Hello, Vasily Zhdanov, in this article we will consider the revaluation of non-current assets and their calculation according to RAS. The cost of various goods in a modern market economy is constantly changing, and many of them can be purchased by organizations for the purpose of exploitation in the course of business activities. The cost of a purchase this year may be much more or less than the price for which the product was purchased previously. Therefore, companies have the right to monitor the prices of items used in production and to recalculate the value of existing assets to account for the difference. We are talking about the revaluation of property. We propose to understand how the revaluation of non-current assets is carried out, and how the results and consequences are reflected in the financial statements.

Revaluation of non-current assets in the balance sheet is

Line 1340

reflects the amount of increase in the value of non-current assets, identified based on the results of their revaluation:

[Credit balance on account 83 “Additional capital”] (in terms of amounts of additional valuation of fixed assets and intangible assets)

A commercial organization can no more than once a year (at the end of the reporting period) year) revaluate groups of similar fixed assets at current (replacement) cost.

When making a decision on revaluation of such fixed assets, it should be taken into account that subsequently they are revalued regularly so that the cost of fixed assets at which they are reflected in accounting and reporting does not differ significantly from the current (replacement) cost.

Revaluation of an object of fixed assets is carried out by recalculating its original cost or current (replacement) cost, if this object was revalued earlier, and the amount of depreciation accrued for the entire period of use of the object.

The results of the revaluation of fixed assets carried out at the end of the reporting year are subject to reflection in accounting separately.

The amount of revaluation of an object of fixed assets as a result of revaluation is credited to the additional capital of the organization. The amount of revaluation of an item of fixed assets, equal to the amount of its depreciation carried out in previous reporting periods and attributed to the financial result as other expenses, is credited to the financial result as other income.

The amount of depreciation of an item of fixed assets as a result of revaluation is included in the financial result as other expenses. The amount of depreciation of an object of fixed assets is included in the reduction of the organization’s additional capital formed from the amounts of the additional valuation of this object carried out in previous reporting periods. The excess of the amount of depreciation of an object over the amount of its revaluation, credited to the organization's additional capital as a result of revaluation carried out in previous reporting periods, is charged to the account of retained earnings (uncovered loss).

When an item of fixed assets is disposed of, the amount of its revaluation is transferred from the organization's additional capital to the organization's retained earnings.

The amount of additional valuation of intangible assets as a result of revaluation is credited to the additional capital of the organization. The amount of revaluation of an intangible asset, equal to the amount of its depreciation carried out in previous reporting years and attributed to the financial result as other expenses, is credited to the financial result as other income.

The amount of write-down of an intangible asset as a result of revaluation is included in the financial result as other expenses. The amount of the writedown of an intangible asset is included in the reduction of the organization’s additional capital formed from the amounts of the additional valuation of this asset carried out in previous reporting years. The excess of the amount of depreciation of an intangible asset over the amount of its revaluation credited to the organization's additional capital as a result of revaluation carried out in previous reporting years is charged to the financial result as other expenses.

When an intangible asset is disposed of, the amount of its revaluation is transferred from the organization’s additional capital to the organization’s retained earnings (uncovered loss) account.

The results of the revaluation of intangible assets carried out at the end of the reporting year are subject to reflection in accounting separately.

Accounting, calculation of revaluation of fixed assets.

Revaluation calculation:

Let's consider the procedure for calculating the amount of revaluation of initial cost and depreciation:

- Revaluation (Increase in value).

- Markdown (Decrease in cost).

A) Overestimation. Consider an example:

Revaluation is carried out for the first time.

The initial cost of the OS is 2,500,00 rubles.

The amount of accumulated depreciation is 700,000 rubles.

Current (market value) 3,000,000 rubles.

SPI (useful life) 120 months, straight-line accrual method.

Solution:

The revaluation of the initial cost will be 500,000 rubles. (3,000,000-2,500,000).

Debit 01 Credit 83-500,000 rubles.

Fixed assets revaluation coefficient 1.2 (3,000,000 /2,500,000).

The amount of accumulated depreciation after revaluation of fixed assets will be 840,000 rubles. (1.2*700,000).

The amount of depreciation adjustment (revaluation) will be 140,000 rubles. (840000-700000)

Debit 83 Credit 02-140,000 rubles.

Starting next year, depreciation on fixed assets per month will be. 25,000 rubles. (3,000,000/120).

