Analysis of financial statements is a complex process that allows one to evaluate both the efficiency of an enterprise’s economic activities and its overall financial condition.

Currently, for balance sheet analysis, four groups of financial indicators are usually distinguished:

Return on capital

Business activity (capital turnover)

Margin of financial strength and stability

Solvency of a trading enterprise

These groups of indicators will be considered in this order below.

The correct selection of economic indicators included in these groups ultimately determines the results of financial diagnostics of the balance sheet. In turn, their choice depends on the type and specifics of the enterprise’s economic activity.

Trade Balance: Why It's Important

The way in which funds received for goods sold and purchased are transferred has a direct impact on both the exchange rate and other macroeconomic indicators.

Depending on the ratio of the components, a trading active balance and a passive one are distinguished.

- Active is characterized by a positive balance between the amount of exports and imports. That is, more was exported and sold abroad than imported. And consequently, more money was received than spent. This is a trade surplus.

- The passive trade balance is characterized by the predominance of imports over exports. That is, the balance will be negative.

Business activity assessment

Another important indicator of the economic activity of a trading enterprise is the turnover of working capital.

Among them, the most important for a trading company is the inventory turnover indicator. The higher the turnover rate of inventories, the faster they go from their acquisition, shipment and to full sale (receiving money for them).

Thus, it can be used to judge the business activity of all involved workers and the company as a whole. And ultimately, evaluate how effectively all the resources of the enterprise were used.

The assessment of the use of working capital is determined by two indicators. This is the turnover ratio or the number of revolutions (Kob) during the planning period. Another indicator is the duration of one revolution in days (Tdn).

The first indicator (Kob) determines the number of turns of the initial stock of goods during their sale. It can be found by dividing the cost of goods sold (for the quarter or year) by their opening inventory or balance. If the balance of goods at the beginning and end of the period is different, then their arithmetic average is taken. Moreover, the cost of goods sold can be taken from line 2120 of form No. 2.

It is somewhat more difficult to estimate the balance of goods on the balance sheet. On the balance sheet form itself, they are now given in the general line as “Inventories.” But they can be deciphered by entering additional lines or in the table given in the explanations of the balance sheet. As a result, for the turnover ratio we will have the following expression:

Cobt = Spr / 0.5*(T1 + T2)

Where, T1 and T2 are the balances of goods in value terms (excluding VAT), respectively, at the beginning and end of the billing period.

The duration of one turnover per estimated time (Trv) is determined by dividing the duration of the period (for example, according to annual reporting - 360 days, according to reporting for the first quarter - 90 days, etc.) by the number of circulations of goods completed during the same time:

Tdn = Trv/Kobt

By accelerating the turnover of inventory, the need for it decreases. This creates a reserve for increasing sales volume in the trading organization.

Let's show this with the following example.

Suppose we have a trading company at the beginning and end of the quarter with a balance of goods, respectively, T1 = 1 million rubles. and T2 = 2 million rubles. Further, the amount of goods sold at cost for the same quarter is 7.5 million rubles. Hence the number of turnovers of goods (turnover ratio) during this time: Cobt = 7.5/0.5(1.0+2.0)=5rev. This means that the average amount of goods inventories (1.5 million rubles) manages to “scroll” five times during the quarter, which gives the total cost of goods sold for the quarter (7.5 million rubles). Then we calculate the average duration of one revolution per quarter: Tdn = 90 days/5 = 18 days. This means that from the moment the goods arrive at the warehouse until they are shipped to customers (until the moment of sale, that is, until the transfer of ownership to the buyer and the recognition of the cost of goods as part of the cost of sales) an average of 18 days pass. This figure can be interpreted this way: the initial stock of goods (on average 1.5 million rubles) without their renewal will last the company a little more than two weeks. And their reserve from the total sales amount at cost for the quarter is 20% (1.5 million rubles / 7.5 million rubles). In this case, there is no overstocking of inventory in the warehouse of the trading company. This may well suit any trading organization.

Trade balance structure

The trade balance includes export and import indicators for the following categories:

- foodstuffs;

- raw materials;

- industrial products;

- consumer products;

- automotive products;

- production means;

- other goods.

