In the course of its activities, in addition to labor relations with employees, an organization can interact with individuals - order work from them. In such cases, a civil law agreement (GPC) is concluded. In this article we will look at how to reflect a GPC agreement in 1C 8.3 Accounting step by step.

Our organization entered into an agreement for the installation of plastic windows with Oleg Sergeevich Makarov.

He is an individual, not employed by us, lives in Russia. The cost of services is 35,000 rubles. The program needs to reflect accruals for GPC, withhold personal income tax and reflect contributions to pension and health insurance.

What is a GPC agreement, when is it needed, why is it appropriate?

A civil law agreement (CLA) is an agreement for the provision of services or the performance of work on the instructions of the customer, for which remuneration is expected to be paid.

This is a job or service that is one-time in nature. The fact of its completion is reflected in the certificate of completion of work. The agreement is drawn up in writing if the amount exceeds ten thousand rubles. The contractor has the opportunity to combine work under several contracts and attract third parties to perform the work.

In this case, the customer can terminate the GPC agreement at any time.

What types of civil law contracts are there:

- work agreement;

- contract for paid services;

- storage agreement;

- contract of agency;

- agency contract;

- transport expedition or transportation.

How are such relations regulated by law, what documents should be drawn up in 1C ZUP?

Relations between participants under a contract are regulated by the Civil Code of the Russian Federation. When concluding a GPC agreement, no hiring is carried out, no order is issued in the T-1 form, and no note is made in the contractor’s work book.

He must present to the customer his

- TIN,

- SNILS,

- passport.

For a foreigner, a work permit or patent is required. The contract is concluded for a certain period, includes a list of works or services, as well as the cost of remuneration. The contract is not included in the T-3 “Staffing Schedule” form, does not provide benefits and guarantees for individuals, and wages are not paid under it. This is not an employment relationship between employer and employee. This is the main difference. Under the contract, sick leave is not paid and annual paid leave is not provided.

Labor relations involve personal performance of the functions provided for in the job description, and this is a long-term daily process that corresponds to the operating mode of the organization. An employee does not have the right to hire an assistant. The employer is required to keep a time sheet and pay for work at night, overtime, weekends and holidays. And also ensure proper working conditions (working clothes, equipment, workplace). The customer is not responsible for this. At the same time, the contractor under the contract sets his own working hours and plan for completing the work, and can attract a subcontractor to help him.

If, in fact, the relationship between an organization and an individual is labor, the individual has the right to go to court and recognize such an agreement as an employment contract.

An employment contract is of interest to regulatory authorities, such as the Social Insurance Fund (FSS) and the Labor Inspectorate, since under such an agreement there are obligations to comply with labor standards and pay contributions to the funds, for failure to comply with which they have the right to impose sanctions, issue fines and calculate penalties.

Calculation of remuneration under a contract in 1C ZUP 3.1: step-by-step instructions

Step 1: Setup

The 1C:ZUP 3.1 program provides functionality for calculating remuneration under contract agreements. To enable it, you can use the program’s initial setup assistant and check the “Use GPC agreements” checkbox.

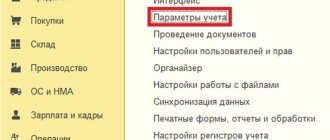

If you have been working in the program for a long time and cannot enter the initial setup assistant, do not worry, you can open the “Settings” menu, go to “Payroll calculation” and check the box “Payments under GPC agreements are registered”.

Step 2. Fill out personnel information

Next, we need to go to the “Personnel” section, the “Employees” directory and create a new one. We fill in the last name, first name and patronymic, INN, SNILS, date of birth, gender. The program will automatically check by last name, first name and patronymic whether such an individual is in the directory, offer to use it or create a new one. At this point, it is very important not to miss if such an individual is already in the database in order to avoid duplication of data. We save the entered data.

The program will highlight in color and display a message if the entered TIN or SNILS is incorrect. Using the “Insurance” hyperlink we will indicate the insurance status of an individual, and using the “Income Tax” hyperlink we will establish the “resident” status and the right to apply deductions if necessary. After this, click the “Complete Agreement” hyperlink.

Step 3. Create an agreement

We fill out the contract period. Enter the contract amount and select the payment method. There are three options: a lump sum at the end of the contract, according to certificates of completion and at the end of the contract with advance payments every month.

It is possible to indicate the need to calculate insurance premiums against accidents. It is also possible to indicate to which account the posting for uploading to 1C:BP 3.0 will be generated.

Conduct and close the contract.

It is also worth noting that the number of executed contracts with the same individual in the 1C: ZUP 3 program is not limited.

