For many of us, a valid mark in the work book is a guarantor of a certain well-being and stability in life. Today, the overwhelming majority of the working-age population of Russia is employed somewhere, goes to work every day and earns a living. The trouble that goes beyond this harmonious picture comes down to the fact that the average earnings, due to various circumstances, do not suit many of us. In view of this, there is a need for an additional source of income. There are not many people burdened with responsibilities who are able to give up their small but stable income in favor of private enterprise. Actually, this is why, and maybe for some other reasons, newly minted individual entrepreneurs and those who just want to become one do not strive to immediately leave hired work, but are looking for ways and loopholes in the legislation in order to skillfully learn to combine the status of an individual entrepreneur with the main job. Is this possible in principle, what would be a good idea to pay attention to and whether the game is worth the candle - we will tell our clients about this later in our article.

Can an individual entrepreneur work in another place using a work book?

Any citizen (with the exception of state and municipal employees, deputies who carry out their activities on a permanent basis) has the right to register an individual entrepreneur while already working for hire. The same applies to those who provide services under a civil contract.

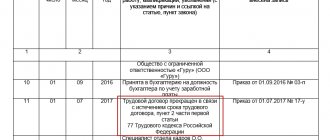

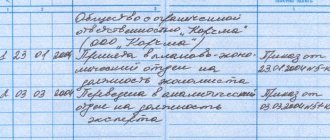

The employee who makes such a decision is absolutely not obliged to notify his employer about this. The personnel service is not provided with information about their receipt of a certificate of state registration. A work book is a document for making records of work as an employee. Individual entrepreneur data is entered into the state register.

In the same way, any individual entrepreneur can officially get a job. He comes to the interview as an individual. Entrepreneurial status does not matter to the employer.

The employment contract guarantees him access to all the benefits of such cooperation:

- he receives wages on time;

- along with others, is entitled to bonuses;

- he is granted leave at the expense of the employer;

- the employer pays the necessary insurance premiums from his income.

Naturally, an employed entrepreneur is obliged to fulfill the duties specified in the contract and behave in accordance with the labor regulations determined by local regulations.

Types of employment

There are two types of part-time work:

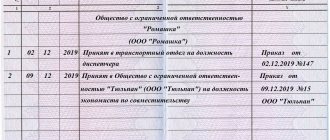

- Internal. An employee works at one company, but at the same time performs different functions. In employment agreements, the same organization acts as the employer. The option is quite simple to design and comfortable for both parties. A person actually has one place of work, but performs several job functions. There are also no difficulties with registering a work book, since it is stored in both work options in one place. Another advantage is that there is no need to re-assemble the package of necessary documentation; the employer can independently make duplicates of the necessary papers.

- External. In this situation, the employee enters into two employment contracts with different companies. Accordingly, the workplaces will be located at two different addresses. This option is much more complicated than the first and requires separate paperwork for employment. Yes, and there may be problems with granting sick leave or vacation.

The current legislation of the Russian Federation allows both options for combining activities, so the right to choose remains with the employee.

In what cases is this combined?

Running a business and working as an employee can be successfully combined. There is a whole list of positions that allow you to earn good money and leave time and energy for developing your own business in order to replenish your budget with additional income.

However, current practice leads to certain conclusions: not every field of activity has conditions that allow working and developing an individual business. What aspects should you pay special attention to?

Situation 1.

Official citizens want to open their own business. First, they need to find out exactly whether it is possible to simultaneously work as an employee and be an individual entrepreneur at the same time. The main risk is the danger of going broke if the new business does not bring the planned profit. Such fears are justified, so it is better not to interrupt the employment relationship at first.

There are also restrictions when registering a new status. For this to happen, the citizen must meet the requirements established for opening an individual entrepreneur. He must:

- be of legal age;

- have Russian citizenship;

- meet the category of full legal capacity;

- document the absence of prohibitions on such activities.

Limitation of legal capacity is established by a court decision. This procedure can be performed on people with mental disorders or those diagnosed with drug, alcohol or gambling addictions.

Note! The parameters of a certain age and legal capacity are established because entrepreneurial activity is accompanied by a high degree of risk, and a beginning businessman must have a good understanding of the potential danger.

