The work of some employees is inextricably linked with business trips. Traveling to other cities, regions and countries is an integral part of an effective production process for them.

Business trips may be caused by the need for personal participation in business negotiations, exchange of experience, conclusion of transactions, etc.

As soon as the company's management decides to send one of its employees on a business trip, the company's accounting department is puzzled by a number of questions, in particular, how to properly register, calculate and conduct a business trip. In this article we will talk in detail about business trips, their procedure and calculation.

Should an employee be reimbursed for travel expenses during absences on a business trip ?

By the way, our special calculator will help you quickly calculate the amount of travel allowances.

What is a business trip

A business trip is a trip by an employee by order of the employer for a certain period of time to fulfill an official assignment outside the place of permanent work (Article 166 of the Labor Code).

A trip to a branch of your organization that is located outside your permanent place of work is also considered a business trip. This is enshrined in paragraph 3 of the Regulations on the specifics of sending employees on business trips, approved by Decree of the Government of the Russian Federation dated October 13, 2008 No. 749 (hereinafter referred to as the Regulations on Business Travel).

Automatically calculate the salary of a posted worker according to current rules Calculate for free

Travel allowances issued in cash documents

Traveler's checks may be issued to posted employees. A traveler's check is an obligation of the issuer to pay the amount of the check to its owner. Accounting for traveler's checks is kept in account 50-3 “Cash documents”. The following entries must be made in accounting:

- Dt 50-3 Kt 60 (76) - purchase of traveler's checks;

- Dt 71 Kt 50-3 - traveler's checks issued.

Unfortunately, the use of traveler's checks is not common in the Russian Federation. They can only be exchanged for money, but even then not in all financial institutions. Therefore, this type of financial document is most convenient to use when traveling on business trips abroad. The use of traveler's checks as a means of payment has its advantages - both in the simplicity and safety of their use.

The organization can purchase and issue travel documents to the posted employee. The accounting of travel documents is carried out similarly to the accounting of cash checks in account 50-3.

Who can be sent on a business trip

The employer has the right to send on a business trip a person who usually works in the same building or in the same city: an engineer, an accountant, etc. If the employee’s work is initially traveling in nature, a business trip is not issued for him. This applies, for example, to couriers and truck drivers.

An employee who works from home can be sent on a business trip on a general basis. This follows from Article 310 of the Labor Code, which states that homeworkers are subject to labor legislation and other acts containing labor law norms. This means that the provisions on business trips are fully applicable to homeworkers.

Please note: only employees who are on staff are allowed to be sent on a business trip. Specialists hired under a civil contract cannot be seconded.

Travel allowances are transferred to a personal card

Currently, non-cash payments using bank cards are becoming widespread. Issuing travel allowances is no exception. It is also possible to transfer accountable amounts to an employee’s salary card (letter of the Ministry of Finance of the Russian Federation, Treasury of the Russian Federation dated September 10, 2013 No. 02-03-10/37209, No. 42-7.4-05/5.2-554).

In accounting, the transfer of travel allowances should be reflected by posting Dt 71-1 Kt 51 - transfer of money for reporting.

You can learn about the important nuances of such an operation from the article “Transferring a sub-report to an employee’s card from a current account.”

Duration of business trip

The employer is free to set any duration of the business trip based on the volume, complexity and other nuances of the upcoming trip (clause 4 of the Business Travel Regulations).

However, the maximum duration is not indicated anywhere. Thus, a business trip can last as long as desired, up to several months or years.

The issue of minimum duration has not been fully resolved. Strictly speaking, a business trip can be considered a trip lasting more than one day. A one-day trip does not count as a business trip. This was recognized by the Supreme Arbitration Court of the Russian Federation in Resolution No. 4357/12 dated September 11, 2012 (see “SAC: payments in lieu of daily allowances for one-day business trips are not subject to personal income tax”).

But in practice, companies and entrepreneurs often send employees on day trips, and arrange them in the same way as regular business trips. In other words, they pay daily allowances, reimburse travel costs, etc. We will discuss below how to properly account for such expenses.

Travel accounting: basic procedures

Participation of an employee on a business trip is a process that consists of the following basic procedures:

1. Issuance of advances and daily allowances to the employee.

The exact deadline for issuing advance funds, as well as the procedure for their calculation, is not established by law. But in any case, they are issued before a business trip. If the advance is not issued, the employee has the right to refuse the trip, and this will not be a violation of work duties.

2. Checking the advance report and establishing specific items of travel expenses.

This procedure is carried out after a business trip upon submission of an advance report by the employee. Depending on the results of the audit, amounts of money are classified into certain categories (we will study how exactly later).