Analysts, studying the trade balance, monitor the dynamics of such particularly important components: the overall balance deficit, the export of automobile equipment, and gasoline sales.

What it is?

As mentioned above, a country’s trade balance is the ratio of the value of imports and exports of certain products over a separate period of time. The foreign trade balance, in parallel with actually paid contracts, also includes those transactions that were carried out on credit. When contracts are actually paid, the foreign trade balance represents a separate element of the country's balance of payments.

The impact of the trade balance on the exchange rate

It is known that an increase in price volatility in the foreign exchange market in response to macrostatistics occurs when the actual value of the indicator differs from the predicted one. In the case of the trade balance, the strengthening of the currency can be facilitated by a positive balance, its growth, or a decrease in the level of the negative balance.

For the exchange rate, the trade balance is a very important indicator. The predominance of exports provides prerequisites for GDP growth and is favorable for the national currency. But growing imports may indicate an increase in inventories and a decrease in sales within the economy, which is a pressure factor.

However, at the time of the release of statistics, the increase in volatility may be very restrained. This is due to the lagging nature of this indicator, since the data comes out for the month before last. In addition, experts analyze the trade balance not only based on the overall balance indicator, but also on the dynamics of its individual components.

Trade balance statistics are published, as a rule, in the second half of the month, mainly in the third week.

Become a client of Gerchik & Co and trade Forex on the best conditions

How to draw up a Balance Sheet. Example of filling out a balance sheet

Example of how to fill out a Balance Sheet

On March 23, 2021, Alpha’s accountant began preparing annual financial statements for 2015. The annual financial statements consist of the Balance Sheet, the Statement of Financial Results and appendices thereto. The accountant, after drawing up the Financial Results Report for 2015, moved on to drawing up the Balance Sheet for 2015.

Before drawing up the balance sheet, Alpha's accountant checked, firstly, whether all business transactions for the reporting period were reflected in the accounts. And, secondly, are the turnovers on synthetic and analytical accounts formed correctly?

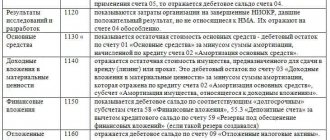

To fill out the Balance Sheet line by line, the accountant used: – data about the organization (Table 1); – data on account balances as of December 31, 2015 (Table 2); – information about the organization’s assets and liabilities for 2014 and 2013, contained in the Balance Sheet for 2014 (Table 3).

Table 1

| Full name of the organization | Limited Liability Company "Alfa" |

| Code in accordance with the classifier of enterprises and organizations | 77123456 |

| TIN | 770013254479 |

| Type of economic activity | Manufacture of hosiery (17.71) |

| Organizational and legal form of OKOPF/OKFS | Limited Liability Company 65/16 |

| Unit of measurement (OKEI) | thousand roubles. (384) |

| The address of the organization, which is stated in the charter and recorded in the Unified State Register of Legal Entities | 125008, Moscow, st. Mikhalkovskaya, 21 |

table 2

| Check | Account balances as of December 31, 2015, rub. | |

| Debit | Credit | |

| 01 "Fixed assets" | 12 358 000 | |

| 02 “Depreciation of fixed assets” | 1 561 464 | |

| 04 "NMA" | 2 420 000 | |

| 05 “Depreciation of intangible assets” | 413 611 | |

| 08 “Investments in non-current assets” | ||

| 10 "Materials" | 2 469 600 | |

| 19 “Value added tax on acquired assets” | 925 100 | |

| 20 "Main production" | 4 000 000 | |

| 43 “Finished products” | 3 030 000 | |

| 44 “Sales expenses” | ||

| 50 "Cashier" | 21 344 | |

| 51 “Current account” | 3 389 731 | |

| 58 “Financial investments” | ||

| 60 “Settlements with suppliers and contractors” | 236 000 | 2 541 600 |

| 62 “Settlements with buyers and customers” | 4 456 000 (with maturity less than 12 months) | 2 619 000 |