B) Markdown. Let's look at an example:

Initial cost of the fixed asset: 1,000,000 rubles.

Current cost (expert assessment) 800,000 rubles.

Amount of accumulated depreciation: 200,000 rubles.

SPI (useful life) 24 months. Linear method.

Solution:

The difference between the original and current cost is 200,000 rubles. (1,000,000-800,000), a posting is made for this amount

Debit 91 Credit 01,200,000 rubles.

Conversion factor 0.8 (800,000/1000,000).

What should be the accumulated depreciation after revaluation of 160,000 rubles. (0.8*200,000)

Depreciation markdown (adjustment) -40,000 rubles. (160000-200000)

Debit 02 Credit 91-40,000 rubles.

Depreciation from next year will be. 33,333 rubles (800,000/24)

Revaluation entries:

Depending on the markdown, revaluation being carried out for the first time, or the markdown after revaluation, or the revaluation after markdown, the postings will be different. Let's look at each of them in detail in different situations:

- Additional assessment is carried out for the first time.

- The assessment is carried out for the first time.

- The first was markdown, then revaluation.

- The first was an additional valuation, then a markdown.

1) Additional assessment is carried out for the first time , during the first additional assessment the following entries will be made (Let's use the example from task A):

a) Debit 01 Credit 83-500,000 rubles. -An additional estimate of the original cost was made.

b) Debit 83 Credit 02-140,000 rubles. - Depreciation was adjusted.

2) The markdown is carried out for the first time (we will use the conditions of task B, read above):

a) Debit 91 Credit 01-200,000 rubles. - Markdown of original cost

b) Debit 02 Credit 91-40,000 rubles - Markdown (adjustment) of accrued depreciation.

3) The first was markdown, then revaluation . (We will use the conditions and data of the solutions to problems A and B)

The previous markdown cost of the OS was reduced by 200,000 rubles.

The previous markdown reduced depreciation by 40,000 rubles.

An additional assessment of the cost of the fixed assets was made to 500,000 rubles.

Depreciation was additionally estimated by 140,000 rubles.

Solution: revaluation of wiring:

a) Debit 01 Credit 91-200,000 rubles - Additional valuation of fixed assets within the limits of the previous markdown.

b) Debit 91 Credit 02-40,000 rubles. Additional assessment of depreciation within the limits of the previous markdown.

c) Debit 01 Credit 83-300,000 rubles. (500000-200000) -Additional valuation in excess of the previous markdown.

d) Debit 83 Credit 02-100,000 rubles (140,000-40,000) - Additional valuation in excess of the previous markdown.

4) The first was an additional valuation, then a markdown.

Example conditions:

Previous revaluation of the cost of fixed assets (on account 83): 500,000 rubles.

Previous additional estimate of depreciation (on account 83): 140,000 rubles.

Current markdown of the original cost: 700,000 rubles.

Current depreciation markdown: 200,000 rubles

Postings:

a) Debit 83 Credit 01-500,000 rubles. Depreciation within the limits of the previous revaluation.

b) Debit 02 Credit 83-140,000 rubles. Markdown of depreciation within the limits of the previous revaluation.

c) Debit 91 Credit 01-200,000 rubles. (700000-500000) Depreciation in excess of the previous revaluation.

d) Debit 02 Credit 91-60,000 rubles. (200000-140000) Depreciation markdown in excess of the previous revaluation.

Revaluation of non-current assets

Related publications

Revaluation of non-current assets in the balance sheet is the amount of increase in their value resulting from the revaluation. This information is reflected in the 3rd section of the liabilities side of the balance sheet, participating in changes in the volume of retained earnings and separately highlighting the amount of revaluation of fixed assets and intangible assets. This will be discussed in the article.

Methods for carrying out PI

There are two ways to carry out revaluation - direct price recalculation and indexation. The recalculation method is the most common. To implement it, it is necessary to determine the market price of the items of property subject to PI. To obtain information about this, you can use manufacturers' websites, special literature, government statistics, the services of independent appraisers, etc. After this, you can re-evaluate using the calculations described in the next section.

The second PI method is practically not used. To implement it, you need to know deflator indices - price indices (in our case for SAI). Until 2001, government statistics agencies regularly provided information on the SAI price index. Now such a service can only be obtained for a fee from the same statistical authorities.

Which assets are overvalued and why?

