Taxes and contributions Alexey Borisov Leading expert on labor relations Current as of June 29

2-NDFL The 2-NDFL certificate reflects all amounts paid to the employee, withheld personal income tax and deductions provided.

The wage fund (WF) is all expenses for personnel wages, including

Among labor disputes, one can highlight disputes based on or related to night work.

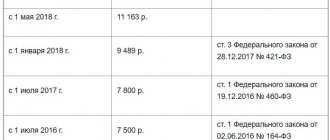

Entrepreneur's insurance premiums are divided into two parts. One is fixed, set in a fixed amount

Changing the procedure for submitting financial statements On January 1, the Federal Law of November 28, 2018 comes into force

Providing workers of certain professions with special clothing is the responsibility of the employer in accordance with the Labor Code of the Russian Federation (Article 221). TO

Economic phenomena in the country inevitably affect the quality of life of each of its residents. Together with

Home — Articles The pension fund will not accept a personalized report with negative amounts of accrued insurance

In the process of financial activity, many companies provide loans to each other. Previously we looked at how