| 68 “Calculations for taxes and fees” | 1 427 000 | |

| 69 “Calculations for social insurance and security” | 376 600 | |

| 70 “Settlements with personnel” | 2 000 000 | |

| 71 “Settlements with accountable persons” | 14 000 | 2 000 |

| 76 “Settlements with other debtors and creditors” | 1 180 000 | 12 000 |

| 80 “Authorized capital” | 1 000 000 | |

| 82 “Reserve capital” | ||

| 83 “Additional capital” | ||

| 84 “Retained earnings” | 22 546 500 | |

| 97 “Deferred expenses” | ||

Table 3

| Indicator name | Code | As of December 31, 2014, thousand rubles. | As of December 31, 2013, thousand rubles. |

| ASSETS | |||

| I. NON-CURRENT ASSETS | |||

| Intangible assets | 1110 | 1638 | 1520 |

| Research and development results | 1120 | ||

| Intangible search assets | 1130 | ||

| Material prospecting assets | 1140 | ||

| Fixed assets | 1150 | 11 905 | 11 963 |

| Profitable investments in material assets | 1160 | ||

| Financial investments | 1170 | ||

| Deferred tax assets | 1180 | ||

| Other noncurrent assets | 1190 | ||

| Total for Section I | 1100 | 13 543 | 13 483 |

| II. CURRENT ASSETS | 8167 | 10 765 | |

| Reserves | 1210 | ||

| Value added tax on purchased assets | 1220 | 3953 | 1582 |

| Accounts receivable | 1230 | 7059 | 5357 |

| Financial investments (excluding cash equivalents) | 1240 | ||

| Cash and cash equivalents | 1250 | 2766 | 1894 |

| Other current assets | 1260 | ||

| Total for Section II | 1200 | 21 945 | 19 598 |

| BALANCE | 1600 | 35 488 | 33 081 |

| PASSIVE | 1310 | 1000 | 1000 |

| III. CAPITAL AND RESERVES | |||

| Authorized capital (share capital, authorized capital, contributions of partners) | |||

| Own shares purchased from shareholders | 1320 | () | () |

| Revaluation of non-current assets | 1340 | ||

| Additional capital (without revaluation) | 1350 | ||

| Reserve capital | 1360 | ||

| Retained earnings (uncovered loss) | 1370 | 19 660 | 16 821 |

| Total for Section III | 1300 | 20 660 | 17 821 |

| IV. LONG TERM DUTIES | 1410 | ||

| Borrowed funds | |||

| Deferred tax liabilities | 1420 | ||

| Estimated liabilities | 1430 | ||

| Other obligations | 1450 | ||

| Total for Section IV | 1400 | ||

| V. SHORT-TERM LIABILITIES | 1510 | ||

| Borrowed funds | |||

| Accounts payable | 1520 | 14 828 | 15 260 |

| revenue of the future periods | 1530 | ||

| Estimated liabilities | 1540 | ||

| Other obligations | 1550 | ||

| Total for Section V | 1500 | 14 828 | 15 260 |

| BALANCE | 1700 | 35 488 | 33 081 |

The accountant began drawing up the balance sheet by indicating general information about the organization. Next, I started filling out the assets of the Balance Sheet.

The accountant determined the residual value of intangible assets as of December 31, 2015 as the difference between the balances of accounts 04 “Intangible assets” and 05 “Amortization of intangible assets”: – RUB 2,006,389. (RUB 2,420,000 – RUB 413,611).

This amount was reflected in the corresponding column of line 1110 of the Balance Sheet. The accountant transferred the indicators of line 1110 as of December 31 of the previous year and as of December 31 of the year preceding the previous one from the Balance Sheet for 2014: – as of December 31, 2014 – 1,638 thousand rubles; – as of December 31, 2013 – 1,520 thousand rubles.

The accountant did not fill out line 1120 of the Balance Sheet, since there were no expenses for completed R&D to be accounted for in account 04.

There are no expenses for the organization to search for, evaluate mineral deposits and explore mineral resources. Accordingly, lines 1130 and 1140 of the Balance Sheet are not completed.

The accountant determined the residual value of fixed assets as of December 31, 2015 as the difference between the balances of accounts 01 “Fixed assets” and 02 “Depreciation of fixed assets”: – RUB 10,797,000. (RUB 12,358,000 – RUB 1,561,464).

