Companies strive to take care of maintaining a positive microclimate within the team. For this reason, among the constant expenses of companies, one can often find expenses for the purchase of water, tea and coffee. This is not only a tribute to fashion trends, but also compliance with the requirements of current legislation. In the article we will talk about accounting for water, tea, coffee, sweets, and give examples of postings.

Having the opportunity to offer tea or coffee to partners, the organization creates a positive image and increases the likelihood of concluding a deal or continuing productive cooperation. Like other company expenses, the cost of purchasing tea or coffee must be taken into account. The accountant who will be entrusted with the responsibility for carrying out the action must know all the features of its implementation.

Accounting for drinking water at an enterprise

Drinking water is included in the MPZ. The actual cost of the product is taken into account. It represents the amount the company spent on the purchase. In this case, VAT and other refundable taxes are excluded.

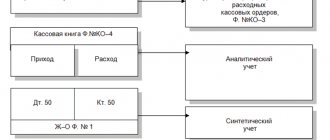

To reflect the flow of water, the accountant will need to make the following entries: (click to expand)

- Dt 10 Kt (76) (receipt of water received from the supplier).

- Dt 19 Kt (76) (VAT accounting has been completed.) The action is carried out if there is an invoice containing the tax amount.

- Dt 68, subaccount “Calculations for VAT” K-t 19 (Acceptance of the VAT amount for accounting.) During the manipulation, it is necessary to comply with all the conditions specified in Chapter 21 of the Tax Code of the Russian Federation.

According to the provisions enshrined in PBU 10/99, expenses incurred by the company are divided into other costs and expenses for ordinary activities.

Receipt of returnable reusable packaging

Returnable packaging does not meet the definition of inventory (clauses 3, 5 of FSBU 5/2019). Ownership of it does not pass to the buyer, therefore it is recorded on the balance sheet in account 002 “Inventory assets accepted for safekeeping” at the cost indicated in the acceptance documents.

Reflect the security deposit behind the balance sheet using the document Transaction entered manually (Transactions - Transactions entered manually).

Fill in the information about the supplier, the quantity and cost of the deposit containers according to the invoice.

Reflect the return of the deposit container to the supplier with a return entry.

Accounting for tea and coffee in the organization

Products that a company purchases for its employees and customers must be included in the inventory. In this case, the following transactions are carried out:

- Dt 10 Kt 60 (76) – the received product was recorded as inventory.

- Dt 91-2 Kt 10 – written off.

Products are accepted for accounting at actual cost. To find out, you need to refer to the contract with the supplier. The figure indicated there will appear in other company documents. As in the case of water, VAT is not taken into account.

Features of accounting for tea and coffee depend on the presence of the corresponding clause in the collective agreement.

So, if the document contains a provision according to which the organization is obliged to provide its employees with drinks and sweets, expenses for the purchase of products are classified as expenses for ordinary activities. If the products are transferred to the person who is responsible for replenishing them, the actual cost of tea and coffee is written off from account 10 to the debit of account 26. The basis for the manipulation is the corresponding primary document.

While it is possible to include water in expenses for tax purposes, it will not be possible to perform a similar manipulation in relation to tea and coffee. Tax authorities will certainly have questions regarding the legality of the action. The absence of a clause on the provision of drinks and sweets in the collective agreement leads to changes in the accounting procedure for tea and coffee. In this situation, the accountant must include the products among other expenses.

Alexander Druz about the Universal Accounting System

In addition to the opinions of ordinary users about the USU program, the opinions of experts are now presented to your attention. Alexander Druz is the first master of the intellectual game “ChGK”. He was awarded the Crystal Owl prize six times as the club's best player. Winner of the Diamond Owl - a prize for the best player. Champion of the television version of the Brain Ring. In the television program “Own Game” he won “Line Games”, “Super Cup”, won the “III Challenge Cup” with the team, and set an absolute record for performance in one game. Author and presenter of intellectual games and educational programs on various TV channels.

Spending on water, tea, coffee: taxation features

The main problem that a company may face during taxation is justifying the costs of purchasing drinks and sweets for employees and clients. At first it may seem that spending money on buying water is inappropriate. Each office building is equipped with a water supply system and each employee or visitor has free access to unlimited quantities of liquid. However, practice shows that the water that flows from the tap is more like technical water than drinking water.

In most cases, the liquid does not meet the requirements that SanPiN imposes on it.

The expediency of spending on purchasing water can be proven by obtaining a conclusion from the State Sanitary and Epidemiological Supervision Service that the liquid from the tap does not meet the requirements of Sanitary Regulations and Regulations. If such a certificate is missing, tax authorities may consider that incurring such expenses is inappropriate.

