Commission trading benefits both buyers and sellers. You can organize such a business in specialized stores or other retail outlets; there are no restrictions on this matter. In order for the activity to be carried out legally, the entrepreneur must declare the correct OKVED code “Commission trade” during state registration with the tax service.

Read also: Is it possible to carry out activities without OKVED

What does the concept itself mean?

The concept of commission sales involves the sale of used products: antique items (figurines, paintings, money from past centuries, furniture, cutlery), modern household appliances, clothing, shoes, sports equipment. When you bring your property to a retail outlet, an agreement is concluded between you and the commission agent, where the price and a certain period are signed. In this case, the seller must sell the object and receive a small percentage (reward) for it.

In the contract, be sure to read the line with the store’s terms and conditions. The following points will be defined there:

- You have the right to receive funds on the third day after the sale of your item. You should be informed about this via a mobile call or SMS.

- If you do not arrive on time, the funds received remain in the local budget.

- You must have an identification card and a receipt with you, which will indicate what products you handed over, in what quantity and for how much.

- If it was not possible to sell the goods within the established period, then it is returned to you, but you will have to pay a small amount for the storage service - not exceeding three percent of the cost of the item.

Now you know what it is - goods on commission. Now we will tell you which regulatory documents can be used by both parties.

Commission agreement form online

According to the Civil Code of the Russian Federation, a commission agreement refers to a commercial type of intermediary activity, since the condition for the payment of remuneration is expressly stated in Art. 990 Civil Code of the Russian Federation. However, this option of cooperation also provides for other features that need to be taken into account when filling out the contract:

- volume and nature of orders.

Thus, the parties must indicate what transactions the executor must make; each transaction will be made on behalf of the commission agent, i.e. he will act as a party to contracts, sign legally significant forms, draw up payment and transport documents, etc.; All transactions are made at the expense of the customer. The agreement must stipulate how payment occurs, the procedure for submitting payment documents and accepting the results of completed orders.

The Civil Code of the Russian Federation provides special rules for determining the terms of a transaction made in the interests of the customer.

The commission agreement may contain a list of instructions on the most profitable options for the supply of goods, the purchase of transport or real estate, or other types of transactions.

If there are no such instructions in the commission agreement, the contractor must take into account the standard requirements and business customs applicable to this type of legal relationship.

It is possible that the order will be executed on significantly more favorable terms than those previously stipulated in the contract. In this case, the contractor has the right to claim part of the benefits received from the transactions. It is divided in half between the commission agent and the customer, unless otherwise provided by the commission agreement.

Form of commission agreements

The law does not contain mandatory requirements for the form of the commission agreement. However, due to its commercial nature, all terms and conditions can only be stated in writing. According to Art. 990 of the Civil Code of the Russian Federation, counterparties can choose the following options for formalizing relations:

- indicating the duration of the agreement or for an indefinite period; you can determine the territorial limits of the execution of orders, or leave this issue at the discretion of the executor; it is possible to indicate a clause on the transfer of rights to carry out transactions to other persons if such a decision is made by the commission agent (if the commission agreement does not contain such a rule , transfer of authority is not allowed);

The parties can agree in advance on the range of products that will be the subject of the transaction.

These and other terms of the agreement will be agreed upon by the partners at their own discretion. The more detailed the list of rights and obligations of the commission agent and the customer is defined, the fewer problems will arise when fulfilling the conditions.

Using the Documentoved service, you can quickly fill out a ready-made sample commission agreement. All provisions of the standard form comply with legal requirements and have been verified by a professional lawyer.

Since commission agreements provide for many alternative conditions, you can get detailed advice from an experienced specialist in the field of civil law on any questions that arise.

Payment methods according to the agreement

The commission agreement must contain clauses on the amount of remuneration to the intermediary, or the procedure for determining it. The law does not prohibit parties from specifying any payment options, including:

- in cash or non-cash form.

It should be taken into account that cash payments for legal entities are significantly limited in amounts; by advance payment or full payment after transactions are completed; in a fixed amount or taking into account the volume of transactions and achieved results.

If the amount of remuneration or the procedure for determining it is not fixed in the commission agreement, payment to the commission agent will follow the rules of Article 424 of the Civil Code of the Russian Federation - the standard price for carrying out such transactions under similar conditions.

All orders and instructions of the customer are carried out at his expense. This means that he is obliged to execute the payment documents presented by the commission agent when making transactions.

