Home — Articles

Payments that are alimony in accordance with the Family Code of the Russian Federation and received by their claimants are not subject to personal income tax (clause 5 of Article 217 of the Tax Code of the Russian Federation, Letter of the Ministry of Finance of Russia dated October 4, 2012 N 03-04-05/6-1141, dated March 11, 2012 N 03-04-05/3-276, dated 03/07/2012 N 03-04-05/3-274). However, in a number of non-standard situations, accountants have problems with this. In addition, questions are raised by the very procedure for calculating alimony from the debtor (before deducting personal income tax or after), the calculation of personal income tax when withholding alimony from material benefits, or if the debtor uses a property tax deduction, whether the employee paying alimony is entitled to a standard tax deduction for personal income tax for a child.

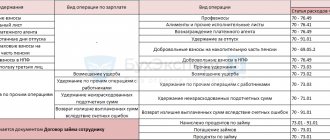

Grounds for deduction of alimony

An order to withhold and transfer alimony through the company’s accounting department is sent to the employee at his main place of work. The basis may be:

- performance list;

- court order;

- alimony agreement certified by a notary;

- resolution of the bailiff.

Accountants should be aware that alimony payments should only be withheld after income taxes have been withheld. That is, they are, as it were, second in line (Part 1 of Article 99 of the Federal Law of October 2, 2007 No. 229-FZ “On Enforcement Proceedings”, hereinafter referred to as Law No. 229-FZ).

How are children's benefits paid if the payer has a material benefit?

A material benefit is the money a taxpayer receives as a cost savings on something.

As a rule, material benefits appear when receiving an interest-free loan. That is, savings occur due to unpaid interest.

From the provisions of the Tax Code, it becomes clear that children’s payments cannot be collected from material benefits, since these funds exist “theoretically,” that is, only on paper. At the same time, this moment is taken into account in taxation and deductions increase due to it.

For example, consider a situation: an employee receives an interest-free loan from an enterprise. Here the material benefit will be expressed in savings on interest. The benefit amount is determined as 2/3 of the refinancing rate. The Tax Code of the Russian Federation (Article 224) states that this category of income is subject to an income tax of 35%.

It should be borne in mind that children's transfers are calculated without taking into account the tax levy on material benefits.

Deduction amounts

The writ of execution does not always indicate the specific amount of a fixed amount of alimony. Then the unfortunate spouse and his employer should know that they will have to pay:

- for one child – 25 percent of the amount of calculated earnings excluding personal income tax;

- for two children - a third of the same income according to the same calculations;

- for three or more children, you will have to share half of your income.

It should be noted that some individuals are deeply mired in paying child support. But keep in mind that Law 229-FZ contains a strict restriction: one person cannot be deducted for payments to other persons in an amount greater than 70 percent of his income minus income tax.

Personal income tax when withholding alimony if the debtor uses a property deduction

When constructing or purchasing housing, the taxpayer has the right to a property tax deduction (clause 2, clause 1, article 220 of the Tax Code of the Russian Federation). To obtain such a deduction, he can contact the employer by presenting him with the necessary documents (clause 3 of Article 220 of the Tax Code of the Russian Federation).

As a rule, the amounts of the named deduction are significant. This means that for several months or even an entire tax period, personal income tax will not be withheld from such an employee. But alimony must be withheld from the entire amount of wages (other income) received by the employee. After all, when providing property tax deductions, the tax base actually decreases and, accordingly, income increases (Letter of Rostrud dated December 28, 2006 N 2261-6-1).

