Each tax agent (individual entrepreneurs, enterprises and organizations) annually submits to the Federal Tax Service at the place of registration

For many of us, a valid mark in the work book is a guarantor of a certain well-being and

The essence of the process of introducing online cash registers Since 07/01/2017, the following have become mandatory for use by persons receiving cash proceeds:

Letter of the Federal Tax Service of Russia dated 06/03/2020 No. BS-4-11/ [email protected] Question: About entering information about codes by legal entities

In the course of its activities, in addition to labor relations with employees, the organization may interact with individuals

In this article, Professor M.L. Pyatov continues to acquaint readers with the provisions of the new law “On

We contribute property to the authorized capital You can contribute not only money to the authorized capital of a company,

Author: Ivan Ivanov Inventories represent one of the most important parts of financial statements. The decisive role is played by the correct

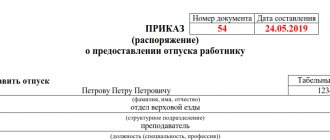

How to draw up an order correctly An order to satisfy an application for leave is drawn up by personnel service employees

Is return to the simplified tax system income of the Organization and individual entrepreneurs on the simplified tax system does not reflect monetary