting) will be equal to the value of the property according to the documents, but no more than the value of the valuation (Article 277 of the Tax Code of the Russian Federation).

06 June 2012, 18:27

City not specified

Hello! In practice, there are often situations when the authorized capital of a company is formed partially or entirely from non-monetary contributions. In this case, the assessment of non-monetary contributions in most cases should be carried out by an independent appraiser. When making a non-monetary contribution to the authorized capital of a newly created or reorganized company, the assessment of the non-monetary contribution by an independent appraiser is mandatory.

The purpose of assessing a non-monetary contribution is to justify its market value in order to make a decision on the contribution of this non-monetary contribution to the authorized capital.

In this case, the market value of the non-monetary contribution to the authorized capital is determined, that is, the price for which it can be sold at the moment.

Documentation of payment

The fact that the obligation to make a contribution has been fulfilled must be confirmed. If the transaction is not properly formalized, there will be a risk of a corporate dispute. Claims due to lack of documentary evidence may also be filed by regulatory authorities. The presence of primary forms is recognized as a prerequisite for the completeness of accounting.

The transaction to pay for the share with property is recorded in a deed. This document becomes the closing link of the entire formal chain. The complete list is as follows:

- memorandum of association;

- a decision indicating the size of the authorized capital and a list of property;

- an independent appraiser’s conclusion on the market value of assets or a protocol on price agreement by participants;

- deed of transfer.

Next, the company prepares a standard set of reports. If the property is recognized as a fixed asset, an inventory card is drawn up. Primary reporting forms may be taken from the appendix to the Resolution of the State Statistics Committee of Russia No. 7 dated January 21, 2003. An alternative is the individual development of forms and their approval by accounting policies.

Simplified taxation system

If the recipient applies the simplified tax system, he also does not include the received property in income (subclause 3, clause 1, article 251, subclause 1, clause 1.1, article 346.15 of the Tax Code of the Russian Federation). But is it possible to take this property into account as expenses if the object of taxation is income reduced by expenses incurred? After all, Art. 346.16 of the Tax Code of the Russian Federation allows you to reduce income by costs of acquiring fixed assets and intangible assets (subclause 1, 2 clause 1 of Article 346.16 of the Tax Code of the Russian Federation), as well as by material expenses (subclause 5 of clause 1 of Article 346.16 of the Tax Code of the Russian Federation). According to the Ministry of Finance of Russia, this cannot be done (letters dated 02/03/2010 No. 03-11-06/2/14, dated 01/29/2010 No. 03-11-06/2/09, dated 04/11/2007 No. 03-11-04 /2/99). Financiers explain this by the fact that according to the simplified tax system, expenses are recognized as expenses after their actual payment (clause 2 of article 346.17 of the Tax Code of the Russian Federation). And when receiving property as a contribution to the authorized capital, the company does not incur expenses for its acquisition (it does not actually pay for this property).

Most courts share this opinion (resolutions of the Volga-Vyatka District AS of 02.02.2017 No. F01-6095/2016, FAS of the Ural District of 12.15.2008 No. F09-9338/08-S3, Northwestern District of 05.26.2008 No. A56- 25050/2006, dated September 28, 2007 No. A56-4532/2007 (Decision of the Supreme Arbitration Court of the Russian Federation dated April 21, 2008 No. 1193/08 refused to transfer the case for review)).

However, there is a court decision where the arbitrators recognized that a company using the simplified tax system can take into account the property contributed to its authorized capital as expenses. Thus, the Federal Antimonopoly Service of the Central District, in a resolution dated July 18, 2006 in case No. A09-142/06-25-16, indicated that the receipt by a company of property in the authorized capital cannot be considered as a gratuitous transfer. Indeed, in exchange, participants receive the right to participate in the management of the company and receive dividends.

In our opinion, it is impossible to take into account property received as a contribution to the authorized capital in the costs of the simplified tax system. Indeed, for the purposes of Chapter 26.2 of the Tax Code of the Russian Federation, payment is recognized as the termination of the buyer’s obligation to the seller (clause 2 of Article 346.17 of the Tax Code of the Russian Federation). But with the addition of property to the authorized capital of the recipient company, its obligations to the participant do not stop, but only begin. She has an obligation to distribute profits in favor of the participants.