This amount was reflected in the corresponding column of line 1150 of the Balance Sheet. The accountant transferred the indicators of line 1150 as of December 31 of the previous year and as of December 31 of the year preceding the previous one from the Balance Sheet for 2014: – as of December 31, 2014 – 11,905 thousand rubles; – as of December 31, 2013 – RUB 11,963 thousand.

The organization does not have fixed assets subject to accounting on account 03 “Income-generating investments in material assets”. Therefore, line 1160 of the Balance Sheet is not completed.

The organization made no financial investments. Therefore, lines 1170 and 1240 of the Balance Sheet are not completed.

There are no other non-current assets in the organization. Therefore, line 1190 of the Balance Sheet is not completed.

The value of line 1100 “Total for section I” is equal to the sum of lines 1110, 1120, 1130, 1140, 1150, 1160, 1170, 1180, 1190: – as of December 31, 2015 – 12,803 thousand rubles. (2006 thousand rubles + 10,797 thousand rubles); – as of December 31, 2014 – RUB 13,543 thousand. (RUB 1,638 thousand + RUB 11,905 thousand); – as of December 31, 2013 – RUB 13,483 thousand. (RUB 1,520 thousand + RUB 11,963 thousand).

The accountant calculated the cost of the organization’s inventories by adding up the debit balance of accounts 10 “Materials”, 20 “Main production”, 43 “Finished products”: - 9,499,600 rubles. (RUB 2,469,600 + RUB 4,000,000 + RUB 3,030,000).

This amount was reflected in the corresponding column of line 1210 of the Balance Sheet. The accountant transferred the indicators of line 1210 as of December 31 of the previous year and as of December 31 of the year preceding the previous one from the Balance Sheet for 2014: – as of December 31, 2014 – 8,167 thousand rubles; – as of December 31, 2013 – RUB 10,765 thousand.

The balance of input VAT as of December 31, 2015, listed on account 19 in the amount of 925 thousand rubles, was reflected by the accountant in the corresponding column on line 1220 of the balance sheet.

The accountant transferred the indicators of line 1220 as of December 31 of the previous year and as of December 31 of the year preceding the previous one from the Balance Sheet for 2014: – as of December 31, 2014 – 3953 thousand rubles; – as of December 31, 2013 – 1,582 thousand rubles.

The accountant determined the amount of accounts receivable as of December 31, 2015 by adding up the debit balances of accounts 60, 62, 71, 76: - RUB 5,886,000. (RUB 236,000 + RUB 4,456,000 + RUB 14,000 + RUB 1,180,000).

This amount was reflected in the corresponding column of line 1230 of the Balance Sheet. The accountant transferred the indicators of line 1230 as of December 31 of the previous year and as of December 31 of the year preceding the previous one from the Balance Sheet for 2014: – as of December 31, 2014 – 7,059 thousand rubles; – as of December 31, 2013 – RUB 5,357 thousand.

The accountant determined the amount of cash as of December 31, 2015 by adding up the balances of accounts 50 “Cash”, 51 “Cash accounts”: - RUB 3,411,075. (RUB 21,344 + RUB 3,389,731).

This amount was reflected in the corresponding column of line 1250 of the Balance Sheet. The accountant transferred the indicators of line 1250 as of December 31 of the previous year and as of December 31 of the year preceding the previous one from the Balance Sheet for 2014: – as of December 31, 2014 – 2,766 thousand rubles; – as of December 31, 2013 – 1894 thousand rubles.

There are no other current assets in the organization. Therefore, line 1260 of the Balance Sheet is not completed.

The value of line 1200 “Total for section II” is equal to the sum of lines 1210, 1220, 1230, 1240, 1250, 1260: – as of December 31, 2015 – 19,722 thousand rubles. (9500 thousand rubles + 925 thousand rubles + 5886 thousand rubles + 3411 thousand rubles); – as of December 31, 2014 – RUB 21,945 thousand. (8167 thousand rubles + 3953 thousand rubles + 7059 thousand rubles + 2766 thousand rubles); – as of December 31, 2013 – RUB 19,598 thousand. (RUB 10,765 thousand + RUB 1,582 thousand + RUB 5,357 thousand + RUB 1,894 thousand).