Revaluation is possible for long-term financial investments, fixed assets and intangible assets. It is practiced to smooth out the difference between the original price of an object and its market value at a certain point in time. It is believed that a five percent gap between these two indicators is a reason for revaluation. It should be noted that revaluation is not a mandatory procedure; it may not be carried out until the need arises. However, the company does not have the right to revalue the property whenever it wants. This decision must be recorded in the UP.

All property of the company may be subject to revaluation, or categories of similar items may be formed, which the company has the right to determine independently.

There are many reasons for revaluation. For example, an organization plans to sell part of its assets, or wants to attract investment, for which it needs to obtain a loan, etc. In addition, companies have to control the value of net assets, which should not fall below the size of the company's authorized capital.

What is replacement and market price?

Replacement price is the cost of completely restoring an item of property in the event of its breakdown or loss. In other words, this is the money that the company must pay for exactly the same item if the old one ceases to participate in production activities. Market price is the price at which a newly purchased item can be sold. That is, this is the money that can be received if you decide to sell the property immediately after purchase (at the time it is included in the accounting).

In fact, in our case there is no difference between the replacement price and the market price. In some situations, for example, when a company receives an item of property free of charge, it is included in accounting at the market price. Then we can say that the market value becomes the original value. In our case, the market price becomes the replacement price.

Revaluation of non-current assets (fixed assets and intangible assets): how to take into account?

Commercial companies have the right to revalue homogeneous categories of fixed assets at current (replacement) cost no more than once a year. The procedure is carried out by recalculating the initial value of the object (or already the replacement value, if this is not the first revaluation) and the amount of depreciation accrued during the period of its use. Those. simultaneously with the change in the value of the fixed asset/intangible asset, the amount of accrued depreciation is proportionally recalculated.

Revaluation pursues the goal of bringing the accounting value of an asset as close as possible to its market value, which, based on market realities, can either increase or decrease. Therefore, depending on various circumstances, both an additional valuation (increase in value) and a markdown, i.e. its reduction, can be carried out. The results of the revaluation of fixed assets and intangible assets are reflected in the company’s accounting:

- The additional valuation is recorded in additional capital (account 83);

- The markdown is included in the financial result as another expense (account 91).

When disposing of fixed assets or intangible assets, their increased value from additional capital is transferred to retained earnings.

Changes in the value of financial investments

Changes in the amounts of financial investments are attributed to the results of operations, creating the following entries:

- D/t 58 - K/t 91, if their value is increased to market value and income is received;

- D/t 91 - K/t 58, if investments have fallen in price and expenses have been allowed.

Consequently, the revaluation of investments is involved in the formation of the company’s financial result (account 99), and in the 3rd section of the balance sheet it will be reflected in retained earnings (account 84) on line 1370.

Thus, the balance sheet line 1340 will reflect the result of the revaluation, expressed in an increase in the value of the objects, i.e. account balance 83. In this case, line 1130 records the cost of fixed assets with changes included in it based on the results of revaluation (similarly, line 1110 – the changed value of intangible assets), and line 1350 should reflect the amount of additional capital without taking into account the results of revaluation. When the value decreases (markdown) and the investment amounts change, the revaluation process will be recorded on the results (account 99) and will be present in line 1370 along with the balance on account 84.

What can be overvalued in non-current assets?

The latest edition (dated 04/06/2015) of the full form of the balance sheet, approved by order No. 66n dated 07/02/2010, divides non-current assets into 9 lines, which essentially contain data on 5 types of assets:

- OS (this includes lines for OS, profitable investments, material exploration assets).

- Intangible assets (these are lines for intangible assets, R&D, intangible exploration assets).

- Unfinished investments in fixed assets and intangible assets (data on them in the balance sheet is either distributed between the lines of fixed assets and intangible assets, or allocated to the line of other assets).

- Long-term (for a period of more than a year) financial investments.

- SHE.

Revaluation rules

The revaluation of non-current assets is subject to a number of rules:

- It is voluntary (except for situations requiring the revaluation of securities). Therefore, the decision to carry it out (or not) must be reflected in the accounting policies.

- The fact of making a decision to conduct a revaluation makes it mandatory in relation to selected groups of fixed assets and intangible assets at the end of each reporting year (clause 15 of PBU 06/1, clause 18 of PBU 14/2007). Mandatory revaluation of financial investments is carried out at the organization's discretion monthly, quarterly or once at the end of the year (clause 20 of PBU 19/02).