If the employee has declared to the employer his right to provide a property tax deduction not from the first month of the tax period (by submitting a written application and notification issued by the tax authority, in the form approved by Order of the Federal Tax Service of Russia dated December 25, 2009 N MM-7-3/ [email protected ] ), this deduction is provided starting from the month in which the employee applied for its provision, in relation to the entire amount of income accrued to the employee on an accrual basis from the beginning of the tax period with offset of the previously withheld tax amount. At the same time, the tax previously withheld from the employee’s income must be offset against future payments, since the personal income tax is calculated on an accrual basis (clause 2, clause 1, article 220, clause 3, article 226 of the Tax Code of the Russian Federation, Letters of the Ministry of Finance of Russia dated 22.01. 2013 N 03-04-06/4-18, dated 12/29/2012 N 03-04-06/4-374, dated 09/14/2012 N 03-04-08/4-301, Federal Tax Service of Russia dated 10/02/2012 N ED -4-3/ [email protected] ). But it is impossible to return to an employee the personal income tax withheld before receiving a notice of deduction. After all, only over-withheld tax can be returned, and when providing a deduction, such tax is only personal income tax withheld after receiving a notification from the employee. And the amount of tax withheld from the beginning of the year until the month of receipt of the notification is legally withheld (Letters of the Ministry of Finance of Russia dated October 26, 2011 N 03-04-06/7-286, Federal Tax Service of Russia for Moscow dated March 22, 2011 N 20-14/ 4/026441).

The algorithm of the organization’s actions in relation to the calculation of alimony when the employer provides a property tax deduction depends on the size of the deduction and the employee’s income and will be as follows.

Option 1. If the amount of the deduction is less than or equal to the employee’s income received for the period from the month of notification to the end of the year, then:

- months before the notification is provided to the Federal Tax Service, it is not necessary to restore the income of an employee from whom alimony was not previously withheld, and there is no need to recalculate the amount of alimony, since personal income tax was legally withheld, is not subject to recalculation and must be reflected in the personal income tax register until the end of the year (Letter of the Ministry of Finance of Russia dated 22.01. 2013 N 03-04-06/4-18). To obtain a refund of this tax amount, the employee will have to contact the Federal Tax Service at the place of residence at the end of the year (clause 2 of Article 220 of the Tax Code of the Russian Federation), submitting a personal income tax declaration (form 3-personal income tax, approved by Order of the Federal Tax Service of Russia dated November 10, 2011 N MMV-7 -3/ [email protected] ) and documents confirming the right to a property deduction (paragraph 24, paragraph 2, paragraph 1, article 220 of the Tax Code of the Russian Federation, Letter of the Ministry of Finance of Russia dated November 26, 2012 N 03-04-08/7-413, Federal Tax Service of Russia dated December 17, 2012 N ED-4-3/ [email protected] ). The tax inspectorate will recalculate and return to the employee the overpaid personal income tax, but it is not granted the right to recalculate and collect child support from persons obligated to pay it. Therefore, the Federal Tax Service will not recalculate alimony;

- starting from the month of notification and up to December inclusive (provided that the amount of the deduction is less than or equal to the employee’s income received for the period from the month of notification to the end of the year), alimony is calculated from the full amount of wages (other income) of the employee (without deduction Personal income tax), since the employee does not need to withhold personal income tax in connection with the provision of a deduction.

Option 2. If the amount of the deduction is greater than the employee’s income received for the period from the month of notification to the end of the year, then:

- (or) alimony throughout the year is calculated in the generally established manner: (accrued amount of salary (other income) minus personal income tax) x 1/4, 1/3 or 1/2, and at the end of the year the employee will apply for a return of personal income tax to his Federal Tax Service with declaration (form 3-NDFL) and documents confirming the right to deduction. The tax office will not recalculate alimony payments, which is beneficial to the employee;

- (or) actions under option 1, and then the employee will have to submit an application to the Federal Tax Service for issuing a notice of deduction for the next year in order to continue receiving a property deduction from the employer.

Note! An employing organization that has returned to an employee personal income tax withheld prior to the notification of the Federal Tax Service for deduction may be subject to liability in the form of a fine in the amount of 20% of the amount of tax and penalties not transferred to the budget (Articles 75, 123 of the Tax Code RF, Letter of the Ministry of Finance of Russia dated September 14, 2012 N 03-04-08/4-301).