The value of line 1600 “BALANCE” of the Balance Sheet asset is equal to the sum of lines 1100 and 1200: – as of December 31, 2015 – RUB 32,525 thousand. (RUB 12,803 thousand + RUB 19,722 thousand); – as of December 31, 2014 – RUB 35,488 thousand. (RUB 13,543 thousand + RUB 21,945 thousand); – as of December 31, 2013 – RUB 33,081 thousand. (RUB 13,483 thousand + RUB 19,598 thousand).

Next, the accountant began filling out the liabilities of the Balance Sheet.

When filling out line 1310 of the Balance Sheet, he used data on the credit balance in account 80 “Authorized capital” as of December 31, 2015. The balance is 1,000,000 rubles. was reflected in the corresponding column of this line.

The accountant transferred the indicators of line 1310 as of December 31 of the previous year and as of December 31 of the year preceding the previous one from the Balance Sheet for 2014: – as of December 31, 2014 – 1,000 thousand rubles; – as of December 31, 2013 – 1000 thousand rubles.

The shares were not repurchased by the organization from its shareholders. Therefore, line 1320 of the Balance Sheet is not completed.

The organization did not revaluate non-current assets. Therefore, line 1340 of the Balance Sheet is not completed.

Additional and reserve capital was not formed in the organization. Therefore, lines 1350 and 1360 of the Balance Sheet are not completed.

When filling out line 1370 of the Balance Sheet, the accountant used data on the credit balance in account 84 “Retained earnings (uncovered loss)” as of December 31, 2015. The balance is RUB 22,546,500. was reflected in the corresponding column of this line.

The accountant transferred the indicators of line 1310 as of December 31 of the previous year and as of December 31 of the year preceding the previous one from the Balance Sheet for 2014: – as of December 31, 2014 – 19,660 thousand rubles; – as of December 31, 2013 – RUB 16,821 thousand.

The value of line 1300 “Total for section III” is equal to the sum of lines 1310, 1320, 1340, 1350, 1360, 1370: – as of December 31, 2015 – 23,547 thousand rubles. (RUB 1,000 thousand + RUB 22,547 thousand); – as of December 31, 2014 – RUB 20,660 thousand. (RUB 1,000 thousand + RUB 19,660 thousand); – as of December 31, 2013 – RUB 17,821 thousand. (RUB 1,000 thousand + RUB 16,821 thousand).

There are no long-term obligations in the organization. Therefore, section IV of the Balance Sheet is not completed.

The organization did not take out any short-term loans or short-term loans. Therefore, line 1510 of the Balance Sheet is not completed.

The accountant determined the amount of accounts payable as of December 31, 2015 by adding up the credit balances of accounts 60, 62, 70, 71, 76, 68, 69: - RUB 8,978,200. (RUB 2,541,600 + RUB 2,619,000 + RUB 1,427,000 + RUB 376,600 + RUB 2,000,000 + RUB 2,000 + RUB 12,000).

This amount was reflected in the corresponding column of line 1520 of the Balance Sheet. The accountant transferred the indicators of line 1520 as of December 31 of the previous year and as of December 31 of the year preceding the previous one from the Balance Sheet for 2014: – as of December 31, 2014 – 14,828 thousand rubles; – as of December 31, 2013 – RUB 15,260 thousand.

The organization does not have deferred income, that is, income (including other income) received in the reporting period but relating to subsequent reporting periods. Therefore, line 1530 of the Balance Sheet is not completed.

The organization forms an estimated liability for vacation pay. At the same time, all employees in 2013–2015 went on vacation and fully used their rest days. Accordingly, there is no balance on account 96 “Reserves for future expenses” as of December 31, 2015, 2014 and 2013. Therefore, line 1540 of the Balance Sheet is not filled in.

The organization does not have any other obligations other than those reflected above. Therefore, line 1550 of the Balance Sheet is not completed.

The value of line 1500 “Total for section V” is equal to the sum of lines 1510, 1520, 1530, 1540, 1550: – as of December 31, 2015 – 8978 thousand rubles; – as of December 31, 2014 – RUB 14,828 thousand; – as of December 31, 2013 – RUB 15,260 thousand.