- Revaluation involves bringing the accounting value of assets to their current market value. Therefore, this cost must be documented. And since both an increase and a decrease in value are possible on the market, both revaluation and depreciation will occur in relation to assets.

- When revaluing depreciable property (fixed assets or intangible assets), simultaneously with a change in the value of the asset itself, the amounts of depreciation accrued on it are recalculated in a similar proportion, i.e., essentially, the residual value of the asset is revalued.

What is the point of holding a PI?

As was already mentioned at the beginning of the article, prices for various things that can become the SAI of a company are constantly changing. Revaluation of non-current assets allows you to equalize the original cost of these assets and make them the same as the prices on the market at a given time.

There are many reasons for PI. It must be carried out if it is necessary to sell part of the property or the entire company as a whole. If a company decides to attract investment, it is also necessary to conduct an investment project if the attraction concerns obtaining a loan. To do this, the price of the collateral must be reliably determined. And since the collateral is the company’s property, it is impossible to do without PI. If a decision is made to place (issue) securities, a revaluation of property is also carried out, since the authorities must know the real financial position of the company (issuer) that will issue securities into circulation.

Simply for the sake of improving investment attractiveness for potential investors, PI is also necessary. If the company's net assets fall below its authorized capital, the company risks going bankrupt. Therefore, to clarify the value of assets, a revaluation of property is also necessary. If a decision is made to insure property, an insurance base must be formed. PI is also needed here. Also, the reasons for revaluation include processes of mergers and acquisitions of companies, especially if these processes concern foreign companies operating under the international financial reporting standard (IFRS). In such cases, PI is mandatory. When an item of property becomes obsolete, when its market price drops sharply against the background of new developments, revaluation makes it possible to equalize the cost of existing items with their market price for more accurate information about the financial situation of society. There are other reasons for PI.

Accounting for revaluation and reflection in the balance sheet

Each change in the value of financial investments is attributed to the current financial result (clause 20 of PBU 19/02), which is expressed in the transactions:

Dt 58 Kt 91 – cost increased to market value (income received);

Dt 91 Kt 58 – cost reduced to market value (consumption reflected).

Accordingly, the revaluation of financial investments will participate in the formation of the total amount of the current financial result (account 99) and in the balance sheet will appear in the “Capital and Reserves” section on the line “Retained earnings (uncovered loss)”, reflected there together with the balance of account 84.

The revaluation carried out in relation to fixed assets and intangible assets is shown in accounting according to the same rules (clause 15 of PBU 06/1 and clause 21 of PBU 14/2007):

- The first revaluation (an increase in the value of an asset with a simultaneous commensurate increase in the depreciation accrued on it) goes to additional capital (account 83) to its separate subaccount in two entries:

Dt 01, 04 Kt 83 – asset value added;

Dt 83 Kt 02, 05 – depreciation has been added for it.

- The first markdown (a decrease in the value of an asset with a simultaneous commensurate decrease in the depreciation accrued on it) is reflected in the current financial result:

Dt 91 Kt 01, 04 – asset value reduced;

Dt 02, 05 Kt 91 – depreciation on it has been reduced.

Subsequent revaluations are made from the current (replacement) value (i.e. from what was already revalued earlier) taking into account the previous result:

- An additional valuation to an existing revaluation will increase the amount reflected in account 83 by transactions similar to those made during the first revaluation.

- An additional valuation in the event that there was previously a markdown should be attributed to account 83 only to the extent that exceeds the previous markdown. Accruals within the amount of the previous markdown will be taken into account in the financial result by postings that are reverse to those made during the first markdown:

Dt 01, 04 Kt 91 – asset value added;

Dt 91 Kt 02, 05 – depreciation has been added for it.

- A markdown carried out after a previously occurring revaluation reduces the amount listed on account 83 by postings that are reverse to those made during the first revaluation:

Dt 83 Kt 01, 04 – asset value reduced;

Dt 02, 05 Kt 83 – depreciation on it has been reduced.

If the amount of the markdown exceeds the amount of the existing revaluation, then the amount of this excess must be included in the financial result using entries similar to those made during the first markdown.

- A markdown carried out following a previous markdown is recorded by additional postings similar to those made during the first markdown.

In the event of disposal of an asset, the amount of additional valuation on it, listed in account 83, increases the amount of retained earnings: Dt 83 Kt 84.