Example 4. Based on a writ of execution, alimony for the maintenance of one minor child in the amount of 1/4 of income is withheld from the employee’s salary.

The employee's salary is 100,000 rubles. per month. The annual income that will be accrued to the employee for 2013 will be 1,200,000 rubles. To simplify the calculation, we will assume that a standard tax deduction for child support expenses is not provided.

Monthly - in January, February 2013 - the following was withheld from the employee’s salary:

Personal income tax in the amount of 13,000 rubles:

13,000 rub. = 100,000 rub. x 13%;

alimony in the amount of 21,750 rubles:

RUB 21,750 = (RUB 100,000 - RUB 13,000) x 1/4.

In March 2013, the employee submitted to the organization’s accounting department (clause 2, clause 1, clause 3, article 220 of the Tax Code of the Russian Federation):

- an application for a property tax deduction for personal income tax for 2013 in the amount spent by him on the purchase of an apartment;

- notification from the Federal Tax Service confirming his right to a property tax deduction in the amount of 1,200,000 rubles. in connection with the purchase of an apartment.

An employer can provide a property tax deduction only in an amount equal to the employee’s income from March to December inclusive, i.e. in the amount of 1,000,000 rubles. (RUB 100,000 x 10 months). Personal income tax in the amount of 26,000 rubles. from income for January - February is already legally withheld and is not recalculated (Letter of the Ministry of Finance of Russia dated January 22, 2013 N 03-04-06/4-18), the tax base for January - February remains unchanged, alimony is not recalculated, since the employee’s income is not restored . To request a refund of this tax amount, the employee must contact his tax office, which will return the tax, but will not recalculate alimony.

For the period from March to December 2013, personal income tax does not need to be withheld from the employee due to the provision of a property tax deduction. The tax base for personal income tax (cumulatively) for each month (March - December) will remain unchanged and will be equal to 200,000 rubles. (in January - 100,000 rubles, in February - 200,000 rubles), and the amount of personal income tax withheld and transferred to the budget (on an accrual basis) will remain equal to 26,000 rubles during March - December. (January - 13,000 rubles, February - 26,000 rubles). Alimony must be calculated from the full amount of wages. Their monthly amount for March - December will be 25,000 rubles: 25,000 rubles. = 100,000 rub. x 1/4.

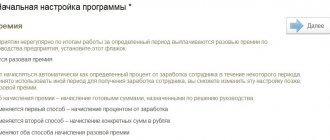

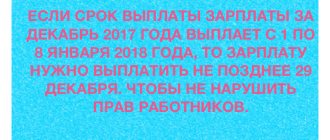

Quick transfer

The same Law No. 229-FZ determines the period for payment (transfer) of alimony to the other parent of the child. It is three days after the accrual of wages and other payments. That is, taking into account all bonuses, vacation pay, sick leave pay.

A profitable loophole for alimony payers is travel accruals. The fact is that, according to the law, alimony is not withheld from them, since the entire amount goes to support the posted worker. In different years, the amounts of travel allowances were different. Sometimes their size was significant when the employee was sent on long business trips.

Employees are given a pay slip, which clearly states (Article 136 of the Labor Code of the Russian Federation):

- the amount of calculated and transferred alimony;

- income tax;

- the balance of the amount received by the alimony holder.

Controversial issues

It is worth highlighting some points:

- Alimony is not calculated from travel allowances, the lifting part of payments when an employee is transferred or sent to another region, subsidies paid at a wedding, the birth of a child, or in the event of the death of a loved one.

- If the alimony worker does not work, this is not a reason to refuse to pay payments. This is clearly reflected in Article 80 of the SK. The security is set in the form of a fixed amount. According to the claim document, it is possible to obtain the recovery of funds from the non-payer.

