Home — Articles

The Pension Fund will not accept a personalized report with negative amounts of accrued insurance contributions. Let's look at how to avoid this in the 1C program.

In what cases can the amounts of accrued insurance premiums turn out to be negative? As a rule, this situation arises when the amount of overpaid vacation pay for days not worked is withheld from the dismissed employee. If the amount of vacation pay subject to withholding exceeds the salary for the last month of work, the final amount of accruals will be negative and the amount of accrued insurance premiums for this month will also have a minus sign. Let's look at how to fix this in the program "1C: Salaries and Personnel Management 8 edition 2.5". We will show the sequence of operations using an example.

Arguments against

The Russian Tax Service outlined its position regarding cases of payers indicating negative contributions in the calculation of insurance premiums in letter No. BS-4-11/16793 dated August 24, 2021. Of course, we are talking about periods from the first quarter of 2017. Since it was only on January 1, 2017 that tax authorities began to oversee these mandatory contributions (except for contributions for work-related injuries and illnesses).

Also see “Insurance premiums from 2021: memo from the Federal Tax Service.”

The Federal Tax Service believes that from the rules of Section II “General requirements for the procedure for filling out the Calculation” of the Procedure, which was approved by Order No. ММВ-7-11/551 dated October 10, 2021, a negative amount of insurance premiums is not provided for when filling out the corresponding lines of this report.

Also, the tax authorities’ rejection of a negative amount in calculating insurance premiums is based on the specifics of personalized accounting for each insured person maintained by the Russian Pension Fund.

Thus, there are regulations for the interaction of the territorial structures of the Pension Fund of the Russian Federation with the regional departments of the Tax Service (approved on September 21, 2016 No. MMV-23-1/20 and No. 4I). As part of it, tax authorities actively and constantly exchange data with the fund. Namely, they upload information from calculations on accrued contributions for compulsory pension insurance to the Pension Fund. Let us remind you that this is Section 3 of the calculation “Personalized information about insured persons”:

Then the Pension Fund transfers them to the individual personal accounts of the insured persons.

According to the law, the Pension Fund returns the received data to the tax authorities within 5 working days from the date of receipt from them in the case (clause 2 of Article 11.1 of the Law of 01.04.1996 No. 27-FZ “On transfer accounts in the OPS system”):

- detection of errors and/or contradictions in the submitted data;

- inconsistency between the presented data and the information held by the Pension Fund of the Russian Federation, which does not make it possible to take this information into account in the individual personal accounts of the insured.

The Federal Tax Service states that it has studied, as part of a regular exchange, the grounds for refusal on which the Pension Fund does not accept data from it for the purposes of personalized accounting. There are many cases where the submitted calculation contains accrued negative insurance premiums in 2021. And the fund cannot transfer them to individual personal accounts of insured persons in the compulsory pension insurance system, since this may violate their rights.

Thus, the calculation of insurance premiums with a minus is ultimately not beneficial to the employees themselves.

When else will they ask for clarification?

Calculations for insurance premiums must be submitted:

- to the tax authority at the location of the organization;

- to the tax authority at the location of separate divisions of organizations that are authorized to accrue payments and other remuneration in favor of individuals;

- to the tax authority at the place of residence of the individual making payments and other remuneration to other individuals.

The calculation will be considered not submitted if it contains unacceptable errors:

- the amounts of insurance contributions for compulsory pension insurance, which are calculated for each of the last three months of the billing (reporting) period as a whole for the payer based on a base that does not exceed the maximum value (line 061 of subsection 1.1 of Appendix 1 to Section 1), do not correspond to the amount of calculated contributions for all insured persons for the specified period (the amount of line 240 of subsection 3.2.1 of section 3);

- Inaccurate personal data identifying the insured persons is indicated: Full name, SNILS, Taxpayer Identification Number (if available).

If discrepancies are detected, the tax authority will send a notification to the payer. The payer is obliged to eliminate the detected inconsistencies and resubmit the payment as a primary one.

The following deadlines have been established for this:

- five days from the date of sending the notification in electronic form;

- ten days from the date of sending the notice on paper.

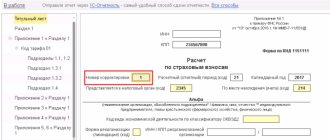

In the “Adjustment number” field on the title page of the clarifying calculation, when eliminating inconsistencies, you must indicate “0—”.

If the payer meets the five-day deadline (ten days for a paper report), then the date of submission of the calculation with clarifications will be considered the date of submission of the initial calculation, which was recognized as not submitted.

This procedure for providing a clarifying calculation for insurance premiums is set out in paragraph 7 of Article 431 of the Tax Code.

How to act

The Federal Tax Service of Russia offers two ways to combat negative accruals of insurance premiums:

- Conduct explanatory work with payers on correctly filling out a single calculation of contributions.