Thus, in the balance sheet in the “Capital and Reserves” section, the line “Revaluation of non-current assets” will only include the balance according to the corresponding analytics available in account 83, i.e. the total of the recorded amount of revaluation (increase in asset value). In all other situations, the process of revaluation of fixed assets and intangible assets will be reflected in the current financial result (account 99) and will participate in the generation of data on the line “Retained earnings (uncovered loss)” together with the balance on account 84.

To learn about the value of fixed assets and intangible assets to calculate the property tax base, read the material “How to determine the residual value of fixed assets .

System for revaluation of property (postings, features)

Depending on whether the property was revalued previously, the system for conducting the first/new revaluation will be different:

| The situation with property revaluation | Property revaluation system |

| Revaluation is being carried out for the first time | The additional valuation will be charged to Kt account 83 “Additional capital”. The markdown is charged to account 91.2 “Other income and expenses”. If the revaluation was made at the beginning of the year, and not at the end, the value of the markdown will be assigned to Account 84 “Retained earnings (uncovered loss)”. Depreciation is subject to recalculation. |

| Revaluation is repeated | The new revaluation should be included in additional capital. If the value is equivalent to the previous markdown, the additional assessment is added to Kt account 91.1. If the value exceeds the old value, the remaining value is transferred to additional capital. |

| The property has already been discounted | The new value must be credited to account 91.2. If markdown is carried out at the beginning of the year - to account 84. |

| The property has already been overvalued | The additional capital must be reduced by the value of the markdown. If its value is > the previous value, first the additional capital must be reduced by the amount of the previous markdown. The remaining value will go to account 91.1. If the markdown is at the beginning of the year - to account 84. |

Accounting entries when revaluing non-current assets (fixed assets):

| Revaluation procedure | Operation | DEBIT | CREDIT |

| Revaluation (first revaluation of an asset) | Reflected revaluation | 01 | 83 |

| Increased depreciation | 83 | 02 | |

| Markdown (first revaluation, or previously there was a markdown) | Markdown reflected | 91.2 | 01 |

| Reduced depreciation | 02 | 91.1 | |

| Markdown (first revaluation at the beginning of the year, or previously there was a markdown) | Markdown reflection | 84 | 01 |

| Reduced depreciation | 02 | 84 | |

| Revaluation (previously there was a markdown) | Reflection of revaluation | 01 | 91.1 |

| Overestimation of depreciation | 91.2 | 02 | |

| Residual value of revaluation | 01 | 83 | |

| Residual depreciation value | 83 | 02 | |

| Markdown (previously revaluation was carried out) | Markdown reflection | 83 | 01 |

| Depreciation markdown | 02 | 83 | |

| Residual markdown value | 91.2 | 01 | |

| Residual depreciation value | 02 | 91.1 | |

| Markdown (at the beginning of the year, previously revaluation was carried out) | Markdown reflection | 83 | 01 |

| Depreciation markdown | 02 | 83 | |

| Residual markdown value | 84 | 01 | |

| Residual depreciation value | 02 | 84 |

Revaluation of assets. What should you keep in mind?

Agricultural organizations can clarify the value of assets. In relation to fixed assets, this can be done using revaluation. Organizations decide on their own whether to conduct it or not. But it should be taken into account that in accounting, revaluation must be considered in conjunction with the reflection of transactions in accounting accounts and in reporting, as well as assessing the tax consequences. As a rule, such an event is held in the first quarter.

We organize revaluation

Revaluation of non-current assets

Non-current assets in accounting are property that is used by a company in business activities for more than a year, transferring its value to the cost of finished products in parts and capable of generating income for the organization. Non-current assets include fixed assets (PBU 19/02), deferred tax assets, as well as other non-current assets (Order of the Ministry of Finance of Russia dated July 2, 2010 N 66n). The classification of non-current assets is given in a separate consultation.

Account 08 “Investments in non-current assets” is used to reflect acquired non-current assets and collect costs to bring the asset to a state suitable for use in the organization’s activities.

Non-current assets are the fundamental basis of an organization's production process. The final financial result of the organization depends on how they are formed at the initial stage of creating a company, how non-current assets are managed in the future, and how effectively they are used in the business process. To assess the current structure and condition of fixed production assets, as well as the efficiency of their use, an analysis of non-current assets is carried out.