Refusal to pay can only be caused by a significant violation of the terms previously agreed upon by the parties (for example, the delivery of goods not specified in the commission agreement, or the presence of claims regarding the quality of products that have not been verified by the commission agent).

In addition, the customer is obliged to pay all costs associated with the execution of his orders and instructions (unless otherwise specified in the commission agreement).

Costs may include transportation costs, banking fees, government fees and charges.

The contractor may receive reimbursement of expenses and remuneration even if the instructions under the contract were not actually fulfilled. To do this, he needs to prove that the failure to perform was due to the fault of the customer.

Responsibility for violation of financial terms

Violation of the terms of settlements, payment of remuneration and compensation of expenses results in liability in the form of penalties.

To do this, it is necessary to indicate in the text which violations will result in liability, as well as the procedure for filing and considering claims.

If the terms of the commission agreement include a clause on mandatory compliance with the claim procedure for resolving the dispute, you can go to court to protect your interests only after filing a claim.

document

The parties can determine the composition of the provisions of the commission agreement independently by mutual agreement. The agreement will not come into force until the customer and the commission agent agree on all essential and additional terms of cooperation.

General information. The first block of the document includes the following points:

- the name of the contract, as well as its serial number (if the company is registering); place and date of drawing up the document (if it is signed by mail, the location of the customer is usually indicated);

name and details of the parties, powers of the head of legal entities or representative by power of attorney.

A representative can sign an agreement on behalf of an enterprise or individual entrepreneur if such powers are specified in the power of attorney.

Subject of the agreement. The ability to correctly and timely fulfill the customer’s instructions depends on the description of the subject of the commission agreement. To do this, the parties must provide the following details:

- the essence of the order is the description and conditions of transactions that need to be carried out in the interests of the principal; requirements for goods, works and services that need to be taken into account when the commission agent signs contracts; requirements for the preparation of documents, including for payment for transactions (for example, for subsequent VAT refund a special set of documents is required); the need for preliminary approval of the range, quantity and quality of goods (if such a requirement is not included in the terms of the commission agreement, the contractor is guided by the basic conditions);

minimum and maximum volumes of transactions that the commission agent is entitled to carry out.

Instructions to the commission agent should be as detailed as possible. This applies to the quantity and quality of products, terms of warranty and packaging, requirements for the place of transfer of goods.

If there are no special requirements for instructions, the contractor will determine them himself, taking into account business customs and reasonable prudence. The conditions for the payment of monetary compensation may depend on the results of completed transactions, but the parties must provide for a guaranteed amount of payment.

These rules cannot be changed unilaterally (except in cases of significant changes in circumstances or violations of the contract).

Rights and obligations of the parties

They are fixed as follows:

- the customer is obliged to provide all the necessary information and documents that are required to execute orders; the commission agent is obliged to comply with the deadlines for completing transactions if they are fixed in the contract;

Based on the results of the execution of all orders, the commission agent is obliged to submit a report, including expenses incurred.

The agreement may provide for the submission of reports as orders are executed (at the end of the month or after several transactions have been completed); the customer is obliged to review the report within the period specified in the commission agreement. This period of time cannot exceed 30 days, within which the customer has the right to make claims regarding the contents of the report.

The full list of mutual obligations will depend on the nature of the orders and instructions.

Conditions for submitting a report

The basis for payment of remuneration to the commission agent will be his report. The parties can provide in advance the form, as well as the order of its submission (by mail, via the Internet, etc.). the report is also determined by the contract. As a rule, it includes a register of completed transactions, the composition of costs incurred, a description of the characteristics of the delivered products, etc.

Penalties. For violation of the terms of the commission agreement, the parties may provide the following sanctions:

- In case of violation of the deadline for payment of remuneration, as well as compensation for expenses incurred, the customer will pay a penalty.

The parties determine its size independently; additional sanctions may be imposed for an unjustified refusal to accept the report; The commission agent is responsible for violation of the terms and conditions for the execution of orders, as well as for untimely transfer of payment and accompanying documents.

The amount of the penalty is also determined by the contract or calculated according to the norms of the Civil Code of the Russian Federation; the contract can specify the procedure for compensation for losses that the parties will incur in the event of improper fulfillment of obligations by the counterparty.