- The total debt is calculated for the last three years that preceded the date of the court decision. When an agreement is concluded between divorced parents, the calculation occurs in accordance with the points specified in it.

- There are situations in which you can ask for more money from the payer: a serious illness that requires expensive treatment, the purchase of medications, surgery, or injury to the baby.

- If the father of the child is a foreigner, then you can demand payment of funds in court through the bailiffs.

If the parents are not divorced and are fully raising and raising the child, the question of the procedure for calculating and withholding alimony payments does not arise. The material describes in detail the aspects of calculating and transferring payments to a child.

Alimony for 1st child

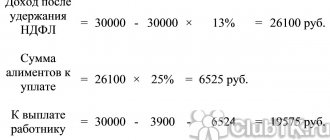

Parent Kovalenko V.P. pays child support for one child. In May, he received a salary with all additional payments in the amount of 36 thousand rubles. According to the law, 25 percent of income must be withheld from each child.

Income tax for 36 thousand is 4680 rubles. (36,000 x 13:100).

The amount that remains after paying personal income tax: 36,000 – 4680 = 31,320 rubles. This is the indicator from which the amount of alimony is calculated.

In our case, child support for one child will be: 31,320 x 25:100 = 7,830 rubles. This amount will be transferred to the other parent within 3 days for the maintenance of their son or daughter.

Kovalenko V.P. will receive a salary minus income tax, alimony, other deductions for social and pension insurance, and union dues. If we do not take into account other deductions, the amount in hand will be:

36,000 – 4680 – 7830 = 23,490 rubles.

How to correctly reflect alimony in 6 personal income taxes?

Since 2021, a second form of reporting has been introduced for the calculation and withholding of personal income tax from employees by tax agents.

On a quarterly basis, employers draw up and submit to the tax office a report on Form 6 Personal Income Tax, approved by Order of the Federal Tax Service of Russia No. ММВ-7-11/ [email protected] dated 10/14/2015.

In the first section, they are indicated as a cumulative total:

- line 020 - the sum of all income of the tax agent’s employees;

- line 030 - the sum of all tax deductions that reduce the tax base;

- line 040 - calculated personal income tax amount;

- line 070 - personal income tax amount withheld.

Not a single line mentions alimony, so it is not reflected in section 1.

In the second section, quarterly indicators:

- line 130 - the sum of all income. This reflects the amount calculated and not issued in person, i.e. until the moment of deduction of personal income tax, standard, property and other deductions.

- line 140 - personal income tax actually withheld from line 130 minus tax deductions.

As you can see, alimony is not highlighted in any of the paragraphs, so they do not fit separately in Form 6 of the personal income tax.

ATTENTION! Along with the 6th personal income tax report, every year before April 1, a 2nd personal income tax certificate is submitted, which has not been cancelled.

One child

In our case, with a salary of 36,000 rubles while supporting one child, income tax is taken not from the indicated amount, but from the amount:

36,000 – 1400 = 34,600 rub.

The tax from this amount will be equal to 4498 rubles. (34,600 x 13:100), and not 4,680 rubles without taking into account the deduction.

Then alimony will be calculated based on the amount of 31,502 rubles. (36,000 – 4498).

The amount of alimony is 7875.50 rubles. (31,502 x 25:100).

The employee will receive: 36,000 – 4498 – 7875.50 = 23,626.50 rubles.

Let's compare the amounts received by the worker in different cases: 23,490 and 23,626.50 rubles.

The difference with the tax deduction refund is only 136.50 rubles. (23,626.50 – 23,490).

Thus, with a tax deduction, a person will receive 136.50 rubles more than without its use.

Summary

We found out that money received for a baby is not considered the recipient’s earnings. Alimony payments are just a method of distributing children's money between ex-spouses and parents of the child for his maintenance year after year.

Neither in 2021 nor in 2021, child support is not subject to taxes and fees ( Clause 5, Article No. 217 of the Tax Code of the Russian Federation ). The question is: “Alimony is considered immediately before or after the deduction of personal income tax?” is clearly regulated by law.

