- home

- About company

- Articles

- Advances / Settlement of advances in 1C: Accounting 8

September 17, 2019

From July 1, 2021, owners of online cash registers are required to punch checks not only for the advance payment, but also for offset of the advance payment. For a number of configurations there are already brief instructions on .

At the time of writing this instruction, there is no data regarding 1C: Accounting on the ITS website. Therefore, we will analyze the procedure on the demo base. As an example we will use:

| Platform | 8.3.15.1565 |

| Configuration | Enterprise accounting 3.0.72.66 Prof. |

| KKT model | ATOL FPrint-22PTK |

This instruction is current as of September 11, 2019.

A little theory

The process of breaking through Advance Receipts can be divided into two main stages:

- prepaid expense;

- advance credit.

For each stage, a separate document is created in 1C. And, subsequently, the check comes through.

| Type of transaction: | Document: |

| Prepaid expense | Receipt of cash (PKO), Payment card transaction (acquiring), Receipt to the current account; |

| Advance offset | Sales of goods, Sales of services. |

Reminder

:

Prepayment and Advance payment are different signs of the payment method.

Prepayment is the receipt of funds from the payer for a specific list of goods/services.

Advance – receipt of funds when the payer does not yet know what he wants to purchase

Receipt of advance payment

To make this example clear, we will first register the receipt of the advance in the program. Let’s assume that we receive funds from our counterparties in two ways: through a cash register and through a bank account.

We will not consider filling out these documents in detail. You can read about this in another article.

The receipt of cash is documented by a cash receipt order. You can find it in the “Bank and Cash Office” section, “Cash Documents” item. Make a new document by clicking on the “Receipt” button in the list that opens.

Our team provides consulting, configuration and implementation services for 1C. You can contact us by phone +7 499 350 29 00 . Services and prices can be seen at the link. We will be happy to help you!

The document generated a posting in the amount of 10,000 rubles from account 62.02 to account 50.01. Now this DS amount is listed in our cash register.

Non-cash payment is registered by the document “Receipt to the current account”. You can also find and do it in the “Bank and Cash Office” section in the “Bank Statements” item.

The document generated a similar posting, only the DS arrived at Dt 51.

Step-by-step instruction. Prepaid expense

1) To reflect the Advance in 1C, create one of the documents:

- “Cash receipt”;

- “Receipt by payment card”;

- “Receipt to the current account”;

2) After filling out all the details, click on the button at the top of the document;

Figure 1 — Filling out the “Cash receipt” document

3) If the DS receipt document did not have a basis document, then in the preview of the check, “Indicator of the payment method” and “VAT” take on the correct values automatically;

Figure 2 - Preview of the check, comparison of details, punching the check on the cash register

4) To punch a check, press the corresponding button;

5) The payment method sign is visible on the check – “Advance”. Depending on the document from which the check was punched, the payment type is substituted: Cash/non-cash

Figure 3 - Example of a check for “Advance”

Reflection of advance transactions in the declaration: postings, restoration

In accounting, VAT is charged on the advance received from the buyer using the following entries:

To reflect the accrual of VAT on advance payments, the chart of accounts provides a subaccount “VAT on advances received (prepayments)” to account 62 “Settlements with buyers and customers” and account 76 “Settlements with various debtors and creditors”. This allows:

- keep in accounting data on advances received and VAT on them (according to Kt 62, 76);

- in the balance sheet, reflect the amounts of advances received (excluding VAT, accounted for on the Dt of the relevant accounts) as accounts payable.

Please note that the previously received advance payment at the time of sale of goods (services or work) is counted towards the prepayment amount. An invoice is issued for the shipped product (service or work). On the date of offset of advances, the company accepts for deduction VAT on advances received. Please note that the deduction is made in the amount of tax calculated on goods (services or work) shipped for which advances were received. It is understood here that if VAT on advances is charged at a rate of 20/120%, and the product (service or work) is shipped at a rate of 10%, then VAT on advances received is credited at a rate of 10/110%.

In the VAT return, the advance received is reflected in section 3 on line 070 in column 3, and the amount of tax on the advance is reflected in column 5.

The deduction of VAT on advances received is reflected in section 3 of the declaration on line 170 in column 3 for the tax period in which the goods were shipped.

Reflection in accounting of VAT on the advance paid to the supplier is reflected by postings.

Account 19 is used for the purpose of separating VAT from an advance, when the issuance of an advance and the deduction of VAT are separated in time. If advance VAT on the reporting date is not accepted for deduction, then the tax reflected in account 19 is recorded in the balance sheet as a current asset separately from the “receivables” for the transferred advance payment.

To separate VAT from advances issued, you can use separate subaccounts “VAT on advances issued (prepayments)” to account 60 “Settlements with suppliers and contractors” or to account 76 “Settlements with various debtors and creditors”. Thereby:

- the accounting stores data on advances paid, including VAT (according to Dt 60, 76);

- the balance sheet shows “receivables” (minus VAT accounted for in the KT of the relevant accounts) in the form of advances issued.

VAT on advances received, accounted for under Dt 62-VAT (76-VAT), is not indicated in the balance sheet, as well as VAT on advances issued, accounted for under Kt 60-VAT (76-VAT). In the balance sheet, tax amounts are reduced by the “debtor” in the form of advances issued and the “creditor” in the form of advances received.

Reflected in account 19 from the advance VAT issued, which was not accepted for deduction by the end of the reporting period, must be included in the balance sheet. This VAT is indicated in line 1220 “VAT on acquired assets.”