The value of line 1700 “BALANCE” of the balance sheet liability is equal to the sum of lines 1300, 1400 and 1500: – as of December 31, 2015 – 32,525 thousand rubles. (RUB 23,547 thousand + RUB 8,978 thousand); – as of December 31, 2014 – RUB 35,488 thousand. (RUB 20,660 thousand + RUB 14,828 thousand); – as of December 31, 2013 – RUB 33,081 thousand. (RUB 17,821 thousand + RUB 15,260 thousand).

The head of the organization signed the finished Balance Sheet for 2015 on March 25, 2021. On the same day, it was submitted to the tax office as part of the annual financial statements.

How is it composed?

The compilation of the trade balance is carried out by the authorized financial statistical and foreign trade authorities of each individual country. It is worth noting that if the trade balance of a trading enterprise is considered, then in this case it is determined by the department of relevant specialists.

These calculations are carried out in order to determine the foreign economic position of a company or country, to clarify the level of competitiveness of its own products, as well as the purchasing power of the national currency used. The technology for calculating the cost of imports and exports in different countries differs in its own characteristics, and therefore it is quite difficult to compare the corresponding indicators.

Current account balance

The current account balance can be called the most informative, since it includes absolutely all asset flows, including official and private, which are associated with the movement of all kinds of services and goods. A positive current account balance indicates that the country's credit has higher rates than the debit for the movement of services and goods, and also demonstrates the volume of obligations of non-residents relative to residents.

In other words, if there is a positive balance, this indicates that the country is a net investor relative to other countries. At the same time, if there is a current account deficit, this indicates that this state is becoming a net debtor over time and must pay for additional net imports of products.

Recommendations

The UN Statistical Commission recommends that all countries use a single technology in relation to the system itself, as well as the basis for recording price indicators in their own foreign trade. In particular, when forming a trade balance, it is necessary to take into account the price of all imported goods, based on an FOB basis, that is, the price of an imported product includes its price at the border or at various exit ports of the selling country, as well as all kinds of costs associated with insurance or delivery of products to the border of the consumer country. In this case, the price of the exported goods bears all the seller’s expenses associated with the delivery of the goods to the output port or to its own border, including all kinds of duties and other similar fees.

The economy directly depends on what the trade balance will be. In this regard, in the vast majority of cases, when compiling a trade balance, countries fully comply with the technology recommended by the UN Statistical Commission. Approximately 30 countries record import and export prices based on FOB.

Assets and liabilities of the enterprise balance sheet

The balance sheet form, applicable in official reports on the territory of the Russian Federation, is a table consisting of two parts, which displays the liabilities and assets of the balance sheet. As a result, the amount of assets and liabilities should be the same.

A balance sheet asset is a reflection of liabilities and property used in business operations for the possible extraction of certain benefits in the foreseeable future.

Assets are usually divided into two types:

- non-current - property used or generating income for more than one year, whose value is taken into account in parts;

- current assets - property, the use of which brings profit to the enterprise during the year and information about the value of which is taken into account once in the reporting period.

Balance sheet liability is a description of the sources of financial instruments and other property that make up the balance sheet asset, liabilities and debts of the enterprise.

The balance sheet liability is divided into three parts: (1) reserves and capital, (2) long-term and (3) short-term liabilities.

Accounting for enterprise liabilities

Liabilities reflect the sources of formation of the enterprise's property resources. In horizontal recording, this is the right side of the balance; in vertical recording, it is the lower side.

The liability reflects information about the enterprise’s own (authorized and share capital) and borrowed capital (the latter is formed through loans and credits and reflects the entire volume of obligations of the commercial organization).

Summing up debt and equity capital allows you to obtain an estimate of the total capital of a business entity.

It is generally accepted to divide liabilities into (1) current liabilities, (2) long-term liabilities and (3) long-term debts.

The first group includes obligations due to be paid next year, the second group includes debts on taxes, rent payments, and labor, and the third group includes long-term bonds and loans.

The essence of any obligation is the debt generated in the process of business activity, the repayment of which is associated with an outflow of assets.

The outflow of assets can be direct (payment of money in the process of executing business agreements) or indirect (the creditor's refusal of his claims, the replacement of some obligations with others, the transformation of individual obligations into capital).

The reasons for the formation of debt can be legal or contractual norms, as well as customs practiced in business relations.

All obligations can be classified into (1) real, (2) hidden and (3) imaginary.