Simplified tax system: what is the income of the principal?

April 5, 2013

Letter of the Department of Tax and Customs Tariff Policy of the Ministry of Finance of the Russian Federation dated January 21, 2013 N 03-11-06/2/06 On accounting for revenue from the sale of goods under commission agreements as part of income when applying the simplified tax system

Organizations that apply the simplified tax system take into account income from sales and non-operating income when determining the object of taxation.

The Tax Code of the Russian Federation also lists income that is not taken into account for tax purposes. At the same time, a reduction in the principal’s income by the amount of commissions paid by him to the commission agent is not provided for here.

It is clarified that the principal's income from transactions involving the sale of goods by a commission agent is recognized as the entire amount of proceeds received from sales under the commission agreement, including the commission agent's commission.

The date of receipt of income is recognized as the day of receipt of funds to bank accounts and (or) to the cash desk, acquisition of other property (work, services) and (or) property rights, as well as repayment of debt (payment) to the taxpayer in another way (cash method).

Income tax from the principal

The funds received by the principal after the sale of his property by the commission agent are the income of the enterprise on which income tax is paid.

The following can be accepted for tax deduction:

- cost of goods sold,

- the amount of costs for their sale (this includes the amount of the intermediary’s fee under the commission agreement and the amount compensating for his costs, both amounts do not include VAT).

If the charter of the enterprise adopts the accrual method, the day of receipt of income is considered the day of the actual sale of the principal's property (taken from the notice received from the commission agent within 3 days after the end of the reporting period, or from the intermediary's report).

The amount of costs for the sale of property can be deducted from the tax base on the day the intermediary’s report on the work done is approved.

Income from the sale of consignment goods goes to KUDiR

First of all, it is worth reminding that this product is not yours. And if so, then you are only an intermediary in the sale and, therefore, the revenue received cannot in any way be considered YOUR income. Well, if this is not your income, then:

- In 1C Accounting, revenue from commission trading should not fall into the column “Expenses taken into account when calculating the tax base”;

- You don't have to pay tax on this money!

One day a client came to us for whom everything worked out the other way around. That is, when selling goods belonging to the consignor (the owner of the commission goods), the proceeds from the sale went to KUDiR. But in order not to pay taxes on the amount that would still have to be paid, the person tried to “go the other way,” namely:

What not to do!

If the proceeds from the sale under a commission agreement fall into KUDiR, then there is no need to try to count the amount that you then give to the principal as expenses (for the simplified tax system 15%)!

Remember, there are no costs associated with commission trading. There is only your income (as a commission agent) in the form of a percentage (or other amount) from the sale of non-own goods. This is the amount you need to pay tax on!

If in the book of income and expenses you see the amount of proceeds from the sale of the principal’s goods, then this means that you are simply keeping records incorrectly!

If you still have questions

In this article, I did not aim to fully and in detail consider all the cases and features of commission trading, so not everything is shown here. If you have read the article, but still do not fully understand the principles of selling someone else’s goods, then you can get a consultation with us on this issue.

To undergo consultations, you will need Skype and the installed 1C program (“Enterprise Accounting” or “Simplified”). If you don’t have your own program, we can install a training version.

also have a ready-made test database for this article , which contains all the necessary commission trading operations. You can obtain a copy of this database for a fee.

Commission wholesale trade in 1C Accounting

The simplest case from the point of view of reflection in 1C is the case of wholesale trade (remember the definition of wholesale trade!). Let's say we received goods from another company for sale under a commission agreement. In this case, we must capitalize it. It is worth remembering the following:

- The goods must be credited to an off-balance sheet account, since they are not your property (the goods have not been purchased, they are simply lying in your warehouse);

- When posting a posting document, you do not have any debt to the principal (“supplier”);

In 1C Accounting version eight, to reflect the receipt of goods accepted for commission, you should use the document “Receipt: goods, services, commission”. An example is given below:

Have questions about training? Order a free call artemvm.info_5a3a625ad472fc185bb7a9d8c741b2ed

For more convenient accounting and automatic entry of invoices in the document, enter all goods accepted for commission in the “Goods on commission” folder in the Nomenclature directory. If you do not have such a folder, then you need to create it and set up accounting accounts. You can read about setting up groups.

So, you have accepted the goods. Now we need to sell it. I will not show sales transactions, since they are no different from the usual sale of your own goods (both the sale itself and the acceptance of payment); the rules for accounting for advances from the buyer also remain the same.

Worth remembering:

If you first received an advance from the buyer, and carried out the sale later, then in this case there will be two reports to the committent: the first - regarding the advance received, and the second - after the sale.

You should also always remember that your debt to the principal under the commission agreement arises precisely when documenting the sale of goods. You can check this by generating a balance sheet for account 76.09 immediately after the sale of consignment goods.

Returning to the question of income, I would like to draw your attention once again to the fact that when selling the principal’s goods, the proceeds received do not fall into the book of income and expenses. Create KUDiR for the required period after entering the sales documents: you should NOT see any(!) income there.

After selling the goods, you need to draw up a Report to the consignor. This document is located in 1C in the “Purchases” section, and not “Sales”, where it is often searched for (the logic of constructing the menu is not broken: you are a commission agent, so you receive the goods and make a report to its owner - the consignor).