- Oblige payers to make the necessary adjustments and submit an updated version of the calculation to the Federal Tax Service.

Also see “Rules and procedure for clarifying payments to the Federal Tax Service for insurance premiums from 2017.”

Let us remind you that when filling out updated calculations for insurance premiums for previous reporting (calculation) periods, you should act in accordance with the general rules - which are enshrined in the order of the Federal Tax Service of October 10, 2016 No. ММВ-7-11/511, as well as Art. 81 of the Tax Code of the Russian Federation.

In the current reporting (calculation) period, the amount of recalculation made for the previous period does not need to be included in the calculation.

Read also

19.09.2017

We correct reporting to the Pension Fund of Russia

After data transfer, corrective reporting forms should be submitted to the Pension Fund:

- RSV-1 PFR;

- individual information.

Corrective form RSV-1 Pension Fund of Russia

To create the corrective form RSV-1 of the Pension Fund for the first quarter of 2013, in the “Payroll calculation” interface, menu “Reports” - “Regulated reports”, add a new report, specifying the calculation type “corrective”. And we fill it out taking into account the transfer made (Fig. 5).

Report on form RSV-1 PFR

Figure 5

The generated report will take into account the adjustments made. The PFR RSV-1 corrective form can be downloaded and transferred to the fund at any time as soon as it is ready.

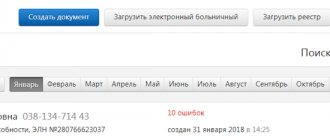

Preparing corrective individual information

Corrective individual information is submitted along with the original forms of personalized reporting for the next reporting period. In this case, adjustments are made to the reporting using the forms that were in effect in the reporting period for which the changes are made. For the first quarter of 2013 - in the form SZV-6-4 (Letter of the Pension Fund of the Russian Federation dated May 23, 2011 N 08-25/5577). To create the correcting form SZV-6-4 in the “Personnel records of organizations” interface of the “Personalized accounting” menu - “Preparation of Pension Fund data” in the document “Preparation of data for transfer to the Pension Fund”, you need to add an additional pack of SZV-6-4 (Fig. 6 on page 63).

Preparation of data for transfer to the Pension Fund. Addition of SZV-6-4

Figure 6

For the added pack of SZV-6-4 forms, you must set the “Corrective” attribute (Fig. 7).

Setting up details

Figure 7

Then, to the added stack of SZV-6-4 forms, you must add an entry for the employee dismissed in May (Fig. 8).

Adding an entry

Figure 8

After adding a record for an employee, you need to refill the indicators of the taxable base and the amount of insurance contributions (Fig. 9).

Re-filling the tax base and contribution amounts

Figure 9

After clicking the “Refill income and contributions” button, the tabular part of your earnings by month will be filled in. The program will automatically change the payment of contributions. But in our case, the amount of insurance premiums paid has not changed. Therefore, it is necessary to set the values of the original form in the “Paid” field, and reset the amounts in the “Additional Paid” fields to zero (Fig. 10).

Adjustment of paid contributions

Figure 10

The Federal Tax Service reminds: calculations for insurance premiums should not contain negative values

November 1, 2021 November 1, 2021 If an employee took vacation “in advance” and then decided to quit, the employer has the right to withhold the amount for unworked vacation days. Upon final settlement with this employee, a negative amount of accrued insurance premiums may be formed (this occurs when the amount of payments accrued to the employee is less than the amount of overpaid vacation pay).

At the same time, indicating negative values in the DAM is not allowed. What to do in such a situation? The payer should submit an updated calculation of insurance premiums for the previous period with correct indicators. This conclusion follows from the letter of the Federal Tax Service dated October 11, 2017 No. GD-4-11/20479. The authors of the letter refer to the procedure for filling out the calculation, approved.

by order of the Federal Tax Service of Russia. Based on the provisions of Section II “General requirements for filling out calculations,” negative values are not provided for when filling out line indicators.

In case of adjustment of the base for calculating insurance premiums for previous reporting periods, the payer submits an updated calculation for this period. In the calculation for the current reporting period, the amount of recalculation made for the previous period is not reflected.

Experts also explained that negative amounts of accrued insurance premiums cannot be reflected in the individual personal accounts of insured persons. For this reason, the Pension Fund authorities that have received such data return them to the tax authorities. In this regard, if the payer previously submitted to the inspectorate a calculation with negative values, he needs to submit a “clarification”.

Let us recall that the same conclusion is contained in letters from the Federal Tax Service (see.

""). Please note: when submitting calculations of premiums, those policyholders who use web services to prepare and check reports (for example, the system for sending reports “”) will feel most comfortable. There, all current control ratios are established automatically, without user intervention.