If a company makes contributions to the state under the simplified tax system, and the object of taxation is income minus expenses, it will not be possible to take into account expenses for the purchase of water. The list of expenses that reduce the amount of profit received is given in the Tax Code of the Russian Federation. The list is closed. You won't be able to add new items to it.

If you carefully study the list, you will not be able to find the costs of ensuring normal working conditions, which include the purchase of drinking water. A similar rule applies to the purchase of sweets and coffee. To know the tax implications, you must carefully study the table below.

| Types of taxes | Expenses for purchasing tea for employees | Representation expenses | |||

| Impact on income tax accounting | |||||

| Taken into account | Accounting cannot be performed | Taken into account | Accounting cannot be performed | ||

| Personal income tax | Determine the profit of an enterprise employee: | ||||

| Can | + | + | – | – | |

| Will not work | – | – | – | – | |

| UST + contributions to mandatory pension insurance | Can | + | – | – | – |

| Will not work | – | – | – | – | |

Sergey Karyakin about tactics in business

In addition to the opinions of ordinary users about the USU program, the opinions of experts are now presented to your attention. Sergey Karyakin. At the age of 12 he became the youngest grandmaster in human history. Included in the Guinness Book of Records. Won the Candidates Tournament. Winner of the FIDE World Cup. World champion in rapid chess, world champion in blitz. Honored Master of Sports of Ukraine. Honored Master of Sports of Russia, Grandmaster of Russia. Awarded the Order of Merit, III degree. Member of the Public Chamber of the Russian Federation of the VI composition. Repeated winner of children's and youth world and European championships. Winner and medalist of a number of major tournaments. Champion of the XXXVI World Chess Olympiad as a member of the Ukrainian team, silver medalist of the Olympics as a member of the Russian team. He showed the best result on his board and received the first individual prize (on board 4). Champion of Russia with the best result on board 1. World champion in the Russian national team. World Cup semi-finalist. Winner of a number of international tournaments.

How to deal with VAT when accounting for costs

If a company purchases tea and sweets for employees, it is considered that a gratuitous transfer of goods occurs. This is the official position of the Ministry of Finance. Sales of products in Russia are subject to VAT. It turns out that it is necessary to calculate the tax base. However, the courts have a different opinion.

Representatives of government bodies believe that the gratuitous transfer of drinks and sweets will not be subject to VAT for the following reasons: (click to expand)

- There is no personalization of users by the product. The company does not take into account exactly who drank the tea and ate the cookies purchased for all employees.

- Tea is consumed only at work. A person cannot take a drink or sweets home. This means that there is no ownership right.

- The employer, on his own initiative, purchases drinks and sweets, expecting positive consequences - increasing productivity or creating a positive image of the company.

VAT that the company paid when purchasing drinks and sweets for visitors or office employees cannot be deducted. It can be included in the cost of purchased tea, coffee, sugar and other goods belonging to this category.

Determining the tax rate

The list of applied rates is even wider than when determining the tax base. The choice of bet depends on several criteria:

- type of water use;

- location of the object - above ground or underground;

- the economic region in which the payer operates;

- type of water tax object – river, lake or sea.

A specific list of all rates for each type of water body is contained in Article 333.12 of the Tax Code of the Russian Federation.

The rate is set in rubles for each unit of the tax base - the total amount payable is determined by multiplying these indicators.

In addition, a correction coefficient has been established for each bet - its size in 2015 is 1.15.

Every year, the size of such indexation will increase slightly (1.32 in 2021, 1.52 in 2021, 1.75 in 2021, 2.01 in 2021, 2.31 in 2021, etc.). By the end of 2025, it is planned to achieve an adjustment factor of 4.65.

How to prove to tax authorities the legitimacy of expenses?

Some companies count the cost of purchasing coffee and tea as expenses to ensure normal working conditions. To clarify what exactly this includes, you can make an appropriate entry in a collective agreement or other local act of the organization. However, if the company indicates in the document the provision of tea and coffee to employees, disputes may arise with representatives of the tax service.

The Ministry of Finance claims that only expenses for the purchase of drinking water can be taken into account to reduce taxes. In this case, there must be a document confirming that the tap liquid does not comply with SanPin standards.

If the company wants to defend its position, it will have to enter into a dispute with representatives of the government agency. Practice shows that in this situation the courts side with the taxpayer. The arguments presented in the table below can be cited as arguments confirming the company’s correctness.

| Statement | Rationale |

| The purchase of equipment that allows the supply of drinking water and other drinks to the place of work of employees is included in the category of occupational safety measures | Resolution of the Ministry of Labor dated February 27, 1995 No. 11 |

| It is impossible to assess the validity of costs that reduce taxation from the point of view of rationality. The company is able to independently decide how appropriate certain expenses are. | Determination of the Constitutional Court dated June 4, 2007 No. 320-O-P, No. 366-O-P |

Who is the payer of water tax?