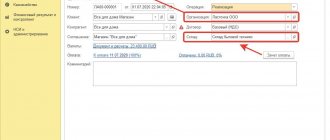

The committent must fill out all the fields correctly in the report, otherwise you will receive incorrect postings. Here is part of the document:

Have questions about training? Order a free call artemvm.info_5a3a625ad472fc185bb7a9d8c741b2ed

Look at the picture above: all four tabs are filled in. I will not show screenshots of filling out all the tabs, just look at the resulting postings of the Report to the committent:

Have questions about training? Order a free call artemvm.info_5a3a625ad472fc185bb7a9d8c741b2ed

If you withheld the commission in this document, then you still owe the principal an amount reduced by the amount of the commission. All that remains to be done is to transfer the balance to the principal through a bank or cash desk. At the end of this chain of documents you should have the following:

- You do not owe anything to the principal (check according to SALT 76.09);

- You have income reflected in KUDiR automatically;

This is what the income book should look like:

Have questions about training? Order a free call artemvm.info_5a3a625ad472fc185bb7a9d8c741b2ed

If for some reason your income book includes the entire amount of sold consignment goods, then look for an error!

Return of goods to the commission agent from the buyer

Let’s say that a retail buyer wants to return an item for some reason.

Considering that, when selling goods to a client, the commission agent, on his own behalf, entered into a purchase and sale agreement with him, then he formalizes the refusal of this transaction.

If the buyer returns the goods due to detected defects, responsibility for them must be distributed between the commission agent and the consignor. If the goods were damaged due to the fault of the store, then the buyer will reimburse the costs. And if it turns out that the supplier is at fault, the commission agent will be entitled to reimbursement of expenses and remuneration.

The goods can be returned before the commission agent's report is signed by the parties, or after. In the first case, the intermediary makes an entry in the report for the amount of the return with a minus sign. In the second, the wholesale buyer, returning the goods, issues an invoice in the name of the commission agent. If the final buyer is a retailer, then he must write a statement to return the goods. After this, the commission agent returns the goods to the consignor, accompanied by a return note in his name, as well as an invoice. Based on these documents, the principal will be able to reduce his VAT payable.

Sales under a commission agreement without deduction of the commission agent's remuneration

Sometimes there are situations in which the report to the committent does not need to immediately deduct your commission from the amount of goods sold. In this case, two options are possible:

- After making a report to the committent, you independently (manually) calculate the amount of your commission (and create the necessary document in 1C; which document is best for you, since you decided to do so);

- Or you do not withhold the reward at all, but transfer the ENTIRE amount of proceeds from the sale of the principal’s goods;

In the latter case, the committent is obliged to transfer (back) some part of the amount to you - this will be your commission. The transfer can be through a bank or cash desk (or in another way) - the main thing is that the payment from the principal is also carried out under a commission agreement.

This situation (with a “reverse” payment) seems a little illogical (indeed, it is much easier to IMMEDIATELY withhold the amount of your commission from the revenue). However, in practice this also happens. Here, for example, is a “reverse” translation:

Have questions about training? Order a free call artemvm.info_5a3a625ad472fc185bb7a9d8c741b2ed

There may also be a slightly different option, shown in the screenshot below. Pay attention to other accounting accounts.

Have questions about training? Order a free call artemvm.info_5a3a625ad472fc185bb7a9d8c741b2ed

Ultimately, you (as an accountant) can determine how you do your accounting. However, it is worth remembering that you should not complicate this accounting unnecessarily.

VAT on advances for commission agent services

Upon completion of the intermediary’s operations for the sale of the principal’s property, they are provided with a report and an invoice to receive a well-deserved fee, which will be registered with the principal in Part 2 of the register of records of received and issued invoices and in the purchase book.

VAT on the amount of fees for intermediary services and on the amount of compensation for the commission agent's expenses can be taken into account when calculating the tax base only after accounting for these costs, and only if invoices have been saved.

“Input” VAT on the fee of the commission agent for the sale of the tenant’s property will be taken as a deduction when calculating the taxable base of the principal.

When offsetting mutual claims, the VAT amount is paid to the commission agent who sold the principal's goods in a separate payment order, but this does not need to be done in the case where the intermediary independently deducts the amount of his fee for services from the total amount of the employer's funds.

When selling goods of the consignor:

- Accounting for the amount of VAT on the fee of the intermediary company: D 19 K 76 sub. “Settlements with the commission agent.”

- VAT deduction on the intermediary's fee: D 68 K 19.

When purchasing goods for the consignor:

- Accounting for VAT on the commission agent's fee: D 19 K 60.

- VAT deduction for payment of intermediary services: D 68 K 19.

Income of the principal under the simplified tax system

Accounting for income from the principal using the simplified tax system

The principal includes in income the entire amount received from the buyer, without reducing it by the intermediary fee. In this case, the date of accounting for income is the day the money is received from the commission agent.

Now let's explain in more detail. Organizations using the simplified tax system take into account income from sales in accordance with Art. 249 of the Tax Code of the Russian Federation. It states that revenue is all receipts related to goods (work, services) sold, expressed in cash or in kind. Therefore, the income of the principal under the intermediary agreement is the entire amount received by the commission agent into the current account or into the cash register. This is true even if the commission agent withholds remuneration from the funds due to the principal.

Under the simplified system, the cash method is used, according to which income is reflected in the tax base on the day the money is received in a bank account or at the cash desk, or on the date the debt is repaid in another way (clause 1 of Article 346.17 of the Tax Code of the Russian Federation). Based on this, the principal recognizes income on the day he receives money from the commission agent.

And further. A commission agent who sells goods at a price lower than specified in the contract is in some cases obliged to compensate the principal for the difference in price. The principal must take into account the amount of compensation for losses in non-operating income on the day the funds are received (clause 1 of Article 346.15, clause 3 of Article 250 and clause 1 of Article 346.17 of the Tax Code of the Russian Federation).