The requirements that must be met before registration do not contain a clause stating that only an unemployed person can become a businessman. The legislator designates this OJSC or LLC as a legal form of organization. Individual entrepreneur is interpreted as a special status of an individual. It makes it possible to engage in commercial activities legally.

With their new status, entrepreneurs also take on certain responsibilities. They have to:

- maintain reports and submit them to government agencies;

- pay mandatory contributions to the Pension Fund and the Federal Tax Service;

- independently bear responsibility for the obligations assumed.

By registering as an individual entrepreneur, a person remains an individual; he retains all the rights and obligations of an ordinary Russian citizen. He can still carry out work if he wishes.

Situation 2.

An individual entrepreneur wants to get a hired job. The legislation in force in 2021 does not prohibit combining business and work activities. So the answer to the question whether an individual entrepreneur can get a job officially is positive.

An individual entrepreneur is the same individual, and the Constitution of the Russian Federation protects his rights. In Art. 37 states in detail that every person has the freedom to dispose of his own labor as he sees fit. These postulates are enough for an individual with the status of an individual entrepreneur to enter into an employment contract with a third-party organization.

It is possible to combine your business and your main job, but it is quite problematic. Business, especially at the development stage, requires constant monitoring of what is happening. If a person runs his own business and at the same time has an employment relationship, then he needs to plan his time so that productivity at his main job does not suffer. Otherwise, difficulties may arise with your superiors.

When combining positions is prohibited

Some categories of civilians cannot officially work two jobs at the same time. It refers to:

- For minor children. They work only in one place and receive additional benefits.

- People doing hard work. They expend a large amount of physical effort to perform their job duties, and they need time to recover.

- Employees working in hazardous industrial production.

- Other categories of citizens. In Art. 282 of the Labor Code of the Russian Federation states that, in addition to the Labor Code, the activities of some employees are controlled by other regulatory documents, which may contain a ban on combining activities. Employees of the prosecutor's office cannot combine service and earn extra money; police; judges; deputies; employees of the Central Bank of the Russian Federation, etc.

Sometimes working two jobs at the same time is officially acceptable, but with some reservations. For example:

- The director of an enterprise can be a part-time worker in another organization, having permission to do so from the owner.

- Athletes or coaches combine positions only after obtaining permission from higher authorities.

An important point when finding a part-time job is the availability of free time from your main activity to perform job duties. Accordingly, it is officially possible to work two jobs only if the schedules do not coincide (for example, a rotational employment method).

What risks can you face?

Anyone officially working with a registered individual entrepreneur may experience a number of difficulties. The most important ones include the following:

- It is difficult to combine two types of activities. His own business also requires a lot of time, even if the entrepreneur hires employees to carry it out. Therefore, when deciding to organize a business, you need to think carefully about how to organize everything so that you have some personal time left for your family or vacation.

- The businessman does not have a social package. Receiving vacation or sick leave pay is only permissible at the place of official employment.

- Being an employee of an organization or working at an enterprise, an ordinary employee is not responsible for the company’s losses. But the business owner is personally involved in all financial aspects; he is responsible for losses with his own property.

Organizing your own business attracts people with possible independence, freedom to make decisions, and enhanced development of their potential. However, this increases the risk of using unprofitable sources of financing. You need to be prepared for a decrease in purchasing power, currency fluctuations, and many other negative factors. If something seriously goes wrong, the business will be destroyed, and its owner will be left with an empty wallet.

Important! Combining an individual entrepreneur with their main job is most convenient for those who work on a shift or flexible schedule.

It is difficult to combine individual entrepreneurs and work under an employment contract for those involved in labor relations on a full-time basis. In this case, to facilitate the functioning of the business, it is logical to employ a person to keep records. For example, a remote accountant can help out.

A self-employed individual entrepreneur may face a negative reaction from a controlling employer. Such managers strive to ensure that their employees give their all to their main job, and they do not have any energy left for other activities. They will not welcome distracted business on the side, especially without notifying their superiors.

Entrepreneurs, compared to other forms of business, do not have ample opportunities to delegate authority. If at his official place of work he occupies an administrative position that requires a lot of effort to control, it is likely that managing his own business will fade into the background. This can lead to serious consequences.

If an individual business coincides with the responsibilities at work or the tasks performed are similar, at some points the situation will be characterized as an attempt to dishonestly conduct business, or even sabotage. Such conclusions can lead not only to loss of work, but also business reputation.