Lack of liability is possible in the event of force majeure circumstances that the parties could not foresee in advance. To eliminate possible disputes, special attention must also be paid to filling out this block.

Settlement of disputes. The text of the document must provide for the procedure for resolving disputes. The following points may be indicated for this:

- the timing and procedure for conducting mutual negotiations to resolve disagreements; the timing and procedure for filing a claim, as well as its consideration on the merits;

conditions for filing claims in court.

In addition to applying to arbitration, the parties may consider filing a claim in an arbitration court, as well as change the jurisdiction of the dispute. The agreement will come into force from the moment it is signed by both parties. Signatures are placed by the heads of organizations or their representatives by proxy. The signature of the official is sealed with the seal of the enterprise.

Sample commission agreement from the Documentoved service

Having agreed on all the conditions, you can quickly fill out a standard form through the Documentoved service. The standard list of items meets the requirements of regulations.

You only need to fill out the required items, after which the finished document can be printed or saved in electronic form.

If you encounter any difficulties or additional questions about filling out a sample commission agreement, you can consult an experienced lawyer.

Source: https://www.documentoved.ru/instructions/contracts/dogovor_komissii

Business Solutions

- shops clothing, shoes, groceries, toys, cosmetics, appliances Read more

- warehouses

material, in-production, sales and transport organizations Read more

- marking

tobacco, shoes, consumer goods, medicines Read more

- production

meat, procurement, machining, assembly and installation Read more

- rfid

radio frequency identification of inventory items More details

- egais

automation of accounting operations with alcoholic beverages Read more

The legislative framework

The entire algorithm of actions is described in paragraphs of Articles 990, 991, 999 and 1001 of the Civil Code of the Russian Federation. In order not to delve into the legal subtleties, we will describe this procedure in a brief form:

- You bring an item to a retail outlet.

- An intermediary between you and the buyer, who does not have ownership of your item, makes a visual inspection and sets a specific price.

- If you are satisfied with the proposed valuation, you sign an agreement stating that the commission agent, on behalf of the principal, will sell this product for a fee (the amount is also indicated).

- Please indicate the notice period for the sale in advance.

- After this, the product is accepted and an invoice is drawn up in the TORG-12 form.

- The law states that goods received must be placed on the display shelf on the second day after receipt.

- After successful sale, the seller draws up a report indicating the name of the item, quantity, day of sale and amount of remuneration.

- It is advisable for the commission agent to draw up a statement that he has provided this service.

- Ultimately, the proceeds are transferred to you, and you give the seller a percentage of the sale.

- The collaboration is over.

- If you are not satisfied with something, you can file a complaint within 30 days.

Currently, this process has been improved thanks to automation and has become much better and faster. By installing software from a Russian developer of mobile accounting systems, you can create an automated agreement, which will contain information about acceptance, sales, commission and reporting.

New OKVED codes in 2021 with breakdown by type of activity

— conducting expertise in the field of information technology: development, changes, testing and support of software, planning and design of computer systems that combine computer equipment, software and communication technologies;

What OKVED codes are in effect in 2021?

Tax officials are getting rid of companies with false information in the state register. Any organization can come under suspicion. Editorial office of the newspaper “Accounting. Taxes. Pravo" learned that the tax authorities will check first of all.

Activities for the production of soy products: soy milk drinks and yogurt, soy soft cheeses, soy curd should be identified with code 15.89.1. “Production of ready-to-eat food products and preparations for their preparation, not included in other groups.”

Wardrobe services are classified in group 93.05 “Provision of other personal services” if the organization carries out this type of activity for a fee. Otherwise, its activities are auxiliary.

What types of stores are there?

Depending on what you want to sell, you will have to choose a specific trading point:

- You can donate your used items to a second-hand store.

- Consignment stores for mixed items.

- A special niche is used cars and weapons.

They also differ in the payment method. Some work only by bank transfer, others - with cash, and still others provide installment plans.

OKVED for 2021 with decoding official website

Secondly , to submit reports. Many reporting forms provide for the indication of OKVED, usually on the title pages. The regulations on the procedure for filling out calculations and declarations directly provide for this detail.

What is OKVED and why is it needed in 2021

Thirdly , the tariff for contributions for injuries depends on the type of activity. It is set individually for each policyholder: organization or individual entrepreneur. Every year, policyholders send documents to social insurance to confirm the main OKVED. If this is not done, FSS specialists will set a maximum tariff for the company. They will again focus on OKVEDs, which the company entered into the Unified State Register of Legal Entities.