This means that the principal on the simplified tax system needs to take into account 1 million rubles in income. And pay tax on it to the budget.

Example. Aquamarine LLC, which applies the simplified tax system with the object of taxation “income minus expenses,” transferred the goods for sale under a commission agreement to individual entrepreneur P.R. Vlaskin, who is not a VAT payer. According to the terms of the agreement, the commission agent had to sell 10 sets of books at a minimum price of 7,000 rubles. per set. The commission is 15% of the cost of goods sold. The commission agent participates in the settlements. The principal reimburses the commission agent for all costs incurred in connection with the sale of goods, including transportation and storage.

To execute the order, the commission agent paid rent for the warehouse in the amount of 4,956 rubles. (including VAT - 756 rubles) and delivery of goods worth 2950 rubles. (including VAT - 450 rubles). All goods were sold on December 13, 2014. The commission agent transferred the proceeds received by him to the principal's bank account, minus his remuneration and expenses incurred on December 16. The committent approved the commissioner's report on December 17.

We will reflect these business transactions in the tax accounting of Aquamarine LLC.

Proceeds from the sale of books equal to 70,000 rubles. (RUB 7,000 x 10 pcs.), the principal must reflect on the day of receipt of funds to the current account - December 16, 2014. Please note: in reality, Aquamarine LLC received a smaller amount to the current account on this day.

The principal has the right to include in expenses:

— commission — 10,500 rubles. (RUB 70,000 x 15%) according to paragraphs. 24 clause 1 art. 346.16 Tax Code of the Russian Federation;

— rent for the use of a warehouse without VAT — 4,200 rubles. (4956 rubles - 756 rubles) according to paragraphs. 4 paragraphs 1 art. 346.16 Tax Code of the Russian Federation;

— VAT on rent — 756 rubles. according to paragraphs. 8 clause 1 art. 346.16 Tax Code of the Russian Federation;

— delivery cost excluding VAT — 2500 rub. (2950 rub. - 450 rub.) according to paragraphs. 23 clause 1 art. 346.16 Tax Code of the Russian Federation;

— VAT on delivery costs — 450 rubles. according to paragraphs. 8 clause 1 art. 346.16 Tax Code of the Russian Federation.

The commission agreement is considered executed on the day the commission agent’s report is signed, therefore, Aquamarine LLC has the right to reflect all expenses on December 17.

Question from Klerk.Ru reader Elena (Moscow)

The commission agent company (using the simplified tax system) accepted the goods from the principal (OSNO) at a cost of 30,000 rubles, handed over the goods to the sub-commission agent (OSNO) for sale at least 35,000 rubles. Commission/sub-commission is the difference between the transfer price and the sale price. What documents and transactions should these transactions be documented by the principal and the commission agent?

If we assume that the goods were sold by a subcommission agent for 40,000 rubles (including VAT), in the commission agent’s accounting, transactions with goods accepted for sale under a commission agreement will be reflected in the entries: Dt 004 - 30,000 rubles. — goods accepted for commission on invoice (TORG-12) Dt 62 Kt 90 – 10,000 rub. – commission agent’s remuneration (40,000 rubles – 30,000 rubles) – on the basis of an act of services rendered, signed with the principal Dt 44 Kt 60 (76) – 5,000 rubles. - remuneration of the sub-commission agent (in the amount of the difference between the proceeds actually received by the sub-commission agent from the sale of goods and the cost at which the goods were transferred to him by the commission agent: 40,000 rubles - 35,000 rubles) - on the basis of an act of services rendered, signed with the sub-commission agent, and sub-commissioner's report on the execution of the order

Kt 004 – 30,000 rub. – sale of goods accepted for commission - on the basis of the commission agent’s report, approved by the committent;

In the principal's accounting records are made: Dt 45 Kt 41 - in the amount of cost - shipment of goods to the commission agent using the TORG-12 invoice Dt 62 Kt 90 - 40,000 rubles. – revenue from the sale of goods is reflected (based on the commission agent’s report) Here we remind you that everything received by the commission agent in a transaction concluded in the interests of the principal, in accordance with Art. 999 Civil Code is the property of the latter. Thus, the entire amount of proceeds received from the sale of the principal's goods is his income. Dt 90 Kt 45 - in the amount of the cost price sold by the commission agent Dt 90 Kt 68 / VAT - 6,101.70 rubles. – VAT accrued for payment to the budget on the sale of goods Dt 44 Kt 60 (76) – 10,000 rubles. – the commission agent’s remuneration is based on the act of services rendered, signed with the commission agent.

It’s very easy to get a personal consultation with Olga Ziborova online - you just need to fill out a special form. Several of the most interesting questions will be selected daily, the answers to which you can read on our website.

Tax audits are becoming tougher. Learn to protect yourself in the Clerk's online course - Tax Audits. Defense tactics."

Watch the story about the course from its author Ivan Kuznetsov, a tax expert who previously worked in the Department of Economic Crimes.

Come in, register and learn. Training is completely remote, we issue a certificate.

