Home / Taxes / What is VAT and when does it increase to 20 percent? / Rate and base

Back

Published: December 28, 2017

Reading time: 7 min

0

422

According to the current legislation of the Russian Federation, the VAT interest rate is of three types - zero, 10%, 18%. For a group of goods produced and sold in Russia, you can get a 10% rate. All necessary requirements are enshrined in the legislative acts of the Tax Code of the Russian Federation.

- List of goods subject to the VAT rate of 10% Food products

- Goods for children

- Medical products

- Printed products

- Breeding cattle

- Air transportation

In what cases is VAT 10% from January 1, 2020

There are several rates for value added tax in Russia. In 2021, their value is 0%, 10% and 20% (clauses 1-3 of Article 164 of the Tax Code of the Russian Federation). The difference between them is due to:

- linking to certain types of activities, most of which involve crossing Russian borders - for a 0% rate;

- providing preferential tax conditions for a number of goods and some services - at a rate of 10%.

A rate of 20% should be used in all other situations, if they do not require the use of a calculated rate (derivative of 10% or 20%), at which the tax is calculated from the amount that includes its value (clause 4 of Article 164 of the Tax Code of the Russian Federation).

In what cases does 10 percent VAT apply? As of 01/01/2020, VAT 10% applies (clause 2 of article 164):

- to a number of food products, including: live cattle and poultry;

- meat obtained from them and products made using this meat (except for delicacies);

- products arising during the life of livestock and poultry (milk, eggs) and products created on their basis;

- vegetable oil, with the exception of palm oil, which is subject to VAT at a rate of 20% from 10/01/2019 (law dated 08/02/2019 No. 268-FZ);

- margarine and special purpose fats;

- sugar and salt;

- bread, cereals, flour, pasta;

- live fish and seafood (except delicacies) and products made from them;

- products made for children and diabetics;

- vegetables, including potatoes;

- from 10/01/2019 - fruits and berries, including grapes (law dated 08/02/2019 No. 268-FZ);

There are some nuances in applying the 10% rate to fruits and berries. Read about them in the Review from ConsultantPlus. Trial access to the system can be obtained for free.

- goods intended for children: knitwear;

- garments for sewing production (except for products made of genuine leather and natural fur, with the exception of sheepskin and rabbit);

- shoes (except sports shoes);

- beds, mattresses, strollers, diapers;

- toys and plasticine;

- stationery intended for training and development;

ConsultantPlus experts spoke in detail about how VAT is assessed on the sale of medical equipment and medicines. Get trial access to the system for free and go to the Ready-made solution.

- transportation carried out by air within Russia (except for those taxed at a rate of 0%).

By type (in relation to the codes of these types), the goods listed in this list are specified in the decrees of the Government of the Russian Federation:

- dated December 31, 2004 No. 908 - in relation to food products and goods for children;

- dated September 15, 2008 No. 688 - on medical goods;

- dated January 23, 2003 No. 41 - in relation to printed materials.

Therefore, to find an answer to the question: “What goods are subject to VAT of 10 percent in 2021?” — you should refer not only to the current edition of the Tax Code of the Russian Federation, but also to the current editions of these resolutions, keeping in mind that the text of the first of the documents (Resolution No. 908) was updated twice during the year.

Food Taxation: Rate Options

There are three options for VAT rates on products - 0.10 and 20% after the introduction of changes. Previously, interest rates were 10 and 18, now the largest interest rate is 20%, the preferential rate of 10% has not been changed.

The benefit applies, for example, to meat, however, there are exceptions in which cases the percentage will be maximum. Delicacies are not classified as socially significant goods. The preferential interest rate will apply to milk, bread, and products such as mayonnaise.

Changes in the list of products and children's goods in 2019-2020

From 07/01/2020, the import and sale of some milk-containing products with milk fat substitute will be taxed at a rate of 10%. Thus, the list of food products on the sale of which a tax must be paid at a rate of 10% includes the following milk-containing products with a milk fat substitute:

- drinks, cocktails and jelly;

- jellies, sauces, creams, puddings, mousses, pastes and soufflés;

- condensed canned food.

In addition, sales of milk-containing ice cream should also be taxed at a reduced rate. These changes are provided for by Government Decree No. 250 dated 03/09/2020.

In 2021, changes to Resolution No. 908, containing a list of products and goods for children subject to VAT of 10 percent, were introduced by resolutions of the Government of the Russian Federation:

- dated 01/30/2019 No. 58 (effective from 02/09/2019) - they added fish fillets and other fish meat (including minced meat) in fresh and chilled form to the list of products;

- dated 12/06/2018 No. 1487 (effective from 04/01/2019) - the list of amendments here is quite wide.

What exactly does the update in the list of goods with 10 percent VAT apply to? What specific products and children's products does it apply to? The full list of changes is as follows:

- in terms of food products: for live livestock and poultry, an indication has been added that the benefits do not include their breeding species;

- for fats and oils of animal origin, as well as for palm, coconut, palm kernel babassu and other vegetable oils, the marking on their intended use for food purposes is excluded;

- for soups and broths prepared with meat, it is clarified that they do not include not only vegetable ones, but also others that do not contain meat;

- ornamental rodents and reptiles have been added to the number of animals excluded from the list of consumers of boiled feed;

- it is clarified that other types of edible ice are also excluded from the list of benefits;

- the list includes hatching eggs, with the exception of breeding eggs;

- the composition of products for animal feeding has been detailed, and ornamental rodents and reptiles have been added to the list of those excluded from the list of consumers;

- The codes for onions and bulbous vegetables, as well as for other vegetables, have been clarified;

- the list of preferential knitwear and clothing products has been significantly expanded by adding the definition “similar” to the text of the description;

Thus, due to the changes in 2021, the list of goods with a VAT rate of 10 percent has expanded.