First, the accountant, according to Resolution No. 841 , calculates the entire income “basket” of the payer (his salary, bonus and allowance). Then the personal income tax (NDFL) is subtracted from the received amount. After this, the children's money is withheld and only then is it transferred to the recipient. In this case, all payments for the money transfer must be borne by the payer.

For 2 children

Income tax is calculated from the amount: 36,000 – 1,400 x 2 = 33,200 rubles.

Personal income tax is taken from this amount and amounts to: 33,200 x 13: 100 = 4,316 rubles.

In the first case, excluding tax deductions, the amount of alimony was 10,440 rubles. In our case, this is: 36,000 – 4316 = 31,684 rubles. A third is taken from this amount. Then the alimony will be:

31,684: 3 = 10,561.3 rub.

The employee will receive: 36,000 – 4316 – 10,561.3 = 21,122.7 rubles.

The difference with and without the deduction is: 21,122.7 – 20,880 = 242.7 rubles.

How are child benefits calculated when the payer has writs of execution?

Law No. 229-FZ (Article 111) approves the procedure for the execution of penalties. It states that first, tax is deducted from the salary of an employed person, after which compensation for remaining debts begins with the priority category:

- penalties begin with alimony;

- the amount of damage caused to a third party is compensated;

- the amount of the returned funds for causing moral damage is deducted.

Payments to the budget (fines and other taxes) are considered second priority and are reimbursed by the employee later.

At the same time, the amount of all executive priority payments cannot exceed 70% of a person’s earnings. Payments of the second and third categories in total cannot exceed 50% of earnings.

The accountant’s responsibilities include calculating the amount of all payments according to the employee’s executive documents, taking into account the maximum allowable. If the second stage of payments is not fully repaid, then its balance is transferred to the next payment stage.

If, for certain reasons, a debt has arisen to collect compensation for children, then it is transferred to the next payment stage, and it is not allowed to impose penalties.

Calculation of tax deduction for 3 children

36,000 – (1400 x 2 + 3000) = 30,200 rub.

The tax will be: 30,200 x 13: 100 = 3,926 rubles.

36,000 – 3926 = 32,074 rubles.

Of the amount 32,074 rubles. 50% is taken:

32,074 x 50: 100 = 16,037 rubles. This is alimony.

The employee will receive: 36,000 – 3926 – 16,037 = 16,037 rubles.

The difference will be 377 rubles. (16,037 –15,660).

These amounts are insignificant, which is why many people simply ignore taking standard deductions for their children.

Read also

29.06.2016

Features of alimony payments

Child support has a number of pitfalls that you should be aware of before the hearing:

- Child support is paid in full even by the parent who has lost parental rights or abandoned the minor. At the same time, he does not have the right to demand payments from the child for his maintenance in the future.

- If child support was paid in a fixed amount , and income increased sharply, then the second parent can file a claim and the amount of payments will be increased.

- There is no need to worry about whether tax is withheld from alimony , even if the payments are in a fixed amount. The answer is no.

- Child support is paid until the child reaches the age of majority , and alimony for an adult until the urgent need for it ceases.

- The percentage of payments is tied to wages , so payments will increase along with wages.

- In the event of a settlement agreement, alimony is also paid without taking into account personal income tax , since the defendant pays it independently and within the terms agreed upon with the former spouse, and not according to the procedure established by the court.

What types of income are taxed on in 2019?

Tax legislation classifies the following as income on which personal income tax must be paid:

- wage;

- income received for performing work or providing a service;

- insurance payments;

- income from rental payments (renting out housing, transport);

- income from the sale of real estate (if the property was owned for less than three years) and vehicles;

- profit from business activities;

- dividends from shares;

- royalties;

- winnings and prizes (tax rate 35%), etc.

These are the most common types of taxable income.