Accounting entries of the principal

Below are examples of accounting entries:

| Operation | DEBIT | CREDIT |

| The commission agent sells the principal's property | ||

| The property was given to the commission agent for sale | 45 | 41 |

| Cash receipts from the sale of property are reflected | 62 | 90 |

| VAT amount charged | 90 | 68 |

| Write-off of the cost of property sold | 90 | 45 |

| A fee was paid to the intermediary | 44 | 76 Sat. “Settlements with commission agent” |

| The amount of VAT on the fee has been deducted | 19 | 76 Sat. “Settlements with commission agent” |

| Accounting for buyer's debt | 76 Sat. “Settlements with commission agent” | 62 |

| VAT deducted on the intermediary's fee | 68 | 19 |

| The account received income from the sale of property | 51 | 76 Sat. “Settlements with commission agent” |

| The commission agent buys property for the principal | ||

| Money was paid to the intermediary for the purchase of goods | 76 Sat. “Settlements with commission agent” | 51 |

| Receipt of goods from the counterparty | 10 | 60 |

| VAT calculation on purchased items | 19 | 60 |

| The amount of the intermediary's fee is added to the cost of the goods | 10 | 60 |

| VAT accrual on fees | 19 | 60 |

| Debt to counterparty taken into account | 60 | 76 Sat. “Settlements with commission agent” |

| Debt to intermediary taken into account | 60 | 76 Sat. “Settlements with commission agent” |

| VAT deducted | 68 | 19 |

| Remaining money from the transaction accepted | 51 | 76 Sat. “Settlements with commission agent” |

Example of accounting for a principal

ZAO Tenant sent property to OOO Posrednik for sale. According to the commission agreement, 350 thousand rubles will be earned for it (including VAT - 63 thousand rubles). The cost of the property is 175 thousand rubles. The commission agent's fee is 35 thousand rubles (including VAT – 6300 rubles).

Posrednik LLC completed the sale of the property. It participates in the calculations and has the right to withdraw the amount of its fee from the general money belonging to the Tenant CJSC. CJSC “Tenant” in its accounting policy approved work in the “shipment” mode for the purpose of calculating the amount of VAT. The accounting department of ZAO Tenant will make the appropriate entries.

Note: Sub-accounts were opened for the main accounts:

- 76-5 (Settlement with commission agent),

- 76-6 (Settlement with the principal),

- 76-7 (Settlement with the buyer).

| Operation | DEBIT | CREDIT | Amount (RUB) |

| The property was given to the warehouse of Posrednik LLC | 45 | 41 | 175000 |

| Revenues from sales are reflected | 62 | 90-1 | 350000 |

| Calculation of VAT amount on them | 90-3 | 68 | 63000 |

| Write-off of the actual cost of property sold | 90-2 | 45 | 175000 |

| The fee of Posrednik LLC is included in the sales costs | 44 | 76-5 | 28700 (35000 – 6300) |

| VAT credited on fees | 19 | 76-5 | 6300 |

| Accounting for commission agent's fees among payments for property sold | 76-5 | 62 | 35000 |

| VAT has been deducted for the service of LLC “Posrednik” | 68 | 19 | 6300 |

| Receipts for items sold minus intermediary fees are accepted. | 51 | 62 | (315000 – 35000) |

| Write-off of sales expenses | 90-2 | 44 | 28700 |

| Profit from the transaction | 90-9 | 99 | 83300 (350000 – 63000 – 175000 – 28700) |

How should a committent using the simplified tax system take into account income and expenses?

Principal's income

Entrepreneurs (and organizations) using a simplified system take into account income from sales according to the rules set out in Article 249 of the Tax Code (clause 1 of Article 346.15 of the Tax Code of the Russian Federation). It states that income is sales proceeds. Is the commission agent's remuneration part of the proceeds? It is, since it directly follows from the Civil Code that all things acquired by the commission agent at the expense of the principal are the property of the latter. In addition, the intermediary is obliged to transfer to the principal everything received under the commission agreement (Articles 999 - 1001 of the Civil Code of the Russian Federation). Consequently, the principal is obliged to show income without deducting from it the fee for the services of the commission agent. In this case, it does not matter whether the commission agent transfers the full amount of proceeds or independently withholds his remuneration. The date of receipt of income will be the day when the proceeds arrived at the principal’s account or cash desk (clause 1 of Article 346.17 of the Tax Code of the Russian Federation).

Committent's expenses

The principal has the right to include the intermediary fee in the costs. The expense recognition date is the day the commission agent’s report is approved, which shows the amounts of revenue and remuneration. If the report does not contain information about remuneration, then the principal and the commission agent are required to draw up a separate act of reconciliation of mutual settlements and reflect in it information about the fee for the services of the intermediary. Then the committent will be able to generate expenses on the date of signing the act.

Example: A principal using a simplified system received goods from a supplier in the amount of 1,000,000 rubles in April 2009. (but didn't pay for it). In the same month, the principal shipped these products to the commission agent. The intermediary sold the goods for 1,500,000 rubles, withheld a reward in the amount of 150,000 rubles, and the rest of the money in the amount of 1,350,000 rubles. (1,500,000 – 150,000) transferred to the principal. The funds arrived in the latter’s account on April 30. On this date, the principal generated income from sales in the amount of 1,500,000 rubles, reflected them in the book of income and expenses and took them into account when calculating the advance payment for the “simplified” tax for the first quarter of 2009.

The commission agent drew up a report in which he indicated the amount of revenue and intermediary remuneration for the transaction. The committee approved the report on May 12, 2009. In the book of income and expenses, he reflected expenses in the amount of 150,000 rubles. and took them into account when calculating the advance payment for the single tax for the first half of 2009.

In July 2009, the principal settled with the supplier of the goods. At the same time, he recorded expenses in the amount of 1,000,000 rubles. in the book of income and expenses. He took this amount into account when calculating advance payments for the single tax for the nine months of 2009.