If the data entered by the policyholder does not correspond to the control ratios, the system will certainly warn him about this and tell him how to correct the errors.

And timely correction of errors will save the accountant from the need to submit “clarifications”. 2 482 Discuss on the forum 2 4822 482 Discuss on the forum 2 48253 06642 27910 1737 6369 2454 6924 461 Accounting news by mail Also read us on Yandex.Zen and on social networks.

Updated calculation of insurance premiums - Kontur.Accounting

» Attention If discrepancies are justified, it is recommended to attach explanations to the calculation. ATTENTION!

If errors in the DAM did not lead to an understatement of the tax base for contributions and do not relate to the personal data of employees, an update on the DAM for the 1st quarter of 2021 does not need to be submitted. Deadlines for filing an adjustment DAM: what to pay attention to? A common situation is when errors and inaccuracies are discovered by the payer himself after submitting reports to the Federal Tax Service.

2 tbsp. 81 of the Tax Code of the Russian Federation). If after, then penalties should be assessed and paid.

- Printing is done in Courier New font with a height of 16 to 18 points.

- The procedure for filling out the new calculation form and the requirements for its preparation are described in detail in the above-mentioned Federal Tax Service order No. ММВ-7-11/ in attachment 2 (hereinafter referred to as the Federal Tax Service Procedure).

- Handwriting is done in blue, black or purple ink.

- “0” is placed in the place of the missing sum (numeric) indicator; in other cases, dashes are added (when filling out the form manually).

- Text data is entered in capital block letters.

- Data is entered from left to right, from the first position.

- The following are not allowed: edits using a proofreader, printing calculations on both sides of the pages, fastening sheets with a stapler or any other similar method.

- Cost indicators in sections, as well as in attachments to the first section, are recorded in rubles and kopecks.

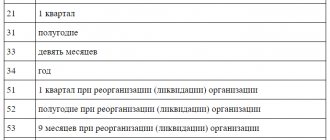

Organizations and individual entrepreneurs, if errors are detected in the primary DAM, must make adjustments and submit an updated report according to the rules of Art. 81 Tax Code of the Russian Federation. If the data for 2021 is adjusted, the report is submitted to the tax service, if for 2021 and the periods preceding it, the report is submitted to the Pension Fund. The corrective calculation must be submitted in the form that was used at the time of submission of the initial report (clause

1.2 Procedure for filling out the DAM, approved. Federal Tax Service of the Russian Federation by Order dated October 10, 2016 No. ММВ-7-11/ [email protected] - Procedure): for 2021, the DAM is specified on the KND form 1151111; for 2021 and earlier, adjustments are made to the DAM-1 Pension Fund.

It is also necessary to submit an updated DAM if the base for the previous period has been recalculated downwards. The recalculation amount is not reflected in the current period because, from October 2021, a report with negative amounts is considered to be inconsistent with the format. Policyholders submit the initial calculation of insurance premiums to the Federal Tax Service on the 30th day of the month following the 1st quarter, half year, 9th month.

and year (clause 7 of article 431 of the Tax Code of the Russian Federation).

If you submit an adjustment before the 30th, it is considered submitted on the day the clarifying DAM is submitted (clause

2 tbsp. 81 of the Tax Code of the Russian Federation). Submitting an adjustment that increases the insurance premiums payable relieves the policyholder from liability if the report is filed before the tax authority learned about the understatement of premiums or ordered an on-site audit for the period of adjustment. Before submitting the amended report, the policyholder must pay the debt on insurance premiums and penalties (clause

3, 4 tbsp. 81 of the Tax Code of the Russian Federation). If the Federal Tax Service found errors in section 3 of the primary

Questions about individual entrepreneurs and heads of peasant farms

Individual entrepreneur on a patent provides services to the public. Which payer tariff should he choose?

In accordance with subparagraph 9 of paragraph 1 of Article 427 of the Tax Code of the Russian Federation, individual entrepreneurs with a patent can count on the use of reduced insurance premium rates. This is possible if the entrepreneur is not engaged in leasing real estate, retail trade or providing catering services.

If an individual entrepreneur applies a preferential tariff, then in Appendix 1 to Section 1 he must indicate the tariff code “12”.

An individual entrepreneur combines the simplified tax system and UTII; there are employees in both systems. Should he fill out one RSV?

The calculation must be completed alone. However, since different tariff codes are used (02 and 03), it may be necessary to fill out 2 options of Appendix 1 to Section 1. We recommend that you check with your inspectorate whether it is necessary to separate tax systems in this case, taking into account the fact that contributions are paid at the same tariff.

What is the frequency of submitting accounts to the head of the peasant farm?

Heads of peasant farms submit accounts once a year if they do not have employees. If there are employees, the calculation is submitted quarterly.