It is important to minimize risks, approach creating a business responsibly, focusing on common sense, carefully studying tax and pension policies in order to clearly understand in each specific case whether it is possible to both work and be an individual entrepreneur.

Who is an employee?

First of all, in the conditions of commodity-production relations, there is one form in which an individual can enter into professional interactions with an organization. At the same time, it becomes a participant, a “component” of the enterprise. In modern conditions, a subject can realize his objective need to receive cash income in almost one form - as an employee. This means that, to one degree or another, he takes part in the creation and operation of the enterprise. Legally, all members of the team belong to the category in question. According to their economic situation, they all act as partners. An employee is also a member of a certain category of society who receives income for his activities from sources not generated through operations performed by him. In this case, he does not need to enter into a relationship with a legal entity to participate in the process of formation and operation of the enterprise. In addition, there is no need to generate revenue for the organization. The company has its own money, from which employees are paid.

Pros of being hired

- The main risks lie with the business owner. You don’t have a headache about where to get money for your salary. Didn't get paid on time? Okay, a letter to the labor inspectorate and the prosecutor's office. Let the scoundrel be punished!

- Responsibility for earning money is shared with the employer. It's your job, it's his money. Somehow we don’t worry whether there will be money or not. There should be, and that's all there is to it. It’s the boss’s responsibility to find you money for your salary, not yours, and this thought somehow makes you feel better.

- "Stability". You always know that give or take on such and such days, you will receive such and such an amount. I put stability in quotes, you’ll understand why later.

- Pension (some kind, maybe someday - something will happen).

- You can quickly change your job if you are not happy with something (unlike business).

- Free on-the-job training.

- Employment opportunities: career growth, honor and respect from colleagues, etc.

Disadvantages of working for hire

- A certain loss of freedom of choice.

- You are selling your time (the most precious resource a person has) to achieve someone else's goals. You only achieve your goals (financial), and even then incompletely. Although, if you like the work, then this point does not apply.

- Lack of opportunity (or limited opportunity) to influence your income. It is hardly possible to grow your income by 2-5 times. Especially, if you grow, there’s nowhere in the company/city (my situation is in the past).

- High level of stress (not always, but often).

The most important disadvantages are the restriction of freedom (you have to be at work on average 8 hours a day, and you don’t always decide when to rest and when to work).

The second (as a consequence of the first) is serious restrictions on earning opportunities. You simply don’t have time to evaluate (see) the opportunity to make money, much less turn it into money.

You can “clean money karma” as much as you like, pronounce affirmations for money, change bad beliefs about money... But if you are employed, what can God (the Universe, Life) give you in this case:

- Increase in salary by 10-20%?

- One-time bonuses?

- New job with higher pay?

Of course, all this is good, but it does not fundamentally change the situation. If you are satisfied with everything, and this is possible, then, as they say, good luck.

Paying taxes

What happens when a person is officially employed, but at the same time takes up entrepreneurship? He receives a salary at his place of work, and the organization also pays all the necessary contributions to the funds for him. At the same time, the entrepreneur himself transfers fixed insurance and pension payments. There is some duplication, but it is impossible to change this situation.

There is only one option to reduce payments. By agreement with the employer, you can terminate the employment contract, and for the same scope of activity enter into an agreement with him as an individual entrepreneur.

Additional Information! This can be done if there are suitable areas among the available OKVEDs. You can also add them, the procedure will not require additional payment.

It may be beneficial for an employer to accept such an offer. After all, he not only pays salaries, but also pays almost 50% additionally in the form of taxes and contributions. You can draw up an agreement with an individual entrepreneur, increasing direct payments so much that he receives at least 30% more and has enough to pay 6% of the simplified tax system and remain in the black.

However, this option is legal only if certain conditions are met:

- An entrepreneur receives money for performing a certain amount of work.

- There is no job description.

- There are no mandatory hours in the office.

- Vacations and sick leave are not paid.

- The individual entrepreneur does not bear financial responsibility and works with other contractors.

Specific conditions must be carefully discussed with the employer before terminating the employment contract. If, in fact, there is an employment agreement, it cannot be disguised by passing it off as other forms.