>Reflection of transactions under commission agreements in the 1C: Simplified 8 program

Typical accounting entries for the principal

When the principal agrees with the commission agent to sell the goods, he continues to own them as the owner, and on the day the goods are sold, the rights to them will pass from the principal directly to the buyer. On this date, the principal's accountant must reflect the receipt of funds for this transaction, and the price per unit of goods must coincide with that announced by the commission agent.

The difficulty of making entries in accounting registers lies in the fact that the accountant needs information from the intermediary’s report on the transactions performed, indicating the results of the work and the actual cost of the property sold, as stated to the buyer.

Typically, the commission agent can withhold the amount of his fee from the funds he received from the buyer of the principal's property or from the principal himself for the intermediary's performance of the commission agreement. Therefore, the report on the work done will also contain information about the amount he took as payment for his services. This means that the report will serve as evidence for writing off sales expenses, the list of which will include the intermediary’s fee.

However, VAT can be deducted from its amount only after the offset of mutual claims between the employer and the hired intermediary or after actual payment for his services. For this payment, a separate account “Commission Agent's Remuneration” is created to account 76 “Settlements with various debtors and creditors”.

Technology for accounting for commission trade in the 1C: Simplified 8 program

All transactions that arise during commission trading under the simplified tax system for the committent and the commission agent are presented in Table 1.

Table 1. Reflection of transactions under a commission agreement in the 1C: Simplified 8 program

| No. | Type of operation | Reflection from the committent | Reflection from the commission agent |

| Conclusion of a commission agreement | Directory Contracts of counterparties, type of contract With commission agent | Directory Contracts of counterparties, type of agreement With the principal | |

| Transfer of goods from the principal to the commission agent | Document Sales of goods and services with transaction type Sale, commission | Document Receipt of goods and services with transaction type Purchase, commission | |

| Sale of goods by commission agent | Document Sales of goods and services with transaction type Sale, commission | ||

| Receiving payment from the buyer | Document Incoming payment order (for non-cash payment) or Incoming cash order (for cash payment). Transaction type Payment from buyer | ||

| Transfer of payment for goods to the consignor | Document Payment order incoming with transaction type Payment from buyer | Document Payment order outgoing with transaction type Payment to supplier | |

| Sales report | Document Agent's Sales Report | Document Report to the consignor on sales of goods | |

| Commission remuneration | Document Payment order outgoing with transaction type Payment to supplier | Document Payment order incoming with transaction type Payment from buyer |

Each operation is performed by the corresponding document type in the 1C: Simplified 8 program. Let us consider these operations in more detail separately from the committent and from the commission agent.

Transactions under commission agreements with the principal

Reflection of transactions under a commission agreement is carried out in several stages.

Stage 1. The goods are shipped to the commission agent.

Upon shipment of the goods, the consignor’s accountant, using the 1C: Simplified 8 program, creates a document for the sale of goods. To do this, open the menu (or function panel tab) Sales, select the document Sales of goods and services and click the Add button. The program will offer various types of implementation documents. You should choose the document type Sales, commission. This document must be completely filled out and posted.

Stage 2. The product is sold to the buyer.

After selling the goods to the buyer, the commission agent sends the commission agent's report to the principal. This is an important document, its originals are signed by authorized persons. One copy of the report is sent back to the commission agent, the other remains with the committent. Based on this report, the document Sales Agent Report is entered into the 1C: Simplified 8 program. It can be found in the menu (or in the function panel tab) Sales. The report indicates both the price at which the goods were transferred for sale and the price at which the goods were sold by the commission agent to the buyer. The commission amount is automatically calculated immediately. The most difficult and important thing when filling out this document is to correctly enter the accounting accounts (Accounting Account (AC), Income Account (AC), etc.). When working with the commissioner's report, we suggest being guided by our example.

Stage 3. Formation of a book of income and expenses of the simplified tax system at the committent and calculation of the taxable base for a single tax.

Of course, the book of income and expenses under the simplified tax system is generated in the 1C: Simplified 8 program automatically. You just need to check the correctness of the entries displayed there.

The principal's income is the entire amount received by the commission agent from the buyer for the goods sold and transferred to the principal within the established time frame. In this case, income is recognized on a cash basis, that is, on the day when funds were received into a bank account and (or) to the principal's cash desk (Article 346.17 of the Tax Code of the Russian Federation, letter of the Federal Tax Service for Moscow dated December 1, 2005 No. 18-11/ 3/88099).

However, what to do in a situation where the commission agent deducted his commission from the amount received from the buyer, and transferred the remaining money to the principal’s bank account? In accordance with Article 273 of the Tax Code of the Russian Federation, for tax purposes, the payment of receivables is equivalent to the receipt of money in the taxpayer’s current account. Thus, the principal’s income is precisely the amount of revenue received from the buyer, including the money that the commission agent has already calculated as a commission.

In the program “1C: Simplified 8” this situation is implemented. As income, the program will take into account exactly the revenue received from the buyer, regardless of whether this entire amount was transferred to the principal’s bank account, or whether a commission was deducted from it.

The principal's expense is the commission paid to the commission agent. In accordance with Article 346.16 of the Tax Code of the Russian Federation, such an expense is taken into account when calculating the taxable base if the single tax is calculated for the object “income minus expenses”. What date is this expense recognized?