3. Reimbursement of overexpenditures made at the expense of the employee’s personal funds, or, conversely, deduction of the shortfall from him (if there is an overexpenditure or shortage).

Unconfirmed expenses, as well as expenses exceeding the daily allowance limit, are subject to return to the company. In turn, if an employee makes any expenses on a business trip at his own expense, the company must reimburse them.

ConsultantPlus experts tell you in detail how to prepare and submit an advance report for a business trip. Get free demo access to K+ and go to the Ready Solution to find out all the details of this procedure.

4. Payment of wages to an employee on a business trip.

During a business trip, the employee continues to be on the company’s staff and receives a salary. But it is accrued according to a special scheme (we will consider its features below).

Now let’s study in more detail the specifics of these accounting transactions, as well as what accounting entries are used to reflect these transactions in the accounting registers.

First and last day of the trip

The first day of a business trip is the date of departure of a train, plane, bus or other vehicle. The last day of a business trip is the date of arrival of the corresponding vehicle at the locality where the place of permanent work is located.

When the vehicle departs (or arrives) before 24 hours inclusive, the day of departure (or arrival) is considered the current day, and from 00 hours onwards - the next day. If a station, pier or airport is located outside a populated area, the time required to travel to (or from) the station, pier or airport is taken into account.

How to calculate daily allowance during a business trip in Russia and abroad

When calculating daily allowance, regardless of where the employee is sent, either within Russia or abroad, the calculation formula is the same:

RS = SD × D,

Where

RS – estimated daily allowance;

SD – the amount of daily allowance for one day, which is established at the enterprise in internal regulatory documents;

D – Duration of a business trip, which is expressed in days, including days en route.

Important!!! If the daily allowance is not spent in full, then the unspent amount does not need to be returned, unlike an advance payment provided during a business trip.

There are cases when the daily allowance is not enough, then the employee, in agreement with the employer, spends his money, and after returning, the company reimburses him for the amount spent, only it is necessary to save all supporting documents.

What documents to submit when traveling on a business trip

First of all, it is necessary to draw up an order or instruction from the manager about sending him on a business trip.

Until January 8, 2015, when sending employees on business trips, employers were required to approve job assignments and issue travel permits. However, now there is no need to do this. From this date, the actual length of stay of the employee at the place of business trip is determined by travel tickets presented upon return from the business trip. If the employee is sent on a business trip by personal transport, then the actual length of stay at the place of business trip the employee must indicate in the memo.

Note that for organizations that regularly send employees on business trips, it is better to prepare a local regulatory act, for example, a regulation on business trips. It should contain all the details: the amount of daily allowance, the amount of compensation for business trip expenses, etc. Such a document can become one of the decisive arguments in favor of the taxpayer during audits or in court.

Compose HR documents using ready-made templates for free

Accounting for expenses on foreign business trips

A business trip abroad is processed in the same way as in Russia, only it has some features:

- Additional expenses are added for obtaining a visa, a foreign passport, consular and other fees necessary for traveling abroad (subclause 12 of Article 264 of the Tax Code).

- The daily allowance limit, exempt from personal income tax and contributions when traveling to another country, is 2,500 rubles.

- When traveling abroad, the time for calculating daily allowances is determined by travel documents, and in case of their absence, by travel documents or by supporting documents of the receiving party (clause 7 of the regulations on business trips No. 749).

- Primary documents drawn up in a foreign language must be translated into Russian (clause 9 of the Accounting Regulations, approved by order of the Ministry of Finance of the Russian Federation dated July 29, 1998 No. 34n).

If an employee purchased currency on his own, then when drawing up a report he must attach certificates of purchase. If such a certificate is not available, then the expenses will be recalculated at the rate of the Central Bank at the time of receipt of accountable money (clauses 5, 6, 7 of PBU 3/2006).

After the report is approved:

- the balance of the advance, returned in foreign currency, is credited to the cash desk with conversion into rubles at the official exchange rate on the date of receipt of money;

- overexpenditure made in foreign currency is issued to the employee in rubles, recalculated at the exchange rate on the day the advance report is approved.

For daily allowances in foreign currency, that part of them that is subject to personal income tax must be recalculated into rubles at the rate on the last day of the month in which the advance report was approved (letter of the Ministry of Finance dated November 1, 2016 No. 03-04-06/64006).

ConsultantPlus experts explained how to take into account expenses in foreign currency for a business trip abroad. Get trial access to the system and upgrade to the Ready Solution for free.