Operating mode

For persons who are part-time workers, there is a restriction on working hours

according to Article 284 of the Labor Code. In one day, an employee must work no more than four hours (unless he is relieved of duties at the main workplace!), and in a month his employment cannot exceed half of the working time, the norm of which is established for a specific position or profession. That is, such work activity implies payment of half the rate (50% of the official salary).

If an employee is employed in several jobs at once (this is not prohibited by labor legislation), the salary for him is calculated within conditional limits, for example, at 0.25% of the rate.

The full rate (full salary for a working day) is paid only for days that were worked in full. For example, a teacher worked all day when he was free from his main work activity, or worked on a holiday or day off. For these days he will receive a full salary.

The employment regulations are described in detail in our article. How do I find out if sick pay is included in the calculation of vacation pay? The link has the information you need. You can better understand what salary deductions are by reading our material!

Relations with the employer

The law does not limit the desire of an individual with individual entrepreneur status to get hired. In the same way, citizens who have their main place of work are not prohibited from becoming entrepreneurs.

It happens that superiors are absolutely indifferent to what their subordinates do outside the organization or enterprise.

It happens that it welcomes this scenario, hoping that for an employee who has income on the side, regular salary increases will not be fundamentally important.

There is a third option: the employer is categorically against it, because he sees in this the danger of careless performance of work duties due to heavy workload. If the situation does not change, he may do everything possible to encourage the person to quit.

Registration of an individual under the Labor Code of the Russian Federation

Employment of a citizen in Russia occurs as follows:

- a specialist is selected from several job applicants when a competition is announced;

- an employment agreement (contract) is concluded between this individual and the entrepreneur, which can be fixed-term or signed for an indefinite period;

- In large companies, lawyers are involved in the development of this agreement, because it is this document that is checked primarily by regulatory authorities;

- the procedure for employing a citizen under the Labor Code must take into account a number of nuances, in particular - the employee becomes familiar with a number of local regulations: regulations on remuneration, internal labor regulations, collective agreement (if any), etc. Personnel accounting requires significant labor and time expenditure from the entrepreneur.

The advantages of drawing up employment contracts between an employee and an entrepreneur are listed in the table below:

| Obvious advantages of an employment contract | |

| For the employer - individual entrepreneur | For individuals |

| use of knowledge and experience of highly qualified specialists | the presence of a permanent, stable job every day, the possibility of long-term planning of the family budget |

| absence of staff turnover in the absence of conflicts of interest between the parties | social guarantees that an employee receives when signing an employment contract (the right to paid leave, receiving additional payments and bonuses in accordance with local regulations, payment of sick leave and the right to proper rest) |

| professionals can increase business profitability several times | prospects for career growth if you have the makings of a leader and creative potential |

| accumulation of insurance experience and formation of pension savings (caring for the future) | |

An employee hired under the Labor Code of the Russian Federation is obliged to strictly follow the labor regulations in the team. His working day is strictly regulated, i.e. has a clear duration. For all overtime, the individual entrepreneur must pay extra money or provide additional time off.

Important: the minimum amount of remuneration paid under employment contracts in Russia is established and approved by law. For example, as of January 01, 2021 The minimum wage is 9,489 rubles, and from May 1, another increase in the value is planned - it will be equal to the amount of the regional subsistence minimum.

When an employee is dismissed, according to the Labor Code of the Russian Federation, he is entitled to be paid compensation for unused vacation, and in case of staff reduction, severance pay.

Who should not combine work and individual entrepreneurs?

Not everyone who receives an official income from employment can become an individual entrepreneur. Russian legislation clearly defines the list of positions in which it is impossible to combine the status of an individual entrepreneur. This applies to:

- state civil and municipal employees, including through proxies;

- judges;

- notary employees;

- employees of the Ministry of Internal Affairs and other law enforcement agencies;

- military personnel;

- directors of state enterprises;

- deputies of all levels exercising these powers on an ongoing basis.

Such restrictions are based on political, economic and human risks. It is necessary to reduce as much as possible the potential opportunities for committing corrupt acts for those who are vested with serious powers of power.

To prevent conflicts of interest, they can combine their main activities exclusively with teaching or research.