Confirmation of preferential regulation

Many tax payers often have the question of how to confirm the VAT rate of 10%? It is imperative that all agents report to their inspection on time and without errors. So, if a tax agent applies preferential regulation, then he is obliged to attach to the reporting documents confirmation of the 10% VAT rate on children's goods and other objects sold. In other words, he must document the actual sale of goods subject to the rules of the law with a VAT rate of 10%. How to do this? You can confirm the legality of the use by collection agents of the 10% VAT tax rate by sending to the inspection a compliance document containing information about the object of compliance, making it possible to find compliance with the required OKP code.

Results

The 10% VAT rate is considered preferential and applies to goods specified in the Tax Code of the Russian Federation, but with product type codes mentioned in special decrees of the Government of the Russian Federation. In paragraph 2 of Art. 164 of the Tax Code of the Russian Federation, as well as one of the indicated resolutions (No. 908), changes were made in 2019-2020 that expanded the list of goods sold at a reduced rate.

Sources:

- Tax Code of the Russian Federation

- Government Decree No. 688 dated September 15, 2008

- Government Decree No. 908 dated December 31, 2004

- Government Decree No. 41 dated January 23, 2003

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

What value added tax rates are applied in the Russian Federation?

The amounts of established tax tariffs when calculating value added tax are prescribed in Article 164 of the Tax Code of the Russian Federation:

- 0% - export, international transportation (clause 1 of Article 164 of the Tax Code of the Russian Federation);

- 10% - a list of goods with a preferential VAT rate, recognized by the Government of the Russian Federation as socially significant;

- 20% - all other operations recognized as sales;

- 20/120 and 10/110 - calculated, used when the tax base includes tax (receipt of an advance, withholding by a tax agent);

- 16/167 – provision of services by foreign companies in electronic form, sale of an enterprise as a property complex.

Types of medical goods subject to VAT rate 10

Some medical products have been added to the list of goods subject to VAT at rate 10. Thus, medicines and medical products are taxed at a rate of 10 percent. To obtain the right to apply this benefit, you must have a registration certificate, as well as compliance of the object with the codes.

Hot discussions

Relatively recently, a law was adopted to increase the VAT rate. If previously it was 18%, now the size will be 20%. More than half of the deputies voted for the increase. At the same time, a number of amendments were adopted related to the establishment of a preferential rate of 0% for transportation to the Far East, Crimea, and Kaliningrad.

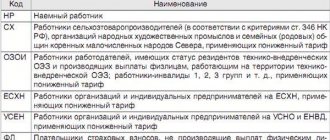

The size of the payment percentage for agricultural producers in 2021, including the Unified Agricultural Tax, has been repeatedly discussed. VAT rates under the Unified Agricultural Tax in 2021 do not apply in the case of exemption from payers' obligations if the income for the previous year did not exceed 100,000,000. In the new year 2021, the maximum amount of revenue will decrease to 90,000,000 per year. In 2021 – up to 80 million, in 2021 – 70, etc. The rate for producers of agricultural goods, for example, grain, wheat, will be 10%. There is an established list according to which it is allowed to introduce a low tariff.

Example of applying VAT rate 10

To apply the 10% rate, it is important to have confirmation of entry into the list. To apply such a percentage for medical products, appropriate certification and registration are required.

Let's look at an example of how this rate is used. For example, it sells children's products, including soft toys. On 05/10/2016 she entered into an agreement with organization “B”, and on 06/11/2016 she sold part of the products. The party amounted to 700 thousand.

According to the provisions of the Tax Code, this version of the product is taxed at a preferential interest rate of -10. The base will be seven hundred thousand. You need 700,000*10%/110 = 63636.36. Thus, the total cost including tax will be 763636.36.

Confirmation of right to bet 10

Not all products are subject to the 10 percent VAT rate. With VAT, which is reduced, the state provides incentives for certain types of activities.

A prerequisite for switching to a new percentage is its confirmation. If the object was released by a company registered in the Russian Federation, it is required to indicate the code according to the classifier, after which the accuracy of the information is checked.

When selling medical products, it is mandatory to present a certificate and registration. To reduce the payment percentage, you must submit to the Federal Tax Service confirmation of the product’s compliance with the requirements.

There is a set list of products that are eligible for a preferential rate. It includes food, things for children, some medicines and products, books, etc.

Confirmation steps:

- Studying the full list of objects subject to benefits.

- Registration.

- Collection of documentation.

After a full inspection, it is possible to obtain permission for a reduced rate. To avoid any difficulties during registration, it is recommended to familiarize yourself with the provisions of the Tax Code in advance.

Tax exemption

There are objects that are not subject to VAT. Their full list is presented in the Tax Code; it is not supplemented and is closed. Thus, no tax is collected on the sale of medical equipment, some products for medical purposes, and means for the rehabilitation of the disabled.

Particular attention is paid to goods of own production of payers who are engaged in the production of agricultural goods. Ores of valuable metals, rough diamonds, and goods supplied as part of gratuitous assistance are also not taxed.