This class includes: - retail sale in specialized stores of goods for cultural and entertainment purposes, such as books, newspapers, audio and video recordings, sports equipment, games and toys

Terms and Conditions

If you yourself want to open a retail outlet, adhere to certain requirements, compliance with them is of great importance.

You must understand that you are providing a service for the sale of goods and their storage, so when drawing up an agreement, indicate:

- date, month and year of acceptance;

- agreement number;

- name of the item;

- price;

- your future percentage of the deal;

- If the product is not sold at a specific time, then write down the further procedure.

In addition, you have the right to take goods for sale not only according to the passport data of Russian citizens, but also from stateless people and foreigners. And any person has the right to terminate an agreement with you for various circumstances.

Conditions for opening a consignment store

First of all, decide the issue of registering with the tax service; you must register with the Federal Tax Service as an individual entrepreneur or legal entity.

Next, you need to rent a building or a separate office, purchase and install counters, organize a workplace with a computer (you must have access to the Internet). And you can start working!

What should be in the room

Rent in small towns does not exceed 20 thousand rubles per month, and in large cities - about 50,000-60,000. This is an acceptable amount, provided that the premises do not require additional repair costs.

If the room is in unsatisfactory condition, make every effort to put it in order, otherwise buyers will simply avoid you. Then there can be no talk of any profit.

How the commission markup occurs: what does it mean?

Your task includes:

- Visually inspect the item for damage.

- Find out the original cost.

- Analyze how much it will be in demand.

- Take into account the wishes of the principal, but also do not forget about yourself.

Every person wants to sell their goods at a higher price, and you should receive a decent reward for this service. You will need to not only pay rent, but also pay taxes and pay wages to hired employees.

What is prohibited from selling

In order to avoid infection and spread of skin and sexually transmitted diseases, the occurrence of allergic reactions in humans, Russian legislation prohibits the sale of certain types of used goods: underwear; tights, socks and stockings; swimwear; household chemicals, cosmetics and medicines; hygiene items.

We make an equal balance between supply and demand

If you don't want to lose everything, follow our recommendations:

- Take no more than 5-6 units per month from one person.

- Look at seasonality. This applies to clothes and shoes. You should not wear winter boots in summer.

- Sell items in good condition.

- Arrange things in zones (clothes on one side, household appliances on the other).

- If the sell-by date is running out, have a 10-15% sale.

- Maintain a database. This way you can correctly prepare reports to the appropriate inspection body.

How to increase demand using the Internet

Almost all buying/selling actions are carried out through social networks and company websites. Register in several groups and accounts. Take a photo of your product, post it on an online resource and supplement it with a brief description of the characteristics and price.

Conditions for accepting mobile equipment and household devices

If you don't have enough technical knowledge, hire someone who is knowledgeable in this area. His responsibilities should include: visual inspection of the surface for possible damage (scratches, chips, paint peeling), checking for functionality, determining the price.

FLP on EN - commission agent: business at someone else's expense

First of all, let’s figure out what restrictions are established for individual entrepreneurs on an individual entrepreneur who plans to act as an intermediary commission agent in business activities.

What is not allowed and who is allowed

Let's start with the restrictions established in paragraphs 291.5.1 NKU ,

in particular, for all individual entrepreneurs, compliance with which gives the latter the right to work for an individual.

Firstly, they are prohibited from engaging in financial intermediation ( clause 6, clause 291.5.1 of the Tax Code of Ukraine

) - this is

section 64 of the KVED

.

Secondly, they are not allowed, on any terms - including intermediary (commission) - to deal with the sale of items prohibited in paragraphs 291.5.1 NKU of goods (107.03 BZ).

As for the corresponding restrictions for individual entrepreneurs on EH already “in the context” of EH groups, then the freest in this sense, of course, is the third group.

Since commission transactions are carried out on the basis of a commission agreement ( Article 1011 of the Civil Code of Ukraine

) and inherently involve

the provision of services , such activities are not permitted for individual entrepreneurs of the first group . And the logic here is as follows.

According to paragraphs 1 clause 291.4 NKU

Individual entrepreneurs of the first group have the right to provide only

household services to the population , but the list of such services defined in clause 291.7 of the Tax Code

does not include intermediary services. You can’t - that’s the point.