IMPORTANT! If the company’s local regulatory act specifies the amount of daily allowance in foreign currency and pays the employee in rubles, then there is no need to recalculate (letter of the Ministry of Finance dated April 22, 2016 No. 03-04-06/23252).

How to fill out a time sheet

In the working time sheet (unified forms No. T-12 and T-13), working days that fell during a business trip are indicated by the code “K” or its digital equivalent “06”. The number of hours worked is not entered.

If during a business trip the employee worked on his day off or on a holiday, the report card is marked with the code “РВ” or its equivalent “03”. In the column reserved for the number of hours worked, the value previously agreed upon with the employer is indicated. If there was no agreement to work on a day off, the employer has the right not to indicate the number of hours in the timesheet and, as a result, not to pay for this time. This is stated in the letter of the Ministry of Labor of Russia dated February 14, 2013 No. 14-2-291.

A situation is possible when on a day off the employee was on the road, that is, either going to the place of business trip or returning back. It is not entirely clear whether this time should be counted as worked. In our opinion, a road that falls on Saturday, Sunday or a holiday is nothing more than work. Therefore, in the work time sheet you should enter “РВ” (or “03”) and the number of hours actually spent on the road.

Keep timesheets for free in an accounting web service

Results

The posting when issuing money to the travel expenses account will depend on the source of the issue - be it cash, non-cash money, cards or monetary documents.

Examples of transactions for settlements with accountable persons are given in the article “Procedure for settlements with accountable persons - transactions”.

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Salary during a business trip

The business trip period is paid not in the same way as regular work, but according to average earnings (Article 167 of the Labor Code of the Russian Federation). Whatever the work schedule, average earnings are calculated based on the actual accrued wages and actual time worked for the 12 calendar months preceding the month when the business trip began.

Example

The employee was on a business trip from June 22 to June 26, 2021 (five working days).

All payments received by the employee for the period from June 2021 to May 2021 inclusive (12 months) are shown in table 1. Table 1

Payments to the employee for the period from June 2021 to May 2020

Month of billing period Type of payment Amount (rub.) June 2019 salary 30 000 July 2019 salary 30 000 August 2019 salary 30 000 September 2019 salary 30 000 October 2019 salary 30 000 November 2019 salary 30 000 December 2019 salary 5 714 sick leave 19 000 January 2020 salary 40 000 February 2020 salary 40 000 March 2020 salary 40 000 April 2020 salary 40 000 May 2020 salary 40 000 Total: 404 714 To calculate the average earnings, the accountant found out that out of the 12 months preceding the business trip, the employee worked only 11 fully, and from December 3 to December 25, 2021 (17 working days) was on sick leave. Sickness time must be excluded from the calculation period, and temporary disability benefits will not be included in the calculation. As a result, the average earnings were 385,714 rubles (404,714 - 19,000).

The accountant then calculated the number of working days in the billing period. It was 246 days. The number of working days taken into account when calculating average earnings is 229 (246 - 17). The average daily earnings is 1,684.34 rubles (385,714 rubles: 229 days). Salary during a business trip - 8,421.7 rubles. (RUB 1,684.34 x 5 days).

Note that some companies pay for business trips not according to average, but according to actual earnings. This option, although not entirely correct, is acceptable. The main thing is that the actual earnings during the business trip are not less than the average earnings, because otherwise the employee’s rights will be violated. To prevent this from happening, it is better to compare two salary values for each business trip: the first - based on average earnings, the second - based on actual earnings. And if the first value is not greater than the second, you can pay for the business trip based on the salary.

If a person worked on a business trip on his day off, and this is reflected in the timesheet, then such work must be paid double. There is an alternative option: at the employee’s request, provide payment in a single amount and give additional days off (Article 153 of the Labor Code of the Russian Federation).

Procedure for reporting travel advance

After arriving from a business trip, the employee must provide, within 3 working days, an advance report drawn up in form No. AO-1 (According to resolution clause 4.4). It must reflect the expenses incurred during the trip according to the primary documents that are attached to the report (sales receipts, cash receipts, transport documents, etc.). It is advisable to number the primary documents in accordance with the report entries.

Reimbursement of travel expenses and daily allowances

The employer is obliged not only to pay the employee a salary during the business trip, but also to reimburse travel expenses. They are listed in Article 168 of the Labor Code of the Russian Federation. These are daily allowances, travel costs, rent for living quarters and other costs agreed with the employer. Let's look at each type of expense separately.

Daily allowance

The employee is entitled to daily allowance for each day he is on a business trip, including weekends and holidays, as well as for days on the road (clause 11 of the Business Travel Regulations).