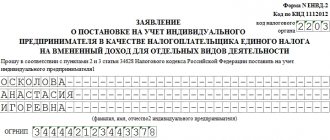

Registration of individual entrepreneur

An individual entrepreneur is most often denied registration due to an incorrect application or provision of an incomplete package of necessary documents. In addition to this, there are other reasons that cannot be ignored. Thus, the following persons do not have the right to register as an individual entrepreneur and engage in entrepreneurial activities:

- State Duma deputies;

- Fed. Meetings;

- other levels that work constantly;

- heads of municipalities;

- other persons who engage in various types of public activities.

Is it necessary to inform your employer about your status?

There is no need to notify your management about doing business during your free time. Theoretically, this does not affect the relationship with the employer. However, in practice sometimes it turns out differently. So it is necessary to decide what is the right thing to do in each specific case, based on prudence and expediency.

Thus, combining the open status of an individual entrepreneur and employment is quite legal. Sometimes this can bring additional benefits to the employer. Starting a business is not difficult, but you should study and weigh all the positive and negative aspects in advance. If you are afraid to part with your main job, but you also want to develop your own business, it is more convenient to start with the activity that is easiest to combine.

Part-time and combination

It is necessary to clearly distinguish between the concepts of part-time and part-time work, since these are two different categories that are formalized differently and paid differently. A part-time worker is always an employee who performs other duties in his free time, and such work can be indefinite.

A part-time worker is a person who, during his working hours, combines the performance of his main duties and additional ones. Such work is always temporary and cannot be performed without the written consent of the employee.

Remuneration for part-time workers and part-time workers occurs on different bases and is calculated differently. The first - based on the provisions of the employment contract, the second - by agreement of the parties. Usually this is a percentage of wages or a strictly agreed amount.

In addition, these two categories of employees are issued with different documents and are taken into account differently when filling out documents for the tax service. These two categories of workers - part-time and part-time workers - must be correctly taken into account and properly registered at the enterprise in order to avoid fines.

In addition, there is a certain circle of people who cannot perform part-time work:

- heads of enterprises and organizations;

- minors;

performing work under harmful and difficult working conditions, if part-time work implies the same conditions.

Back to contents

Nuances of drawing up contract agreements

The procedure for concluding civil contracts is regulated by another code - the Civil Code of the Russian Federation. Registration of an individual under such a document to perform certain work occurs as follows:

- the entrepreneur needs to perform some kind of work that can be measured in quantitative terms - hours, tons, kilometers, etc.;

- an individual is ready to undertake a given amount of work for a certain remuneration;

- the work of a person hired under a contract does not have a time frame - he can work day, night, take any breaks, etc. The main thing is that he must achieve the result by the initially agreed upon date;

- a civil contract may contain a list of the rights and obligations of the parties, but the main points of the document will remain the scope of work, its specification, the amount of payment and completion dates;

- Upon delivery of the work to the customer-entrepreneur, all legal relations between the parties are terminated. No compensation, vacation pay, sick leave, etc.

Important: the contractor has the right to involve assistants in the work, the goal is a faster solution to the task.

The amount of deductions to extra-budgetary funds from work contracts is slightly less when compared with the tax burden on the fund of employees with employment agreements. The difference is insurance premiums for temporary disability in the Federal Social Insurance Fund of Russia. But there are exceptions to this rule - the employer specifically insures some contractors against injuries (most often these are workers whose work involves a risk to life).

A executed GPC agreement is not the basis for making entries in a citizen’s work book. The insurance period does not accumulate.

Taxes and contributions of individual entrepreneurs working for hire

So, we answered the question whether it is possible to work officially as an employee and open an individual entrepreneur at the same time. Now let’s figure out what will happen to taxes in such a situation.

In relation to the employee, the company is a tax agent and insurer. This means that she withholds personal income tax from the amounts due to him at a rate of 13%. In addition, the employer pays contributions to the budget for the employee’s pension, medical and social insurance, and from his own funds. What to do with all these payments if a citizen has received the status of an individual entrepreneur?

The answer is simple - all these payments will remain. That is, nothing will change in terms of the amount that a citizen earns as an employee. But the individual entrepreneur makes all transfers from business income himself in accordance with the taxation system he has chosen.

And another popular question: is it possible to open an individual entrepreneur and not pay insurance premiums if you are officially employed? After all, the employer continues to do this. No, you won't be able to save money. From the amounts that an individual entrepreneur receives from his business, he is obliged to pay contributions to pension and health insurance himself.