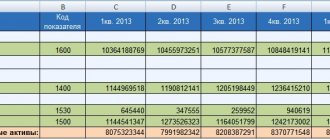

Analysis of non-current assets

When analyzing non-current assets to assess the condition of fixed assets, the following indicators are determined:

- depreciation rate, which determines how worn out the assets are;

- serviceability coefficient used in assessing the obsolescence of assets;

- retirement ratio, showing the share of assets retired from operation;

- renewal coefficient, which determines the share of received assets at the end of the year;

- and other indicators.

When analyzing non-current assets in order to determine the efficiency of using fixed assets, the following indicators are calculated:

- turnover ratio of non-current assets (capital productivity), the growth of which indicates an increase in the efficiency of assets;

- coefficient of investment activity of fixed assets;

- return on assets, the growth of which indicates an increase in the efficiency of use of assets (read more about the profitability of non-current assets in a separate consultation;

- and other indicators.

In addition to analyzing fixed production assets, a company can carry out a revaluation of non-current assets, which is a revision of the cost at which certain property of the organization was acquired by comparing this value with the current (replacement) value.

Revaluation of non-current assets

Revaluation of non-current assets is carried out on the basis of a decision to carry it out. Information about the revaluation of fixed production assets (which assets are subject to revaluation, the frequency of its implementation, etc.) will need to be fixed in the accounting policy of the organization.

When making a decision on the revaluation of a group of similar objects of fixed assets and intangible assets, their assessment at current (replacement) cost must be carried out regularly at the end of the reporting year (no more than once a year) (clause 15 of PBU 6/01, clause 17, clause 18 of PBU 14/2007).

The company must reassess the value of financial investments (securities), for which a procedure has been established for determining their current market value. Subsequent assessment of financial investments can be carried out by the organization, at its choice, monthly, quarterly or once at the end of the year (clause 20 of PBU 19/02). Small businesses are exempt from revaluation of financial investments (clause 19 of PBU 19/02).

Based on the results of the revaluation, fixed assets or intangible assets can be either discounted or overvalued. The amounts by which fixed assets or intangible assets have been discounted are reflected in account 91 “Other income and expenses” separately in the subaccounts “Revaluation of fixed assets” and “Revaluation of intangible assets” and are included in the financial result. And the amounts by which fixed assets or intangible assets were overvalued are recorded on account 83 “Additional capital” separately in the context of the subaccounts “Revaluation of fixed assets” and “Revaluation of intangible assets”. When revaluing depreciable property, simultaneously with a change in its value, the amount of depreciation accrued on it is also recalculated (clause 15 PBU 6/01, clause 21 PBU 14/2007).

Changes in the value of financial investments are reflected in account 91 “Other income and expenses” and are included in the financial result (clause 20 of PBU 19/02).

Please note that for tax purposes, revaluation of fixed assets or intangible assets is not carried out.

Answers to frequently asked questions on the topic “Revaluation of non-current assets”

Question: If the management of an enterprise has decided to revaluate property, does this mean that it will be necessary to revaluate or discount all assets in the company?

Answer: No, revaluation can be carried out only in relation to property that needs to be revalued or devalued.

Question: How to form groups of property objects for the purpose of their revaluation?

Answer: At the legislative level, there are no requirements for grouping assets according to strictly defined criteria. When grouping objects, you should pay attention to similar technological characteristics, operating purposes, etc., not to qualities such as color or to the location of assets. For example, equipment can be classified into one group, but fixed assets located in one warehouse (if this is the only grouping criterion) cannot.

Revaluation of non-current assets in the balance sheet

Revaluation of non-current assets in the balance sheet is a separate line with code 1340 in Section III “Capital and Reserves”, which indicates the balance of account 83 (analytical accounts of the amounts of revaluation of fixed assets and intangible assets) (Order of the Ministry of Finance of Russia dated July 2, 2010 N 66n, clause 15 PBU 6/01, clause 21 PBU 14/2007).

The amounts of depreciation of fixed assets and intangible assets, as well as the results of the revaluation of financial investments are reflected in account 99 “Profits and losses” and are used to generate balance sheet data on line 1370 “Retained earnings (uncovered loss)” (Order of the Ministry of Finance of Russia dated July 2, 2010 N 66n, clause 15 PBU 6/01, clause 21 PBU 14/2007, clause 20 PBU 19/02).