When considering the possibility of engaging in mediation activities for individual entrepreneurs in the second group , it is necessary to take into account the presence of two restrictions, related, again, to the fact that such mediation is considered the provision of services (to the principal) .

The first limitation is specific: in the fourth paragraph 2 clause 291.4 NKU

second-graders, firstly, are expressly

prohibited from providing intermediary services for the purchase, sale, rental and valuation of real estate (class 70.31 of the KVED).

And secondly, they are prohibited from selling (selling) jewelry and household products made of precious metals, precious stones (including organogenic formations) and semi-precious stones

That is, such individual entrepreneurs are essentially prohibited from being a commission agent, unless the subject of the relevant agreement is similar goods.

Another second-group restriction is of a more general nature: such FLP on EH in p.p. 2 clause 291.4 of the Tax Code of Ukraine is allowed to provide services only to payers of social security and/or to the population (i.e. ordinary citizens). And since you already know that commission (intermediary) services are services, it turns out that the principal of the second group under a commission agreement can only be:

1) a business entity with a legal entity (both sole proprietorship and legal entity);

2) an ordinary individual. By the way, in this case, the commission agent must perform all the functions of a tax agent (withhold and pay personal income tax and sun, submit form No. 1DF - see more details on p. 31).

If the individual entrepreneur is satisfied with all this, then, of course, he can choose the second group of EH, but if not, he only has the third group of EH.

Activity coding

Since we are talking about individual entrepreneurs specifically in the Unified Economic Code - and for such business entities it is critically important to clearly define the specific code of their type of business activity according to the Classification of Economic Activity

, - note that this document (

DK 009:2010

) does not use the term “commission” at all, but uses the broader term “activities of intermediaries in trade.”

Moreover, this term refers specifically to group 46.1 of the KVED

“Wholesale trade for a fee or on the basis of a contract” (there are 9 classes in this group).

That is, classes starting with 46 are suitable only for that individual entrepreneur on the EH who is a commission agent- wholesaler .

If an individual entrepreneur on the EH plans to engage in retail commission trade, then he should select the appropriate code starting with 47... For example, for the classic “commission store” there is a code 47.79 KVED

“Retail sale of used goods in stores.”

We will not exaggerate here the issue of the consequences of non-compliance by an individual entrepreneur with an EN declared type (code) of activity (which threatens to pay EN at a rate of 15% on income from the “wrong” activity and even parting with a simplified tax regime) and the corresponding quibbles of tax authorities in this regard, but will only address attention of retail commission agents to the need to comply with the requirements not only of General Order No. 833

, but also special

Rules No. 37

, as well as

Instructions No. 343

.

Commission agent's income

Let's discuss the procedure for determining the income of a sole proprietor on an unified account from his commission (intermediary) activities as a commission agent.

Of course, from this point on we forget about individual entrepreneurs on the EH of the first group...

But before we touch upon the actual procedure for determining income, we note the following.

Firstly, a sole proprietorship on an unified account - the commission agent is obliged to provide the principal with a report drawn up in any form based on the results of the transaction ( Article 1022 of the Civil Code of Ukraine

).

Secondly, with regard to individual entrepreneurs in the single-income of the second and third groups, the amount of income received by them needs to be controlled during the calendar year, at least in order not to inadvertently jump beyond the two limits of annual income:

(1) “group” - established in clause 291.4 of the NKU

(for the second group - in the amount of 1,500,000 UAH, for the third - in the amount of 5,000,000 UAH);

(2) “without RROshny” - established in clause 296.10 of the NKU

in the amount of 1,000,000 UAH.

(let us immediately remind you that neither compliance with this limit nor the Lord God himself will save you from the obligation to use PPO if you begin to trade in complex household appliances that are subject to warranty repair - either on a commission basis, or on any other terms) … ☹

As for (in addition to this) individual entrepreneurs on the EH of the third group, the income received serves as the actual basis for calculating the EH (at a rate of 3% or 5%).

Let us recall that exceeding the corresponding “group” limit entails two obligations: firstly, to pay the unified tax at a rate of 15%, and secondly, from the next quarter to move from your second group to a “higher” third, or - if the offender was already in the third group - switch to the general taxation system. Well, or “register”, that is, end business activity.