If the commission agent does not participate in the calculations of the commission fee and the principal transfers the remuneration separately, then the date of recognition of the expense is the day when the money was sent to the commission agent from the principal’s current account (Article 346.17 of the Tax Code of the Russian Federation). If the commission agent is involved in the calculation of the commission and the principal has received from him the amount from which the commission has already been calculated, then the date of recognition of this expense is the date of signing the commission agent’s report.

Example (continued)

LLC "Dairy Farm" transferred 1,000 liters of sterilized milk with a fat content of 2.5% to the commission of LLC "Posrednik" at a price of 20 rubles. per liter According to the commission agreement, Posrednik LLC must sell this milk to the buyer within a month at a price of 40 rubles. per liter Both the principal and the commission agent apply the simplified tax system with the object of taxation “income minus expenses.”* As for the method of settlements between the principal and the commission agent for commission remuneration, we will consider both methods of calculation: both when the principal separately transfers the remuneration to the commission agent, and when mutual claims are offset .

Note: * At the same time, our example can also be used by “simplified people” who calculate a single tax according to the “income” system. Small differences will arise when creating a book of income and expenses, as well as calculating the taxable base and the tax itself.

So, Dairy Farm LLC handed over a ton of milk to the Intermediary. It is necessary to create a document Sales of goods and services: Sales, commission.

The fields of the document will be filled in as follows: Organization LLC “Dairy Farm”, Counterparty LLC “Intermediary”, Agreement No. 1 dated 01.08.09. Nomenclature - Milk 2.5%, Quantity - 1,000 l, Price 20 rub. excluding VAT, Total 20,000, Accounting account (BU) 41.01, Transferred, accounting account (BU) - account 45.01.

Next you need to click OK. The document will be held. After this, it is recommended to click on the Dt-Kt button and check the correspondence of the accounts:

Debit 45.01 Credit 41.01 - 20,000 rub.

2 weeks after the goods were shipped, a commission agent’s report was delivered to LLC “Dairy Farm”, according to which LLC “Posrednik” sold all the milk to LLC “Supermarket” at a price of 40 rubles. per liter

Based on the commission agent’s report, the principal’s accountant prepares the commission agent’s report in the “1C: Simplified 8” program (see Fig. 3). The commission agent's sales report should be filled out as follows: Organization LLC "Dairy Farm", Percentage of remuneration 10, VAT of remuneration excluding VAT, Counterparty LLC "Intermediary", Payment method and Agreement should be "inserted" automatically.

Rice. 3. Filling out the document “Commission Agent’s Sales Report”

In the Products tab you need to indicate: Nomenclature Milk 2.5%, Quantity 1000, Price 40, Amount 40,000, Transfer price 20, Transfer amount 20,000, % VAT excluding VAT.

In this case, the remuneration should be calculated automatically - 4,000 rubles. In order for the reward to be calculated correctly, you must also click the Prices and Currency button and uncheck the Consider VAT checkbox, if this checkbox is there.

The accounting account indicators are filled in as follows: Accounting Account (BU) 45.01, Income Account (BU) 90.01.1, VAT Account 90.03.

When filling out the Cost Accounting tab, you need to take into account that here we are talking about accounting for the costs of remuneration to the commission agent. Indicate: Cost Account (BU) 44.01, Cost items, commission.

Please note: in the Settlement Accounts tab, the Retain commission checkbox is checked only if the commission agent, having received payment from the buyer, deducts his commission from this amount and transfers the remaining funds to the principal. Otherwise (if the remuneration is transferred to the commission agent by the principal), there is no need to check the Withhold commission checkbox.

Accounts in the Settlements Accounts tab (regardless of the method of settlements between the principal and the commission agent) can be specified as follows: Account for settlements for goods 62.01, Account for settlements for advances received 62.02, Account for settlements for intermediary services 76.06, Account for settlements for advances issued 76.06, VAT account 19.04.

Next, you need to post the document by clicking OK. After this, it is recommended to click the Dt-Kt button and check the correspondence of the accounts.

In the event that the commission agent’s remuneration is transferred by the principal, the postings will be as follows:

Debit 90.02.1 Credit 45.01 - 20,000 rub. — the actual cost of goods sold is written off; Debit 62.01 Credit 90.01.1 - 40,000 rubles. — reflects the amount of sale of goods to the buyer; Debit 44.01 Credit 76.06 - 4,000 rub. — the commission agent’s remuneration has been accrued.

In the event that the commission agent independently calculates his remuneration from the sales amount received from the buyer (offset of mutual claims), the correspondence of the accounts will be as follows:

Debit 90.02.1 Credit 45.01 - 20,000 rub. — the actual cost of goods is written off; Debit 62.01 Credit 90.01.1 - 40,000 rubles. — reflects the amount of sale of goods to the buyer; Debit 76.06 Credit 62.01 - 4,000 rub. — the commission agent’s remuneration is allocated from the sale amount; Debit 44.01 Credit 76.06 - 4,000 rub. — commissions are included in overhead expenses.

The next stage is the formation of a ledger for accounting income and expenses of the simplified tax system. Of course, you can move to this stage only after the commission agent transfers the proceeds from the buyer to the principal.