Each employer is free to set the amount of daily allowance that it considers necessary. At the same time, it is not forbidden to approve different daily allowance amounts for different categories of workers. For example, a manager's per diem may be higher than an engineer's per diem. An employee returning from a business trip is not required to report on what he spent his daily allowance on. Simply put, the employee does not need to provide primary documents and an advance report on daily allowance to the accounting department.

In tax accounting, daily allowances are written off as expenses without limitation. Daily allowances are exempt from personal income tax within the limit: for business trips within the country - in the amount of 700 rubles. for each day, for business trips abroad - in the amount of 2,500 rubles. for every day. If the company has established a daily allowance in excess of these amounts, then you must pay personal income tax on the excess. In the income certificate, the amount of excess daily allowance should be reflected as “other income”.

For business trips lasting one day (so-called “one-day business trips”), strictly speaking, daily allowances are not required. Despite this, most companies pay them. The Ministry of Finance of Russia, in letter dated May 17, 2018 No. 03-15-06/33309, proposed the following option for their accounting. If the employee has provided supporting documents, then the daily allowance should be regarded as reimbursement for other expenses associated with the business trip. Then they are fully exempt from personal income tax. If there are no documents, then you need to apply the limit, as in the case of longer business trips (see “The Ministry of Finance explained in which case expenses associated with a one-day business trip are fully exempt from personal income tax”).

In arbitration practice, there are examples when judges confirmed: daily allowances for a “one-day business trip” are exempt from contributions to the Pension Fund (Resolution of the FAS of the Volga District dated January 22, 2013 No. A65-27465/2011) and are included in expenses (Resolution of the FAS of the North-Western District of July 30 .12 No. A56-48850/2011).

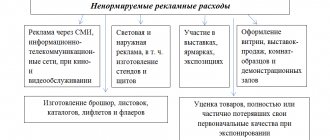

Fare payment

The cost of travel to the place of business trip and back can be included in expenses on the basis of subparagraph 12 of paragraph 1 of Article 264 of the Tax Code of the Russian Federation. In this case, the “input” VAT can be deducted (clause 7 of Article 171 of the Tax Code of the Russian Federation).

When reimbursing a business trip employee for travel expenses, there is no need to withhold personal income tax (clause 3 of Article 217 of the Tax Code of the Russian Federation) and pay insurance premiums (clause 2 of Article 422 of the Tax Code of the Russian Federation).

However, the above norms can only be applied if travel costs are confirmed by primary documents (it is acceptable to accept a “primary document” issued in electronic form; letter of the Ministry of Finance dated 08.08.19 No. 03-03-06/1/59877). In practice, accountants constantly have questions about whether this or that document can be accepted as confirmation.

If the employee traveled by regular transport, he will have to provide a travel ticket. It is not necessary that the ticket be in the prescribed form. The main thing is that it contains the details, signature and seal of the carrier, as well as the name of the points of departure and arrival, the price (Resolution of the Federal Antimonopoly Service of the Far Eastern District dated August 22, 2012 No. F03-3467/2012).

If we are talking about a taxi, then the supporting documents will be an order for the provision of a vehicle for transporting passengers and luggage, as well as a receipt for payment for passenger taxi services. The Ministry of Finance of Russia recalled this in letter No. 03-11-04/2/80 dated June 27, 2012 (see “The Ministry of Finance explained what documents can be used to confirm the costs of an employee’s travel by taxi to the place of business trip and back”).

In the case of air travel, you will need two primary documents: a ticket on which its cost is indicated, and a boarding pass. If the air ticket is electronic, then the supporting document is the itinerary receipt containing the required details: fare, total cost of transportation, form of payment, etc. If you lose your boarding pass, you must obtain a certificate from the air carrier. This opinion was expressed by the Russian Ministry of Finance in letter No. 03-03-07/33 dated September 21, 2011 (see “In case of loss of a boarding pass, the fact of a business trip can be confirmed by a certificate from the air carrier”).

Input VAT on an air flight can be deducted only if the tax amount is indicated on the ticket or on the itinerary receipt. The Ministry of Finance pointed this out in letter No. 03-07-11/01 dated January 10, 2013 (see “The Ministry of Finance recalled the procedure for deducting VAT on air tickets for business travelers”). The same rule applies if the employee used an electronic ticket (letter of the Ministry of Finance dated May 28, 2018 No. 03-07-07/36077; see “How to deduct VAT on electronic train and plane tickets”).

