Debt offset Adjustment of debt is a business transaction that has a direct impact on the total result of

Characteristics An enterprise can establish one of the following types of work schedules according to the Labor Code of the Russian Federation: Daily

No one is immune from tax debt. Is it possible to write off the resulting debt if

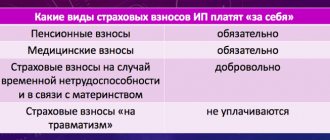

Which BCCs are valid for individual entrepreneurs’ insurance premiums in 2021? Have new codes been introduced?

At the beginning of 2021, the procedure for calculating the amount of taxes on wages changed in the Russian Federation.

About the form Most small businesses submit their balance sheet for 2016 in the form approved by order

Accounting entries for income tax are a reflection of business transactions in the accounting of an organization

What property is recognized as depreciable for tax purposes in 2017–2018 In 2017–2018 still

Is it possible to charge penalties on penalties? This article describes in detail whether it is possible to charge

Employer reporting Current as of June 29, 2017 What are the deadlines for submitting a report on Form 4-FSS