In 2021, taxpayers were recognized as organizations and individual entrepreneurs who use underground water bodies on the basis of licenses, but on December 31, 2021, the “water amnesty” expired in Russia.

Already from January 2021, ordinary gardeners and vegetable gardeners have become tax payers for water abstraction from wells, if the volumes of water consumed exceed the norms prescribed below.

Water amnesty is a period introduced to allow summer residents to get used to the new rules (official registration), during which gardening associations could use wells without obtaining permits.

How to document expenses

All operations related to the company’s business activities must be accompanied by primary documentation (Law No. 402-FZ). Such papers can be accepted for accounting only if they were compiled according to the form that is present in the albums of primary documentation forms. If an accountant needs to draw up a document for which a special form is not established, it is necessary to include the details specified in the law.

The papers required to record sweets and drinks purchased for employees and visitors are presented in the table.

| Type of transaction | Document's name | Form |

| Accounting after purchase | Packing list | No. TORG-12 |

| Receipt order | No. M-4 | |

| Moving products within the company | Request-invoice | No. M-11 |

| Write-off of drinking water | Act on write-off of materials for production | A form that the company specialist developed independently. It must be drawn up taking into account the requirements of Federal Law No. 402-FZ |

To confirm the validity of classifying water as an expense, experts advise drawing up internal organizational and administrative documents. An example could be an order from a manager. The company has the right to develop its own corporate standards in accordance with which workers are provided with drinking water and sweets. The action is carried out with the aim of creating favorable conditions for carrying out work activities.

Maxim Potashev on the effectiveness of the USU program

In addition to the opinions of ordinary users about the USU program, the opinions of experts are now presented to your attention. Maxim Potashev - master of the game “What? Where? When?”, four-time winner of the “Crystal Owl” prize, twice world champion, three-time Russian champion, six-time Moscow champion, three-time winner of the Moscow Open Championship in the game “ChGK”. Based on the results of a general audience vote in 2000, he was recognized as the best player in the entire 25 years of the elite club’s existence. 50 thousand viewers of the program voted for the candidacy of Maxim Potashev. He received the “Big Crystal Owl” and the main prize of the anniversary games - the “Diamond Star” of the master of the game. Member of the board and since 2001 - vice-president of the International Association of Clubs. By profession - mathematician, marketer, business coach. Graduated from the Faculty of Management and Applied Mathematics, taught at the Department of General and Applied Economics at MIPT. In August 2010, he was elected president of the All-Russian public organization “Russian Sports Bridge Federation”. He heads a consulting company that helps various organizations solve problems related to sales, marketing, customer service and business process optimization.

Writing off expenses

Companies often classify expenses incurred due to the purchase of tea and coffee for their employees as entertainment expenses. However, such an action will be considered erroneous (Tax Code of the Russian Federation, Article 264). Some experts suggest including expenses for the purchase of drinks and sweets as other expenses that arose due to ensuring normal working conditions. But in this case there will be a problem with VAT calculation.

Experts recommend writing off expenses for the purchase of drinks and sweets for employees using the funds remaining after taxation.

Anatoly Wasserman presents the new version 5.0 of the USU program

In addition to the opinions of ordinary users about the USU program, the opinions of experts are now presented to your attention. Anatoly Wasserman was born on December 9, 1952. Graduated from the Odessa Technological Institute of Refrigeration Industry, majoring in engineering. After graduation, he worked as a programmer. Then - a system programmer. He first appeared on screen in 1989 in the club “What? Where? When?", then - at the Brain Ring. In the television “Own Game” he won fifteen victories in a row in 2001-2002 and became the best player of the decade in 2004. Five-time champion of Ukraine in the sports version of “Own Game”. Four-time champion of Moscow in the sports version of “Own Game”, bronze medalist of the same competition, silver in 2021. Silver medalist of the “Connoisseur Games” - the World Games of Connoisseurs - 2010 in “Your Game”.

Nuances of the “water” tax for legal entities

Legal persons are required to obtain a license to drill and operate wells in 3 cases:

- if the water is sold;

- the volume of water intake was more than 100 cubic meters. m per day;

- Water was taken from a depth of more than 40 m.

Taxpayers are not organizations and individual entrepreneurs using water sources on the basis of agreements or decisions on the provision of water bodies for use, concluded and adopted after the entry into force of the Water Code of the Russian Federation.