Returning to the discussion of the installed NKU

for the procedure for determining the income of a sole proprietor on a single-sector income from commission (intermediary) activities in the role of a commission agent, we point out a

special norm, namely clause 292.4 of the Tax Code . According to this clause,

if a commission agent - in particular, a sole proprietorship on an individualized enterprise of the second or third group - provides a service to the principal, for example, under a commission agreement “for sale”, then

the commission agent's income is the amount of remuneration he received from the principal

Moreover, the date of recognition of such income is the date of receipt of such remuneration by the commission agent from the principal to a bank account or in cash. This position regarding the determination of the income of individual entrepreneurs as a single-commission agent is confirmed in the letters of the State Fiscal Service dated November 8, 2016 No. 11794/T/99-99-13-01-02-14,

Source: https://i.factor.ua/journals/nibu/2017/august/issue-64/article-29597.html

How is commission trading done?

The operating principle is very simple and includes the following operations:

- They bring you an item for sale.

- You inspect it and ask for packaging, technical data sheets and instructions for equipment, video and photo equipment, and household equipment.

- Set a price.

- Write an agreement indicating the acceptance date, cost and sale period.

- Specify the amount of remuneration and the terms of payment.

Some products are subject to special standards: for jewelry - this is decree number 55, for cars - property documents.

In addition, you can provide additional services if you have certified specialists: assess objects and provide delivery of heavy cargo.

If the seller sells the item for more than planned, the benefit is divided equally between both parties.

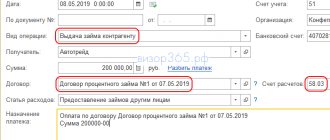

Accounting for commission trade and postings to the commission agent

In accounting, the off-balance sheet account 004 must reflect the cost of the product established by the seller and the person who brought the product to your retail store.

At the time of sale, a receipt appears, and a debt arises to the supplier. Accounts payable are formed based on the price at which the sale was made. The seller is obliged to record this transaction. Only the commission markup, that is, the difference between the sales and valuation prices, is included in the calculation of profit.

Postings

Support is confirmed by primary documents and occurs according to a certain algorithm, guided by legal standards:

- receiving property from the supplier;

- subsequent sale by point;

- writing off the cost of products from the balance sheet;

- revenue from work done;

- payment for the safety of the product;

- VAT calculation;

- receiving money from the buyer;

- transfer of funds to the continent after the sale;

- receiving profit from the primary owner.

OKVED codes 2021 with decoding and easy search

- 43.31 “Production of plastering works”

- 43.32 “Carpentry and carpentry work”

- 43.32.1 “Installation of doors (except automatic and revolving), windows, door and window frames made of wood or other materials”

- 43.32.2 “Installation of internal stairs, built-in wardrobes, built-in kitchen equipment

- 43.32.3 “Performance of work on the interior decoration of buildings (including ceilings, sliding and removable partitions, etc.)”

OKVED codes with decoding for 2021 with decoding

For state registration you must use at least three digital characters. That is, you cannot select the OKVED 43 class, you need to select a subclass. If you carry out several types of activities, you are allowed to indicate the required quantity during registration; there are no restrictions. By the way, immediately after registration it is not necessary to carry out all types of activities - the law does not require this. If suddenly, in the process of doing business, you want to start carrying out other types of activities, you can make changes to the state register and add new codes (or remove unnecessary ones).

We recommend reading: What tax to choose when opening a private retail business 2021

- retail sale of information and communications technology and equipment, such as computers, peripheral equipment, telecommunications equipment and consumer electronics, in specialized stores

Business Solutions

- the shops

clothes, shoes, products, toys, cosmetics, appliances Read more

- warehouses

material, in-production, sales and transport organizations Read more

- marking

tobacco, shoes, consumer goods, medicines Read more

- production

meat, procurement, machining, assembly and installation Read more

- rfid

radio frequency identification of inventory items More details

- egais

automation of accounting operations with alcoholic beverages Read more

Taxation of commission trade

Taxes are levied for the intermediary services of a retail facility, that is, charges are made only on the remuneration received from the buyer. This fact is recorded in the general ledger of account 90. If you work under the simplified system (STS), then article number 251 of the Tax Code states that revenue for goods sold is not taken into account as income, but only commissions are considered as income. In addition, the “simplifier” is not required to issue an invoice for its products. This is done by companies working with VAT.