Although contracts are concluded with individuals who may not be employees of the enterprise, accounting for contracts is not automated and is not provided for in the 1C:BP 3.0 program; the 1C:ZUP program is also intended for these purposes, since the organization will act as a tax agent for income tax individuals not only for their employees, but also for individuals with whom contracts have been concluded.

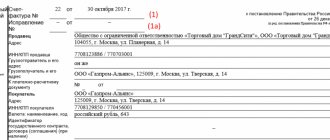

Based on the contract, we can create a certificate of completion of work. Let's file two acts. The first act dated February 12, 2021 in the amount of 20,000 rubles. Payment date is February 12. Accrual month February 2019.

The program provides printed forms of the contract and the acceptance certificate for completed work. You can also edit these forms and add your own.

Step 4. Calculation

Let’s create an accrual of remuneration under a contract; to do this, go to the “Salary” section - “Accruals under contracts” and create a document. We select the accrual month February 2021, date 02/12/2019. On the “Agreements” tab, click “Fill out”. The program calculated the accrual result using information from work completion certificates. Please note that this document does not calculate insurance premiums for compulsory pension and health insurance.

The personal income tax tab calculates the amount of personal income tax. Under a work contract, professional deductions are provided in the event that expenses associated with the execution of the contract, for materials, for example, are not compensated. The standard deduction is available for the executor and/or his children. Deductions apply throughout the duration of the contract. If remuneration is not paid every month under the agreement, then deductions are still applied for each month of the agreement. Personal income tax is not withheld from the cost of materials, transportation or other expenses that the organization compensates to the contractor under the contract.

After that, in this document, click on the button “Pay”, “Post and close”. The program will create a statement for the cash register.

The statement will be in the form of “accruals under contracts”.

At the end of the month, we will reflect the certificate of completion of work for the remaining amount of remuneration. The accrual month is February 2021, the act date is 02/28/2019, the accrual will be calculated during the final payroll calculation.

In the act, the “account as” field can be of two types: payroll settlements and settlements with counterparties. The first type corresponds to accounting account 70, the second – to account 76. Postings with such correspondence will be generated in 1C: Enterprise Accounting 3.0 after exchanging data with 1C: Salary and Personnel Management 3.0.

For the final payroll calculation, we will create a “Payroll” document. In addition to information about the calculated salary, personal income tax and insurance premiums for employees of the enterprise, in this document, on the “Contracts” tab, accruals under work contracts will be filled in, and the income tax on individuals executing the contract will be calculated.

If the contract includes accident insurance, insurance premiums will be calculated at the end of the month using the “Payroll” document.

In this case, income under a contract is subject to insurance contributions for compulsory pension and health insurance. Insurance premiums for non-resident performers will be calculated based on their status: permanent resident, temporary resident, temporarily staying in the Russian Federation.

After that, by clicking the “Pay” button, we will create a statement to the cashier for payment.

A statement will be created for the cash register with the “salary accrual” type.

In order to reflect accounting entries, after calculating wages for the entire month, create and fill out the document “Reflection of wages in accounting.” After synchronization, this document will be loaded into the 1C: Enterprise Accounting 3.0 program and, when posted, will generate the necessary transactions.

Creation of contractual employees

A GPC agreement in 1C 8.3 ZUP can be issued both to a person who is not an employee of the organization, and to an employee of the organization. Both elements are entered into the Employees . At the same time, if a GPC agreement is concluded with employees of an organization, then you do not need to create a separate element in the Employees . It is advisable to create a separate element if:

- It is planned to pay the amounts under the GPC agreement separately Gazette... (in this case in Vedomosti... in field Pay you need to select a value Remuneration to employees under GPC agreements. For amounts for the same employee, but only under an employment contract, you should indicate in the same field Salaries of workers and employees):

- It is required to generate separate Payslips (Salary – Salary reports – Payslip) for the employee according to the amounts of the GPC agreement and the employment contract.

How to report on personal income tax?

For tax accounting in terms of filling out the regulated 6-NDFL report, line 100 will reflect the date of actual receipt of income under the contract, that is, the date of payment from the statement. The date of tax withholding is line 110, also the date of payment of income according to the statement. Line 120 will indicate the deadline for transferring the tax - no later than the day following the day the income is paid. This date is automatically determined by the program.

To always fill out reports without errors and in an up-to-date form, enter into a support agreement with the First BIT company. Our specialists will help you update the program and draw up a report. They will also answer all your questions.

Setting up the program

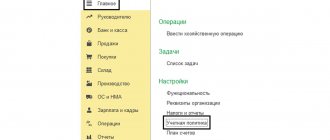

In older versions of the GPC accrual program, they were reflected through manual operations. But since the release of 1C 3.0.77 (September 2020), these operations have been automated. To do this, let's go to the program functionality settings.

On the “Employees” tab, check the “Contract agreements” checkbox.