Payment for housing

The amount spent on renting housing for a posted employee can be taken into account when taxing profits. The company also has the right to write off the cost of additional services provided by the hotel (with the exception of bars and restaurants, room service, as well as saunas and fitness centers). This is stated in subparagraph 12 of paragraph 1 of Article 264 of the Tax Code of the Russian Federation. Input VAT on housing is allowed to be deducted (clause 7 of Article 171 of the Tax Code of the Russian Federation).

When reimbursing an employee for housing expenses, there is no need to withhold personal income tax (clause 3 of Article 217 of the Tax Code of the Russian Federation) and pay insurance premiums (clause 2 of Article 422 of the Tax Code of the Russian Federation).

However, the above standards can only be applied in a situation where housing costs are confirmed by primary documents (it is acceptable to accept a “primary document” issued in electronic form; letter of the Ministry of Finance dated 08.08.19 No. 03-03-06/1/59877). Namely, a strict reporting form independently developed by the hotel. It must contain the details that are listed in paragraph 3 of the regulations approved by Decree of the Government of the Russian Federation dated 05/06/08 No. 359**. In addition, the form must highlight the amount of VAT.

In practice, tax authorities often make claims when a hotel document contains a non-existent or “foreign” TIN. But arbitration practice on this issue is positive for taxpayers (see, for example, decisions of the FAS of the North-Western District dated November 15, 2012 No. A52-1635/2012, FAS of the Ural District dated 08/08/12 No. F09-6736/12).

If a posted worker paid for housing using a card, he must attach “paper” documents confirming the fact of payment to the advance report. Such documents include, in particular, the slip and receipt of the electronic terminal (letter of the Ministry of Finance of Russia dated October 6, 2017 No. 03-03-06/1/65253).

If the employee lost the supporting document or did not receive it at all because he lived in the private sector, then the expenses cannot be reflected in tax accounting, just as VAT cannot be deducted. Personal income tax from the amount of compensation must be withheld from an amount exceeding 700 rubles. for each day during a business trip within the country, and from an amount exceeding 2,500 rubles. for each day of a business trip abroad. Insurance premiums must be charged on the entire amount of unconfirmed housing expenses. This was reported by specialists from the Ministry of Health and Social Development of Russia dated November 11, 2010 No. 3416-19, the conclusion was confirmed by the judges (resolution of the Administrative Court of the North Caucasus District dated November 20, 2017 No. A32-1706/2017).

Fill out and submit 6‑NDFL and 2‑NDFL for free via the Internet

Payment for food

Tax officials believe that meals during a business trip should be paid for through daily allowances. Therefore, if the employer reimburses the cost of food separately, such expenses cannot be taken into account when taxing profits, and insurance premiums and personal income tax must be paid on them.

Even if the company does not pay daily allowances at all, but only reimburses food expenses, such expenses do not reduce profits and are included in the base for contributions and personal income tax. The fact is that the cost of food is not mentioned among travel expenses either in the Labor Code or in the Regulations on Business Travel.

Arbitration practice on this issue is contradictory. There are cases won by companies (see, for example, the resolution of the Federal Antimonopoly Service of the Moscow District dated 07.11.12 No. A40-112186/11-20-455). But there are also cases won by inspectors (see, for example, the resolution of the Federal Antimonopoly Service of the Far Eastern District dated March 20, 2012 No. F03-912/2012).

In our opinion, it is safer to prevent a conflict and not reflect the cost of food in tax accounting, and it is better to pay contributions and personal income tax.

How much is the employee reimbursed?

It often happens that the purchase of tickets and booking a hotel room is handled directly by the company administration, which means that the employee does not receive money for this. And there are no questions with them. But if money for travel expenses is given to a person, then you need to understand what standards are used to reimburse them.

By law, travel expenses allow an employee to get to their destination, buy food, pay for accommodation, and afford other things previously agreed upon with the head of the company. And since the person went to perform an official assignment, he should be compensated for all expenses incurred and agreed upon with his superiors, and not consider the amount issued as income. That is, neither income tax nor insurance premiums are withheld from them. But this is provided that the company has approved a regulatory document (regulations on business trips), which provides for compensation standards, as well as the procedure for this procedure.

The only expense item that is standardized at the legislative level is the amount of daily allowance. In particular, the Tax Code of the Russian Federation states that daily allowances issued in the following amounts are not subject to personal income tax and insurance contributions:

- 700 rubles - per day of travel around the country;

- 2500 rubles - per day of a business trip abroad.

This does not mean that the employer cannot pay more. Maybe. But in this case, the company will have to withhold income tax and insurance premiums from the excess amount.

We also note that the subordinate is not required to report on what he spent the daily allowance on and whether he spent it at all. This is the item of travel expenses that is taken into account when taxing company profits without documents confirming that the money was spent.