Advances issued are not reflected in the VAT return, but the tax on these advances accepted for deduction is indicated in section 3 on line 130.

Please note that for the advances listed by the suppliers, the buyer acts according to the following scheme:

1) receives an invoice for the advance payment, records it in the purchase book, and accepts the advance VAT for deduction;

2) after shipment of goods (services, works), records the shipping invoice in the purchase book;

3) indicates the previously registered advance invoice in the sales book, thus recovering VAT from the advance payment issued.

Kontur.VAT+ allows you to avoid discrepancies in the quotas and reconciles invoices for transactions with advances for all quarters.

Find out more

Regarding the recovery of VAT from an advance received, the situation is as follows. The seller, having received an advance payment, charges VAT on it. Having sold the goods (service, work), he draws up an invoice for the sale and accepts VAT from the previously received advance for deduction. That is, in this case the term “restoration” is incorrect to use. The seller records an advance invoice in the sales book, and later, after shipment of the goods (service, work), an invoice for sales. At the same time, the seller registers an invoice for the advance payment in the purchase book, thereby deducting advance VAT. Oh, that is, the deduction, VAT on the advance received is not limited, the main thing is that the deduction is declared in the quarter in which all the conditions for the deduction are met.

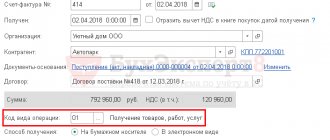

Checking mutual settlements with the supplier

You can check settlements with the supplier in terms of contracts using the analysis of mutual settlements in the report Analysis of subcontos in the context of Counterparties and Contracts.

The report shows that under supply agreement No. 418 dated March 12, 2018, the receivables of the supplier Avtopark LLC are reflected in the debit of account 60.02 in the form of an advance issued to him in the amount of RUB 792,960.

There is no other balance as of March 19, 2021 for other settlement accounts and agreements, therefore, mutual settlements by counterparty and agreements are reflected correctly in 1C.

If the supplier has issued an advance invoice, the Organization may exercise the right to deduct VAT on advances issued to suppliers.

For the continuation of the example, see the publication:

- Acceptance of VAT for deduction on advances issued to suppliers

See also:

- Payment order to pay the supplier

- Document Write-off from current account

Did the article help?

Get another secret bonus and full access to the BukhExpert8 help system for 14 days free of charge

Related publications

- Document Payment order transaction type Payment to supplier The Payment order document with transaction type Payment to supplier allows you to create…

- Transfer of payment to the parent organization for services provided by the branch...

- Payment of principal and interest on the loan...

- Payment order based on the Advance report If accountable funds are overspent in Accounting 8.3, it is possible to create...

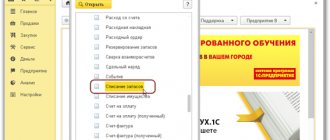

Creating a document debiting from a current account

Creating a document through the menu: Bank – Bank statements – “Add” – transaction type Payment to supplier

Filling out the document header (Fig. 382):

- In the From – the date of the bank statement;

- In the Bank account – the current account from which funds were written off;

- In the Amount – the amount of the transaction;

- In the line Accounting account – one of the cash accounting accounts, on the credit of which an entry will be made to write off funds;

- In the lines Input number and Input date - the number and date of the payment order on the basis of which the transfer was made.

| Attention | |

| Correctly fill in the fields Input number and Input date , because this information will be useful when checking the correctness of the Invoice issued by the supplier, in particular filling out the details for payment and settlement document No. dated . |

- ke Recipient, indicate the supplier to whom the funds were transferred;

- In the Recipient's account , indicate the current account of the recipient of the funds;

Filling out the tabular part of the document (Fig. 382):

- In the Contract , indicate the agreement with the supplier;

| Attention | |

| In the contract selection form, only those contracts that have the type of contract With supplier are displayed. |

- In the line VAT rate VAT field , it must be checked and adjusted if necessary;

- In the line Settlement account, account 60.01 “Settlements with suppliers and contractors” must be indicated;

- In the Advance Account , account 60.02 “Settlements for advances issued” must be indicated.

| Attention | |

| The fields Settlement account and Advance account must be filled out correctly. Otherwise, the advance payment will not be offset automatically, which will lead to incorrect posting. |

- In the line Cash Flow Item, the cash flow item is indicated; analytical accounting will be kept for it in cash accounts;

- In the line Purpose of payment - the purpose of payment, which was in the payment order.

Rice. 382

| STEP 2 |

Postings for payment to the supplier in advance

- Posting a document – “Post” ,

- View transactions – button “Result of document posting” (Fig. 383)

Rice. 383

As a result of posting the document, an entry was made according to Dt 60.02 “Calculations for advances issued.” This means that the program recognized this payment as an advance to the supplier. Those. payment to the supplier was made earlier than our organization received goods and materials (works or services) from him.

| STEP 3 |

And in the OFD you will see such checks and amounts

Don't be surprised - everything is correct.

Big respect to 1C for implementing the new check breaking algorithm. And also to accountant Olga for her help. We will definitely try, at her request, to find out how to reduce the font on the receipt for the TOTAL field and increase RECEIVED so that buyers do not roll their eyes - asking how much money they actually paid.

Of course, we had to return all three checks on the same day (we cannot leave experiments). I had to do this from the Shtrikh driver directly at the cash register, because... In 1C, check returns do not seem to be implemented yet.