In the first case, when the commission agent’s remuneration is transferred by the principal, in columns 4 “Income in total” and 5 “Income taken into account when calculating the taxable base”, the program will put 40,000 rubles, and in Columns 6 “Expenses in total” and 7 “Expenditures taken into account when calculating the tax base” calculation of the tax base" - 4,000 rubles. (see table 2)

Table 2. Book of income and expenses of Dairy Farm LLC. The commission is paid by the principal.

| Registration | Sum | |||||

| No. | Date and number of the primary document | Income - total | incl. income taken into account when calculating the tax base | Expenses - total | incl. expenses taken into account when calculating the tax base | |

| No. 5 from 09/03/2009 | Receipt on the account: payment from the buyer “LLC “Intermediary” under the agreement “Commission Agreement No. 1 dated 01.08.09”. | 40 000,00 | 40 000,00 | |||

| No. 1 from 09/03/2009 | Write-off from the account: payment to the supplier "OOO Posrednik" under the agreement "Commission Agreement No. 1 dated 08/01/09" Expenses for services of third-party organizations are recognized. | 4 000,00 | 4 000,00 | |||

| Decoding of expenses on line No. 2 | ||||||

| Third-party company services. Paid to the supplier: LLC Posrednik. | Paid: No. 1 dated 09/03/2009 | 4 000,00 | ||||

In the second case, when the commission agent’s remuneration was offset from the sales amount received from the buyer, in columns 4 and 5 “Income” the program will put 36,000 rubles received to the current account from the commission agent. As for the commission, this amount (4,000 rubles) will simultaneously fall into both “Income” and “Expenses”. This is absolutely correct, since the principal’s income is the amount of revenue received from the buyer, including the money that the commission agent calculated as a commission (see Table 3).

Table 3. Book of income and expenses of Dairy Farm LLC. The commission is deducted by the commission agent from the sale amount.

| Registration | Sum | |||||

| No. | Date and number of the primary document | Income - total | incl. income taken into account when calculating the tax base | Expenses - total | incl. expenses taken into account when calculating the tax base | |

| No. 1 from 09/03/2009 | Report of the commission agent "LLC "Posrednik" under the agreement "Commission Agreement No. 1 dated 01.08.09"; The commission agent's remuneration is offset from the proceeds from the sale. | 4 000,00 | 4 000,00 | 4 000,00 | ||

| No. 5 from 09/03/2009 | Receipt on the account: payment from the buyer “LLC “Intermediary” under the agreement “Commission Agreement No. 1 dated 01.08.09”. | 36 000,00 | 36 000,00 | |||

In both cases, the amount is 36,000 rubles. will be included in the base for calculating the single tax. When applying the simplified tax system “Income minus expenses”, the tax base will be determined as follows:

Income (40,000 rub.) - Expense (4,000 rub.) = = Taxable base (36,000 rub.).

If the simplified tax system was applied with the object of taxation “Income”, then the taxable base would not be reduced by the amount of expenses incurred by the principal and would be 40,000 rubles.

Transactions under commission agreements with a commission agent

Reflection of transactions under a commission agreement with a commission agent is carried out in several stages.

Stage 1. The goods arrived at the warehouse of the commission agent.

In this case, the commission agent's accountant fills out the document Receipt of goods and services with the transaction type Purchase, commission (which can be found in the Purchase menu). The goods accepted for commission are taken into account in account 004.1.

Stage 2. The product is sold to the buyer.

The commission agent's accountant fills out the document Report to the principal on sales of goods (located in the Purchase menu). It should not be confused with the document Commission Agent's Sales Report, which is filled out by the principal's accountant, not the commission agent's.

The report to the consignor on sales of goods indicates the price of receipt of the goods; the price at which the product was sold to the buyer and the amount of commission.

Stage 3. Formation of a ledger for accounting income and expenses of the simplified tax system.

The commission agent's income is the commission due to him. Income is recognized on a cash basis, that is, on the day when the commission is received in the commission agent's bank account.

Of course, the commission agent’s income cannot in any way be considered the entire sales amount received from the buyer. In accordance with paragraph 9 of Article 251 of the Tax Code and subparagraph 1 of paragraph 1.1 of Article 346.15 of the Tax Code, receipts of funds in favor of the principal are not recognized as income of the commission agent.

When carrying out commercial activities related to the sale of goods accepted for commission, the commission agent incurs various expenses. They are recognized in accordance with Articles 346.16 and 346.17 of the Tax Code of the Russian Federation.

Let's continue to consider our example from the point of view of the commission agent - Posrednik LLC.

When a batch of milk has arrived at the warehouse of Posrednik LLC, the document Receipt of goods and services: Purchase, commission is filled out. The fields of this document are filled in as follows: Organization LLC “Intermediary”, Counterparty LLC “Dairy Farm”, Commission Agreement No. 1 dated 01.08.09.

The Products tab will be filled in as follows: Nomenclature Milk 2.5%, Quantity 1,000, Price 20, Amount 20,000. Account (BU) 004.01, Expenses (NU) are not accepted. In the Settlement Accounts tab, the accounts of settlements with the principal are indicated, for example, account 76.05. It can be used both as an Account for accounting of settlements with the principal, and as an Account for accounting for settlements on advances.

The document Receipt of goods and services: Purchase, commission must be carried out by clicking OK. Then you should click the Dt-Kt button and make sure that the document generated the posting Debit 004.01 in the amount of 20,000 rubles.

After 2 weeks, the milk was sold to Supermarket LLC. In this case, a standard document Sales of goods and services: sales, commission is created. The document indicates the counterparty LLC "Supermarket", quantity, price of goods (1,000 liters for 40 rubles), etc.

In addition, it is necessary to fill out a Report to the consignor on sales of goods (Fig. 4). The fields of this document are filled in as follows: Organization LLC “Intermediary”, Counterparty LLC “Dairy Farm”, Percentage of remuneration 10, VAT excluding VAT, Method of calculation Percentage of sales amount, Commission agreement No. 1 dated 01.08.09.