Mediation activities

Intermediary activity is the activity of an agent (commission agent, attorney) within the framework of an agency agreement (commission agreement, agency agreement).

Intermediary activity is the activity of an agent (commission agent, attorney) within the framework of an agency agreement (commission agreement, agency agreement). There is no definition of the term “intermediary activity” in the legislation, but such a phrase itself is used.

Thus, the Decree of the President of the Russian Federation dated January 29, 1992 N 65 “On Freedom of Trade” determined: “Give enterprises, regardless of their form of ownership, as well as citizens the right to carry out trade, intermediary and procurement activities without special permits with the payment of established payments and fees...”

The All-Russian Classifier of Types of Economic Activities (OKVED) defines codes for intermediary activities, for example:

70.3 Provision of intermediary services related to real estate

74.87.2 Providing intermediary services for organizing the purchase and sale of small or medium-sized commercial enterprises, including professional practice.

Under an agency agreement

one party (agent) undertakes, for a fee, to perform legal and other actions on behalf of the other party (principal) on its own behalf, but at the expense of the principal or on behalf and at the expense of the principal.

Under a transaction made by an agent with a third party on his own behalf and at the expense of the principal, the agent acquires rights and becomes obligated, even if the principal was named in the transaction or entered into direct relations with the third party for the execution of the transaction.

In a transaction made by an agent with a third party on behalf and at the expense of the principal, the rights and obligations arise directly from the principal (Article 1005).

According to the commission agreement

one party (the commission agent) undertakes, on behalf of the other party (the principal), for a fee, to carry out one or more transactions in its own name, but at the expense of the principal.

Under a transaction made by a commission agent with a third party, the commission agent acquires rights and becomes obligated, even if the principal was named in the transaction or entered into direct relations with the third party for the execution of the transaction (Article 990 of the Civil Code of the Russian Federation).

According to the contract of assignment

one party (the attorney) undertakes to perform certain legal actions on behalf and at the expense of the other party (the principal). The rights and obligations under a transaction completed by an attorney arise directly from the principal (Article 971 of the Civil Code of the Russian Federation).

As can be seen from the above definitions, the essence of intermediary transactions is that the intermediary acts on behalf of another person and at his expense.

The peculiarity of the sale of goods under an intermediary agreement is that the intermediary does not acquire ownership of the goods.

Example

The seller of the goods turned to an intermediary company with a request to find buyers and sell his goods.

The seller and the intermediary entered into a commission agreement, under which the commission agent (intermediary) assumes the task of finding a buyer and selling him the goods at a price not lower than that established in the agreement on his own behalf.

For the fulfillment of this order, the principal (seller) pays the commission agent the remuneration specified in the contract.

The commission agent, having found a buyer, enters into a purchase and sale agreement with him on his own behalf. Having received funds from the buyer, he transfers them to the principal. The commission agent's remuneration may be paid by the principal or deducted from the income received by the commission agent from the sale.

Accounting and taxation with an intermediary

has its own characteristics. For accounting and income tax purposes, the intermediary reflects only the amount of its remuneration in income. The amount of goods received for sale by an intermediary is not reflected in the balance sheet accounts. Revenue received from buyers is not recognized as intermediary income.

For VAT, the intermediary also calculates and pays VAT on the amount of his remuneration. The specifics of calculating VAT by an intermediary are determined by Art. 156 of the Tax Code of the Russian Federation.

28.07.2016

How do retail outlets work?

Before opening, you must register with the tax office, select the OKVED code for commission trade, pay the state fee, write two statements about opening a store and about applying the simplified taxation system. Then register with the Pension Fund and obtain permission from the local administration to sell used items. In addition, you should notify Rospotrebnadzor about your activities and obtain a permit from the fire inspectorate.

Scheme of your future activities

The algorithm for this type of point is as follows:

- A client comes to you and wants to sell a used item.

- You set the price.

- You draw up a mutual agreement.

- You are selling a product.

- You take the reward for yourself.

Results

Having considered what OKVED is, we can say that choosing the correct code will not be very difficult; the main thing is to carefully read the reference book itself. In this case, for agent services for finding clients, there is no exact match in the directory, and we can use the code 82.99. If you doubt the correctness of the selected code, you can always call the tax office and consult with them.

You can find the current reference book in the section “All-Russian classifiers assigned to the Ministry of Economic Development of Russia” on the website of the Ministry of Economic Development of Russia.