Rice. 4. Filling out the document “Report to the consignor on sales of goods”

In the Products tab, the Nomenclature Milk 2.5%, Quantity 1,000, Receipt Price 20, Receipt Amount 20,000, Price 40, Amount 40,000, Reward in the amount of 4,000 rubles are indicated. should be calculated automatically, the column Amount of VAT remuneration in this case can be left empty.

In the Income Accounts tab, the service for which remuneration is due is indicated (for example, the item directory may indicate “Intermediary Services”), Income Account 90.01.1. The VAT account for sales (90.03) will also have to be indicated, despite the fact that the “simplified” principal is exempt from paying this tax - otherwise the program will not process our document.

Please note: in the Settlement Account tab, the Withhold commission checkbox is checked only if the commission agent, having received payment from the buyer, deducts his commission from this amount and transfers the remaining funds to the principal.

Otherwise (if the remuneration is transferred to the commission agent by the principal), the Withhold commission check box is not checked. In the indicators Account for accounting of settlements with the counterparty and Account for accounting of settlements for advances, you can specify 76.05.

The document Report to the consignor on sales of goods needs to be carried out. Then click the Dt-Kt button and check the correspondence of the accounts. The document should generate the following transactions.

If the commission agent’s remuneration is transferred by the principal, the posting will be as follows:

Debit 76.05 Credit 90.01.1 - 4,000 rub. — commission accrued.

If the commission agent is involved in commission settlements, the correspondence will be as follows:

Debit 76.05 Credit 62.01 - 4,000 rub. — “offset of the buyer’s advance”; Debit 62.01 Credit 90.01.1 - 4,000 rub. — commission accrued.

The final stage of work is the formation of a book of income and expenses under the simplified tax system. Of course, it will be possible to indicate in the book the income under the commission agreement either after the buyer transfers money for the milk (if the commission agent independently calculates his remuneration from the sale amount) or after the principal transfers his remuneration to the commission agent. In both cases, columns 4 and 5 of the book will indicate the amount of 4,000 rubles. (see tables 4 and 5). This amount is the taxable base when applying the simplified tax system “Income”. If the simplified tax system “Income minus expenses” is used, the tax base may be reduced by the amount of expenses incurred by the commission agent.

Table 4. Book of income and expenses of Posrednik LLC. The commission is paid by the principal.

| Registration | Sum | |||||

| No. | Date and number of the primary document | |||||

Typical errors in the principal's accounting

Mistake #1. The principal's accountant reflected the receipt of money from the sale and purchase transaction carried out by the commission agent, indicating the wrong price per unit of goods for which the intermediary sold it.

Accounting entries must be made after documents are received from the commission agent that reflect the price for the goods at which the settlement with the buyer actually occurred. The commission agent's prices and the prices indicated in the principal's accounting records must match.

Mistake #2. The principal accepted for deduction the amount of the commission agent's fee among the costs of selling the property, but did not deduct the amount of VAT from this amount from the tax base.

VAT can be deducted from the remuneration amount after the offset of mutual claims between the employer and the hired intermediary or after actual payment for his services.

Mistake #3. The principal did not keep the invoices he received from the intermediary.

Invoices must be preserved, since VAT accrued on the amount of fees for intermediary services and on the amount of compensation for the commission agent’s expenses can subsequently be taken into account when calculating the tax base only if there are invoices as grounds for making a deduction.

The contract is the basis of the transaction

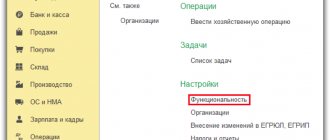

Any business with a counterparty officially begins with the conclusion of an agreement. In the future, it is expected that the contract will be executed, taking into account the specifics of its conclusion. In the 1C:Accounting configuration, you can register two types of contracts with principals - for sale and for purchase.

Fig.1 Creating a contract

Fig. 2 Types of agreement

For each type of contract, the following details are required:

- organization;

- counterparty;

- contract number;

- agreement date;

- contract currency;

- the procedure for calculating commissions (for different types of contracts the choice of calculation methods is limited).

When concluding a sales contract, there is a certain procedure for the commission agent, which corresponds to the sequence of reflection of specialized documents in the program:

- Receives goods from the consignor;

- Sells the goods of the principal;

- Calculates own remuneration for commission sales services and reports for goods sold;

- Pays the principal for what is sold.

Let's take a closer look at each stage.

Debiting from current account

A document is being prepared, accessible from the full interface, section “Bank and cash desk”. A special feature of filling out this document is the use of an input mechanism based on the “Report to the Principal”. Here the payment amount is calculated automatically.

Fig.10 Calculating the payment amount

Postings will be generated that take into account detailed records of sales documents and settlements with customers.

Fig. 11 Postings will be generated

After completing the calculations, the principal's balance should be zero.

When concluding a commission purchase agreement, the sequence of actions of the commission agent changes slightly:

- Purchases goods for the consignor;

- Reports on purchased goods to the consignor.

How to submit a report

You can prepare the report either in handwritten form or in printed form (the second option, of course, is more convenient), on letterhead or on a regular A4 sheet.

The main condition is that it contains the original signature of the commission agent (after receiving his copy, the committent also endorses the document).

It is not necessary to certify report forms using stamps, because from 2021, commercial companies (enterprises and organizations) can use various types of stamps in their activities only when this norm is enshrined in their local regulations.

The report is always generated in two copies , one of which remains with the commission agent, the second is transferred to the principal.